Black Hills SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Black Hills Bundle

The Black Hills region boasts unique natural beauty and a rich cultural heritage, presenting significant tourism opportunities. However, it also faces challenges related to infrastructure development and economic diversification.

Want to fully understand the Black Hills' potential and its hurdles? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support strategic planning and investment decisions.

Strengths

Black Hills Corporation's strength lies in its diversified regulated utility operations, providing a stable revenue stream. Serving around 1.35 million customers across eight states, the company enjoys broad geographic reach, mitigating risks tied to any one market.

Black Hills Corporation has consistently delivered strong financial results, with earnings per share reaching $3.91 in 2024 and projected to be between $4.00 and $4.20 for 2025. This financial stability underpins its ability to reward shareholders.

A key strength is the company's remarkable 55-year streak of consecutive quarterly dividend increases. This sustained growth in dividend payments highlights Black Hills' financial health and its dedication to providing reliable returns to its investors.

Black Hills Corporation's robust capital investment plan is a significant strength, with a five-year forecast now at $4.7 billion for 2025-2029, including $1.0 billion earmarked for 2025.

These substantial investments are strategically channeled into enhancing system integrity, supporting customer growth, and advancing critical infrastructure projects like the Ready Wyoming electric transmission expansion. This focused capital deployment underpins the company's commitment to long-term operational reliability and future expansion.

The aggressive capital expenditure directly fuels anticipated future earnings growth and bolsters overall operational efficiency, positioning Black Hills Corporation for sustained performance.

Effective Regulatory and Customer Growth Strategies

Black Hills Corporation has demonstrated strength in its regulatory approach, successfully securing new rates and rider recoveries that bolstered its 2024 financial performance. This strategic engagement with regulatory bodies ensures a more predictable revenue stream and supports the company's investment in infrastructure. The company's ability to navigate and leverage regulatory frameworks is a key advantage.

Furthermore, Black Hills experienced robust customer growth throughout 2024, adding approximately 15,000 new customers. This expansion of its customer base not only increases overall revenue but also solidifies its market presence and operational efficiency. Consistent customer acquisition is a testament to effective service delivery and market penetration strategies.

- Regulatory Success: Achieved new rates and rider recovery contributing to 2024 earnings.

- Customer Expansion: Added nearly 15,000 new customers in 2024.

- Revenue Stability: Proactive regulatory engagement and customer acquisition drive consistent revenue growth.

Commitment to Sustainability and Emission Reduction

Black Hills Corporation demonstrates a significant commitment to sustainability, evidenced by a 38% reduction in electric utility emissions achieved since 2005. This progress positions them favorably to meet their ambitious targets of a 40% reduction by 2030 and a substantial 70% reduction by 2040, aligning with global environmental goals.

The company is proactively investing in the future of energy through initiatives like renewable natural gas facilities. Furthermore, Black Hills is exploring cutting-edge technologies such as coal-to-hydrogen conversion and testing carbon sequestration capabilities, showcasing a forward-thinking approach to emission reduction.

- Commitment to Sustainability: Demonstrated by a 38% reduction in electric utility emissions since 2005.

- Emission Reduction Targets: On track for 40% by 2030 and 70% by 2040.

- Investment in Renewables: Actively developing renewable natural gas facilities.

- Technology Exploration: Investigating coal-to-hydrogen and carbon sequestration technologies.

Black Hills Corporation's strengths are anchored in its diversified, regulated utility operations, which provide a bedrock of stable revenue. The company serves approximately 1.35 million customers across eight states, offering significant geographic diversification that mitigates single-market risks.

Financially, Black Hills has shown resilience, with 2024 earnings per share at $3.91 and projections for 2025 between $4.00 and $4.20, underscoring its financial health and ability to reward shareholders.

A notable strength is its consistent commitment to shareholder returns, marked by an impressive 55-year streak of consecutive quarterly dividend increases, reflecting financial stability and investor dedication.

The company's robust capital investment strategy, with a five-year forecast of $4.7 billion for 2025-2029, including $1.0 billion for 2025, is a key driver for future growth and operational enhancement.

Black Hills' proactive regulatory engagement has been successful, securing new rates and rider recoveries that positively impacted 2024 performance, ensuring a more predictable revenue stream and supporting infrastructure investments.

Customer growth remains a strong point, with nearly 15,000 new customers added in 2024, further solidifying market presence and increasing overall revenue.

The company's commitment to sustainability is evident in its 38% reduction in electric utility emissions since 2005, with clear targets for further reductions, alongside investments in renewable natural gas and exploration of advanced technologies like coal-to-hydrogen conversion.

| Metric | 2024 Actual | 2025 Projection |

|---|---|---|

| Earnings Per Share (EPS) | $3.91 | $4.00 - $4.20 |

| Customer Growth (2024) | ~15,000 new customers | N/A |

| Capital Investments (2025) | N/A | $1.0 billion |

| Electric Utility Emissions Reduction (since 2005) | 38% | N/A |

What is included in the product

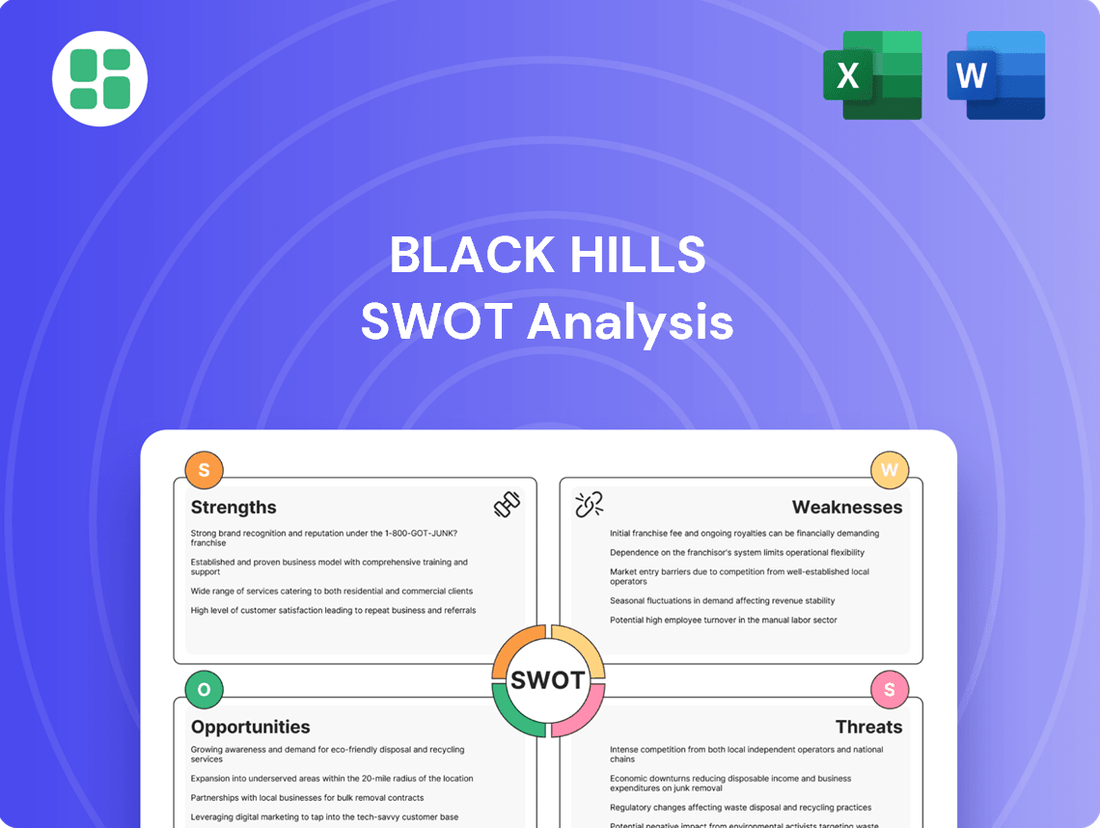

Delivers a strategic overview of Black Hills’s internal and external business factors, outlining its strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable SWOT framework for identifying and addressing the Black Hills' unique challenges and opportunities.

Weaknesses

Black Hills Corporation's continued reliance on fossil fuels for a significant portion of its energy generation, despite clean energy efforts, presents a notable weakness. As of the first quarter of 2024, coal and natural gas still constituted a substantial part of their energy mix, exposing them to the volatility of fuel prices and the increasing risk of stricter environmental regulations. This dependence could necessitate substantial future investments to transition to cleaner sources, potentially impacting profitability.

Black Hills Corporation has faced increasing operational and maintenance expenses, directly impacting its bottom line. For instance, in the first quarter of 2024, the company reported higher costs related to labor, materials, and infrastructure upkeep, which put pressure on its net income.

Furthermore, rising interest rates have led to higher financing costs for Black Hills. This increased cost of capital can affect the company's ability to fund new projects and may reduce the profitability of existing operations, as seen in their 2023 annual report where financing expenses saw a notable uptick.

These combined cost pressures, including those from employee compensation and insurance premiums, are a significant weakness that can compress profit margins. Effective cost management and strategic financing decisions are therefore critical for Black Hills to maintain its financial efficiency and profitability in the current economic climate.

As a regulated utility, Black Hills Corporation's financial results are significantly shaped by regulatory decisions, especially during rate reviews. For instance, in 2023, the company navigated several rate case filings across its service territories, with outcomes directly impacting its revenue streams.

Unfavorable or prolonged regulatory proceedings concerning cost recovery or approved rates can negatively affect Black Hills' profitability and its capacity to finance essential infrastructure upgrades. This reliance on regulatory outcomes introduces a notable level of unpredictability into the company's financial forecasts.

Geographic Concentration Risk

While Black Hills Corporation operates across eight states, its business is notably concentrated in specific regions, particularly in the Midwest and Rocky Mountain areas. This geographic focus means that a regional economic slowdown, such as a downturn in manufacturing in South Dakota or Wyoming, could have a more significant impact on the company's revenue and customer demand than if its operations were more evenly distributed nationwide. For instance, a substantial portion of its electric utility revenue in 2023 came from states like South Dakota and Wyoming, highlighting this regional dependency.

This concentration also exposes Black Hills to the risks associated with state-specific regulatory environments and policy changes. A shift in energy policy or rate-setting decisions in a key operating state could disproportionately affect the company's financial performance. For example, adverse decisions from state utility commissions regarding cost recovery for infrastructure investments could directly impact profitability in those specific jurisdictions.

- Regional Economic Sensitivity: Black Hills' operations are concentrated in the Midwest and Rocky Mountain regions, making it vulnerable to localized economic downturns.

- State-Specific Regulatory Risk: Policy changes or adverse decisions from utility commissions in key states can have a magnified impact due to geographic concentration.

- Weather Pattern Impact: Adverse weather events in its primary operating areas can disrupt service and increase operational costs, affecting a larger segment of its customer base.

- Limited Diversification Benefits: A broader geographic footprint could offer greater insulation from the risks inherent in concentrated regional operations.

Vulnerability to Weather Volatility

Black Hills Corporation's revenue streams are directly tied to weather patterns. Demand for natural gas, crucial for heating, and electricity, needed for cooling, fluctuates significantly with seasonal temperatures. Mild winters or cool summers can translate to lower customer usage and, consequently, reduced earnings for the company, creating a degree of unpredictability in financial performance.

This weather dependency presents a challenge for consistent revenue forecasting. For instance, in 2023, the company experienced periods of milder weather that impacted natural gas volumes, highlighting this inherent vulnerability. The ability to accurately predict and mitigate the financial impact of weather volatility remains a key concern for Black Hills.

- Weather Dependency: Revenue is sensitive to temperature fluctuations affecting heating and cooling demand.

- Revenue Volatility: Mild weather can lead to lower energy consumption and reduced financial results.

- Forecasting Challenges: Predicting earnings is complicated by the unpredictable nature of weather.

Black Hills Corporation faces the challenge of a significant portion of its energy generation still relying on fossil fuels, even as it pursues cleaner energy initiatives. This continued dependence on coal and natural gas, which remained a substantial part of its energy mix in early 2024, exposes the company to volatile fuel prices and the increasing risk of stricter environmental regulations. Such reliance may necessitate considerable future investments for a transition to cleaner energy sources, potentially impacting overall profitability.

Preview Before You Purchase

Black Hills SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You'll find a comprehensive breakdown of the Black Hills' Strengths, Weaknesses, Opportunities, and Threats. This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

Opportunities

Black Hills Corporation is strategically positioned to benefit from the substantial increase in data center energy needs. The company anticipates serving over one gigawatt of data center load from its current customer base within the next ten years.

Specifically, approximately 500 megawatts are projected to be operational by 2029. This growth is supported by a novel tariff structure designed to reduce upfront capital expenditures and could potentially double the earnings per share contribution from data centers to more than 10% by 2028.

Black Hills has a significant opportunity to grow its renewable energy generation. The company is actively pursuing the addition of 400 megawatts of new renewable capacity in Colorado by 2027, which will include solar, wind, and battery storage projects.

This strategic expansion directly supports Colorado's ambitious decarbonization targets and Black Hills' own commitment to reducing emissions. By investing in these cleaner energy sources, the company can enhance its appeal to investors focused on environmental, social, and governance (ESG) factors, potentially leading to improved access to capital and a stronger market valuation.

Black Hills is well-positioned to capitalize on infrastructure modernization efforts. The company's significant investments, like the $350 million Ready Wyoming electric transmission expansion project slated for completion by the end of 2025, are crucial. These projects bolster system resilience and improve access to broader power markets.

These strategic infrastructure upgrades are not merely about maintaining current operations; they are foundational for future expansion. By enhancing service reliability, Black Hills can better support anticipated customer growth and more effectively integrate diverse new generation resources into its network.

Technological Advancements in Energy Production

Black Hills Corporation is actively embracing technological advancements to reshape its energy production. The company's strategic investments, such as acquiring a renewable natural gas facility in Iowa and exploring coal-to-hydrogen technology with carbon sequestration testing, highlight a commitment to innovation. These moves are crucial for diversifying its energy portfolio and improving operational efficiency.

These technological pursuits offer significant opportunities for Black Hills. By integrating new energy sources and cleaner production methods, the company can better adapt to a changing market and regulatory environment. For instance, the move into renewable natural gas aligns with the growing demand for sustainable energy solutions.

- Diversification of Energy Mix: Investments in renewable natural gas and hydrogen technologies broaden the company's energy sources, reducing reliance on traditional fuels.

- Enhanced Operational Efficiency: Advanced technologies can lead to more cost-effective and streamlined energy production processes.

- New Revenue Streams: Exploring areas like hydrogen production and carbon sequestration could unlock future revenue opportunities as these markets mature.

- Market Leadership: Proactive adoption of new technologies positions Black Hills as an innovator in the energy sector.

Leveraging Energy Efficiency and Customer Programs

Black Hills Corporation has a significant opportunity to deepen customer engagement and foster sustainable practices by expanding its energy efficiency and customer choice programs. Initiatives like the 'Green Forward' program, which allows customers to opt for renewable energy sources, not only cater to growing environmental consciousness but also build stronger customer loyalty. These programs are instrumental in managing energy demand effectively, a critical aspect for utility companies.

The company can further capitalize on this by increasing investment in these customer-centric solutions. For instance, in 2023, Black Hills reported a 3.5% increase in customer participation in its energy efficiency programs across its service territories. This trend is expected to continue, driven by rising energy costs and a greater public focus on environmental responsibility.

- Enhanced Customer Loyalty: Programs like 'Green Forward' build stronger relationships by offering customers choices that align with their values.

- Demand Management: Energy efficiency initiatives help reduce peak load, improving grid stability and operational efficiency.

- Cost Savings for Customers: By helping customers use energy more wisely, Black Hills can contribute to their financial well-being, fostering goodwill.

- Alignment with ESG Goals: Investing in these programs directly supports environmental, social, and governance objectives, which are increasingly important to investors and stakeholders.

Black Hills is poised to benefit from the burgeoning demand for data center power, anticipating over one gigawatt of load within the next decade, with 500 megawatts expected by 2029. This growth is facilitated by a new tariff structure designed to minimize upfront capital outlays, potentially doubling the earnings per share contribution from data centers to over 10% by 2028.

The company has a substantial opportunity to expand its renewable energy portfolio, with plans to add 400 megawatts of solar, wind, and battery storage capacity in Colorado by 2027. This initiative aligns with Colorado's decarbonization goals and Black Hills' own emission reduction targets, enhancing its attractiveness to ESG-focused investors.

Infrastructure modernization presents another key opportunity, underscored by the $350 million Ready Wyoming electric transmission expansion project scheduled for completion by the end of 2025. These investments bolster system resilience and improve access to wider power markets, supporting future growth and resource integration.

Black Hills is actively integrating technological advancements, including the acquisition of a renewable natural gas facility and exploration of coal-to-hydrogen technology with carbon sequestration. These efforts diversify its energy mix and improve operational efficiency, opening new revenue streams and positioning the company as an industry innovator.

Threats

The energy sector is navigating a landscape of ever-tightening environmental rules, including potential carbon taxes and more stringent emission limits. For Black Hills Corporation, with its existing dependence on fossil fuels, these evolving regulations can translate into higher compliance expenses, the need for costly facility modernizations, and the risk of assets becoming obsolete.

The push for faster decarbonization presents a significant challenge, potentially stretching Black Hills' financial reserves and limiting its operational agility. For instance, as of early 2024, many utilities are facing increased scrutiny on their carbon footprints, impacting investment decisions and operational planning.

Rising interest rates present a considerable threat to Black Hills Corporation, a company heavily reliant on capital for its operations. Higher borrowing costs directly impact the expense of funding new infrastructure projects and refinancing existing debt, potentially squeezing profit margins. For instance, if Black Hills needs to issue new debt in a higher rate environment, its interest expense will increase, impacting its bottom line.

The energy sector is rapidly evolving with new technologies and competitors, such as distributed solar and battery storage. Black Hills Corporation faces the threat of losing market share if it doesn't innovate, as these advancements could make its traditional infrastructure less competitive.

For instance, the growth of rooftop solar installations, coupled with declining battery costs, presents a direct challenge to utility revenue streams. In 2024, the US solar market saw continued expansion, with residential solar leading the charge in many regions where Black Hills operates, impacting traditional energy demand.

Failure to integrate or effectively compete with these emerging energy solutions could lead to obsolescence of Black Hills' existing assets and business model, potentially impacting its long-term profitability and market position.

Economic Downturns and Customer Affordability

Economic downturns pose a significant threat to Black Hills Corporation. Recessions in its service territories could curb energy demand from homes and businesses. For instance, a prolonged economic slump might see industrial customers reduce operations, directly impacting electricity and natural gas usage. This reduced consumption, coupled with potential payment difficulties for customers, could strain Black Hills' revenue streams.

The impact extends to the company's financial health. Increased bad debt expenses are a likely consequence of customers struggling to afford their utility bills during economic hardship. This directly affects profitability. Furthermore, utility rate increase requests often face heightened public and regulatory scrutiny during economic downturns, potentially delaying or limiting necessary revenue adjustments. In the first quarter of 2024, Black Hills reported a net income of $133.6 million, a figure that could be significantly challenged by widespread economic contraction.

- Reduced Energy Demand: Economic slowdowns can decrease consumption by residential, commercial, and industrial sectors.

- Increased Bad Debt: Customers may struggle to pay bills, leading to higher uncollectible accounts.

- Regulatory Scrutiny on Rates: Utility rate increase requests often face tougher opposition during economic hardship.

- Impact on Profitability: Lower revenues and higher expenses directly reduce the company's bottom line.

Extreme Weather Events and Climate Change Risks

The increasing frequency and intensity of extreme weather events, directly linked to climate change, present significant physical risks to Black Hills Corporation's vital infrastructure. This includes potential damage to power lines, substations, and natural gas pipelines, leading to service interruptions and escalating repair costs. For example, in 2023, the company reported increased storm restoration expenses impacting its operational budget.

These climate-related disruptions necessitate substantial capital investments aimed at hardening infrastructure against severe weather. Black Hills Corporation's existing programs, such as the Emergency Public Safety Power Shutoff (PSPS) designed to mitigate wildfire risks, underscore the growing awareness and proactive measures being taken to address these evolving threats. The company's 2024 capital expenditure plans include provisions for grid modernization projects specifically targeting resilience against weather-related events.

- Increased Frequency of Extreme Weather: Growing evidence suggests a trend towards more frequent and severe weather phenomena impacting service areas.

- Infrastructure Vulnerability: Power lines, substations, and gas pipelines remain susceptible to damage from high winds, heavy snow, ice storms, and wildfires.

- Financial Impact: Service disruptions and repair efforts translate into higher operational costs and potential revenue loss, while infrastructure hardening requires significant capital outlay.

- Mitigation Strategies: Proactive measures like PSPS and grid modernization are crucial for managing climate-related risks and ensuring service reliability.

The increasing cost of capital due to rising interest rates poses a significant threat, impacting Black Hills Corporation's ability to fund necessary infrastructure upgrades and refinance existing debt. For instance, if the company needs to issue new debt in a higher rate environment, its interest expenses will rise, directly affecting profitability. This financial pressure is a key concern for utilities that require substantial investment in their networks.

The rapid advancement of distributed energy resources, such as rooftop solar and battery storage, directly challenges Black Hills' traditional utility model. As these technologies become more affordable and accessible, they can erode the company's customer base and revenue streams. For example, the continued growth of residential solar in 2024, particularly in regions served by Black Hills, highlights this competitive threat and the potential for asset obsolescence if the company fails to adapt.

Economic downturns can significantly reduce energy demand from both residential and industrial customers, impacting Black Hills Corporation's revenue. Furthermore, during such periods, customers may struggle to pay their bills, leading to increased bad debt expenses and potential difficulties in securing necessary rate increases from regulators, thereby squeezing profit margins. In the first quarter of 2024, Black Hills reported a net income of $133.6 million, a figure that could be vulnerable to economic contraction.

The growing frequency and intensity of extreme weather events, exacerbated by climate change, present substantial physical risks to Black Hills Corporation's infrastructure. This necessitates significant capital investment in hardening its assets against damage, which could lead to higher operational costs and potential service disruptions. The company's 2024 capital expenditure plans acknowledge this by including provisions for grid modernization projects aimed at improving resilience against weather-related events.

| Threat Category | Specific Threat | Impact on Black Hills | Example/Data Point (2024/2025) |

|---|---|---|---|

| Financial | Rising Interest Rates | Increased borrowing costs, reduced profitability | Higher interest expense on new debt issuance impacting bottom line. |

| Competition | Distributed Energy Resources (Solar, Storage) | Market share loss, revenue erosion | Continued growth of residential solar in 2024 impacting traditional energy demand. |

| Economic | Economic Downturns | Reduced energy demand, increased bad debt | Potential strain on revenue streams and increased uncollectible accounts; Q1 2024 Net Income: $133.6 million. |

| Operational/Environmental | Extreme Weather Events | Infrastructure damage, higher repair costs, service disruptions | Increased storm restoration expenses reported in 2023; 2024 CAPEX includes grid modernization for resilience. |

SWOT Analysis Data Sources

This Black Hills SWOT analysis is built upon a robust foundation of data, drawing from official government reports, economic development studies, and local business surveys to ensure a comprehensive and accurate assessment.