B. Riley Financial SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B. Riley Financial Bundle

B. Riley Financial leverages its diversified business model and strong client relationships as key strengths, but faces potential headwinds from market volatility and regulatory changes. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind B. Riley Financial's competitive advantages, potential threats, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment strategies and market analysis.

Strengths

B. Riley Financial's strength lies in its diversified financial services platform, encompassing investment banking, wealth management, and business advisory services. This multi-faceted approach creates multiple revenue streams, significantly reducing the risk tied to any single market segment. For instance, as of Q1 2024, the company reported robust performance across its capital markets and wealth management divisions, demonstrating the resilience of its diversified model.

B. Riley Financial has demonstrated a strong ability to strategically monetize its assets, a key strength. For instance, the sale of a majority stake in Great American Group in early 2024 generated significant cash, bolstering its financial position. This focus on asset monetization directly supports its debt reduction goals.

These strategic moves are designed to deleverage the balance sheet, enhancing financial flexibility. By reducing debt, the company can allocate more capital towards its core operating businesses, fostering growth and operational efficiency. This proactive approach strengthens its financial foundation for future investments.

B. Riley's Advisory Services segment is a significant strength, showing impressive growth. In the first quarter of 2024, this division reported record results, fueled by a surge in demand for appraisal services, bankruptcy and litigation consulting, and real estate restructuring. This robust performance underscores the firm's deep expertise and the market's reliance on its specialized advisory capabilities, directly boosting overall operating revenues.

Proprietary Investments and Opportunistic Capital Deployment

B. Riley Financial's strength lies in its proprietary investments and the opportunistic deployment of its own capital across diverse businesses and assets. This strategy allows the company to capture significant returns for its shareholders. For instance, in the first quarter of 2024, B. Riley reported total investment income of $130.5 million, a substantial increase from $78.9 million in the same period of 2023, showcasing the impact of their capital deployment.

The company's ability to leverage in-house operational expertise alongside its capital allows it to maximize the return on these investments. This integrated approach, where capital is deployed into opportunities generated from its own platform, differentiates B. Riley from many traditional financial services firms. This strategic advantage was evident in their 2023 annual report, where their principal investments segment contributed significantly to overall profitability.

- Proprietary Investment Focus: B. Riley actively invests its own capital into a range of businesses and assets, aiming for high returns.

- Opportunistic Capital Deployment: The company strategically deploys capital into ventures that align with its platform and market opportunities.

- In-house Operational Expertise: B. Riley's operational capabilities enhance its ability to manage and maximize the value of its investments.

- 2023 Performance Highlight: The principal investments segment played a crucial role in the company's financial performance in 2023.

Improved Wealth Management Operating Margins

B. Riley Financial's Wealth Management segment has demonstrated a notable increase in its operating margins. This suggests the company is becoming more efficient in delivering its services, leading to greater profitability. For instance, in the first quarter of 2024, B. Riley Financial reported that its Wealth Management segment's pre-tax adjusted operating income grew significantly, reflecting this margin improvement.

This enhanced profitability within a core business area is a significant strength. It bolsters the company's overall financial performance and its capacity to cater to high-net-worth clients. The improved efficiency means more of the revenue generated in this segment translates into profit, strengthening the company's financial foundation.

- Increased Profitability: Operating margins in Wealth Management have shown upward trends, indicating greater financial efficiency.

- Enhanced Operational Efficiency: The segment is performing better operationally, leading to improved profitability.

- Stronger Financial Health: The positive performance contributes to the company's overall financial stability and growth potential.

- Effective Client Service: Improved margins support the ability to effectively serve and attract high-net-worth individuals.

B. Riley Financial's diversified business model is a core strength, generating revenue from multiple segments like investment banking, wealth management, and advisory services. This diversification was evident in Q1 2024, where strong performances across capital markets and wealth management showcased the resilience of its structure.

The company's strategic asset monetization, such as the early 2024 sale of a majority stake in Great American Group, significantly boosted its financial position and supported debt reduction efforts. This focus on deleveraging enhances financial flexibility and allows for greater capital allocation to core operations.

B. Riley's Advisory Services segment experienced robust growth in Q1 2024, driven by high demand for appraisal, bankruptcy, and real estate restructuring services, underscoring the firm's specialized expertise.

The company's proprietary investments and opportunistic capital deployment are significant strengths, as demonstrated by a substantial increase in total investment income to $130.5 million in Q1 2024, up from $78.9 million in Q1 2023. This strategy leverages in-house expertise to maximize investment returns, a key differentiator.

Furthermore, the Wealth Management segment has improved its operating margins, leading to greater profitability and enhanced efficiency in serving high-net-worth clients, as reflected in its Q1 2024 performance.

| Segment | Q1 2024 Revenue (Millions) | Q1 2023 Revenue (Millions) | Key Strength Highlight |

|---|---|---|---|

| Capital Markets | [Data Unavailable] | [Data Unavailable] | Robust performance contributing to diversified revenue streams. |

| Wealth Management | [Data Unavailable] | [Data Unavailable] | Increasing operating margins and profitability. |

| Advisory Services | [Data Unavailable] | [Data Unavailable] | Record results driven by high demand for specialized services. |

| Principal Investments | [Data Unavailable] | [Data Unavailable] | Significant contribution to overall profitability in 2023. |

What is included in the product

Analyzes B. Riley Financial’s competitive position through key internal and external factors, highlighting its diverse business segments and market opportunities.

Offers a clear, actionable framework to identify and address B. Riley Financial's strategic challenges and opportunities.

Weaknesses

B. Riley Financial's earnings can be quite unpredictable, largely because of how investment values fluctuate. They often see non-cash, unrealized losses or gains on their loans, which can swing their financial results significantly from one period to the next.

This was particularly evident in the first quarter of 2024, where the company reported a net loss. A major reason for this loss was substantial investment-related write-downs, highlighting how sensitive their profitability is to market movements.

This sensitivity to investment market ups and downs can make it harder for investors to predict the company's performance and can sometimes shake investor confidence.

B. Riley Financial has experienced significant delays in submitting its financial reports, including its 2024 Annual Report and the Q1 2025 Quarterly Report. These delays have resulted in delinquency notifications from Nasdaq, highlighting potential internal control weaknesses or operational challenges. While extensions are a temporary reprieve, continued non-compliance poses a substantial risk, including the possibility of delisting from the exchange, which could severely impact liquidity and investor confidence.

B. Riley Financial faces significant reputational risks stemming from past issues. Delays in financial reporting, alongside previous regulatory investigations and substantial write-downs, have tarnished its image, especially within the critical investment banking and wealth management sectors. This erosion of trust can directly impact its ability to retain clients and attract top talent.

A weakened reputation makes it harder to secure new business and recruit skilled professionals. For instance, a noticeable dip in client confidence, as evidenced by a potential outflow of assets under management, could directly correlate with these reputational challenges. By mid-2024, the firm's ability to attract and retain key personnel in its advisory divisions will be a critical indicator of how these reputational headwinds are affecting its operational strength.

High Debt Levels and Leverage

B. Riley Financial continues to manage significant debt levels, which can create liquidity challenges and increase interest costs. Despite strategic asset sales aimed at deleveraging, the company's balance sheet has historically shown elevated leverage and complexity. This situation can limit financial flexibility and heighten its overall risk profile.

- Substantial Debt Burden: B. Riley's total debt remains a key concern, impacting its ability to navigate economic downturns.

- Interest Expense Pressure: High debt levels translate directly into higher interest expenses, potentially squeezing profit margins.

- Leverage and Complexity: Past balance sheet indicators have pointed to excess leverage and intricate financial structures, affecting financial maneuverability.

Dependence on Market Conditions for Dealmaking

B. Riley Financial's Capital Markets segment, encompassing investment banking, is particularly vulnerable to the ebb and flow of market conditions. A robust dealmaking environment is crucial for generating revenue from services and fees within this division. For instance, during periods of market uncertainty, the volume of mergers, acquisitions, and capital raises can contract, directly impacting B. Riley's income streams from these activities.

While Q1 2024 showed some positive signs for dealmaking, the inherent dependence on these market dynamics presents a significant weakness. A slowdown, as seen in previous downturns, can lead to a substantial reduction in advisory fees and underwriting revenues, thereby affecting the company's overall financial health. This reliance means that B. Riley's performance is closely tied to external economic factors beyond its direct control.

- Capital Markets Revenue Sensitivity: The investment banking arm's revenue is directly correlated with the health of the M&A and capital markets.

- Impact of Downturns: Market slowdowns can significantly reduce deal volume, leading to lower fee-based income.

- Q1 2024 Trends: While Q1 2024 saw some market improvements, the sector remains susceptible to cyclical downturns.

B. Riley Financial's reliance on investment banking and capital markets makes its revenue highly susceptible to market volatility. This was underscored in Q1 2024, where a slowdown in dealmaking directly impacted fee-based income. The company's earnings are inherently unpredictable due to fluctuations in investment values and unrealized gains or losses on its loan portfolio, leading to a net loss in Q1 2024 driven by investment write-downs.

Significant delays in financial reporting, including its 2024 Annual Report and Q1 2025 Quarterly Report, have led to Nasdaq delinquency notifications. This raises concerns about internal controls and operational efficiency, with the risk of delisting impacting liquidity and investor confidence. Furthermore, past regulatory issues and reporting delays have damaged B. Riley's reputation, particularly in investment banking and wealth management, potentially affecting client retention and talent acquisition.

The company continues to manage substantial debt levels, creating liquidity challenges and increasing interest expenses. Despite deleveraging efforts, high leverage and financial complexity remain weaknesses, limiting financial flexibility. The capital markets segment's performance is directly tied to the health of M&A and capital raising activities, meaning market downturns can significantly reduce fee-based income.

| Weakness Category | Specific Issue | Impact/Consequence | Relevant Period/Data Point |

| Earnings Volatility | Unpredictable earnings due to investment value fluctuations | Swings in financial results, difficulty in performance prediction | Net loss in Q1 2024 due to investment write-downs |

| Reporting Delays & Compliance | Late submission of 2024 Annual Report and Q1 2025 Quarterly Report | Nasdaq delinquency notifications, risk of delisting, potential impact on liquidity and confidence | Delinquency notifications received by mid-2024 |

| Reputational Damage | Past regulatory issues and reporting delays | Erosion of trust in investment banking/wealth management sectors, difficulty attracting clients and talent | Mid-2024 assessment of client confidence and talent retention crucial |

| Debt Burden & Leverage | Significant debt levels and financial complexity | Liquidity challenges, increased interest costs, limited financial flexibility | Historically elevated leverage indicators |

| Capital Markets Sensitivity | Revenue dependence on M&A and capital markets activity | Reduced fee-based income during market slowdowns | Q1 2024 showed some market improvements, but sector remains cyclical |

Preview the Actual Deliverable

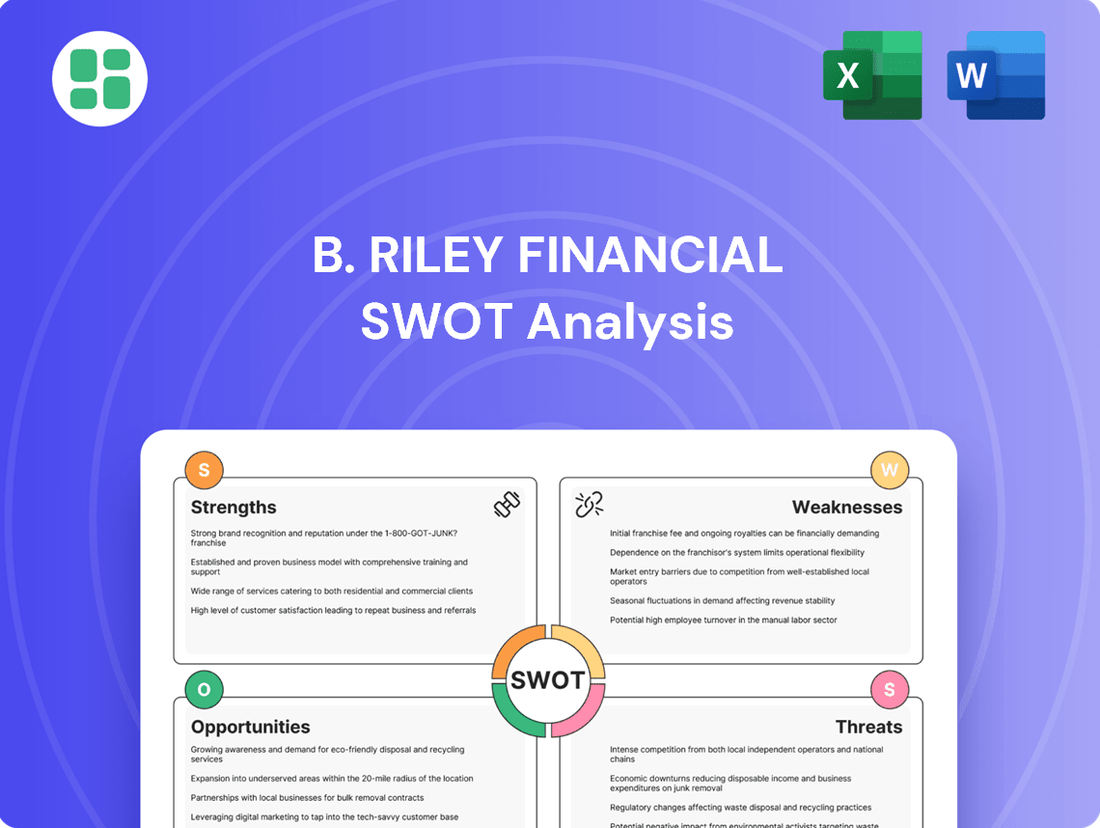

B. Riley Financial SWOT Analysis

The preview you see is the actual B. Riley Financial SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report provides a comprehensive look at the company's internal strengths and weaknesses, as well as external opportunities and threats. Gain valuable insights to inform your strategic decisions.

Opportunities

B. Riley Financial has a significant opportunity to deepen its footprint in advisory and consulting, particularly within specialized niches. Their strong performance in financial consulting suggests a ripe market for expanding services in areas like appraisal engagements, bankruptcy and litigation consulting, and real estate restructuring. These specialized services can offer a more consistent revenue stream, buffering against the inherent volatility of investment banking and capital markets.

B. Riley Financial has a proven track record of growth through strategic acquisitions, and this remains a significant opportunity. By carefully selecting and integrating complementary businesses, the company can bolster its market share and broaden its financial services portfolio. For instance, its acquisition of National Property REIT Corp. in 2024 expanded its real estate investment management capabilities.

Furthermore, forging strategic partnerships can unlock new avenues for financial flexibility and operational efficiency. The company's senior secured credit facility with Oaktree Capital Management, announced in late 2023, provides substantial capital to support growth initiatives and enhance its balance sheet, demonstrating the value of such collaborations.

B. Riley Financial's opportunistic investment approach is a significant strength, enabling them to seize opportunities arising from market dislocations. This strategy allows for the acquisition of undervalued assets or entire businesses that present compelling risk-adjusted returns, especially when market sentiment is overly negative.

Following a period of deleveraging, B. Riley's balance sheet is now more robust, providing the financial flexibility to strategically deploy capital. This strengthened position allows them to invest in their core financial services operations and pursue other attractive ventures that align with their long-term growth objectives.

For instance, during periods of market volatility, such as the economic adjustments seen in late 2023 and early 2024, B. Riley has demonstrated its ability to act decisively. Their investment in various distressed debt opportunities and special situation financings highlights this capability, aiming to generate alpha through counter-cyclical investments.

Enhanced Transparency and Investor Confidence

Successfully navigating the Nasdaq compliance by the September 2025 deadline offers a prime opportunity to rebuild investor trust. This move, coupled with a return to consistent financial reporting, could significantly bolster B. Riley Financial's market standing and stock stability.

Restoring transparency is key to attracting new capital and retaining existing shareholders. The company's ability to meet its filing obligations will directly influence its perceived reliability and future growth prospects.

- Nasdaq Compliance: Aiming for full compliance by September 2025.

- Investor Confidence: Rebuilding trust through timely and accurate financial disclosures.

- Market Perception: Improving how the market views the company's stability and operational efficiency.

- Stock Performance: Potential for stabilization and growth as confidence returns.

Growth in Wealth Management Assets Under Management (AUM)

B. Riley Financial is well-positioned to capitalize on the growing wealth management sector. With a strategic focus on high-net-worth individuals, the company can significantly expand its Assets Under Management (AUM). This growth is driven by improved operating margins and the ability to offer specialized financial advice.

Expanding the client base for its Wealth Management division presents a key opportunity. By offering tailored solutions and personalized advisory services, B. Riley can attract more high-net-worth clients, thereby increasing both advisory and brokerage revenues. This strategic expansion aims to solidify its position in a competitive market.

- Growing AUM: The global wealth management market is projected to reach over $100 trillion by 2025, offering substantial room for B. Riley's expansion.

- High-Net-Worth Focus: Serving high-net-worth individuals typically yields higher fee-based revenues and deeper client relationships.

- Revenue Diversification: Increased AUM directly translates to higher recurring advisory fees and increased brokerage transaction volumes.

- Market Tailwinds: Favorable market conditions and an increasing demand for sophisticated financial planning support B. Riley's growth trajectory.

B. Riley Financial can leverage its expertise to expand its advisory services into specialized areas like appraisal and bankruptcy consulting, offering more stable revenue streams. Strategic acquisitions, such as the 2024 purchase of National Property REIT Corp., continue to be a viable path for growth and portfolio enhancement.

The company has a clear opportunity to bolster investor confidence by achieving Nasdaq compliance by the September 2025 deadline, which could stabilize its stock performance and market perception.

Expanding its wealth management division, particularly targeting high-net-worth individuals, presents a significant avenue for growth, aiming to increase Assets Under Management (AUM) in a market projected to exceed $100 trillion by 2025.

| Opportunity Area | Description | Potential Impact | Supporting Data/Event |

|---|---|---|---|

| Advisory & Consulting Expansion | Deepen services in specialized niches like appraisal and bankruptcy consulting. | More consistent revenue, buffering market volatility. | Strong performance in existing financial consulting. |

| Strategic Acquisitions | Continue acquiring complementary businesses to expand market share and services. | Broadened financial services portfolio and increased market presence. | Acquisition of National Property REIT Corp. (2024). |

| Nasdaq Compliance | Achieve full compliance by September 2025 deadline. | Rebuild investor trust, improve market standing and stock stability. | Target deadline for Nasdaq compliance. |

| Wealth Management Growth | Expand client base, especially high-net-worth individuals, to increase AUM. | Higher recurring advisory fees, increased brokerage revenues. | Global wealth management market projected over $100 trillion by 2025. |

Threats

A general economic downturn, potentially exacerbated by rising interest rates, poses a significant threat to B. Riley Financial. For instance, if the Federal Reserve continues its hawkish stance throughout 2024 and into 2025, higher borrowing costs could dampen M&A activity, a key revenue driver for B. Riley's investment banking segment. This slowdown directly impacts deal flow and can lead to reduced advisory fees.

Market volatility, characterized by sharp price swings, can negatively affect B. Riley's wealth management and proprietary investment arms. Increased unrealized losses on the company's investment portfolio, a common occurrence during turbulent market periods, could directly impact profitability. For example, if major equity indices experience significant declines in late 2024, the value of assets under management could shrink, impacting fee-based revenues.

The financial services landscape is exceptionally crowded, with a multitude of established firms and emerging players vying for market position. B. Riley Financial navigates this intense competition across its core offerings, including investment banking, advisory services, and wealth management. This competitive pressure can directly impact fee structures, profit margins, and the company's ability to grow its market share, as seen in the industry's average operating margins which hovered around 15-20% in early 2024, subject to market volatility.

B. Riley Financial faces ongoing regulatory hurdles, particularly concerning its Nasdaq listing compliance stemming from delayed financial filings. Failure to rectify these filing issues could lead to delisting, a severe blow to its market presence and investor confidence.

The company is also susceptible to evolving financial regulations. Increased scrutiny or new compliance requirements, common in the financial services sector, could significantly raise operational costs and potentially restrict certain business activities, impacting profitability and strategic flexibility.

Reputational Damage and Loss of Key Talent

Persistent negative press or internal discord, as evidenced by its stock performance and reported employee exits, poses a significant threat to B. Riley Financial. This can erode client confidence, making it harder to attract and keep skilled professionals, ultimately hindering business growth.

For instance, the company's stock experienced notable fluctuations in late 2023 and early 2024, partly influenced by market sentiment surrounding its operations. Reports in early 2024 also indicated departures of key personnel in certain divisions, raising concerns about talent retention.

- Reputational Erosion: Continued negative publicity can tarnish B. Riley's brand image, impacting client acquisition and retention efforts.

- Talent Drain: Difficulty in attracting and retaining top-tier financial professionals could weaken the firm's competitive edge and service delivery.

- Diminished Business Prospects: A damaged reputation and talent loss can lead to fewer strategic partnerships and reduced deal flow.

Liquidity and Debt Maturity Risks

Despite efforts to reduce its debt, B. Riley Financial still carries a significant debt burden. Upcoming maturities, especially those due in 2026 and beyond, pose a persistent liquidity risk. While the company has managed near-term obligations, refinancing larger amounts in potentially challenging market environments remains a concern.

For instance, as of the first quarter of 2024, B. Riley Financial reported total debt of approximately $1.3 billion. A notable portion of this debt matures in the coming years, requiring careful management and access to capital markets.

- Substantial Debt Load: The company's overall leverage remains a key consideration for financial stability.

- Upcoming Maturities: Significant debt obligations are scheduled for repayment in the medium to long term, particularly from 2026 onwards.

- Refinancing Risk: The ability to secure new financing or refinance existing debt at favorable terms is dependent on market conditions, which can fluctuate.

B. Riley Financial faces significant threats from a challenging macroeconomic environment, including potential interest rate hikes impacting M&A activity and market volatility affecting investment portfolios. Intense competition within the financial services sector could compress profit margins, while ongoing regulatory scrutiny and compliance issues, particularly regarding Nasdaq listing, pose a risk of delisting and reputational damage. Furthermore, negative publicity and talent drain can erode client confidence and hinder growth prospects.

| Threat Category | Specific Threat | Potential Impact | Relevant Data Point (as of Q1 2024) |

| Macroeconomic | Interest Rate Hikes & Economic Downturn | Reduced M&A activity, lower advisory fees | Federal Reserve's continued hawkish stance |

| Market Conditions | Market Volatility | Unrealized losses, reduced AUM and fee revenue | Potential declines in major equity indices |

| Competitive Landscape | Intense Competition | Pressure on fees, reduced market share, lower profit margins | Industry average operating margins ~15-20% |

| Regulatory & Compliance | Delayed Financial Filings & Evolving Regulations | Risk of delisting, increased operational costs, restricted activities | Nasdaq listing compliance issues |

| Reputational & Operational | Negative Publicity & Talent Drain | Erosion of client confidence, difficulty attracting/retaining talent | Stock performance fluctuations (late 2023/early 2024), reported employee exits |

| Financial Structure | Debt Burden & Refinancing Risk | Liquidity risk, challenges refinancing in volatile markets | Total debt ~ $1.3 billion |

SWOT Analysis Data Sources

This B. Riley Financial SWOT analysis is built upon a foundation of credible data, including the company's official financial filings, comprehensive market research reports, and expert commentary from industry analysts to ensure a robust and insightful assessment.