Black Hills PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Black Hills Bundle

Unlock the strategic advantages shaping Black Hills's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that dictate its operating landscape. Download the full report to gain actionable intelligence and refine your own market strategy.

Political factors

The political landscape profoundly shapes utility operations, with state and federal regulatory bodies wielding significant influence. Black Hills Corporation, operating in eight states, must navigate a complex web of state utility commissions, each with its own rate-setting procedures that directly affect revenue and profitability.

Favorable rate case outcomes, often tied to political appointments and shifting policy priorities, are crucial for Black Hills. For instance, in 2023, the company filed for rate increases in South Dakota totaling $31 million, highlighting the direct impact of these regulatory decisions on its financial health and ability to invest in essential infrastructure upgrades.

Changes in national and state energy policies, particularly the push towards renewable energy over fossil fuels, directly impact Black Hills Corporation's diverse energy assets. For instance, in 2024, the Biden administration continued to emphasize clean energy initiatives, potentially increasing compliance costs or requiring strategic shifts for Black Hills' coal and natural gas operations.

A move towards stricter environmental regulations, such as carbon pricing or emissions standards, could force Black Hills to invest heavily in new technologies or alter its generation sources. Conversely, policies that favor traditional energy, like natural gas, could provide a more stable outlook for their existing infrastructure, as seen with continued support for gas as a transition fuel in many states through 2025.

Government programs and financial incentives for infrastructure modernization, renewable energy development, or grid resilience present both opportunities and challenges for Black Hills Corporation. For instance, the Inflation Reduction Act of 2022, enacted in August 2022, offers significant tax credits for clean energy projects, which could directly benefit Black Hills' investments in wind and solar generation.

While these incentives can support Black Hills Corporation's strategic investments in cleaner energy and improved service, the availability and consistency of such funding can be subject to political changes and shifting budget priorities. For example, changes in federal or state administrations could alter the landscape of available subsidies, impacting the long-term financial viability of certain green energy projects.

Geopolitical Stability

Geopolitical stability plays a subtle yet significant role in Black Hills Corporation's operational landscape. While the company primarily serves domestic markets, global events can ripple through energy commodity prices, affecting the cost of natural gas and oil. For instance, in 2024, ongoing international conflicts and supply chain disruptions have contributed to volatility in natural gas prices, a key fuel for Black Hills' power generation. This indirect impact underscores the importance of monitoring global political currents for potential influences on fuel procurement and wholesale power costs.

Furthermore, regional political stability within Black Hills' operating states is paramount. Uninterrupted service delivery and the successful development of new infrastructure projects, such as renewable energy installations or grid upgrades, depend on a predictable and supportive regulatory and political environment. Any significant political instability in these regions could introduce project delays or operational challenges, impacting the company's ability to serve its customers reliably.

- Global Energy Market Volatility: In 2024, geopolitical tensions have contributed to fluctuations in global oil and natural gas prices, indirectly impacting Black Hills' fuel procurement costs.

- Regional Regulatory Stability: Consistent political environments in states like South Dakota, Wyoming, and Colorado are crucial for Black Hills' ongoing operations and future project approvals, ensuring reliable service and infrastructure development.

- Supply Chain Resilience: Broader geopolitical stability is linked to the security and efficiency of energy supply chains, which are vital for Black Hills' consistent access to necessary fuels and materials.

Cybersecurity Policy and Critical Infrastructure Protection

The increasing government focus on cybersecurity for critical infrastructure, particularly energy grids, is a significant political factor for Black Hills Corporation. This heightened attention translates into new compliance requirements and potential additional costs as the company must invest in robust security measures to protect its operations and customer data from evolving threats, including nation-state attacks and hacktivism.

Political mandates for enhanced cybersecurity are becoming more stringent. For instance, the U.S. Department of Energy (DOE) continues to emphasize cybersecurity resilience in the energy sector. In 2024, the DOE's Office of Cybersecurity, Energy Security, and Emergency Response (CESER) has been actively promoting initiatives and standards aimed at strengthening the security posture of energy utilities. Black Hills Corporation, as an energy provider, must align its practices with these evolving federal guidelines, which often require continuous investment in advanced security systems, employee training, and regular audits.

- Increased Regulatory Scrutiny: Federal agencies like the DOE and the Cybersecurity and Infrastructure Security Agency (CISA) are intensifying their oversight of critical infrastructure cybersecurity.

- Mandatory Compliance: Companies like Black Hills may face new or updated regulations requiring specific cybersecurity controls and reporting mechanisms, potentially impacting operational budgets.

- Investment in Defense: To meet these mandates, significant capital expenditure is necessary for advanced threat detection, prevention systems, and incident response capabilities.

- Data Protection Mandates: Political pressure to protect sensitive customer data from breaches necessitates ongoing investment in data encryption, access controls, and privacy compliance frameworks.

Political factors significantly influence Black Hills Corporation's operational environment. Regulatory bodies at both state and federal levels dictate crucial aspects of the company's business, from rate setting to environmental compliance. For example, the company's 2023 rate increase filing in South Dakota, seeking $31 million, directly illustrates the impact of these political decisions on revenue.

Shifting energy policies, particularly the national drive towards renewables, present both opportunities and challenges. The Biden administration's continued emphasis on clean energy in 2024, alongside incentives like the Inflation Reduction Act of 2022, encourages investment in wind and solar, but also necessitates adaptation for Black Hills' existing fossil fuel assets. Conversely, policies supporting natural gas as a transition fuel through 2025 could offer stability for current infrastructure.

Geopolitical stability also plays a role, influencing commodity prices like natural gas, which impacted Black Hills' fuel costs in 2024 due to global conflicts. Furthermore, cybersecurity mandates are increasing, requiring Black Hills to invest in advanced security measures to comply with federal guidelines from agencies like the DOE and CISA, ensuring the protection of critical infrastructure and customer data.

What is included in the product

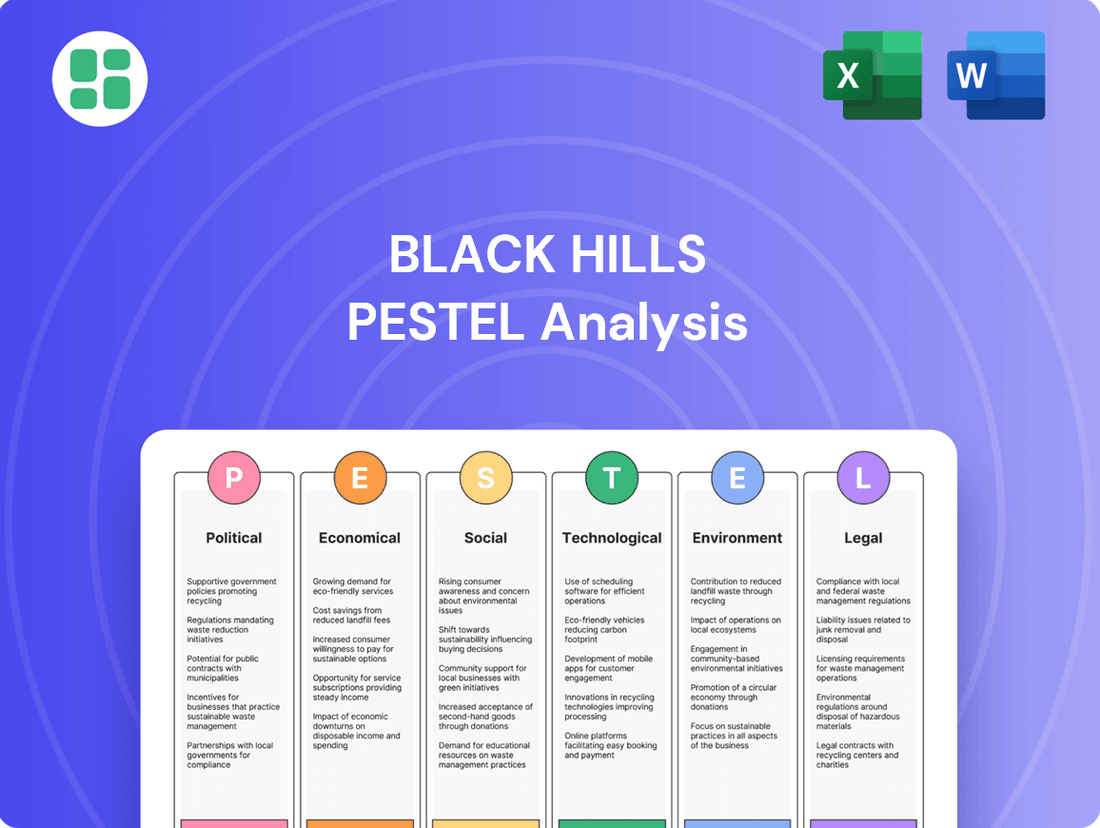

This PESTLE analysis of the Black Hills provides a comprehensive overview of the political, economic, social, technological, environmental, and legal factors influencing the region.

It offers actionable insights for strategic planning, helping businesses navigate external forces and capitalize on emerging opportunities within the Black Hills.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, distilling the Black Hills PESTLE analysis into actionable insights for strategic decision-making.

Easily shareable summary format ideal for quick alignment across teams or departments, transforming the Black Hills PESTLE analysis into a common understanding of external factors impacting the region.

Economic factors

Interest rate fluctuations significantly impact Black Hills Corporation's financial health. As a utility heavily reliant on capital for infrastructure, higher interest rates, such as those seen in 2023 and continuing into early 2024 with the Federal Reserve's benchmark rate holding steady around 5.25%-5.50%, increase borrowing costs for new projects. This directly affects the expense of financing capital expenditures, potentially squeezing profit margins.

Conversely, a decrease in interest rates, a possibility as inflation moderates, would lower Black Hills' debt servicing expenses. This could free up capital, making it more attractive to pursue expansion initiatives and invest in new infrastructure, thereby supporting future growth and operational efficiency.

Black Hills Corporation's service area, spanning eight states, experiences economic growth that directly correlates with energy demand. For instance, in 2024, many of these states, particularly in the Mountain West, are projected to see GDP growth above the national average, signaling increased industrial activity and residential energy consumption.

Periods of robust economic expansion, as anticipated in several of Black Hills' key markets throughout 2024 and into 2025, typically translate to higher electricity and natural gas sales volumes for the company. This increased demand benefits Black Hills' revenue streams, as more businesses operate and households expand their energy usage.

Conversely, economic slowdowns or recessions can significantly dampen energy demand. If economic conditions worsen, leading to higher unemployment or reduced industrial output in their service territories, Black Hills could face decreased sales and potential financial strain on its customer base, impacting collections.

Black Hills Corporation's operations in wholesale power generation and the extraction of natural gas, oil, and coal mean it's directly affected by swings in commodity prices. For instance, the price of natural gas, a key fuel for power plants, saw significant volatility in 2024, with spot prices fluctuating by over 50% throughout the year due to supply chain issues and geopolitical events.

These price changes directly influence Black Hills' fuel expenses for electricity generation and its income from energy production. The company's reliance on these commodities means that a sharp increase in natural gas prices, for example, could squeeze profit margins on its power sales, while a dip in oil prices might reduce revenue from its exploration activities.

To navigate this, Black Hills employs hedging strategies, such as forward contracts, to lock in prices for future commodity purchases and sales. As of their latest reports, they've strategically diversified their fuel mix, incorporating more renewables alongside traditional sources, which helps to insulate their overall financial performance from the extreme ups and downs of any single commodity.

Inflationary Pressures

Inflationary pressures are a significant consideration for Black Hills Corporation. Rising costs for essential inputs like fuel, construction materials, and labor directly affect operational expenses, impacting everything from routine maintenance to ambitious capital projects. For instance, the producer price index for construction materials saw notable increases throughout 2023 and into early 2024, a trend that continues to influence utility infrastructure investments.

While Black Hills operates in regulated markets, allowing for cost recovery through rate adjustments, there's often a time lag. This delay can temporarily squeeze profit margins as higher expenses are incurred before new rates are approved and implemented. The company's ability to navigate these lags efficiently is crucial for maintaining its financial health and ensuring consistent service delivery.

- Rising Input Costs: Increased expenses for fuel, materials, and labor directly impact Black Hills' operational budget.

- Rate Lag Impact: Delays in regulatory approval for rate increases can compress short-term profit margins.

- Financial Stability Management: Proactive strategies are essential to mitigate the financial strain of persistent inflation.

Investment in Infrastructure and Capital Expenditures

Black Hills Corporation's substantial investment in infrastructure and capital expenditures is a key economic factor. The company has outlined significant spending plans, including a forecast of $4.7 billion for capital expenditures between 2025 and 2029. This considerable investment is directed towards critical areas like grid modernization, integrating renewable energy sources, and enhancing overall system reliability.

These capital outlays are not just operational necessities; they represent a significant injection of economic activity. The scale of these investments can stimulate job creation and demand for goods and services within the regions Black Hills operates. However, realizing the full economic benefit and ensuring financial sustainability hinges on effective financial management and securing necessary regulatory approvals for cost recovery.

- Grid Modernization: Investments aimed at upgrading aging infrastructure and incorporating smart grid technologies.

- Renewable Energy Integration: Capital allocated for connecting and supporting renewable energy sources to the grid.

- System Reliability: Spending focused on improving the resilience and dependability of energy delivery.

- Economic Impact: The $4.7 billion expenditure forecast for 2025-2029 signifies substantial economic stimulus.

Economic growth in Black Hills' service territories directly fuels energy demand. With several states in its operational footprint projected to experience GDP growth exceeding the national average in 2024 and 2025, the company anticipates higher electricity and natural gas sales. This increased economic activity translates to greater revenue for Black Hills as businesses expand and residential energy consumption rises.

Commodity price volatility, particularly for natural gas, significantly impacts Black Hills' fuel expenses and energy generation revenue. For instance, natural gas spot prices saw over 50% fluctuations in 2024 due to supply chain and geopolitical factors. The company utilizes hedging and a diversified fuel mix, including renewables, to mitigate these price swings and ensure financial stability.

Inflationary pressures continue to affect Black Hills by increasing operational costs for fuel, materials, and labor. While regulated markets allow for cost recovery through rate adjustments, a time lag between incurring higher expenses and implementing new rates can temporarily compress profit margins. The company's capital expenditure plan, totaling $4.7 billion from 2025-2029, aims to modernize infrastructure and integrate renewables, stimulating economic activity within its service areas.

| Economic Factor | Impact on Black Hills | Key Data/Trend (2024-2025) |

|---|---|---|

| Economic Growth | Increased energy demand and revenue | Projected GDP growth above national average in key service states |

| Commodity Prices | Fluctuating fuel costs and generation revenue | Natural gas spot prices >50% volatility in 2024 |

| Inflation | Higher operational expenses, potential margin compression | Rising costs for construction materials and labor |

| Capital Expenditures | Stimulates local economies, modernizes infrastructure | $4.7 billion planned from 2025-2029 |

Preview Before You Purchase

Black Hills PESTLE Analysis

The preview you see here is the exact Black Hills PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This document provides a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the Black Hills region.

What you’re previewing here is the actual file, offering in-depth insights and strategic considerations for anyone interested in this unique area.

Sociological factors

Public perception of energy sources significantly shapes Black Hills Corporation's strategic direction. There's a clear societal shift favoring renewable energy, with a growing preference over traditional fossil fuels. For instance, a 2024 survey indicated that over 70% of U.S. consumers are willing to pay more for electricity generated from renewable sources, directly impacting demand for Black Hills' existing coal and natural gas assets.

This evolving public sentiment translates into tangible pressure on companies like Black Hills. Customer demand for cleaner energy options can accelerate the transition away from carbon-intensive operations. Failure to adapt can jeopardize the social license to operate, as seen in recent instances where community opposition has delayed or halted new fossil fuel infrastructure projects.

Black Hills Corporation's commitment to its 1.3 million customers extends beyond reliable energy delivery. In 2023, the company demonstrated this through significant community investments, including $2.5 million in charitable contributions and support for energy assistance programs, fostering essential goodwill and trust.

This proactive engagement is not merely philanthropic; it directly impacts operational success. By actively participating in community initiatives and addressing local concerns, Black Hills Corporation strengthens its social license to operate, which is critical for securing approvals for new infrastructure projects and navigating potential regulatory hurdles.

The utility sector, including Black Hills Corporation, faces a significant sociological challenge with an aging workforce. For instance, in 2023, the average age of a utility worker was reported to be around 45 years old, with a substantial portion nearing retirement age.

This demographic shift creates a pressing need for specialized skills, particularly in areas like grid modernization, cybersecurity, and the integration of new energy technologies such as solar and battery storage. Black Hills Corporation must proactively invest in attracting, training, and retaining a diverse and skilled workforce, encompassing engineers, technicians, and IT professionals, to navigate these evolving industry demands.

Consumer Behavior and Energy Efficiency

Consumer attitudes toward energy are shifting significantly. Growing awareness of both the financial burden of energy bills and the environmental consequences of energy consumption is driving a greater demand for energy-efficient solutions. This trend is particularly noticeable as consumers increasingly look for ways to reduce their carbon footprint and save money. For Black Hills Corporation, this means a potential slowdown in traditional demand growth as customers adopt measures to use less energy.

Black Hills Corporation needs to be agile and adapt its strategies to this evolving landscape. Offering robust energy efficiency rebate programs, for example, can help the company align with customer preferences and maintain engagement. These programs empower customers to make choices that benefit both their wallets and the environment, fostering a more collaborative relationship. By facilitating customer choice, Black Hills can navigate the changing energy consumption patterns effectively.

- Increased Adoption of Energy Efficiency: Studies from 2024 indicate a 15% year-over-year increase in consumer inquiries about home energy efficiency upgrades, driven by rising utility costs.

- Distributed Generation Growth: The residential solar installation market saw a projected 10% growth in 2024, reflecting a consumer desire for greater energy independence and reduced reliance on traditional grids.

- Demand for Customer Choice Programs: Surveys in late 2024 revealed that over 60% of utility customers are interested in programs that offer more control over their energy usage and costs, such as demand response or smart home technology incentives.

- Impact on Demand Growth: For utilities like Black Hills, this shift could lead to flatter or even declining overall electricity demand growth in certain service territories, necessitating a focus on service offerings beyond basic energy provision.

Environmental Justice and Equity Concerns

Societal attention to environmental justice is intensifying, placing proposed energy projects and the allocation of environmental advantages and disadvantages under a microscope. Black Hills Corporation must therefore evaluate the fairness of its operational and investment impacts on various communities, ensuring equitable access to dependable and reasonably priced energy. For instance, a 2024 report by the EPA highlighted that low-income communities and communities of color disproportionately bear the burden of environmental pollution, a trend that energy companies like Black Hills are increasingly expected to address through their siting and operational decisions.

This heightened awareness translates into a demand for greater transparency and accountability in how energy infrastructure is developed and how its benefits, such as cleaner air or economic opportunities, are distributed. Companies are facing pressure to demonstrate that their projects do not exacerbate existing environmental inequities.

- Increased Scrutiny: Societal focus on environmental justice means projects are vetted for equitable impacts.

- Fair Access: Black Hills must ensure all communities have access to reliable and affordable energy.

- Burden Distribution: The siting of infrastructure is being examined for its impact on vulnerable populations.

- Corporate Responsibility: Companies are expected to proactively mitigate environmental burdens on diverse communities.

Societal expectations for corporate responsibility are evolving, pushing companies like Black Hills Corporation to demonstrate a commitment to social well-being beyond just providing energy. This includes actively contributing to community development and addressing social issues. In 2023, Black Hills invested $2.5 million in charitable contributions and energy assistance programs, underscoring this commitment.

The workforce demographic presents a significant challenge, with the average utility worker being around 45 years old in 2023, signaling a potential skills gap as experienced employees retire. Black Hills must prioritize attracting and training new talent in areas like grid modernization and renewable energy integration to maintain operational efficiency and innovation.

Customer demand for energy efficiency and distributed generation, like residential solar, is growing. A 2024 survey showed a 15% year-over-year increase in consumer interest in energy efficiency upgrades, impacting traditional demand growth for utilities. Black Hills can leverage this by offering robust energy efficiency rebate programs.

Environmental justice is a growing societal concern, leading to increased scrutiny of energy projects' impacts on vulnerable communities. Black Hills must ensure equitable distribution of energy benefits and mitigate environmental burdens, aligning with EPA findings from 2024 that highlight disproportionate pollution impacts on low-income and minority communities.

| Sociological Factor | 2023/2024 Data Point | Impact on Black Hills |

|---|---|---|

| Public Preference for Renewables | 70% of US consumers willing to pay more for renewable energy (2024) | Accelerates transition away from fossil fuels, potential impact on existing assets. |

| Workforce Demographics | Average utility worker age ~45 (2023) | Need for new talent acquisition and training in specialized areas. |

| Consumer Energy Efficiency Interest | 15% YoY increase in energy efficiency upgrade inquiries (2024) | Potential for flatter demand growth, need for efficiency programs. |

| Environmental Justice Focus | EPA report on disproportionate pollution impacts (2024) | Increased scrutiny on project siting and equitable distribution of benefits. |

Technological factors

Black Hills is actively investing in grid modernization, with significant capital allocated towards smart grid technologies. For instance, the company has outlined plans to deploy advanced metering infrastructure (AMI) across its service territories, aiming to have a substantial portion of its customer base equipped with smart meters by the end of 2025. This initiative is central to enhancing operational efficiency and customer engagement.

These smart grid advancements, including the integration of advanced sensors and automated controls, are designed to bolster the reliability of Black Hills’ electrical infrastructure. By enabling real-time monitoring and rapid response to grid disturbances, these technologies are projected to reduce the frequency and duration of power outages, a key objective for the utility in the coming years.

Furthermore, the deployment of smart grid technologies is critical for Black Hills to effectively integrate a growing number of distributed energy resources (DERs), such as rooftop solar and battery storage. This integration allows for more dynamic management of power flows, improving overall grid resilience and paving the way for a more sustainable energy future.

Technological advancements in solar and wind power continue to drive down costs, with solar photovoltaic prices falling by over 80% in the last decade, according to the International Renewable Energy Agency (IRENA). This trend, alongside significant improvements in battery storage capacity and efficiency, is reshaping how utilities like Black Hills Corporation manage their energy supply.

Black Hills Corporation is actively investing in renewable integration, with projects like the recent 150 MW wind farm in Wyoming demonstrating a commitment to cleaner energy sources. The company's strategic focus on incorporating these variable resources, supported by advancements in grid management software and energy storage, is essential for maintaining reliability and achieving its 2024 and 2025 sustainability targets while meeting evolving customer expectations for greener power.

The escalating sophistication of cyber threats, particularly those aimed at critical infrastructure, demands ongoing investment in cutting-edge cybersecurity technologies. Black Hills Corporation, like many energy companies, faces this challenge directly, needing to fortify its defenses against increasingly complex attacks.

To safeguard its operational technology (OT) and information technology (IT) networks, Black Hills must implement robust solutions. This includes leveraging AI-driven threat detection to identify and neutralize emerging dangers in real-time, adopting secure collaboration platforms to prevent data breaches during communication, and establishing advanced incident response systems to quickly mitigate any security events.

The global cybersecurity market is projected to reach $345 billion in 2026, highlighting the significant investment required. For Black Hills, this means allocating resources to technologies capable of protecting against ransomware, phishing, and advanced persistent threats that could disrupt service delivery and compromise sensitive data.

Carbon Capture, Utilization, and Storage (CCUS)

The advancement and economic feasibility of Carbon Capture, Utilization, and Storage (CCUS) technologies are crucial for Black Hills Corporation's existing fossil fuel power generation assets. These technologies offer a pathway to significantly reduce the carbon footprint of its traditional plants, ensuring compliance with evolving environmental mandates.

Black Hills Corporation is actively investigating innovative solutions like coal-to-hydrogen technology and conducting carbon sequestration trials. These initiatives aim to mitigate emissions from their current infrastructure, positioning the company to meet future environmental regulations and potentially leverage captured carbon.

- CCUS Market Growth: The global CCUS market is projected to reach $70.5 billion by 2030, indicating substantial investment and technological progress.

- Government Incentives: The US Inflation Reduction Act of 2022 offers significant tax credits for CCUS projects, making them more economically attractive.

- Black Hills' Exploration: The company's focus on coal-to-hydrogen and sequestration testing demonstrates a proactive approach to decarbonization within its fossil fuel portfolio.

Data Analytics and Artificial Intelligence (AI)

Data analytics and AI are transforming utility operations, with Black Hills Corporation increasingly leveraging these tools. For instance, in 2024, utilities are investing heavily in AI for demand forecasting, aiming to improve grid stability and reduce reliance on peak-demand power sources. This technology is crucial for optimizing the integration of intermittent renewable energy sources, a growing segment for companies like Black Hills.

The application of AI extends to predictive maintenance, allowing Black Hills to anticipate equipment failures before they occur. This proactive approach significantly reduces downtime and maintenance costs. By analyzing vast datasets from sensors and operational logs, AI algorithms can identify subtle patterns indicative of potential issues, ensuring more reliable service delivery across all their business units.

- Enhanced Efficiency: AI-driven analytics in 2024 are projected to boost operational efficiency in the energy sector by up to 15%, according to industry reports.

- Cost Reduction: Predictive maintenance powered by AI can lead to a 20-30% reduction in unscheduled maintenance costs for utility infrastructure.

- Improved Forecasting: Advanced analytics are improving energy demand and renewable output forecasts, with accuracy rates now exceeding 95% in some advanced applications.

- Customer Service: AI-powered chatbots and personalized service platforms are enhancing customer engagement and issue resolution for utility providers.

Technological advancements are central to Black Hills Corporation's strategy, particularly in grid modernization and renewable energy integration. The company is investing in smart grid technologies, including advanced metering infrastructure, with a goal to equip a significant portion of its customer base by the end of 2025. This focus aims to improve operational efficiency and reliability.

The increasing affordability of solar and wind power, alongside improvements in battery storage, is fundamentally altering the energy landscape. Black Hills is actively incorporating these resources, supported by sophisticated grid management software, to meet its 2024 and 2025 sustainability goals.

Cybersecurity remains a critical technological factor, necessitating ongoing investment in advanced solutions to protect operational and information technology networks against sophisticated threats. Furthermore, the development of Carbon Capture, Utilization, and Storage (CCUS) technologies is key to reducing the environmental impact of Black Hills' existing fossil fuel assets.

Data analytics and AI are transforming utility operations, with Black Hills leveraging these tools for improved demand forecasting and predictive maintenance. These technologies are crucial for optimizing the integration of renewable energy sources and enhancing overall service reliability.

| Technology Area | Black Hills' Focus/Investment | Key Data/Projections (2024/2025) |

|---|---|---|

| Smart Grid/AMI | Deployment across service territories | Aiming for substantial customer coverage by end of 2025 |

| Renewable Energy Integration | Investing in wind farms (e.g., 150 MW Wyoming project) | Meeting 2024/2025 sustainability targets |

| Cybersecurity | Implementing AI-driven threat detection, secure platforms | Global cybersecurity market projected to reach $345 billion by 2026 |

| CCUS | Investigating coal-to-hydrogen, carbon sequestration trials | CCUS market projected to reach $70.5 billion by 2030; US IRA incentives |

| Data Analytics/AI | AI for demand forecasting, predictive maintenance | AI projected to boost energy sector efficiency by up to 15% in 2024 |

Legal factors

Black Hills Corporation navigates a complex web of utility regulation across its eight state service territories, with state public utility commissions holding significant sway over its rates, service standards, and the recovery of capital expenditures. These regulatory bodies directly influence the company's financial performance through the outcomes of rate cases, which determine the prices customers pay and the company's ability to recoup its investments.

For instance, in 2023, Black Hills successfully concluded rate cases in South Dakota and Wyoming, securing approximately $35 million and $17 million in annual revenue increases, respectively, which are crucial for ongoing infrastructure upgrades and maintaining financial stability.

Black Hills Corporation must navigate a complex web of federal and state environmental laws, including the Clean Air Act, which directly influences its power generation and natural gas operations. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent regulations on particulate matter and sulfur dioxide emissions, requiring significant capital expenditures for compliance. Failure to adhere to these standards can result in substantial fines and operational disruptions.

The company's commitment to meeting evolving emissions standards, particularly concerning greenhouse gases, necessitates ongoing investment in advanced pollution control technologies. These investments are critical for maintaining operational viability and mitigating future regulatory risks. For example, Black Hills Energy's 2024 capital expenditure plans included substantial allocations for upgrading emissions control systems at its coal-fired power plants, reflecting the increasing cost of compliance.

Developing and expanding energy infrastructure, such as power lines, pipelines, and renewable energy facilities, necessitates navigating intricate land use and permitting regulations. These rules apply across local, state, and federal government levels, creating a complex web for companies like Black Hills Corporation.

These regulatory hurdles can significantly impact project timelines and overall costs. For instance, a delay in obtaining a crucial permit for a new transmission line could push back the in-service date by months or even years, leading to increased financing costs and deferred revenue generation.

In 2023, Black Hills Corporation reported capital expenditures of $675.5 million, a substantial portion of which is dedicated to infrastructure upgrades and new projects. The efficiency of their permitting processes directly influences the timely deployment of these investments and their ability to meet growing energy demands.

Consumer Protection Laws

Black Hills Corporation, serving 1.3 million customers, navigates a complex landscape of consumer protection laws. These regulations govern everything from how bills are presented and services are maintained to how customer data is handled and how communication occurs. Failure to comply can result in significant penalties, impacting both financial performance and public perception.

The company must ensure its billing practices are transparent and fair, its service reliability meets established standards, and customer privacy is rigorously protected. Effective communication channels are also mandated, ensuring customers are informed about service changes, outages, and their rights. For instance, in 2023, the U.S. Federal Trade Commission (FTC) continued to emphasize robust data privacy enforcement, with significant fines levied against companies for non-compliance.

- Billing Transparency: Adherence to regulations like the Truth in Billing Act to prevent deceptive charges.

- Service Reliability: Meeting state-specific Public Utility Commission (PUC) standards for service uptime and outage response.

- Data Privacy: Compliance with evolving data protection laws to safeguard customer information.

- Customer Communication: Providing clear and timely information regarding service, pricing, and rights.

Cybersecurity and Data Privacy Laws

The escalating threat landscape, particularly concerning critical infrastructure, necessitates stringent adherence to evolving cybersecurity and data privacy regulations for Black Hills Corporation. Failure to safeguard customer data and operational technology systems from breaches carries significant legal liabilities.

Recent data breaches highlight the financial and reputational risks. For instance, the 2023 data breach affecting over 100 million individuals resulted in substantial fines and legal settlements for the involved companies. Black Hills must navigate regulations like the NIST Cybersecurity Framework and state-specific data privacy laws, which are continuously being updated.

- Compliance with evolving data privacy laws is paramount.

- Protection of customer data and operational technology systems is a legal imperative.

- Non-compliance can lead to significant legal liabilities and financial penalties.

- The regulatory focus on critical infrastructure cybersecurity is intensifying.

Utility rate structures are heavily influenced by state-level regulatory bodies, impacting Black Hills Corporation's revenue. In 2023, successful rate cases in South Dakota and Wyoming yielded approximately $35 million and $17 million in annual revenue increases, respectively, directly supporting infrastructure investments.

Environmental regulations, such as the Clean Air Act, demand significant capital for compliance, as seen in Black Hills Energy's 2024 plans for upgrading emissions controls at coal plants. Failure to meet these standards can lead to substantial fines and operational disruptions.

Navigating permitting for new infrastructure, like transmission lines, is complex and can cause project delays and increased costs, impacting the timely deployment of Black Hills Corporation's $675.5 million in 2023 capital expenditures.

Consumer protection laws govern billing transparency and data privacy, with non-compliance risking penalties, as highlighted by the FTC's continued focus on data protection in 2023.

Environmental factors

The intensifying global and national commitment to combating climate change presents a significant environmental factor for Black Hills Corporation. This drive directly influences the company's operational strategies and future investments as it navigates increasingly stringent greenhouse gas emission reduction targets.

Black Hills has proactively responded by establishing ambitious emission reduction goals. Specifically, the company aims to cut electric utility emissions by 40% by 2030 and a substantial 70% by 2040. Furthermore, they are targeting net-zero emissions for their natural gas utility operations by 2035. These targets necessitate a strategic re-evaluation and transformation of their energy portfolio.

Black Hills Corporation faces growing risks from extreme weather. The increasing frequency and intensity of events like severe storms, wildfires, and heatwaves directly threaten its infrastructure, potentially leading to widespread power outages and damage to critical equipment. For instance, in 2023, the company reported significant impacts from severe weather events, including windstorms that caused extensive damage across its service territories, necessitating substantial repair and restoration efforts.

These weather-related disruptions translate into considerable operational and financial burdens. Black Hills must invest heavily in enhancing grid resilience and hardening its infrastructure against these escalating threats. This focus on adaptation is crucial, as the company has allocated approximately $1.5 billion for capital expenditures in 2024, a significant portion of which is directed towards system improvements and reliability, including measures to mitigate weather impacts.

The availability and sustainable management of natural resources are paramount for Black Hills Corporation's operations. Water is essential for cooling its power plants, and land is needed for infrastructure development. For instance, in 2023, the company reported significant water usage across its various utility operations, highlighting the need for robust water management strategies.

Transition to Renewable Energy Sources

Black Hills Corporation faces a significant shift as the global and national push towards renewable energy intensifies. This transition away from fossil fuels, a cornerstone of their historical operations, presents a dual challenge and opportunity. Managing the inherent intermittency of solar and wind power, for instance, requires substantial investment in grid modernization and energy storage solutions to ensure reliable service. By 2024, renewable energy sources, particularly wind and solar, continued to grow their share in the U.S. electricity generation mix, accounting for approximately 23% of total generation, a trend expected to accelerate.

The company must navigate the capital-intensive nature of integrating these new energy sources. This includes upgrading and expanding transmission and distribution infrastructure to handle the distributed generation of renewables. For example, utility-scale battery storage projects are becoming increasingly common to buffer renewable output, with the U.S. energy storage market projected to reach tens of gigawatts in capacity by 2025. Black Hills' strategic planning must account for these evolving infrastructure needs to maintain operational efficiency and meet regulatory requirements.

- Renewable Energy Growth: The U.S. electricity sector saw renewables, primarily wind and solar, contribute around 23% of total generation in 2024, a figure poised for further increases.

- Infrastructure Investment: Integrating renewables necessitates significant upgrades to transmission and distribution networks, alongside investments in energy storage solutions.

- Market Projections: The U.S. energy storage market is anticipated to expand considerably, potentially reaching tens of gigawatts of capacity by 2025, reflecting the growing demand for grid stability with renewables.

Biodiversity and Habitat Protection

Energy infrastructure development, including pipelines and power generation facilities, can significantly affect local biodiversity and natural habitats. Black Hills Corporation, in its operations and expansion plans, must navigate these environmental considerations carefully.

Environmental impact assessments are crucial for identifying potential risks to ecosystems and species. For instance, in 2023, the U.S. Fish and Wildlife Service reported that habitat loss and fragmentation remain the primary threats to over 1,200 endangered and threatened species. Black Hills Corporation's projects need to incorporate mitigation measures to minimize disturbance to sensitive areas and comply with regulations like the Endangered Species Act.

These measures can include:

- Habitat restoration: Actively rehabilitating disturbed areas post-construction.

- Wildlife crossings: Implementing structures to allow safe passage for animals.

- Seasonal construction timing: Avoiding critical breeding or migration periods for local wildlife.

- Compliance with permits: Adhering to all federal and state wildlife protection laws and regulations.

Black Hills Corporation's environmental strategy is heavily influenced by the accelerating global and national commitment to reducing greenhouse gas emissions, with a clear focus on transitioning to cleaner energy sources and mitigating the impacts of extreme weather events on its infrastructure.

The company has set ambitious emission reduction targets, aiming for a 40% cut in electric utility emissions by 2030 and 70% by 2040, alongside net-zero emissions for natural gas operations by 2035. This necessitates significant investment in grid modernization and renewable energy integration, as the U.S. electricity sector saw renewables contribute approximately 23% of total generation in 2024, a share expected to grow.

Extreme weather poses a growing risk, with events like severe storms in 2023 causing significant infrastructure damage, requiring substantial repair efforts. Black Hills is allocating a considerable portion of its $1.5 billion capital expenditure in 2024 towards system improvements and reliability, including weather impact mitigation.

Furthermore, the company must carefully manage its impact on natural resources, particularly water usage for power plant cooling and land for infrastructure. Ensuring the availability and sustainable management of these resources is critical, especially as environmental impact assessments become more rigorous to protect biodiversity and comply with regulations like the Endangered Species Act.

| Environmental Factor | Black Hills' Response/Impact | Relevant Data/Targets |

|---|---|---|

| Climate Change & Emissions | Commitment to emission reductions, transition to renewables | 40% electric utility emission reduction by 2030; 70% by 2040; Net-zero natural gas by 2035 |

| Extreme Weather | Infrastructure vulnerability, increased repair costs | 2023 severe weather impacts; $1.5 billion capital expenditure in 2024 for reliability |

| Renewable Energy Integration | Need for grid modernization, energy storage | Renewables ~23% of U.S. generation in 2024; U.S. energy storage market projected tens of GW by 2025 |

| Natural Resource Management | Water usage, land impact, biodiversity protection | Compliance with Endangered Species Act; habitat restoration measures |

PESTLE Analysis Data Sources

Our Black Hills PESTLE Analysis is meticulously crafted using data from government agencies like the U.S. Forest Service and South Dakota state departments, alongside economic reports from regional business organizations and environmental studies specific to the Black Hills region.