B. Riley Financial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B. Riley Financial Bundle

B. Riley Financial operates within a complex financial services landscape, facing moderate threats from new entrants and substitutes, while buyer power and supplier influence present distinct challenges. Understanding the intensity of each of these forces is crucial for navigating this dynamic market.

The complete report reveals the real forces shaping B. Riley Financial’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

B. Riley Financial's success hinges on its highly skilled financial professionals, including investment bankers, financial advisors, and wealth managers. The intense competition for this specialized talent in the financial services sector grants these individuals considerable leverage. For instance, as of early 2024, average compensation for senior investment bankers in major financial hubs could easily exceed $300,000 annually, plus significant bonuses, reflecting the high demand and the bargaining power of these experts.

B. Riley Financial relies heavily on specialized technology and software providers, particularly for advanced financial software, data analytics platforms, and cybersecurity solutions. The leverage these suppliers hold is considerable because B. Riley's operational efficiency and ability to deliver services are directly tied to these specialized tools.

The cost and complexity associated with switching providers or integrating new systems can significantly limit B. Riley's alternatives, thus strengthening the bargaining power of these technology suppliers. For instance, the global market for financial analytics software was projected to reach over $30 billion in 2024, highlighting the significant investment required for such specialized solutions.

Proprietary market data providers hold significant bargaining power over B. Riley Financial. Access to accurate, timely, and unique market data, research, and intelligence is fundamental to B. Riley's advisory services and investment decisions. In 2024, the demand for specialized financial data continued to rise, with firms increasingly relying on these providers for a competitive edge.

The critical nature of this information, coupled with the substantial investment required to develop and maintain such datasets, allows these suppliers to command premium pricing. The difficulty in replicating proprietary data further solidifies their leverage, as B. Riley has limited alternatives for acquiring comparable insights.

Regulatory and Legal Service Providers

The bargaining power of regulatory and legal service providers for a firm like B. Riley Financial is substantial. Given the highly regulated nature of the financial services industry, B. Riley is heavily reliant on specialized legal counsel and compliance experts to navigate complex frameworks and avoid severe penalties. For instance, in 2023, financial services firms globally faced increasing scrutiny, leading to a rise in compliance costs and a greater demand for specialized legal advice.

These expert providers wield significant influence due to their deep knowledge and the critical nature of their services. Non-compliance with regulations can result in hefty fines, reputational damage, and operational disruptions, making adherence paramount. The market for these services often features a limited number of highly qualified firms, further concentrating their bargaining power.

- High Demand for Specialized Expertise: Financial services firms require niche legal and compliance skills, creating a concentrated demand for a limited supply of top-tier providers.

- Risk of Non-Compliance: The severe financial and reputational consequences of regulatory breaches empower legal and compliance firms to command higher fees and dictate terms.

- Industry Regulation Intensity: The ever-evolving and stringent regulatory landscape in finance necessitates ongoing engagement with these specialized services, solidifying their essential role.

- Limited Substitutes: For critical regulatory matters, there are few, if any, effective substitutes for qualified legal and compliance professionals.

Capital and Funding Sources for Proprietary Investments

B. Riley Financial's involvement in proprietary investments means it often needs external capital. The terms offered by lenders and co-investors can significantly impact the cost and availability of this funding, especially for substantial or intricate transactions.

For instance, in 2024, B. Riley's ability to secure favorable debt financing for its investment activities is crucial. The interest rates and covenants imposed by banks or private credit funds directly affect the profitability of these proprietary deals.

- Reliance on External Capital: Proprietary investments necessitate access to funding beyond B. Riley's own equity.

- Lender Influence: Terms set by lenders, such as interest rates and collateral requirements, directly impact investment costs.

- Co-investor Dynamics: Agreements with co-investors can influence deal structures and profit sharing.

- Impact on Profitability: The cost of capital is a critical determinant of the success of B. Riley's proprietary investment strategy.

B. Riley Financial's reliance on specialized talent, particularly in areas like investment banking and wealth management, grants these professionals significant bargaining power. The high demand for their expertise, evidenced by average senior investment banker compensation exceeding $300,000 annually plus bonuses in early 2024, allows them to negotiate favorable terms.

Suppliers of critical technology and proprietary data also hold considerable sway. The cost and complexity of switching financial analytics software, for example, which was a market projected to exceed $30 billion in 2024, reinforce the leverage of these providers. Similarly, the unique nature of market intelligence data, essential for competitive advantage, allows data providers to command premium pricing.

The bargaining power of regulatory and legal service providers is substantial due to the financial industry's stringent compliance requirements. The increasing global scrutiny on financial services firms in 2023 amplified demand for specialized legal advice, empowering these firms to dictate terms given the severe consequences of non-compliance.

What is included in the product

This analysis dissects the competitive forces impacting B. Riley Financial, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly understand the competitive landscape and identify strategic vulnerabilities with a clear, actionable Porter's Five Forces analysis for B. Riley Financial.

Gain a competitive edge by proactively addressing threats and capitalizing on opportunities identified through this powerful analytical framework.

Customers Bargaining Power

B. Riley Financial caters to a wide array of clients, encompassing corporations, institutional investors, and affluent individuals. This broad client base inherently diversifies demand and reduces the concentrated power any single customer segment might wield.

While large institutional clients or high-net-worth individuals might possess greater individual bargaining power due to the scale of their transactions, B. Riley's ability to serve multiple client types simultaneously dilutes the overall impact of customer power on its operations.

Customers seeking financial services today have an expansive landscape of options. They can choose from massive, globally recognized investment banks, specialized boutique advisory firms, or even independent wealth managers who offer personalized guidance. This sheer volume of alternatives significantly amplifies customer bargaining power.

With so many providers available, clients can readily switch if they encounter dissatisfaction with service quality or find better pricing elsewhere. For instance, in 2024, the wealth management sector continued to see a robust flow of assets between firms, with many clients actively seeking competitive fees and superior digital platforms, underscoring the impact of provider availability on customer leverage.

For commoditized financial services, customers often exhibit significant price sensitivity. This means that when services are similar across providers, clients are more likely to choose the cheapest option. This can put pressure on B. Riley Financial's ability to charge premium fees, particularly in areas where their offerings are not highly differentiated.

Sophistication of Institutional and High-Net-Worth Clients

Institutional and high-net-worth clients possess a high degree of financial sophistication. Their extensive knowledge of market trends and financial instruments allows them to negotiate terms more assertively and seek customized service offerings.

These informed clients often leverage their financial acumen to demand competitive pricing and specialized advice, directly impacting the profitability of financial service providers like B. Riley Financial.

- Informed Negotiators: Clients with substantial assets and deep market understanding are better equipped to scrutinize fees and service quality.

- Demand for Customization: Sophisticated clients expect tailored investment strategies and personalized attention, increasing operational complexity.

- Access to Alternatives: High-net-worth individuals and institutions can often access a wider range of investment vehicles and advisors, intensifying competition.

- Price Sensitivity: Despite wealth, these clients are often highly sensitive to perceived value and may switch providers if better terms are available.

Impact of Digitalization on Customer Expectations

Digitalization has significantly amplified customer bargaining power. The proliferation of online platforms and fintech innovations provides consumers with unprecedented access to information and self-service capabilities. This shift directly influences B. Riley Financial by raising expectations for intuitive digital interactions, greater transparency in services and pricing, and the availability of competitive options. For instance, in 2024, the financial advisory sector saw a notable increase in clients utilizing digital tools for research and comparison, with over 60% of retail investors actively using online platforms to vet financial advisors.

These evolving expectations necessitate that B. Riley adapt its service delivery models to remain competitive. Customers now demand seamless, omnichannel experiences, expecting to interact with the firm through various digital touchpoints with consistent efficiency. The ease with which clients can compare services and fees across different providers online intensifies pressure on B. Riley to offer value propositions that are not only competitive but also clearly communicated. A 2024 survey indicated that 75% of consumers prioritize digital convenience when choosing a financial service provider.

- Increased Information Access: Customers can now easily research and compare financial services and fees online, reducing information asymmetry.

- Demand for Digital Experiences: Expectations for user-friendly interfaces, mobile accessibility, and efficient online support are paramount.

- Price Sensitivity: Greater transparency in pricing and the availability of lower-cost digital alternatives put pressure on traditional fee structures.

- Self-Service Empowerment: Clients increasingly prefer to manage aspects of their financial lives independently through digital tools.

The bargaining power of customers for B. Riley Financial is influenced by the broad availability of financial service providers and the increasing sophistication of clients. Customers can readily switch providers if dissatisfied, especially with readily available digital alternatives and transparent pricing. In 2024, the financial advisory sector saw a significant portion of retail investors actively using online platforms to compare advisors, highlighting the impact of provider choice on customer leverage.

Digitalization has further empowered customers, leading to higher expectations for seamless online experiences and competitive fees. The ease of comparing services online intensifies pressure on B. Riley to offer compelling value propositions. A 2024 survey indicated that a substantial majority of consumers prioritize digital convenience when selecting a financial service provider, underscoring the importance of digital offerings in mitigating customer bargaining power.

| Factor | Impact on B. Riley Financial | 2024 Data/Trend |

|---|---|---|

| Availability of Alternatives | High | Clients actively compare and switch providers based on fees and digital platforms. |

| Customer Sophistication | Moderate to High | Informed clients negotiate assertively for customized services and competitive pricing. |

| Digitalization & Transparency | High | Over 60% of retail investors use online platforms to vet advisors; 75% prioritize digital convenience. |

| Price Sensitivity (for commoditized services) | Moderate | Pressure on premium fees where offerings are not highly differentiated. |

What You See Is What You Get

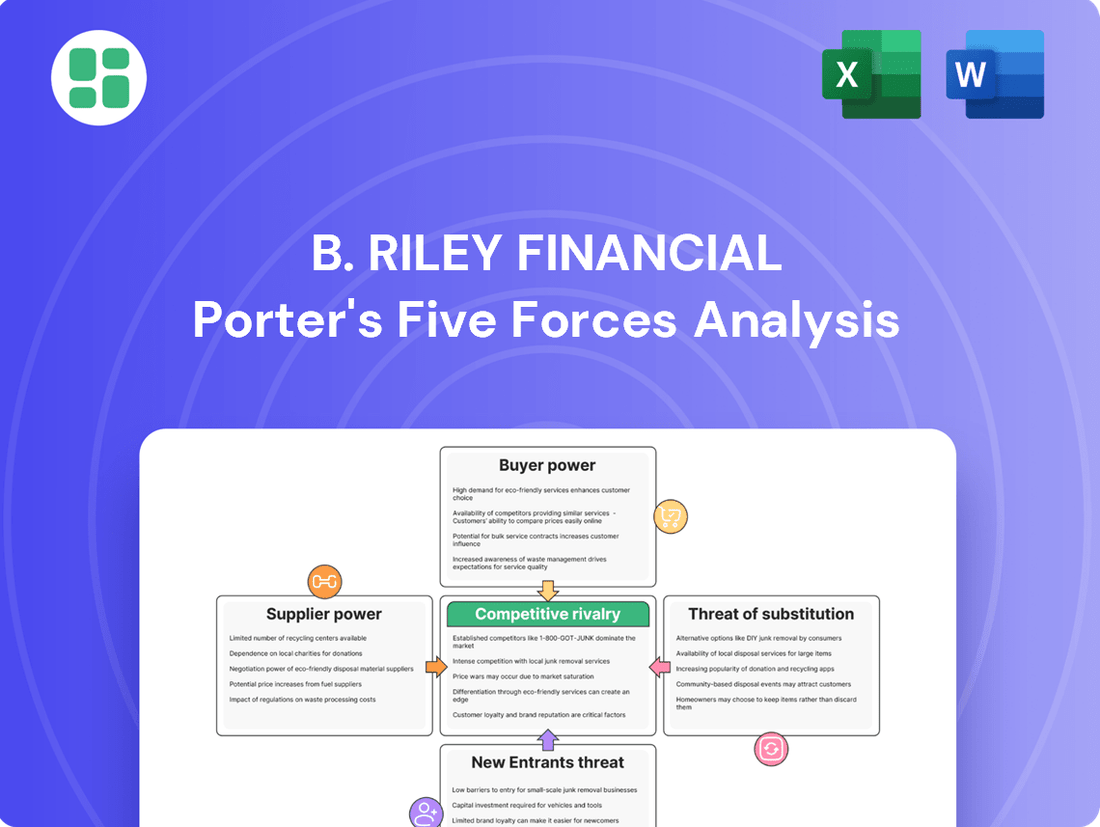

B. Riley Financial Porter's Five Forces Analysis

This preview showcases the full B. Riley Financial Porter's Five Forces Analysis, detailing the competitive landscape, including threats from new entrants, the bargaining power of buyers and suppliers, and the intensity of rivalry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, comprehensive file, ready for immediate use.

Rivalry Among Competitors

B. Riley Financial operates in an environment with significant competitive rivalry from large, diversified financial conglomerates. These giants, such as JPMorgan Chase, Goldman Sachs, and Morgan Stanley, offer a comprehensive suite of services that often overlap with B. Riley's core offerings, including investment banking, wealth management, and various advisory services.

These larger institutions typically possess substantial financial resources, deep-seated brand recognition, and expansive distribution networks, allowing them to invest heavily in technology, talent, and market reach. For instance, as of early 2024, the largest U.S. banks by assets, like JPMorgan Chase with over $3.9 trillion in total assets, demonstrate the scale of capital and operational capacity B. Riley must contend with.

B. Riley Financial encounters significant rivalry from specialized boutique firms, particularly within segments like middle-market investment banking and distinct advisory services. These smaller, focused entities often possess deep expertise in their particular niches, allowing them to be highly responsive and competitive. For instance, in 2024, the advisory landscape saw continued growth in specialized M&A boutiques, with many reporting robust deal pipelines in sectors like technology and healthcare, directly competing for B. Riley's target clients.

The financial services sector is inherently talent-dependent, leading to a constant battle for skilled professionals. This intense rivalry for experienced individuals means firms like B. Riley Financial are frequently engaged in a competitive dance to secure and keep their best people.

This dynamic often results in significant compensation increases as companies try to lure top talent away from rivals or retain their own stars. For instance, in 2024, average compensation packages in specialized financial roles saw an upward trend, with some areas experiencing double-digit percentage increases, directly impacting B. Riley's operational costs and strategic hiring initiatives.

Fragmented Market with Diverse Offerings

The financial services industry is notably fragmented, featuring a multitude of firms providing a wide array of overlapping services. This broad landscape means B. Riley Financial encounters a diverse and often shifting competitive environment.

B. Riley's strategy of operating across multiple financial service verticals significantly expands its competitive set. It contends not only with firms specializing in one area but also with other diversified financial institutions, making direct comparisons challenging.

- Fragmented Market: The financial services sector is characterized by a large number of players, from global banks to boutique advisory firms, all vying for market share.

- Overlapping Services: Many firms offer similar products and services, such as wealth management, investment banking, and capital markets access, intensifying rivalry.

- B. Riley's Diversification: B. Riley's presence in areas like wealth management, financial advisory, and capital markets places it in direct competition with a wide spectrum of specialized and generalist financial entities.

- Competitive Intensity: For instance, in wealth management, B. Riley competes with giants like Merrill Lynch (part of Bank of America) and independent advisors, a testament to the varied competitive pressures.

Technological Advancements and Innovation Race

The financial services industry is in a constant state of flux due to rapid technological advancements. Staying ahead means consistently investing in innovation, particularly in areas like artificial intelligence (AI), automation, and sophisticated digital platforms. Companies that lag in adopting these technologies face a significant disadvantage, fueling an intense rivalry to deliver the most advanced and user-friendly solutions.

This innovation race is clearly visible in the increasing venture capital funding directed towards fintech startups. In 2023 alone, global fintech funding reached over $40 billion, with a substantial portion allocated to AI and data analytics solutions. For instance, firms are developing AI-powered robo-advisors that offer personalized investment strategies, a stark contrast to traditional advisory models. This trend is expected to accelerate, with projections indicating that AI in financial services could reach a market size of over $25 billion by 2025.

- Fintech Funding: Global fintech funding exceeded $40 billion in 2023, highlighting significant investment in technological innovation.

- AI Adoption: Companies are prioritizing AI and automation to enhance efficiency and customer experience, driving competitive differentiation.

- Digital Platforms: The development and adoption of advanced digital platforms are crucial for firms to remain competitive in the evolving financial landscape.

- Market Growth: The AI in financial services market is projected to grow substantially, reaching over $25 billion by 2025, underscoring the importance of this technological shift.

Competitive rivalry for B. Riley Financial is intense, stemming from both large, diversified financial institutions and specialized boutique firms. The sheer scale and resources of giants like JPMorgan Chase, with over $3.9 trillion in assets as of early 2024, present a formidable challenge. Simultaneously, nimble boutique firms offering niche expertise, particularly in areas like middle-market M&A, actively compete for clients. This fragmented market, characterized by overlapping services and a constant battle for top talent, necessitates continuous innovation and strategic positioning for B. Riley.

SSubstitutes Threaten

Corporations increasingly bypass traditional investment banks for capital raising. In 2023, direct listings saw a notable uptick, with companies like Reddit choosing this path, illustrating a growing trend away from IPOs managed by intermediaries. This shift directly impacts firms like B. Riley Financial by reducing the need for their underwriting and advisory services.

The proliferation of robo-advisors and automated investment platforms presents a significant threat of substitution for traditional wealth management services. These digital alternatives offer cost-effective, streamlined investment advice and portfolio management, directly competing with services historically provided by firms like B. Riley Financial.

While B. Riley primarily serves high-net-worth clients, the growing capabilities and widespread adoption of these automated solutions mean they are increasingly encroaching on segments of the advisory market. For instance, by early 2024, assets under management on major robo-advisor platforms had surpassed hundreds of billions of dollars, demonstrating their substantial market presence and appeal, particularly to a younger demographic or those seeking simpler investment strategies.

Large corporations increasingly possess sophisticated in-house corporate finance teams. These internal departments can manage complex tasks like mergers and acquisitions, optimize capital structure, and provide strategic advisory services, thereby lessening the need for external financial advisory firms such as B. Riley.

Alternative Funding Sources and Private Markets

The burgeoning private equity, venture capital, and private credit markets present a significant threat by offering alternative funding avenues. These channels can diminish a company's reliance on traditional investment banking services offered by firms like B. Riley Financial. For instance, the global private equity market size was valued at approximately $7.4 trillion in 2023 and is projected to reach $14.6 trillion by 2030, indicating a substantial shift in capital availability away from public markets.

Furthermore, B. Riley's own direct investments and proprietary capital offerings can function as substitutes for clients. Businesses seeking direct investment opportunities might bypass traditional advisory services altogether, opting instead for direct engagement with capital providers. This trend is amplified as more institutional and sophisticated investors allocate capital to private markets, seeking higher yields and diversification.

- Private Equity Growth: The private equity market continues its rapid expansion, offering substantial capital pools.

- Venture Capital Accessibility: Venture capital is increasingly accessible to a wider range of startups and growth-stage companies.

- Private Credit Expansion: The private credit sector provides flexible and often faster financing solutions compared to traditional bank loans.

- Direct Investment Appeal: Proprietary investment arms of financial institutions, like B. Riley's, offer clients direct access to opportunities, bypassing intermediaries.

Increased Financial Literacy and DIY Investment Tools

The rise of readily available financial information and intuitive investment platforms poses a significant threat of substitution for traditional financial advisory services. As individuals and smaller businesses become more financially literate, they may opt to manage their own portfolios and financial planning, bypassing intermediaries.

This trend is underscored by the increasing adoption of robo-advisors and online brokerage platforms. For instance, by the end of 2023, the assets under management in robo-advisory services globally were projected to reach over $2 trillion, indicating a substantial shift towards self-directed investing.

- Increased Accessibility: Online platforms and educational resources have democratized financial knowledge, making complex investment strategies more understandable.

- Cost-Effectiveness: DIY investing and robo-advisors often come with lower fees compared to traditional human advisors, appealing to cost-conscious investors.

- Technological Advancements: User-friendly apps and tools provide real-time market data, portfolio tracking, and automated rebalancing, enhancing the self-management experience.

- Growing Investor Confidence: As more individuals successfully navigate their investments, their confidence in managing their own finances grows, further reducing reliance on external advice.

The threat of substitutes for B. Riley Financial's services is multifaceted, encompassing alternative capital raising methods, digital investment platforms, and sophisticated in-house corporate finance capabilities. Companies are increasingly exploring direct listings and private markets, bypassing traditional investment banking routes. For instance, the global private equity market was valued at approximately $7.4 trillion in 2023, highlighting a significant alternative funding landscape.

Robo-advisors and automated investment platforms offer cost-effective competition, with assets under management on these platforms surpassing hundreds of billions of dollars by early 2024. This trend is further amplified by readily available financial information and user-friendly online tools, empowering individuals and businesses with DIY financial management solutions.

Large corporations are also building robust internal finance teams capable of handling complex transactions, reducing their reliance on external advisory firms. Furthermore, B. Riley's own direct investment offerings can serve as substitutes, allowing clients direct access to opportunities and circumventing traditional advisory roles.

Entrants Threaten

Establishing a diversified financial services firm, akin to B. Riley Financial, demands significant upfront capital. This includes substantial investments in technology infrastructure, meeting stringent regulatory compliance standards, and funding proprietary investment strategies. For instance, in 2024, the average cost to launch a new registered investment advisor firm in the US was estimated to be between $10,000 and $50,000, but this figure escalates dramatically for firms offering a broader suite of services like B. Riley.

These considerable capital requirements act as a formidable barrier to entry, effectively deterring many potential new competitors from entering the market. The sheer scale of funding needed to build a robust operational framework and maintain a competitive edge makes it challenging for smaller, less capitalized entities to challenge established players.

The financial services sector is a minefield of regulations, demanding extensive licensing, rigorous compliance, and constant reporting. For any new player, the sheer complexity and cost of navigating this intricate web are substantial deterrents. For instance, in 2024, the Securities and Exchange Commission (SEC) continued to enforce stringent rules, with compliance costs for financial firms often running into millions of dollars annually, directly impacting profitability and market entry feasibility.

Success in investment banking, wealth management, and advisory services is built on a foundation of client trust, a proven track record, and a strong brand reputation. New entrants face a steep climb to establish this credibility, as it requires significant time and consistent performance to cultivate. For instance, B. Riley Financial's long-standing presence and established relationships in the market provide a distinct advantage over emerging firms.

Difficulty in Attracting and Retaining Top Talent

The financial services industry, particularly for a firm like B. Riley Financial, faces a significant hurdle in attracting and retaining top-tier talent. The specialized knowledge required in areas like investment banking, wealth management, and research means there's a constant, fierce competition for experienced professionals. New entrants often find it exceptionally difficult to lure away seasoned teams from established players who can offer greater stability, more attractive compensation packages, and a proven track record.

This difficulty directly impacts a new entrant's ability to compete. Without a strong, experienced workforce, they struggle to offer the comprehensive suite of services that clients expect. For instance, in 2024, the demand for financial analysts with expertise in artificial intelligence and data analytics saw a significant uptick, with reported salary increases of 15-20% for those with specialized skills. New firms may not have the capital or the established reputation to match these competitive offers, hindering their growth and service delivery capabilities.

- High Demand for Specialized Skills: Financial services require niche expertise, leading to intense competition for qualified individuals.

- Talent Retention Challenges: Established firms offer better incentives, making it hard for new entrants to poach experienced staff.

- Impact on Service Offering: A lack of experienced talent limits a new firm's ability to provide a full range of financial services.

- 2024 Market Trends: The demand for AI and data analytics specialists in finance drove significant salary increases, exacerbating the challenge for new entrants.

Technological Infrastructure and Scalability Costs

The substantial cost and complexity of building and maintaining advanced technological infrastructure act as a significant deterrent for potential new entrants. This includes robust data analytics capabilities, secure trading platforms, and comprehensive client relationship management systems. For instance, in 2024, the average annual expenditure on financial technology (FinTech) by established firms often runs into tens of millions of dollars, covering everything from cloud computing to cybersecurity and AI-driven tools.

Scalability also presents a major hurdle. New firms must not only invest in current technology but also ensure it can grow with their business, a process that demands continuous capital outlay and specialized IT talent. The need for high-speed, reliable connectivity and sophisticated software development can easily require initial investments exceeding several million dollars before any revenue is generated.

- High Initial Investment: Developing cutting-edge financial platforms can cost millions, creating a substantial barrier.

- Ongoing Maintenance and Upgrades: Continuous investment is needed to keep technology competitive and secure.

- Talent Acquisition: Specialized IT and data science expertise is costly and in high demand.

The threat of new entrants in the diversified financial services sector, like B. Riley Financial, is significantly mitigated by the immense capital required. Launching a comprehensive financial services firm necessitates vast sums for technology, regulatory compliance, and talent acquisition. For example, in 2024, the cost to establish even a basic registered investment advisor firm could range from $10,000 to $50,000, a figure that balloons into millions for firms offering B. Riley's breadth of services.

Furthermore, the industry's complex regulatory landscape, demanding extensive licensing and ongoing compliance, acts as a substantial deterrent. In 2024, the SEC's rigorous enforcement meant compliance costs for financial firms often reached millions annually. This, combined with the need to build trust and a strong brand reputation over time, makes it incredibly challenging for new players to gain traction against established entities.

| Barrier to Entry | Description | Estimated 2024 Impact |

| Capital Requirements | Significant upfront investment in technology, compliance, and operations. | Millions of dollars for comprehensive services. |

| Regulatory Complexity | Navigating licenses, compliance, and reporting demands. | Annual compliance costs in the millions for established firms. |

| Brand Reputation & Trust | Building credibility and client relationships takes considerable time and consistent performance. | Long-standing firms like B. Riley have a distinct advantage. |

| Talent Acquisition | Attracting and retaining specialized financial expertise is costly and competitive. | Demand for AI/data analytics specialists saw 15-20% salary increases in 2024. |

Porter's Five Forces Analysis Data Sources

Our B. Riley Financial Porter's Five Forces analysis is built upon a foundation of comprehensive data, including SEC filings, investor relations materials, and industry-specific market research reports. We also leverage financial databases and analyst reports to capture the nuances of competitive dynamics.