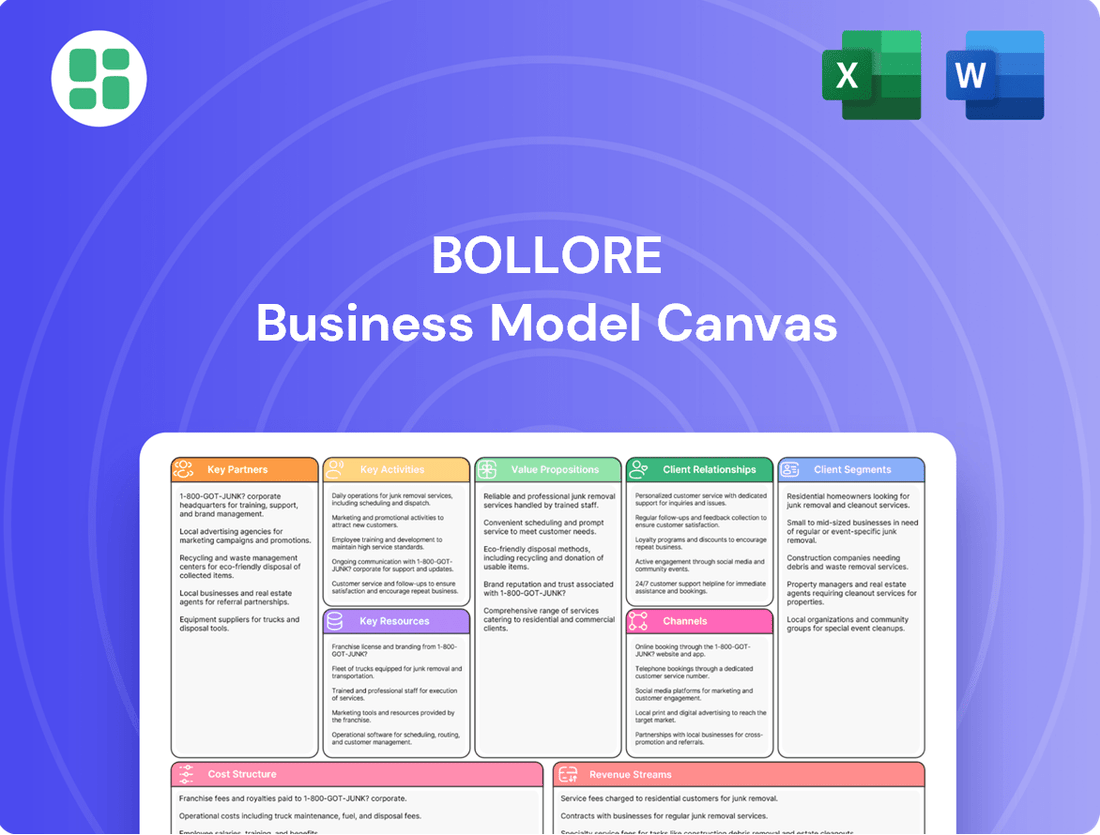

Bollore Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bollore Bundle

Unlock the core components of Bollore's diversified business empire with our Business Model Canvas. Discover how they leverage key resources and partnerships to deliver value across various sectors. This detailed canvas is your key to understanding their strategic advantages.

Partnerships

Bolloré actively pursues co-development contracts with major global players to broaden the use of its battery technology, especially in areas like light electric vehicles and consumer gadgets. These alliances are vital for pushing forward its electric mobility and energy storage initiatives.

These strategic collaborations significantly reduce research and development expenses for Bolloré, while also accelerating the introduction of groundbreaking battery solutions to the market. For instance, in 2024, Bolloré's battery division reported a substantial increase in its order book, partly attributed to these co-development projects, signaling growing market confidence.

Bolloré actively partners with public entities such as RATP and the City of Paris for the delivery of electric buses. These collaborations are crucial for advancing urban sustainable transport initiatives. In 2024, for instance, Bolloré's Bluebus division continued to be a key supplier in France's transition to cleaner public transportation, with significant orders contributing to the electrification of bus fleets in major cities.

Bolloré's media content and distribution strategy hinges on its substantial stakes in key players like Canal+ Group, Havas, and Louis Hachette Group, all under the Vivendi umbrella. These partnerships are crucial for generating and disseminating a wide array of content, from television programming to advertising campaigns.

This integrated approach allows Bolloré to effectively reach diverse audiences and capitalize on cross-sectoral synergies within the communications industry. For instance, Canal+ Group's extensive broadcasting network, coupled with Havas's advertising expertise, creates a powerful distribution channel for content and marketing initiatives.

Logistics and Supply Chain Collaborators

While Bolloré Logistics was divested to CMA CGM in early 2024, historically, key partnerships in logistics and supply chain were crucial. These included collaborations with entities like Alha Group, which provided biofuel trucks, supporting more sustainable transport solutions. Business France was another partner, aiding in the development of export capabilities for small and medium-sized enterprises, demonstrating a commitment to broader supply chain ecosystem growth.

Even with the sale of its direct logistics operations, Bolloré Group's strategic investments in sectors reliant on efficient supply chains continue to foster indirect collaborations. The group's ongoing involvement in areas such as electric vehicle charging infrastructure and entertainment distribution necessitates strong relationships with logistics providers and supply chain experts. This ensures the continued benefit from robust operational expertise, even if not directly managed.

- Historical Partnerships: Alha Group (biofuel trucks), Business France (SME export development).

- Post-Divestment Strategy: Continued reliance on supply chain expertise through strategic investments in related sectors.

- Sectoral Benefits: Electric vehicle charging and entertainment distribution gain from strong logistics and supply chain relationships.

Investment and Portfolio Company Relationships

Bolloré cultivates key partnerships through strategic investments and holdings in other companies. A prime example is its significant stake in Universal Music Group (UMG), which it increased to approximately 18.4% by the end of 2023. This move underscores a long-term strategy to gain influence and benefit from the music industry's growth.

Further demonstrating this approach, Bolloré also holds substantial investments in companies like Rubis, a global player in energy and services. These financial partnerships are crucial for diversifying its overall portfolio and securing returns across different economic sectors, reflecting a deliberate strategy of market participation and value creation.

These relationships are not merely passive investments; they represent an active financial partnership aimed at fostering growth and expanding market influence. By strategically acquiring stakes, Bolloré positions itself to benefit from the performance and strategic direction of its portfolio companies, such as UMG and Rubis, reinforcing its financial strength and operational reach.

- Strategic Acquisitions: Increased stake in Universal Music Group (UMG) to approximately 18.4% by year-end 2023.

- Diversification: Holdings in companies like Rubis contribute to a broad portfolio across various industries.

- Financial Partnership: These relationships are built on a financial model designed for long-term returns and market influence.

- Growth Strategy: Bolstered investments in key companies are central to Bolloré's expansion and revenue generation plans.

Bolloré's key partnerships extend to battery technology co-development with major global firms, accelerating market entry for innovations in electric mobility and consumer electronics. These collaborations, crucial for reducing R&D costs, saw Bolloré's battery division report a significantly boosted order book in 2024, indicative of enhanced market trust.

Furthermore, strategic alliances with public entities like RATP and the City of Paris are fundamental to Bolloré's urban sustainable transport goals, particularly with its Bluebus division securing substantial orders in 2024 for public transport electrification across France.

Bolloré's media influence is amplified through its significant stakes in Vivendi subsidiaries like Canal+ Group and Havas, enabling extensive content generation and distribution, leveraging cross-sectoral synergies for wider audience reach.

Historically, Bolloré Logistics partnered with entities such as Alha Group for sustainable transport solutions; while divested in early 2024, the group's ongoing investments in electric vehicle infrastructure and entertainment distribution maintain critical indirect supply chain relationships.

Bolloré also cultivates financial partnerships through strategic investments, notably increasing its stake in Universal Music Group to approximately 18.4% by the end of 2023, alongside holdings in companies like Rubis, to foster growth and diversify its portfolio.

| Partner Type | Example Partners | Strategic Importance | 2024 Impact/Data Point |

|---|---|---|---|

| Technology Co-development | Global EV and Gadget Manufacturers | Accelerates battery innovation, reduces R&D | Increased order book for battery division |

| Public Transport Operators | RATP, City of Paris | Drives urban sustainable transport | Key supplier for French public transport electrification |

| Media & Entertainment Holdings | Canal+ Group, Havas (Vivendi) | Content generation and distribution, cross-sectoral synergies | Leverages broadcasting and advertising expertise |

| Financial Investments | Universal Music Group (UMG), Rubis | Portfolio diversification, market influence, long-term returns | UMG stake ~18.4% (end 2023) |

What is included in the product

A structured overview of Bolloré's diversified operations, detailing its key customer segments, value propositions, and revenue streams across its various business units.

This model outlines Bolloré's strategic approach to leveraging its industrial and logistical infrastructure to deliver integrated solutions to its global client base.

The Bolloré Business Model Canvas offers a structured approach to identify and address customer pains by clearly mapping out value propositions and customer relationships.

It helps businesses pinpoint and alleviate customer pain points by providing a visual framework to understand their needs and tailor solutions accordingly.

Activities

Bolloré's key activities center on the innovation and manufacturing of cutting-edge electricity storage solutions, notably its 4th-generation solid lithium-metal batteries. This commitment to advanced battery technology drives substantial research and development investments.

The company also actively produces electric vehicles, exemplified by its Bluebus line, integrating its battery advancements directly into tangible products. This dual focus on battery technology and EV manufacturing is crucial for its market position.

By prioritizing enhancements in energy density and charging speeds for its battery systems, Bolloré aims to address critical consumer and industry needs in the rapidly evolving electric mobility sector. For instance, by the end of 2024, the company's battery division, through its subsidiary BatScap, was expected to have delivered a significant number of battery packs for various applications.

Bolloré's media content production and broadcasting activities are primarily channeled through its significant stake in Vivendi. This includes the operations of Canal+ Group, a major player in pay television, and Havas, a global advertising and communications group. These entities are deeply involved in creating and distributing a wide array of content, from films and series to advertising campaigns, reaching audiences across numerous platforms.

Vivendi's extensive content creation capabilities are a cornerstone of Bolloré's media strategy. For instance, Canal+ Group is known for its original productions and acquisitions of premium content, bolstering its broadcasting services. In 2023, Canal+ Group reported revenues of €5.7 billion, highlighting the scale of its content and distribution operations.

The advertising services arm, represented by Havas, leverages content to engage target demographics for clients. Havas reported revenues of €2.4 billion in 2023, demonstrating its significant role in the advertising ecosystem. This strategic involvement in content production and broadcasting, even through an equity stake, positions Bolloré within key segments of the media industry.

The strategic spin-off of key Vivendi entities in December 2024 has notably altered Vivendi's corporate structure, impacting how these media assets are managed and potentially influencing future content production and broadcasting strategies.

Bolloré Energy's core activities in oil logistics and distribution are central to its operations, particularly in France, Switzerland, and Germany. This involves the crucial tasks of storing and distributing a wide range of petroleum products to meet market demand.

The company is actively diversifying its energy portfolio by investing in alternative fuels, such as biodiesel, signaling a strategic shift towards more sustainable energy sources. This diversification is a key part of their long-term strategy to adapt to evolving energy landscapes.

Bolloré Energy continues to bolster its infrastructure by investing in its service station network and expanding its storage capacity for petroleum products. For instance, in 2024, the company continued its focus on optimizing its logistical chains and enhancing its retail presence across its operational territories.

Strategic Investment and Portfolio Management

The group's strategic investment and portfolio management is a core activity, focusing on optimizing its diverse holdings. This includes actively managing a portfolio of listed securities and agricultural assets, such as significant stakes in UMG and Rubis.

Key activities involve strategic acquisitions, divestments, and share buyback programs to enhance financial performance. A prime example of this portfolio restructuring includes the significant sale of Bolloré Logistics in February 2024 and the planned Vivendi spin-off in December 2024.

- Active management of listed securities and agricultural assets.

- Strategic acquisitions, divestments, and share buybacks for portfolio optimization.

- Notable 2024 events: Sale of Bolloré Logistics (February) and Vivendi spin-off (December).

Infrastructure Management and Development

Bolloré's key activities in infrastructure management and development are now primarily focused on long-term strategic investments, particularly in the energy sector. While historically involved in port concessions and freight forwarding, the company has largely divested from these direct logistics operations. This shift indicates a strategic pivot towards managing and developing large-scale infrastructure projects, leveraging past expertise in concession agreements.

The company's current infrastructure activities are deeply intertwined with its energy sector investments. For instance, Bolloré Africa's involvement in the development of renewable energy infrastructure, such as solar power plants, exemplifies this focus. In 2023, Bolloré's investments in energy infrastructure continued to be a significant driver of its strategic direction, reflecting a commitment to sustainable development and energy transition.

- Strategic Energy Infrastructure Development: Bolloré is actively engaged in developing and managing energy infrastructure, particularly in Africa, focusing on renewable energy sources like solar.

- Leveraging Concession Expertise: The company utilizes its historical experience in managing port concessions and similar large-scale projects to secure and manage new infrastructure developments.

- Long-Term Investment Focus: Bolloré's infrastructure activities are characterized by a strategy of long-term investment, aiming for sustained growth and impact in key sectors.

- Divestment from Traditional Logistics: A significant part of their infrastructure strategy involves a strategic divestment from traditional freight forwarding and port operations to concentrate on higher-growth areas like energy.

Bolloré's key activities in battery technology development are geared towards producing advanced energy storage solutions, including its proprietary solid lithium-metal batteries. This focus drives significant R&D investment, aiming to enhance energy density and charging capabilities for electric vehicles and other applications. By the end of 2024, its subsidiary BatScap was slated to deliver a substantial volume of battery packs.

The company's media operations, primarily through its stake in Vivendi, involve content creation and broadcasting via entities like Canal+ Group and Havas. Canal+ Group's 2023 revenues reached €5.7 billion, underscoring its extensive content production and distribution. Havas, its advertising arm, generated €2.4 billion in 2023, highlighting its role in leveraging content for advertising services. The planned Vivendi spin-off in December 2024 is a significant structural change.

Bolloré Energy's core activities encompass oil logistics and distribution across France, Switzerland, and Germany, including storage and delivery of petroleum products. The company is also actively investing in alternative fuels like biodiesel, signaling a strategic move towards sustainability. In 2024, Bolloré Energy continued to optimize its logistics and expand its service station network.

Strategic investment and portfolio management are critical, involving active management of listed securities and agricultural assets, with notable holdings in UMG and Rubis. Key strategic moves in 2024 included the sale of Bolloré Logistics in February and the planned Vivendi spin-off in December, aimed at portfolio optimization.

Infrastructure activities are now strategically focused on long-term energy sector investments, particularly renewable energy projects in Africa, such as solar power plants. This represents a shift from historical involvement in port concessions and freight forwarding, leveraging past expertise in managing large-scale concession agreements for sustainable development.

| Key Activity Area | Primary Focus | Notable 2023/2024 Data/Events | Strategic Significance |

|---|---|---|---|

| Battery Technology | R&D and manufacturing of advanced batteries | Focus on 4th-gen solid lithium-metal batteries; BatScap expected significant battery pack deliveries by end of 2024. | Drives innovation in electric mobility solutions. |

| Media & Content | Content creation and broadcasting (via Vivendi) | Canal+ Group 2023 revenue: €5.7B; Havas 2023 revenue: €2.4B; Vivendi spin-off planned for Dec 2024. | Leverages significant media assets for revenue and influence. |

| Energy Logistics & Distribution | Oil logistics and distribution; alternative fuels | Operations in France, Switzerland, Germany; focus on biodiesel; network expansion in 2024. | Ensures energy supply and adapts to evolving energy markets. |

| Investment & Portfolio Management | Strategic management of diverse assets | Sale of Bolloré Logistics (Feb 2024); holdings in UMG, Rubis; Vivendi spin-off (Dec 2024). | Optimizes financial performance and strategic positioning. |

| Infrastructure Development | Long-term energy infrastructure investments | Focus on renewable energy projects (e.g., solar in Africa); shift from traditional logistics. | Supports sustainable development and energy transition. |

Full Version Awaits

Business Model Canvas

The Bolloré Business Model Canvas preview you're seeing is an authentic representation of the final deliverable. This isn't a mockup; it's a direct snapshot from the actual document you will receive upon purchase. You'll gain full access to this comprehensive and professionally structured Business Model Canvas, ready for your strategic planning needs.

Resources

Bolloré's key resources include its advanced battery technology and a robust patent portfolio, particularly in solid-state batteries. This includes their 4th-generation lithium-metal battery innovations, which offer significant performance advantages.

These proprietary technologies provide a distinct competitive edge in rapidly growing markets like electric vehicles and grid-scale energy storage. For instance, solid-state batteries promise higher energy density and improved safety profiles compared to traditional lithium-ion chemistries.

The company's sustained investment in research and development is crucial, ensuring a continuous stream of advanced and highly efficient battery solutions. This commitment to innovation is vital for maintaining market leadership and addressing the evolving demands for cleaner energy technologies.

Bolloré's financial capital is a cornerstone of its business model, highlighted by robust net cash and liquidity. Following significant divestments, such as the sale of Bolloré Logistics in early 2024 for €5.7 billion, the company is exceptionally well-positioned financially.

This strong financial footing empowers Bolloré to pursue long-term strategic investments, potential acquisitions, and to return value to shareholders through buyback programs. As of the first half of 2024, Bolloré reported a net cash position of €12.1 billion, underscoring its financial strength.

Furthermore, Bolloré maintains a substantial portfolio of listed securities, valued at approximately €5.1 billion as of December 31, 2023. This diversified asset base contributes significantly to the company's overall financial capital and investment capacity.

Bolloré leverages its significant influence through equity stakes in companies like Vivendi and Canal+, granting it access to vast media content libraries and crucial broadcasting licenses. This network is fundamental for its global reach and revenue generation from subscriptions and advertising.

In 2024, Vivendi reported revenues of €10.1 billion, with Canal+ contributing significantly through its extensive pay-TV operations across Europe and Africa, showcasing the direct impact of these distribution networks.

Industrial Infrastructure and Production Facilities

Bolloré's industrial infrastructure is a cornerstone of its business model, particularly for its electric mobility and energy storage segments. The company operates manufacturing facilities dedicated to producing its electric buses, known as Bluebuses, and the associated battery technology. This physical footprint is critical for scaling production to meet growing global demand for sustainable transportation solutions.

Further strengthening its commitment to the energy transition, Bolloré is investing significantly in advanced manufacturing capabilities. A prime example is the development of a new gigafactory in Alsace, France, which is poised to become a major hub for battery production. This facility is expected to significantly boost the company's output and technological prowess in the battery sector, supporting its ambitions in electric vehicles and grid-scale energy storage.

Beyond electric mobility, Bolloré's extensive oil logistics operations rely on a robust network of industrial assets. This includes substantial storage capacities strategically located to ensure efficient distribution and a widespread network of service stations. These facilities are vital for maintaining its position in the traditional energy market while the company pivots towards cleaner energy solutions.

- Manufacturing of Electric Vehicles: Bolloré produces its Bluebus electric buses at dedicated facilities, enabling direct control over quality and production volume.

- Battery Production Facilities: The company operates plants for battery manufacturing and is constructing a significant gigafactory in Alsace, France, to enhance its battery production capacity.

- Oil Logistics Infrastructure: Bolloré maintains a comprehensive network of storage facilities and service stations for its oil logistics business, ensuring reliable supply chain operations.

Human Capital and Expertise

Bolloré's business model hinges on its human capital, a diverse pool of talent essential for its multifaceted operations. This includes highly skilled engineers driving innovation in areas like battery technology, a sector where significant R&D investment is crucial for future growth and competitiveness.

The group also boasts a strong contingent of media professionals, vital for its content creation and distribution arms, ensuring engaging and relevant output across various platforms. Their expertise is paramount in navigating the rapidly evolving media landscape and maintaining audience engagement.

Furthermore, Bolloré relies on seasoned financial management and strategic investment experts. These professionals are instrumental in guiding the company's financial health, identifying lucrative opportunities, and managing the complexities of global markets. Their collective knowledge underpins the group's ability to adapt and thrive amidst dynamic economic conditions.

- Engineers: Crucial for R&D in battery technology and industrial processes.

- Media Professionals: Essential for content creation, distribution, and brand management in broadcasting and advertising.

- Financial Experts: Drive strategic investments, manage capital allocation, and ensure financial stability across diverse sectors.

- Operational Specialists: Ensure efficiency and expertise in logistics, manufacturing, and infrastructure management.

Bolloré's key resources extend to its significant intellectual property, particularly its advanced battery technology and an extensive patent portfolio. Innovations in solid-state batteries, including fourth-generation lithium-metal battery advancements, provide a distinct competitive advantage in the burgeoning electric vehicle and energy storage markets.

The company's financial strength is a critical resource, underscored by a substantial net cash position. Following the sale of Bolloré Logistics in early 2024 for €5.7 billion, the company reported a net cash of €12.1 billion in the first half of 2024, enabling strategic investments and shareholder returns.

Bolloré's industrial infrastructure is vital, encompassing manufacturing facilities for its Bluebuses and battery production, alongside a gigafactory under development in Alsace, France. This physical network supports its electric mobility ambitions and traditional oil logistics operations.

Human capital is paramount, with skilled engineers driving battery technology innovation and media professionals managing content and distribution. Financial experts and operational specialists further bolster the group's diverse capabilities.

| Key Resource | Description | 2024 Data/Impact |

|---|---|---|

| Battery Technology & IP | Proprietary battery innovations, including solid-state and lithium-metal technologies. | Drives competitive edge in EV and energy storage sectors. |

| Financial Capital | Strong net cash position and diversified securities portfolio. | €12.1 billion net cash (H1 2024); €5.1 billion in listed securities (Dec 2023). Enables strategic investments. |

| Industrial Infrastructure | Manufacturing plants for electric buses and batteries; oil logistics network. | Development of Alsace gigafactory to boost battery production. |

| Human Capital | Skilled engineers, media professionals, financial and operational experts. | Drives innovation, content creation, financial strategy, and operational efficiency. |

Value Propositions

Bolloré's value proposition centers on providing advanced sustainable energy and mobility solutions. This includes their innovative Bluebuses, which offer a cleaner alternative for public transportation, and their cutting-edge energy storage systems. These systems are powered by proprietary solid-state batteries, a key differentiator.

The company directly addresses critical market needs by delivering efficient, low-carbon options for both urban mobility and grid stability. Their focus on enhancing charging speed and extending the range of their electric vehicles directly tackles consumer and commercial demands for more practical and reliable sustainable technologies.

In 2024, the global market for electric buses alone was projected to reach over $50 billion, highlighting the significant demand for solutions like Bolloré's Bluebuses. Furthermore, the energy storage market, crucial for grid stability, was expected to see substantial growth, with solid-state battery technology being a key driver of innovation.

Bolloré's diversified media content and entertainment value proposition is primarily delivered through its substantial investment in Vivendi. This strategic stake grants access to a broad portfolio of media assets, including Canal+, Havas, and the Louis Hachette Group. This extensive reach allows Bolloré to offer a wide spectrum of entertainment, news, and advertising services to a global audience.

This diverse content offering provides consumers with a rich selection of choices, catering to varied tastes and preferences across different demographics. For businesses, it translates into significant advertising reach and engagement opportunities, enabling them to connect with specific target markets effectively.

In 2023, Vivendi's revenue reached €10.1 billion, underscoring the scale and impact of these media operations. Canal+ alone reported a significant contribution, highlighting the strength of its pay-TV and content distribution networks.

Bolloré's strategic financial management is a core value proposition, focusing on creating and enhancing value through astute investment decisions. The company actively seeks out long-term growth avenues across its diverse portfolio, using its financial strength to its advantage.

This approach involves carefully planned acquisitions and divestments, all with the ultimate goal of boosting shareholder returns. For instance, in 2023, Bolloré Group reported significant capital gains, underscoring its proficiency in financial operations and its capacity to generate substantial profits from its strategic moves.

Reliable Oil Distribution and Energy Transition Support

Bolloré Energy guarantees a steady and effective flow of petroleum products throughout its service areas, ensuring clients have the energy they need. This reliability is a cornerstone of their offering.

The company is also actively investing in and promoting alternative fuels and advanced storage solutions. This strategic move helps clients navigate the shift towards greener energy options, demonstrating a commitment to future energy needs.

This dual focus on dependable traditional fuel distribution and forward-looking support for energy transition offers clients a balanced and adaptable energy supply strategy.

For instance, in 2024, Bolloré Energy continued to expand its network of service stations, with a notable presence in West Africa where reliable fuel access is critical. Simultaneously, their investments in biofuels and electric vehicle charging infrastructure saw a significant uptick, reflecting market demand for sustainable alternatives. Their commitment to diversifying energy sources is underscored by ongoing projects in renewable energy storage, aiming to provide integrated solutions for businesses seeking to reduce their carbon footprint.

Integrated and Innovative Industrial Solutions

Bolloré's value proposition centers on delivering integrated and innovative industrial solutions, bridging advanced manufacturing with forward-thinking energy applications. This dual focus allows the company to offer specialized industrial products, like polypropylene films crucial for capacitors and packaging, alongside its burgeoning electric mobility services. This integration is a key differentiator, creating unique market offerings that leverage both deep industrial expertise and a commitment to sustainable energy.

The company's industrial segment, for instance, is a significant contributor. In 2023, Bolloré's industrial activities, particularly its film division, demonstrated robust performance, with sales reaching €2.2 billion, showcasing the demand for its high-tech manufacturing capabilities. This segment provides essential components for various industries, underscoring its foundational role within the broader business model.

- Specialized Industrial Products: Bolloré manufactures high-performance polypropylene films used in critical applications such as capacitors and advanced packaging solutions.

- Electric Mobility Integration: The company seamlessly combines its industrial prowess with its expanding electric mobility offerings, creating synergistic market advantages.

- Innovative Applications: This integration fosters the development of novel solutions, positioning Bolloré at the forefront of technological advancements in both industrial materials and sustainable transportation.

- Market Differentiation: By offering a comprehensive package of industrial expertise and energy solutions, Bolloré carves out unique market positions, catering to evolving global demands for efficiency and sustainability.

Bolloré's value proposition in industrial products is built on delivering specialized, high-performance materials, notably polypropylene films. These films are essential components in demanding applications like capacitors and advanced packaging, showcasing the company's manufacturing precision and technological capability.

By integrating this industrial strength with its sustainable energy and mobility initiatives, Bolloré creates a powerful synergy. This allows them to offer comprehensive solutions that address both industrial material needs and the growing demand for eco-friendly technologies.

In 2023, Bolloré's industrial segment, particularly its film division, demonstrated strong market demand, generating €2.2 billion in sales. This underscores the critical role and value of their high-tech manufacturing expertise in serving diverse industrial sectors.

| Value Proposition Segment | Key Offerings | Market Relevance | 2023 Data Point |

|---|---|---|---|

| Specialized Industrial Products | High-performance polypropylene films | Capacitors, advanced packaging | Sales of €2.2 billion in industrial activities |

| Integrated Solutions | Industrial materials + Sustainable energy/mobility | Synergistic market advantages | Leverages deep industrial expertise |

| Technological Advancement | Innovative applications in materials and transport | Meeting evolving global demands | Positioned at forefront of technological advancements |

Customer Relationships

Bolloré cultivates long-term strategic partnerships, notably with governments for significant infrastructure developments and with co-development partners in areas like battery technology. These collaborations are typically formalized through contracts and necessitate deep cooperation on extensive, multi-year projects, aiming for shared prosperity in these ventures.

For its industrial and energy solutions, Bolloré cultivates direct relationships with its business-to-business clientele. This includes key players like public transport operators, such as RATP, major automotive manufacturers, and prominent energy firms.

These engagements are characterized by the provision of highly tailored solutions, supported by dedicated account management teams and continuous technical assistance. This approach ensures that Bolloré deeply understands and effectively addresses the unique requirements of each client, delivering customized value.

In 2023, Bolloré’s energy and transport divisions reported significant B2B contracts, with the company’s battery solutions being integrated into over 10,000 electric buses globally, demonstrating the scale of its direct client engagement.

Bolloré, through its significant media assets such as Canal+, reaches millions of mass consumers. This relationship is primarily indirect, built on subscriptions and the consumption of diverse content. The group's strategic decisions directly influence the availability and evolution of these platforms, aiming to capture and retain a vast audience.

Shareholder and Investor Relations

Bolloré actively engages with its shareholders and the investment community through detailed financial reports and regular general meetings. This commitment to transparency extends to clear communication about the company's financial results, strategic initiatives, and dividend distribution plans. For instance, Bolloré's 2023 financial results, released in early 2024, highlighted a robust performance, aiming to bolster investor confidence.

The company prioritizes building lasting relationships by fostering investor confidence and cultivating long-term shareholder loyalty. This is achieved through consistent and open dialogue, ensuring stakeholders are well-informed about the group's trajectory and value proposition.

- Financial Transparency: Bolloré provides regular financial reports, including annual and interim statements, to keep shareholders informed about performance.

- Investor Engagement: The company holds general meetings and utilizes various communication channels to interact with investors and address their queries.

- Strategic Communication: Bolloré communicates its strategic direction, including major investments and divestitures, to align shareholder expectations.

- Dividend Policy: Shareholders are kept informed about the company's dividend policy, reflecting its commitment to returning value.

Supplier and Ecosystem Collaboration

Bolloré actively cultivates collaborative relationships with its suppliers, especially for critical battery raw materials, ensuring supply chain robustness. This strategic approach extends to its wider industry ecosystems, particularly within logistics networks.

These partnerships are crucial for fostering innovation and maintaining operational efficiency. For instance, in 2024, Bolloré's focus on securing long-term contracts for lithium and cobalt directly impacts its battery production capacity, a key component of its energy storage solutions.

- Supplier Collaboration: Securing stable and ethical sourcing for battery components.

- Ecosystem Integration: Leveraging logistics partners for efficient global distribution.

- Innovation Partnerships: Joint ventures or agreements to advance battery technology.

- Resilience Building: Diversifying supplier base to mitigate geopolitical or economic risks.

Bolloré's customer relationships are multifaceted, ranging from deep strategic alliances with governments and co-development partners to direct B2B engagements with major industrial and energy firms. For its consumer-facing media segment, relationships are built indirectly through content consumption and subscriptions, while shareholder relations are managed through transparency and consistent communication regarding financial performance and strategic direction.

Channels

Bolloré's direct sales and business development teams are crucial for securing large-scale contracts, especially in energy and industrial sectors. These teams engage directly with institutional clients, governments, and major corporations, enabling them to negotiate complex agreements and tailor solutions. This strategy is particularly effective for high-value business-to-business transactions, reflecting the company's focus on strategic partnerships.

Through its significant stake in Canal+ Group, Bolloré's media ventures distribute content via satellite, cable, and increasingly, digital streaming. This multi-channel approach, evident in Canal+’s extensive European and African presence, ensures wide consumer access to a diverse array of entertainment, news, and live sports. For instance, Canal+ reported over 24 million subscribers globally as of the end of 2023, highlighting the vast reach of these broadcast and digital platforms.

Bolloré's industrial distribution networks are crucial for its specialized products like films, reaching manufacturing and packaging sectors. These channels are designed for efficiency, ensuring B2B clients receive necessary components reliably. The emphasis is on industrial customers with precise product needs and a demand for consistent supply chains.

Fuel Distribution Networks

Bolloré Energy leverages its extensive network of service stations and distribution points across France, Switzerland, and Germany. This physical infrastructure is crucial for delivering petroleum products to a broad customer base, encompassing both commercial fleets and individual consumers. In 2023, the company continued to solidify its presence in these key European markets, ensuring reliable fuel access.

This robust network not only facilitates the sale of traditional fuels but also serves as a vital channel for promoting and distributing alternative energy solutions. By integrating new fuel types into their existing distribution system, Bolloré Energy is actively contributing to the energy transition. For instance, their commitment to expanding biofuel offerings in 2024 aims to meet growing demand for more sustainable options.

- Physical Infrastructure: Operates service stations and distribution points in France, Switzerland, and Germany.

- Customer Reach: Serves both commercial and individual customers for fuel requirements.

- Alternative Fuel Channel: Facilitates the introduction and distribution of alternative fuels.

Investor Relations and Financial Communication

Investor Relations and Financial Communication are key to keeping stakeholders informed. Bolloré disseminates crucial information through its official company website, detailed financial reports, timely press releases, and insightful investor presentations. These avenues are vital for maintaining transparency and adhering to all regulatory mandates, fostering trust among investors.

This consistent flow of information is fundamental for bolstering market confidence and attracting necessary capital for growth. For instance, Bolloré's 2023 annual report, released in April 2024, provided a comprehensive overview of its financial performance and strategic outlook. Such reports are critical for investors to make informed decisions.

The company actively engages with the financial community through various platforms. In 2024, Bolloré participated in several major investor conferences, including the European Financial Forum, where its leadership presented the company's strategy and financial results. These interactions are essential for building and maintaining strong relationships with the investment community.

- Official Company Website: A primary hub for financial reports, news, and investor presentations.

- Financial Reports: Including annual and interim reports, offering detailed performance data.

- Press Releases: Timely announcements on significant corporate developments and financial results.

- Investor Presentations: Direct engagement opportunities with analysts and investors to discuss strategy and performance.

Bolloré's channels are diverse, encompassing direct sales for large contracts, media distribution through Canal+, industrial networks for specialized products, and extensive energy distribution points. Investor relations are managed through official communications and direct engagement.

| Channel Type | Description | Key Focus | 2023/2024 Data Point |

|---|---|---|---|

| Direct Sales & Business Development | Securing large-scale contracts with institutional clients and governments. | Energy and industrial sectors, B2B transactions. | Crucial for high-value, tailored solutions. |

| Canal+ Group (Media) | Content distribution via satellite, cable, and digital streaming. | Entertainment, news, live sports across Europe and Africa. | Over 24 million global subscribers (end of 2023). |

| Industrial Distribution Networks | Efficient delivery of specialized products like films to manufacturing sectors. | B2B clients with precise needs and consistent supply chain demands. | Ensuring reliable component delivery. |

| Bolloré Energy | Physical infrastructure of service stations and distribution points. | Petroleum products and alternative energy solutions in France, Switzerland, Germany. | Expanding biofuel offerings in 2024. |

| Investor Relations | Disseminating financial information and engaging with stakeholders. | Transparency, market confidence, capital attraction. | Participation in European Financial Forum (2024). |

Customer Segments

Public Transport Authorities and Municipalities represent a core customer segment for Bolloré, encompassing entities like RATP and various city governments. These organizations are actively looking to procure electric buses to modernize their public transportation fleets, driven by a strong commitment to sustainability and efficiency. For instance, by 2024, many European cities have set ambitious targets for reducing transport emissions, making electric bus adoption a strategic priority.

The primary need for this segment is reliable and environmentally friendly mobility solutions. They are focused on meeting stringent environmental regulations and improving the quality of service for urban populations. Bolloré's Bluebus product line directly addresses these requirements, offering a tangible pathway for these authorities to achieve their green transport goals and enhance urban living.

Global corporations and industrial clients represent a significant customer base for Bolloré, especially those needing sophisticated industrial parts or advanced energy storage. These large enterprises, spanning diverse industries, rely on Bolloré's specialized manufacturing capabilities and cutting-edge battery technology to enhance their operations and product offerings. For instance, in 2023, Bolloré's energy storage solutions were integrated into various industrial applications, contributing to their growing presence in the green energy transition.

Media Consumers and Subscribers represent a vast audience, including individuals and households actively subscribing to pay-TV services like Canal+, or engaging with digital content and advertising platforms offered by Vivendi's various media arms. This segment is crucial as it forms the bedrock of demand for entertainment, news, and sports programming.

In 2024, the global media and entertainment market was projected to reach over $2.9 trillion, underscoring the sheer scale of this consumer base. For Vivendi, the willingness of these consumers to pay for premium content and engage with advertising directly fuels revenue streams, making customer acquisition and retention paramount for the media segment's success.

Energy Sector and Petroleum Product Consumers

This customer segment includes a broad range of entities, from individual households needing heating oil to large industrial players requiring bulk petroleum products. In 2024, Bolloré Energy continued to serve these diverse needs across key European markets, including France, Switzerland, and Germany. The company's commitment to reliable supply chains ensures these consumers have consistent access to essential energy resources.

Beyond direct consumption, Bolloré Energy also engages with businesses focused on the critical infrastructure of fuel storage and distribution. This includes companies looking to manage both traditional fossil fuels and the emerging landscape of alternative energy sources. Their interest lies in secure logistics and adapting to the evolving energy transition.

- France, Switzerland, and Germany represent key geographic markets for Bolloré Energy's petroleum product and heating oil consumers.

- Bolloré Energy caters to both individual consumers and businesses within the energy sector.

- The company also serves companies interested in fuel storage and distribution, encompassing both traditional and alternative fuels.

- A core focus remains on ensuring reliable supply and addressing the dynamic nature of consumer energy requirements.

Financial Investors and Shareholders

Financial investors and shareholders, both institutional and individual, are a key segment for Bolloré SE. These stakeholders are primarily focused on the company's financial performance, seeking robust returns, dividends, and sustained long-term value appreciation. Transparency in financial reporting and strategic capital allocation directly influences their investment decisions.

For instance, Bolloré SE's commitment to shareholder value is reflected in its financial disclosures. As of the end of 2023, the company reported a consolidated revenue of €25.5 billion. Their investment strategy aims to deliver consistent growth, making financial health paramount for this group.

- Focus on Financial Returns: Investors evaluate Bolloré SE based on profitability, cash flow generation, and return on equity.

- Dividend Policy: The company's dividend payout history and future projections are critical for income-seeking investors.

- Long-Term Value Creation: Shareholders are interested in strategic decisions that enhance the intrinsic value of their holdings over time.

- Financial Transparency: Clear and timely financial reporting is essential for building investor confidence and facilitating informed decision-making.

Public transport authorities and municipalities are crucial customers for Bolloré, seeking electric buses to modernize fleets and meet 2024 emission reduction targets. These entities prioritize reliable, eco-friendly mobility solutions to comply with regulations and enhance urban living.

Global corporations and industrial clients are key for Bolloré's specialized manufacturing and advanced energy storage. In 2023, industrial integration of Bolloré's energy storage solutions supported the green energy transition.

Media consumers and subscribers, numbering in the billions globally, are vital for Vivendi's pay-TV and digital platforms. The projected 2024 global media market exceeding $2.9 trillion highlights the revenue potential from this segment.

Bolloré Energy serves individual and industrial consumers of petroleum products and heating oil across Europe, including France, Switzerland, and Germany. The company also supports businesses involved in fuel storage and distribution, adapting to evolving energy needs.

Financial investors and shareholders are a key segment for Bolloré SE, focused on financial performance and long-term value. Bolloré SE's 2023 consolidated revenue of €25.5 billion underscores its financial standing for these stakeholders.

Cost Structure

Bolloré allocates substantial resources to Research and Development, a core component of its business model. These investments are particularly focused on pioneering advancements in battery technology, such as the development of solid-state batteries, and driving innovation in electric vehicle solutions. This commitment to R&D is essential for Bolloré to maintain its competitive advantage and spearhead the creation of future-generation energy products.

For instance, in 2023, Bolloré's R&D expenses represented a significant portion of its operational costs, underscoring the company's dedication to innovation. These expenditures directly fuel the development pipeline for next-generation energy storage systems and electric mobility technologies, positioning Bolloré at the forefront of the evolving energy landscape.

Bolloré's manufacturing and production costs are significant, encompassing the raw materials, labor, and operational expenses for producing electric buses, batteries, and industrial films. These costs scale directly with production volume.

A prime example of this significant investment is the new gigafactory in Alsace, which represents a substantial capital expenditure aimed at scaling battery production. This facility is a cornerstone of their strategy to meet growing demand for electric vehicle components.

For its media segment, Bolloré dedicates significant resources to securing broadcasting rights, developing original programming, and licensing content from other creators. These investments are crucial for offering a compelling media package and growing its subscriber base.

In 2024, the media sector represented a substantial portion of Bolloré's operational expenses, reflecting the high cost of premium content. The company anticipates that the renegotiation or termination of certain costly content agreements, particularly those impacting 2025, will lead to a notable shift in revenue streams and cost structures within its media operations.

Operational and Distribution Network Costs

Bolloré's operational and distribution network costs are significant, encompassing the upkeep of its extensive oil logistics infrastructure. This includes the maintenance of storage facilities, the operation of its transportation fleets, and the running costs associated with its service stations, all crucial for efficient fuel delivery.

Furthermore, the company incurs substantial expenses in managing its media distribution networks, ensuring content reaches its intended audiences effectively. The efficiency of these operational and distribution networks directly impacts Bolloré's overall profitability, making cost management a critical factor.

- Oil Logistics: Expenses for maintaining storage tanks, pipelines, and transportation vehicles.

- Media Distribution: Costs related to broadcasting, content delivery platforms, and network operations.

- Service Stations: Operational overhead for retail fuel outlets, including staffing and maintenance.

- Efficiency Impact: Streamlining these networks is vital for profit margins.

General, Administrative, and Investment Management Costs

General, administrative, and investment management costs encompass the essential overhead supporting Bolloré's diverse operations. These include salaries for administrative personnel, crucial legal fees, and the expenses tied to managing its wide-ranging investment portfolio and strategic acquisitions. These are largely fixed costs that underpin the company's overall structure and long-term strategic planning.

In 2024, these operational expenses are particularly influenced by evolving regulatory landscapes, which necessitate increased investment in legal and compliance functions. For example, as of the first half of 2024, Bolloré Group reported consolidated revenues of €10.4 billion, with administrative expenses remaining a significant, albeit managed, component of its cost structure.

- Salaries and benefits for corporate staff

- Legal and compliance expenditures

- Costs associated with managing investment portfolio

- Expenses for strategic acquisition integration

Bolloré's cost structure is multifaceted, driven by significant investments in R&D for battery technology, manufacturing expenses for electric vehicles and batteries, and substantial outlays for media content and distribution. The company also incurs considerable costs in maintaining its oil logistics and service station networks, alongside general administrative and investment management expenses.

| Cost Category | Key Components | 2024 Relevance |

|---|---|---|

| Research & Development | Battery technology, EV solutions | Ongoing investment to maintain competitive edge. |

| Manufacturing & Production | Raw materials, labor, factory operations | Scales with production volume, e.g., gigafactory investment. |

| Media Operations | Broadcasting rights, content development | High costs for premium content; renegotiations impacting 2025. |

| Operational & Distribution | Oil logistics infrastructure, media networks | Essential for efficient delivery, impacting profitability. |

| General & Administrative | Salaries, legal fees, investment management | Underpins operations; influenced by regulatory landscape. |

Revenue Streams

Bolloré generates significant revenue from selling its electric buses, known as Bluebuses, primarily to public transport authorities. This stream directly benefits from increasing global adoption of electric public transportation. For instance, in 2024, several European cities continued to expand their electric bus fleets, creating ongoing demand.

The company also anticipates substantial growth from its advanced solid-state battery technology. This revenue stream could come from selling these high-performance batteries to other automotive manufacturers or for use in grid-scale energy storage solutions. The expanding electric vehicle market and the growing need for reliable energy storage are key drivers for this segment's future success.

Bolloré generates significant income from subscriptions to Canal+ Group's pay-TV services, a core component of its media operations. This revenue stream is complemented by substantial advertising sales across its diverse media platforms, notably through its advertising agency Havas.

The company also benefits from revenue derived from broadcasting rights and content distribution, further solidifying its media segment's financial performance. For instance, Canal+ Group's strong presence in Africa and Europe contributes to consistent subscription growth.

The Vivendi spin-off, completed in 2023, has reshaped how Bolloré accounts for these media revenues, influencing its overall financial reporting structure. This strategic move aims to streamline operations and potentially unlock greater value for its media assets.

Bolloré Energy generates revenue from selling petroleum products like heating oil and fuels across France, Switzerland, and Germany. This stream also encompasses fees earned from managing oil logistics and storage.

Despite a trend of decreasing oil distribution volumes, this segment is bolstered by its diversification into related services. For instance, in 2023, Bolloré Energy continued to adapt its strategy to navigate these market shifts.

Investment Income and Capital Gains

Bolloré's investment income and capital gains are a cornerstone of its financial strategy, largely driven by dividends from significant equity stakes and profits from asset sales. For instance, its substantial holding in Universal Music Group (UMG) and its stake in Rubis are key contributors to dividend revenue. The group also realizes capital gains through strategic divestments, a prime example being the sale of Bolloré Logistics.

These revenue streams underscore the effectiveness of Bolloré's approach to long-term value creation through strategic investments and portfolio management. The group's ability to generate substantial capital gains, as seen with the Bolloré Logistics divestment, highlights its skill in identifying and capitalizing on market opportunities.

- Dividends from Equity Investments: Revenue generated from dividends received from significant holdings, such as Universal Music Group and Rubis, reflecting successful long-term investments.

- Capital Gains from Divestments: Profits realized from the sale of strategic assets, notably the sale of Bolloré Logistics, demonstrating effective portfolio management and asset realization.

- Strategic Portfolio Management: This revenue stream is a direct result of Bolloré's active management of its investment portfolio, aiming for both income generation and capital appreciation.

Industrial Product Sales

Bolloré generates revenue from selling specialized industrial products, notably polypropylene films. These films are crucial components for capacitors and various packaging applications, highlighting the company's role in diverse industrial supply chains.

This revenue stream is a key part of Bolloré's broader industrial segment. In 2024, this specific industrial segment experienced a positive growth trajectory, indicating increased demand for its specialized offerings.

- Industrial Product Sales: Revenue derived from the sale of specialized industrial goods.

- Key Products: Includes polypropylene films used in capacitors and packaging.

- Segment Contribution: Forms a significant part of Bolloré's diversified industrial operations.

- 2024 Performance: The industrial segment, including these sales, saw an increase in revenue during the year.

Bolloré's revenue streams are multifaceted, encompassing media, energy, industrial products, and investment income. The company's media segment, primarily through Canal+ Group, generates income from subscriptions and advertising, further enhanced by broadcasting rights. Bolloré Energy contributes revenue from petroleum product sales and logistics management, adapting to market shifts. The industrial segment, including polypropylene film sales, saw positive growth in 2024, underscoring demand for specialized components.

| Revenue Stream | Key Activities | 2024/Recent Data Point |

|---|---|---|

| Media (Canal+ Group) | Subscriptions, Advertising, Broadcasting Rights | Consistent subscription growth in Africa and Europe. |

| Energy | Petroleum Product Sales, Logistics Fees | Strategy adaptation to navigate decreasing oil distribution volumes. |

| Industrial Products | Polypropylene Film Sales (Capacitors, Packaging) | Positive growth trajectory for the industrial segment. |

| Investment Income & Capital Gains | Dividends (UMG, Rubis), Asset Sales (Bolloré Logistics) | Substantial capital gains realized from strategic divestments. |

Business Model Canvas Data Sources

The Bolloré Business Model Canvas is informed by extensive market research, financial reports, and operational data from its diverse business units. This comprehensive data ensures each component, from value propositions to cost structures, is grounded in reality and strategic foresight.