Bollore Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bollore Bundle

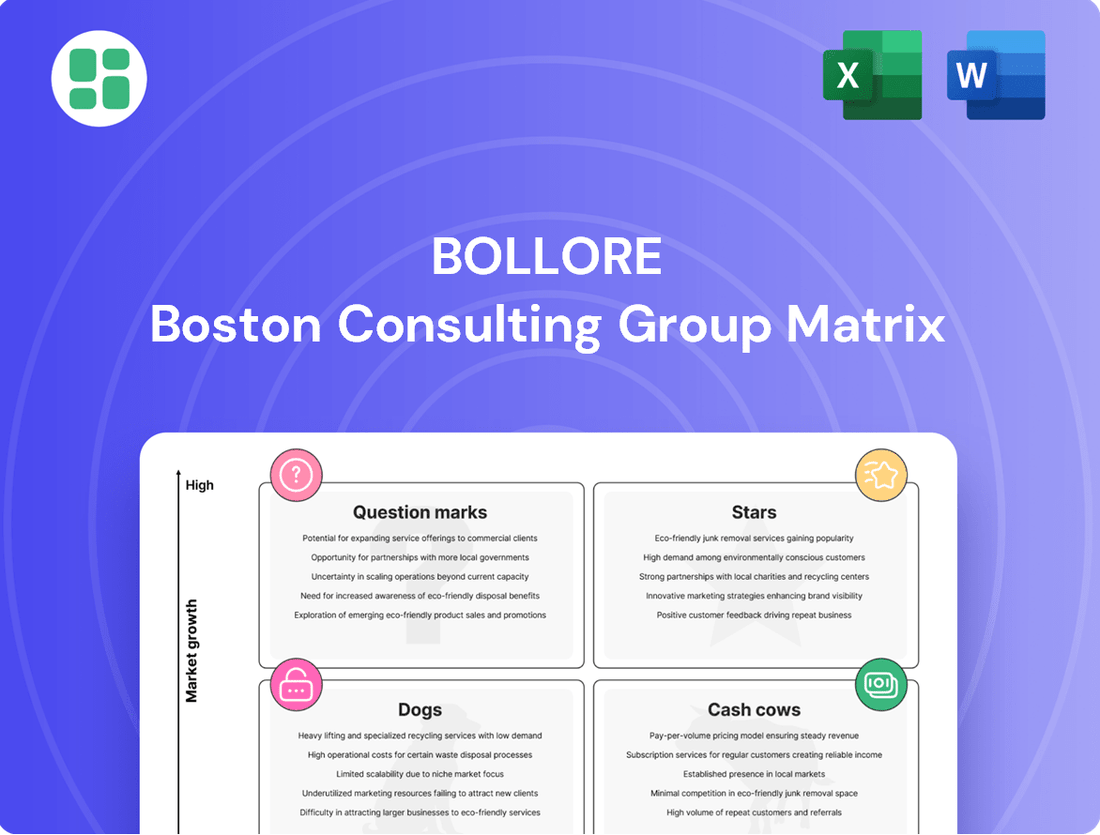

The Bolloré BCG Matrix offers a powerful framework to understand the company's diverse portfolio, categorizing its business units into Stars, Cash Cows, Dogs, and Question Marks. This insightful breakdown reveals which segments are driving growth and which might require strategic re-evaluation.

Ready to move beyond this overview and unlock actionable strategies? Purchase the full BCG Matrix report for a comprehensive analysis of Bolloré's market position, complete with data-driven recommendations to optimize your investment and resource allocation decisions.

Stars

Blue Solutions, a subsidiary of Bolloré, is heavily investing in its fourth-generation solid-state batteries. This strategic move targets the burgeoning electric vehicle and energy storage markets, promising breakthroughs in faster charging and higher energy density.

The company's commitment is further solidified by plans for a gigafactory in Alsace, slated for operation by 2030. This facility is designed to significantly ramp up production, aiming to secure a substantial portion of the rapidly growing solid-state battery market.

Bluebus, a key player in electric urban mobility, secured the second spot among electric bus OEMs in France during the first half of 2024, registering a significant number of vehicles. This strong domestic performance highlights its growing influence in the rapidly expanding electric bus market.

The company's European expansion strategy is actively unfolding, marked by strategic partnerships in countries like Spain, Italy, Greece, Switzerland, Germany, and Belgium. This proactive internationalization aims to leverage Bluebus's established expertise and replicate its French success across the continent.

Canal+ Group, a key player within Bolloré's portfolio, is aggressively expanding its international footprint. A notable move is its public tender offer for MultiChoice Group, a prominent African media company, signaling a strong commitment to the continent's burgeoning pay-TV market. This strategic push aims to solidify Canal+'s presence in high-growth emerging economies.

Further demonstrating this international growth strategy, Canal+ has increased its stakes in both Viaplay and Viu. These investments are designed to bolster its content acquisition and distribution capabilities across diverse geographical regions. The overarching goal is to establish Canal+ as a leading force in global content broadcasting and distribution by tapping into rapidly developing markets.

High-Potential Dielectric Industrial Films

Bolloré's strategic shift towards high-potential dielectric industrial films positions this segment favorably within its Films division. These specialized films are crucial components in the burgeoning energy transition sector, driving demand for advanced materials.

This focus allows Bolloré to tap into a growing market niche, leveraging increasing demand for sustainable technologies. The company's investment in this area is expected to enhance both its market share and profitability in the coming years.

- Market Growth: The global market for dielectric films is projected to grow significantly, driven by electric vehicles, renewable energy storage, and advanced electronics. For instance, the market for dielectric films in the EV battery sector alone was estimated to be worth billions in 2023 and is expected to see substantial CAGR through 2030.

- Technological Advancement: Bolloré's expertise in developing high-performance dielectric films aligns with the increasing technical requirements of these emerging industries.

- Strategic Positioning: By specializing in these high-potential films, Bolloré is moving upmarket, capturing value in critical applications within the green economy.

Strategic Investments in Renewable Energy Solutions

Bolloré is strategically positioning itself to capitalize on the burgeoning renewable energy sector. Leveraging its robust financial standing, bolstered by recent divestitures, the company is set to make substantial investments in a wider array of renewable energy solutions. This strategic move aligns perfectly with the global push towards energy transition.

These investments could manifest as new ventures or the expansion of its existing battery technology into critical areas like grid storage. The company's battery division, a key asset, is well-placed to benefit from the increasing demand for sustainable energy infrastructure. For instance, the global energy storage market was valued at approximately $215 billion in 2023 and is projected to reach over $600 billion by 2030, presenting a significant growth opportunity for Bolloré.

- Strategic Focus: Bolloré is targeting growth in renewable energy solutions, including grid storage and green initiatives.

- Financial Leverage: Recent divestitures have strengthened Bolloré's financial position, enabling significant investment capacity.

- Market Opportunity: The global energy storage market is experiencing rapid expansion, offering substantial revenue potential.

- Technological Advantage: Bolloré's expertise in battery technology provides a competitive edge in the green energy sector.

Bolloré's battery division, particularly Blue Solutions' solid-state battery technology, represents a significant Star. The company is investing heavily in this area, aiming for breakthroughs in electric vehicle and energy storage markets. The planned gigafactory in Alsace, operational by 2030, underscores this commitment to capturing a substantial share of this high-growth sector.

Bluebus's strong performance in the French electric bus market, securing second place in the first half of 2024, and its European expansion efforts also position it as a Star. This focus on electric mobility aligns with global trends towards sustainable transportation.

Canal+ Group's aggressive international expansion, including its tender offer for MultiChoice Group and increased stakes in Viaplay and Viu, highlights its Star potential in the global media and entertainment landscape, particularly in emerging markets.

Bolloré's strategic focus on high-potential dielectric industrial films, critical for the energy transition, also marks this segment as a Star. The company is leveraging its expertise to capture value in specialized applications within the green economy.

The company's broader investments in renewable energy solutions, including grid storage, further solidify its Star status. With a strong financial position and expertise in battery technology, Bolloré is well-positioned to capitalize on the rapidly expanding global energy storage market.

| Bolloré Segment | BCG Category | Key Growth Drivers | 2024 Performance Indicators | Future Outlook |

|---|---|---|---|---|

| Blue Solutions (Solid-State Batteries) | Star | EV market growth, energy storage demand | Gigafactory development (Alsace, by 2030) | Dominance in next-gen battery technology |

| Bluebus (Electric Buses) | Star | Urban mobility electrification, government incentives | 2nd largest electric bus OEM in France (H1 2024) | European market expansion |

| Canal+ Group (Media & Entertainment) | Star | Emerging market media consumption, content acquisition | Public tender offer for MultiChoice Group | Global content distribution leadership |

| Dielectric Industrial Films | Star | Energy transition, advanced electronics | Strategic focus on high-potential films | Value capture in critical green economy applications |

| Renewable Energy Solutions | Star | Global energy transition, grid modernization | Substantial investment capacity post-divestitures | Expansion in grid storage and green initiatives |

What is included in the product

The Bollore BCG Matrix analyzes business units based on market growth and share, guiding investment and divestment decisions.

The Bolloré BCG Matrix offers a clear, visual snapshot of your portfolio's health, instantly highlighting underperforming "Dogs" and guiding strategic divestment or revitalization efforts.

Cash Cows

Bolloré Energy's established petroleum product distribution business is a prime example of a Cash Cow within the broader Bolloré structure. This segment leverages its extensive logistics and distribution networks, particularly in mature markets, to generate reliable and consistent revenue streams. The company’s deep-rooted presence in these areas ensures robust sales volumes, even amidst the inherent volatility of global oil prices.

Despite market fluctuations, Bolloré Energy's petroleum distribution segment demonstrates resilience and sustained profitability. This is largely attributed to efficient operations and well-established trade distribution channels that allow for consistent cash flow generation. For instance, in 2024, the company continued to benefit from strong demand for refined petroleum products across its key African markets, contributing significantly to overall group profitability.

Bolloré holds a significant stake in Universal Music Group (UMG), a dominant force in the music industry. This investment is a prime example of a cash cow within Bolloré's portfolio, as UMG operates in a well-established, albeit mature, market.

UMG's consistent and growing earnings are a major contributor to Bolloré's communications sector. The company's strong financial performance translates into substantial returns for Bolloré through dividends and equity-accounted profits.

As of late 2023, UMG's market capitalization stood around €16 billion, reflecting its robust position. Bolloré's shareholding in this established player provides a stable income stream, underscoring its cash cow status.

Canal+ Group's core French subscriber base represents a significant cash cow for Bolloré. This mature segment likely boasts a substantial market share in its home territory, translating into consistent, recurring revenue streams.

The predictable nature of these subscription revenues, coupled with strong profit margins, makes this a highly valuable asset. In 2024, Canal+ continued to navigate the competitive French pay-TV landscape, with its established subscriber loyalty underpinning its financial stability and ability to generate substantial cash flow with minimal reinvestment needs.

Profitable Packaging Films Business

Bolloré's packaging films business demonstrates robust profitability, a key indicator of its Cash Cow status within the BCG matrix. This segment benefits from a mature market and optimized production processes, leading to consistent cash generation with minimal need for significant capital reinvestment.

The sustained profitability suggests strong customer loyalty and efficient operational management. For instance, in 2024, Bolloré's specialty films division, which includes packaging, reported a significant uptick in operating margins, driven by increased demand for high-performance barrier films and cost-control measures.

- Stable Market Share: The packaging films sector, while competitive, offers predictable demand, allowing Bolloré to leverage its established infrastructure and brand recognition.

- Consistent Cash Flow: This business unit reliably generates substantial cash, which can be deployed to fund other ventures or reduce debt.

- Low Reinvestment Needs: Mature product lines and efficient manufacturing mean that capital expenditure requirements are typically limited to maintenance and incremental improvements.

Equity Stakes in Havas and Louis Hachette Group

Bolloré's equity stakes in Havas and Louis Hachette Group represent significant holdings in established media businesses. These are considered cash cows within its portfolio, contributing stable income rather than rapid expansion.

Havas, a global advertising and communications group, and Louis Hachette Group, a major player in publishing, operate in mature markets. Their consistent performance generates reliable earnings for Bolloré.

- Havas: As of Bolloré's latest disclosures, its stake in Havas provides a steady stream of dividend income, reflecting the advertising giant's consistent profitability.

- Louis Hachette Group: The holding in this publishing powerhouse also generates stable returns, underscoring its position as a mature, income-generating asset.

- Financial Contribution: These stakes are key contributors to Bolloré's overall earnings, primarily through dividends and equity method accounting, solidifying their cash cow status.

Cash Cows are established, highly profitable business units within Bolloré's portfolio that generate more cash than they consume. These segments typically operate in mature markets with strong market share, requiring minimal investment for maintenance or incremental growth.

Bolloré's holdings in Universal Music Group (UMG) and its core Canal+ subscriber base in France exemplify this category. UMG's substantial market capitalization, around €16 billion as of late 2023, and Canal+'s consistent French subscriber revenues in 2024 highlight their stable, recurring income generation.

The packaging films business also fits this description, with its 2024 operating margins showing an uptick due to demand for specialty films and cost controls, indicating efficient operations and reliable cash generation.

Similarly, Bolloré's stakes in Havas and Louis Hachette Group contribute stable dividend income, underscoring their roles as mature, cash-generating assets within the group.

| Business Unit | Market | Status | Key Financial Indicator (2024 Data where available) |

|---|---|---|---|

| Bolloré Energy (Petroleum Distribution) | Mature African Markets | Cash Cow | Continued strong demand and efficient operations contributing to group profitability. |

| Universal Music Group (UMG) | Global Music Industry | Cash Cow | UMG's market capitalization around €16 billion (late 2023) signifies robust, stable earnings. |

| Canal+ Group (French Subscribers) | French Pay-TV Market | Cash Cow | Established subscriber loyalty ensures consistent, recurring revenue streams and financial stability. |

| Packaging Films Business | Mature Packaging Market | Cash Cow | Reported uptick in operating margins in 2024, driven by demand for specialty films and cost controls. |

| Havas & Louis Hachette Group Stakes | Advertising & Publishing | Cash Cow | Provide steady dividend income and stable returns through equity method accounting. |

What You See Is What You Get

Bollore BCG Matrix

The preview you're currently viewing is the exact, fully formatted Bolloré BCG Matrix document you will receive immediately after your purchase. This means you're seeing the complete, professional analysis, ready for strategic application without any alterations or hidden charges. You can confidently assess the quality and content, knowing that the purchased file will be identical and free of any watermarks or demo indicators. Invest in this comprehensive strategic tool, confident that the preview accurately represents the valuable, actionable report you will obtain.

Dogs

Bolloré's Specialized Terminals within its Systems activity saw a revenue decline in the first quarter of 2025, signaling a weak position in a market that may be shrinking. This performance suggests the segment is a poor performer with limited growth prospects.

Given the revenue dip, Specialized Terminals likely represent a question mark in the BCG matrix. Significant investment might be needed to revive this area, but the potential for success is uncertain, making it a candidate for careful review and potential divestment.

Bolloré Energy's traditional fuel distribution, including domestic heating oil, operates in segments experiencing declining demand. These legacy operations face significant challenges in maintaining market share as consumer preferences shift towards alternative energy sources and efficiency measures.

In 2024, the European market for heating oil continued its downward trend, with some regions seeing a decline of over 5% year-on-year due to increased adoption of natural gas and renewable heating systems. This directly impacts Bolloré's legacy distribution networks, which are heavily reliant on these products.

These segments are characterized by low growth prospects and can be considered as "cash cows" that generate steady, albeit declining, income. However, the investment required to maintain these operations may outweigh the returns, making them candidates for divestment or strategic repositioning within the BCG matrix.

Bolloré's prior investments in earlier battery technologies have resulted in what the company terms non-recurring exceptional items. This phrasing strongly implies that these older battery generations are now underperforming or have become obsolete in the market.

These legacy battery lines likely hold a negligible market share. Consequently, they continue to consume valuable resources and capital without making a substantial contribution to Bolloré's ongoing growth or future prospects.

Non-Strategic Minority Holdings in Stagnant Industries

Non-strategic minority holdings in stagnant industries represent investments where Bolloré possesses a small stake in companies within mature or declining sectors. These holdings offer little to no strategic advantage, as Bolloré's influence is minimal, and the returns are typically low. Such assets can become a drain on capital without contributing to the group's overall growth trajectory.

These types of investments often represent capital that could be better deployed in areas with higher growth potential or strategic alignment. For instance, if Bolloré held a minor stake in a traditional print media company in 2024, that company might be facing declining advertising revenues and readership, making the investment a drag rather than a driver of value. The lack of control means Bolloré cannot steer the company towards innovation or diversification, leaving it vulnerable to market shifts.

- Limited Influence: Minority stakes mean little say in company direction.

- Stagnant Industries: Investments are in sectors with low or negative growth.

- Low Returns: These holdings generate minimal profits or capital appreciation.

- Capital Tie-up: Funds are locked in assets with poor future prospects.

Underperforming Niche Manufacturing Units

Within Bolloré's diverse portfolio, certain niche manufacturing units might find themselves categorized as Dogs. These are typically smaller operations, perhaps in specialized industrial goods, that contend with sluggish market growth and a diminished competitive standing. For instance, a unit producing legacy industrial components might face declining demand as newer technologies emerge.

These underperforming segments often struggle with low profitability due to a combination of factors. Intense price competition from more agile or technologically advanced rivals can squeeze margins. Furthermore, outdated production processes can lead to higher operational costs, making it difficult to compete effectively. In 2024, reports indicated that some smaller industrial suppliers faced significant margin pressure due to rising raw material costs and the need for capital investment in modernization.

- Low Market Share: These units typically hold a small portion of their respective markets, often due to specialization in declining sectors or an inability to scale effectively.

- Limited Growth Prospects: The industries these niche manufacturers serve may be experiencing stagnation or decline, offering little opportunity for expansion.

- Profitability Challenges: High operating costs, inability to pass on price increases, and intense competition contribute to persistent low or negative profitability.

- Strategic Review: Such units are often candidates for strategic reassessment, which could involve restructuring to improve efficiency, seeking a buyer, or complete divestment to reallocate resources to more promising areas of the business.

Bolloré's legacy battery technologies, characterized by prior investments, are now considered underperforming or obsolete. These segments likely hold negligible market share and consume resources without contributing to growth.

Non-strategic minority holdings in stagnant industries also fall into the Dog category. These investments offer minimal strategic advantage and typically yield low returns, potentially draining capital.

Niche manufacturing units facing sluggish market growth and diminished competitive standing, such as those producing legacy industrial components, are also likely Dogs. These operations often struggle with low profitability due to intense competition and higher operational costs.

In 2024, the European heating oil market, a segment for Bolloré Energy, saw declines exceeding 5% in some regions, underscoring the challenges for legacy fuel distribution.

| Bolloré Segment Example | BCG Category | Rationale |

|---|---|---|

| Legacy Battery Technologies | Dog | Obsolete, negligible market share, resource drain. |

| Non-strategic Minority Holdings (e.g., traditional print media) | Dog | Low influence, stagnant industry, minimal returns, capital tie-up. |

| Niche Manufacturing (e.g., legacy industrial components) | Dog | Low market share, limited growth, profitability challenges. |

| Bolloré Energy (Heating Oil Distribution) | Dog | Declining demand, facing competition from alternatives. |

Question Marks

Bolloré's venture into new electric bus models, like the 18-meter e-bus, targets a rapidly expanding sector within the EV market where its presence is minimal. This strategic move necessitates substantial capital outlay to build market share and achieve a competitive edge.

The development of longer, articulated e-buses addresses the growing demand for higher-capacity public transportation solutions. For instance, in 2023, global sales of electric buses surpassed 70,000 units, indicating a robust market opportunity for innovative offerings.

These new models, while potentially high-growth, also represent a significant investment, aligning with the characteristics of a 'Question Mark' in the BCG matrix. Bolloré must carefully manage these expenditures to ensure future profitability and market penetration.

Bluebus, as part of the Bolloré Group, is strategically positioned as a question mark in the BCG matrix concerning its European expansion. While it holds a strong presence in its home market of France, its ventures into Switzerland, Germany, and Belgium represent entry into high-growth potential markets.

However, Bluebus's market share in these new territories is currently low, necessitating significant investment in marketing and sales to capture a meaningful share of these burgeoning markets. For instance, the European electric bus market is projected to grow substantially, with an estimated CAGR of over 15% through 2030, presenting a clear opportunity for Bluebus if it can effectively navigate these new landscapes.

Bolloré's investment in a pilot line for its 4th generation solid-state batteries, set to launch in Brittany in 2026, signifies a significant strategic move into a high-growth, high-risk area. This venture, requiring substantial capital, positions the company at the forefront of next-generation battery technology, aiming for superior performance and safety compared to current lithium-ion offerings.

Currently, these advanced solid-state batteries represent a minimal portion of Bolloré's market share, reflecting their status as an emerging technology still undergoing crucial scaling for mass production. The pre-gigafactory phase means that while the potential is immense, the immediate revenue contribution is negligible, placing this initiative squarely in the question mark category of the BCG matrix.

Canal+ Group's Ventures into Highly Competitive International Streaming

Canal+ Group's aggressive expansion into international streaming markets, including Africa and Asia, showcases a clear growth strategy within the Bolloré Group's portfolio. However, this push directly confronts deeply entrenched global giants like Netflix and Disney+. In 2023, Canal+ reported a significant increase in its subscriber base, reaching over 25 million worldwide, demonstrating its ability to attract new users even in saturated markets.

The challenge lies in achieving substantial market share gains against these dominant players, which necessitates ongoing, considerable investment in content acquisition, local production, and marketing. For instance, Canal+ has been actively acquiring rights to popular local content and investing in original productions, such as the acclaimed series 'Lupin' which has a global appeal.

- International Expansion: Canal+ has prioritized growth in regions like Africa, where it holds a leading position, and is exploring opportunities in Asia.

- Competitive Landscape: The group faces formidable competition from global streaming behemoths with vast content libraries and significant marketing budgets.

- Market Share Challenges: Despite subscriber growth, securing a dominant market share in these highly fragmented and competitive digital content environments remains a significant hurdle.

- Investment Requirements: Sustained investment in original content, local programming, and technology is crucial for Canal+ to compete effectively and differentiate itself.

Diversification into Emerging Alternative Fuels (Bolloré Energy)

Bolloré Energy's strategic focus on emerging alternative fuels, such as B100 biodiesel and HVO (Hydrotreated Vegetable Oil) synthetic diesel, places it in rapidly expanding sectors fueled by global decarbonization efforts. These markets are experiencing significant growth, with the European biofuels market alone projected to reach approximately €60 billion by 2027, demonstrating substantial upward potential.

While these investments target high-growth segments, Bolloré Energy's current market penetration in these developing alternative fuel markets is likely modest. This necessitates ongoing capital allocation to build infrastructure, secure supply chains, and enhance market presence to achieve economies of scale and establish a competitive position.

- Market Position: Bolloré Energy is investing in high-growth alternative fuels like B100 and HVO, aligning with the energy transition.

- Growth Potential: The global market for advanced biofuels is expanding significantly, driven by regulatory mandates and environmental concerns. For instance, the EU aims for 14% renewable energy in transport by 2030, boosting demand for these fuels.

- Investment Needs: As these markets are still maturing, substantial and sustained investment is crucial for Bolloré Energy to scale operations, improve cost-efficiency, and capture a meaningful market share.

- Strategic Importance: Diversification into these fuels represents a forward-looking strategy to adapt to evolving energy landscapes and secure future revenue streams.

Bolloré's investments in new electric bus models and advanced battery technology represent significant opportunities in high-growth sectors. These ventures, however, require substantial capital to establish market presence and scale production.

The company's strategic focus on international streaming expansion for Canal+ and alternative fuels for Bolloré Energy also places them in competitive, albeit growing, markets. Success in these areas hinges on continued investment to gain market share against established players and evolving industry demands.

These initiatives, characterized by high potential returns but also significant risk and investment needs, align with the 'Question Mark' quadrant of the BCG matrix. Effective management of these investments will be crucial for Bolloré's future portfolio performance.

| Bolloré Initiative | Market Segment | BCG Quadrant | Key Investment Driver | Market Potential (2024/2025 Data) |

|---|---|---|---|---|

| New Electric Bus Models | Urban Public Transport | Question Mark | High-growth EV market, capacity demand | Global electric bus sales projected to exceed 100,000 units in 2024. |

| Solid-State Batteries | Next-Gen Energy Storage | Question Mark | Technological advancement, safety and performance | Solid-state battery market expected to reach $15 billion by 2027. |

| Canal+ International Streaming | Global Digital Entertainment | Question Mark | Subscriber growth, content acquisition | Global video streaming market revenue projected to surpass $150 billion in 2024. |

| Alternative Fuels (B100, HVO) | Sustainable Energy | Question Mark | Decarbonization efforts, regulatory mandates | European biofuels market estimated to reach €65 billion by 2028. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, industry growth rates, and competitive landscape analysis, to accurately position each business unit.