B. Riley Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B. Riley Financial Bundle

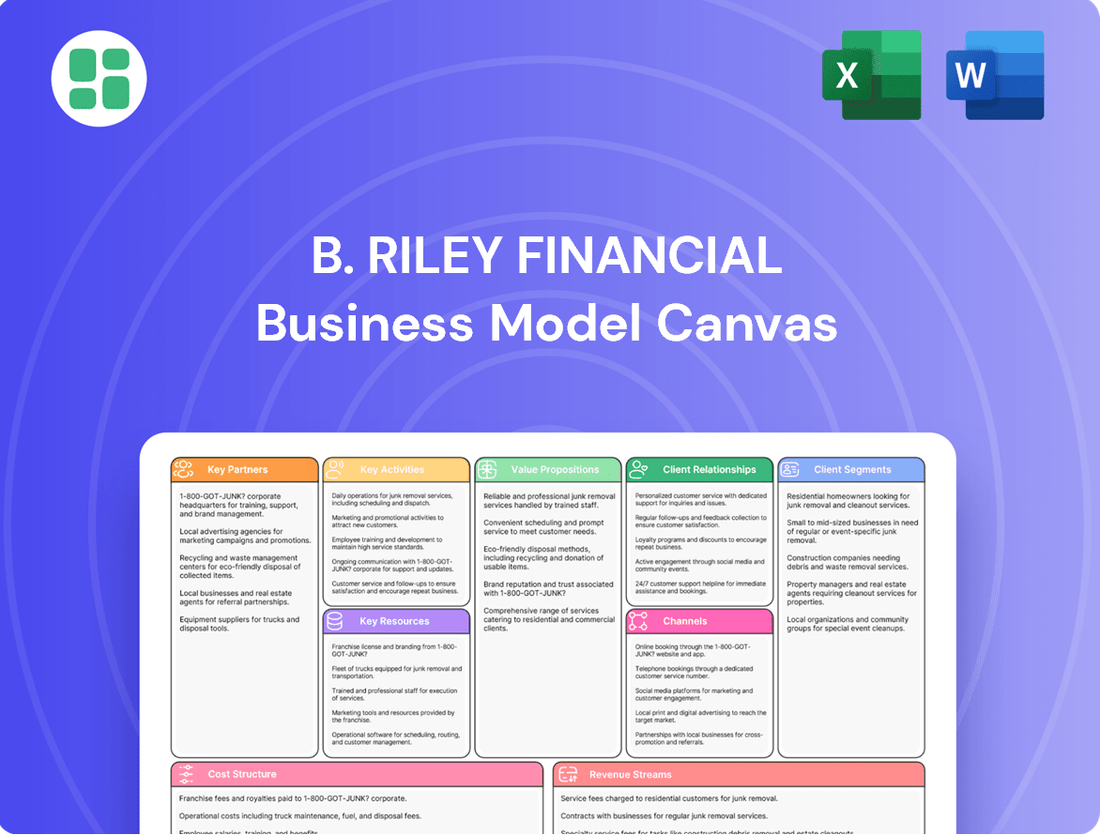

Explore the intricate workings of B. Riley Financial's business model with our comprehensive Business Model Canvas. This detailed breakdown illuminates their diverse revenue streams, strategic partnerships, and customer relationships, offering a clear picture of their market approach. Unlock actionable insights for your own strategic planning.

Partnerships

B. Riley Financial actively collaborates with a diverse range of financial institutions, including banks and credit unions. These relationships are fundamental to their capital markets operations, facilitating co-underwriting, syndication of deals, and various lending activities.

These strategic alliances are vital for B. Riley Financial, enabling them to significantly broaden their market presence and enhance their capacity to handle larger, more complex transactions. For instance, in 2024, their involvement in syndicated loan markets demonstrated the critical role these partnerships play in their deal origination and execution capabilities.

B. Riley Financial actively collaborates with private equity firms and family offices, leveraging these relationships to enhance its investment banking and advisory offerings. This partnership is crucial for generating deal flow in mergers and acquisitions and for securing capital solutions for B. Riley's portfolio companies.

These strategic alliances are instrumental in driving value creation by connecting capital with opportunities. For instance, in 2023, B. Riley's investment banking segment advised on numerous transactions, many of which involved private equity sponsors, underscoring the importance of these key partnerships in their business model.

B. Riley Financial strategically partners with prominent legal and accounting firms to offer clients robust financial advisory, restructuring, and litigation support. These alliances are crucial for navigating complex regulatory landscapes and ensuring specialized expertise for intricate client requirements, thereby bolstering compliance and providing essential external validation.

Industry Experts and Consultants

B. Riley Financial actively cultivates relationships with a cadre of industry experts and specialized consultants. These partnerships are crucial for bolstering their business advisory and valuation services. By tapping into this deep well of specialized knowledge, B. Riley can offer clients unparalleled insights across a broad spectrum of industries. This collaborative approach ensures more informed decision-making and the development of highly tailored, effective solutions for their clientele.

In 2024, B. Riley's strategic engagement with these external specialists directly contributed to their ability to navigate complex market dynamics. For instance, their advisory services on mergers and acquisitions in the technology sector benefited from consultants with direct experience in emerging AI and cybersecurity trends. This access to cutting-edge expertise allowed B. Riley to provide clients with valuations that reflected the most current market valuations and future growth projections.

The benefits of these key partnerships are multifaceted:

- Enhanced Advisory Services: Access to niche industry knowledge elevates the quality and depth of strategic advice provided to clients.

- Accurate Valuations: Collaboration with experts ensures valuations are grounded in the latest market data and sector-specific trends.

- Tailored Solutions: The ability to draw on diverse specialized expertise allows for the creation of bespoke strategies addressing unique client challenges.

- Broader Sector Coverage: Partnerships enable B. Riley to effectively serve clients across a wider array of industries, from healthcare to advanced manufacturing.

Technology and Data Providers

B. Riley Financial relies heavily on technology and data providers to fuel its sophisticated analytics and market intelligence capabilities. These partnerships are essential for maintaining efficient platform operations, particularly within its institutional brokerage and wealth management divisions. By integrating robust data streams and advanced technological solutions, the firm significantly enhances its service delivery and solidifies its competitive edge in the financial services landscape.

These collaborations enable B. Riley Financial to offer clients cutting-edge insights and streamlined investment processes. For instance, access to real-time market data and powerful analytical tools allows advisors to provide more informed recommendations and manage portfolios with greater precision. This strategic reliance on external expertise ensures B. Riley remains at the forefront of technological adoption in the industry.

- Data Access: Partnerships with providers like Bloomberg, Refinitiv, and FactSet offer critical real-time financial data, news, and analytics.

- Platform Integration: Collaborations with technology firms ensure seamless integration of trading platforms, CRM systems, and client portals.

- Advanced Analytics: Leveraging AI and machine learning capabilities from tech partners enhances predictive modeling and investment research.

- Operational Efficiency: Outsourcing certain technological infrastructure and data management tasks allows for greater focus on core financial services.

B. Riley Financial's key partnerships are crucial for expanding its service offerings and market reach. Collaborations with banks and credit unions facilitate capital markets activities, while alliances with private equity firms and family offices drive deal flow in mergers and acquisitions.

Strategic partnerships with legal and accounting firms are vital for navigating complex regulatory environments and providing specialized client support. Furthermore, relationships with industry experts and consultants enhance advisory and valuation services, ensuring clients receive tailored and informed solutions.

These partnerships are essential for leveraging specialized knowledge and accessing capital, directly impacting B. Riley's ability to execute complex transactions and deliver high-value advisory services. For instance, in 2024, the firm actively engaged with these partners to bolster its deal origination and client advisory capabilities across various sectors.

What is included in the product

A comprehensive, pre-written business model tailored to B. Riley Financial’s strategy, detailing its diverse client base and integrated financial services.

Organized into 9 classic BMC blocks, it reflects B. Riley Financial’s real-world operations and plans, offering insights for informed decision-making.

B. Riley Financial's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex operations, simplifying strategic understanding for stakeholders.

Activities

Investment banking and capital markets at B. Riley Financial are central to their operations, focusing on advising clients through complex transactions like mergers and acquisitions. They also facilitate capital raising through both equity and debt issuances, a critical function for many businesses. This segment also includes institutional brokerage, connecting buyers and sellers of securities.

B. Riley's strength lies in its integrated approach. Their cross-platform expertise means they can offer comprehensive, collaborative solutions, leveraging insights from across their various business units. This allows them to provide a full suite of services, from initial advisory to the execution of capital markets transactions.

In 2023, B. Riley Securities, their investment banking arm, was active in numerous M&A deals and capital raises. For instance, they were a lead bookrunner on several significant follow-on equity offerings, demonstrating their capability in the public markets. Their advisory services were also in demand, with a notable presence in middle-market transactions across various sectors.

B. Riley Financial's Financial Advisory & Consulting segment is a cornerstone of its operations, focusing on providing expert advice across critical areas like corporate restructuring, bankruptcy proceedings, and litigation support. This involves crucial services such as business appraisal and valuation, essential for navigating complex financial situations.

This specialized consulting arm has demonstrated robust performance, largely fueled by a consistent and growing demand for its niche expertise. In 2024, the firm's advisory services played a significant role in facilitating transactions and providing strategic guidance to clients facing intricate financial challenges, underscoring the value of their specialized knowledge.

B. Riley Financial's wealth and asset management segment focuses on serving high-net-worth individuals and institutions. This involves crafting personalized investment portfolios and offering comprehensive private wealth management services. In 2024, the firm continued to expand its reach in this area, aiming to provide sophisticated financial solutions.

The business also encompasses institutional brokerage and asset management, catering to a broader client base. These services are crucial for generating recurring revenue and deepening client relationships. B. Riley's strategy emphasizes leveraging its expertise to deliver tailored investment outcomes for its diverse clientele.

Proprietary Investments

B. Riley Financial actively pursues proprietary investments, deploying capital into a diverse range of businesses and assets. This strategy leverages their deep operational knowledge to enhance value and generate superior returns, setting them apart from firms solely focused on advisory services.

In 2024, B. Riley Financial's commitment to proprietary investments was evident in their strategic capital allocation. For instance, their investments in sectors like digital media and specialized manufacturing demonstrate a proactive approach to identifying and capitalizing on growth opportunities. These ventures are managed with an emphasis on operational improvement and strategic integration, aiming to unlock inherent potential.

- Opportunistic Deployment: Capital is strategically deployed into businesses and assets offering significant upside potential.

- Operational Expertise: In-house operational capabilities are utilized to actively manage and improve portfolio companies.

- Value Creation Focus: The primary objective is to maximize returns through active management and strategic enhancements.

- Differentiated Offering: This direct investment approach distinguishes B. Riley from traditional fee-based financial service providers.

Auction and Liquidation Services

B. Riley Financial's Auction and Liquidation Services are a core component of their advisory offerings, specializing in managing the sale of various assets, particularly in situations like corporate restructuring or when businesses face financial distress. This segment provides clients with a complete solution for asset disposition.

These services are crucial for companies needing to efficiently convert assets into cash, often under tight deadlines. The expertise here lies in valuing, marketing, and executing sales for a wide range of items, from real estate and equipment to intellectual property and inventory.

- Asset Disposition Expertise B. Riley Financial manages the sale of diverse assets, including machinery, inventory, and intellectual property.

- Distressed Situations Focus A significant portion of their work involves liquidating assets for companies undergoing bankruptcy or financial restructuring.

- Comprehensive Service Model They offer end-to-end solutions, covering valuation, marketing, and the final sale execution.

B. Riley Financial's key activities revolve around providing comprehensive financial advisory and capital markets services. They facilitate mergers and acquisitions, manage capital raises through equity and debt, and offer institutional brokerage. Furthermore, their financial advisory and consulting segment delivers expert advice on restructuring and valuations, while wealth and asset management caters to high-net-worth clients. The firm also engages in proprietary investments and specialized auction and liquidation services.

| Key Activity | Description | 2024 Focus/Data Point |

| Investment Banking & Capital Markets | Advising on M&A, facilitating capital raises, institutional brokerage. | Active in middle-market transactions and public market capital raises. |

| Financial Advisory & Consulting | Corporate restructuring, bankruptcy, litigation support, business valuation. | Consistent demand for niche expertise in complex financial situations. |

| Wealth & Asset Management | Serving high-net-worth individuals and institutions with personalized portfolios. | Continued expansion of reach, providing sophisticated financial solutions. |

| Proprietary Investments | Deploying capital into diverse businesses and assets for value enhancement. | Strategic allocation in sectors like digital media and specialized manufacturing. |

| Auction & Liquidation Services | Managing asset sales for distressed companies or restructuring. | End-to-end solutions for efficient asset-to-cash conversion. |

What You See Is What You Get

Business Model Canvas

The B. Riley Financial Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the complete, ready-to-use file. You will gain full access to this professionally structured and formatted Business Model Canvas, identical to what you see here, allowing you to immediately leverage its insights for your strategic planning.

Resources

B. Riley Financial's human capital is its bedrock, comprising highly skilled financial professionals, investment bankers, advisors, and analysts. This deep pool of talent represents the firm's core intellectual capital, driving its success across a spectrum of financial services.

The collective expertise of these individuals, spanning investment banking, wealth management, and capital markets, is a critical resource. For instance, as of the first quarter of 2024, B. Riley Financial reported total employees of approximately 2,500, underscoring the scale of its human capital investment.

B. Riley Financial's access to significant financial capital, including proprietary investment funds and credit facilities, is a cornerstone of its business model. This robust capital base, estimated in the billions of dollars, directly fuels its capacity for underwriting, lending, and principal investments. For instance, in 2024, the company continued to leverage its substantial liquidity to execute a range of strategic transactions and support its diverse client base.

B. Riley Financial's reputation for expertise and successful execution in financial services is a cornerstone of its business model, fostering client trust and driving new opportunities. This intangible asset, built over years of operation, underpins their ability to attract and retain clients across various segments of the financial industry.

While the company has navigated challenges, the ongoing effort to maintain and rebuild its reputation remains paramount. A strong brand image directly influences client acquisition and retention, especially in a competitive landscape where trust is a key differentiator. For instance, in 2023, B. Riley Financial continued to emphasize its advisory capabilities, a testament to its focus on leveraging its established expertise to generate business.

Proprietary Data and Market Intelligence

B. Riley Financial leverages proprietary data and market intelligence to fuel its operations. This includes access to extensive market data, research reports, and sophisticated analytical tools. This information advantage is crucial for developing informed investment strategies and providing expert advisory services, ultimately delivering high-value insights to clients.

- Proprietary Data Access: B. Riley's internal databases and curated external feeds provide a deep well of market information.

- Advanced Analytical Tools: The firm utilizes proprietary software and models for in-depth market analysis and forecasting.

- Informed Decision-Making: This intelligence directly supports the strategic allocation of capital and the formulation of client recommendations.

- Competitive Edge: The ability to process and interpret unique data sets offers a distinct advantage in identifying opportunities and mitigating risks.

Technology Infrastructure

B. Riley Financial relies on robust and secure technology infrastructure to power its diverse financial services. This includes sophisticated platforms for trading execution, comprehensive wealth management tools, advanced data analytics capabilities, and secure client communication channels, all essential for efficient operations and superior service delivery.

The company's technology backbone also incorporates critical systems for stringent compliance and proactive risk management. For instance, in 2024, B. Riley Financial continued to invest in cybersecurity measures, with technology spending across the financial services sector seeing significant increases to combat evolving threats.

- Trading Platforms: Enabling seamless and high-speed execution for various asset classes.

- Wealth Management Systems: Providing tools for portfolio tracking, financial planning, and client reporting.

- Data Analytics: Leveraging technology to derive insights from market data and client information.

- Compliance & Risk Management: Ensuring adherence to regulatory requirements and mitigating operational risks.

B. Riley Financial's key resources are its skilled workforce, substantial financial capital, strong reputation, proprietary data, and advanced technology. These elements collectively enable the firm to deliver a wide range of financial services and maintain a competitive edge.

| Key Resource | Description | 2024 Data/Context |

|---|---|---|

| Human Capital | Expert financial professionals, bankers, advisors, analysts. | Approx. 2,500 employees (Q1 2024). |

| Financial Capital | Proprietary funds, credit facilities, substantial liquidity. | Billions of dollars in capital base, used for underwriting, lending, and investments. |

| Reputation | Trust and expertise built over years of operation. | Emphasis on advisory capabilities in 2023 to leverage expertise. |

| Proprietary Data & Analytics | Market intelligence, research, analytical tools. | Crucial for informed investment strategies and client advisory. |

| Technology Infrastructure | Trading, wealth management, analytics, compliance platforms. | Continued investment in cybersecurity in 2024 amidst sector-wide increases. |

Value Propositions

B. Riley Financial provides a wide array of financial services, acting as a single source for clients' needs throughout their business journey. This means clients can access everything from investment banking to wealth management without needing multiple providers.

The firm’s integrated model allows for seamless collaboration across its different divisions, creating a powerful synergy. This cross-platform expertise is a key differentiator, enabling B. Riley to offer truly end-to-end solutions.

For instance, in 2024, B. Riley Securities advised on over 200 M&A transactions and capital raises, demonstrating the breadth of its integrated capabilities. This comprehensive offering caters to a diverse client base, from startups to established corporations.

B. Riley Financial crafts bespoke financial solutions and advisory services, meticulously aligning with each client's unique strategic, operational, and capital requirements. This personalized strategy is core to their business model, ensuring relevance and impact.

Collaboration is paramount, with B. Riley actively partnering with clients throughout every phase of engagement. This hands-on approach was evident in their 2024 performance, where they facilitated numerous complex transactions tailored to specific client needs, demonstrating their commitment to partnership.

B. Riley Financial excels at untangling intricate financial knots, particularly in corporate restructuring and bankruptcy proceedings. Their advisory teams possess specialized knowledge to guide clients through these demanding situations, often involving distressed assets or complex legal frameworks.

Opportunistic Investment Capabilities

B. Riley Financial leverages its proprietary capital and deep operational expertise to seize unique investment opportunities. This dual capability allows the firm to not only invest in various businesses and assets but also actively participate in their growth and value creation, benefiting both clients and shareholders.

This approach translates into direct participation in value creation for stakeholders. For instance, in 2023, B. Riley Financial reported total revenue of $1.3 billion, demonstrating its capacity to generate returns through these opportunistic investments.

- Proprietary Capital Deployment: Ability to invest own funds into attractive ventures.

- Operational Expertise: Providing hands-on management and strategic guidance.

- Client & Shareholder Benefit: Direct participation in the upside of successful investments.

- Value Creation Focus: Actively driving growth and enhancing the worth of portfolio companies.

Access to Capital Markets

B. Riley Financial offers clients efficient pathways to capital markets, crucial for fueling expansion and ensuring liquidity. This includes facilitating both equity and debt offerings, as well as providing robust institutional brokerage services. In 2024, the firm continued to be a key player in helping companies navigate the complexities of raising funds and managing their public market profiles.

The firm's expertise in capital markets access is a cornerstone of its value proposition. By connecting businesses with the necessary financial resources, B. Riley Financial directly contributes to their growth trajectories. For instance, their involvement in underwriting and distributing securities allows companies to access a broad investor base.

- Facilitating Growth: Enabling companies to raise capital for expansion, research and development, and strategic acquisitions.

- Enhancing Liquidity: Providing avenues for existing shareholders to sell their stakes, thereby improving market liquidity.

- Institutional Brokerage: Offering sophisticated trading and execution services for institutional investors, ensuring efficient transactions.

- Public Market Management: Assisting companies in maintaining and optimizing their presence and communication within public markets.

B. Riley Financial's value proposition centers on delivering integrated financial solutions, acting as a single point of contact for clients across their entire business lifecycle. This comprehensive approach, evident in their 2024 M&A and capital raise advisory activities, ensures clients receive seamless support from investment banking to wealth management.

The firm distinguishes itself through bespoke financial strategies and active client collaboration, tailoring services to unique client needs. This partnership model was underscored in 2024 by their facilitation of numerous client-specific transactions, demonstrating a commitment to driving client success through hands-on engagement.

B. Riley Financial also leverages proprietary capital and operational expertise to actively participate in value creation, investing in opportunities and guiding portfolio companies toward growth. This dual capability, reflected in their 2023 revenue of $1.3 billion, allows them to generate returns while directly benefiting clients and shareholders.

Furthermore, the firm provides efficient access to capital markets, crucial for business expansion and liquidity. Their 2024 involvement in capital raises and institutional brokerage services highlights their role in connecting companies with essential financial resources and facilitating strategic growth.

| Value Proposition Aspect | Description | 2024 Data/Example |

|---|---|---|

| Integrated Services | Single source for diverse financial needs | Advised on over 200 M&A and capital raise transactions |

| Bespoke Solutions & Collaboration | Tailored strategies with active client partnership | Facilitated numerous complex client-specific transactions |

| Proprietary Capital & Operational Expertise | Investing own funds and providing strategic guidance | Contributed to value creation in portfolio companies |

| Capital Markets Access | Facilitating growth through equity/debt offerings and brokerage | Continued key role in helping companies raise funds |

Customer Relationships

B. Riley Financial prioritizes building enduring client connections through dedicated relationship management. This involves assigning specific professionals to each client, fostering a deep understanding of their unique and changing financial requirements.

This personalized strategy is particularly vital in the realm of intricate financial services, where trust and tailored advice are paramount. For instance, in 2024, B. Riley's wealth management segment continued to emphasize this model, contributing to a stable client retention rate.

B. Riley Financial cultivates deep customer relationships through its expert advisory and consultation services. Clients trust the firm for high-value, strategic guidance across a spectrum of financial needs, from investment banking to wealth management.

This commitment to expert advice is a cornerstone of their client retention. For instance, in 2024, B. Riley's advisory segments continued to be a significant driver of revenue, reflecting the ongoing demand for their specialized knowledge in navigating complex financial landscapes.

B. Riley Financial excels in customized service delivery, tailoring its financial solutions to the distinct needs of each client. This bespoke approach, evident in their wealth management and capital markets divisions, fosters deep client loyalty and satisfaction.

Proactive Communication and Market Insights

B. Riley Financial prioritizes proactive communication to keep clients informed about market trends, investment opportunities, and their financial performance. This approach ensures clients remain engaged and confident in their financial strategies. For instance, in the first quarter of 2024, B. Riley reported a significant increase in advisory fees, reflecting successful client engagements driven by insightful market analysis.

Providing timely updates and strategic perspectives is a cornerstone of their client relationship management. This includes sharing research reports and commentary that offer actionable insights into economic shifts and sector performance. The firm's commitment to transparency and consistent engagement builds trust and fosters long-term partnerships.

- Market Trend Updates: Regular dissemination of analysis on evolving market conditions.

- Investment Opportunity Alerts: Proactive identification and communication of potential investment avenues.

- Financial Performance Reporting: Transparent and timely updates on client portfolio progress and firm performance.

- Strategic Perspective Sharing: Offering expert insights and guidance on navigating financial landscapes.

High-Touch Support

B. Riley Financial emphasizes a high-touch customer relationship model, offering responsive and accessible support across its diverse service lines. This ensures clients, whether individual investors or institutional clients, receive timely assistance and effective solutions to their inquiries and challenges. This dedicated, hands-on approach cultivates strong client confidence and reinforces the firm's reliability.

This commitment is reflected in their client service philosophy, aiming to build long-term partnerships. For instance, in 2024, B. Riley continued to invest in its client service infrastructure, including digital tools and dedicated relationship managers, to enhance client engagement and satisfaction. Their focus remains on providing personalized guidance, a key differentiator in the competitive financial services landscape.

- Dedicated Relationship Managers

- Proactive Communication Channels

- Tailored Client Solutions

- 24/7 Accessibility for Critical Needs

B. Riley Financial's customer relationships are built on personalized service and expert advice, fostering trust and loyalty. This approach is evident across their diverse financial service offerings, from investment banking to wealth management.

In 2024, B. Riley's focus on dedicated relationship managers and proactive communication, including market trend updates and performance reporting, continued to drive client engagement. This strategy underpins their ability to provide tailored solutions, enhancing client satisfaction and retention.

The firm’s commitment to a high-touch model ensures clients receive responsive support, reinforcing B. Riley's reputation for reliability and expertise in complex financial matters.

| Customer Relationship Aspect | Description | 2024 Data/Observation |

|---|---|---|

| Relationship Management | Dedicated professionals assigned to clients | Continued emphasis on personalized client engagement |

| Communication | Proactive updates on market trends and performance | Increased advisory fees reflect successful client interactions |

| Service Delivery | Tailored financial solutions | Stable client retention in wealth management |

Channels

B. Riley's direct sales and business development teams are crucial for acquiring and nurturing client relationships. These internal groups proactively engage with corporations, institutions, and high-net-worth individuals through direct outreach, networking events, and personalized relationship building. This hands-on approach is the bedrock of their personalized service model.

In 2024, B. Riley Financial continued to emphasize these direct channels, recognizing their efficacy in securing significant mandates and fostering long-term partnerships. The firm's success in areas like investment banking and wealth management heavily relies on the ability of these teams to connect with and understand the unique needs of their target clientele, driving a substantial portion of their revenue generation.

B. Riley Financial's online investor relations portal acts as a primary communication hub, offering timely access to vital documents like their latest quarterly earnings report and SEC filings. This digital channel ensures transparency and broad accessibility for all stakeholders seeking to understand the company's financial performance and strategic direction.

B. Riley Financial leverages industry conferences and events as crucial channels for networking, thought leadership, and client acquisition. Their flagship event, the B. Riley Institutional Investor Conference, is a prime example, drawing significant participation from investors and corporate management.

In 2024, the B. Riley Institutional Investor Conference in May hosted over 1,500 attendees, including representatives from more than 300 public companies. This direct engagement allows B. Riley to showcase its expertise across various sectors and build relationships.

Strategic Partnerships and Referrals

B. Riley Financial actively cultivates strategic partnerships with entities like legal firms and accounting practices. These collaborations are crucial for generating client referrals, thereby expanding their market reach. In 2024, this channel continues to be a cornerstone for organic growth, tapping into established networks of trusted advisors.

These alliances allow B. Riley to access a broader client base that may not be directly reached through their own marketing efforts. By integrating with other professional services, they create a synergistic ecosystem that benefits all parties involved.

- Leveraging existing relationships with legal firms, accounting firms, and other financial intermediaries to generate referrals.

- Expanding reach to new clients through these established professional networks.

- These partnerships serve to organically grow B. Riley's client base and service offerings.

Digital Marketing and Professional Networks

B. Riley Financial leverages digital marketing and professional networks to amplify its brand and connect with its target audience. This involves strategic use of financial news outlets and online platforms to disseminate information and build relationships.

The firm actively engages potential clients and investors through targeted digital campaigns. This proactive approach ensures B. Riley Financial stays visible and relevant in a competitive landscape. In 2024, digital marketing spend across the financial services sector saw continued growth, with a focus on personalized content and data-driven outreach.

Key elements of their digital strategy include:

- Press Releases and Financial News Distribution: Proactively sharing company updates and market insights through reputable financial news channels to enhance transparency and reach a wider audience of investors and industry professionals.

- Professional Network Engagement: Actively participating on platforms like LinkedIn to share expertise, engage in industry discussions, and build direct connections with potential clients, partners, and talent.

- Targeted Digital Advertising: Utilizing paid search and social media advertising to reach specific demographics and professional profiles interested in financial services, investment banking, and wealth management.

- Content Marketing: Producing and distributing valuable content such as white papers, webinars, and market analysis reports to establish thought leadership and attract inbound leads.

B. Riley Financial utilizes a multi-channel approach, blending direct engagement with strategic partnerships and digital outreach. Their direct sales and business development teams are pivotal in cultivating client relationships, while industry conferences, like their Institutional Investor Conference which hosted over 1,500 attendees in 2024, provide significant networking opportunities. Furthermore, collaborations with legal and accounting firms serve as a vital referral engine, expanding their market reach organically.

Digital marketing, including press releases, professional network engagement, and targeted advertising, amplifies their brand visibility. This comprehensive strategy ensures B. Riley remains connected with a diverse audience of investors and corporate clients, driving growth across their service offerings.

Customer Segments

B. Riley Financial serves corporations, both publicly traded and privately held, by offering crucial investment banking services. This includes assisting them with raising capital, navigating complex mergers and acquisitions, and providing strategic financial advice to guide their growth and development.

For instance, in 2024, B. Riley Financial played a significant role in numerous capital raises and M&A transactions across diverse industries, demonstrating their commitment to supporting corporate clients through critical financial events.

Financial institutions, including banks, hedge funds, and mutual funds, represent a key customer segment for B. Riley Financial. These entities require sophisticated institutional brokerage services, in-depth market research, and robust capital markets support to navigate complex transactions and gain crucial market access. In 2024, the demand for specialized financial services from these institutions remained strong, driven by evolving market dynamics and regulatory landscapes.

High-net-worth individuals and family offices represent a core customer segment for B. Riley Financial, seeking sophisticated wealth management, private investment opportunities, and highly personalized financial planning. This group, often characterized by significant asset accumulation, prioritizes tailored strategies and discreet, high-touch service to preserve and grow their wealth. Globally, the number of high-net-worth individuals (those with $1 million or more in investable assets) reached over 22 million in 2023, demonstrating the substantial market opportunity.

Distressed Companies and Creditors

B. Riley Financial serves businesses grappling with significant financial distress and their creditors, offering essential restructuring, appraisal, and liquidation expertise. These situations demand specialized knowledge to navigate complex legal and financial landscapes.

For instance, in 2023, B. Riley’s investment banking segment saw continued activity in restructuring advisory, assisting companies through Chapter 11 filings and out-of-court workouts. Their ability to provide liquidity solutions and asset disposition services is crucial for maximizing recovery for all stakeholders involved.

- Restructuring Advisory: Assisting companies in financial distress with strategic planning and execution to improve financial health or facilitate orderly wind-downs.

- Creditor Services: Providing specialized advice and representation to creditors, including secured lenders and bondholders, during restructuring and bankruptcy proceedings.

- Asset Disposition: Facilitating the sale of distressed assets, including inventory, equipment, and intellectual property, to generate liquidity.

- Valuation and Appraisal: Offering expert valuations of businesses and assets in distressed scenarios to support decision-making for both companies and creditors.

Private Equity Sponsors

B. Riley Financial serves private equity sponsors by offering crucial M&A advisory, capital markets support, and strategic value creation services tailored for their portfolio companies. The firm positions itself as a collaborative partner, actively involved across the entire investment lifecycle to enhance portfolio company performance and facilitate successful exits.

Their expertise is particularly valuable for sponsors seeking to optimize deal sourcing, due diligence, financing, and eventual divestiture. In 2024, the private equity sector continued to be a significant driver of M&A activity, with many firms focusing on operational improvements and bolt-on acquisitions for their existing investments, areas where B. Riley’s advisory capabilities are highly relevant.

- M&A Advisory: Providing strategic advice and execution for buy-side and sell-side transactions, including carve-outs and platform acquisitions.

- Capital Markets Support: Facilitating debt and equity financings, recapitalizations, and IPO readiness for portfolio companies.

- Strategic Value Creation: Offering operational expertise and market insights to drive growth and improve profitability within portfolio investments.

- Lifecycle Partnership: Engaging with sponsors from initial investment through to exit, ensuring alignment and maximizing value at each stage.

B. Riley Financial's customer base is broad, encompassing corporations needing investment banking services for capital raising and M&A, and financial institutions seeking brokerage, research, and capital markets support. They also cater to high-net-worth individuals and family offices requiring wealth management and private investment opportunities. Additionally, the firm assists businesses in financial distress and their creditors with restructuring and asset disposition, and partners with private equity sponsors on M&A and capital markets for their portfolio companies.

Cost Structure

Employee compensation and benefits represent a substantial cost for B. Riley Financial. This category encompasses salaries, bonuses, and comprehensive benefits packages for their extensive workforce of financial experts, including investment bankers, financial advisors, and essential support personnel.

In 2024, B. Riley Financial's total compensation and benefits expenses are projected to be a significant driver of their operational costs, reflecting the high caliber of talent they employ to deliver specialized financial services across investment banking, wealth management, and capital markets.

B. Riley Financial invests heavily in technology and infrastructure to support its diverse financial services. These costs encompass maintaining and upgrading sophisticated IT systems, essential for trading, data analysis, and client interactions. In 2023, technology spending is a significant component of their operational expenses, enabling seamless data flow and robust cybersecurity measures.

B. Riley Financial incurs significant costs related to its physical presence and day-to-day operations. These include expenses for office leases across its numerous locations, essential utilities to keep those spaces running, and the general administrative overhead necessary to support a diversified financial services enterprise. For instance, in 2023, the company reported selling, general, and administrative expenses totaling $711.8 million, reflecting the broad scope of these operational necessities.

Furthermore, operating in the highly regulated financial services industry necessitates substantial investment in regulatory compliance. This involves adhering to various legal and financial standards, which often translates into costs for specialized personnel, legal counsel, and compliance software. These expenditures are critical for maintaining the firm's license to operate and its reputation within the market.

Marketing and Business Development Costs

B. Riley Financial dedicates significant resources to marketing and business development, recognizing these as vital engines for expansion and client engagement. These investments are strategically channeled into building brand recognition, attracting new clients, and fostering key industry relationships.

Key expenditures in this area include participation in industry conferences and professional networking events. These activities are essential for staying abreast of market trends, showcasing B. Riley's capabilities, and generating valuable new business leads. For instance, in 2024, the company continued its active presence at major financial and industry-specific gatherings, aiming to broaden its market reach.

The company's approach to client acquisition is multifaceted, involving targeted outreach and relationship management. This focus on expanding its client base is a cornerstone of its growth strategy, directly contributing to increased revenue streams and market share. The effectiveness of these efforts is reflected in the company's ongoing efforts to secure new mandates and partnerships across its diverse service offerings.

The specific allocation of funds towards these initiatives supports B. Riley's overarching goal of sustainable growth and market leadership. These costs are not viewed as mere expenses but as critical investments in future revenue generation and long-term client value.

- Brand Building: Investments in advertising, public relations, and content marketing to enhance B. Riley's reputation and visibility within the financial services sector.

- Client Acquisition: Costs associated with sales teams, lead generation platforms, and client relationship management systems to attract and onboard new clients.

- Industry Engagement: Expenses for attending and sponsoring industry conferences, trade shows, and networking events to foster connections and identify business opportunities.

- Professional Development: Funding for training and development programs for marketing and business development staff to ensure they possess the latest skills and market knowledge.

Professional Fees and Regulatory Compliance

B. Riley Financial incurs substantial professional fees, covering essential legal counsel, accounting services, and external audits to ensure financial accuracy and transparency. These expenditures are critical for navigating the complex legal landscape of the financial services sector.

Furthermore, significant costs are associated with regulatory compliance. This includes fees for filings with bodies like the SEC and FINRA, as well as investments in systems and personnel to adhere to evolving financial regulations. In 2023, for example, many financial institutions saw increased spending on compliance due to new data privacy and cybersecurity mandates.

- Legal and Accounting Expenses: Costs for external legal advisors, auditors, and accounting firms.

- Regulatory Filing Fees: Payments to government agencies and regulatory bodies for compliance.

- Compliance Infrastructure: Investment in technology and staff to meet regulatory requirements.

- Consulting Services: Fees paid for specialized advice on financial strategy and operations.

Employee compensation and benefits are a significant cost driver for B. Riley Financial, reflecting the specialized expertise of its workforce in investment banking, wealth management, and capital markets. In 2024, these expenses are expected to remain a substantial portion of operational costs, underscoring the firm's commitment to attracting and retaining top talent.

Technology and infrastructure investments are crucial for B. Riley Financial's operations, encompassing IT systems for trading, data analysis, and client interactions. These costs are vital for maintaining robust cybersecurity and ensuring seamless data flow, as seen in their continued spending in 2023.

Operating expenses, including office leases, utilities, and general administrative overhead, represent another key cost area for B. Riley Financial. In 2023, selling, general, and administrative expenses amounted to $711.8 million, highlighting the broad scope of these necessities for their diversified financial services enterprise.

B. Riley Financial incurs considerable costs related to marketing and business development, including participation in industry conferences and networking events. These expenditures in 2024 are strategic investments aimed at enhancing brand visibility and generating new business opportunities.

Professional fees, encompassing legal counsel, accounting services, and external audits, are essential for B. Riley Financial's adherence to financial accuracy and transparency. Additionally, significant investments are made in regulatory compliance, including filing fees and systems to meet evolving financial regulations, with increased spending noted across the industry in 2023.

| Cost Category | 2023 Actuals (Millions USD) | 2024 Projections (Millions USD) | Notes |

|---|---|---|---|

| Employee Compensation & Benefits | N/A | Significant Driver | Reflects high-caliber talent |

| Technology & Infrastructure | Significant Component | Ongoing Investment | Cybersecurity, trading systems |

| Selling, General & Administrative | 711.8 | Projected Increase | Office leases, utilities, overhead |

| Marketing & Business Development | N/A | Strategic Investment | Conferences, networking |

| Professional & Regulatory Fees | N/A | Critical for Compliance | Legal, accounting, filings |

Revenue Streams

B. Riley Financial generates significant revenue through investment banking fees, primarily from advising on mergers and acquisitions (M&A). This segment also earns income by underwriting equity and debt offerings, helping companies raise capital. In 2023, B. Riley's capital markets segment, which includes these activities, saw revenue of $308.7 million.

B. Riley Financial generates significant revenue through its financial advisory and consulting services. These fees stem from specialized expertise offered in areas like corporate restructuring, bankruptcy advisory, business valuation, and litigation support. This segment consistently demonstrates robust performance within the company's portfolio.

In 2023, B. Riley's advisory and consulting segment was a key contributor to its financial success. For instance, the company advised on numerous transactions and restructuring efforts, directly translating into substantial fee income. This expertise is particularly valued during periods of economic uncertainty, driving demand for their specialized services.

B. Riley Financial generates significant revenue through wealth and asset management fees. These fees include a recurring management fee based on a percentage of assets under management, ensuring a stable income stream.

Performance fees are also a key component, incentivizing managers to outperform benchmarks and aligning their interests with clients. In 2024, the firm's focus on these fee-based models continued to drive consistent growth in its advisory and asset management segments.

Commissions earned from executing trades and providing brokerage services for wealth and institutional asset management clients further bolster this revenue stream. This diversified approach to fee generation provides a robust and recurring financial foundation.

Proprietary Investment Gains/Losses

Proprietary investment gains and losses represent profits or losses B. Riley Financial realizes from its direct investments in various businesses and assets. This includes both realized gains from selling investments and unrealized gains from changes in their market value.

This revenue stream can be quite volatile, as the value of investments can fluctuate significantly based on market conditions. For instance, in the first quarter of 2024, B. Riley Financial reported net investment gains of $21.8 million, a notable increase from $4.2 million in the prior year period, showcasing this inherent variability.

- Realized Gains: Profits earned from selling investments at a price higher than their purchase cost.

- Unrealized Gains: Increases in the value of investments that have not yet been sold, reflected through fair value adjustments.

- Volatility: This revenue source is subject to market fluctuations, leading to potential swings in profitability.

- Q1 2024 Performance: The company saw a significant uptick in net investment gains, reaching $21.8 million compared to $4.2 million in Q1 2023.

Brokerage Commissions and Trading Income

B. Riley Financial generates significant revenue through brokerage commissions and trading income. This stream includes fees earned from executing trades on behalf of both institutional and individual clients. In 2023, the firm's capital markets segment, which encompasses these activities, saw robust performance, contributing substantially to overall earnings.

Beyond direct trade execution, B. Riley Financial also profits from securities lending and other proprietary trading activities. These operations leverage the firm's market expertise and access to capital. For instance, income from these diverse trading operations plays a vital role in their institutional brokerage services, a core pillar of their business model.

- Brokerage Commissions: Fees from facilitating trades for clients.

- Trading Income: Profits from proprietary trading and market-making activities.

- Securities Lending: Revenue generated by lending out securities held by the firm or its clients.

- Institutional Services: A significant portion of this revenue is tied to their core institutional brokerage operations.

B. Riley Financial's revenue streams are diverse, encompassing investment banking, financial advisory, wealth and asset management, and proprietary investments. These segments collectively contributed to the company's financial performance throughout 2023 and into 2024, reflecting a multi-faceted business model.

| Revenue Segment | Primary Activities | 2023 Revenue (Millions USD) | Key Drivers |

|---|---|---|---|

| Capital Markets | Investment banking, underwriting, brokerage | $308.7 | M&A advisory, equity/debt offerings, trade execution |

| Advisory & Consulting | Restructuring, bankruptcy, valuation, litigation support | Not separately disclosed, but a key contributor | Economic uncertainty, specialized expertise |

| Wealth & Asset Management | Management fees, performance fees, commissions | Not separately disclosed, but consistent growth | Assets under management, investment performance |

| Net Investment Gains | Realized and unrealized gains from direct investments | $21.8 (Q1 2024) vs. $4.2 (Q1 2023) | Market conditions, investment portfolio performance |

Business Model Canvas Data Sources

The B. Riley Financial Business Model Canvas is constructed using a combination of internal financial statements, proprietary market research, and analysis of industry-specific trends. These diverse data sources ensure a comprehensive and accurate representation of the company's strategic framework.