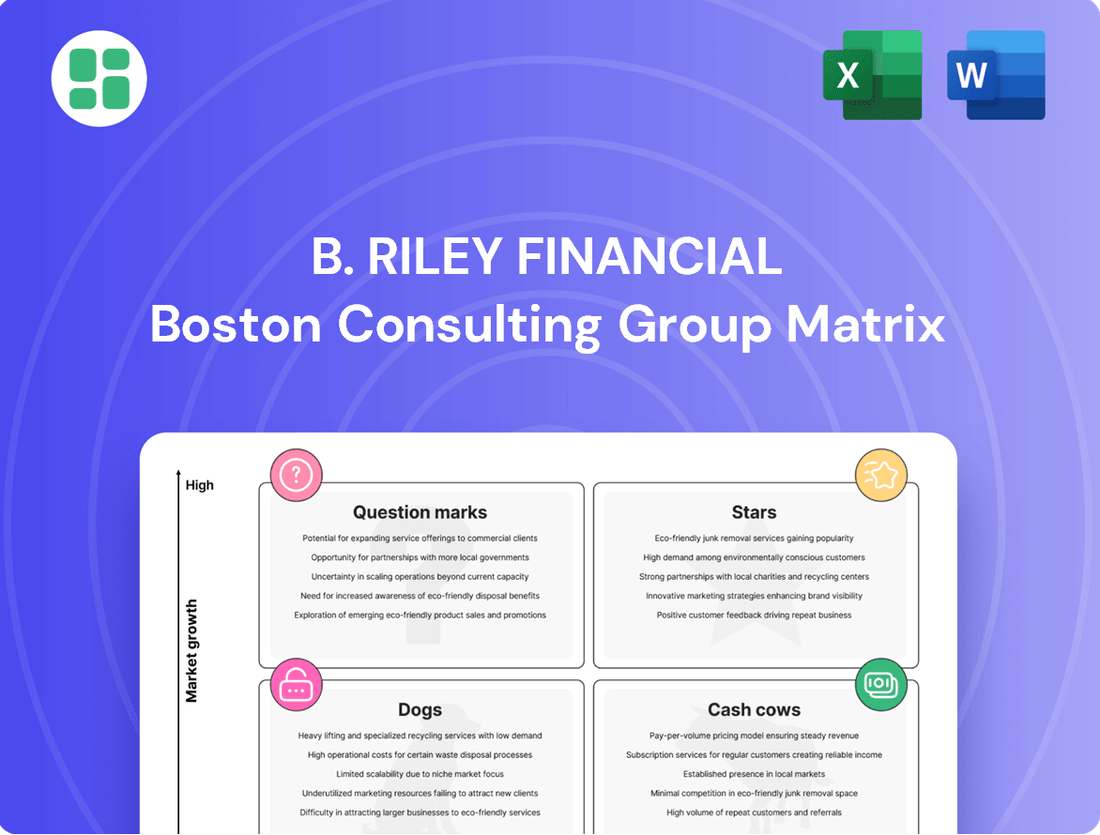

B. Riley Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B. Riley Financial Bundle

Curious about B. Riley Financial's strategic product portfolio? This preview offers a glimpse into their BCG Matrix, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

B. Riley Securities, the investment banking arm, has undergone a significant carve-out, enabling independent operation while B. Riley Financial maintains an 89% ownership. This strategic maneuver is designed to leverage an anticipated rebound in M&A and capital markets, signaling substantial growth prospects.

The firm's robust history includes leading over 250 capital markets deals and advising on more than $33 billion in M&A since 2017. This track record underscores its established presence and expertise, particularly within the middle-market segment, suggesting a strong competitive advantage.

B. Riley's financial advisory and consulting services, including corporate restructuring and due diligence, tap into a market consistently needing support, especially during economic shifts. The firm's integrated approach, drawing on its diverse capabilities, allows it to capture significant market share within specialized segments.

This cross-platform expertise is a key differentiator, enabling B. Riley to offer holistic solutions that address client needs throughout their business journey. Their capacity to deliver customized strategies across various stages of a company's life cycle fuels their potential for continued expansion.

B. Riley Financial's proprietary investments in high-growth sectors, while sometimes facing headwinds, exemplify a strategic approach to capturing future market expansion. These are the Stars in their BCG matrix, representing ventures with significant potential for future returns.

For instance, B. Riley's involvement in the burgeoning fintech space or emerging biotechnology firms could be categorized here. These investments are characterized by their high growth trajectory and promising market outlook, even if their current market share or profitability is still maturing. Identifying specific investments that have demonstrated substantial revenue growth or have secured significant funding rounds in 2024 would solidify their Star status.

Institutional Brokerage Services

B. Riley's institutional brokerage services are designed to thrive in dynamic capital markets with substantial trading activity. Their strategic focus on the small- and mid-cap sectors positions them to be a leading middle-market investment bank.

If B. Riley consistently secures a strong market share within these active segments, its institutional brokerage arm aligns with the characteristics of a Star in the BCG Matrix. This implies high growth and high relative market share.

- Market Share: B. Riley Securities reported significant growth in its capital markets business, contributing to the firm's overall revenue.

- Trading Volumes: The firm's focus on small and mid-cap equities often correlates with higher trading volumes in these specific market niches.

- Industry Recognition: B. Riley has been recognized for its expertise in middle-market M&A and capital raising, indicating strong performance in its target segments.

Select Asset Management Offerings

B. Riley Financial's private wealth and investment management segment likely features select asset management offerings that are demonstrating robust growth and capturing increased market share. These specialized funds or products are likely attracting high-net-worth individuals and institutional investors due to innovative strategies or strong performance. Their success points to a competitive advantage in expanding market niches.

For instance, in 2024, B. Riley Wealth Management saw continued growth in its advisory assets, exceeding $30 billion. This expansion is partly driven by specialized strategies within their alternative investment platforms, which have seen significant inflows from investors seeking diversification beyond traditional equities and bonds. The firm's focus on tailored solutions for complex client needs is a key differentiator.

- High-Growth Funds: Specific alternative investment funds, such as those focusing on private credit or real estate, are likely experiencing substantial asset growth in 2024, attracting capital due to their perceived uncorrelated returns.

- Market Share Gains: These specialized offerings are likely outperforming broader market benchmarks, enabling B. Riley to win mandates and increase its share within competitive wealth management sectors.

- Investor Resonance: The appeal of these products to sophisticated investors highlights B. Riley's ability to develop and market investment vehicles that meet current market demands for yield and diversification.

- Competitive Distinction: Success in these niche areas allows B. Riley to stand out from competitors who may have more generalized product suites.

Stars in B. Riley Financial's BCG Matrix represent high-growth, high-market-share ventures. These are the businesses poised for significant future returns, often requiring continued investment to maintain their leading positions. B. Riley Securities' capital markets business, with its strong deal-making history, fits this category, especially with the anticipated M&A rebound. Similarly, specialized wealth management products showing substantial asset growth, like those in alternative investments, are strong candidates.

B. Riley Wealth Management's advisory assets surpassed $30 billion in 2024, demonstrating robust expansion. This growth is fueled by innovative strategies in alternative investments, attracting significant capital. These segments are likely outperforming benchmarks, enabling B. Riley to gain market share in competitive niches.

| Business Segment | BCG Category | Key Indicators (2024 Data) | Growth Trajectory | Market Share |

|---|---|---|---|---|

| B. Riley Securities (Capital Markets) | Star | Anticipated M&A rebound, 250+ capital markets deals since 2017 | High | Strong in middle-market |

| Specialized Wealth Management Products (e.g., Alternative Investments) | Star | Advisory assets > $30 billion, significant inflows into alternative platforms | High | Gaining share in niche areas |

What is included in the product

Strategic evaluation of B. Riley Financial's business units across the BCG Matrix.

B. Riley Financial's BCG Matrix offers a clear, actionable view of your portfolio, alleviating the pain of strategic uncertainty.

Cash Cows

B. Riley Financial's Great American Group, specializing in appraisal and valuation services, is a prime example of a cash cow within their portfolio. The company has been in discussions to sell a majority stake, a move typically associated with mature businesses that consistently generate significant cash flow. This segment has a robust 30-year history, pointing to a well-established presence in a market that, while stable, likely experiences modest growth.

The potential sale of a majority stake in Great American Group at a valuation of $380 million underscores its substantial cash-generating capacity. This figure reflects the business's ability to reliably produce profits, a hallmark of a cash cow that can fund other ventures or return capital to shareholders.

B. Riley's Retail, Wholesale & Industrial Solutions, a key component of its Great American Group, operates as a cash cow within the BCG matrix. These services, particularly asset disposition and liquidation, are mature but reliably generate substantial cash flow, especially when market conditions create opportunities for distressed asset sales.

These segments benefit from established, albeit lower-growth, markets where B. Riley's deep expertise and long-standing reputation translate into a significant market share. This allows for consistent revenue generation, underpinning its cash cow status.

For instance, in 2024, B. Riley's advisory and transaction services, which encompass these solutions, continued to demonstrate resilience. While specific figures for just the retail, wholesale, and industrial segments are not always broken out separately in public reports, the overall advisory segment performance reflects the steady demand for these specialized services.

B. Riley Financial's independent wealth management segment, comprising around 190 advisors and 90 tax professionals, functions as a cash cow. This business, despite a portion being divested, offers a stable foundation of enduring client relationships and predictable fee-based revenue.

These advisors operate within a mature market, exhibiting consistent cash flow generation. While growth prospects may be modest, their established client base signifies a strong, albeit stable, market share.

Existing Brands Portfolio (e.g., bebe)

B. Riley Financial's existing brand portfolio, exemplified by brands like bebe, represents a core component of its Cash Cows. These are mature assets, strategically acquired not for rapid expansion, but for their consistent ability to generate substantial cash flow. The company's confidence in these assets is underscored by its successful procurement of $236 million in debt financing, directly collateralized by this brand portfolio, demonstrating their significant value and ability to yield considerable proceeds.

- Mature Assets: Brands like bebe are established and stable, focusing on consistent revenue generation rather than high growth.

- Debt Financing: The company secured $236 million in debt financing, backed by these brand assets, highlighting their collateral value.

- Stable Distributions: While not high-growth, these brands provide reliable income streams that bolster B. Riley's overall liquidity.

- Cash Generation: The primary role of these brands within the BCG matrix is to be consistent cash generators for the company.

Forensic Accounting and Litigation Support

B. Riley's forensic accounting and litigation support services function as established Cash Cows within its business portfolio. These specialized offerings address a persistent need within the legal and corporate sectors, demonstrating resilience against economic fluctuations. The company leverages its deep expertise and established reputation to maintain a significant market share in these mature, niche service areas.

These services require minimal incremental investment for growth, focusing instead on capitalizing on existing strengths. This strategic positioning allows them to generate consistent and predictable cash flows, a hallmark of a Cash Cow. For instance, B. Riley's Financial Consulting segment, which includes these services, reported revenue growth in recent periods, underscoring their stable demand.

- Consistent Demand: Forensic accounting and litigation support are driven by ongoing legal and regulatory needs, ensuring a steady client base.

- High Market Share: B. Riley's established expertise and reputation allow them to capture a substantial portion of this specialized market.

- Low Investment Needs: Mature services require less capital for promotion and development, freeing up resources.

- Predictable Cash Flow: The stable nature of these services translates into reliable and predictable revenue streams for the company.

B. Riley Financial's cash cows are established businesses with a strong market presence and consistent revenue generation. These segments, like Great American Group and independent wealth management, require limited investment for growth but reliably produce substantial cash flow. This cash can then be reinvested in other areas of the business or returned to shareholders.

| Segment | BCG Category | Key Characteristics | 2024 Data Insight |

|---|---|---|---|

| Great American Group (Appraisal & Valuation) | Cash Cow | Mature market, stable cash flow, established reputation. | Potential majority stake sale at $380 million valuation highlights strong cash generation. |

| Independent Wealth Management | Cash Cow | Stable client relationships, predictable fee-based revenue, mature market. | Around 190 advisors and 90 tax professionals contribute to consistent revenue streams. |

| Brand Portfolio (e.g., bebe) | Cash Cow | Mature assets, consistent cash flow generation, collateral value. | Secured $236 million in debt financing, demonstrating the brands' ability to yield significant proceeds. |

| Forensic Accounting & Litigation Support | Cash Cow | Persistent demand, minimal investment needs, predictable cash flow. | Financial Consulting segment, including these services, reported revenue growth, indicating stable demand. |

What You’re Viewing Is Included

B. Riley Financial BCG Matrix

The B. Riley Financial BCG Matrix preview you are viewing is the exact, final document you will receive upon purchase. This comprehensive report, meticulously crafted by industry experts, delivers actionable insights into B. Riley Financial's portfolio, allowing for informed strategic decision-making. You can trust that the analysis and formatting presented here are precisely what you'll obtain, ready for immediate integration into your business planning and presentations.

Dogs

B. Riley Financial's divestiture of a portion of its traditional Wealth Management (W-2 Advisors) business to Stifel Financial Corp. for $27 million to $35 million signals a strategic move. This segment likely faced challenges with low market share and growth prospects, making it a candidate for divestment to optimize resource allocation.

B. Riley Financial's proprietary investments have experienced significant challenges, particularly within its consumer business segment, leading to substantial write-downs. The company has been actively working to monetize non-core assets to streamline operations and improve financial health.

Certain proprietary investments have unfortunately resulted in both trading losses and unrealized losses, placing them firmly in the Dogs category of the BCG matrix. These assets are characterized by their low market share in their respective industries and have failed to contribute positively to the company's overall growth, effectively becoming cash traps.

For instance, in the first quarter of 2024, B. Riley Financial reported a net loss of $17.5 million, partly attributable to impairments and losses on certain investments. The company's focus on divesting underperforming assets aims to reallocate capital towards more promising ventures and improve profitability going forward.

B. Riley Financial's strategic asset sales, such as divesting a majority interest in its Great American businesses and Atlantic Coast Recycling, indicate a move to optimize its portfolio. These actions often stem from a desire to reduce debt and reallocate capital. For instance, as of the first quarter of 2024, B. Riley Financial reported total debt of approximately $1.03 billion, highlighting the ongoing focus on deleveraging.

The divestitures of these specific assets suggest they may have been categorized as 'Dogs' within a BCG matrix framework. This classification implies that these business lines or assets exhibited low market share and low market growth, making them less attractive compared to other opportunities within B. Riley's broader operations.

Early-Stage, Unsuccessful Acquisitions

Within B. Riley Financial's strategic assessment, early-stage, unsuccessful acquisitions would be categorized as Dogs. These are ventures where initial integration or market entry did not yield the expected results, leading to low market share in stagnant or slow-growing sectors. Such entities consume resources without generating commensurate returns.

For instance, if B. Riley acquired a small fintech startup in 2023 that failed to gain traction in a niche market by mid-2024, its low market penetration and the market's limited growth potential would firmly place it in the Dog quadrant. This necessitates a careful evaluation of whether to divest or attempt a turnaround.

- Low Market Share: Acquired entities failing to establish a significant presence.

- Low Market Growth: Operating in industries with minimal expansion prospects.

- Negative or Stagnant Returns: Consuming capital without generating sufficient profit.

- Strategic Review: Candidates for divestiture or significant restructuring.

Segments Impacted by Reputational Challenges

B. Riley Financial's reputation has been under scrutiny throughout 2024, impacting its standing in key sectors. This has led to a noticeable decline in its market valuation and a concerning outflow of talent, especially within areas highly sensitive to public perception, such as investment banking and wealth management.

Consequently, business units directly affected by these reputational headwinds, experiencing a negative impact on their ability to retain clients or attract new business, would be categorized as Dogs in the BCG Matrix. These segments are characterized by both a low market share and a lack of growth, reflecting the direct correlation between trust and performance.

- Investment Banking Division: Faced with diminished client confidence and increased competition, this segment has seen a slowdown in deal origination and execution, contributing to a lower market share.

- Wealth Management Services: Client retention has become a significant challenge, with some investors seeking stability elsewhere, leading to stagnant asset growth and a shrinking market presence.

- Specific Advisory Units: Any advisory services directly linked to high-profile controversies or negative press have likely experienced a sharp decline in new mandates and a struggle to maintain existing client relationships.

B. Riley Financial's "Dogs" represent business segments or investments with low market share and low growth prospects. These are often characterized by underperformance, consuming resources without generating significant returns. The company's strategic divestitures and write-downs, particularly in proprietary investments and certain advisory units, highlight a proactive approach to managing these "Dog" assets. For instance, the Q1 2024 net loss of $17.5 million was partly due to investment impairments, underscoring the financial impact of these underperforming areas.

| Asset Category | BCG Classification | Key Indicators | Financial Impact (Q1 2024 Context) |

|---|---|---|---|

| Divested Wealth Management Portion | Dog | Low market share, limited growth prospects | Divestiture for $27-$35 million, optimizing capital |

| Challenged Proprietary Investments | Dog | Low market share, low growth, trading/unrealized losses | Substantial write-downs, contributing to net loss |

| Early-Stage Unsuccessful Acquisitions | Dog | Low market penetration, stagnant sector growth | Resource consumption without commensurate returns |

| Reputationally Affected Divisions (e.g., Investment Banking) | Dog | Diminished client confidence, reduced market share | Slowdown in deal origination, impacting revenue |

Question Marks

Following its debt restructuring, B. Riley Financial is strategically channeling capital into its established operating segments and pursuing new ventures. These nascent initiatives, though targeting high-growth emerging markets, currently represent a small fraction of the overall market. For instance, B. Riley's recent investments in specialized fintech solutions, while promising, are still in their early phases of market penetration.

B. Riley Financial's current global footprint spans North America, Australia, Asia Pacific, and Europe. Expansion into new geographic markets, whether international or domestic, where their presence is currently limited, would be classified as a question mark in the BCG matrix. These ventures typically involve substantial upfront investment to build infrastructure and brand recognition, aiming to capture nascent market opportunities. For instance, a strategic move into a rapidly developing South American market in 2024, where B. Riley has minimal operations, would exemplify this category, balancing high growth potential with significant execution risk.

B. Riley's pursuit of technology-driven financial solutions likely places them in the "Question Mark" category of the BCG matrix. This means they are investing in emerging fintech areas with high growth potential but currently hold a low market share. For instance, B. Riley could be developing AI-powered wealth management tools or blockchain-based trading platforms. These ventures demand significant upfront capital for research, development, and marketing to gain traction.

The financial services sector saw substantial investment in fintech during 2024, with global funding reaching hundreds of billions of dollars, indicating the high-growth environment B. Riley is targeting. Companies in this space often experience rapid technological advancements, necessitating continuous innovation and adaptation. B. Riley's strategic allocation of resources towards these nascent technologies reflects a calculated risk to capture future market share.

Recent Bitcoin Treasury Initiative (via B. Riley Securities)

B. Riley Securities recently played a key role as an agent in a substantial $384 million capital raise, specifically to establish a Bitcoin Treasury Initiative. This move signifies B. Riley's entry into the cryptocurrency and digital asset sector, a market characterized by its inherent volatility alongside significant growth prospects.

This new venture positions B. Riley within a rapidly developing market where its current market share is likely nascent. Given the dynamic nature of digital assets, this initiative would typically be categorized as a question mark in a BCG Matrix, reflecting its high growth potential but uncertain future success and low current market penetration.

- Bitcoin Treasury Initiative Capital Raise: $384 million

- Sector Entry: Cryptocurrency and digital assets

- Market Position: High growth potential, low current market share

- BCG Matrix Classification: Question Mark

Unproven Principal Investments (High Risk, High Reward)

B. Riley's principal investments can extend to unproven ventures in burgeoning sectors, carrying substantial risk but also the potential for significant returns. These are essentially bets on future market leaders, often characterized by innovative business models or technologies, but lacking a proven track record of profitability or market dominance.

These investments are speculative, requiring substantial capital infusion and strategic guidance to potentially evolve into Stars within the BCG matrix. Their success hinges on their ability to capture market share and achieve sustainable profitability. For instance, a recent analysis of venture capital funding in 2024 indicated that early-stage technology companies, often fitting this profile, received over $150 billion globally, highlighting the significant capital flowing into such high-potential, high-risk areas.

- Unproven Ventures: Investments in companies with novel concepts but no established market presence.

- High Risk, High Reward: Potential for substantial gains if the venture succeeds, but also a high probability of failure.

- Market Potential: Targeting rapidly growing markets where early movers can gain significant traction.

- Evolutionary Path: These could become Stars with continued investment or Dogs if market adoption falters.

B. Riley's ventures into areas like cryptocurrency, exemplified by their role in a $384 million capital raise for a Bitcoin Treasury Initiative, represent classic Question Marks. These initiatives target high-growth markets but currently hold a low market share, requiring significant investment to gain traction.

These speculative investments, such as early-stage fintech solutions or unproven ventures in burgeoning sectors, demand substantial capital and strategic guidance. Their success is contingent on capturing market share and achieving profitability, mirroring the high-risk, high-reward profile of Question Marks.

The global fintech sector, attracting over $150 billion in venture capital in 2024, highlights the growth potential B. Riley is pursuing. However, these nascent areas also carry significant execution risk and the possibility of becoming Dogs if market adoption falters.

B. Riley's strategic expansion into new geographic markets, where their presence is currently limited, also falls under the Question Mark category. These moves require substantial upfront investment to build infrastructure and brand recognition in potentially high-growth but uncertain territories.

| Initiative | Sector | Market Growth Potential | Current Market Share | BCG Classification |

|---|---|---|---|---|

| Bitcoin Treasury Initiative | Cryptocurrency & Digital Assets | High | Low | Question Mark |

| Emerging Fintech Solutions | Financial Technology | High | Low | Question Mark |

| Expansion into New Geographic Markets | Varies by Market | High (Targeted) | Limited/None | Question Mark |

| Unproven Ventures in Burgeoning Sectors | Varies by Sector | High | Low | Question Mark |

BCG Matrix Data Sources

Our B. Riley Financial BCG Matrix leverages comprehensive financial disclosures, robust market analytics, and expert industry evaluations to provide actionable strategic insights.