Black Hills Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Black Hills Bundle

Black Hills's competitive landscape is shaped by moderate buyer power, as customers have some alternatives but are often loyal to established brands. The threat of new entrants is relatively low due to capital requirements and brand recognition, but it's not negligible.

The full Porter's Five Forces Analysis reveals the real forces shaping Black Hills’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Black Hills Corporation's reliance on a select group of specialized equipment manufacturers for critical infrastructure, such as power plants and natural gas pipelines, significantly amplifies supplier bargaining power. These suppliers often possess unique technological expertise and substantial market dominance, allowing them to dictate pricing and delivery schedules. For instance, in the energy sector, the lead times for custom-built turbines or advanced control systems can extend for years, giving the few manufacturers ample leverage. This limited choice means Black Hills has fewer alternatives, making it harder to negotiate favorable terms.

Black Hills Corporation's reliance on key fuel suppliers, such as those for natural gas and coal, significantly influences its operational costs and stability. For instance, in 2023, natural gas prices experienced considerable volatility, impacting the cost of electricity generation for utilities that depend on this resource. This dependence means suppliers can wield considerable bargaining power, particularly when market conditions favor them due to tight supply or elevated transportation expenses.

The availability of skilled labor significantly impacts the bargaining power of suppliers within the utility sector. For Black Hills, a scarcity of qualified engineers, technicians, and specialized construction personnel for energy projects can drive up labor costs. For instance, in 2024, the U.S. Bureau of Labor Statistics reported a strong demand for electrical power-line installers and repairers, with a projected job growth of 4% from 2022 to 2032, indicating a potentially tight market for specialized utility labor.

Technology and Software Providers

As Black Hills Corporation increasingly digitizes its energy infrastructure, its reliance on technology and software providers for critical functions like grid management, cybersecurity, and customer service platforms becomes a significant factor. These specialized providers can wield considerable bargaining power, particularly when their solutions are proprietary or present substantial integration challenges with alternative systems. For instance, the global cybersecurity market was projected to reach $231.4 billion in 2024, highlighting the essential nature and potential leverage of key players in this space.

The bargaining power of technology and software suppliers is amplified when Black Hills faces limited viable alternatives for essential operational software or specialized grid management systems. This dependence can lead to price increases or unfavorable contract terms if switching costs are prohibitively high. The demand for advanced analytics and AI-driven solutions in the utility sector, expected to grow significantly by 2025, further empowers suppliers with unique capabilities.

- Proprietary Solutions: Suppliers offering unique, patented software or hardware essential for Black Hills' operations can command higher prices and exert greater influence.

- High Switching Costs: The expense and complexity of migrating data, retraining staff, and integrating new systems with existing infrastructure can lock Black Hills into current providers.

- Concentration of Suppliers: If only a few specialized technology providers offer the necessary solutions, their collective bargaining power increases significantly.

- Criticality of Technology: The more integral a technology or software is to Black Hills' core operations and regulatory compliance, the more power its supplier holds.

Regulatory Compliance Vendors

Vendors providing critical regulatory compliance services, such as environmental monitoring or safety equipment, hold significant bargaining power over Black Hills. The potential for severe penalties and operational disruptions due to non-compliance makes Black Hills reliant on these specialized suppliers to maintain its licenses and avoid hefty fines.

In 2024, the energy sector faced increasing scrutiny regarding environmental regulations, with companies investing heavily in compliance technologies and services. For instance, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent air and water quality standards, driving demand for specialized monitoring and reporting vendors. Companies like Black Hills, operating in a highly regulated utility space, must secure these services to ensure continued operation.

- High Switching Costs: Specialized compliance software and services often require significant integration and training, making it costly and time-consuming for Black Hills to switch vendors.

- Criticality of Service: Failure to comply with regulations can lead to substantial fines, operational shutdowns, and reputational damage, underscoring the essential nature of these vendor services.

- Limited Supplier Pool: The market for highly specialized regulatory compliance experts and technology providers can be concentrated, giving dominant players more leverage.

Black Hills Corporation's bargaining power with its suppliers is significantly influenced by the concentration of specialized providers for critical infrastructure components. These suppliers often possess unique technological expertise, leading to limited alternatives for Black Hills and allowing them to dictate terms. For example, the lead times for custom-built power generation equipment can be lengthy, granting the few manufacturers considerable leverage in pricing and delivery schedules.

The company's reliance on specific fuel sources, such as natural gas and coal, also empowers its suppliers. Fluctuations in energy markets, like the volatility seen in natural gas prices during 2023, can give fuel providers substantial bargaining power, especially when supply is tight. This dependence means Black Hills has fewer options to negotiate favorable pricing or secure consistent supply chains.

Furthermore, the availability of skilled labor within the utility sector impacts supplier power. A shortage of specialized technicians and engineers in 2024, as indicated by strong demand for electrical power-line installers, can drive up labor costs for suppliers, which may then be passed on to Black Hills. This dynamic strengthens the hand of suppliers who can secure this essential workforce.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Black Hills | Example Data/Trend (2023-2024) |

|---|---|---|---|

| Infrastructure Equipment Manufacturers | Proprietary technology, high switching costs, concentration of suppliers | Higher equipment costs, longer lead times, limited negotiation flexibility | Extended lead times for custom turbines; specialized control systems |

| Fuel Suppliers (Natural Gas, Coal) | Market volatility, supply/demand imbalances, transportation costs | Increased operating expenses, potential supply disruptions | Natural gas price volatility in 2023; rising transportation costs |

| Skilled Labor Providers | Labor shortages, demand for specialized skills, unionization | Increased labor costs for projects, potential project delays | Projected 4% job growth for electrical power-line installers (2022-2032) |

| Technology & Software Providers | Proprietary solutions, integration complexity, cybersecurity needs | Higher software licensing fees, vendor lock-in, reliance on specific platforms | Global cybersecurity market projected at $231.4 billion in 2024 |

| Regulatory Compliance Services | Criticality of service, limited supplier pool, high switching costs | Increased compliance costs, risk of penalties for non-compliance | Increased EPA scrutiny on air/water quality standards in 2024 |

What is included in the product

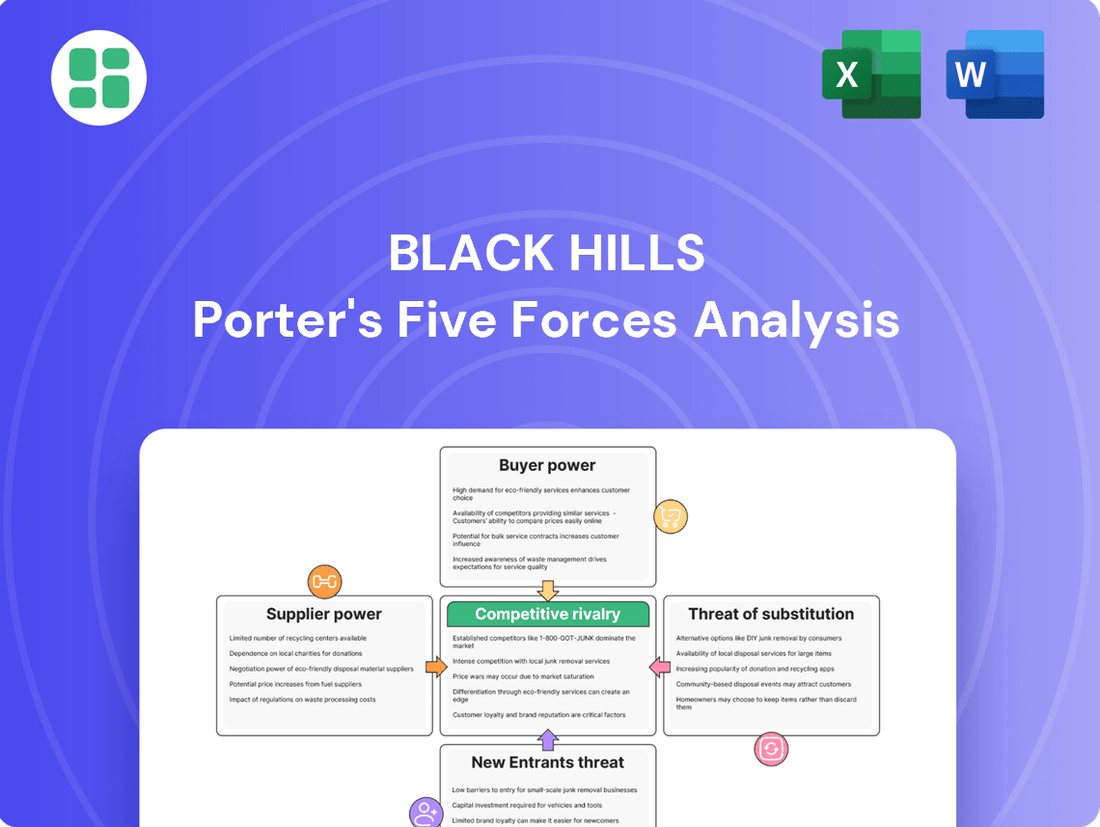

Analyzes the competitive intensity, buyer and supplier power, threat of new entrants, and substitutes impacting Black Hills' market position.

Quickly identify and mitigate competitive threats with a visual breakdown of buyer power, supplier power, new entrants, substitutes, and industry rivalry.

Customers Bargaining Power

Black Hills Corporation enjoys a dominant position as a regulated utility in its service areas, operating as a near-monopoly for natural gas and electric services. This lack of direct competition severely curtails the bargaining power of its residential and commercial customers. Customers generally cannot switch providers, meaning their ability to negotiate rates is minimal, as these are ultimately determined by state regulatory bodies.

Large industrial and wholesale power customers for Black Hills Corporation wield more bargaining power than individual residential users. These major consumers often purchase substantial volumes of electricity, giving them leverage to negotiate pricing and contract terms. For instance, in 2023, Black Hills' industrial customers represented a significant portion of their electricity sales, and their ability to explore alternative energy sources or even on-site generation for non-regulated operations further enhances their negotiating position.

Regulatory rate reviews significantly impact the bargaining power of customers for utilities like Black Hills. Customer advocacy groups and public utility commissions (PUCs) act as powerful representatives during these crucial rate cases. These bodies scrutinize proposed price hikes and service changes, effectively amplifying the collective voice of individual customers.

While a single customer might have minimal sway, their aggregated influence through regulatory channels is substantial. For instance, in 2023, PUCs across various states reviewed numerous utility rate increase requests, often leading to adjustments that benefit consumers. This indirect but potent form of customer power forces utilities to justify their pricing and service levels, thereby increasing customer bargaining power.

Demand-Side Management Programs

Black Hills offers programs that allow customers to manage their energy use, like demand-side management and energy efficiency initiatives. These programs give customers more control over their consumption and, consequently, their bills.

This customer empowerment, while positive for consumers, translates into a form of bargaining power for them. By actively reducing their energy needs, customers can directly impact the overall demand for Black Hills' services, potentially slowing revenue growth.

- Customer Control: Demand-side management programs give customers the tools to reduce their electricity usage.

- Revenue Impact: Reduced consumption can lead to lower overall sales for Black Hills, affecting revenue.

- Energy Efficiency Growth: In 2024, many utilities saw increased participation in energy efficiency programs as customers sought to lower costs.

- Shifting Demand: This trend highlights customers' ability to shape the utility's demand profile.

Geographic Concentration of Customers

Black Hills Corporation's customer base is geographically dispersed, serving approximately 1.3 million customers across eight states. This wide distribution significantly dilutes the bargaining power of any single customer or regional group. For instance, a localized issue affecting a small percentage of their customer base would not pose a systemic threat to Black Hills' overall revenue streams.

The broad geographic footprint means that no single state or customer segment holds a disproportionate amount of leverage. This diversification is a key strength in mitigating customer power. If one region experiences economic downturn or regulatory changes impacting demand, the impact is cushioned by the company's presence in other, potentially more stable, markets.

- Geographic Dispersion: Black Hills serves over 1.3 million customers across eight states, spreading its customer base widely.

- Reduced Concentration Risk: This broad distribution prevents any single region from wielding significant influence over the company.

- Mitigation of Localized Impacts: Issues in one state or customer segment are less likely to have a critical impact on overall demand.

While individual customers have limited direct bargaining power due to the regulated nature of Black Hills' services, their collective influence through regulatory bodies is significant. Customer advocacy groups and Public Utility Commissions (PUCs) actively participate in rate reviews, scrutinizing proposed price increases and service changes. This process allows customers, indirectly, to negotiate rates by presenting a united front against utility proposals, as seen in numerous PUC reviews throughout 2023 where rate adjustments often favored consumers.

Preview Before You Purchase

Black Hills Porter's Five Forces Analysis

This preview showcases the complete Black Hills Porter's Five Forces analysis, detailing the competitive landscape of the region's tourism and hospitality sector. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing firms. The document you see here is the exact, professionally formatted analysis you'll receive immediately after purchase, ready for your strategic planning needs.

Rivalry Among Competitors

Black Hills Corporation experiences very little direct competition in its main regulated utility operations. State regulations typically grant exclusive service territories for natural gas and electric distribution, meaning there aren't other companies vying for the same customers. This limited rivalry is a key factor in the stability of Black Hills' revenue.

Black Hills faces intense competition in its wholesale power generation segment, primarily from independent power producers and other utilities actively participating in regional electricity markets. This competitive landscape is largely dictated by price, with factors such as the cost of generation, fluctuating fuel prices, and the availability of transmission infrastructure playing crucial roles in determining market outcomes.

The rivalry among these power suppliers is robust, often leading to price-based competition as entities vie for power purchase agreements and market share. For instance, in 2024, the average wholesale electricity price in many regions remained a key battleground, with utilities constantly seeking efficiencies to offer more competitive rates. The availability and terms of power purchase agreements significantly influence profitability and market position, making contract negotiation a critical aspect of this competitive environment.

While not direct competitors in the traditional sense, entities promoting energy efficiency and smart home technologies present a form of indirect competition for Black Hills. These initiatives, focusing on reducing overall energy consumption, can impact the utility's sales volumes and future growth. For instance, widespread adoption of energy-efficient appliances and smart thermostats can lead to a decrease in kilowatt-hour sales per customer.

Inter-Fuel Competition in Generation

Black Hills Corporation's power generation assets, encompassing natural gas, coal, and a growing renewable portfolio, face intense competition within the wholesale electricity market. This rivalry is primarily shaped by the fluctuating economics of different fuel sources, the evolving landscape of environmental regulations, and government incentives designed to promote renewable energy adoption.

The dispatch order of generation units, a critical factor in profitability, is directly influenced by these competitive forces. For instance, in 2024, the increasing cost of natural gas, which saw spot prices reaching over $3.00 per MMBtu at various points, often made coal-fired generation more economically viable for baseload power, despite environmental considerations. Conversely, periods of low natural gas prices could shift the advantage, while renewable energy sources, with their near-zero marginal costs once built, increasingly compete for market share, particularly during peak daylight hours.

- Fuel Cost Volatility: Fluctuations in natural gas prices directly impact the competitiveness of Black Hills' gas-fired plants against its coal assets and other market participants.

- Environmental Regulations: Stricter emissions standards, such as those being considered for mercury and other pollutants in 2024, can increase operating costs for coal plants, potentially favoring cleaner alternatives.

- Renewable Energy Incentives: Tax credits and renewable portfolio standards continue to make solar and wind power more attractive, driving their integration and increasing competition for traditional generation sources.

- Market Pricing Dynamics: The wholesale market price of electricity is a key determinant, with lower prices favoring more efficient or lower-cost generation, including renewables with zero fuel costs.

Regulatory and Policy Landscape

The competitive rivalry for Black Hills is significantly shaped by the dynamic regulatory and policy landscape. State and federal energy policies, including renewable energy mandates and carbon pricing mechanisms, directly influence the competitive advantages of energy providers. For instance, in 2024, states like Colorado continued to advance clean energy goals, potentially favoring utilities with robust renewable portfolios.

These policy shifts create an evolving environment where Black Hills and its rivals must adapt to maintain their market positions. For example, changes in transmission access rules or grid modernization investments can alter cost structures and operational efficiencies, impacting competitive parity. The Federal Energy Regulatory Commission (FERC) also plays a crucial role in setting wholesale electricity market rules, influencing how all participants compete.

- Evolving Renewable Mandates: States are increasingly setting ambitious renewable energy targets, such as Colorado's goal of 100% clean electricity by 2040, impacting investment decisions and competitive positioning.

- Carbon Pricing Mechanisms: The potential implementation or expansion of carbon pricing, like cap-and-trade systems or carbon taxes, can alter the cost of generation for fossil fuel-reliant competitors.

- Market Structure Changes: FERC's ongoing review of wholesale electricity market design and transmission pricing can create new competitive opportunities or challenges for Black Hills and its peers.

Competitive rivalry for Black Hills is minimal in its regulated utility segments due to exclusive service territories, ensuring stable revenue streams. However, the wholesale power generation sector faces intense price-based competition from independent power producers and other utilities. This competition is driven by fuel costs, generation efficiency, and power purchase agreement terms, with 2024 seeing continued focus on cost-competitiveness in regional electricity markets.

Indirect competition arises from energy efficiency initiatives and smart home technologies, which can reduce overall energy consumption and impact sales volumes. Black Hills' diverse generation portfolio, including natural gas, coal, and renewables, competes based on fuel economics, environmental regulations, and government incentives, with dispatch order heavily influenced by these factors. For example, in 2024, natural gas price volatility, with spot prices exceeding $3.00/MMBtu, influenced the economic viability of coal versus gas generation.

| Competitive Factor | 2024 Impact/Observation | Implication for Black Hills |

|---|---|---|

| Wholesale Electricity Prices | Key battleground, driven by generation costs and fuel prices. | Requires efficient operations to offer competitive rates. |

| Fuel Cost Volatility (Natural Gas) | Spot prices exceeded $3.00/MMBtu at times. | Affects competitiveness of gas-fired plants vs. coal. |

| Renewable Energy Integration | Continued growth driven by incentives and falling costs. | Increases competition for traditional generation sources. |

| Energy Efficiency Adoption | Widespread adoption can decrease per-customer sales. | Potential impact on future sales volumes and growth. |

SSubstitutes Threaten

Customers are increasingly adopting energy efficiency measures and conservation practices, which serve as a significant substitute for Black Hills' core utility services. These actions directly reduce the overall demand for electricity and natural gas. For instance, in 2024, residential energy efficiency programs offered by utilities nationwide have reported substantial energy savings, with some programs achieving reductions of 10-15% in electricity consumption for participating households.

The rise of distributed generation, particularly rooftop solar, poses a significant threat of substitution for traditional utility revenue streams. As customers increasingly adopt on-site solar, their demand for electricity purchased from the grid diminishes. This trend is amplified by the falling costs of solar technology; for instance, residential solar panel prices have seen a substantial decline, making it a more accessible option for a wider consumer base.

While the exact impact varies by region and regulatory environment, the growing adoption of rooftop solar directly substitutes for the electricity Black Hills Corporation would otherwise sell. In 2023, solar capacity additions in the U.S. continued their upward trajectory, with distributed solar playing a key role, indicating a persistent challenge to utility sales models.

The threat of substitutes for natural gas in heating and cooling is growing. Technologies like electric heat pumps and geothermal systems are becoming more efficient and affordable, directly challenging natural gas demand. For instance, the U.S. Department of Energy reported that by 2024, advancements in heat pump technology are projected to significantly improve their performance in colder climates, making them a more viable alternative across a wider range of regions.

Self-Generation for Industrial Customers

Large industrial clients, especially those with substantial energy demands, are increasingly exploring self-generation options. This can involve setting up co-generation plants or other on-site power solutions, directly substituting Black Hills' utility services with their own energy production.

This trend poses a significant threat as these customers can bypass traditional utility providers altogether. For instance, in 2024, industrial energy consumption represented a notable portion of utility sales, and a shift towards self-generation by even a few major players could impact revenue streams.

- Industrial customers are exploring co-generation and on-site power solutions.

- This represents a direct substitution for utility-provided energy.

- The ability to bypass traditional utility services is a key driver.

- Customer retention is challenged by these alternative energy sources.

Emerging Energy Technologies

Emerging energy technologies pose a significant threat of substitution for Black Hills. Advanced battery storage systems, for instance, are becoming increasingly viable, allowing consumers and businesses to store solar or wind power, thereby reducing their dependence on grid electricity. In 2024, the global energy storage market is projected to see substantial growth, with advancements in battery chemistry and cost reductions making these solutions more accessible.

Microgrids, which can operate independently or connected to the main grid, offer another avenue for customers to bypass traditional utility services. These localized energy networks enhance reliability and can integrate renewable sources, presenting a direct alternative to relying solely on Black Hills for power. The development and deployment of microgrids are accelerating, driven by resilience needs and the desire for greater energy independence.

Hydrogen-based energy solutions, while still in earlier stages of widespread adoption, represent a longer-term disruptive threat. These technologies could provide clean energy for heating, transportation, and electricity generation, potentially offering a comprehensive substitute for current energy delivery models. As research and investment in green hydrogen production and utilization increase, its potential to displace traditional energy sources grows.

These nascent technologies collectively challenge Black Hills' established business model by providing pathways for customers to generate, store, and manage their own energy, thereby reducing or eliminating their reliance on the utility. The increasing efficiency and decreasing costs of these alternatives are key factors driving this substitution threat.

The threat of substitutes for Black Hills' core utility services is significant, driven by customer adoption of energy efficiency, distributed generation like rooftop solar, and emerging technologies. These alternatives directly reduce demand for electricity and natural gas, impacting traditional revenue streams. For example, residential energy efficiency programs in 2024 have shown savings of 10-15% in electricity consumption, while falling solar costs make it a more accessible option. Furthermore, advancements in heat pump technology by 2024 are making them a more viable alternative for heating and cooling.

| Substitute Technology | Impact on Black Hills | Key Driver | 2024 Data/Trend |

|---|---|---|---|

| Energy Efficiency & Conservation | Reduced electricity/gas demand | Cost savings for consumers | Programs achieving 10-15% household energy reductions |

| Rooftop Solar | Decreased grid electricity sales | Falling solar panel costs | Continued upward trajectory in solar capacity additions |

| Electric Heat Pumps & Geothermal | Reduced natural gas demand for heating | Improved efficiency and affordability | Enhanced performance in colder climates projected |

| On-site Generation (e.g., Co-generation) | Bypassing utility services for large industrial clients | Desire for energy independence and cost control | Industrial consumption is a notable portion of utility sales |

| Battery Storage & Microgrids | Reduced reliance on grid electricity | Increased resilience and energy independence | Global energy storage market showing substantial growth |

Entrants Threaten

The sheer scale of infrastructure required for regulated utility operations presents a formidable barrier to new entrants. Black Hills, like its peers, must invest billions in power generation facilities, extensive transmission and distribution networks, and natural gas pipelines. For instance, in 2023, Black Hills Corporation reported capital expenditures of $826.3 million, a significant portion of which was dedicated to maintaining and upgrading its existing utility infrastructure, underscoring the substantial upfront investment needed to even begin competing in this sector.

New entrants in the utility sector, like Black Hills Corporation, encounter substantial regulatory hurdles that act as a significant barrier. These include complex and time-consuming approval processes at both state and federal levels, often requiring years of dedicated legal and administrative work to secure necessary licenses, permits, and rate approvals.

Black Hills benefits significantly from its established grid infrastructure, a complex and extensive network built over many years. This existing framework represents a substantial barrier for any potential new entrant.

For a new company to enter the market, it would need to either construct a comparable grid, a process that is both incredibly capital-intensive and time-consuming, or secure access to the existing infrastructure. The sheer scale of this undertaking makes it a formidable challenge, reinforcing Black Hills' strong position.

In 2023, Black Hills Corporation reported capital expenditures of $845.8 million, much of which was directed towards infrastructure improvements and expansions. This ongoing investment underscores the commitment required to maintain and grow such an essential asset, a commitment that new entrants would struggle to match.

Economies of Scale and Experience

Economies of scale present a formidable barrier for potential new entrants into the energy sector where Black Hills operates. As an established, diversified energy company, Black Hills leverages significant cost advantages across its operations, from procurement of fuel and equipment to the maintenance of its extensive infrastructure. For instance, in 2023, Black Hills Corporation reported total operating revenues of $1.5 billion, indicative of the scale required to achieve competitive pricing.

New companies entering the market would find it exceedingly difficult to match these efficiencies without achieving comparable operational volume and accumulated experience. This disparity in cost structure makes it challenging for newcomers to compete effectively on price against an incumbent like Black Hills, which can spread its fixed costs over a larger base.

- Significant cost advantages in purchasing and operations due to large-scale infrastructure.

- New entrants face challenges in achieving comparable cost efficiencies without substantial initial investment.

- Black Hills' 2023 revenues of $1.5 billion highlight the scale needed to compete.

- Experience curve benefits reduce per-unit costs for established players.

Brand Recognition and Customer Loyalty

While customer choice is inherently limited in the regulated utility sector, Black Hills Corporation has cultivated significant brand recognition and a strong service relationship with its existing customer base. This established trust is a formidable barrier for potential new entrants. In 2024, utilities continue to rely on long-standing customer relationships for stability, and any newcomer would need substantial investment to build comparable credibility.

Overcoming this loyalty and establishing trust and reliability, crucial for essential services, presents a major hurdle even if regulatory barriers were surmounted. For instance, customer satisfaction scores, a key indicator of loyalty, are closely watched by regulators and can influence market entry. New entrants would need to demonstrate a proven track record of dependable service, a difficult feat to achieve quickly in this industry.

- Brand Recognition: Black Hills has a long history of service in its operating regions, fostering familiarity.

- Customer Loyalty: Existing customers are accustomed to Black Hills' service and reliability.

- Trust and Reliability: Essential services demand a high level of trust, which is hard for new entrants to build quickly.

- Regulatory Environment: While barriers exist, customer loyalty is a non-regulatory factor that protects incumbents.

The threat of new entrants for Black Hills is considerably low due to the immense capital required for infrastructure and the stringent regulatory environment. For example, Black Hills invested approximately $845.8 million in capital expenditures in 2023, primarily for infrastructure upgrades, demonstrating the scale of investment needed. New companies would struggle to replicate this extensive network or navigate the lengthy approval processes required for utility operations, making market entry highly prohibitive.

Economies of scale further deter new entrants. Black Hills' 2023 operating revenues of $1.5 billion reflect its ability to spread fixed costs over a large customer base, leading to cost efficiencies that newcomers cannot easily match. This scale advantage translates into competitive pricing, a significant barrier for any potential competitor aiming to gain market share.

Established customer relationships and brand loyalty also present a substantial hurdle. In 2024, utilities rely on this trust, built over years of dependable service. A new entrant would require significant time and investment to establish comparable credibility and overcome customer inertia, making it difficult to gain traction against an incumbent like Black Hills.

| Barrier Type | Description | Example Data (Black Hills 2023/2024) |

| Capital Requirements | Massive upfront investment in generation, transmission, and distribution networks. | Capital Expenditures: $826.3 million (2023) |

| Regulatory Hurdles | Complex and lengthy approval processes for licenses, permits, and rates. | Years of dedicated legal and administrative work required. |

| Economies of Scale | Cost advantages from large-scale operations, procurement, and infrastructure maintenance. | Total Operating Revenues: $1.5 billion (2023) |

| Customer Loyalty & Brand Recognition | Established trust and service history make it difficult for new entrants to gain customers. | Focus on long-standing customer relationships in 2024. |

Porter's Five Forces Analysis Data Sources

Our Black Hills Porter's Five Forces analysis leverages data from industry-specific market research reports, financial statements of key players, and regional economic indicators. We also incorporate insights from government tourism data and local business association surveys to understand the competitive landscape.