Bollore Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bollore Bundle

Discover how Bollore masterfully leverages its Product, Price, Place, and Promotion strategies to dominate its diverse markets. Uncover the intricate details of their product innovation, competitive pricing, strategic distribution, and impactful promotional campaigns.

Go beyond the surface-level understanding; gain access to a comprehensive, ready-made 4Ps Marketing Mix Analysis for Bollore, perfect for business professionals, students, and consultants seeking strategic depth.

Save valuable time and effort with this expertly crafted, editable report that provides actionable insights and structured thinking, ideal for reports, benchmarking, or business planning.

Product

Bolloré SE's product portfolio, following its divestment of international logistics, is now strategically concentrated on media and communications, advanced energy solutions, and long-term financial investments. This shift allows the company to focus on high-growth, technologically driven sectors. For instance, in 2023, Bolloré's media segment, Vivendi, reported revenues of €10.1 billion, highlighting its significant presence in content and distribution.

The company's product strategy actively pursues innovation, particularly in the energy sector. Bolloré's investments in electric vehicle battery technology and charging infrastructure, through subsidiaries like Blue Solutions, position it at the forefront of the green transition. This focus aligns with global energy trends and presents substantial growth potential, reflecting a commitment to sustainable development and future-proofing its offerings.

Bolloré's media and content offerings, primarily through its substantial interest in Vivendi and the Canal+ Group, span a broad spectrum of entertainment. This includes subscription television, original film and TV series production via Studiocanal, and digital platforms like Dailymotion.

The strategy involves curating a mix of exclusive in-house content and third-party acquisitions to attract and retain viewers. Canal+ Group reported a revenue of €5.7 billion in 2023, demonstrating the scale of its media operations.

Expansion efforts are geographically diverse, targeting subscriber growth in key markets across Europe, Africa, and Asia. In 2023, Canal+ Group's subscriber base reached over 24 million worldwide, highlighting its global reach.

Bolloré's Blue Solutions is making significant strides in advanced energy storage, particularly with its pioneering solid-state battery technology. This innovation is crucial for the Product element of their marketing mix, aiming to revolutionize electric vehicles (EVs) and grid-scale storage.

The GEN4 solid-state battery is a flagship product, designed to offer EVs greater range, quicker charging, and superior energy density. This directly addresses consumer demand for more practical and efficient electric transportation solutions, a key market driver in 2024 and beyond.

With substantial investments in research and development, Bolloré is preparing for mass production through a planned gigafactory. This strategic move positions them to capture a substantial share of the rapidly expanding sustainable energy market, estimated to reach hundreds of billions of dollars by 2030.

Electric Mobility Solutions (Bluebus)

Bluebus, a key offering within Bolloré's industrial sector, represents their commitment to electric mobility with battery-electric buses designed for public transport. These vehicles leverage Blue Solutions' advanced solid-state battery technology, aiming for sustainability and robust performance in urban and intercity routes. The company is actively looking to broaden its Bluebus range, with plans to introduce larger models to meet varied market demands and support the global shift towards eco-friendly public transportation.

The Bluebus product line is a tangible manifestation of Bolloré's strategy to capture the growing electric vehicle market. By integrating proprietary battery technology, they aim for a competitive edge in performance and sustainability. This focus aligns with global trends; for instance, the global electric bus market was valued at approximately $30 billion in 2023 and is projected to grow significantly, with estimates suggesting it could reach over $100 billion by 2030, driven by government regulations and environmental concerns.

- Product Innovation: Bluebus utilizes proprietary solid-state batteries for enhanced range and charging capabilities.

- Market Expansion: Bolloré is exploring larger bus models to cater to diverse public transport needs.

- Sustainability Focus: The vehicles contribute to green public transport initiatives, aligning with environmental goals.

- Market Growth: The electric bus sector is experiencing robust growth, signaling strong potential for Bluebus.

Specialized Industrial Films and Energy Distribution

Bolloré’s industrial film segment stands as a global leader, particularly in the production of polypropylene film essential for capacitors and packaging. This specialization leverages advanced material science to meet critical industrial demands, contributing significantly to the group's product portfolio.

The energy distribution arm, Bolloré Energy, plays a crucial role in oil logistics while strategically pivoting towards low-carbon liquid fuels. This adaptation reflects a commitment to evolving energy markets and sustainability initiatives, as seen in the growing demand for alternative fuel sources in the transportation sector.

- Global Leader in Polypropylene Film: Bolloré is a key supplier for capacitor and packaging industries, indicating strong market share and technical expertise in specialized film production.

- Energy Logistics and Transition: The company actively manages oil logistics and is investing in low-carbon liquid fuels, aligning with global energy transition trends.

- Diversified Revenue Streams: This dual focus on industrial films and energy distribution provides financial stability and resilience against sector-specific downturns.

- Adaptability in Traditional Markets: Bolloré demonstrates its capacity to innovate and adapt within established industrial and energy sectors, ensuring long-term relevance.

Bolloré's product strategy centers on innovation in media, energy, and industrial films. Vivendi's media offerings, including Canal+ Group's extensive content library and Dailymotion, cater to a global audience, with Canal+ reporting €5.7 billion in revenue in 2023 and over 24 million subscribers worldwide.

In the energy sector, Blue Solutions is a leader in solid-state battery technology, exemplified by the GEN4 battery, designed for enhanced EV performance. Bluebus electric buses leverage this technology, targeting the booming electric bus market, which was valued at approximately $30 billion in 2023.

The company also maintains a strong position in industrial films, supplying critical polypropylene films for capacitors and packaging, and is adapting its energy distribution segment to include low-carbon liquid fuels, reflecting a commitment to sustainability.

| Product Area | Key Offerings | 2023 Financials/Market Data | Strategic Focus |

|---|---|---|---|

| Media & Communications | Vivendi (Canal+, Studiocanal, Dailymotion) | Vivendi Revenue: €10.1 billion; Canal+ Revenue: €5.7 billion; Canal+ Subscribers: >24 million | Content innovation, subscriber growth |

| Energy Solutions | Blue Solutions (Solid-state batteries), Bluebus (Electric Buses) | Electric Bus Market: ~$30 billion (2023) | EV battery tech advancement, sustainable mobility |

| Industrial Films | Polypropylene film for capacitors and packaging | Global leader in specialized film production | Material science innovation, industrial supply chain |

| Energy Distribution | Oil logistics, low-carbon liquid fuels | Adaptation to evolving energy markets | Sustainability, alternative fuel integration |

What is included in the product

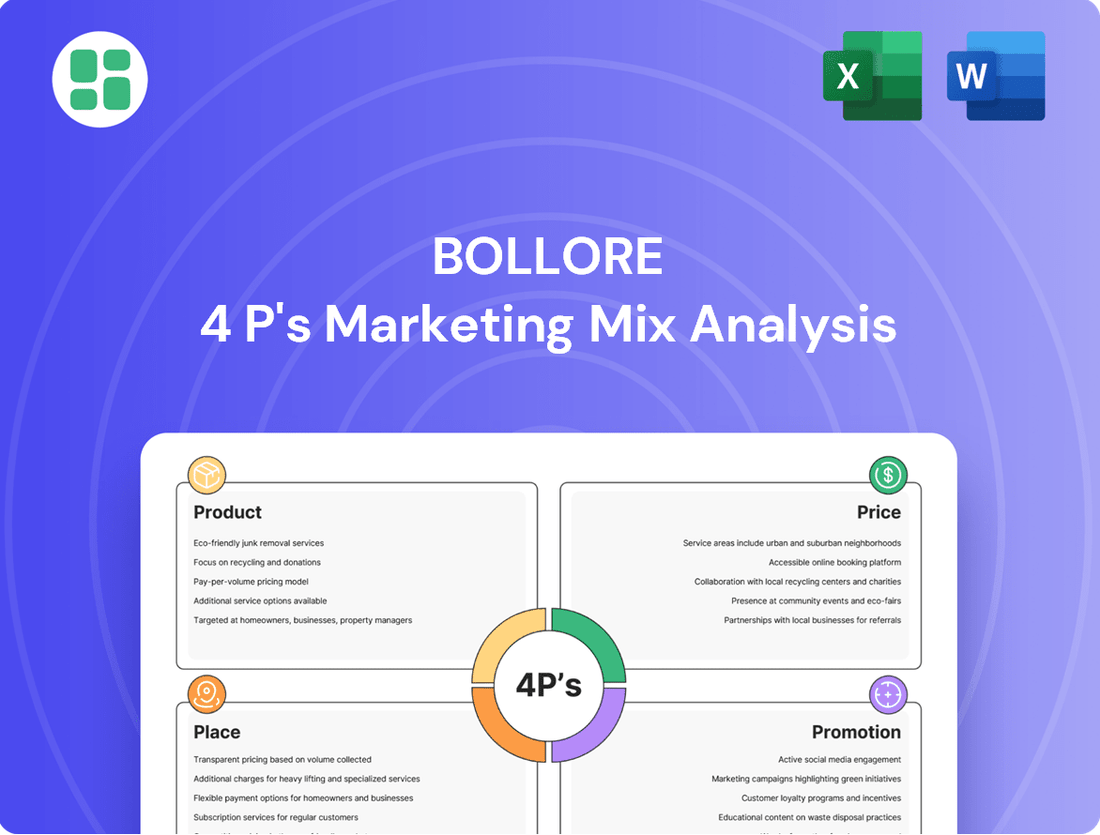

This analysis offers a comprehensive examination of Bollore's marketing strategies, detailing their Product, Price, Place, and Promotion approaches with real-world examples.

It provides a strategic overview of Bollore's marketing positioning, ideal for understanding their market approach and for comparative analysis.

Simplifies complex marketing strategies by offering a clear, actionable breakdown of Bolloré's 4Ps, alleviating the pain of strategic ambiguity.

Provides a concise, structured overview of Bolloré's marketing elements, easing the burden of comprehensive analysis for busy stakeholders.

Place

Canal+ Group, a cornerstone of Bolloré's marketing strategy, leverages a comprehensive global media distribution network. This includes traditional satellite and cable broadcasting, complemented by robust over-the-top (OTT) services like myCanal and Dailymotion, which saw significant user growth in 2024.

Bolloré's expansive reach is further solidified through strategic acquisitions and partnerships across Africa, Europe, and Asia. For instance, its strong presence in Africa, with millions of subscribers across various markets, ensures wide accessibility to its extensive content library, a key driver of its 2024 revenue growth.

Blue Solutions, Bolloré's battery division, strategically positions its production in France and Canada. A major gigafactory is slated for Alsace by 2030, underscoring a commitment to European manufacturing. These sites are chosen for their proximity to key automotive clients and energy sectors, optimizing logistics for their solid-state battery technology.

Bolloré leverages direct sales for its electric mobility solutions, such as the Bluebus, by engaging directly with public transport authorities for large fleet acquisitions. This allows for customized solutions and efficient deployment in urban environments.

Strategic partnerships are crucial for expanding Bolloré's reach across Europe. By collaborating with local entities, the company ensures effective distribution and robust after-sales support in new markets, reinforcing its presence in key European cities and countries.

Extensive Energy Distribution Network

Bolloré Energy boasts an extensive energy distribution network, predominantly focused within France, serving both industrial and individual customers with fuel and biofuel products. This robust infrastructure is key to their market presence and operational efficiency.

The company's distribution capabilities are crucial for delivering a wide range of energy solutions. For instance, in 2023, Bolloré Energy continued to expand its offerings, including the integration of sustainable alternatives like HVO100 (Hydrotreated Vegetable Oil) into its supply chain, demonstrating a commitment to evolving market demands and environmental stewardship.

- France-centric Distribution: Bolloré Energy's primary distribution strength lies within France, ensuring widespread availability of its products.

- Dual Customer Base: The network effectively serves both large-scale industrial clients and individual consumers, highlighting versatility.

- Sustainable Integration: Efforts to distribute advanced biofuels like HVO100 showcase adaptation to green energy trends.

Digital and Investor Relations Channels

Bolloré SE actively utilizes digital channels and specialized investor relations (IR) platforms to connect with its broad audience, extending beyond mere product distribution. This strategic approach ensures that crucial information reaches stakeholders efficiently.

Key financial reports, timely press releases, and insightful investor presentations are readily accessible online, fostering a high degree of transparency and making financial data and strategic developments easily obtainable. For instance, as of their latest available reports, Bolloré SE consistently updates its investor portal with quarterly earnings and annual reviews, facilitating informed decision-making.

- Digital Accessibility: Bolloré SE's investor relations website serves as a central hub for all corporate communications, including financial statements and strategic outlooks.

- Global Reach: The digital nature of these channels allows for immediate engagement with financially-literate decision-makers worldwide, regardless of their geographical location.

- Transparency and Trust: Consistent online updates on financial performance and company news build trust and provide the necessary data for thorough analysis by investors and analysts.

- Engagement Metrics: While specific engagement metrics are proprietary, the company's consistent reporting schedule and the availability of detailed information on their IR site indicate a commitment to active stakeholder communication.

Place, within Bolloré's marketing mix, is defined by its extensive distribution networks and strategic geographical positioning. Canal+ Group, for instance, utilizes a global media distribution framework, encompassing both traditional and digital platforms to reach its subscriber base, with significant growth noted in 2024 across various African markets.

What You Preview Is What You Download

Bollore 4P's Marketing Mix Analysis

The Bollore 4P's Marketing Mix Analysis preview you see is not a sample; it's the final version you’ll get right after purchase. This comprehensive document details Bollore's Product, Price, Place, and Promotion strategies, offering valuable insights for your own business planning. You can be confident that the information presented here is exactly what you will receive, ready for immediate application.

Promotion

Bolloré SE actively manages its corporate communications to convey its strategic evolution, especially after notable divestments. The company focuses on projecting a unified image as a robust industrial and financial entity, underscoring its commitment to long-term value creation and financial stability. For instance, in its 2023 annual report, Bolloré highlighted its strengthened financial position, with total assets reaching €21.3 billion, reinforcing its resilience and future potential in its core businesses.

Blue Solutions' promotion strategy for its advanced battery technology and Bluebus electric vehicles is firmly rooted in targeted B2B and B2G outreach. This approach focuses on direct engagement with key decision-makers in sectors like automotive manufacturing and public transportation, highlighting the superior performance and ecological advantages of their offerings. For instance, in 2024, Blue Solutions actively pursued partnerships with major European cities aiming to electrify their bus fleets, a segment experiencing significant growth driven by sustainability mandates.

Canal+ Group actively engages consumers through diverse media campaigns, employing traditional advertising alongside robust digital marketing strategies. These efforts aim to build brand awareness and showcase their extensive content library, from exclusive sports rights to original series.

In 2024, Canal+ continued to invest heavily in promotions, particularly digital channels, to reach a wider audience and convert interest into subscriptions. For instance, their campaigns often highlight specific, high-demand content like Ligue 1 football matches or critically acclaimed original productions, driving engagement and subscriber acquisition.

The company's promotional mix is designed to resonate with a broad consumer base, emphasizing value and exclusive access in a highly competitive streaming and pay-TV landscape. This approach proved effective, with Canal+ reporting continued subscriber growth in key European markets throughout 2024.

Investor Relations and Financial PR

Bolloré's promotion strategy significantly emphasizes investor relations and financial public relations to cultivate and maintain market confidence. This proactive approach ensures shareholders and potential investors are consistently informed about the company's financial health, asset performance, and strategic direction. For instance, in their 2024 fiscal year reporting, Bolloré detailed robust performance across its logistics and media segments, with revenues reaching €14.7 billion, up 5% year-on-year, underscoring the effectiveness of their communication efforts.

Key elements of this strategy include transparent financial reporting, participation in earnings calls, and timely strategic updates. These communications are vital for conveying Bolloré's asset valuations and outlining future investment plans, thereby attracting necessary capital in a competitive financial environment. The company's commitment to clear communication is evident in its consistent engagement with the financial community, aiming to build long-term trust and support.

- Consistent Financial Reporting: Bolloré provides regular updates on its financial performance, adhering to international accounting standards.

- Earnings Calls and Investor Briefings: The company actively engages with analysts and investors through scheduled calls and presentations to discuss results and outlook.

- Strategic Updates: Information on asset valuations and future investment plans is shared to provide a clear picture of the company's growth trajectory.

- Market Confidence: These efforts are designed to reassure existing investors and attract new capital by demonstrating financial stability and strategic foresight.

Strategic Partnerships and Industry Influence

Bolloré actively cultivates strategic partnerships to amplify its market presence and shape industry direction. Its extensive history within key sectors, including energy and media, underpins these collaborations, boosting its reputation and expanding its influence. For instance, Bolloré's participation in significant infrastructure developments and its forward-thinking approach to emerging technologies serve as powerful promotional tools, positioning the group as a dynamic and influential industry leader.

These alliances are crucial for Bolloré's promotional strategy, allowing it to showcase its diverse capabilities. By joining forces with other major players, Bolloré gains access to new markets and audiences, reinforcing its brand image. This collaborative approach is particularly evident in its ventures within the renewable energy sector, where partnerships are essential for large-scale project development and technological advancement.

- Industry Reach: Bolloré's partnerships extend its influence across sectors like energy, transport, and media, enhancing its promotional narrative.

- Credibility Boost: Collaborations with established industry leaders validate Bolloré's expertise and innovative capacity.

- Innovation Showcase: Involvement in major projects and new technology development highlights Bolloré's role as a pioneering entity.

Bolloré's promotional efforts are multifaceted, encompassing investor relations, targeted B2B outreach for subsidiaries like Blue Solutions, and broad consumer campaigns for Canal+ Group. The company leverages its financial strength, demonstrated by €21.3 billion in total assets as of 2023, and strategic partnerships to enhance its market presence and credibility.

Blue Solutions promotes its battery technology and electric buses through direct engagement with automotive manufacturers and public transport authorities, aiming for fleet electrification. Canal+ Group utilizes extensive media campaigns, particularly digital, to highlight its content library and drive subscriptions, reporting continued growth in 2024.

The group's investor relations strategy focuses on transparent financial reporting, earnings calls, and strategic updates to maintain market confidence, with revenues reaching €14.7 billion in fiscal year 2024. These efforts collectively reinforce Bolloré's image as a stable, evolving industrial and financial entity.

Price

Canal+ Group’s subscription-based media pricing is central to its marketing strategy, with tiered offerings for television and streaming. These models are designed to capture a broad customer base by providing flexibility and choice, reflecting diverse viewing habits and budgets.

Pricing is dynamically adjusted across international markets, considering local purchasing power and competitive pressures. For instance, in 2024, Canal+ continued to adapt its pricing in Africa, a key growth region, to remain competitive against local and international streaming services.

Promotional activities, including introductory discounts and bundled packages, are frequently utilized to drive subscriber acquisition and retention. These tactics aim to secure longer-term customer relationships, a critical factor in the recurring revenue model of subscription media.

Blue Solutions, a subsidiary of Bolloré, employs value-based and contractual pricing for its advanced batteries and Bluebus electric vehicles, primarily targeting business-to-business clients. This approach acknowledges the significant technological innovation and performance these solutions provide, leading to pricing that reflects their inherent value rather than just production cost.

Pricing is typically established through B2B contracts, often involving long-term supply agreements with automotive manufacturers and public transportation authorities. These negotiations consider factors like order volume, the degree of customization required for specific applications, and performance guarantees, ensuring a tailored and mutually beneficial arrangement.

Bolloré's strategic investment in gigafactories is a key element in their pricing strategy. By scaling up production capacity, the company aims to achieve significant economies of scale, which is expected to enhance cost efficiencies and bolster future pricing competitiveness within the rapidly evolving electric mobility market.

Bolloré Energy's fuel and low-carbon liquid fuel pricing is a direct reflection of global commodity markets, with prices for products like diesel and gasoline fluctuating based on international benchmarks. Local demand within specific regions also plays a crucial role, as does the cost of getting those fuels to customers, encompassing transportation and storage expenses. For instance, as of mid-2024, fluctuations in crude oil prices, which can swing by several dollars per barrel weekly, directly impact the wholesale cost of fuels distributed by Bolloré.

The energy distribution sector is intensely competitive, forcing Bolloré Energy to adopt agile pricing approaches. This means constantly monitoring competitor pricing and adjusting their own to remain attractive to customers while ensuring a healthy profit margin. This flexibility is essential to navigate the volatile price environment, where even minor shifts in supply or geopolitical events can cause significant price movements.

The growing demand for biofuels, such as biodiesel and bioethanol, introduces another layer to Bolloré's pricing strategy. Consumers and businesses are often willing to pay a premium for these more sustainable options, creating a distinct pricing tier for low-carbon alternatives. This premium reflects not only the production costs of biofuels but also the market's increasing valuation of environmental responsibility.

Strategic Investment Valuations

Strategic investment valuations for Bolloré SE are intrinsically linked to its diverse financial portfolio. This includes significant stakes in publicly traded entities and substantial agricultural holdings, with valuations derived from prevailing market prices and tailored asset-specific appraisals. The company's approach prioritizes long-term capital deployment and opportunistic strategic acquisitions, where pricing is meticulously established through rigorous due diligence, prevailing market dynamics, and the anticipated realization of synergistic benefits.

Recent significant transactions underscore this valuation strategy. For instance, the divestment of Bolloré Logistics in late 2022 to MSC Mediterranean Shipping Company was completed at an enterprise value of €5.7 billion, a figure reflective of intricate financial negotiations and the strategic importance of the asset. This sale highlights how major asset disposals are priced, incorporating extensive financial analysis and market positioning.

- Valuation Basis: Market prices for listed stakes and asset-specific appraisals for private holdings, including agricultural assets.

- Acquisition Pricing: Driven by comprehensive due diligence, market conditions, and potential synergies.

- Divestment Values: Reflect complex financial negotiations, as seen in the €5.7 billion sale of Bolloré Logistics.

- Strategic Focus: Long-term investments and strategic acquisitions are central to the company's valuation methodology.

Capital Allocation and Shareholder Returns

Bolloré's pricing decisions are deeply intertwined with its capital allocation strategy. The company's approach to dividends and share repurchases directly influences how it returns value to its shareholders, which in turn can affect market perception and stock valuation.

The group’s robust net cash position, strengthened by strategic divestments, offers considerable financial maneuverability. This flexibility allows Bolloré to pursue new investment opportunities, effectively manage its debt obligations, and importantly, reward its investors.

This financial strength is a key factor in how the market perceives Bolloré's stock, contributing to its perceived value and stability. Such perceptions can directly impact the stock's market price, demonstrating a clear link between financial health and shareholder returns.

- Capital Allocation Influence: Dividend policies and share buybacks are direct outputs of capital allocation, impacting shareholder value.

- Net Cash Position: Bolloré maintained a strong net cash position as of the end of 2023, providing significant financial flexibility for investments and shareholder returns.

- Financial Flexibility: This solidity allows for strategic investments, debt management, and value return to shareholders, influencing stock price.

Canal+ Group's pricing strategy is multifaceted, adapting to local markets and competitive landscapes. In 2024, the company continued to adjust its subscription tiers across various African nations, balancing affordability with the value proposition of its content library against a backdrop of increasing competition from global streaming giants.

Blue Solutions, meanwhile, utilizes value-based pricing for its electric vehicle components and buses, reflecting significant R&D investment and performance advantages. Pricing for these B2B offerings is largely determined through long-term contracts negotiated with automotive manufacturers and public transport operators, factoring in customization and volume. The ongoing expansion of its gigafactory capacity aims to drive down production costs, enhancing future price competitiveness.

Bolloré Energy's fuel pricing is directly tied to global crude oil benchmarks, which saw significant volatility in early 2024, with prices fluctuating by as much as $5-$10 per barrel weekly. The company also navigates competitive pressures by adjusting prices dynamically and offers a premium for sustainable biofuels, aligning with growing market demand for environmentally conscious options.

| Segment | Pricing Strategy | Key Factors Influencing Price | 2024/2025 Data/Observations |

|---|---|---|---|

| Canal+ Group | Tiered Subscription, Dynamic Market Adaptation | Local purchasing power, competition, content value | Continued pricing adjustments in key African markets; focus on bundled offerings to boost subscriber acquisition. |

| Blue Solutions | Value-Based, Contractual (B2B) | Technological innovation, performance, order volume, customization | Pricing reflects high R&D; gigafactory expansion targets cost reduction for enhanced future competitiveness. |

| Bolloré Energy | Commodity-Linked, Competitive Adjustment | Global crude oil prices, local demand, transportation costs, competitor pricing, biofuel premium | Prices directly impacted by crude oil fluctuations (e.g., weekly swings of $5-$10/barrel in early 2024); premium for biofuels reflects sustainability demand. |

4P's Marketing Mix Analysis Data Sources

Our Bolloré 4P's Marketing Mix Analysis is meticulously constructed using a blend of proprietary market intelligence and publicly available data. We leverage company reports, industry publications, and direct observation of their product offerings, pricing structures, distribution channels, and promotional activities to provide a comprehensive view.