B. Riley Financial Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B. Riley Financial Bundle

Discover how B. Riley Financial strategically leverages its product offerings, pricing models, distribution channels, and promotional activities to achieve market dominance. This analysis goes beyond the surface, offering a comprehensive look at their marketing blueprint.

Unlock actionable insights into B. Riley Financial's marketing success by exploring the intricate interplay of their 4Ps. Get the full, editable report to understand their approach and apply it to your own strategic planning.

Product

B. Riley Financial's diversified financial services are a cornerstone of its offering, encompassing investment banking, financial advisory, wealth management, and business advisory. This broad spectrum is designed to meet a wide array of client needs, from facilitating capital raising and navigating mergers and acquisitions to providing personalized financial planning and guiding corporate restructuring. For instance, in Q1 2024, B. Riley's Capital Markets segment reported revenue of $134.6 million, demonstrating significant activity in its investment banking and advisory arms.

The integrated nature of these services allows B. Riley to deliver synergistic solutions by drawing expertise across different financial disciplines. This means a client engaging in a complex merger might also benefit from the firm's wealth management insights for personal asset allocation or its business advisory for operational improvements. This holistic approach aims to provide comprehensive support, fostering deeper client relationships and maximizing value creation.

B. Riley Financial's Tailored Client Solutions focuses on crafting bespoke strategies for corporations, institutions, and high-net-worth individuals. This approach directly addresses the unique strategic, operational, and capital requirements of each client, ensuring maximum relevance and impact. For instance, in 2024, B. Riley advised on over $10 billion in M&A transactions, demonstrating their capacity to deliver customized capital solutions.

The company's ability to provide integrated, cross-platform expertise is a key differentiator. This allows them to offer collaborative solutions that span a business's entire lifecycle, from initial capital raising to strategic advisory and eventual divestiture. Their advisory services in 2024 helped numerous companies navigate complex market conditions and achieve their specific growth objectives.

B. Riley's Proprietary Investments and Asset Management arm actively deploys capital into diverse businesses and assets. This strategy, distinct from pure advisory, allows them to directly participate in value creation, offering a unique edge. For instance, their investments in sectors like technology and healthcare provide tangible experience that informs their broader financial strategies.

This direct investment approach, which includes managing assets for clients and their own accounts, grants B. Riley a hands-on understanding of market dynamics. Their commitment of proprietary capital, as seen in their significant stakes in various portfolio companies, underscores a confidence that benefits their advisory clientele by offering real-world insights and potential co-investment opportunities.

Institutional Brokerage and Capital Markets

B. Riley's Institutional Brokerage and Capital Markets segment is a cornerstone of their business, offering comprehensive services for companies needing to raise funds or navigate complex financial transactions. This includes expertise in both equity and debt financing, as well as specialized structured finance solutions tailored to specific client needs.

Their capital markets capabilities are extensive, covering critical events such as initial public offerings (IPOs), secondary offerings, and follow-on offerings. They also excel in institutional private placements, connecting companies with sophisticated investors. For instance, in 2023, B. Riley Securities advised on numerous capital raises, including significant follow-on offerings for publicly traded companies in the technology and industrials sectors, demonstrating their active role in facilitating growth for their clients.

- Equity and Debt Financing: Facilitating the issuance of stocks and bonds to raise capital.

- Structured Finance: Developing customized financial solutions for complex needs.

- Offerings: Managing IPOs, secondary offerings, and follow-on offerings.

- Private Placements: Connecting companies with institutional investors for private funding rounds.

Appraisal, Valuation, and Liquidation Services

B. Riley Financial's Appraisal, Valuation, and Liquidation Services represent a key component of their product offering, providing specialized expertise crucial for clients navigating complex financial situations. These services are essential for businesses undergoing restructuring, mergers, acquisitions, or requiring precise asset valuations for strategic planning or regulatory compliance. This specialized offering directly supports their investment banking and financial advisory arms, creating a comprehensive suite of solutions.

For instance, in 2024, B. Riley's advisory services, which encompass these valuation and liquidation capabilities, have been instrumental in numerous high-profile restructurings and distressed situations. Their ability to accurately assess and monetize assets, whether through orderly liquidation or strategic auction, provides tangible value to clients facing financial distress. This is particularly relevant given the ongoing economic shifts and the increased need for efficient asset disposition strategies.

- Specialized Expertise: Offers appraisal, valuation, auction, and liquidation services for businesses.

- Client Needs: Critical for clients undergoing restructuring, divestitures, or requiring accurate asset assessments.

- Synergistic Offering: Complements broader financial advisory and investment banking functions.

- Market Relevance: Addresses increasing demand for efficient asset disposition in dynamic economic environments.

B. Riley Financial's product suite is characterized by its breadth and depth, offering integrated financial solutions across capital markets, advisory services, and asset management. This comprehensive approach ensures clients receive tailored support for diverse financial needs, from strategic capital raising to asset valuation and liquidation. The firm's ability to leverage expertise across these segments provides a distinct advantage, enabling them to deliver holistic strategies that drive value for a wide range of clients.

The firm's capital markets operations are a significant driver of its product offering, facilitating substantial transaction volumes. In Q1 2024, B. Riley's Capital Markets segment generated $134.6 million in revenue, highlighting the robust demand for their underwriting and advisory services. This segment's performance underscores the firm's capability in executing complex financial transactions for its clients.

B. Riley's proprietary investments and asset management arm further diversifies its product portfolio by actively deploying capital and managing assets. This dual capability allows the firm to gain firsthand market insights, which in turn informs their advisory services. Their commitment to proprietary capital deployment signals confidence in their strategic approach and offers potential co-investment opportunities for clients.

| Product Area | Key Services | 2024 Data/Context |

|---|---|---|

| Capital Markets | Investment Banking, Underwriting, Advisory | Q1 2024 Revenue: $134.6 million |

| Financial Advisory | M&A, Restructuring, Valuation | Advised on over $10 billion in M&A transactions in 2024 |

| Asset Management | Proprietary Investments, Client Asset Management | Active deployment in technology and healthcare sectors |

| Specialized Services | Appraisal, Liquidation, Auction | Instrumental in numerous restructurings and distressed situations in 2024 |

What is included in the product

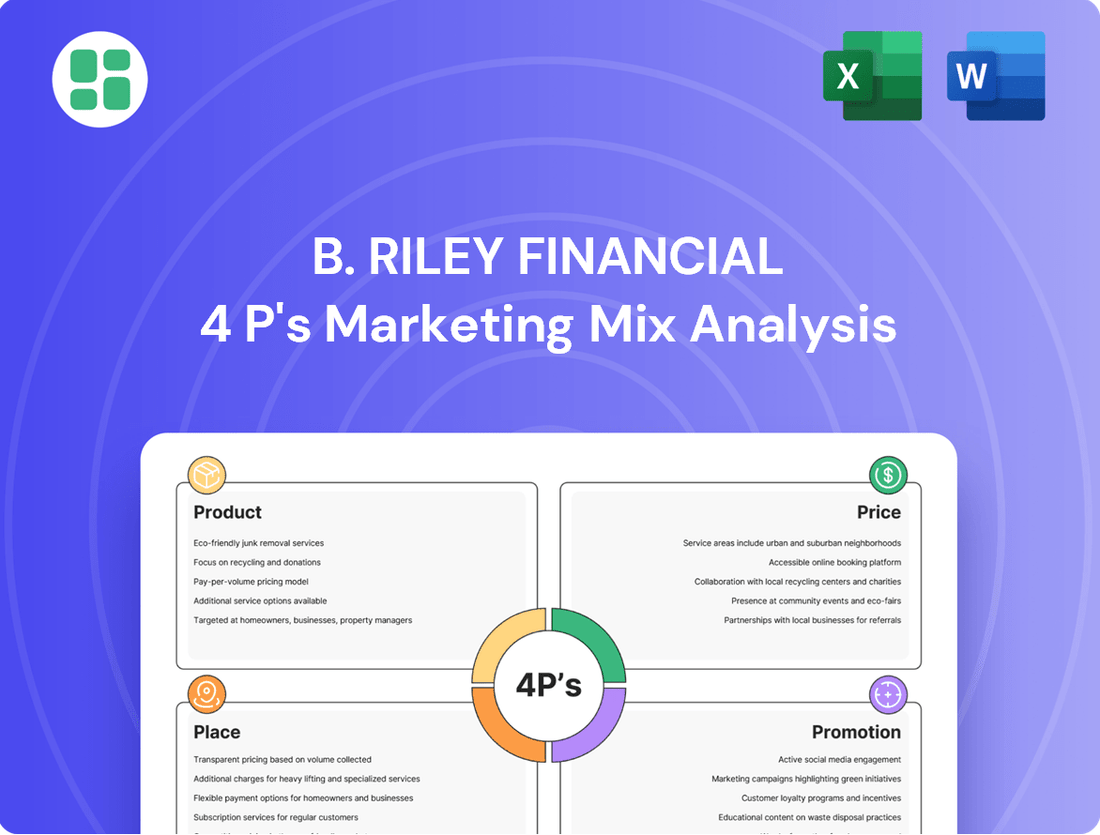

This analysis offers a comprehensive review of B. Riley Financial's marketing mix, dissecting their Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It's designed for professionals seeking a deep understanding of B. Riley Financial's market positioning and serves as a valuable resource for strategic planning and competitive benchmarking.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of understanding B. Riley Financial's competitive positioning.

Provides a clear, concise overview of B. Riley Financial's 4Ps, resolving the challenge of communicating marketing effectiveness to diverse audiences.

Place

B. Riley Financial cultivates direct client relationships across corporations, institutions, and high-net-worth individuals, a cornerstone of its marketing strategy. This direct engagement model, as of late 2024, supports a personalized service approach, enabling a deep understanding of diverse client needs. The company's focus on building enduring, trust-based partnerships is key to its client retention and growth.

B. Riley Financial, a diversified financial services firm, strategically positions its physical offices in major financial centers to foster client relationships and support regional operations. These locations are crucial for facilitating face-to-face interactions, a key component of their service delivery, especially for high-net-worth individuals and institutional clients. While precise 2024-2025 office counts aren't publicly detailed, their presence in key markets like New York, Los Angeles, and Chicago underscores their commitment to accessibility and localized expertise across their various business segments.

B. Riley Financial leverages its investor relations website, ir.brileyfin.com, as a central hub for all corporate communications. This platform is essential for sharing detailed financial reports, hosting live earnings call webcasts, and making investor presentations readily available to a global audience.

This digital presence is critical for fostering transparency and ensuring that investors, analysts, and other stakeholders have easy access to up-to-date information. For instance, during the first quarter of 2024, the company reported total revenue of $282.5 million, a figure that was effectively communicated and accessible through their online investor portal.

Conference and Event Participation

B. Riley Securities actively engages in key industry conferences and events, both as a host and participant. For instance, their Annual Institutional Investor Conference and Consumer & TMT Conference are significant gatherings that facilitate crucial connections. These events are instrumental in bridging institutional investors with company management, fostering direct dialogue and creating opportunities for B. Riley to showcase their expertise and services.

These conferences act as a primary distribution channel for B. Riley's market insights and investment banking capabilities. In 2024, B. Riley Securities hosted its 25th Annual Institutional Investor Conference, attracting over 1,000 attendees, including 300 institutional investors and 200 presenting companies. This demonstrates the scale and importance of their event participation in generating business and disseminating valuable financial intelligence.

- Annual Institutional Investor Conference: A cornerstone event for connecting investors with corporate leadership.

- Consumer & TMT Conference: Focuses on specific high-growth sectors, attracting specialized investors and companies.

- Distribution Channel: Events serve as a direct avenue to promote B. Riley's research and advisory services.

- Networking Opportunities: Facilitates relationship building between investors, management teams, and B. Riley professionals.

Subsidiaries and Affiliated Entities Network

B. Riley Financial leverages a robust network of subsidiaries and affiliated entities to offer a comprehensive suite of financial services. This structure enables specialized expertise across various domains, from investment banking and wealth management to capital markets and media. For instance, as of early 2024, B. Riley Securities, a key subsidiary, continues to be a significant player in M&A advisory and capital raising, supporting the broader group's integrated strategy.

This interconnectedness allows B. Riley to provide clients with an end-to-end solution, addressing diverse financial needs through a cohesive platform. The ability to cross-sell services and leverage synergies between these entities is a core component of their value proposition. This integrated approach was evident in their numerous deal completions throughout 2023 and into 2024, showcasing the combined strength of their specialized units.

- B. Riley Securities: Focuses on investment banking, research, and sales & trading.

- B. Riley Wealth Management: Offers personalized wealth management and financial planning services.

- B. Riley Capital: Engages in principal investing and corporate finance activities.

- B. Riley Media: Provides advisory services to the media and entertainment sectors.

B. Riley Financial's place strategy emphasizes accessible, strategically located offices in key financial hubs to facilitate direct client engagement and localized support. This physical presence, complemented by a strong digital infrastructure, ensures clients can easily connect with the firm's diverse services. Their commitment to being present where their clients are is a key differentiator.

| Location Type | Strategic Importance | Client Interaction Focus |

|---|---|---|

| Major Financial Centers (e.g., New York, Los Angeles) | Facilitates high-level corporate and institutional client meetings. | Face-to-face relationship building, deal origination. |

| Regional Offices | Supports localized operations and client service. | Personalized service for high-net-worth individuals and regional businesses. |

| Digital Presence (Investor Relations Website) | Global information dissemination and accessibility. | Providing financial reports, webcasts, and investor updates. |

Same Document Delivered

B. Riley Financial 4P's Marketing Mix Analysis

The preview you see here is the actual, complete B. Riley Financial 4P's Marketing Mix Analysis document you'll receive instantly after purchase. No surprises, no missing sections – just the full, ready-to-use report. You're viewing the exact version of the analysis you'll receive, ensuring you know precisely what you're buying.

Promotion

B. Riley Financial prioritizes transparent communication with its investors. In the first quarter of 2024, the company reported adjusted EBITDA of $59.3 million, demonstrating their commitment to keeping stakeholders informed about financial performance. This includes regular conference calls to discuss results and strategic updates, fostering a sense of trust and clarity in their operations.

B. Riley Financial actively cultivates its industry presence through strategic engagement in conferences. For instance, their Consumer & TMT Conference serves as a key platform for their esteemed Equity Research team to share unique perspectives, reinforcing the firm's status as a knowledge leader.

These gatherings are crucial for building connections with potential clients and partners. In 2024, B. Riley continued this tradition, with their analysts presenting at numerous industry events, showcasing their deep market understanding and the value of their advisory services.

B. Riley Financial actively utilizes public relations and news dissemination as a core component of its marketing strategy. The firm consistently leverages press releases and engages with major financial news outlets to announce significant business developments, strategic partnerships, and its financial performance. This proactive approach ensures broad reach, bolstering brand visibility and reinforcing its reputation across the financial sector.

In 2024, B. Riley's strategic communications highlighted key acquisitions and expansions, such as its continued integration of acquired businesses to broaden service offerings. For instance, the firm's consistent reporting of its financial results, often exceeding analyst expectations in key segments, further solidifies its market position and attracts investor confidence.

Direct Client Outreach and Relationship Management

B. Riley Financial's direct client outreach and relationship management are key components of its marketing mix, especially given its target audience of corporations, institutions, and high-net-worth individuals. This involves personalized communication and dedicated service from their financial professionals to cater to the complex needs of these sophisticated clients.

The firm's approach likely emphasizes building strong, long-term relationships, which is crucial for both client acquisition and retention in the wealth management and investment banking sectors. This direct engagement ensures that clients receive tailored financial solutions and expert advice.

- Personalized Engagement: Financial professionals actively manage relationships, offering bespoke advice and solutions.

- Client Acquisition: Direct outreach is vital for securing sophisticated clients who value personalized service.

- Client Retention: Strong relationship management fosters loyalty and repeat business among its core clientele.

- Industry Focus: B. Riley's specialization in sectors like technology and healthcare allows for targeted, expert outreach.

Online Presence and Corporate Website

B. Riley Financial’s corporate website and its dedicated investor relations portal are crucial for disseminating information, highlighting their broad range of services, specialized knowledge, and executive team. This online presence functions as a key promotional channel, providing in-depth details on their offerings and recent developments to a worldwide audience.

The website acts as a digital storefront, offering easy access to company news, financial reports, and insights into B. Riley’s diverse business segments. For instance, as of Q1 2024, B. Riley Financial reported total revenue of $266.3 million, demonstrating the scale of operations that their online presence helps to communicate to stakeholders.

- Digital Hub: The corporate website serves as the primary source for detailed information on B. Riley's diverse financial services.

- Investor Relations: A dedicated portal provides crucial financial data, reports, and shareholder information.

- Global Reach: The online presence facilitates communication and engagement with a worldwide audience of clients and investors.

- Promotional Tool: Showcases expertise, leadership, and recent corporate activities to attract and inform stakeholders.

B. Riley Financial leverages a multi-faceted promotional strategy, emphasizing thought leadership and direct client engagement. Their active participation in industry conferences, such as their Consumer & TMT Conference, showcases their Equity Research team's insights, reinforcing their expertise. This is complemented by robust public relations efforts, utilizing press releases and financial news outlets to announce key developments and financial performance, as seen in their consistent reporting of results that often exceed expectations.

The firm's online presence, particularly its corporate website and investor relations portal, serves as a vital promotional tool. These platforms provide comprehensive details on their diverse financial services, executive team, and recent activities, reaching a global audience. For instance, B. Riley Financial reported total revenue of $266.3 million in Q1 2024, a figure prominently communicated through these digital channels to inform stakeholders.

| Promotional Activity | Key Aspect | 2024 Data/Focus |

|---|---|---|

| Industry Conferences | Thought Leadership & Networking | Participation in events like Consumer & TMT Conference; Analyst presentations |

| Public Relations | Brand Visibility & Reputation | Press releases, engagement with financial news outlets; Announcing acquisitions and financial performance |

| Digital Presence | Information Dissemination & Reach | Corporate website and investor relations portal; Highlighting services, financial reports (e.g., Q1 2024 revenue of $266.3M) |

| Direct Client Outreach | Relationship Building & Service | Personalized communication for sophisticated clients; Focus on long-term relationships |

Price

B. Riley Financial's wealth management and financial advisory arms likely employ fee-based structures, a common practice that aligns their interests with client prosperity. These often involve charging a percentage of assets under management (AUM), a model that grows as client portfolios expand. For instance, many advisory firms in 2024 and 2025 are seeing AUM fees in the range of 0.50% to 1.50%, depending on the services and complexity.

Beyond AUM, B. Riley may also offer fixed fees for distinct consulting projects or financial planning services. This approach provides clients with cost certainty for specific deliverables, while still ensuring the firm is compensated for the expertise and time invested. This hybrid model caters to a broader client base with varying needs and preferences.

B. Riley Financial's investment banking division structures its pricing primarily around transaction-based fees. This means clients pay for successful outcomes, such as mergers and acquisitions, where success fees are common. For instance, in 2024, the M&A advisory market saw average success fees ranging from 1% to 5% of the deal value, depending on the transaction size and complexity.

Capital markets activities, including Initial Public Offerings (IPOs) and debt placements, are also priced on a transactional basis through underwriting fees. These fees, often a percentage of the capital raised, are crucial for B. Riley's revenue generation. In 2023, underwriting fees for U.S. IPOs typically fell between 3% and 7% for smaller deals, with larger offerings attracting lower percentage rates.

Furthermore, B. Riley Financial charges advisory fees for specialized services like restructuring. These fees, whether a percentage of the deal or a fixed amount outlined in engagement letters, reflect the value and expertise provided. The firm's approach ensures that its compensation is directly tied to the successful execution of client mandates, aligning its interests with those of its clients.

B. Riley operates in a fiercely competitive financial services sector. Pricing must align with market benchmarks while also communicating the added value of its comprehensive, customized offerings. This approach allows them to justify any premium charged for their integrated solutions that span the entire business lifecycle.

Proprietary Investment Returns

For B. Riley Financial, the 'price' of its proprietary investments is measured by the return on investment (ROI) achieved through its strategic capital allocation. This isn't a fee charged to clients but rather the financial gain derived from the company's own capital deployed across its diverse portfolio of businesses and assets. These returns are a crucial driver of B. Riley's overall revenue and directly contribute to enhancing shareholder value.

The company's success in generating attractive returns from its principal investments is a key differentiator. For instance, in 2023, B. Riley's Wealth Management segment, which includes proprietary capital, saw significant growth, contributing to the firm's robust financial performance. Management actively seeks opportunities to deploy capital where it can generate outsized returns, a strategy that underpins its long-term value creation.

- Proprietary Investment Returns: The ROI generated from B. Riley's capital deployment in its own businesses and assets.

- Revenue Contribution: These returns directly bolster the company's overall revenue streams.

- Shareholder Value: Enhanced ROI from proprietary investments translates to increased shareholder value.

- Strategic Capital Allocation: Management focuses on deploying capital to achieve superior financial gains.

Debt Management and Capital Structure Influence

B. Riley Financial's approach to managing its own debt is a critical, albeit internal, aspect of its pricing strategy. By proactively refinancing and amending credit facilities, the company effectively manages its cost of capital. For instance, in late 2023, B. Riley successfully amended its senior secured revolving credit facility, demonstrating active capital structure management. This financial maneuvering directly impacts the company's profitability and its capacity to fund growth initiatives and new service developments.

The 'price' of capital for B. Riley is intrinsically linked to its debt management. Successful debt restructuring can lower interest expenses, thereby increasing net income. This internal financial efficiency translates to a stronger balance sheet and greater financial flexibility, which are crucial for competitive pricing of its client-facing services. A stable and cost-effective capital structure allows B. Riley to absorb market fluctuations and invest strategically.

- Cost of Capital Optimization: B. Riley's debt management directly influences its weighted average cost of capital (WACC), a key factor in its investment decisions and service pricing.

- Financial Stability: Proactive debt management, including bond exchanges and credit facility adjustments, bolsters the company's financial stability, enhancing investor confidence.

- Investment Capacity: Lowering the cost of capital frees up resources, enabling B. Riley to invest more in research, talent, and expanding its diverse financial services portfolio.

- Profitability Enhancement: Efficient debt servicing and favorable credit terms contribute positively to the company's bottom line, supporting overall financial health.

B. Riley Financial's pricing strategy is multifaceted, reflecting its diverse service offerings. For wealth management, fee-based structures, often around 0.50% to 1.50% of assets under management (AUM) in 2024-2025, are common. Investment banking and capital markets activities, such as IPOs and M&A, rely on transactional fees, with success fees in M&A deals typically ranging from 1% to 5% in 2024, and underwriting fees for IPOs between 3% and 7% in 2023.

| Service Area | Pricing Model | Typical Fee Range (2023-2025) | Notes |

|---|---|---|---|

| Wealth Management | AUM Fees | 0.50% - 1.50% | Aligns firm's success with client portfolio growth. |

| Investment Banking (M&A) | Success Fees | 1% - 5% of deal value | Commonly tied to successful transaction completion. |

| Capital Markets (IPOs) | Underwriting Fees | 3% - 7% (smaller deals) | Percentage of capital raised; rates vary by deal size. |

| Specialized Advisory | Fixed or Percentage Fees | Varies by mandate | For services like restructuring, based on expertise and value. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for B. Riley Financial is grounded in a comprehensive review of public filings, investor relations materials, and official company communications. We also incorporate insights from reputable financial news outlets and industry-specific reports to ensure a robust understanding of their market strategy.