Bollore SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bollore Bundle

Bolloré's diverse portfolio presents significant strengths, but also exposes it to market volatility and regulatory scrutiny. Understanding these internal capabilities and external challenges is crucial for navigating its complex business landscape.

Want the full story behind Bolloré's competitive advantages, potential threats, and growth opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support strategic planning and investment decisions.

Strengths

Bolloré SE's strength lies in its diversified business model, spanning transportation, logistics, media, and electricity storage. This broad operational base acts as a natural hedge, mitigating risks associated with sector-specific downturns. The strategic divestment of Bolloré Logistics and the spin-off of Vivendi in 2024 further sharpen this focus, positioning the group to leverage its remaining core assets for potentially stronger performance in 2025.

Bolloré Group's financial standing is exceptionally robust following the strategic sale of Bolloré Logistics to CMA CGM in February 2024 for €4.8 billion. This significant transaction bolstered the company's liquidity, evidenced by a net cash position of €5.3 billion as of December 31, 2024.

Further enhancing its financial flexibility, Bolloré reported a total of €8 billion in readily available cash and confirmed credit lines by the end of 2024. This substantial financial cushion provides the company with considerable capacity to pursue new strategic investment opportunities and effectively manage potential economic headwinds.

Bolloré's Blue Solutions stands out as a leader with its proprietary solid-state Lithium Metal Polymer (LMP®) battery technology, making it the only European manufacturer of this advanced power source. This technological edge is crucial as the global demand for electric mobility and efficient energy storage solutions continues to surge.

The company's strategic investment in a gigafactory in Alsace, slated for completion by 2030, underscores its commitment to scaling production of next-generation batteries. These batteries promise enhanced vehicle range and significantly reduced charging times, directly addressing key consumer concerns in the EV market.

This specialization in advanced battery tech positions Bolloré to capture substantial market share in the rapidly expanding electric vehicle and grid energy storage sectors, sectors projected for significant growth through 2025 and beyond.

Strategic Acquisitions and Shareholder Returns

Bolloré demonstrates a proactive growth strategy through strategic acquisitions, notably increasing its stake in UMG NV in July 2024 and acquiring a position in Rubis in March 2024. These moves highlight the group's commitment to expanding its investment portfolio and capitalizing on market opportunities.

The company's focus on shareholder returns is evident in its 2024 initiatives. Bolloré launched a share buyback program and proposed a significant 14% dividend increase for fiscal year 2024, underscoring its financial health and dedication to rewarding its investors.

Significant Media Holdings

Despite the Vivendi spin-off finalized in December 2024, Bolloré SE maintains a robust media portfolio. The company holds a substantial 30.4% direct stake in Canal+ Group, a major player in pay-TV and content production, and retains significant influence in Havas, a global advertising and communications group, and Louis Hachette Group. Furthermore, Bolloré holds a 29.3% stake in the newly formed Vivendi entity, underscoring its continued strategic presence in the media landscape. These holdings are anticipated to contribute positively to financial results throughout 2025.

Bolloré's strategic media assets offer several advantages:

- Diversified Revenue Streams: Direct stakes in Canal+ Group and Havas provide exposure to television, content creation, and advertising markets.

- Synergistic Opportunities: Cross-promotional and operational synergies can be leveraged across its media holdings.

- Market Influence: Significant ownership in key media companies grants Bolloré considerable influence over strategic direction and operational decisions.

- Future Growth Potential: The ongoing evolution of the media sector presents opportunities for growth and value creation within these invested entities.

Bolloré's financial strength is a key asset, significantly bolstered by the €4.8 billion sale of Bolloré Logistics in February 2024. This transaction resulted in a net cash position of €5.3 billion by the end of 2024, with total readily available cash and confirmed credit lines reaching €8 billion. This robust liquidity provides substantial capacity for strategic investments and navigating economic uncertainties.

The company's technological leadership in battery manufacturing through Blue Solutions, particularly its proprietary solid-state Lithium Metal Polymer (LMP®) technology, positions it advantageously. The ongoing development of a gigafactory in Alsace, expected to scale production of advanced batteries by 2030, directly addresses the growing demand in electric mobility and energy storage markets.

Bolloré's strategic investments, including increased stakes in UMG NV (July 2024) and Rubis (March 2024), showcase a proactive approach to portfolio expansion and capitalizing on market opportunities. Furthermore, the company's commitment to shareholder value is evident in its 2024 share buyback program and a proposed 14% dividend increase.

Despite the Vivendi spin-off, Bolloré retains significant influence in the media sector through substantial stakes in Canal+ Group (30.4%), Havas, and Louis Hachette Group, along with a 29.3% stake in the new Vivendi entity. These holdings are expected to contribute positively to financial performance through 2025.

| Strength | Description | Impact |

| Financial Liquidity | €5.3 billion net cash (Dec 31, 2024); €8 billion total cash & credit lines. | Enables strategic investments and risk management. |

| Battery Technology Leadership | Proprietary LMP® solid-state battery technology; Gigafactory development. | Captures growth in EV and energy storage markets. |

| Strategic Investments | Increased stakes in UMG NV and Rubis in 2024. | Expands investment portfolio and capitalizes on market opportunities. |

| Shareholder Returns | 2024 share buyback program; Proposed 14% dividend increase. | Demonstrates financial health and rewards investors. |

| Media Holdings | Significant stakes in Canal+ Group, Havas, and Vivendi. | Provides diversified revenue and market influence. |

What is included in the product

Offers a full breakdown of Bollore’s strategic business environment, detailing its internal capabilities and external market dynamics.

Brings clarity to complex market dynamics by pinpointing key competitive advantages and potential threats.

Weaknesses

Bolloré's extensive restructuring in 2024, notably the sale of Bolloré Logistics and the spin-off of Vivendi, while strategically sound, introduced significant accounting complexities. This led to a near-flat adjusted operating profit of €1.26 billion for 2024, highlighting the immediate financial impact of these major shifts.

Navigating a portfolio reshaped by such substantial divestitures and reorganizations presents ongoing operational and strategic hurdles. Effectively managing these new structures and their interdependencies requires careful attention and can strain resources.

Bolloré has encountered significant regulatory hurdles, notably in April 2025. The French financial regulator, AMF, deemed its buyout proposals for Compagnie du Cambodge, Financière Moncey, and Société Industrielle et Financière de l'Artois as non-compliant. This was primarily due to concerns over the transparency of the valuations and suspicions of potential insider trading.

These issues resulted in a substantial fine for the company and have cast a shadow over its governance practices. The scrutiny from the AMF could erode investor confidence and complicate future business dealings and acquisitions for Bolloré.

The industrial segment, encompassing Blue (e-mobility and batteries) and Films, recorded a negative adjusted operating income in 2024, exacerbated by one-off charges tied to prior battery generations.

This sector's reliance on developing and expanding new battery technologies and electric vehicles necessitates significant capital expenditure with extended return horizons.

Impact of Logistics Divestiture

The divestiture of Bolloré Logistics, while a strategic move to generate cash, has undeniably weakened the group's overall revenue base. This segment was a significant contributor, and its absence leaves a noticeable gap in the company's financial structure.

The remaining Bolloré Energy business has already felt the impact, with revenues declining in 2024. This downturn is directly linked to falling petroleum prices, highlighting a potential vulnerability to volatile commodity markets within its core energy distribution operations.

- Revenue Impact: Loss of a major revenue-generating segment due to logistics divestiture.

- Energy Sector Vulnerability: Bolloré Energy's 2024 revenue decrease linked to lower petroleum prices.

- Market Dependence: Potential over-reliance on fluctuating commodity markets for remaining energy distribution.

Market Skepticism and Valuation Lag

Despite its innovative battery technology, Bolloré's market valuation has notably lagged behind competitors. For instance, as of early 2024, while the company showcased significant advancements, its stock performance did not fully reflect these technological gains compared to industry peers.

This valuation lag appears to be influenced by market skepticism, potentially stemming from past regulatory challenges and the intricate restructuring of its business segments. Such sentiment can contribute to a sustained underperformance of its stock, even as its underlying technological capabilities mature.

- Valuation Gap: Bolloré's market capitalization has not kept pace with its technological advancements in areas like solid-state batteries when compared to key industry players in early 2024.

- Investor Sentiment: Lingering concerns from previous regulatory scrutiny and the complexity of its diversified business model may be contributing to investor caution.

- Stock Performance: This skepticism can translate into a persistent discount on its stock price, hindering its ability to reach its full market potential.

Bolloré's industrial segment, particularly its e-mobility and battery operations, faced significant headwinds in 2024, reporting a negative adjusted operating income. This was partly due to one-off charges related to older battery generations, indicating ongoing costs associated with technological evolution.

The divestiture of Bolloré Logistics in 2024, a substantial revenue generator, has left a noticeable gap in the group's financial structure, impacting overall revenue generation. Furthermore, the remaining Bolloré Energy business experienced a revenue decline in 2024, directly attributed to falling petroleum prices, highlighting vulnerability to commodity market fluctuations.

The company's market valuation, as of early 2024, has not kept pace with its technological advancements, particularly in battery technology, when compared to industry peers. This valuation lag is likely influenced by market skepticism, potentially stemming from past regulatory issues and the complexity of its restructured business segments, leading to a persistent discount on its stock price.

| Weakness | Description | Financial Impact (2024) | Strategic Implication |

| Industrial Segment Performance | Negative adjusted operating income in industrial segment (e-mobility, batteries) | Exacerbated by one-off charges; requires significant capital expenditure | Hinders growth in key innovation areas; potential for continued losses |

| Revenue Base Reduction | Sale of Bolloré Logistics | Significant contributor to revenue base removed | Weakened overall financial structure; necessitates revenue diversification |

| Energy Sector Vulnerability | Revenue decline in Bolloré Energy | Linked to falling petroleum prices | Exposes remaining energy operations to volatile commodity markets |

| Market Valuation Lag | Stock performance lagging behind technological advancements | Early 2024 market capitalization did not reflect innovation | Investor caution due to past regulatory issues and business complexity; potential for sustained stock underperformance |

What You See Is What You Get

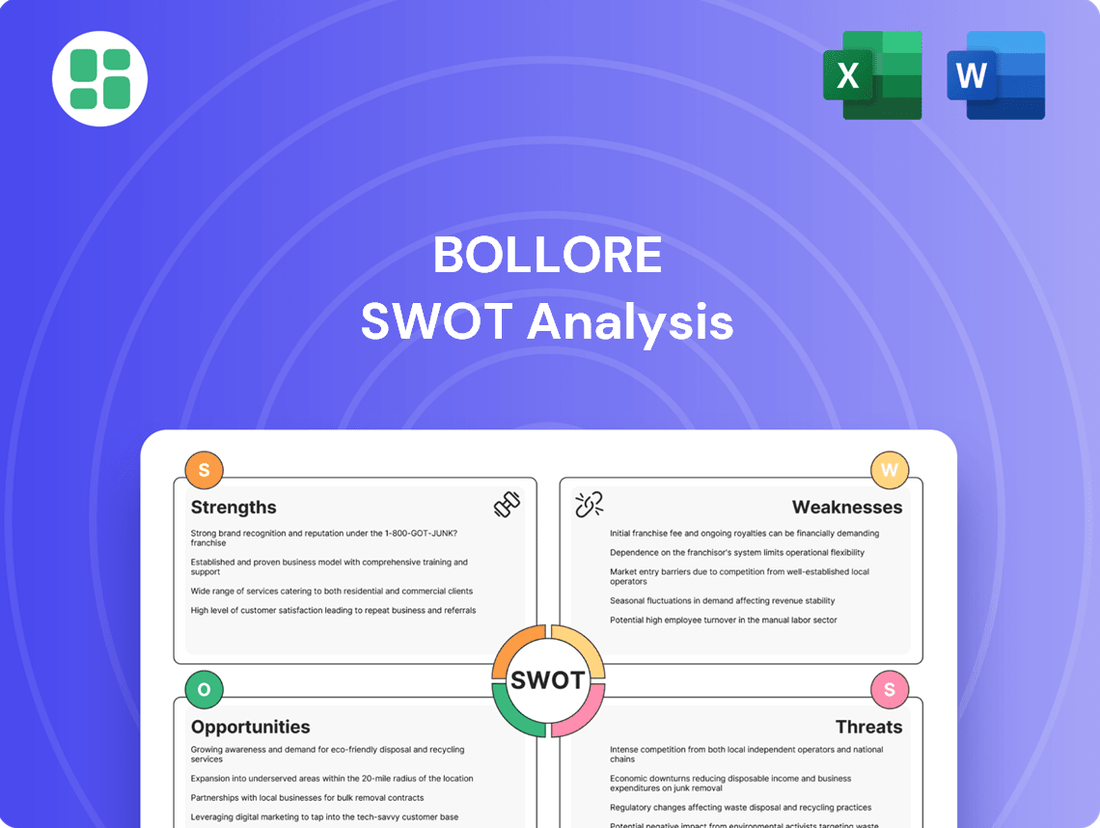

Bollore SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This means you get a direct look at the professional quality and structure of the Bollore SWOT Analysis. Purchase unlocks the entire in-depth version, ensuring no surprises.

Opportunities

Bolloré's advanced 4th-generation solid lithium-metal batteries, offering enhanced range and quicker charging, place it advantageously to capitalize on the burgeoning electric vehicle (EV) market, which is anticipated to reach 85 million units by 2025. This technological edge also positions the company to tap into the rapidly expanding grid energy storage sector, a market projected to reach $50 billion by 2030.

The company's strategic investment in the Alsace gigafactory further underscores its commitment to scaling production and meeting the escalating global demand for these cutting-edge battery solutions.

Bolloré's significant holdings in Canal+, Havas, and the Louis Hachette Group, especially after the Vivendi spin-off, create a powerful platform for synergy. This integration allows for enhanced content production, broader broadcasting capabilities, and more sophisticated advertising strategies. For instance, Canal+ is actively expanding internationally, and leveraging Havas's global advertising network can significantly amplify this reach, potentially boosting subscriber growth in new territories.

Bolloré's substantial net cash position, bolstered by the sale of Bolloré Logistics for approximately €5.7 billion in 2024, presents a prime opportunity for strategic investments. This financial firepower allows for targeted acquisitions in burgeoning sectors like renewable energy or advanced logistics solutions, enhancing its competitive edge.

This financial flexibility enables Bolloré to optimize its existing portfolio by divesting underperforming assets and reinvesting in areas with higher growth potential. Such strategic capital allocation, supported by its strong cash reserves, can drive long-term value creation and resilience against market volatility.

Technological Advancements in Battery Production

Ongoing advancements in battery technology, particularly the development of next-generation solid-state batteries, present a significant opportunity for Bolloré. Research indicates these batteries could achieve charging times as low as 20 minutes and boast a 50% increase in energy density, offering a substantial competitive advantage.

Bolloré's unique position as the sole European producer of solid-state batteries is a key differentiator. This exclusivity allows the company to capture a significant share of a rapidly growing market, especially as demand for electric vehicles and energy storage solutions continues to surge. The global battery market is projected to reach over $400 billion by 2030, with solid-state batteries expected to be a major growth driver.

- Technological Edge: Next-generation solid-state batteries offer faster charging (20 minutes) and higher energy density (50% increase).

- European Market Dominance: Bolloré is the only European producer of solid-state batteries, providing a unique market entry.

- Market Growth: The global battery market is expanding rapidly, with solid-state technology poised for significant adoption.

Growth in African and Emerging Markets

Despite the sale of Bolloré Logistics, the group retains significant opportunities in Africa and other emerging markets. Its established presence, built over decades, provides a strong foundation for leveraging existing relationships. For instance, CanalOlympia's network of cinemas across the continent offers a platform for brand visibility and community engagement, crucial for expanding other ventures.

The potential development of telecommunications services, such as GVA, taps into the burgeoning digital economy in Africa. This sector is experiencing rapid growth, with mobile penetration rates continuing to climb. Bolloré's historical footprint positions it well to capitalize on this trend, offering essential connectivity and digital services to underserved populations.

- Continued Expansion in Africa: Bolloré's deep-rooted connections in African nations offer a strategic advantage for market penetration in sectors beyond logistics.

- Leveraging Media Assets: The CanalOlympia cinema chain provides a valuable touchpoint for brand building and consumer interaction across the continent.

- Digital Economy Growth: The potential for telecommunications services like GVA aligns with Africa's increasing demand for digital infrastructure and connectivity.

- High-Growth Region Potential: Emerging markets, particularly in Africa, represent significant growth potential for Bolloré's remaining and future business lines.

Bolloré's technological leadership in solid-state batteries, with advancements like 20-minute charging and a 50% energy density increase, positions it to capture significant market share in the rapidly growing EV and energy storage sectors. As the sole European producer of these batteries, Bolloré benefits from a unique market entry point, capitalizing on a global battery market projected to exceed $400 billion by 2030.

The company's substantial net cash, enhanced by the €5.7 billion sale of Bolloré Logistics in 2024, provides ample resources for strategic acquisitions and investments in high-growth areas. This financial flexibility allows for portfolio optimization, enabling Bolloré to divest underperforming assets and reinvest in promising ventures.

Bolloré's established presence and deep relationships in Africa offer a strong foundation for expanding its remaining and future business lines. Leveraging assets like the CanalOlympia cinema network and exploring telecommunications services through GVA taps into the continent's burgeoning digital economy and increasing demand for connectivity.

| Opportunity | Description | Market Data |

| Battery Technology Leadership | Advancements in solid-state batteries (20-min charging, 50% energy density increase). | Global battery market to exceed $400B by 2030. |

| European Solid-State Battery Monopoly | Sole European producer of solid-state batteries. | EV market projected at 85M units by 2025; Grid energy storage market to reach $50B by 2030. |

| Financial Flexibility | €5.7B net cash from Bolloré Logistics sale (2024). | Enables strategic acquisitions and reinvestment in growth sectors. |

| African Market Penetration | Leveraging existing infrastructure and relationships. | Africa's digital economy growth and increasing mobile penetration. |

Threats

Bolloré operates in highly competitive arenas, notably the electric vehicle (EV) battery sector where it contends with established automotive suppliers and rapidly growing battery manufacturers. This intense rivalry, especially from Asian players dominating production, puts pressure on market share and pricing strategies.

In its media and telecommunications segments, Bolloré faces a dynamic and fragmented market. The proliferation of streaming services and digital content platforms, alongside traditional broadcasters, creates a challenging environment for subscriber acquisition and retention, impacting revenue streams significantly.

Bolloré faces ongoing regulatory and legal challenges that could impact its operations and financial standing. For instance, the Autorité des marchés financiers (AMF) issued a non-compliance ruling concerning buyout offers in April 2025, highlighting persistent scrutiny.

Furthermore, the company is entangled in unresolved legal disputes, such as those stemming from the Vivendi spin-off. These legal entanglements represent a significant threat, potentially leading to substantial fines, damage to its reputation, and a diversion of critical resources away from strategic growth projects.

Macroeconomic and geopolitical uncertainties pose significant threats to Bolloré. Global economic slowdowns, as seen in the projected 2.6% global GDP growth for 2024 by the IMF, can dampen consumer spending and business investment, directly impacting Bolloré's logistics and advertising segments. Ongoing geopolitical tensions, such as the disruptions in the Red Sea in early 2024 that led to increased shipping costs and delays, directly affect freight volumes and operational efficiency for Bolloré's transport and logistics operations.

Furthermore, high tariffs and trade barriers can create headwinds for international trade, reducing cargo volumes and potentially impacting Bolloré's revenues. While Bolloré's diversified business model offers some resilience against these shocks, the interconnected nature of global markets means these external factors can still materially affect overall business performance and profitability.

Technological Disruption and Rapid Innovation

The electric vehicle (EV) and energy storage sectors are experiencing an unprecedented rate of technological advancement. While Bolloré actively invests in cutting-edge battery technologies, the sheer speed of innovation means that new breakthroughs by competitors could quickly render its current solutions less competitive. For instance, advancements in solid-state batteries or novel chemistries could significantly disrupt the market, potentially eroding Bolloré's established market position if it cannot adapt swiftly.

This rapid innovation poses a significant threat, as a competitor's unforeseen technological leap could rapidly diminish the value of Bolloré's existing battery intellectual property and manufacturing capabilities. The market is dynamic, and staying ahead requires continuous, substantial R&D investment and agility to pivot quickly to emerging technologies. For example, by early 2025, several major automotive manufacturers are expected to announce significant advancements in battery density and charging speeds, potentially outdating current offerings.

- Rapid Pace of EV Battery Innovation: The EV battery market is characterized by extremely fast technological evolution, with new chemistries and designs emerging frequently.

- Competitor Breakthroughs: Unforeseen innovations by rivals could quickly erode Bolloré's competitive advantage in battery technology.

- Risk of Obsolescence: Current battery solutions may become obsolete faster than anticipated due to rapid industry advancements.

- Need for Continuous R&D: Sustaining a competitive edge necessitates ongoing, substantial investment in research and development to keep pace with or lead innovation.

Volatility in Energy Markets

Bolloré Energy's financial performance is directly tied to the often-unpredictable nature of energy markets. For instance, the price swings observed in petroleum products throughout 2024 highlight this vulnerability. This reliance on volatile commodity prices can lead to significant swings in profitability and create revenue instability for a substantial part of the group's business activities.

This susceptibility to market fluctuations poses a considerable threat:

- Revenue Instability: Fluctuations in oil and gas prices can directly impact Bolloré Energy's sales volume and margins, making revenue less predictable.

- Profitability Squeeze: Rising energy costs without a corresponding ability to pass them onto customers can compress profit margins.

- Inventory Valuation Risk: Changes in commodity prices can affect the value of inventory held by Bolloré Energy, potentially leading to write-downs.

- Strategic Planning Challenges: The unpredictable nature of energy markets makes long-term financial forecasting and strategic investment decisions more complex.

Bolloré faces intense competition across its diverse business segments, particularly in the rapidly evolving electric vehicle battery market where it competes with established global players and emerging Asian manufacturers. The telecommunications and media sectors are also highly dynamic and fragmented, with new digital platforms constantly challenging subscriber bases and revenue models. Additionally, the company is subject to significant regulatory scrutiny and ongoing legal disputes, such as those related to past acquisition activities and corporate restructurings, which could result in substantial financial penalties and reputational damage.

SWOT Analysis Data Sources

This Bolloré SWOT analysis is built upon a foundation of comprehensive data, drawing from official company financial reports, extensive market intelligence, and expert industry analyses to provide a robust and insightful strategic overview.