B. Riley Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B. Riley Financial Bundle

Navigate the complex external forces shaping B. Riley Financial's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements create both challenges and opportunities for the firm. Gain a strategic advantage by leveraging these expert-level insights to refine your own market approach. Download the full PESTLE analysis now for actionable intelligence that drives informed decision-making.

Political factors

The upcoming US presidential election in late 2024 is a significant political factor for B. Riley Financial. A new administration could usher in substantial shifts in financial regulatory policy. For instance, a move towards deregulation might ease compliance burdens for B. Riley's diverse operations, which span investment banking, wealth management, and proprietary trading. Conversely, increased oversight or new compliance mandates from bodies like the SEC or OCC could necessitate significant operational adjustments and investments in the 2025 fiscal year.

Global geopolitical events and evolving international trade policies significantly influence cross-border investment banking and proprietary investment valuations for firms like B. Riley Financial. For instance, ongoing trade disputes between major economies, such as those seen between the US and China throughout 2023-2024, can create uncertainty, impacting deal flow and the valuation of assets involved in international transactions.

B. Riley's diversified business model, encompassing investment banking, wealth management, and diversified industrials, exposes it to both risks and opportunities stemming from shifts in international relations and trade agreements. A slowdown in global trade due to new tariffs or protectionist measures could dampen M&A activity, a key revenue driver for its investment banking segment.

Market volatility, often amplified by geopolitical tensions like the ongoing conflicts in Eastern Europe and the Middle East, directly affects investor confidence and, consequently, deal origination. For example, increased energy price volatility in 2024, linked to geopolitical instability, can lead to broader market sell-offs, making clients more hesitant to pursue transactions.

Government fiscal policies, such as the Inflation Reduction Act of 2022, continue to shape economic landscapes, impacting sectors relevant to B. Riley Financial. For instance, increased government spending on infrastructure and green energy initiatives, projected to be significant through 2025, can boost M&A activity and capital markets, directly benefiting B. Riley's advisory services.

Changes in taxation policies also play a crucial role. Potential adjustments to corporate tax rates or capital gains taxes, debated in the lead-up to and during 2024, could influence investor sentiment and the volume of transactions B. Riley facilitates, affecting their wealth management and investment banking segments.

A proactive fiscal stance, aimed at fostering economic stability or growth, can translate into greater client confidence and increased demand for financial planning and investment opportunities. For example, if fiscal stimulus measures successfully curb inflation and support job growth, B. Riley's clients are likely to be more inclined to engage in investment activities.

Financial Sector Support and Intervention

Government attitudes toward the financial sector significantly shape B. Riley Financial's operational landscape. Policies designed to bolster financial stability or mitigate systemic risks, such as the Federal Reserve's continued focus on capital requirements and liquidity, can introduce new compliance burdens but also foster a more predictable market. For instance, the Dodd-Frank Act, though enacted earlier, continues to influence regulatory frameworks in 2024, requiring ongoing adaptation.

Conversely, heightened regulatory scrutiny or the implementation of punitive measures can directly affect B. Riley's profitability. The ongoing discussions around potential changes to capital gains taxes or increased oversight of non-bank financial institutions, particularly in light of market volatility observed in late 2023 and early 2024, present a dynamic environment. The U.S. financial sector, as a whole, saw a net increase in regulatory filings and compliance costs in 2023, a trend expected to persist.

- Regulatory Adaptability: B. Riley must continuously adapt to evolving financial regulations, which can impact operational efficiency and costs.

- Market Stability Measures: Government interventions aimed at market stability, like interest rate adjustments by the Federal Reserve, can influence B. Riley's investment banking and asset management arms.

- Potential for Increased Oversight: The financial sector's inherent systemic importance means it is subject to potential increased scrutiny, which could lead to new compliance requirements or restrictions.

Antitrust and Competition Policy

Antitrust and competition policy is a significant political factor for B. Riley Financial. Regulators are increasingly scrutinizing consolidation within the financial services sector, which can directly impact B. Riley's M&A advisory services. For instance, in 2024, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) continued their aggressive stance on mergers, reviewing a higher volume of deals across various industries, including financial services.

This heightened regulatory focus can create hurdles for B. Riley's clients seeking to merge or acquire other companies. Stricter enforcement makes it more challenging to gain approval for transactions, potentially leading to deal delays or outright blocking. Consequently, this can reduce the volume of successful M&A transactions that B. Riley advises on, impacting its investment banking revenue.

- Increased Scrutiny: Antitrust agencies like the FTC and DOJ are actively investigating mergers in financial services, aiming to prevent market concentration.

- Deal Uncertainty: Tighter enforcement creates greater uncertainty for clients pursuing M&A, potentially discouraging transactions or leading to longer approval processes.

- Revenue Impact: A slowdown in successful M&A deals directly affects B. Riley's advisory fees and commissions, a key revenue stream.

- Strategic Adjustments: B. Riley may need to adapt its M&A strategies and client targeting in response to evolving antitrust landscapes.

The upcoming US presidential election in late 2024 presents a significant political variable for B. Riley Financial, potentially leading to shifts in financial regulation and oversight in 2025. Global geopolitical events continue to influence cross-border deal flow and valuations, with trade disputes and regional conflicts creating market uncertainty throughout 2024. Government fiscal policies, including infrastructure spending and tax policy debates in 2024, directly impact sectors where B. Riley operates, influencing M&A activity and investor sentiment.

Antitrust enforcement, particularly by the FTC and DOJ, intensified in 2024, scrutinizing financial services mergers and potentially impacting B. Riley's advisory revenue. The Federal Reserve's ongoing focus on capital requirements and liquidity, a continuation of post-2008 frameworks, shapes the operational landscape for financial institutions like B. Riley.

| Political Factor | Impact on B. Riley Financial | 2024/2025 Data/Trend |

| US Presidential Election | Potential regulatory shifts | Upcoming election in late 2024; potential for new administrations to alter financial regulations in 2025. |

| Geopolitical Instability | Market volatility, deal flow disruption | Ongoing conflicts in Eastern Europe and Middle East contributed to energy price volatility in 2024, impacting investor confidence. |

| Fiscal Policy | M&A activity, capital markets | Government spending on infrastructure and green energy, a trend noted from 2022 and expected through 2025, can boost advisory services. |

| Antitrust Enforcement | M&A deal approval, advisory revenue | FTC and DOJ reviewed a higher volume of deals in 2024, indicating stricter merger scrutiny. |

What is included in the product

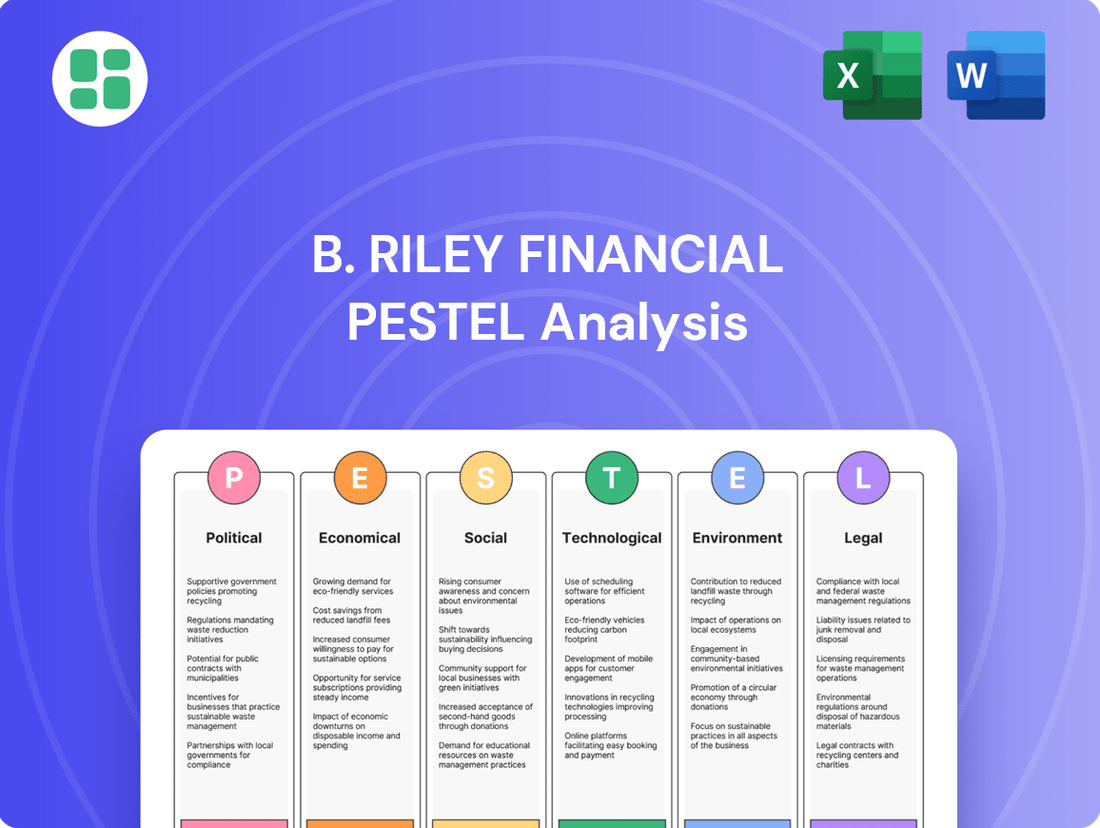

This PESTLE analysis for B. Riley Financial examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the firm, providing a comprehensive understanding of its external operating landscape.

It offers actionable insights derived from current trends and data, enabling strategic decision-making for B. Riley Financial's leadership and stakeholders.

A concise, actionable PESTLE analysis for B. Riley Financial that highlights key external factors, enabling proactive strategy adjustments and mitigating potential disruptions.

Economic factors

Fluctuations in interest rates, largely driven by central bank policies, significantly influence B. Riley Financial's diverse business segments. For instance, the Federal Reserve's benchmark rate, which stood around 5.25%-5.50% as of mid-2024, directly impacts borrowing costs and investment yields across the company's operations.

Anticipated rate cuts in 2025 could potentially fuel mergers and acquisitions (M&A) and encourage greater capital deployment, which would be a boon for B. Riley's investment banking division. However, a lower interest rate environment might also compress net interest margins for its lending activities and alter the returns on some of its proprietary investments.

Economic growth directly fuels demand for B. Riley Financial's services. A robust economy in 2024, with projections indicating continued, albeit potentially moderating, growth, supports higher volumes of investment banking transactions and increased client wealth, benefiting wealth management.

However, recession risks loom. Should economic headwinds intensify, leading to a contraction, B. Riley could experience a downturn in deal activity and a decline in asset values. For instance, if GDP growth falters significantly in late 2024 or into 2025, this would directly impact client confidence and transactional volumes.

Market volatility directly influences B. Riley Financial's core operations. For instance, during periods of heightened uncertainty, such as the broad market sell-offs seen in late 2023 and early 2024, investor confidence tends to wane, leading to a slowdown in initial public offerings (IPOs) and mergers and acquisitions (M&A) activity, key revenue drivers for B. Riley's investment banking division.

Conversely, stable market conditions foster greater investor participation and risk appetite. In 2024, as markets generally trended upwards with the S&P 500 reaching new highs, B. Riley's wealth management segment likely benefited from increased asset valuations and higher inflows into managed portfolios. This stability also supports the performance of the firm's proprietary investments.

Inflationary Pressures

Inflationary pressures remain a significant concern, directly impacting the purchasing power of capital and consequently influencing asset valuations. For B. Riley Financial and its clients, this means that the real return on investments can be diminished, and the cost of doing business, from technology to personnel, can increase.

Managing these persistent inflationary trends is paramount for B. Riley to sustain its profitability and deliver effective financial guidance. The firm must navigate a landscape where the nominal value of assets might rise, but their real value, after accounting for inflation, could stagnate or decline.

- Consumer Price Index (CPI) in the U.S. averaged 3.4% in the first quarter of 2024, a notable decrease from the 4.1% average in the same period of 2023, yet still above the Federal Reserve's target.

- The Personal Consumption Expenditures (PCE) price index, the Fed's preferred inflation gauge, also showed a moderation, though core PCE remained elevated, indicating sticky inflation in services.

- Rising interest rates, a common response to inflation, can increase borrowing costs for B. Riley and its clients, potentially dampening investment activity and M&A transactions.

- The firm's ability to generate fee income from asset management and advisory services is directly tied to the performance of client portfolios, which are vulnerable to inflation-driven valuation shifts.

Credit Market Conditions

Credit market conditions are a significant factor for B. Riley Financial, directly impacting its direct lending operations and the financing capabilities of its investment banking clients. When credit is readily available and less expensive, it fuels more transactions and investments.

As of late 2024, there are indications of improving credit conditions, with projections for lower base interest rates extending into 2025. This trend is expected to invigorate deal-making across various sectors.

- Lower Base Rates: Anticipated reductions in benchmark interest rates, such as the Federal Funds Rate, are expected to decrease borrowing costs for businesses. For instance, if the Federal Reserve lowers its target rate by 75 basis points in 2024, this could translate to lower prime rates for B. Riley's lending portfolio.

- Increased Deal Flow: More favorable lending environments typically correlate with a higher volume of mergers, acquisitions, and capital raises, directly benefiting B. Riley's investment banking division.

- Direct Lending Impact: Improved credit availability and lower costs are crucial for B. Riley's direct lending business, allowing them to deploy capital more effectively and potentially achieve better returns on their loan portfolios.

Economic growth is a primary driver for B. Riley Financial's revenue streams. A healthy economy in 2024, with GDP growth projected to continue, albeit at a potentially slower pace than the prior year, supports increased deal volumes in investment banking and greater asset inflows for wealth management. Conversely, any significant economic slowdown or recessionary pressures in late 2024 or 2025 would likely dampen client activity and transaction levels.

| Economic Indicator | Q1 2024 Value | 2024 Projection | 2025 Projection |

|---|---|---|---|

| US Real GDP Growth | 1.3% (Annualized) | 2.0% - 2.5% | 1.5% - 2.0% |

| Inflation (CPI) | 3.5% (Annual Rate) | 3.0% - 3.5% | 2.5% - 3.0% |

| Federal Funds Rate (Target) | 5.25% - 5.50% | 5.00% - 5.25% | 4.50% - 4.75% |

What You See Is What You Get

B. Riley Financial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive B. Riley Financial PESTLE analysis details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to the complete PESTLE analysis, providing actionable insights into B. Riley Financial's operating environment.

The content and structure shown in the preview is the same document you’ll download after payment. This in-depth analysis offers a strategic overview crucial for understanding B. Riley Financial's market position and future outlook.

Sociological factors

Demographic shifts are significantly reshaping the financial landscape. The aging population in developed nations, for instance, increases demand for retirement planning, healthcare-related investments, and estate management services. Conversely, the growing influence of younger, tech-savvy investors, often referred to as Gen Z and Millennials, is driving the adoption of digital platforms, robo-advisors, and ESG (Environmental, Social, and Governance) focused investments.

B. Riley Financial must strategically position its wealth management and advisory services to cater to these evolving generational needs. The firm's ability to adapt to the preferences of diverse cohorts, from those seeking stable, income-generating assets to those prioritizing growth and digital accessibility, will be crucial. Furthermore, the anticipated intergenerational wealth transfer, estimated to be in the trillions of dollars over the coming decades, presents a substantial opportunity for advisory firms that can effectively guide both wealth holders and inheritors through complex financial transitions.

Societal expectations are shifting, with a growing number of investors prioritizing Environmental, Social, and Governance (ESG) criteria in their investment choices. This trend isn't just a niche movement; it's becoming mainstream. For instance, a 2024 survey indicated that over 70% of institutional investors consider ESG factors when making investment decisions, a significant jump from previous years.

B. Riley Financial must actively integrate ESG considerations into its core operations to align with these evolving investor preferences. This includes embedding ESG analysis into advisory services, shaping investment strategies to favor sustainable and responsible companies, and ensuring proprietary investments reflect these values. Failing to do so risks not only missing out on significant capital flows but also facing reputational damage, especially concerning accusations of greenwashing, where a company may falsely market itself as environmentally friendly.

Public trust in financial institutions significantly influences B. Riley Financial's ability to attract and retain clients. A 2024 survey indicated that only 45% of Americans expressed high confidence in major financial institutions, a slight decrease from the previous year, highlighting the ongoing challenge of rebuilding public faith.

Any perception of unethical practices or financial impropriety can trigger heightened regulatory oversight and a cautious approach from potential customers. For instance, following the 2023 regional banking turmoil, consumer deposits shifted towards larger, perceived safer institutions, demonstrating a direct link between trust and capital flow.

B. Riley Financial's commitment to transparency and ethical conduct is therefore paramount. Maintaining a robust reputation is not just about compliance; it's a critical driver for sustained business growth and market stability in the competitive financial services landscape.

Workforce and Talent Trends

The financial services sector, including companies like B. Riley Financial, is navigating a dynamic labor market. Demand for specialized skills in areas such as FinTech, data analytics, and cybersecurity continues to surge. For instance, in 2024, the U.S. Bureau of Labor Statistics projects robust job growth for information security analysts, with a median annual wage of $125,070. This heightened demand for niche expertise directly impacts B. Riley's capacity to recruit and retain top-tier talent essential for innovation and competitive advantage.

The widespread adoption of hybrid and remote work models presents both opportunities and challenges for talent acquisition and retention. While offering flexibility can broaden the talent pool, it also necessitates robust infrastructure and management strategies to maintain productivity and company culture. B. Riley's ability to adapt its operational framework to these evolving work arrangements will be crucial in attracting and keeping skilled professionals who value flexibility alongside career growth.

Key workforce trends impacting B. Riley Financial include:

- Growing demand for FinTech and cybersecurity expertise: Companies are increasingly prioritizing professionals with skills in digital transformation and data protection.

- Shifting employee expectations regarding work arrangements: Hybrid and remote work options are becoming standard expectations for many skilled professionals.

- Intensified competition for specialized financial talent: The need for niche skills creates a competitive landscape for attracting and retaining top performers.

Financial Literacy and Accessibility

Societal financial literacy directly influences demand for B. Riley Financial's services. In 2024, a significant portion of the adult population still struggles with basic financial concepts, creating a need for clearer, more digestible financial guidance. For instance, a 2023 FINRA study found that only 57% of Americans could answer three out of five basic financial literacy questions correctly.

The increasing demand for accessible financial services, particularly through digital channels, is a key trend shaping B. Riley's strategy. This shift is driven by a younger demographic that prefers online platforms for managing their investments and seeking advice. By 2025, it's projected that digital financial advisory services will see continued robust growth, with many fintech companies offering simplified investment options.

B. Riley can leverage these societal trends by enhancing its digital offerings and simplifying its communication. This includes:

- Developing user-friendly online portals and mobile applications for easier account management and access to research.

- Creating educational content that breaks down complex financial topics into understandable terms.

- Exploring partnerships with fintech firms to broaden reach and cater to evolving client preferences.

- Offering tiered service models that accommodate varying levels of financial knowledge and engagement.

Societal values are increasingly emphasizing ethical investing and corporate responsibility, directly impacting how firms like B. Riley Financial are perceived and how clients allocate capital. A 2024 survey by the Global Sustainable Investment Alliance revealed that sustainable investments now account for over 30% of all professionally managed assets globally, a figure that continues to climb.

B. Riley Financial must therefore integrate Environmental, Social, and Governance (ESG) principles not just as a compliance measure, but as a core component of its investment strategy and client advisory services to align with these evolving societal expectations and capture growing market demand.

Technological factors

The financial services sector is seeing a significant shift due to rapid advancements in FinTech and Artificial Intelligence (AI). For B. Riley Financial, this presents a dual opportunity: to streamline operations and to enrich its client services. For instance, AI is increasingly being used to personalize investment advice and identify potential risks with greater accuracy.

AI-powered tools are becoming essential for staying competitive. By leveraging AI for tasks like predictive analytics in risk assessment and automating investment strategies, B. Riley can improve efficiency and offer more sophisticated solutions. The global AI in financial services market was valued at approximately $10.4 billion in 2023 and is projected to grow substantially, indicating the critical nature of these technologies.

The escalating complexity of cyber threats demands sustained, significant investment in cybersecurity to safeguard sensitive client information and ensure operational continuity for B. Riley Financial. A data breach in the financial sector can result in substantial financial repercussions, severe reputational harm, and stringent regulatory sanctions.

In 2024, the global average cost of a data breach reached an all-time high of $4.73 million, underscoring the immense financial risk. For B. Riley Financial, maintaining robust data protection is paramount to preserving client trust and avoiding such costly incidents, with ongoing vigilance against evolving threats like ransomware and phishing attacks being critical.

B. Riley Financial, like many in the financial services sector, is navigating a significant digital transformation. This shift impacts everything from how clients are brought on board and services are delivered, to the efficiency of back-office functions. For instance, in 2024, many firms reported increased investment in digital client portals and AI-driven customer service tools to enhance user experience and streamline interactions.

Automation, powered by advancements in artificial intelligence and machine learning, is a key driver of this transformation. By automating repetitive tasks in areas like data analysis, compliance checks, and transaction processing, B. Riley can significantly boost operational efficiency and reduce costs. Reports from 2025 indicate that financial institutions leveraging AI for process automation saw an average reduction in operational expenses by up to 15%.

Blockchain and Digital Assets

Blockchain and the rise of digital assets, including cryptocurrencies and non-fungible tokens (NFTs), are reshaping the financial landscape. For B. Riley Financial, this presents a dual-edged sword: opportunities for innovation and significant regulatory hurdles. The potential for increased transaction efficiency and novel investment products is considerable, but navigating the evolving legal frameworks surrounding these assets is paramount.

The decentralized finance (DeFi) sector, built on blockchain, offers alternative avenues for lending, borrowing, and trading, bypassing traditional intermediaries. B. Riley must consider how to integrate or compete within this space, which saw substantial growth and volatility through 2024. For instance, the total value locked (TVL) in DeFi protocols, while fluctuating, remained a significant indicator of market activity, reaching hundreds of billions of dollars at various points in 2024.

- Market Evolution: The global digital asset market capitalization fluctuated significantly in 2024, underscoring both its growth potential and inherent volatility, impacting B. Riley's risk assessment for new ventures.

- Regulatory Uncertainty: As of mid-2025, regulatory clarity for digital assets remains a key challenge, with different jurisdictions adopting varied approaches, requiring B. Riley to maintain agile compliance strategies.

- New Financial Instruments: The development of tokenized securities and other blockchain-based financial products offers B. Riley opportunities to expand its service offerings and cater to a growing investor interest in digital alternatives.

- Technological Adoption: The increasing adoption of blockchain for supply chain management and digital identity solutions suggests broader integration possibilities beyond traditional finance, which B. Riley could leverage.

Data Analytics and Personalization

Data analytics is fundamentally reshaping how financial services firms like B. Riley Financial engage with clients. By leveraging big data, the firm can move beyond generic offerings to provide highly personalized advice and solutions. This is critical for staying competitive in a market where clients increasingly expect tailored experiences.

For B. Riley, this means utilizing client data to understand individual financial goals, risk appetites, and investment preferences. This granular insight allows for the creation of customized wealth management plans and advisory services. Such personalization directly enhances client engagement and strengthens retention across all business lines, from wealth management to investment banking.

The impact of data analytics is already evident. For instance, in 2024, the wealth management industry saw a significant push towards AI-driven personalization, with firms reporting higher client satisfaction scores when digital tools were used to tailor advice. B. Riley's strategic investment in advanced analytics platforms is poised to capitalize on this trend, aiming to deliver superior client outcomes and solidify its market position.

- Personalized Client Experiences: Utilizing big data to offer bespoke financial advice and investment strategies.

- Enhanced Client Retention: Data-driven insights foster deeper client relationships and reduce churn.

- Competitive Differentiation: Tailored services powered by analytics set B. Riley apart in a crowded market.

- Improved Operational Efficiency: Analytics can streamline client onboarding and service delivery processes.

Technological advancements are fundamentally reshaping the financial services landscape, presenting both opportunities and challenges for B. Riley Financial. The increasing sophistication of AI and machine learning enables more personalized client experiences and streamlined operations, with the global AI in financial services market projected for substantial growth beyond its 2023 valuation of $10.4 billion.

Cybersecurity remains a critical technological factor, as the average cost of a data breach reached $4.73 million in 2024, highlighting the need for robust protection of sensitive client data. Digital transformation, driven by automation and improved client portals, is enhancing efficiency, with firms leveraging AI for process automation reporting up to a 15% reduction in operational expenses by 2025.

Emerging technologies like blockchain and digital assets necessitate careful navigation due to their innovative potential and evolving regulatory frameworks, impacting B. Riley's strategy in areas like tokenized securities and decentralized finance. Data analytics is key to competitive differentiation, allowing for highly personalized advice and improved client retention, a trend evidenced by increased client satisfaction in wealth management firms utilizing AI-driven personalization in 2024.

| Technology Area | 2024/2025 Impact for B. Riley | Key Data Point |

|---|---|---|

| Artificial Intelligence (AI) | Enhanced personalized advice, operational efficiency, predictive analytics. | Global AI in financial services market projected for significant growth from $10.4B (2023). |

| Cybersecurity | Essential for data protection, client trust, and regulatory compliance. | Average cost of data breach reached $4.73M in 2024. |

| Digital Transformation/Automation | Streamlined operations, improved client onboarding, reduced costs. | AI-driven automation can reduce operational expenses by up to 15% (reported by 2025). |

| Blockchain & Digital Assets | Opportunities in new financial instruments, regulatory navigation required. | Total Value Locked (TVL) in DeFi protocols remained in the hundreds of billions in 2024. |

| Data Analytics | Personalized client experiences, enhanced retention, competitive advantage. | Wealth management saw increased client satisfaction with AI personalization in 2024. |

Legal factors

B. Riley Financial operates in a sector where regulatory changes are constant, with bodies like the SEC and FINRA frequently updating rules. Staying compliant with these evolving regulations, including new mandates for Environmental, Social, and Governance (ESG) reporting and stricter cybersecurity protocols, is critical. For instance, the SEC's proposed climate disclosure rules, expected to be finalized in 2024, will significantly impact reporting requirements for many financial firms.

B. Riley Financial, like all financial institutions, must navigate a complex web of Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules are designed to prevent illicit financial activities, and failure to comply can result in significant penalties. For instance, in 2023, the Financial Crimes Enforcement Network (FinCEN) continued to emphasize the importance of robust AML programs, with fines levied against institutions for compliance failures remaining a substantial risk.

The regulatory landscape for AML and KYC is constantly evolving, demanding continuous adaptation and investment in compliance technology and personnel. For example, the ongoing implementation of beneficial ownership rules and enhanced due diligence requirements means that financial firms must maintain sophisticated systems to identify and verify the ultimate owners of accounts. The Financial Action Task Force (FATF) regularly updates its recommendations, influencing national regulations and requiring firms like B. Riley to stay ahead of global best practices.

Global data privacy regulations, such as the EU's GDPR and various US state laws like the California Consumer Privacy Act (CCPA), significantly impact B. Riley Financial. These laws mandate strict protocols for collecting, storing, and processing client data, requiring robust cybersecurity measures and transparent data handling practices.

Failure to comply can lead to substantial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. B. Riley must invest in compliance infrastructure and ongoing training to safeguard client information and maintain trust, crucial for a financial services firm.

Litigation and Enforcement Risks

B. Riley Financial, as a financial services firm, navigates a landscape fraught with litigation and enforcement risks stemming from its advisory, investment, and compliance activities. These risks are amplified by the stringent regulatory environment governing the financial sector.

Regulatory bodies like the Securities and Exchange Commission (SEC) actively monitor financial firms. Enforcement actions, which can arise from alleged violations of securities laws or compliance failures, pose a significant threat. For instance, in 2023, the SEC brought numerous enforcement actions against financial institutions, leading to substantial fines and settlements. While specific B. Riley enforcement actions are not publicly detailed here, the general trend indicates a heightened risk environment.

- Litigation Exposure: B. Riley's diverse operations, including investment banking, wealth management, and principal investments, expose it to potential lawsuits from clients, counterparties, and other stakeholders.

- Regulatory Scrutiny: The firm is subject to ongoing oversight from regulators, increasing the likelihood of enforcement actions for compliance breaches.

- Reputational and Financial Impact: Adverse litigation outcomes or enforcement actions can result in significant financial penalties, operational disruptions, and severe damage to B. Riley's reputation, impacting client trust and market standing.

Corporate Governance and Reporting Requirements

Adhering to corporate governance standards and ensuring timely financial reporting are critical legal mandates for publicly traded companies like B. Riley Financial. These obligations are essential for maintaining investor confidence and complying with regulatory bodies such as the SEC and stock exchanges, like Nasdaq.

Recent reporting challenges faced by B. Riley Financial, including delays in filing its annual and quarterly reports, underscore the vital need for strong internal controls and efficient operational processes. These delays can have significant implications, potentially impacting the company's ability to meet Nasdaq's listing requirements and adhere to SEC filing deadlines, which are crucial for transparency and market integrity.

- Nasdaq Listing Requirements: Failure to file reports on time can lead to non-compliance with Nasdaq's continued listing standards, potentially resulting in delisting warnings or actions.

- SEC Filing Deadlines: B. Riley, like all public companies, must meet specific deadlines for filing Forms 10-K (annual) and 10-Q (quarterly) with the Securities and Exchange Commission.

- Internal Control Weaknesses: Reporting delays often signal underlying issues with internal financial reporting processes and controls, which are legally required to be effective under Sarbanes-Oxley (SOX) provisions.

- Investor Confidence: Consistent and timely financial disclosures are fundamental to building and maintaining trust with investors, analysts, and the broader financial community.

B. Riley Financial must navigate evolving legal frameworks, including those related to ESG disclosures and cybersecurity, with the SEC's climate disclosure rules expected in 2024 impacting reporting. Compliance with AML and KYC regulations remains paramount, with FinCEN continuing to focus on robust programs and levying fines for failures, as seen in 2023. Data privacy laws like GDPR and CCPA necessitate stringent data handling, with GDPR fines potentially reaching 4% of global annual revenue.

Environmental factors

The increasing client and institutional investor demand for Environmental, Social, and Governance (ESG) compliant investments is a significant factor influencing B. Riley Financial's strategic direction. This trend necessitates a closer look at how ESG integration affects investment and advisory services.

To remain competitive and attract capital, B. Riley must actively incorporate ESG criteria into its product suite. This includes offering instruments like green bonds and sustainability-linked loans, aligning with the growing market preference for responsible investing.

Globally, ESG assets under management are projected to reach $50 trillion by 2025, highlighting the immense market opportunity and the pressure on financial firms like B. Riley to adapt their strategies to meet this evolving investor appetite.

Regulatory bodies globally are intensifying their focus on climate risk disclosure, compelling financial institutions like B. Riley Financial to meticulously assess and report their exposure to both physical climate events and the economic shifts driven by the transition to a low-carbon economy. For instance, the SEC's proposed climate disclosure rules, though subject to ongoing debate and potential revisions, signal a clear direction towards greater transparency, potentially impacting how companies like B. Riley report their climate-related financial impacts.

To navigate this evolving landscape, B. Riley must establish sophisticated frameworks for climate stress testing and scenario analysis. This proactive approach will enable the company to quantify potential impacts on its investment portfolios and operations, ensuring resilience against various climate futures. By integrating these analyses, B. Riley can better manage its climate-related financial risks and opportunities, aligning with growing investor and stakeholder expectations for comprehensive environmental, social, and governance (ESG) reporting.

B. Riley Financial's reputation is intrinsically linked to the environmental stewardship of its clients and portfolio companies. Negative public perception stemming from poor environmental practices within its network could significantly impact client acquisition and investor confidence. For instance, a substantial portion of institutional investors now integrate ESG (Environmental, Social, and Governance) factors into their decision-making, with many explicitly excluding companies with poor environmental records, a trend that intensified throughout 2024.

The firm's advisory and financing activities expose it to reputational risks if associated entities engage in environmentally damaging practices. This necessitates robust environmental due diligence to mitigate potential backlash. As of early 2025, surveys indicate that over 70% of consumers are more likely to support brands demonstrating strong environmental responsibility, highlighting the market's sensitivity to such issues.

Resource Scarcity and Operational Footprint

While B. Riley Financial's core business isn't directly tied to heavy resource consumption, long-term trends in resource scarcity and evolving environmental regulations can still present indirect impacts. For instance, increased costs associated with energy consumption or waste management could marginally affect the operational expenses of its physical office spaces and data centers. Companies that proactively address their environmental footprint, such as by investing in energy efficiency or sustainable practices, often see a positive impact on their brand perception among increasingly environmentally conscious investors and clients.

Consider these points:

- Energy Efficiency Initiatives: B. Riley's commitment to reducing its carbon footprint, potentially through energy-efficient office upgrades, could lead to modest operational cost savings. For example, a 10% reduction in energy consumption across its facilities could translate to savings in utility bills.

- Regulatory Compliance Costs: While not a primary driver, any new regulations concerning data center energy usage or office waste disposal could introduce minor compliance costs, though these are unlikely to be material given the company's service-oriented model.

- Brand Reputation and ESG: Demonstrating a commitment to Environmental, Social, and Governance (ESG) principles, including environmental stewardship, can enhance B. Riley's appeal to a growing segment of investors prioritizing sustainability. This can indirectly support asset management and investment banking divisions.

- Indirect Supply Chain Impacts: Although B. Riley's direct resource use is limited, potential disruptions or cost increases in the supply chains of its technology vendors or service providers due to resource scarcity could have a very minor ripple effect on its operational costs.

Development of Green Finance Products

B. Riley Financial has a significant opportunity to tap into the burgeoning green finance market. The increasing global focus on sustainability and environmental, social, and governance (ESG) factors is driving demand for specialized financial products and services.

This presents a chance for B. Riley to innovate by developing new offerings. These could include products focused on sustainable investing, financing for nature-based solutions, and advisory services to help clients navigate their transition to more environmentally conscious operations.

The green finance sector is experiencing substantial growth. For instance, the global sustainable investment market reached an estimated $35.3 trillion in assets under management as of 2024, indicating a strong and expanding client base for B. Riley's potential green finance initiatives.

- Sustainable Investing Growth: Global sustainable investment assets are projected to exceed $50 trillion by 2025, offering a vast market for B. Riley to develop tailored investment products.

- Green Bond Market Expansion: The green bond market, a key component of green finance, saw issuance reach over $1 trillion globally in 2024, demonstrating a clear demand for environmentally focused debt instruments.

- Nature-Based Solutions Financing: With growing recognition of the economic value of natural capital, financing for nature-based solutions is expected to surge, creating new avenues for B. Riley's advisory and financing services.

- Corporate ESG Transition Support: As regulatory pressures and investor expectations around ESG performance intensify, companies are seeking expert guidance and financial solutions to improve their environmental footprint.

The increasing demand for ESG-compliant investments is a significant driver for B. Riley Financial. This trend necessitates integrating ESG criteria into their offerings, such as green bonds, to align with investor preferences. The projected growth of ESG assets under management to $50 trillion by 2025 underscores the competitive pressure for financial firms to adapt.

Regulatory bodies are intensifying their focus on climate risk disclosure, compelling firms like B. Riley to assess and report their exposure to climate-related financial impacts. This push for transparency, exemplified by evolving SEC proposals, requires sophisticated climate stress testing and scenario analysis to manage risks and align with stakeholder expectations.

B. Riley's reputation is tied to the environmental practices of its clients and portfolio companies. Negative perceptions from poor environmental conduct can impact client acquisition and investor confidence, especially as a substantial portion of institutional investors now integrate ESG factors, often excluding companies with poor environmental records, a trend that intensified throughout 2024.

B. Riley Financial has a substantial opportunity in the expanding green finance market, driven by global sustainability and ESG focus. Developing specialized products like sustainable investments and nature-based solutions financing can tap into a client base for B. Riley's advisory and financing services.

| Environmental Factor | Impact on B. Riley Financial | Data Point/Trend (2024-2025) |

| ESG Investment Demand | Increased need for ESG-compliant products and services. | Global ESG assets projected to reach $50 trillion by 2025. |

| Climate Risk Disclosure | Necessity for robust climate stress testing and reporting. | SEC climate disclosure rules signal growing regulatory focus. |

| Reputational Risk | Potential damage from association with environmentally poor practices. | Over 70% of consumers favor environmentally responsible brands (early 2025). |

| Green Finance Market Growth | Opportunity to develop and offer green financial products. | Global sustainable investment market reached $35.3 trillion (2024); green bond issuance exceeded $1 trillion (2024). |

PESTLE Analysis Data Sources

Our B. Riley Financial PESTLE Analysis is meticulously constructed using data from leading financial news outlets, regulatory filings, economic forecasting agencies, and industry-specific market research. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.