Bollore Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bollore Bundle

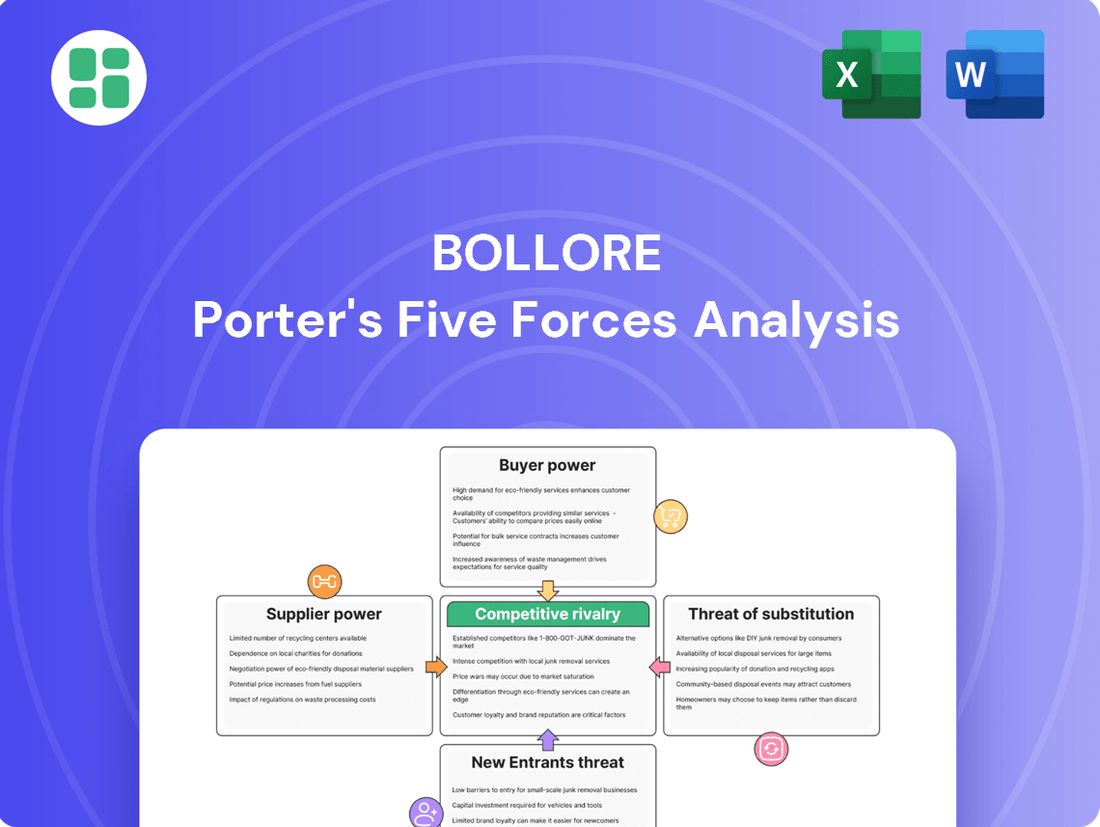

Understanding the competitive landscape is crucial for any business, and Porter's Five Forces provides a powerful framework. For Bollore, this analysis unpacks the intensity of rivalry, the power of buyers and suppliers, and the threats of substitutes and new entrants. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bollore’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Bolloré's varied business segments experience different levels of supplier concentration. For highly specialized needs, such as advanced battery materials for its Blue Solutions division or critical port equipment, the limited number of expert suppliers grants them significant bargaining power. For instance, the development of next-generation solid-state batteries relies on a small group of material science innovators, potentially giving these suppliers leverage in pricing and terms.

Switching costs for Bolloré can be substantial, particularly in areas like logistics and port management where core IT systems are deeply integrated. Re-tooling manufacturing lines for new battery chemistries also presents significant capital expenditure and training challenges. These factors empower incumbent suppliers who have established themselves within Bolloré's operational framework.

Suppliers offering highly unique or proprietary inputs significantly bolster their bargaining power. For instance, Canal+ relies on exclusive content rights, making those content creators powerful negotiators. Similarly, specialized engineering firms for complex infrastructure projects, like those Bolloré might undertake, hold considerable sway if their expertise is not easily replicated. In 2024, the media landscape saw continued consolidation of premium content rights, increasing the leverage of key studios and production houses over broadcasters like Canal+.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Bolloré's diverse industries is generally low. This is primarily due to the significant scale and complexity involved in operating across Bolloré's various sectors, such as logistics, energy, and media.

For example, a supplier of raw materials for Bolloré's battery division would face immense challenges in developing and marketing full-scale electric vehicles or complex energy storage solutions. Similarly, content creators supplying Bolloré's media arms are unlikely to establish their own global broadcasting networks, which require substantial infrastructure and capital investment.

- Scale Barrier: Bolloré's extensive global operations in areas like logistics and energy require massive capital and established infrastructure, making forward integration by typical suppliers prohibitively expensive.

- Complexity: Bolloré's businesses span multiple complex industries, each with unique operational demands, regulatory environments, and market dynamics that are difficult for suppliers to replicate.

- Focus: Suppliers typically specialize in their core competencies, such as component manufacturing or content creation, and lack the expertise and resources to manage entire value chains in industries like automotive manufacturing or broadcasting.

Supplier Importance to Bolloré vs. Bolloré's Importance to Suppliers

Bolloré's position as a large, diversified conglomerate means it's often a substantial customer for its suppliers, granting it considerable bargaining power. This is particularly true for suppliers of more commoditized goods or services where Bolloré can easily switch providers. For instance, in 2023, Bolloré's logistics and transport segments likely represented a significant portion of revenue for many of their upstream partners in fuel, vehicle maintenance, and port services, giving them leverage in negotiations.

However, the dynamic shifts when considering suppliers of highly specialized or niche components and technologies. For these specialized providers, Bolloré might constitute a smaller, though perhaps strategically important, part of their overall client base. This can empower such suppliers, especially if their unique offerings are critical to Bolloré's operations, such as advanced battery technology for its electric vehicle initiatives or specific software solutions for its media and telecommunications divisions. In such cases, the supplier's specialized knowledge and limited alternatives for Bolloré can tip the scales of bargaining power.

- Supplier Dependence: Bolloré's scale as a customer can reduce supplier power in general markets.

- Specialized Inputs: For niche or critical suppliers, Bolloré's reliance can increase their bargaining leverage.

- Market Position: Bolloré's own market share in its various sectors influences how much power its suppliers can wield.

- Contractual Terms: The specific terms and duration of supply contracts significantly shape the balance of power.

Bolloré's bargaining power with suppliers is influenced by its size and the specificity of its needs. For standardized inputs, Bolloré's substantial purchasing volume often gives it leverage. However, for specialized components or critical intellectual property, particularly in emerging sectors like advanced battery technology, suppliers with unique offerings can command greater power. The 2024 market for electric vehicle components, for example, saw tight supply chains for rare earth materials, increasing supplier leverage.

| Factor | Bolloré's Influence | Supplier Influence |

|---|---|---|

| Purchase Volume | High for commoditized goods | Low |

| Supplier Specialization | Low for specialized inputs | High for critical/unique technologies |

| Switching Costs | High for integrated systems | Low for easily replaceable suppliers |

| Threat of Forward Integration | Very Low due to complexity | Very Low |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Bollore's diverse business segments.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's five forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

Bolloré's customer base is diverse, encompassing large multinational corporations needing comprehensive logistics services and individual subscribers to its Canal+ media offerings. For major corporate clients and significant content distributors, their substantial order volumes and the feasibility of shifting to alternative service providers grant them significant leverage.

This high volume of business means that losing even a few key clients could materially impact Bolloré's revenue. For instance, in 2024, the logistics segment, a key area for large corporate clients, continued to see significant demand, but also intense competition, underscoring the importance of retaining these high-value accounts.

In contrast, individual Canal+ subscribers possess far less individual bargaining power. While collectively they represent a significant customer base, their ability to influence pricing or service terms on an individual basis is minimal, reflecting the typical dynamics in the media subscription market.

Customer price sensitivity is a key factor impacting Bolloré's profitability. In the highly competitive logistics sector, where numerous providers exist, clients often have a strong inclination to seek the lowest possible rates. For instance, in 2024, global shipping rates saw fluctuations, putting pressure on logistics firms to maintain competitive pricing to retain business.

However, this sensitivity isn't uniform across all of Bolloré's operations. While individual subscribers to Canal+ in the media segment might react to price hikes, the exclusive and high-quality content provided by the service can justify a certain level of premium pricing, mitigating extreme price sensitivity. This is a common trend in subscription-based media where content differentiation plays a crucial role.

In the energy solutions domain, particularly when dealing with large industrial or utility clients, the focus often shifts. These customers tend to prioritize the reliability of supply and the overall long-term cost-effectiveness of the energy solution rather than solely focusing on the initial purchase price. This strategic consideration allows for more stable pricing models in this segment.

Customers possess significant bargaining power when a wide array of substitute services are readily available. In the logistics sector, for instance, clients can easily switch to other global freight forwarders, such as CEVA Logistics, especially following significant market consolidation like the Bolloré Logistics acquisition by CMA CGM in 2024. Alternatively, large corporations might choose to develop their own in-house logistics capabilities, further diminishing reliance on third-party providers.

This principle extends to other industries where Bolloré may operate. In media and entertainment, the proliferation of streaming services and diverse digital platforms provides consumers with abundant alternatives to traditional content providers. This broad availability of substitutes across various sectors empowers customers, allowing them to demand better pricing, higher quality, and more favorable terms from service providers like Bolloré.

Customer Switching Costs

Customer switching costs for Bolloré are generally moderate, influencing their bargaining power. For logistics services, while there's administrative work and potential disruption when changing providers, the process is manageable. In 2024, the global logistics market, valued at approximately $10.6 trillion, sees companies frequently evaluating providers to optimize costs and efficiency, indicating a degree of substitutability.

In the media sector, switching between streaming or pay-TV services is typically straightforward. However, the allure of exclusive content, a common strategy in the competitive streaming landscape, can act as a retention factor, slightly increasing switching costs for consumers invested in specific platforms. The subscription video-on-demand market alone was projected to reach over $130 billion globally by the end of 2024.

For Bolloré's energy solutions, particularly for large corporate clients, the initial investment in their systems can create more significant switching costs. This capital outlay, coupled with the integration of new technologies, makes it less appealing for clients to move to a competitor, thereby reducing their bargaining power in this segment.

- Logistics: Moderate switching costs due to administrative effort but feasible provider changes.

- Media: Easy service switching, but exclusive content can be a deterrent to changing.

- Energy Solutions: Higher switching costs for large clients due to substantial upfront investment.

Customer Information and Transparency

Increased transparency in pricing and service offerings, especially within logistics and media, significantly bolsters customer bargaining power. For instance, in 2024, the proliferation of online comparison tools for freight forwarding services allowed businesses to easily identify cost discrepancies, leading to more assertive negotiations. This ease of access to information levels the playing field.

Online platforms and readily available industry benchmarks empower customers to scrutinize service providers and negotiate more favorable terms. In 2024, many B2B clients in the media buying space leveraged data from digital advertising exchanges to challenge inflated agency fees, demonstrating a clear shift in negotiation leverage. This information asymmetry increasingly favors the customer.

The ability for customers to readily compare services and pricing creates a more competitive environment, directly impacting supplier margins. In the logistics sector, for example, reports from 2024 indicated that companies utilizing digital freight marketplaces saw an average cost reduction of 8-12% on their shipments due to enhanced price transparency and competitive bidding.

- Information Availability: Customers can easily access pricing and service details for logistics and media services.

- Benchmarking Power: Industry benchmarks and online platforms enable direct comparison of offerings.

- Negotiation Leverage: Enhanced transparency allows customers to negotiate better terms and prices.

- Reduced Information Asymmetry: The gap in knowledge between buyers and sellers narrows, favoring informed customer decisions.

Bolloré's customers, particularly large corporate clients in logistics, wield significant bargaining power due to their substantial order volumes and the availability of numerous alternative providers. This leverage is amplified by price sensitivity, especially in the competitive logistics market where global shipping rates in 2024 saw fluctuations, compelling firms to offer competitive pricing. Furthermore, the ease with which customers can switch providers, coupled with increasing price transparency through online platforms, further strengthens their negotiating position.

| Customer Segment | Bargaining Power Factors | Impact on Bolloré |

|---|---|---|

| Large Corporate Logistics Clients | High order volumes, availability of substitutes (e.g., CMA CGM acquisition impact in 2024), moderate switching costs. | Pressure on pricing, need for competitive service offerings. |

| Individual Media Subscribers (Canal+) | Low individual power, but collective influence. Exclusive content mitigates price sensitivity. | Ability to maintain premium pricing for differentiated content, but vulnerability to competitor offerings. |

| Industrial/Utility Energy Clients | Focus on reliability and long-term cost, higher switching costs due to initial investment. | More stable pricing models, reduced customer price sensitivity. |

Preview the Actual Deliverable

Bollore Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive analysis of Bollore's Porter's Five Forces is fully formatted and ready for your strategic review. You're looking at the actual document, providing a detailed understanding of the competitive landscape affecting Bollore.

Rivalry Among Competitors

Bolloré operates within sectors characterized by a substantial and varied competitive landscape. Even after divesting its logistics arm, the company still contends with numerous players in areas like media and specialized manufacturing.

The sheer volume of competitors, from multinational corporations to highly specialized firms, means that rivalry is a constant factor across Bolloré’s diverse business interests. For instance, in the media sector, it competes with established global broadcasters and agile digital content creators.

While Bolloré has secured strong positions in certain segments, such as its port concessions, the broad spectrum of competitors necessitates continuous strategic adaptation. This competitive pressure is evident in the market for electric vehicle batteries, where numerous technology firms are vying for market share, with significant investment flowing into research and development globally.

The industry growth rate significantly influences competitive rivalry. While the global logistics sector, a core area for Bolloré, can experience cyclicality, other segments like energy storage and electric vehicles are seeing robust expansion. For instance, the electric vehicle market is projected to reach over $800 billion by 2027, indicating substantial growth potential.

This differential growth creates a complex competitive environment. Rapidly expanding sectors, such as renewable energy and digital media, naturally attract more players, intensifying competition. However, these high-growth areas also present opportunities for Bolloré to scale its operations and gain market share without necessarily engaging in direct, zero-sum competition with established players in slower-growing segments.

Bolloré strives to stand out through sustained investments, strategic acquisitions, and technological advancements, notably its solid-state battery development. However, in sectors like logistics and general media, creating distinctiveness is often difficult, intensifying competition based on price. For instance, in 2024, the global logistics market saw intense price wars, with companies like Maersk reporting fluctuating freight rates influenced by supply and demand dynamics.

High Fixed Costs and Exit Barriers

Industries where Bolloré operates, such as port logistics and media, often come with significant upfront investments in infrastructure and technology. For instance, establishing a modern port facility can easily run into hundreds of millions of dollars, while setting up a broadcasting network requires substantial capital for studios, transmission equipment, and content acquisition. These high fixed costs create a strong incentive for companies to maintain operations and compete fiercely, even when market conditions are unfavorable, to spread these costs over a larger revenue base.

The barriers to exiting these markets are also considerable. Selling off specialized assets like port cranes or broadcasting licenses can be challenging and often results in significant losses compared to their book value. This economic reality means companies are less likely to withdraw from the market, even if profitability dips. Instead, they tend to engage in aggressive pricing strategies to capture market share and ensure capacity utilization, directly intensifying the competitive rivalry within the sector.

Consider the global container port industry, where high capital expenditure is a given. In 2024, major port development projects continue to demand billions in investment. Companies in this space must achieve high throughput to justify these investments. If a port operator cannot achieve sufficient volume, the fixed costs per container handled become prohibitively high, forcing them to compete aggressively on pricing to attract business, rather than risk underutilization and potential insolvency due to sunk costs.

- High Fixed Costs: Industries like port operations and media broadcasting necessitate substantial capital outlays for infrastructure and technology.

- Exit Barriers: The specialized nature of assets in these sectors makes exiting the market difficult and potentially very costly.

- Price Competition: To cover fixed costs and avoid losses from exiting, companies often engage in aggressive price competition.

- Capacity Utilization: Maintaining high operational capacity is crucial for spreading fixed costs, leading to intense rivalry to secure business.

Strategic Stakes and Aggressiveness of Competitors

Bolloré operates in markets characterized by intense competition from large, well-capitalized entities. These rivals frequently engage in aggressive strategies, including mergers, acquisitions, and significant investments in cutting-edge technology to gain or maintain market dominance. For instance, in the logistics sector, major players are continually consolidating to achieve economies of scale and expand their global reach, directly impacting Bolloré's competitive landscape.

The strategic significance of Bolloré's core industries, such as the burgeoning energy transition and the critical global supply chains, fuels this high level of competitive rivalry. Companies are compelled to invest substantial capital and resources, leading to a fiercely contested environment. This dynamic is evident in the renewable energy sector, where substantial government incentives and the drive for decarbonization have attracted massive investments, intensifying competition for project development and market share.

This aggressive stance translates into sustained pressure on pricing, innovation, and market access for all participants. Bolloré must navigate a landscape where competitors are not only large but also strategically driven to capture growth opportunities, often at the expense of market stability. For example, in 2024, several major logistics firms announced ambitious expansion plans, including significant fleet upgrades and the acquisition of smaller regional players, underscoring the ongoing battle for competitive advantage.

- Aggressive Market Share Pursuits: Competitors frequently utilize acquisitions and technological innovation as primary tools to expand their market presence.

- High Strategic Importance of Sectors: Industries like energy transition and global logistics demand significant investment due to their critical economic and environmental roles.

- Sustained Investment and Rivalry: The strategic value of these sectors encourages heavy capital deployment, fostering continuous and intense competition.

- Impact on Bolloré: Bolloré faces constant pressure on pricing, innovation, and market access due to these aggressive competitive dynamics.

Competitive rivalry is a significant force for Bolloré, stemming from the diverse and often mature industries it operates in. Even after divesting its logistics arm, Bolloré faces numerous competitors in sectors like media and specialized manufacturing, ranging from global corporations to niche specialists.

The intensity of this rivalry is amplified by high fixed costs and substantial exit barriers inherent in many of Bolloré's operational areas, such as port infrastructure and broadcasting. Companies are incentivized to maintain high capacity utilization and compete fiercely on price to cover these costs, as seen in the global logistics market where price wars were prevalent in 2024.

Furthermore, the strategic importance of sectors like the energy transition and global supply chains attracts massive investment, leading to aggressive market share pursuits through acquisitions and technological innovation. This dynamic creates sustained pressure on pricing and market access for Bolloré.

| Industry Segment | Key Competitors | Competitive Dynamics | 2024 Market Context |

|---|---|---|---|

| Media | Global broadcasters, digital content creators | Intense competition on content, distribution, and advertising revenue. | Continued shift towards digital platforms, impacting traditional media revenue streams. |

| Port Operations | Major global port operators (e.g., DP World, Hutchison Ports) | High capital expenditure, focus on efficiency, and strategic location. | Ongoing investments in automation and expansion to handle increasing trade volumes. |

| Energy Storage (Batteries) | Tesla, LG Chem, CATL | Rapid technological advancement, significant R&D investment, and production scaling. | Strong growth driven by electric vehicles and grid storage, with intense competition for raw materials and market share. |

SSubstitutes Threaten

For Bolloré's remaining logistics operations, such as oil logistics and specialized transport, customers possess several viable alternatives. They can choose to develop their own in-house logistics capabilities, engage with other established freight forwarding companies, or utilize different transportation methods altogether. This broadens the competitive landscape significantly.

Even with the divestment of Bolloré Logistics, the underlying threat of customers exploring alternative supply chain management strategies remains a potent force. This pressure directly impacts Bolloré's pricing power and the necessity to continually refine its service offerings across its ongoing logistics segments.

In 2023, the global logistics market was valued at approximately $9.5 trillion, and while Bolloré's divestments shifted its market share, the overall market dynamics highlight the intense competition from various substitute solutions. For instance, the rise of integrated digital logistics platforms offers customers greater flexibility and potentially lower costs, representing a significant substitute threat.

The media sector, particularly for players like Vivendi's Canal+ Group, faces a substantial threat from digital and streaming media alternatives. The widespread availability of over-the-top (OTT) services such as Netflix, Disney+, and Amazon Prime Video offers consumers a vast array of content, directly competing with traditional pay-TV models.

Online video platforms and an abundance of free digital content further dilute the market. For instance, by the end of 2023, global streaming service subscriptions were estimated to exceed 1.7 billion, showcasing the immense reach of these substitutes. This shift in consumer behavior, driven by convenience and diverse offerings, can significantly diminish the demand for established pay-TV subscriptions.

For Bolloré's Blue Solutions, the threat of substitutes is significant, with advancements in lithium-ion batteries from competitors like CATL and LG Energy Solution posing a constant challenge. These established technologies are rapidly improving in energy density and cost-effectiveness, directly impacting the market share potential for Bolloré's offerings. For instance, by the end of 2024, the global lithium-ion battery market is projected to exceed $150 billion, showcasing the scale of competition.

Furthermore, emerging technologies such as hydrogen fuel cells are gaining traction, particularly in heavy-duty transportation and grid-scale storage applications. Companies like Plug Power are making substantial investments in hydrogen infrastructure, presenting an alternative pathway for decarbonization that could divert demand from battery solutions. The global hydrogen fuel cell market is expected to reach over $50 billion by 2028, indicating a growing alternative market.

Shifting Consumer Preferences and Lifestyles

Shifting consumer preferences pose a significant threat of substitution for Bolloré. For instance, the media sector sees a clear move from traditional linear television to on-demand streaming services. In 2024, global streaming subscriptions continued to grow, with many consumers prioritizing flexibility and personalized content over scheduled broadcasting, directly impacting traditional media revenue streams.

Similarly, in the energy sector, evolving industrial needs and a strong push towards sustainability are driving demand for alternative energy solutions. Companies are increasingly exploring options beyond traditional fossil fuels, which could affect Bolloré's energy-related businesses if they do not adapt. This trend is supported by substantial investments in renewable energy infrastructure globally, with projections indicating continued growth throughout 2024 and beyond.

To counter this threat, Bolloré must remain agile and invest in innovation. Adapting its media offerings to cater to on-demand consumption patterns and developing competitive sustainable energy solutions are crucial. The company's ability to anticipate and respond to these changing consumer behaviors and industrial demands will determine its continued relevance and market position.

- Media Consumption Shift: Global streaming market valued at over $80 billion in 2023, with continued double-digit growth expected through 2024.

- Energy Transition: Renewable energy investments surpassed $1.7 trillion globally in 2023, highlighting a strong market preference for sustainable alternatives.

- Innovation Imperative: Companies failing to adapt to changing consumer preferences risk losing market share to more agile competitors.

- Bolloré's Response: Strategic investments in digital media platforms and renewable energy technologies are key to mitigating substitution threats.

Regulatory and Technological Shifts

Regulatory and technological shifts can significantly alter the threat of substitutes. New regulations might favor specific technologies or business models, creating viable alternatives that were previously uneconomical or unavailable. For instance, in 2024, governments worldwide continued to explore and implement policies aimed at promoting renewable energy sources, which could indirectly reduce the demand for traditional fossil fuel-based energy storage solutions.

Disruptive technological breakthroughs are equally potent in introducing substitutes. Advances in areas like decentralized energy generation, such as improved solar panel efficiency and battery storage, directly challenge the dominance of centralized power grids and the need for large-scale storage facilities. Similarly, evolving digital rights management technologies are reshaping media distribution, potentially offering new models that bypass traditional channels and reduce reliance on existing platforms.

- Regulatory Impact: Policies promoting green energy in 2024, like extended tax credits for solar installations in some regions, made decentralized generation a more attractive substitute for traditional grid power.

- Technological Disruption: Breakthroughs in solid-state battery technology, showing promise for higher energy density and faster charging by mid-2025, could significantly impact the electric vehicle market, offering a substitute for current battery chemistries.

- Media Landscape: The rise of user-generated content platforms and direct-to-consumer streaming services, bolstered by advancements in compression and delivery, continues to present substitutes for conventional media distribution models.

The threat of substitutes for Bolloré's diverse operations is substantial, driven by evolving consumer preferences and technological advancements. In media, the shift from traditional pay-TV to streaming services like Netflix and Disney+ represents a significant substitution, with global streaming subscriptions exceeding 1.7 billion by late 2023. Similarly, in energy and transport, advancements in hydrogen fuel cells and improved lithium-ion batteries from competitors like CATL and LG Energy Solution offer compelling alternatives to Bolloré's Blue Solutions, with the lithium-ion battery market projected to surpass $150 billion by the end of 2024.

| Bolloré Segment | Primary Substitutes | Market Data (2023/2024 Estimates) | Impact on Bolloré |

|---|---|---|---|

| Media (Canal+ Group) | OTT Streaming Services (Netflix, Disney+, Amazon Prime Video) | Global streaming subscriptions > 1.7 billion (end of 2023); Global streaming market valued at over $80 billion (2023) | Reduced demand for traditional pay-TV; Pressure on subscription pricing |

| Energy & Transport (Blue Solutions) | Advanced Lithium-ion Batteries (CATL, LG Energy Solution); Hydrogen Fuel Cells (Plug Power) | Global lithium-ion battery market projected > $150 billion (end of 2024); Global hydrogen fuel cell market expected > $50 billion (by 2028) | Competition for market share; Need for continuous innovation in battery technology and cost reduction |

| Logistics | In-house logistics; Other freight forwarders; Alternative transport methods; Digital logistics platforms | Global logistics market valued at approx. $9.5 trillion (2023) | Price pressure; Need for service differentiation and efficiency |

Entrants Threaten

High capital requirements significantly deter new entrants in many of Bolloré's core businesses. For instance, securing port concessions, like those managed by Bolloré Ports, often involves substantial upfront investment in infrastructure and technology, running into hundreds of millions of dollars. Similarly, large-scale media production and the development of battery gigafactories, such as Blue Solutions' planned facility in Mulhouse, France, require billions in initial capital outlay, creating a formidable barrier.

The threat of new entrants for Bolloré Ports is significantly dampened by stringent regulatory hurdles and licensing requirements. Obtaining the necessary permits and licenses, especially for critical infrastructure like ports, broadcasting, and energy, is a complex and expensive undertaking. For instance, securing a concession for a major port operation often involves extensive environmental impact assessments and adherence to international maritime regulations, a process that can take years and substantial capital investment, effectively deterring smaller or less capitalized competitors.

Incumbents like Bolloré possess significant advantages due to economies of scale, particularly in areas such as logistics, content acquisition, and manufacturing. For instance, Bolloré’s extensive network of ports and logistics infrastructure in Africa, a key operational area, allows for substantial cost efficiencies that are difficult for newcomers to replicate.

New entrants would face a considerable challenge in matching these cost efficiencies. To compete effectively, they would need to rapidly achieve a scale comparable to Bolloré’s, a feat that is often hindered by high initial investment requirements and market penetration difficulties.

Furthermore, the experience curve plays a crucial role in these complex industries. Bolloré's years of operation have allowed it to refine its processes, reduce waste, and improve operational effectiveness, creating a knowledge-based advantage that new entrants would struggle to overcome in the short to medium term.

Brand Loyalty and Established Relationships

Bolloré's extensive history, particularly in specialized logistics and port operations, has cultivated deep-seated brand loyalty and trust with its clientele. This long-standing presence makes it challenging for newcomers to replicate the established relationships Bolloré enjoys.

In the media sector, Canal+ stands as a prime example of Bolloré's strong brand recognition. New entrants in this competitive landscape would require significant investment in marketing and considerable time to build comparable credibility and foster the same level of customer relationships.

- Brand Loyalty: Bolloré's long operational history fosters strong customer loyalty.

- Established Relationships: Decades of service have solidified client partnerships, especially in logistics.

- Media Recognition: Canal+ offers significant brand equity in the media market.

- Barriers to Entry: Newcomers face high hurdles in matching Bolloré's established credibility and market penetration.

Access to Distribution Channels and Resources

Newcomers face significant hurdles in securing access to established distribution channels, such as Bolloré's extensive port networks and broadcasting platforms. This exclusivity makes it difficult for new players to reach their target markets efficiently.

Acquiring essential resources, like the specialized raw materials needed for battery production, presents another barrier. Bolloré's established supply chain and resource management offer a distinct advantage, making it hard for new entrants to compete on cost and availability.

- Distribution Channel Control: Bolloré's integrated logistics and media distribution networks are not easily replicated, limiting market reach for new entrants.

- Resource Scarcity: Access to critical raw materials, particularly for advanced battery technologies, is often controlled by established players, creating supply chain vulnerabilities for newcomers.

- Infrastructure Investment: The substantial capital required to build comparable infrastructure, like port facilities or broadcasting studios, acts as a significant deterrent to potential new entrants.

The threat of new entrants for Bolloré is generally low due to substantial capital requirements across its diverse operations. For example, establishing a new port concession or gigafactory demands hundreds of millions to billions in investment, a significant deterrent. Furthermore, regulatory complexities and the need for specialized licenses, particularly in logistics and media, create formidable barriers that new players struggle to overcome. Bolloré's established economies of scale and brand loyalty, especially through Canal+, further solidify its competitive position, making market entry exceptionally challenging.

| Barrier Type | Example for Bolloré | Estimated Capital Requirement (USD) | Impact on New Entrants |

|---|---|---|---|

| Capital Requirements | Port Infrastructure Development | Hundreds of millions to billions | Very High |

| Regulatory Hurdles | Port Concessions & Broadcasting Licenses | Millions (for compliance & legal) | High |

| Economies of Scale | Logistics Network Efficiency | N/A (achieved through volume) | High |

| Brand Loyalty & Relationships | Canal+ Subscription Base | Billions (for marketing & content) | High |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bolloré leverages data from annual reports, investor presentations, and industry-specific market research. We also incorporate information from financial news outlets and regulatory filings to provide a comprehensive view of the competitive landscape.