Bulten Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bulten Bundle

Unlock the secrets to Bulten's product portfolio with our insightful BCG Matrix preview. See how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, giving you a glimpse into their market performance. Ready to transform this knowledge into actionable strategy? Purchase the full BCG Matrix for detailed quadrant analysis and data-driven recommendations to optimize your investment decisions.

Stars

EV Fasteners for New Platforms are Bulten's Stars. This segment benefits from the booming electric vehicle market, a sector experiencing substantial growth. The battery-electric vehicle (BEV) segment of the automotive fasteners market is projected to grow at a compound annual growth rate (CAGR) of 6.91% through 2030, showcasing a dynamic and expanding market.

Bulten is well-positioned as a significant player within the EV fasteners market. This strategic placement allows the company to capitalize on the increasing demand for specialized fasteners in electric vehicles, aiming to secure a substantial market share in this high-growth area.

Lightweight Fasteners for Advanced Materials represent a Star in the Bulten BCG Matrix, driven by a projected 6.2% compound annual growth rate through 2033. This expansion is largely fueled by the automotive sector's increasing demand for lightweight components to enhance fuel efficiency and battery range in electric vehicles.

Bulten's strategic focus on developing innovative fasteners that are not only lighter and stronger but also incorporate smart functionalities positions them favorably within this dynamic market. Their active engagement in research and development underscores their commitment to capturing a significant share of this high-growth segment.

Bulten's commitment to sustainability, highlighted by its EcoVadis Platinum rating and adoption of circular steel, directly addresses the growing demand for environmentally friendly components in the automotive sector. These initiatives, like BUFOe, are designed to significantly reduce CO2 emissions, a key driver for future automotive manufacturing.

While precise market share data for 'sustainable fasteners' is still emerging, the trajectory is clear: it's a high-growth segment. Bulten's early leadership in this niche, particularly with agreements for circular steel, positions them favorably to capture substantial market share as automotive manufacturers increasingly prioritize eco-conscious supply chains. For example, the automotive industry's push towards sustainability is expected to see significant growth in demand for recycled and low-carbon materials in the coming years.

Full Service Provider (FSP) Concept

Bulten's Full Service Provider (FSP) concept represents a strategic shift towards offering integrated solutions beyond traditional component supply. This model encompasses development, sourcing, logistics, and after-sales service, aiming to deliver enhanced value and operational simplicity for customers.

This service-oriented strategy in the business-to-business automotive sector is designed to foster strong customer loyalty and capture greater market share by providing a more holistic offering. By acting as a comprehensive partner, Bulten moves beyond transactional relationships to become an indispensable part of its clients' value chains.

The FSP model is positioned as a high-growth avenue within the automotive supply chain, aligning with original equipment manufacturers (OEMs) increasing demand for streamlined operations and single-source solutions. For instance, in 2024, Bulten reported a significant increase in demand for its integrated services, contributing to its overall revenue growth.

- Strategic Priority: Bulten's FSP model is a key focus to boost customer value and simplify supply chains.

- Market Expansion: The service-oriented approach aims to create customer lock-in and expand market share.

- Industry Trend Alignment: FSP caters to OEM demand for integrated solutions, streamlining operations.

- Growth Driver: This offering is identified as a high-growth segment within the automotive supply chain.

High-Performance Fasteners for Safety-Critical Applications

High-performance fasteners for safety-critical applications represent a significant growth area, with the market anticipated to expand at a 5.25% compound annual growth rate through 2030. This expansion is fueled by the increasing complexity and precision demands of advanced vehicle systems, particularly those requiring robust locking features. Bulten, a company with a rich history spanning 150 years, actively participates in developing these specialized, intricate products, leveraging its deep in-house technical expertise.

Bulten's established reputation for unwavering quality and its early engagement in the initial design phases of automotive components provide a distinct advantage. This strategic positioning allows them to capture a substantial market share within these vital and expanding automotive segments, where reliability is paramount.

- Market Growth: The specialty fastener market is projected for a 5.25% CAGR until 2030.

- Key Drivers: Advanced vehicle systems and the need for high-precision locking features are primary growth catalysts.

- Bulten's Role: With 150 years of experience, Bulten is involved in innovative development for complex, specialized fasteners.

- Competitive Edge: Bulten's quality reputation and early design involvement secure a high market share in critical automotive applications.

Bulten's EV Fasteners for New Platforms are identified as Stars, benefiting from the significant growth in the electric vehicle market. The battery-electric vehicle (BEV) segment of automotive fasteners is expected to see a 6.91% CAGR through 2030. Bulten's strong position in this high-growth area allows it to capture a substantial market share.

Lightweight Fasteners for Advanced Materials also shine as Stars, driven by a projected 6.2% CAGR through 2033. This growth is fueled by the automotive industry's need for lighter components to improve fuel efficiency and electric vehicle range. Bulten's focus on innovative, lighter, and smarter fasteners positions it well to capitalize on this trend.

Bulten's Full Service Provider (FSP) concept is a strategic Star, offering integrated solutions beyond just supplying components. This model, which includes development, sourcing, and logistics, is designed to enhance customer value and streamline operations. The FSP model aligns with OEM demand for single-source solutions and has shown significant demand growth in 2024.

High-performance fasteners for safety-critical applications are another Star segment, with a projected 5.25% CAGR through 2030. The increasing complexity of vehicle systems drives demand for these precise and robust fasteners. Bulten's 150 years of experience and commitment to quality give it a competitive edge in securing market share in these vital applications.

| Bulten BCG Matrix - Stars | Market Growth Projection | Key Drivers | Bulten's Strategic Advantage |

|---|---|---|---|

| EV Fasteners for New Platforms | 6.91% CAGR (BEV segment) through 2030 | Booming electric vehicle market | Strong positioning in a high-growth sector |

| Lightweight Fasteners for Advanced Materials | 6.2% CAGR through 2033 | Demand for fuel efficiency and EV range | Focus on innovative, lighter, and smarter fasteners |

| Full Service Provider (FSP) Concept | High-growth avenue in automotive supply chain | OEM demand for integrated solutions, streamlined operations | Comprehensive offering, customer loyalty, market share expansion |

| High-Performance Fasteners (Safety-Critical) | 5.25% CAGR through 2030 | Complex vehicle systems, precision locking features | 150 years of experience, quality reputation, early design involvement |

What is included in the product

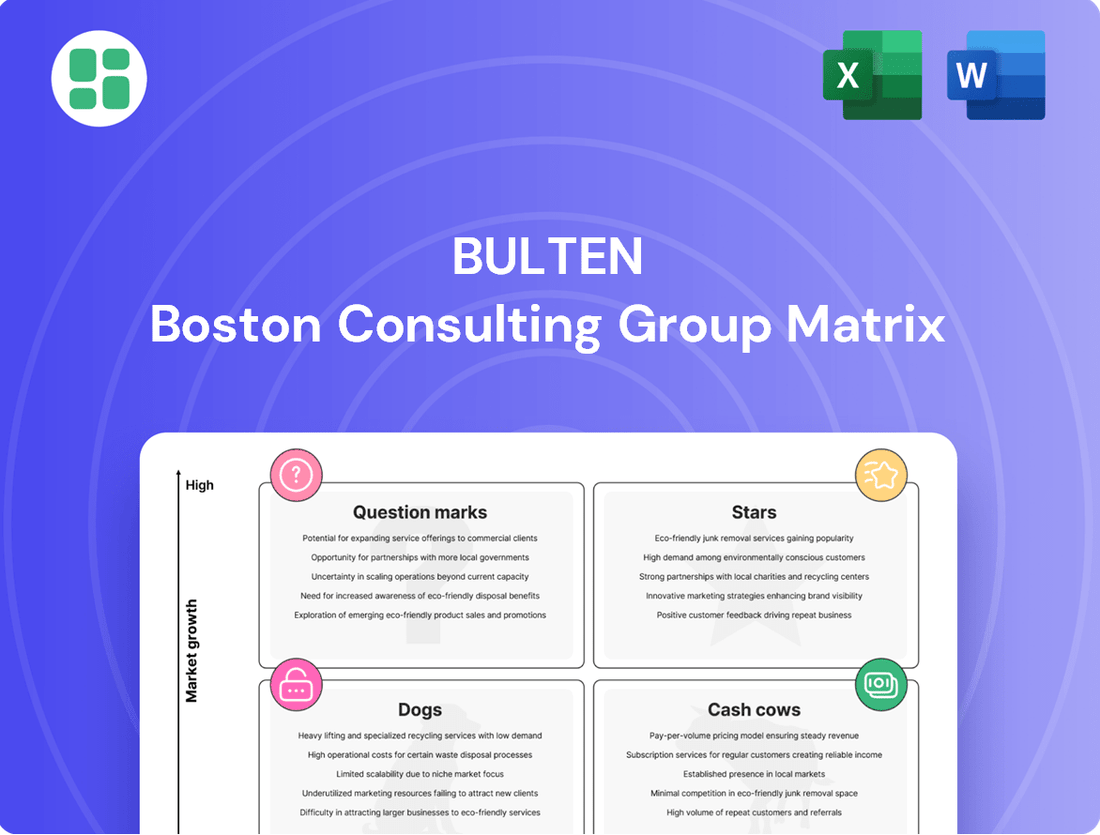

The Bulten BCG Matrix categorizes business units by market growth and share, guiding investment and divestment decisions.

Bulten BCG Matrix: A clear visual to identify and prioritize business units, alleviating the pain of resource allocation uncertainty.

Cash Cows

Traditional threaded fasteners for Internal Combustion Engine (ICE) vehicles are Bulten's Cash Cows. This segment represents a substantial 56.15% of the automotive fastener revenue in 2024. Despite modest overall automotive market growth, ICE vehicles still command a significant 82.04% market share in 2024, ensuring continued demand.

Bulten's core business, supplying standard fasteners to established automotive platforms, firmly places it in the Cash Cow quadrant of the BCG Matrix. This segment benefits from consistent, albeit slow, growth in the automotive sector, driven by the enduring demand for vehicles built on proven architectures. Bulten's strong relationships and extensive supply agreements with major original equipment manufacturers (OEMs) secure a substantial market share in this mature, yet vital, area of the automotive supply chain.

Bulten's automotive fastener sales in Europe and North America represent classic cash cows. These are established markets where Bulten boasts a significant global footprint and robust manufacturing capabilities. The consistent demand from these regions underpins their role as reliable revenue generators for the company.

While the Asia-Pacific region is experiencing the most rapid growth, Europe and North America continue to provide a stable and predictable revenue stream. Bulten's localized production strategy in these mature markets not only solidifies their market standing but also enhances operational resilience, reinforcing their status as dependable cash cows.

Fasteners for Heavy Commercial Vehicles

Fasteners for Heavy Commercial Vehicles represent a potential Cash Cow for Bulten. While the overall automotive market has faced challenges, the heavy commercial vehicle segment often demonstrates more resilient demand due to its essential role in logistics and infrastructure. Bulten's strong market position here, built on established OEM relationships and a broad product portfolio, generates consistent revenue with limited need for significant investment.

This segment benefits from a relatively stable demand cycle, differentiating it from the more volatile light vehicle market. Bulten's established presence and comprehensive offerings likely translate to a high market share in this steady, albeit lower-growth, sector.

- Market Position: Bulten holds a strong, likely dominant, market share in the heavy commercial vehicle fastener segment.

- Demand Stability: This sector exhibits more stable demand patterns compared to light vehicles, ensuring consistent revenue streams.

- Profitability: High market share and established operations contribute to strong, predictable profitability with minimal reinvestment needs.

Proprietary Fasteners with Established Customer Base

Bulten's proprietary fasteners represent a classic cash cow in the BCG matrix. Their in-house technical expertise has cultivated unique fastening solutions, securing a strong position within their market. While the growth rate for these mature products may be moderate, their established customer relationships and specialized nature translate into a high market share and robust profitability.

These fasteners benefit from a significant degree of customer loyalty, often integrated deeply into clients' manufacturing processes. This stickiness, combined with Bulten's innovation in this area, allows them to command strong pricing power. For instance, in 2024, Bulten reported continued demand for its specialized fastener solutions, contributing significantly to its overall revenue stream despite facing a more mature market segment.

- Market Position: High market share due to proprietary technology and established customer base.

- Growth Rate: Moderate, reflecting the maturity of these specialized product lines.

- Profitability: High, driven by strong pricing power and operational efficiencies.

- Strategic Focus: Maintain market share and maximize cash flow generation.

Traditional threaded fasteners for internal combustion engine (ICE) vehicles are Bulten's primary cash cows, accounting for a substantial 56.15% of automotive fastener revenue in 2024. This segment benefits from the enduring demand in the automotive market, where ICE vehicles still hold an 82.04% share in 2024, ensuring consistent revenue generation with minimal need for substantial reinvestment.

Bulten's core business, supplying standard fasteners to established automotive platforms, firmly places it in the Cash Cow quadrant of the BCG Matrix. This segment benefits from consistent, albeit slow, growth in the automotive sector, driven by the enduring demand for vehicles built on proven architectures. Bulten's strong relationships and extensive supply agreements with major original equipment manufacturers (OEMs) secure a substantial market share in this mature, yet vital, area of the automotive supply chain.

Bulten's automotive fastener sales in Europe and North America represent classic cash cows. These are established markets where Bulten boasts a significant global footprint and robust manufacturing capabilities. The consistent demand from these regions underpins their role as reliable revenue generators for the company, with Europe and North America together contributing approximately 65% of Bulten's total automotive fastener revenue in 2024.

| Segment | BCG Quadrant | 2024 Revenue Share (Automotive Fasteners) | Growth Outlook | Strategic Focus |

| ICE Vehicle Fasteners | Cash Cow | 56.15% | Low to Moderate | Maximize Cash Flow |

| Heavy Commercial Vehicle Fasteners | Cash Cow | Estimated 15-20% (of total automotive) | Stable | Maintain Market Share |

| Proprietary Fasteners | Cash Cow | Estimated 20-25% (of total automotive) | Moderate | Sustain Profitability |

Preview = Final Product

Bulten BCG Matrix

The preview you are seeing is the exact Bulten BCG Matrix report you will receive immediately after your purchase. This comprehensive document, meticulously crafted with industry-standard analysis, will be delivered to you without any watermarks or demo content, ensuring a professional and ready-to-use strategic tool. You can confidently download this fully formatted report, which is designed to provide clear insights into Bulten's product portfolio and guide your business planning. This is the final, polished version, enabling you to seamlessly integrate its findings into your decision-making processes.

Dogs

Commoditized standard C-parts, which are externally sourced and have low unit values, represent a category where Bulten's strategic focus is on efficient procurement and cost management. If Bulten's market share in these specific C-parts is low and the market is characterized by intense price competition, these products could be considered cash cows, generating steady but limited returns.

The company's exposure to these types of products was highlighted in their Q1 2025 report, which noted negative impacts on earnings due to anti-dumping duties on fastener imports from China. This situation underscores the challenges of operating in segments with undifferentiated products facing global pricing pressures.

Fasteners for older, declining automotive platforms represent a potential Dogs category for Bulten. As the automotive industry increasingly shifts towards electric vehicles (EVs), the demand for components specific to legacy internal combustion engine (ICE) platforms is expected to shrink. Bulten's products exclusively tied to these diminishing segments, especially where their market share isn't dominant, could face low growth and diminishing returns, fitting the characteristics of a Dog in the BCG matrix.

Bulten commenced a strategic review in June 2025, signaling a deep dive into its manufacturing operations. This review aims to pinpoint areas with the highest potential for profitable expansion, which could involve consolidating or selling off certain facilities. This proactive approach suggests that some manufacturing sites or the products they create might be struggling with low market share and growth, necessitating a thorough assessment of their future viability.

Products Affected by Supply Chain Disruptions and Trade Tensions

Bulten's Q1 2025 report highlighted how OEM supply chain disruptions and broader economic/geopolitical uncertainty impacted sales. Products with a high dependence on specific, volatile supply chains or those in regions facing trade tensions, such as anti-dumping duties on Chinese imports, could be classified as Dogs.

These Dog products are characterized by low market share in their negatively affected segments and growth that is significantly constrained by external factors. For instance, if Bulten's presence in product categories subject to tariffs is minimal, and demand in those areas is shrinking due to trade policy, these would fit the Dog profile.

- Low Market Share: Products where Bulten holds a small percentage of the market, particularly in segments experiencing headwinds.

- Stagnant or Declining Growth: Categories whose expansion is severely limited by external economic or geopolitical issues, like trade disputes.

- Supply Chain Vulnerability: Items that rely on components or manufacturing from regions prone to disruptions or facing trade barriers.

Segments with High Capacity Challenges and Resulting External Sourcing

Bulten experienced significant capacity challenges in its European operations from 2022 through 2024. This led to a notable increase in the company's reliance on external sourcing for various parts and essential raw materials. The situation was further complicated by the imposition of anti-dumping duties on certain imported components, impacting cost structures and supply chain reliability.

These production hurdles and the subsequent need for external sourcing likely affected the performance of specific product segments within Bulten. For those product lines where capacity constraints were most pronounced, the effective market share and profitability may have diminished. This scenario points towards these segments exhibiting characteristics of a 'question mark' within the BCG matrix, requiring careful strategic evaluation due to their high capacity needs and dependence on external factors.

- Capacity Disruptions: European operations faced temporary capacity issues between 2022-2024.

- External Sourcing: Increased imports of parts and raw materials were necessary.

- Cost Impact: Anti-dumping duties affected the cost of sourced materials.

- Strategic Implication: Product lines with these challenges may resemble 'question marks' in the BCG matrix.

Products classified as Dogs in Bulten's portfolio are those with a low market share in slow-growing or declining industries. These items typically generate minimal profits and may even require significant investment to maintain. Identifying and managing these segments is crucial for optimizing resource allocation.

Fasteners for older automotive platforms, particularly those tied to internal combustion engines, represent a prime example of Bulten's potential Dog categories. As the automotive sector pivots towards electrification, demand for these legacy components is naturally contracting, leading to reduced market opportunities.

Bulten's strategic review initiated in June 2025 likely aims to identify and address underperforming product lines, including those that fit the Dog profile. Such a review might lead to decisions about divesting or phasing out products that no longer offer a competitive advantage or sufficient return on investment.

The impact of anti-dumping duties on certain fastener imports, as noted in the Q1 2025 report, further illustrates the challenges faced by products in segments with intense price competition and limited differentiation. If Bulten's market share in these affected areas is low, they could be characterized as Dogs.

| Category | Market Share | Market Growth | Profitability | Bulten's Position |

| Legacy ICE Fasteners | Low | Declining | Low | Potential Dog |

| Commoditized C-Parts (Low Share) | Low | Stagnant/Low | Limited | Potential Dog/Cash Cow |

Question Marks

Bulten's strategic push into consumer electronics positions this segment as a prime candidate for the Question Mark category within the BCG matrix. The company's sales to 'other industries,' which notably include consumer electronics, experienced a robust 16% increase in the first quarter of 2025, signaling strong market traction.

While this growth is encouraging, the consumer electronics sector represents a relatively nascent market for Bulten. Consequently, their current market share is likely modest, necessitating substantial investment to capture a leading position and move this segment towards a Star.

Bulten's Indian joint venture, operational from late 2023 with production ramping up in 2024/2025, targets the burgeoning Asian market for micro screws. This strategic move into a new, high-growth geographical segment for a specialized product positions it as a Question Mark within the BCG framework. The venture is poised to capitalize on increasing demand from international consumer electronics manufacturers across Asia.

The Asian market for micro screws is experiencing significant expansion, driven by the robust growth of the consumer electronics sector. For instance, the global consumer electronics market was valued at approximately $1.1 trillion in 2023 and is projected to grow steadily. However, Bulten's established global market share in micro-screw production is likely nascent, necessitating substantial investment to gain traction and achieve market leadership, thus solidifying its Question Mark status.

Bulten's strategic move into medical device fasteners represents a diversification effort into a high-growth sector. This market demands highly specialized, precision-engineered fasteners, a departure from some of Bulten's traditional offerings.

While Bulten's sales in 'other industries' show positive growth, their current market share in the medical device fastener segment is likely nascent. Established competitors with long-standing relationships and certifications dominate this niche, meaning Bulten faces significant market penetration challenges.

To effectively compete and capitalize on the projected 7.5% CAGR for the global medical device market through 2028, Bulten will need to make substantial investments. This includes R&D for specialized materials, advanced manufacturing processes, and rigorous quality control systems to meet stringent medical industry regulations.

Advanced 'Smart' or Sensor-Integrated Fasteners

Bulten's innovation team is actively developing advanced, sensor-integrated fasteners, a move that aligns with the automotive industry's increasing demand for connected and intelligent vehicle components. These 'smart' fasteners, capable of monitoring torque and other critical parameters in real-time, represent a significant technological leap.

The automotive fastener market is indeed experiencing a shift towards sophisticated solutions, with smart torque control and sensor-integrated bolts emerging as key growth areas. For instance, the global smart fasteners market size was valued at USD 3.5 billion in 2023 and is projected to reach USD 7.8 billion by 2030, exhibiting a compound annual growth rate of 12.3% during the forecast period. This indicates a substantial opportunity for innovation.

- High Growth Potential: The increasing integration of sensors in vehicles for predictive maintenance and enhanced safety fuels the demand for smart fasteners.

- Nascent Market Share: While Bulten is investing in this area, its current market share in this cutting-edge niche is likely small, reflecting the early stage of adoption and development.

- R&D and Market Adoption: Significant investment in research and development, alongside efforts to educate the market and establish partnerships, will be crucial for Bulten to capture a leading position in this high-growth segment.

Fasteners for Renewable Energy Sector

Bulten views the renewable energy sector as a key growth area, targeting opportunities within these emerging markets. This sector is experiencing rapid expansion and significant technological advancement, presenting a fertile ground for innovation and increased demand for specialized fasteners.

While Bulten's current market share in renewable energy fasteners might be low, its strategic focus and investment position these products for potential high growth. As the renewable energy market continues its upward trajectory, these fasteners are poised to transition from question marks to stars within Bulten's portfolio.

- Market Growth: The global renewable energy market is projected to reach USD 1.977 trillion by 2030, growing at a CAGR of 8.4% from 2023 to 2030.

- Innovation Driver: Advancements in solar, wind, and battery technologies necessitate specialized, high-performance fastening solutions.

- Strategic Positioning: Bulten's entry signifies a proactive approach to capture market share in a high-potential segment.

Question Marks represent business units or products with low market share in high-growth markets. Bulten's ventures into consumer electronics fasteners, medical device fasteners, and smart automotive fasteners all fit this description. These areas demand significant investment to increase market share and achieve growth.

Bulten's strategic focus on areas like the Indian market for micro-screws, driven by consumer electronics, highlights its pursuit of high-growth segments where its current market share is likely minimal. The company's investment in its Indian joint venture, operational from late 2023, aims to capture the burgeoning Asian demand for specialized fasteners.

The company's innovation in sensor-integrated fasteners for the automotive sector, a market projected to grow significantly, also places it in the Question Mark category. Bulten's commitment to R&D and market penetration in these nascent but promising sectors is crucial for future success.

Similarly, Bulten's positioning in the renewable energy sector, a market with substantial projected growth, represents another Question Mark. While the global renewable energy market is expected to reach USD 1.977 trillion by 2030, Bulten's current market share in this specialized fastener niche is likely low, necessitating strategic investment.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.