Bollore PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bollore Bundle

Navigate the complex external forces shaping Bollore's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both opportunities and challenges for the company. Gain actionable intelligence to inform your own strategic decisions and stay ahead of the curve. Download the full PESTLE analysis now for a complete roadmap to understanding Bollore's operating environment.

Political factors

Governmental regulations significantly shape Bolloré SE's operations, particularly within its media and formerly logistics sectors. The French financial regulator, AMF, has played a crucial role, notably in decisions concerning Bolloré's buyout offers for subsidiaries and its pronouncements on the group's control over Vivendi. These regulatory interventions directly impact strategic maneuvers and corporate governance frameworks.

Bolloré's historical reliance on logistics and port operations, though significantly reduced with the sale of its logistics division in early 2023, still means geopolitical shifts and trade tensions remain a consideration. For instance, the ongoing Red Sea crisis, which intensified in late 2023 and continued into 2024, disrupted shipping routes, increasing transit times and costs for many global supply chains, a factor that would have directly affected Bolloré's former logistics arm and could still influence its energy sector by impacting the transport of materials.

Bolloré has encountered significant legal challenges stemming from allegations of corruption related to securing port concessions in Africa. Non-governmental organizations filed complaints in France in March 2024, initiating a period of heightened scrutiny.

These corruption allegations pose substantial risks, including prolonged legal battles, severe reputational harm, and intensified oversight from international organizations and national governments. Such factors can impede Bolloré's capacity to win new contracts and maintain operational presence in various markets.

Media Content Regulation and Censorship

Media content regulation and censorship significantly shape Bolloré's operations, particularly through its Canal+ Group. Evolving policies on broadcasting, content creation, and licensing across different markets directly influence revenue and market access. For instance, the anticipated cessation of broadcasting for Canal+'s French free-to-air channel C8 and the termination of sublicensing agreements in France highlight these regulatory pressures. These shifts can necessitate strategic adjustments to content portfolios and distribution models.

The regulatory landscape directly impacts Bolloré's media assets. Changes in censorship laws can restrict content availability, affecting viewership and advertising revenue. Broadcasting licenses are crucial for market entry and continued operation, and their renewal or modification can have substantial financial implications. In 2023, Canal+ reported a subscriber base of approximately 23.7 million globally, demonstrating the scale of its operations and the widespread impact of regulatory changes.

- Regulatory Impact on Content: Evolving censorship laws and content standards in key markets like France and Africa can limit the types of programming Bolloré can broadcast, potentially affecting audience engagement and advertising revenue.

- Licensing and Market Access: The renewal or modification of broadcasting licenses is critical for Canal+ Group's operations. For example, the French audiovisual regulator Arcom's decisions influence the group's presence on free-to-air platforms.

- Financial Ramifications: Changes in regulatory frameworks, such as the aforementioned termination of sublicensing contracts, can lead to direct revenue losses or necessitate costly adjustments to business models, impacting overall profitability.

Government Support for Green Initiatives

Government support for green initiatives significantly bolsters Bolloré's electricity storage and electric vehicle segments. Policies promoting renewable energy and electric mobility directly benefit operations like Blue Solutions and Bluebus through incentives and subsidies.

France's commitment to reindustrialization and energy transition is a prime example. The French government's backing for Bolloré's battery gigafactory in Alsace underscores this crucial support, aiming to create a robust domestic supply chain for green technologies.

- Increased Demand: Government subsidies for electric vehicles and renewable energy projects directly stimulate market demand for Bolloré's products.

- Investment Incentives: Tax credits and grants for green technology manufacturing, like battery production, reduce operational costs and encourage expansion.

- Regulatory Tailwinds: Favorable regulations and emissions standards push industries towards electrification, creating a more receptive market for Bolloré's solutions.

Political stability and government policies are critical for Bolloré's diverse operations, from media to energy storage. Allegations of corruption, such as those filed in France in March 2024 concerning African port concessions, create significant legal and reputational risks, potentially hindering future contract acquisition and market presence.

Regulatory frameworks, particularly in media, directly influence Bolloré's Canal+ Group. The French regulator Arcom's decisions on broadcasting licenses and content, alongside evolving censorship laws in various markets, can impact revenue streams and operational strategies, as seen with the termination of sublicensing agreements in France.

Government support for green initiatives, like France's reindustrialization efforts, provides a strong tailwind for Bolloré's Blue Solutions and Bluebus segments. Incentives and subsidies for electric mobility and battery production, exemplified by the Alsace gigafactory project, directly boost demand and reduce operational costs.

| Political Factor | Impact on Bolloré | Example/Data (2023-2024) |

| Regulatory Scrutiny & Legal Challenges | Increased operational risk, reputational damage, potential contract limitations | Corruption allegations filed March 2024; AMF pronouncements on Vivendi control |

| Media Content Regulation | Affects revenue, market access, and content strategy | Canal+ Group subscriber base ~23.7 million (2023); termination of sublicensing agreements in France |

| Government Support for Green Tech | Drives demand, provides investment incentives | French government backing for Alsace battery gigafactory; subsidies for EVs and renewable energy |

What is included in the product

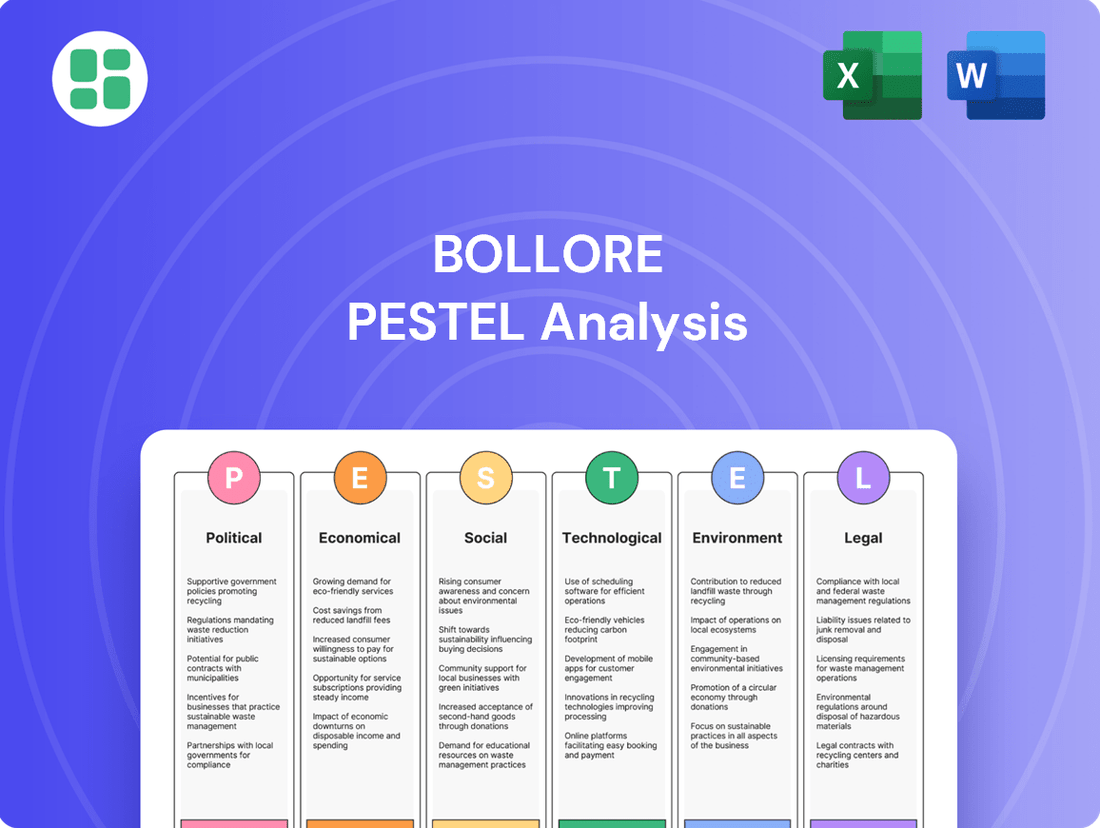

This PESTLE analysis examines the external macro-environmental factors influencing Bollore across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive understanding of its operating landscape.

A clear, actionable summary of the Bolloré PESTLE analysis that highlights key external factors, simplifying complex market dynamics for strategic decision-making.

Provides a concise overview of the Bolloré PESTLE analysis, enabling rapid identification of potential opportunities and threats to streamline strategic planning.

Economic factors

Bolloré's varied business interests, from media to energy, are significantly influenced by the health of the global economy and how much consumers are spending. When economies slow down, companies like Havas might see less advertising income, Canal+ could experience fewer subscribers, and demand for Bolloré Energy products might dip. For instance, in 2023, while specific figures for Bolloré's segments aren't directly comparable to UMG's standalone performance, the broader media and entertainment sector experienced mixed results due to inflationary pressures impacting consumer discretionary spending.

Conversely, periods of global economic expansion tend to boost demand across Bolloré's portfolio. Stronger economies generally lead to higher consumer confidence and increased spending on entertainment, media, and energy. While UMG's contribution to Vivendi's (a former major stake held by Bolloré) earnings was robust, this highlights how positive economic cycles can lift performance in sectors where Bolloré has significant interests, suggesting a similar positive correlation for its direct operations.

High inflation rates in 2024 and projected into 2025 present a significant challenge for Bolloré's diverse operations. For instance, rising energy costs directly impact its logistics and transportation segments, while increased production expenses can affect profitability in media and entertainment. This inflationary pressure could see operational costs climb, potentially squeezing margins across the group.

The prevailing interest rate environment, with central banks like the European Central Bank and the US Federal Reserve continuing to manage inflation through monetary policy, directly influences Bolloré's borrowing costs. Following substantial asset sales, Bolloré holds a considerable cash position, but any future strategic investments or acquisitions will be more expensive to finance. For example, if benchmark interest rates remain elevated through 2025, the cost of capital for new ventures will be higher, requiring careful financial planning to maintain healthy returns.

Currency exchange rate volatility significantly impacts Bolloré's global financial performance. As a group with extensive international operations, fluctuations between the euro and other currencies directly affect the reported value of its revenues and profits. For instance, a strengthening euro against the currencies where Bolloré generates substantial income, like the West African CFA franc or the US dollar, would lead to lower reported earnings when converted back to euros. This dynamic creates inherent unpredictability in financial planning and can challenge the stability of its consolidated financial statements.

Market Competition and Consolidation

Bolloré operates in highly competitive arenas, including logistics, media, and electric vehicles, where intense rivalry can compress profit margins. For instance, the global logistics market, a sector where Bolloré was a significant player before its divestment, is characterized by numerous global and regional operators vying for market share, impacting pricing power.

The company's strategic moves, such as the significant sale of Bolloré Logistics to CMA CGM for €5.6 billion in December 2022, underscore a broader trend of industry consolidation. This divestment, alongside the spin-off of its media assets under Vivendi, demonstrates Bolloré's active portfolio management aimed at streamlining operations and strengthening its financial standing in response to these competitive pressures.

- Intense competition in logistics, media, and EV sectors pressures Bolloré's profitability.

- Strategic divestments, like the €5.6 billion sale of Bolloré Logistics in 2022, highlight industry consolidation.

- Portfolio optimization is a key strategy to adapt to market dynamics and competitive landscapes.

- Industry consolidation creates opportunities for larger players and necessitates agile strategic responses.

Impact of Asset Divestments and Spin-offs

Bolloré's strategic asset divestments and spin-offs in late 2024 have fundamentally altered its financial landscape. The sale of Bolloré Logistics in February 2024, for instance, injected significant capital, positioning the company for future growth initiatives and share repurchases. This move, coupled with the planned spin-off of key Vivendi entities like Canal+ and Havas by December 2024, signals a deliberate re-evaluation of the conglomerate's operational focus, particularly within its media and communications portfolio.

These significant transactions are expected to yield substantial net cash, providing Bolloré with enhanced financial flexibility. This newfound liquidity is earmarked for strategic investments, potentially in emerging technologies or market expansions, and for bolstering shareholder returns through buyback programs. The group's decision to spin off its communication assets reflects a broader trend of portfolio optimization, aiming to unlock value and streamline operations.

- February 2024: Completion of Bolloré Logistics sale.

- December 2024: Planned spin-off of Vivendi's entities (Canal+, Havas, Louis Hachette Group).

- Financial Impact: Generation of substantial net cash for strategic reinvestment and share buybacks.

- Strategic Re-evaluation: Focus on optimizing the group's involvement in communication assets.

Economic factors significantly shape Bolloré's performance, with global growth driving demand across its varied sectors. Conversely, economic downturns can reduce consumer spending, impacting advertising revenue for Havas and subscription numbers for Canal+. Inflationary pressures in 2024 and into 2025 are increasing operational costs, potentially squeezing profit margins across the group.

Interest rate policies by central banks directly affect Bolloré's cost of capital for any future investments. Currency fluctuations also play a crucial role, as Bolloré's extensive international operations mean that changes in exchange rates can impact reported revenues and profits. Navigating these economic variables is key to maintaining financial stability and pursuing strategic growth opportunities.

| Economic Factor | Impact on Bolloré | 2024/2025 Outlook |

|---|---|---|

| Global Economic Growth | Drives demand for media, energy, and logistics. | Mixed outlook, with potential for recovery in some regions but persistent inflation impacting consumer spending. |

| Inflation | Increases operational costs, potentially reducing profit margins. | Expected to remain a significant challenge, requiring cost management strategies. |

| Interest Rates | Affects cost of borrowing for new investments. | Likely to remain elevated as central banks manage inflation, making financing more expensive. |

| Currency Exchange Rates | Impacts reported value of international revenues and profits. | Volatility expected to continue, requiring hedging strategies and careful financial management. |

What You See Is What You Get

Bollore PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Bollore PESTLE Analysis provides a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain valuable insights into Bollore's strategic positioning within its operating environment.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed analysis is designed to equip you with a thorough understanding of the external forces shaping Bollore's business.

Sociological factors

Consumers are increasingly migrating from traditional television to digital platforms and streaming services. This shift directly affects Bolloré's media division, particularly Canal+, as viewers opt for on-demand content. For instance, by the end of 2024, global streaming subscriptions were projected to surpass 1.7 billion, highlighting the scale of this trend.

Adapting to these changing media consumption habits is paramount for Bolloré's success. Maintaining subscriber numbers and advertising revenue hinges on offering compelling digital content and flexible viewing options. Failure to innovate in this space could lead to a decline in engagement with legacy media assets.

Consumers and investors are increasingly demanding that businesses operate responsibly, focusing on environmental protection and fair labor practices. This societal shift directly influences corporate strategy, pushing companies like Bolloré to integrate Environmental, Social, and Governance (ESG) principles into their core operations.

Bolloré's sustainability report highlights its dedication to these ESG pillars, demonstrating an active response to these societal expectations. For instance, in 2023, the company reported a reduction in its Scope 1 and 2 greenhouse gas emissions by 15% compared to 2022, showcasing tangible progress in its environmental commitment across its diverse industrial and energy sectors.

Bolloré navigates a complex global workforce, managing diverse labor laws and cultural expectations across its logistics, media, and industrial operations. In 2024, companies like Bolloré face increasing pressure to ensure equitable treatment and fair working conditions, impacting talent acquisition and retention.

Public scrutiny on diversity and inclusion is intensifying, with a growing demand for transparency in hiring practices and pay equity. For instance, a 2024 report by McKinsey & Company highlighted that companies with greater gender diversity on their executive teams were 25% more likely to have above-average profitability.

Public Perception and Brand Reputation

Bolloré's brand reputation is significantly shaped by its legal entanglements and environmental stewardship. For instance, the company faced scrutiny in 2021 regarding alleged corruption in West Africa, which, if substantiated, could erode consumer trust and deter potential business collaborations.

Public perception of Bolloré's media holdings also plays a crucial role. Negative reactions to the content or editorial stances of its media outlets can translate into broader brand damage, impacting its diverse business interests from logistics to energy.

- Legal Challenges: Ongoing investigations and past allegations can create a cloud of uncertainty around the company's ethical practices.

- Environmental Performance: Public concern over sustainability means that any perceived missteps in environmental management can lead to reputational harm.

- Media Influence: The public's view of Bolloré's media assets can indirectly influence perceptions of the parent company.

Urbanization and Infrastructure Development Needs

The rapid pace of urbanization globally significantly shapes the demand for Bolloré's core offerings. As more people flock to cities, the need for efficient transportation, seamless logistics, and reliable energy solutions escalates. This trend directly impacts strategic decisions, such as investments in electric mobility, aiming to address congestion and emissions in these growing urban centers. For instance, as of early 2025, over 60% of the world's population resides in urban areas, a figure projected to reach nearly 70% by 2050, underscoring the sustained demand for infrastructure development.

Developing economies, in particular, present a dual-edged sword for Bolloré. The burgeoning infrastructure needs in these regions offer substantial growth opportunities, from expanding logistics networks to implementing sustainable energy solutions. However, these opportunities are often coupled with challenges related to regulatory frameworks, land acquisition, and the sheer scale of investment required. Bolloré's historical involvement in port concessions, for example, highlights the critical role of infrastructure in facilitating trade and economic activity in these developing urban landscapes.

- Urban Population Growth: Globally, urban populations are expected to increase by approximately 1.5 billion people between 2020 and 2050, driving demand for infrastructure and related services.

- Logistics Demand: The growth of e-commerce, fueled by urbanization, is projected to increase global freight volume by 40% by 2050, creating opportunities for logistics providers like Bolloré.

- Energy Transition: Investments in electric vehicles and charging infrastructure are crucial for urban sustainability, with the global EV market expected to reach over $1.5 trillion by 2030, presenting a key growth area for Bolloré's electric mobility solutions.

Shifting consumer preferences towards digital media present a significant challenge for Bolloré's media division, particularly Canal+. The increasing adoption of streaming services, with global subscriptions projected to exceed 1.7 billion by the end of 2024, necessitates a robust digital content strategy. Bolloré must adapt its offerings to retain subscribers and advertising revenue in this evolving landscape.

Societal expectations regarding corporate responsibility are also a key sociological factor. Consumers and investors increasingly demand adherence to Environmental, Social, and Governance (ESG) principles. Bolloré's 2023 sustainability report, detailing a 15% reduction in Scope 1 and 2 emissions compared to 2022, demonstrates a commitment to these principles, which are vital for maintaining brand reputation and stakeholder trust.

The global workforce presents diverse labor laws and cultural expectations that Bolloré must navigate. In 2024, companies face heightened pressure for equitable treatment and fair working conditions, impacting talent acquisition and retention. Furthermore, public scrutiny on diversity and inclusion is intensifying, with a 2024 McKinsey report indicating that companies with greater gender diversity on executive teams are 25% more likely to achieve above-average profitability.

| Sociological Factor | Impact on Bolloré | Supporting Data/Trend |

|---|---|---|

| Digital Media Consumption | Affects Canal+ subscriber numbers and advertising revenue. | Global streaming subscriptions projected to surpass 1.7 billion by end of 2024. |

| ESG Expectations | Influences corporate strategy and brand reputation. | Bolloré reported a 15% reduction in Scope 1 & 2 emissions in 2023 vs. 2022. |

| Workforce Diversity & Inclusion | Impacts talent acquisition, retention, and profitability. | Companies with greater gender diversity on executive teams are 25% more likely to be more profitable (McKinsey, 2024). |

Technological factors

Bolloré's strategic focus on electric vehicle (EV) and battery technology, primarily via its Blue Solutions and Bluebus subsidiaries, is intrinsically linked to ongoing technological advancements. Improvements in battery energy density, faster charging capabilities, and more efficient manufacturing are crucial for the viability and adoption of these electric mobility solutions.

The company's significant investment in this sector is underscored by its ambitious plan to construct a gigafactory dedicated to solid lithium-metal batteries. This initiative signals a commitment to pushing the boundaries of battery technology, aiming for enhanced safety and performance compared to current lithium-ion alternatives.

While Bolloré Logistics has been divested, the logistics and supply chain sector continues its rapid digital transformation. This evolution is crucial for Bolloré's remaining energy and industrial businesses, which depend on streamlined operations. For instance, AI-powered solutions are increasingly being deployed to optimize energy consumption within warehouses, a trend exemplified by companies investing in smart grid technologies for their facilities.

Enhanced data analytics are also playing a pivotal role in improving flow management across supply chains. These advancements allow for better forecasting, inventory control, and route optimization. For example, in 2024, the global supply chain analytics market was projected to reach over $10 billion, underscoring the significant investment and reliance on data-driven insights within the industry.

Technological shifts are fundamentally reshaping the media landscape. The rapid ascent of streaming services, the nascent but growing interest in virtual reality (VR) experiences, and the demand for more interactive content mean that companies like Canal+, a key asset within the Bolloré Group, must constantly adapt. This requires ongoing investment in new content production techniques and advanced distribution technologies to stay ahead of the curve and maintain audience engagement.

For Bolloré's media operations, this translates into a strategic imperative to invest in cutting-edge technologies. For instance, the global video streaming market was valued at over $220 billion in 2023 and is projected to grow significantly. Canal+ needs to allocate capital towards developing and acquiring rights for high-quality, on-demand content, exploring immersive VR content creation, and enhancing its digital platforms to offer seamless, interactive viewing experiences. Failing to do so risks losing subscribers to more agile, tech-forward competitors.

Cybersecurity and Data Protection

Cybersecurity and data protection are paramount for Bolloré, given its extensive operations across logistics, media, and telecommunications, which involve handling vast amounts of sensitive information. The group must continually invest in advanced technologies to safeguard its digital infrastructure against increasingly sophisticated cyber threats. For instance, the global cybersecurity market was projected to reach over $232 billion in 2024, highlighting the significant investment required.

Compliance with stringent data privacy regulations, such as the General Data Protection Regulation (GDPR), presents an ongoing technological challenge. Bolloré needs to ensure its data handling practices align with these evolving legal frameworks to avoid substantial penalties. Failure to comply can lead to significant financial repercussions and reputational damage, making technological adaptation a critical business imperative.

The technological landscape demands proactive measures:

- Investment in AI-powered threat detection systems to identify and neutralize cyberattacks in real-time.

- Implementation of robust encryption protocols for all sensitive data, both in transit and at rest.

- Regular security audits and penetration testing to identify and address vulnerabilities.

- Employee training programs focused on cybersecurity best practices and data privacy awareness.

Automation and Robotics in Industrial Operations

Bolloré's industrial segments, such as film production and systems, stand to gain significantly from automation and robotics. By integrating these advanced technologies, the company can boost operational efficiency, leading to substantial cost reductions. For instance, automated film processing can decrease labor expenses and minimize waste, enhancing overall profitability.

The adoption of robotics in manufacturing and logistics can also elevate product quality and consistency. Automated systems are less prone to human error, ensuring higher standards in production. This technological advancement is crucial for maintaining a competitive edge in the global market, especially as industries increasingly rely on precision and speed.

Investment in automation and robotics is a strategic imperative for Bolloré. In 2024, the global industrial automation market was valued at approximately $260 billion and is projected to grow substantially. Companies that embrace these technologies are better positioned to adapt to evolving market demands and outperform competitors.

Key benefits for Bolloré include:

- Increased production speed and output

- Reduced operational costs through optimized resource utilization

- Enhanced product quality and consistency

- Improved workplace safety by automating hazardous tasks

Bolloré's strategic direction is heavily influenced by technological advancements, particularly in electric vehicle (EV) battery technology and digital transformation within logistics. The company's commitment to solid lithium-metal batteries, as evidenced by its gigafactory plans, aims to leverage breakthroughs in energy density and charging speed, crucial for the EV market's expansion. For instance, the global battery market was projected to exceed $150 billion in 2024, indicating significant investment opportunities and competitive pressures.

The media sector, notably Canal+, faces rapid evolution due to streaming services and interactive content demands. Bolloré's investment in new production and distribution technologies is vital to compete in a market where the global video streaming market reached over $220 billion in 2023. This necessitates continuous adaptation to evolving viewer preferences and technological platforms.

Cybersecurity and data protection are critical operational imperatives. Bolloré must invest in advanced technologies to safeguard its diverse operations, a necessity highlighted by the global cybersecurity market's projected value exceeding $232 billion in 2024. Compliance with data privacy regulations like GDPR also demands ongoing technological adaptation to prevent significant financial and reputational risks.

Automation and robotics offer substantial benefits for Bolloré's industrial segments, promising increased efficiency and reduced costs. The global industrial automation market, valued at approximately $260 billion in 2024, underscores the strategic importance of adopting these technologies to enhance production speed, product quality, and workplace safety.

Legal factors

Antitrust and competition laws significantly shape Bolloré's strategic maneuvers. For instance, the sale of Bolloré Logistics to CMA CGM, a deal valued at approximately €5.6 billion in 2022, underwent scrutiny from competition regulators across multiple continents to ensure it wouldn't stifle market competition. Similarly, the complex spin-off of Vivendi's various entities, including Canal+ and Havas, also required careful navigation of these regulations in key markets like Europe and Africa.

Recent legal challenges, particularly the AMF's ruling concerning Bolloré's control over Vivendi and non-compliance with buyout offers for subsidiaries, underscore the critical need for robust corporate governance and unwavering respect for minority shareholder rights. These legal battles can result in substantial financial penalties and protracted appeals, impacting the company's financial health and market reputation.

In 2024, the financial implications of such governance failures are becoming increasingly apparent, with regulators worldwide stepping up scrutiny. For instance, the potential fines and compensation payouts stemming from these disputes can run into millions of euros, directly affecting Bolloré's profitability and cash flow, as seen in ongoing legal proceedings that could extend well into 2025.

Bolloré, with its significant media holdings via Vivendi, navigates a complex web of media ownership regulations. These rules, which differ significantly across jurisdictions, aim to prevent excessive market concentration and promote a diverse media landscape.

For instance, in France, where Vivendi has a strong presence, regulations often limit the percentage of media market share a single entity can control. These legal frameworks directly impact Bolloré's ability to consolidate and expand its media empire, influencing strategic decisions regarding acquisitions and content development.

International Trade Laws and Sanctions

Bolloré's extensive global operations, especially within its energy and industrial segments, necessitate rigorous compliance with a complex web of international trade laws, customs protocols, and economic sanctions. These regulations, enacted by entities like the United Nations, the European Union, and individual nations, directly impact the company's ability to conduct business across borders.

Failure to navigate these legal frameworks accurately can lead to significant financial penalties, reputational damage, and even the suspension of vital business activities. For instance, in 2023, companies globally faced billions in fines for sanctions violations, underscoring the critical importance of robust compliance programs. Bolloré's strategic planning must therefore incorporate detailed assessments of evolving trade landscapes and sanctions regimes to mitigate risks.

- Global Trade Compliance: Bolloré must adhere to diverse import/export regulations and customs procedures in over 100 countries where it operates, impacting supply chain efficiency and costs.

- Sanctions Enforcement: The company's exposure to sanctions regimes, such as those targeting Russia or Iran, requires constant monitoring and adaptation to avoid severe legal and financial repercussions.

- Regulatory Changes: Anticipating and responding to shifts in international trade policies and sanctions, which can change rapidly based on geopolitical events, is crucial for maintaining operational continuity.

Environmental Regulations and Compliance

Bolloré's diverse operations, spanning energy, logistics, and industrial sectors, face stringent environmental compliance requirements. These regulations govern everything from air and water emissions to waste disposal and the sustainable sourcing of materials. For instance, in 2024, the European Union continued to strengthen its emissions trading system (EU ETS), impacting industrial players like Bolloré.

The company's stated sustainability goals, such as reducing its carbon footprint, are not just voluntary commitments but also responses to evolving legal frameworks and societal expectations. By investing in cleaner technologies and responsible resource management, Bolloré aims to mitigate risks associated with non-compliance and capitalize on the growing demand for environmentally sound business practices. In 2025, expect continued regulatory pressure on carbon intensity across global markets.

- Emissions Standards: Bolloré must adhere to national and international standards for greenhouse gas and pollutant emissions from its industrial facilities and transportation activities.

- Waste Management: Compliance with regulations concerning hazardous and non-hazardous waste generation, treatment, and disposal is critical for all of Bolloré's operational sites.

- Resource Efficiency: Environmental laws increasingly mandate efficient use of water, energy, and raw materials, pushing companies like Bolloré towards circular economy principles.

- Biodiversity Protection: Projects, especially in sensitive areas, require adherence to regulations protecting local ecosystems and biodiversity.

Bolloré's operations are heavily influenced by antitrust and media ownership regulations, requiring careful navigation of market concentration rules. For example, the €5.6 billion sale of Bolloré Logistics in 2022 faced extensive antitrust reviews globally.

The company's recent legal challenges, including AMF rulings regarding Vivendi control and buyout compliance, highlight the critical importance of strong corporate governance and minority shareholder protection, with potential fines in the millions of euros impacting profitability through 2025.

Global trade laws, sanctions, and customs protocols are paramount for Bolloré's international activities, with non-compliance risking severe penalties and operational disruptions, as evidenced by billions in global sanctions violation fines in 2023.

Environmental factors

Bolloré's diverse operations, including energy and industrial manufacturing, inherently contribute to carbon emissions. This reality places the company under significant scrutiny from regulators, investors, and the public to actively reduce its environmental impact.

The growing demand for sustainability is evident in initiatives like Bolloré Logistics' past carbon reduction targets and the group's published sustainability reports, reflecting a clear acknowledgment of the need to address its environmental footprint.

Bolloré's industrial operations, particularly in battery manufacturing and film production, depend heavily on access to critical raw materials. The increasing global demand for electric vehicles, a sector where Bolloré is actively involved, directly impacts the availability and cost of materials like lithium. For instance, the price of lithium carbonate surged by over 400% between early 2021 and late 2022, highlighting the volatility and scarcity challenges.

Ensuring a sustainable and ethical supply chain for these resources is paramount for Bolloré's long-term operational health and its commitment to responsible business practices. The company's strategy must account for geopolitical risks, environmental regulations, and the growing pressure from consumers and investors for transparency in sourcing, especially for materials like cobalt, which is often associated with human rights concerns in its extraction.

Effective waste management and the adoption of circular economy principles are becoming increasingly important for industrial groups. Bolloré's efforts in rationalizing the use of consumables and exploring circular economy projects demonstrate a response to these environmental imperatives.

In 2023, the global waste management market was valued at approximately $1.6 trillion, with a projected compound annual growth rate of 5.2% through 2030, highlighting the significant economic and environmental focus on this sector. Companies like Bolloré are increasingly investing in sustainable practices, such as reducing single-use plastics and optimizing logistics to minimize waste.

Energy Consumption and Renewable Energy Transition

Bolloré's extensive industrial operations, particularly within its energy sector and manufacturing facilities, inherently involve substantial energy consumption. This makes the group particularly sensitive to energy market dynamics and the ongoing global shift towards cleaner power sources.

The company's strategic investments are directly addressing this environmental factor. Bolloré is actively developing electric vehicle (EV) technologies and energy storage solutions, signaling a commitment to the renewable energy transition. A prime example is its significant investment in battery gigafactories, crucial for the widespread adoption of EVs and grid-scale energy storage.

This focus positions Bolloré to capitalize on the global imperative to reduce reliance on fossil fuels. For instance, by 2023, renewable energy sources accounted for approximately 30% of the European Union's gross final energy consumption, a trend that is accelerating and creating substantial market opportunities for companies like Bolloré that are aligned with this trajectory.

- Energy Consumption: Bolloré's industrial footprint necessitates significant energy input, impacting operational costs and environmental footprint.

- Renewable Energy Transition: The group's strategic focus on EV development and energy storage directly supports the global move away from fossil fuels.

- Gigafactory Investments: Bolloré's commitment to battery gigafactories is a key enabler of the electric mobility and renewable energy storage sectors.

- Market Alignment: The company's activities are well-positioned to benefit from increasing global demand for sustainable energy solutions, driven by environmental regulations and consumer preferences.

Impact of Environmental Disasters and Extreme Weather

Bolloré's extensive logistics and infrastructure assets, particularly its former port concessions and global supply chain operations, face significant risks from climate-related disasters. Extreme weather events, such as hurricanes, floods, and droughts, can directly damage physical infrastructure, leading to operational disruptions and increased maintenance costs.

For instance, the increasing frequency and intensity of such events, as highlighted by the World Meteorological Organization's reports in 2024, pose a direct threat to Bolloré's ability to maintain seamless operations. These disruptions can lead to delays in shipments, increased insurance premiums, and the need for substantial capital expenditure to build more resilient infrastructure, impacting profitability and market competitiveness.

- Supply Chain Vulnerability: Global supply chains are inherently susceptible to climate shocks, affecting Bolloré's ability to move goods efficiently.

- Infrastructure Damage: Extreme weather can cause direct physical damage to ports, warehouses, and transportation networks.

- Increased Operational Costs: Repairing damage, rerouting shipments, and higher insurance premiums contribute to rising operational expenses.

- Investment in Resilience: Companies like Bolloré must invest in climate-resilient infrastructure to mitigate future impacts.

Bolloré's operations are significantly impacted by environmental regulations concerning pollution and waste management. The company must comply with evolving standards for emissions, chemical usage, and disposal, which can influence production processes and require capital investment in cleaner technologies.

The increasing global focus on sustainability and corporate responsibility means Bolloré faces pressure from stakeholders to minimize its environmental footprint. This includes managing resource consumption and adopting circular economy principles, as seen in efforts to reduce waste and optimize material use.

Climate change presents a direct risk to Bolloré's extensive logistics and infrastructure, particularly its port operations. Extreme weather events can disrupt supply chains and necessitate investments in climate-resilient infrastructure to ensure operational continuity and mitigate financial losses.

Bolloré's strategic investments in electric vehicle technologies and energy storage solutions align with the global transition to renewable energy. This positions the company to benefit from the growing demand for sustainable energy, driven by environmental policies and market shifts away from fossil fuels.

| Environmental Factor | Impact on Bolloré | Key Considerations/Data |

|---|---|---|

| Regulatory Compliance | Adherence to emission, waste, and chemical standards | Stricter environmental laws can increase operational costs and necessitate technology upgrades. |

| Sustainability Demands | Pressure for reduced environmental footprint | Growing investor and consumer focus on ESG performance; Bolloré Logistics has set carbon reduction targets. |

| Climate Change Risks | Vulnerability of logistics and infrastructure to extreme weather | Increased frequency of events like hurricanes and floods can disrupt supply chains and damage assets. The WMO reported 2023 as the warmest year on record. |

| Energy Transition | Opportunities in renewable energy and EV sectors | Investments in gigafactories and battery technology capitalize on the shift from fossil fuels; renewable energy share in EU's gross final consumption reached ~30% by 2023. |

PESTLE Analysis Data Sources

Our Bolloré PESTLE analysis is built on a robust foundation of data from official government publications, reputable financial news outlets, and extensive market research reports. We incorporate insights from international organizations and industry-specific analyses to ensure comprehensive coverage.