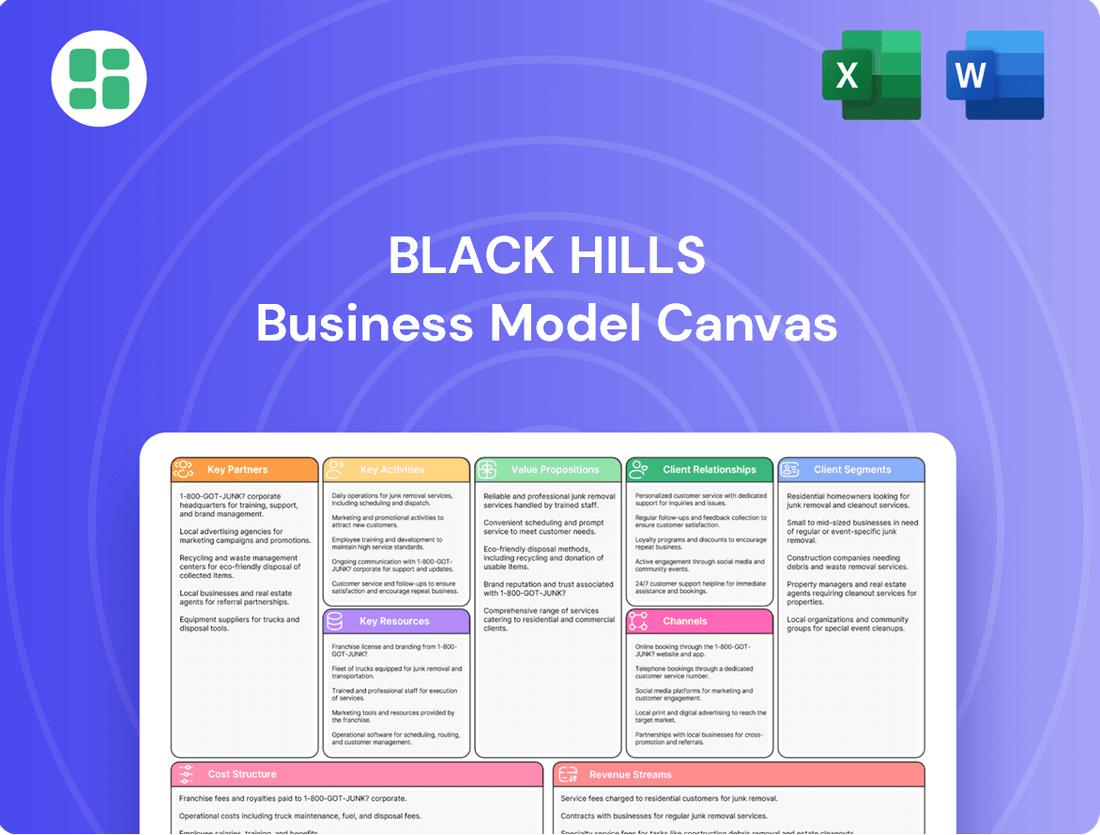

Black Hills Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Black Hills Bundle

Unlock the full strategic blueprint behind Black Hills's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Black Hills Corporation's key partnerships include state and federal regulatory bodies, such as Public Utilities Commissions. These relationships are fundamental for obtaining necessary rate approvals and operating licenses. In 2024, the company actively engaged with these commissions on various dockets, which are critical for its financial planning and infrastructure investments.

Black Hills Corporation actively collaborates with a diverse range of fuel suppliers, including those providing natural gas, coal, and other essential energy sources. This strategic approach is fundamental to securing a consistent and economically viable supply chain for their power generation and natural gas distribution segments. In 2024, Black Hills continued to emphasize these partnerships to ensure operational reliability.

Black Hills Corporation actively partners with technology and infrastructure providers to modernize its operations. These collaborations are crucial for upgrading grid infrastructure and integrating smart energy solutions, ultimately boosting system resilience and efficiency.

A prime example is Black Hills’ involvement in the Ready Wyoming electric transmission expansion project, a significant undertaking that relies on advanced infrastructure development. Furthermore, partnerships in coal-to-hydrogen technology development showcase a commitment to innovation and future energy solutions.

Community Organizations and Local Governments

Black Hills Corporation actively partners with community organizations and local governments throughout its eight-state operational footprint. These collaborations are vital for addressing community needs and ensuring a strong social license to operate.

In 2024, Black Hills Corporation continued its commitment to supporting local initiatives. For instance, the company provided over $1.5 million in charitable contributions and sponsorships across its service territories, directly benefiting numerous community programs and economic development projects. This engagement includes vital energy assistance programs, helping thousands of households manage their utility costs, and investing in local infrastructure improvements that foster economic growth.

- Community Engagement: Black Hills Corp. donated over $1.5 million in 2024 to community organizations and local initiatives.

- Energy Assistance: The company supports energy assistance programs, aiding thousands of families with utility bills.

- Economic Development: Partnerships with local governments focus on supporting economic development and infrastructure projects.

- Social License: These relationships are crucial for maintaining goodwill and the company's ability to operate effectively within communities.

Interconnected Utilities and Grid Operators

Black Hills Corporation actively collaborates with other utilities and regional transmission organizations (RTOs) to ensure dependable electric service and facilitate wholesale power transactions. These vital interconnections are crucial for managing the ebb and flow of electricity across broader networks, thereby bolstering grid stability and providing Black Hills access to wholesale power markets. In 2023, Black Hills' Electric segment generated $1.4 billion in revenue, underscoring the importance of these partnerships in maintaining operational efficiency and market reach.

These strategic alliances enable Black Hills to effectively balance supply and demand across its service territories and beyond. By integrating with larger grids, the company can better manage peak loads and ensure energy security, especially during periods of high demand or unexpected generation disruptions. For instance, participation in RTOs like the Southwest Power Pool (SPP) allows for more efficient resource allocation and cost management, contributing to the overall reliability and affordability of power for customers.

- Interconnection Agreements: Formal agreements with neighboring utilities and RTOs ensure seamless power flow and operational coordination.

- Wholesale Market Participation: Access to organized wholesale electricity markets allows Black Hills to buy and sell power, optimizing generation dispatch and procurement costs.

- Grid Reliability Enhancement: Collaborative efforts with grid operators help maintain voltage stability, frequency control, and rapid restoration of service in the event of disturbances.

- Energy Security: These partnerships are fundamental to ensuring a resilient energy supply, mitigating risks associated with localized generation or transmission constraints.

Black Hills Corporation's key partnerships are essential for its operational success and strategic growth. These include critical relationships with state and federal regulatory bodies, fuel suppliers, technology providers, community organizations, and other utilities.

These collaborations ensure regulatory compliance, secure vital resources, drive innovation, foster community goodwill, and enhance grid reliability. The company's active engagement in 2024 with these diverse partners underscores their importance in achieving operational and financial objectives.

For example, in 2024, Black Hills continued to invest in infrastructure modernization through partnerships with technology providers, while also reinforcing community ties by donating over $1.5 million to local initiatives. These multifaceted relationships are fundamental to Black Hills' business model.

| Partnership Type | Key Activities | 2024 Impact/Focus |

|---|---|---|

| Regulatory Bodies | Rate approvals, operating licenses | Active engagement on critical dockets for financial planning |

| Fuel Suppliers | Securing natural gas, coal, etc. | Ensuring consistent and economically viable supply chain |

| Technology/Infrastructure Providers | Modernizing operations, smart grid integration | Upgrading grid infrastructure, advancing coal-to-hydrogen technology |

| Community Organizations/Local Govts | Community needs, social license | Over $1.5M in charitable contributions, energy assistance programs |

| Other Utilities/RTOs | Dependable electric service, wholesale power transactions | Balancing supply/demand, enhancing grid stability (e.g., SPP participation) |

What is included in the product

A structured framework detailing customer segments, value propositions, and revenue streams, designed to guide strategic decision-making for Black Hills businesses.

The Black Hills Business Model Canvas streamlines strategic planning by offering a visual, one-page overview that helps pinpoint and address critical business challenges.

It acts as a pain point reliever by providing a clear, structured framework for identifying and resolving operational inefficiencies and market gaps.

Activities

Black Hills Corporation generates electricity from a diverse portfolio, including natural gas, coal, and a growing share of renewables like wind and solar. In 2024, the company continued to invest in its generation fleet, aiming to enhance reliability and sustainability. This includes strategic procurement of power through various agreements to meet the evolving energy needs of its customers efficiently.

The company's commitment to a resilient energy future is evident in its ongoing investments. For instance, Black Hills Energy's renewable energy projects, such as wind farms, are crucial for diversifying its energy mix. These investments are designed to ensure consistent power supply while aligning with environmental goals and regulatory expectations.

Black Hills Corporation's key activities center on the regulated distribution of natural gas and electricity, serving around 1.3 million customers across eight states. This involves the critical day-to-day management, upkeep, and enhancement of their vast infrastructure, which includes natural gas pipelines, extensive electrical transmission and distribution lines, and numerous substations. The overarching goal is to ensure the delivery of safe, dependable, and economically viable utility services to these communities.

In 2024, Black Hills continued to invest heavily in its infrastructure. For instance, capital expenditures for the electric segment were projected to be around $500 million, with a significant portion allocated to grid modernization and reliability projects. Similarly, the natural gas segment saw substantial investment, with planned capital spending exceeding $300 million, primarily focused on pipeline integrity and expansion to meet growing demand.

Black Hills Corporation consistently invests substantial capital, with approximately $600 million allocated in 2023 for infrastructure upgrades and expansions across its electric and natural gas utilities. This significant outlay is crucial for enhancing system reliability, accommodating growing customer demand, and incorporating advanced technologies into their operations.

These modernization efforts are vital for ensuring the resilience of their energy delivery networks. For instance, projects like the Ready Wyoming electric transmission expansion are designed to bolster the grid's ability to withstand disruptions and efficiently transport energy to meet evolving needs.

Regulatory Management and Rate Reviews

Black Hills Corporation's key activity of regulatory management and rate reviews is crucial for its financial stability. This involves proactively engaging with state public service commissions and federal agencies to file for and obtain approval for rate adjustments and new rate riders. These approvals are essential for recovering the significant capital investments made in infrastructure and covering ongoing operational expenses, thereby ensuring the company's ability to provide reliable service and generate adequate returns.

In 2024, Black Hills continued to navigate this complex regulatory landscape. For instance, in February 2024, the company filed for a rate increase in South Dakota, seeking to recover approximately $100 million in capital investments. This demonstrates the ongoing commitment to this critical activity. The company also successfully implemented new rates in Wyoming in late 2023, reflecting its ability to gain regulatory approval for necessary cost recovery.

- Actively files for and secures approval for new rates and riders from regulatory commissions.

- Ensures recovery of capital investments and operational costs, vital for financial health.

- Successfully implemented new rates in various jurisdictions, including Wyoming in late 2023.

- Filed for a significant rate increase in South Dakota in February 2024 to recover capital investments.

Natural Resource Production

Black Hills Corporation's natural resource production segment is a key activity that extends beyond its regulated utility operations. This involves the extraction of natural gas, oil, and coal, which not only diversifies the company's energy portfolio but also offers a potential direct fuel source for its power generation facilities.

This strategic involvement in resource production allows Black Hills to leverage its existing assets and considerable expertise in extraction processes. For instance, in 2024, the company continued its focus on natural gas production, contributing to its overall energy supply chain. This segment is crucial for maintaining operational flexibility and potentially hedging against volatile fuel costs.

- Natural Gas Production: Focus on efficient extraction and management of natural gas reserves.

- Oil Production: Engages in the exploration and extraction of crude oil.

- Coal Production: Operates coal mines to supply fuel for its power plants, though this is subject to evolving environmental regulations and market demand.

Black Hills Corporation's key activities are multifaceted, encompassing the operation of regulated utilities and the production of natural resources. The company focuses on generating electricity from diverse sources, including natural gas, coal, and renewables, while also managing the distribution of natural gas and electricity to a broad customer base. A significant portion of their efforts involves maintaining and upgrading infrastructure to ensure reliability and meet evolving energy demands.

Furthermore, Black Hills actively engages in regulatory processes to secure necessary rate adjustments, which are crucial for recovering capital investments and operational expenses. This proactive approach to regulation is vital for the company's financial health and its ability to continue providing essential utility services. The company also participates in natural resource production, such as natural gas and coal, which diversifies its energy portfolio and can supply its own power generation facilities.

| Key Activity | Description | 2024/2023 Focus/Data |

| Utility Operations & Infrastructure | Regulated distribution of natural gas and electricity; upkeep and enhancement of pipelines, transmission and distribution lines. | Invested approximately $500 million in electric segment and over $300 million in natural gas segment for infrastructure in 2024. Spent $600 million in 2023 on infrastructure upgrades. |

| Regulatory Management | Filing for and obtaining approval for rate adjustments and riders from state and federal agencies. | Filed for a rate increase in South Dakota in February 2024. Successfully implemented new rates in Wyoming in late 2023. |

| Resource Production | Extraction of natural gas, oil, and coal for energy supply and diversification. | Continued focus on natural gas production in 2024. |

What You See Is What You Get

Business Model Canvas

The Black Hills Business Model Canvas preview you see is the actual document you'll receive upon purchase. This means you're getting a direct look at the complete, ready-to-use file, ensuring there are no surprises in its structure or content. Once your order is processed, you'll gain full access to this exact Business Model Canvas, prepared for your strategic planning needs.

Resources

Black Hills Corporation's extensive utility infrastructure forms the bedrock of its business, featuring a vast network of electric transmission and distribution lines, alongside power plants fueled by natural gas, coal, and wind. This physical backbone is critical for reliably delivering energy to its 1.3 million customers across multiple states.

The company also operates significant natural gas pipelines and storage facilities, further solidifying its role as an essential energy provider. This integrated infrastructure allows Black Hills to manage diverse energy sources and ensure consistent service delivery, a key component of its value proposition.

Black Hills Corporation's ownership of natural gas, oil, and coal reserves ensures a stable energy supply for its operations and wholesale customers. The Wyodak mine is a significant asset, contributing to their coal supply chain.

Black Hills Corporation relies heavily on its skilled workforce, encompassing engineers, technicians, customer service representatives, and management. This expertise is fundamental to ensuring safe and reliable operations, driving infrastructure development, and maintaining strict regulatory compliance across its diverse business segments.

The company frequently emphasizes employee dedication as a cornerstone of its success. This commitment is directly linked to achieving strategic goals, including expanding renewable energy projects and enhancing customer service, underscoring the human capital's vital role in operational excellence.

In 2024, Black Hills continued to invest in its people through ongoing training and development programs. For instance, their commitment to safety and operational efficiency is reflected in their robust safety records and the continuous upskilling of their technical teams to manage evolving energy technologies.

Regulatory Approvals and Licenses

Regulatory Approvals and Licenses represent critical intangible assets for Black Hills Corporation, granting the fundamental right to operate its diverse utility services across multiple states. These approvals are not static; they necessitate continuous engagement with state public utility commissions and federal agencies to ensure ongoing compliance and updates.

Maintaining these licenses is paramount for operational continuity and market access. For instance, as of year-end 2023, Black Hills Corporation held numerous operating licenses and permits across its electric, gas, and mining segments, facilitating its ability to serve over 1.3 million customers. The company's proactive approach to regulatory affairs helps mitigate risks associated with operational changes or new service offerings.

- State and Federal Operating Authority: Essential permits from bodies like the Wyoming Public Service Commission and the South Dakota Public Utilities Commission allow Black Hills to conduct its core utility business.

- Environmental Compliance Permits: Licenses related to air quality, water discharge, and waste management, often mandated by the Environmental Protection Agency (EPA) and state environmental departments, are crucial for its mining and energy operations.

- Safety and Reliability Certifications: Approvals ensuring the safe and reliable delivery of electricity and natural gas, adhering to standards set by organizations like the North American Electric Reliability Corporation (NERC).

- Ongoing Regulatory Filings: The company regularly submits rate cases and compliance reports, a key aspect of maintaining its license to operate and adjust service pricing.

Financial Capital and Access to Funding

Black Hills Corporation's financial capital is a cornerstone of its operations, enabling significant capital expenditures and growth. This includes robust equity, debt financing, and strong credit ratings, which are essential for funding its multi-year capital plans. For instance, in 2024, the company continued to execute its strategic investments in regulated utility infrastructure and renewable energy projects, relying on its established access to capital markets.

The company's financial strength allows it to secure necessary funding through various avenues. Equity issuances and debt offerings are key components of its strategy to support substantial capital investments. This consistent access to financing ensures that Black Hills can meet its operational needs and pursue ambitious growth objectives.

- Equity and Debt: Black Hills Corporation maintains a balanced capital structure, utilizing both equity and debt to fund its operations and expansion.

- Credit Ratings: Strong credit ratings are vital for securing favorable financing terms, reducing the cost of capital for investments.

- Capital Expenditures: Access to financial capital directly supports the company's significant investments in infrastructure upgrades and new energy projects.

- Growth Initiatives: Robust financial resources are critical for executing strategic growth plans, including the development of renewable energy sources.

Black Hills Corporation's key resources are its extensive utility infrastructure, including electric and gas networks, and its owned energy reserves like coal. The company also leverages its skilled workforce, essential regulatory approvals and licenses, and robust financial capital to operate and grow. These elements collectively enable the reliable delivery of energy services to over 1.3 million customers.

| Resource Category | Specific Assets/Components | Significance | 2024 Data/Context |

|---|---|---|---|

| Infrastructure | Electric transmission/distribution lines, power plants (gas, coal, wind), natural gas pipelines, storage facilities | Reliable energy delivery, service continuity | Serving 1.3 million customers across multiple states. Continued investment in infrastructure upgrades. |

| Natural Resources | Owned natural gas, oil, and coal reserves (e.g., Wyodak mine) | Stable energy supply, cost control | Supports integrated energy operations and wholesale supply. |

| Human Capital | Engineers, technicians, management, customer service staff | Operational excellence, safety, regulatory compliance, innovation | Ongoing training programs focused on safety and evolving energy technologies. |

| Intangible Assets | State/Federal operating authority, environmental permits, safety certifications, regulatory filings | Right to operate, market access, risk mitigation | Numerous licenses held across electric, gas, and mining segments. Proactive regulatory engagement. |

| Financial Capital | Equity, debt financing, strong credit ratings | Funding capital expenditures, growth initiatives | Continued execution of capital plans for utility infrastructure and renewables. Access to capital markets. |

Value Propositions

Black Hills Corporation's core promise is the dependable and secure supply of natural gas and electricity. This commitment to safe, reliable energy is paramount for everyone who relies on their services, from households to businesses.

The company's emphasis on operational excellence and ongoing investment in its infrastructure, including significant capital expenditures, ensures this consistent delivery. For instance, in 2023, Black Hills Corporation invested over $1.3 billion in its utility businesses to enhance safety and reliability.

Black Hills Corporation is committed to offering energy at competitive and affordable rates. In 2024, the company continued to focus on operational efficiencies and disciplined regulatory strategies to manage costs and minimize bill impacts for its customers, even while undertaking essential infrastructure upgrades.

The company's approach aims to strike a balance between maintaining high service quality and ensuring customer affordability. This involves careful planning and execution of investments, as seen in their ongoing efforts to modernize infrastructure while keeping rates stable.

Black Hills is actively pursuing ambitious emissions reduction goals, aiming for a 40% cut in electric utility emissions by 2030 and a substantial 70% reduction by 2040, building on their 2005 baseline. This focus on sustainability, including a 38% reduction already achieved, resonates strongly with customers and investors prioritizing environmental responsibility.

The company is investing in renewable energy sources and exploring cutting-edge technologies like converting coal to hydrogen and implementing carbon sequestration methods. These initiatives not only align with their environmental commitments but also position Black Hills as a forward-thinking leader in the clean energy transition.

Customer Choice and Energy Efficiency Programs

Black Hills Corporation's value proposition centers on empowering its customers with choices and promoting energy efficiency. Programs like Green Forward allow customers to actively participate in renewable energy, offering a tangible way to align their energy use with sustainability values.

These initiatives directly translate into cost savings for customers. For instance, in 2023, Black Hills provided over $14 million in energy efficiency rebates across its service territories, helping customers reduce their energy bills. This focus on efficiency not only benefits individual households and businesses but also contributes to a more sustainable energy future by lowering overall demand.

- Customer Empowerment: Offering programs like Green Forward that give customers control over their energy sources and costs.

- Cost Savings: Providing financial incentives through energy efficiency rebates, as evidenced by over $14 million distributed in 2023.

- Sustainability Focus: Supporting broader environmental goals by helping customers reduce their energy consumption and carbon footprint.

- Choice and Flexibility: Presenting diverse options for customers to manage their energy needs effectively.

Community Investment and Economic Impact

Black Hills Corporation actively invests in the communities it serves, creating a tangible economic ripple effect. In 2024 alone, the company's total economic impact was estimated at a substantial $1.5 billion, highlighting its crucial role in local economies. This impact stems from direct contributions like job creation, tax payments, and significant charitable donations, solidifying its position as a vital community partner.

The company's commitment extends beyond its operational footprint, fostering local prosperity through various initiatives. These efforts translate into:

- Job Creation: Black Hills Corp. directly and indirectly supports numerous employment opportunities within its service territories.

- Tax Contributions: The company's tax payments are a significant source of revenue for local and state governments, funding essential public services.

- Charitable Giving: Substantial investments in charitable causes further bolster community well-being and development.

Black Hills Corporation's value proposition is built on delivering reliable, affordable, and increasingly sustainable energy solutions. They empower customers through energy efficiency programs and community investment, creating a positive economic impact. This multi-faceted approach addresses diverse customer needs while aligning with environmental goals.

| Value Proposition Area | Key Offering | Supporting Data/Fact |

|---|---|---|

| Reliable Energy Delivery | Dependable natural gas and electricity supply | Invested over $1.3 billion in utility infrastructure in 2023 for safety and reliability. |

| Customer Affordability | Competitive and stable energy rates | Focused on operational efficiencies and disciplined regulatory strategies in 2024 to manage costs. |

| Sustainability Commitment | Emissions reduction and renewable energy adoption | Aiming for a 40% cut in electric utility emissions by 2030; achieved 38% reduction from 2005 baseline. |

| Community Economic Impact | Job creation, tax contributions, and charitable giving | Estimated total economic impact of $1.5 billion in 2024. |

Customer Relationships

Black Hills Corporation operates dedicated customer service centers and call support lines, ensuring prompt responses to customer inquiries, service requests, and emergencies. This direct interaction is vital for managing accounts, resolving issues efficiently, and providing immediate assistance, fostering a reliable utility experience for its customers.

In 2023, Black Hills Corporation reported that its customer service teams handled millions of calls, with a significant portion resolved on the first contact. This focus on efficient resolution aims to minimize customer wait times and improve overall satisfaction with utility services.

Black Hills Corporation provides robust online portals and digital self-service tools, empowering customers to manage their accounts, review billing statements, and track their energy consumption with ease. These platforms significantly boost customer autonomy and simplify everyday interactions.

Black Hills Corporation actively cultivates community ties through a robust calendar of local events and educational outreach. In 2024, the company sponsored over 150 community events across its service territories, reinforcing its presence and local commitment.

These engagement efforts extend to vital partnerships with non-profit organizations, aiming to address local needs and foster sustainable development. For instance, Black Hills invested $500,000 in 2024 towards various community development projects, underscoring its dedication to regional well-being.

Through these programs, Black Hills builds essential trust and enhances its public image, showcasing a genuine commitment to the areas where its customers and employees live and work. This approach demonstrably strengthens stakeholder relationships and supports long-term operational success.

Energy Efficiency and Assistance Programs

Black Hills Corporation fosters strong customer relationships by offering energy efficiency rebates and crucial energy assistance programs. These initiatives directly benefit customers by lowering their energy bills, demonstrating a commitment to affordability and customer welfare.

- Energy Efficiency Rebates: In 2024, Black Hills Energy continued to provide incentives for customers undertaking energy-saving upgrades, such as installing high-efficiency appliances and improving insulation.

- Energy Assistance: The company actively supports customers facing financial hardship through various energy assistance programs, ensuring essential services remain accessible.

- Customer Well-being: These programs are designed not only to manage energy consumption but also to enhance the overall well-being and financial stability of the communities served.

Account Management for Large Customers

Black Hills Energy prioritizes dedicated account management for its large commercial and industrial clients. This is particularly crucial for sectors experiencing rapid expansion, such as data centers and blockchain operations, which demand substantial and consistent energy supply.

This specialized approach ensures that the unique energy requirements of these significant customers are met, fostering reliable, high-capacity service. For instance, in 2024, Black Hills continued to invest in infrastructure upgrades aimed at supporting increased industrial load, a direct benefit for these key accounts.

- Dedicated Account Managers: Assigned to large C&I customers to provide personalized service.

- Tailored Energy Solutions: Addressing specific needs of growing sectors like data centers.

- Reliability and Capacity Assurance: Ensuring consistent, high-capacity power delivery.

- Strategic Partnership Focus: Supporting significant load growth and long-term collaboration.

Black Hills Corporation leverages a multi-faceted approach to customer relationships, combining direct support with digital self-service options. This ensures accessibility and efficiency for all customer segments.

The company's commitment to community engagement, including sponsorships and partnerships, builds trust and reinforces its local presence. These efforts are backed by tangible investments in community development projects, demonstrating a dedication to regional well-being.

Specialized account management is provided for large commercial and industrial clients, particularly those in high-growth sectors like data centers. This tailored approach guarantees that significant energy demands are met, fostering reliable, high-capacity service and long-term collaboration.

| Customer Relationship Strategy | Key Initiatives | 2024 Data/Impact |

|---|---|---|

| Direct Customer Support | Call centers, direct interaction | Millions of calls handled, focus on first-contact resolution |

| Digital Self-Service | Online portals, mobile apps | Empowering customers for account management and consumption tracking |

| Community Engagement | Local events, educational outreach, non-profit partnerships | Sponsored over 150 events, invested $500,000 in community projects |

| Customer Assistance Programs | Energy efficiency rebates, energy assistance | Lowering customer energy bills, enhancing financial stability |

| Key Account Management | Dedicated managers, tailored solutions | Supporting high-capacity needs of industrial clients, infrastructure upgrades |

Channels

Black Hills Corporation's electric transmission and distribution networks are the vital arteries that deliver electricity. This physical infrastructure, comprising power lines, substations, and transformers, directly connects residential, commercial, and industrial customers to a reliable energy supply across its service areas.

In 2024, Black Hills Corporation continued to invest in modernizing and expanding these essential networks. For instance, significant capital expenditures were allocated to upgrade aging infrastructure and enhance grid resilience, ensuring the continuous flow of power and supporting the integration of new energy sources.

Black Hills Corporation's natural gas pipeline and distribution systems are the backbone of its energy delivery. This extensive network, comprising thousands of miles of transmission and gathering pipelines, safely and reliably moves natural gas from supply points to end-users across its service territories.

In 2023, Black Hills Corporation reported that its natural gas utility operations served approximately 1.3 million customers. The company consistently invests in maintaining and upgrading this critical infrastructure to ensure safety, efficiency, and compliance with regulatory standards, a key component of its value proposition.

Black Hills Corporation's official website, alongside its customer portals, acts as a crucial digital touchpoint. These platforms streamline customer interactions, offering easy access to account management, bill payment, and valuable energy efficiency programs. In 2023, the company reported that its digital channels facilitated millions of customer transactions, highlighting their importance in customer service and engagement.

Customer Service Centers and Emergency Services

Physical customer service centers and 24/7 emergency hotlines are crucial touchpoints for Black Hills, facilitating direct customer engagement and immediate support during critical service needs, such as power outages. In 2024, Black Hills maintained a network of physical service locations, complemented by dedicated emergency lines, ensuring prompt assistance for its diverse customer base across its operational regions.

These channels are indispensable for resolving customer issues efficiently and maintaining service reliability. The company’s commitment to accessibility through these means underscores its focus on customer satisfaction and operational responsiveness.

- Customer Service Centers: Provide in-person assistance for inquiries and account management.

- 24/7 Emergency Hotlines: Offer immediate support for service disruptions and urgent issues.

- Customer Interaction: Facilitate direct communication, enhancing problem resolution.

- Service Reliability: Ensure timely support, crucial during outages or critical events.

Community Partnerships and Local Presence

Black Hills leverages its network of community offices as a primary channel for direct customer engagement and local support. These offices are crucial for building trust and understanding the unique needs within each service area.

Through strategic community partnerships, Black Hills actively participates in local initiatives, reinforcing its commitment to the areas it serves. This engagement often translates into tangible support for local causes and events.

- Community Offices: Black Hills operates numerous physical locations across its service territories, facilitating face-to-face interactions and providing essential customer service.

- Local Sponsorships: In 2024, the company allocated over $1.5 million to local sponsorships and community development projects, supporting over 200 events and organizations.

- Stakeholder Engagement: These partnerships serve as a vital conduit for gathering feedback and addressing specific community concerns, ensuring services remain aligned with local expectations.

- Economic Impact: The presence of these offices and the company's community involvement contribute to local economies through job creation and support for small businesses.

Black Hills Corporation utilizes a multi-channel approach for customer interaction and service delivery. These channels range from robust digital platforms to essential physical touchpoints and community engagement initiatives. The company prioritizes accessibility and direct communication to ensure customer satisfaction and operational efficiency.

| Channel Type | Description | Key Function | 2023/2024 Data Point |

|---|---|---|---|

| Digital Platforms | Official website, customer portals | Account management, bill payment, energy programs | Millions of customer transactions facilitated in 2023 |

| Physical Service Centers | Local community offices | In-person assistance, direct engagement | Network of physical locations across service territories |

| Emergency Hotlines | 24/7 support lines | Immediate assistance for service disruptions | Maintained dedicated emergency lines in 2024 |

| Community Engagement | Local sponsorships, partnerships | Stakeholder feedback, community support | Over $1.5 million allocated to local sponsorships in 2024 |

Customer Segments

Residential customers represent the backbone of Black Hills Corporation's customer base, encompassing individual households in the eight states where the company operates. These customers depend on a reliable and safe supply of electricity and natural gas for essential daily functions like heating, cooking, and lighting.

In 2024, Black Hills Corporation served approximately 1.3 million customer accounts across its utility operations, with a significant portion being residential. These households anticipate consistent energy availability and predictable pricing, making affordability and safety paramount concerns for their household budgets and well-being.

Commercial customers, encompassing small to medium-sized businesses, offices, and retail establishments, form a crucial segment for Black Hills. These businesses rely on energy for their day-to-day operations, from powering equipment and lighting to maintaining comfortable climate control for staff and customers. In 2024, the commercial sector represented a significant portion of Black Hills' customer base, with a substantial portion of its revenue derived from these entities.

Their energy needs are often characterized by a demand for consistent and reliable service, particularly during standard business operating hours. Black Hills addresses this by ensuring robust infrastructure and proactive maintenance. Furthermore, many commercial clients are increasingly seeking energy efficiency solutions, recognizing their potential to lower operational costs and improve their bottom line. This focus on efficiency aligns with Black Hills' own sustainability goals and its efforts to provide value-added services to its business clientele.

Industrial Customers represent a crucial segment for Black Hills, encompassing large-scale manufacturing plants and other high-demand operations that require a substantial and reliable energy supply. In 2024, industrial customers accounted for a significant portion of Black Hills' energy consumption, with their demand often fluctuating based on production cycles and economic conditions.

These clients frequently possess specialized energy needs, such as stringent power quality standards to protect sensitive equipment or specific capacity requirements to support their production processes. Black Hills works closely with these customers to ensure these unique demands are met, sometimes through tailored service agreements that may include provisions for interruptible service to manage grid load.

Wholesale Customers

Black Hills Corporation's wholesale customers are primarily other utilities and energy marketers. These entities acquire electricity and natural gas in large volumes from Black Hills' generation and natural resource operations. These sales are typically structured through long-term power purchase agreements or operate under prevailing market prices.

For instance, in 2023, Black Hills' wholesale segment played a role in its overall revenue generation, contributing to the company's ability to manage energy supply and demand across broader markets. The strategic importance of these wholesale relationships lies in their capacity to ensure consistent off-take for Black Hills' production assets and provide flexibility in energy procurement for other market participants.

- Wholesale Customers: Other utilities and energy marketers.

- Transaction Basis: Bulk purchase of electricity and natural gas.

- Agreement Types: Long-term power purchase agreements and market-based sales.

- Market Role: Facilitates energy supply and demand management for other entities.

Data Center and Blockchain Operators

Data center and blockchain operators represent a crucial and expanding customer segment for Black Hills. These businesses have an insatiable appetite for electricity, needing vast amounts of power that must be consistently available to ensure uninterrupted operations. Black Hills is strategically positioning itself to meet this demand, with plans in place to support over 1 gigawatt (GW) of data center power requirements. This focus on high-demand energy users is anticipated to be a significant driver of future earnings per share (EPS) growth.

- High Energy Demand: Data centers and blockchain operations are inherently energy-intensive, requiring substantial and dependable power supplies.

- Strategic Growth Area: Black Hills is actively developing infrastructure and strategies to capture a significant share of this rapidly growing market.

- Future EPS Contribution: The company projects that serving over 1 GW of data center demand will materially boost its future earnings per share.

Black Hills Corporation serves a diverse customer base, segmented by their energy needs and consumption patterns. This includes residential households, commercial businesses, industrial facilities, and wholesale energy providers. The company also identifies data centers and blockchain operators as a key growth segment due to their substantial and consistent energy demands.

In 2024, Black Hills managed approximately 1.3 million customer accounts across its utility operations, highlighting the broad reach of its services. Residential customers form the largest group, relying on electricity and natural gas for daily living, with affordability and reliability being primary concerns. Commercial clients, ranging from small businesses to larger establishments, depend on consistent energy for operations and are increasingly interested in efficiency solutions to manage costs.

Industrial customers require significant and dependable energy supplies, often with specialized needs like stringent power quality standards, and their demand can fluctuate with production cycles. Wholesale customers, primarily other utilities and marketers, purchase energy in bulk through agreements that help manage broader market supply and demand. The company is also strategically investing to meet the high energy requirements of data centers, anticipating this segment to be a significant contributor to future earnings growth, with plans to support over 1 gigawatt (GW) of data center power needs.

| Customer Segment | Description | Key Needs | 2024 Relevance |

|---|---|---|---|

| Residential | Individual households | Reliability, Affordability, Safety | Largest customer group (approx. 1.3M accounts total) |

| Commercial | Small to medium businesses, offices, retail | Consistent service, Energy efficiency | Significant revenue contributor, demand for operational uptime |

| Industrial | Large-scale manufacturing, high-demand operations | Substantial and reliable supply, specific power quality | High consumption, demand fluctuates with production |

| Wholesale | Other utilities, energy marketers | Bulk electricity and natural gas purchase | Facilitates energy supply/demand management, revenue from production assets |

| Data Centers/Blockchain | Energy-intensive digital operations | Massive, consistent power availability | Strategic growth area, targeting >1 GW of demand, projected EPS growth |

Cost Structure

Operating and maintenance expenses are the backbone of Black Hills' daily operations, encompassing everything from employee compensation and benefits to the costs of outside services and insurance. In 2024, these costs are critical for maintaining the reliability of their utility infrastructure and power generation facilities, with a keen eye on efficiency to manage overall expenditures. For instance, while employee salaries are a significant component, the company also navigates the rising costs of essential services and insurance premiums, which can impact profitability.

Black Hills makes substantial investments in its infrastructure. This includes building new facilities, improving current systems, and undertaking expansion projects like growing its transmission network and developing new power generation sources.

The company operates with a multi-year capital plan to manage these significant expenditures. For 2025, Black Hills has outlined a capital plan totaling $1 billion, demonstrating a commitment to long-term operational reliability and accommodating customer growth.

Fuel and purchased power costs are a significant driver of Black Hills Corporation's expenses, directly influencing the price of electricity and natural gas supplied to its customers. In 2023, fuel and purchased power costs for Black Hills Corporation amounted to approximately $1.5 billion, representing a substantial portion of their overall operating expenses.

These expenditures are highly sensitive to volatile commodity markets, with fluctuations in natural gas and coal prices, as well as the cost of electricity acquired from third-party suppliers, directly impacting profitability. For instance, a 10% increase in natural gas prices could add tens of millions of dollars to their annual costs, necessitating careful hedging strategies and efficient procurement practices.

Regulatory and Compliance Costs

Black Hills Corporation faces significant expenses related to navigating a complex regulatory landscape. These include costs for filing rate reviews with state public utility commissions and ensuring adherence to stringent environmental and safety standards. For instance, in 2023, the company reported significant investments in environmental compliance initiatives, reflecting the ongoing need to meet evolving regulations.

These expenditures are crucial for maintaining operating licenses and upholding mandated industry standards. The company's commitment to compliance directly impacts its ability to operate and serve its customer base. In 2024, regulatory filings for rate adjustments are a key component of managing operational costs and ensuring financial stability.

- Environmental Compliance: Costs associated with meeting EPA regulations and state-specific environmental mandates.

- Rate Case Filings: Expenses incurred for preparing and presenting evidence in proceedings before public utility commissions.

- Safety and Operational Standards: Investments in training, equipment, and processes to ensure compliance with safety regulations.

- Permitting and Licensing: Fees and administrative costs for obtaining and renewing operating permits.

Depreciation and Financing Costs

As a capital-intensive utility, Black Hills Corporation faces substantial fixed costs primarily from depreciation of its vast infrastructure and interest expenses on its debt. These are crucial elements within its cost structure, directly impacting profitability and operational capacity.

For instance, in 2023, Black Hills reported depreciation and amortization expenses of $448.1 million. Similarly, interest expense on debt for the same period was $220.4 million. These figures underscore the significant financial commitment required to maintain and expand its operations in the energy sector.

- Depreciation: Reflects the wear and tear on physical assets like power plants, pipelines, and transmission lines. In 2023, this amounted to $448.1 million.

- Financing Costs: Primarily interest paid on the company's outstanding debt, which was $220.4 million in 2023, crucial for funding capital projects.

- Impact on Balance Sheet: These costs are meticulously managed to ensure a strong financial foundation and maintain investment-grade credit ratings, vital for future borrowing and investment.

- Strategic Management: The company actively manages its debt levels and capital structure to mitigate financial risks and support its long-term growth objectives.

Black Hills' cost structure is dominated by fuel and purchased power, which were approximately $1.5 billion in 2023, directly tied to volatile energy markets. Operating and maintenance expenses, including employee costs and insurance, are also significant for ensuring infrastructure reliability. The company also carries substantial fixed costs from depreciation ($448.1 million in 2023) and financing ($220.4 million in 2023), reflecting its capital-intensive nature.

| Cost Category | 2023 Expense (Millions USD) | Key Drivers | 2024 Focus |

|---|---|---|---|

| Fuel & Purchased Power | ~1,500 | Natural gas, coal prices, electricity market volatility | Hedging strategies, efficient procurement |

| Operating & Maintenance | Varies (includes salaries, services, insurance) | Employee compensation, infrastructure upkeep, insurance premiums | Efficiency, reliability maintenance |

| Depreciation | 448.1 | Wear and tear on infrastructure (plants, pipelines) | Long-term asset management |

| Financing Costs (Interest) | 220.4 | Debt levels for capital projects | Debt management, capital structure optimization |

| Regulatory Compliance | Significant investments (environmental, safety) | EPA regulations, state mandates, rate case filings | Meeting evolving standards, rate adjustments |

Revenue Streams

Black Hills Corporation's regulated electric utility sales are its bedrock revenue source, stemming from electricity provided to homes, businesses, and industries within its franchised areas. These sales are crucial, forming the backbone of the company's financial stability.

In 2024, Black Hills reported significant revenue from its electric segment. For instance, the company's electric utilities generated over $1.7 billion in revenue for the year ended December 31, 2024, highlighting the substantial contribution of these regulated sales to its overall financial performance. This revenue is directly tied to the volume of electricity sold and the approved rate structures.

The rates Black Hills can charge are not set by the market but are determined by state public utility commissions. This regulatory oversight ensures that revenues cover operational costs, including fuel and infrastructure maintenance, and allow for a fair profit margin, typically a predetermined rate of return on the company's invested capital. This structure provides a degree of revenue predictability.

Black Hills Corporation generates revenue from the sale and distribution of natural gas to its regulated customer base, much like its electricity segment. These sales are a core component of its utility operations, providing essential energy services to homes and businesses.

The company’s ability to recover costs and earn a fair return is overseen by regulatory bodies through rate reviews. These reviews allow Black Hills to adjust rates to cover expenses related to natural gas procurement, maintaining and upgrading its distribution infrastructure, and the overall cost of delivering reliable service. For instance, in 2023, Black Hills Corporation reported natural gas utility revenues of approximately $1.4 billion, underscoring the significance of this revenue stream.

Black Hills Corporation generates revenue by selling electricity from its diverse power generation portfolio to other utilities and through wholesale electricity markets. This wholesale segment provides a crucial avenue for income diversification, supplementing its regulated retail electricity sales. In 2024, the company continued to leverage its generation assets, including natural gas, coal, and renewable sources, to participate in these broader energy markets.

Natural Gas, Oil, and Coal Production Sales

Black Hills Corporation generates revenue by directly selling the natural gas, crude oil, and coal it produces from its own operations. This core activity is a significant driver of the company's overall financial performance, effectively monetizing its owned resource assets.

In 2024, the energy markets continued to play a crucial role in the company's revenue mix. For instance, Black Hills Corporation's oil and gas segment reported significant contributions, reflecting the ongoing demand for these commodities.

- Revenue Source: Direct sales of produced natural gas, crude oil, and coal.

- Profitability Driver: Leverages the company's owned resource assets for income.

- 2024 Impact: Oil and gas production sales remained a key contributor to overall revenue.

Rider Recoveries and Energy Efficiency Program Fees

Black Hills Corporation generates additional revenue through specific regulatory riders. These riders are approved by regulators and allow the company to recover costs associated with significant investments, such as transmission infrastructure upgrades or compliance with clean energy mandates. For instance, in 2023, the company continued to implement riders for its various capital improvement plans.

Furthermore, fees collected from energy efficiency programs represent another revenue stream. These programs incentivize customers to reduce their energy consumption, and the associated program administration fees contribute to Black Hills' overall income. The company actively promotes these programs to its customer base.

- Regulatory Riders: Allow recovery of costs for transmission investments and clean energy plans.

- Energy Efficiency Program Fees: Revenue generated from customer participation in energy-saving initiatives.

- Value-Added Services: Fees for other services offered to customers that enhance their energy experience.

Black Hills Corporation's revenue streams are diverse, primarily driven by its regulated utility operations in electricity and natural gas. Beyond these core services, the company also generates income from its non-regulated energy production and other service fees.

In 2024, the company's electric utilities were a significant revenue driver, with sales contributing over $1.7 billion. Similarly, natural gas utility revenues reached approximately $1.4 billion in 2023, underscoring the substantial role of these regulated segments.

Wholesale electricity sales and direct sales of produced commodities like natural gas, crude oil, and coal also add to the revenue mix. Additionally, regulatory riders for infrastructure investments and fees from energy efficiency programs provide further income streams.

| Revenue Stream | Primary Source | 2024 (Approx.) |

|---|---|---|

| Regulated Electric Utility Sales | Electricity to homes and businesses | $1.7+ billion |

| Regulated Natural Gas Utility Sales | Natural gas to homes and businesses | $1.4 billion (2023) |

| Wholesale Electricity Sales | Sales to other utilities and markets | Continued participation in markets |

| Energy Production Sales | Direct sales of natural gas, oil, coal | Key contributor to revenue |

| Regulatory Riders & Program Fees | Infrastructure costs, energy efficiency programs | Support revenue through cost recovery |

Business Model Canvas Data Sources

The Black Hills Business Model Canvas is built using extensive market research, customer feedback, and internal operational data. These sources provide a comprehensive understanding of the local business landscape and customer needs.