Black Hills Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Black Hills Bundle

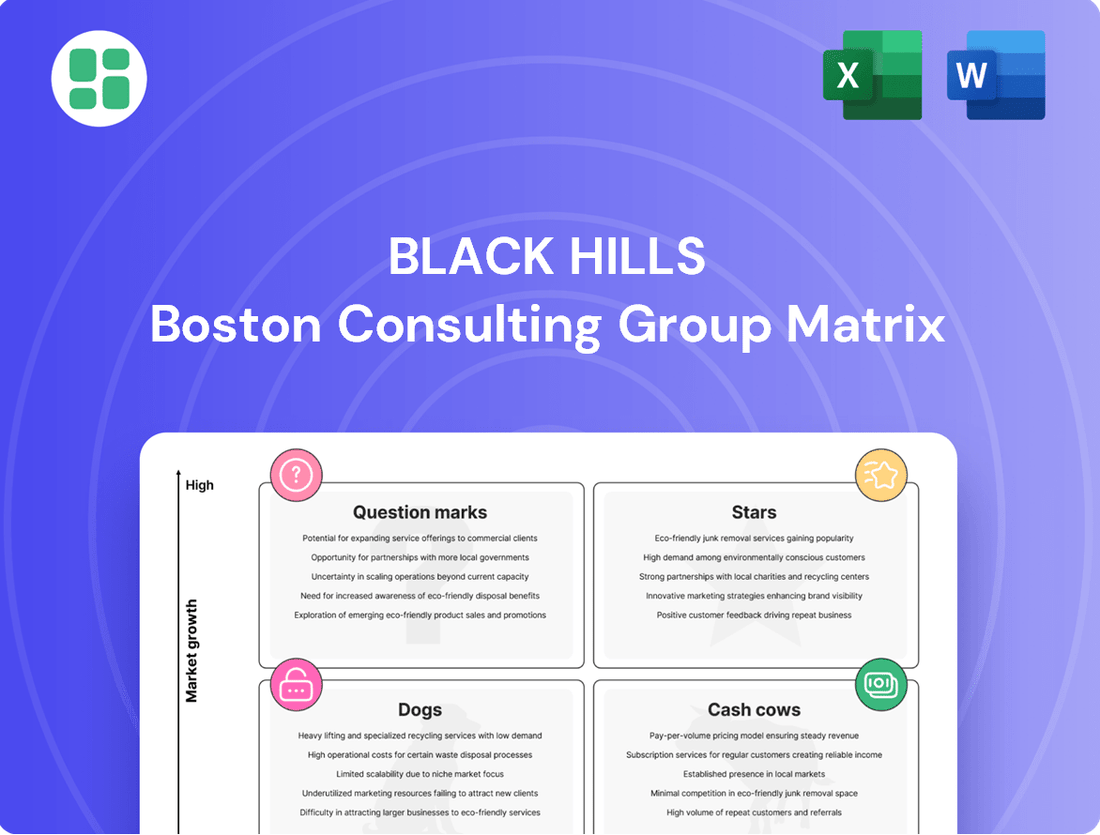

Uncover the strategic positioning of Black Hills with our comprehensive BCG Matrix analysis. See which of their offerings are Stars, Cash Cows, Dogs, or Question Marks, and understand the dynamics driving their portfolio.

This preview offers a glimpse into the potential of Black Hills' market performance. Purchase the full BCG Matrix to gain actionable insights, detailed quadrant breakdowns, and a clear roadmap for optimizing their product strategy and investment decisions.

Stars

Black Hills Corporation's Wyoming electric utility is seeing a surge in demand from data centers and blockchain operations. This burgeoning sector is poised to become a major earnings driver, with projections indicating it will account for more than 10% of the company's earnings per share (EPS) by 2028. This signifies a rapid expansion for Black Hills in a high-growth market.

The impact of this new demand is already evident, as Black Hills has recorded new all-time peak loads in its Wyoming electric service territory. This demonstrates the immediate and substantial contribution of these customers to the utility's operational metrics and revenue potential.

The Ready Wyoming Electric Transmission Project, a substantial $350 million investment, is poised for completion by the end of 2025. This initiative is categorized as a Star within the Black Hills BCG Matrix due to its high growth potential and significant strategic importance.

This project is designed to bolster system resilience and broaden market access, directly supporting economic development in Wyoming. A key aspect is its role in integrating renewable energy sources like wind and solar, aligning with the region's growing demand for clean energy.

The expansion is anticipated to be a major contributor to the future growth of Black Hills' electric utility operations, reflecting the increasing energy needs and infrastructure development in the region.

The $280 million Lange II generation project in South Dakota, slated for service in the latter half of 2026, represents a substantial growth investment for Black Hills. This initiative is designed to address rising energy needs and bolster generation capabilities in a region experiencing consistent customer expansion.

This strategic development aims to solidify Black Hills' position as a market leader in providing reliable, dispatchable generation for its service territory. The project underscores a commitment to meeting future energy demands and supporting regional economic growth.

Colorado Clean Energy Plan Initiatives

Black Hills is making significant strides with its Colorado Clean Energy Plan, a key initiative that aligns with the company's strategic growth in renewable energy. This plan includes a substantial commitment to adding 350 megawatts of new renewable generation resources, primarily solar and battery storage, by 2030. These investments are crucial for meeting the increasing demand for clean power and solidify Black Hills' position as a frontrunner in integrating renewable energy solutions within its Colorado operations.

The company's proactive approach to regulatory approvals for these renewable projects underscores a commitment to a high-growth, high-demand market segment. By securing the necessary approvals, Black Hills is ensuring the timely execution of its clean energy strategy, which is designed to enhance its service offerings and contribute to a more sustainable energy future for its customers in Colorado.

Key initiatives within the Colorado Clean Energy Plan include:

- Addition of 350 MW of renewable generation (solar and battery storage) by 2030.

- Regulatory approvals secured for renewable projects.

- Addressing growing demand for clean energy in Colorado.

- Positioning the company as a leader in renewable integration.

Strategic Capital Investment Program

Black Hills Corporation's Strategic Capital Investment Program positions it for significant expansion. The company has boosted its five-year capital forecast to $4.7 billion for 2025 through 2029, with a robust $1.0 billion earmarked for 2025 alone. This aggressive investment strategy is designed to fuel customer growth, enhance system integrity, and modernize electric generation capabilities.

This substantial capital deployment directly supports Black Hills' ambitious 4% to 6% long-term earnings per share (EPS) growth target. It underscores a firm commitment to solidifying its market leadership and pursuing strategic expansion initiatives across its operating territories.

- Capital Forecast: $4.7 billion (2025-2029)

- 2025 Allocation: $1.0 billion

- Key Investment Areas: Customer growth, system integrity, electric generation

- Growth Target Support: 4% to 6% long-term EPS growth

Stars in the Black Hills BCG Matrix represent high-growth, high-market share segments. The Wyoming data center and blockchain demand, alongside the Ready Wyoming Electric Transmission Project, exemplify these Star characteristics. These initiatives are driving substantial earnings growth and require significant investment to maintain their leading positions.

The Ready Wyoming Electric Transmission Project, a $350 million investment, is a prime example of a Star. Its completion by the end of 2025 aims to bolster system resilience and integrate renewables, directly supporting economic development in a high-demand sector.

The company's overall capital investment program, with a five-year forecast of $4.7 billion (2025-2029) and $1.0 billion allocated for 2025, fuels these Star initiatives. This aggressive spending supports ambitious EPS growth targets and solidifies market leadership.

| Initiative | Investment (Est.) | Completion/Target | BCG Classification | Key Driver |

|---|---|---|---|---|

| Ready Wyoming Transmission Project | $350 million | End of 2025 | Star | Data center/blockchain demand, renewables integration |

| Lange II Generation Project (SD) | $280 million | H2 2026 | Question Mark/Star | Rising energy needs, regional expansion |

| Colorado Clean Energy Plan | 350 MW Renewables | By 2030 | Star | Clean energy demand, renewable integration |

What is included in the product

The Black Hills BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

A clear visual representation of your portfolio's strategic positioning, simplifying complex business unit analysis.

Cash Cows

Black Hills Corporation's regulated electric utility operations are a prime example of a cash cow within its business portfolio. These operations, spanning across eight states, benefit from a stable customer base and the predictable returns allowed by regulatory frameworks. This stability translates into a consistent and reliable stream of cash flow for the company.

In 2023, Black Hills reported that its electric utilities generated a significant portion of its earnings, underscoring their cash-generating capabilities. The company's regulated nature, often a monopoly in its service territories, allows for a high market share and a strong ability to recover costs and earn a fair return on its investments, making these operations a dependable source of funds.

Black Hills Corporation's regulated natural gas utility operations in Arkansas, Iowa, Kansas, and Nebraska are significant cash cows. These segments benefit from stable customer bases and successful rate case outcomes, which are crucial for predictable revenue generation. For instance, recent rate reviews in Arkansas, Iowa, and Kansas have secured new annual revenues, bolstering their cash-generating capabilities.

Black Hills Corporation stands out with a remarkable 55-year streak of increasing its annual dividends, a testament to its financial strength and stability. This longevity places it second only to a select few in the electric and natural gas sectors, highlighting its consistent performance and commitment to shareholder returns.

This enduring dividend history is a direct reflection of the robust and predictable cash flows generated from its established utility businesses, which hold significant market share. These mature operations are the bedrock of its Cash Cow status within the BCG matrix, reliably funding its dividend payouts and supporting its strategic growth initiatives.

Existing Baseload Generation Assets

Black Hills Corporation's existing baseload generation assets, primarily natural gas and some coal-fired plants, are its established Cash Cows. These facilities are crucial for providing reliable, dispatchable power to their utility customers, ensuring grid stability. While new investment in this segment is limited, their high market share in delivering consistent energy generates significant and predictable cash flows.

- High Market Share: These assets dominate the reliable power supply for Black Hills' service territories.

- Steady Cash Flow: The consistent demand for baseload power translates into predictable revenue streams.

- Grid Stability: Their dispatchable nature is vital for maintaining the integrity of the electricity grid.

- Low Growth, High Profitability: While expansion is minimal, the existing infrastructure is highly profitable.

Successful Regulatory Outcomes

Black Hills Corporation's regulated utility segments are prime examples of cash cows, largely due to their consistent success in navigating regulatory environments. The company has a track record of achieving constructive and timely outcomes in utility regulatory dockets, which is crucial for securing new rates and rider recovery for necessary investments.

This adeptness in managing regulatory processes ensures that Black Hills can effectively recover costs associated with system improvements and accommodate customer growth. For instance, in 2024, the company continued to leverage its regulatory expertise to maintain stable and high profit margins from these regulated operations. This predictable revenue stream, bolstered by successful rate cases, solidifies the cash cow status of these segments.

- Consistent Regulatory Success: Black Hills has a history of favorable outcomes in regulatory proceedings, enabling timely recovery of investments.

- Stable Profit Margins: The regulated nature of its utility operations, combined with successful rate adjustments, ensures high and predictable profit margins.

- Investment Recovery: The company effectively recovers capital expenditures for system upgrades and expansion driven by customer demand.

- 2024 Performance: Continued success in securing new rates and rider recovery in 2024 reinforced the strong cash-generating capabilities of its regulated businesses.

Black Hills Corporation's regulated electric and natural gas utilities are its core cash cows, benefiting from stable demand and regulatory frameworks that ensure predictable earnings. These segments have a history of strong performance, with the company consistently achieving favorable outcomes in rate cases. This allows for the recovery of investments and maintenance of healthy profit margins, generating reliable cash flow.

The company's commitment to its utility operations is further evidenced by its impressive 55-year streak of increasing annual dividends, a rare feat in the industry. This sustained dividend growth is directly supported by the robust cash generation from these mature, high-market-share businesses. In 2024, ongoing success in securing new rates and rider recovery in regulatory proceedings continued to bolster the cash-generating power of these essential utility assets.

| Segment | Market Share | Cash Flow Generation | Growth Outlook |

|---|---|---|---|

| Electric Utilities | High (Dominant in service territories) | Strong & Predictable | Low to Moderate (Regulatory driven) |

| Natural Gas Utilities | High (Dominant in service territories) | Strong & Predictable | Low to Moderate (Regulatory driven) |

| Baseload Generation Assets | High (Reliable power supply) | Strong & Predictable | Very Low (Focus on existing infrastructure) |

Full Transparency, Always

Black Hills BCG Matrix

The Black Hills BCG Matrix preview you see is the complete, unwatermarked document you will receive immediately after purchase. This means you're getting the exact same professionally designed and analysis-ready file, ready for immediate integration into your strategic planning or presentations without any hidden surprises or demo limitations.

Dogs

Black Hills' older coal-fired power plants are categorized as Dogs in the BCG Matrix. These aging assets are facing a declining market, with limited new investment opportunities due to their environmental impact and increasing compliance costs. For instance, in 2024, Black Hills continued its strategy to retire or convert older coal units, aligning with broader industry trends and regulatory pressures.

Non-strategic legacy fossil fuel production assets for Black Hills Corporation, while the company does have natural gas, oil, and coal operations, would represent smaller, older sites not crucial to their core utility business. These might be in areas where extraction is becoming too expensive or inefficient, offering little profit. For instance, if a particular legacy coal mine in a declining region only produced 50,000 tons in 2024, requiring significant maintenance for that output, it would fit this category.

The Corporate and Other segment within Black Hills Corporation's operations has seen its operating losses widen at times, notably influenced by unallocated outside services expenses. This points to a potential drag from ventures or overheads not directly tied to the core utility business or strategic growth areas.

For instance, in 2023, the Corporate and Other segment reported an operating loss of $35.4 million. This segment often includes costs associated with non-regulated activities or corporate-level expenses that aren't directly allocated to specific business units, impacting overall profitability.

Infrastructure Not Part of Strategic Upgrades

Infrastructure not part of strategic upgrades, such as older, less efficient segments of Black Hills Corporation's transmission or distribution network, could be considered a 'Dog' in the BCG Matrix. These assets might require substantial, unbudgeted future investment to meet modern operational standards or growth demands.

For instance, while Black Hills is investing $4.7 billion in strategic capital projects through 2028, certain legacy infrastructure components might fall outside this scope. These could be characterized by higher operating expenses due to increased maintenance needs or reduced energy efficiency compared to newer systems.

- Underinvestment Risk: Segments not included in the $4.7 billion capital plan face a higher risk of underinvestment, potentially leading to decreased reliability.

- Operational Inefficiency: Older infrastructure may exhibit lower energy transmission efficiency, resulting in greater energy losses and higher operational costs.

- Limited Growth Capacity: These components might lack the capacity to support future load growth without significant, unplanned capital outlays.

- Low Return Potential: Due to their inherent limitations and potential for high maintenance costs, these assets are likely to generate low returns on investment.

Segments Disproportionately Impacted by Unplanned Outages or Persistent Mild Weather

Certain operational segments or regions within Black Hills Corporation, as highlighted in their financial reports, might be considered 'Dogs' in the BCG Matrix if they are consistently impacted by unplanned generation outages or persistent mild weather. For instance, if a specific service territory experiences frequent disruptions due to aging infrastructure or is heavily reliant on weather-dependent energy sources that underperform, it can strain resources.

These challenges often translate into reduced sales volumes and increased operational expenses, such as those related to repairs or the need for backup power. This situation points to areas with lower inherent reliability or weaker market demand that consume capital and attention without generating proportional returns.

For example, in 2024, Black Hills Corporation reported that extreme weather events, including prolonged periods of mild temperatures in certain regions, impacted their energy delivery and sales. This led to a need for increased maintenance and potentially lower revenue generation in those specific areas, aligning with the characteristics of a 'Dog' segment.

- Impact of Mild Weather on Sales: In 2024, regions with milder-than-average winter temperatures saw a decrease in heating-related energy consumption, directly affecting sales figures for Black Hills Corporation.

- Operational Costs of Outages: Unplanned generation outages, particularly in areas with older generating assets, incurred significant repair and replacement costs in 2024, increasing operating expenses.

- Resource Allocation Strain: Segments experiencing frequent issues require disproportionate management attention and capital investment, diverting resources from potentially more profitable ventures.

- Lower Reliability Metrics: Persistent outages can lead to lower reliability metrics, potentially impacting customer satisfaction and regulatory standing in affected service territories.

Black Hills Corporation's older, less efficient power generation assets, particularly those reliant on coal, are classified as Dogs in the BCG Matrix. These assets operate in a declining market due to environmental concerns and increasing regulatory costs, with limited prospects for future growth or investment.

These segments are characterized by low market share in a shrinking industry, often requiring significant maintenance and facing operational inefficiencies. For example, in 2024, Black Hills continued its strategic retirement of older coal units, reflecting the challenges these assets face in the current energy landscape.

The financial performance of these 'Dog' assets is typically marked by low returns and potential operating losses, as seen in the Corporate and Other segment which reported a $35.4 million operating loss in 2023, often encompassing such legacy costs.

These underperforming assets may also include parts of the transmission and distribution network not included in strategic upgrade plans, facing underinvestment risk and operational inefficiencies that limit their capacity and profitability.

Question Marks

Black Hills' 2024 acquisition of its inaugural renewable natural gas (RNG) production facility in Iowa positions it as a new entrant in a rapidly expanding sector. This strategic move into RNG, a key component of the energy transition, places the company in a 'Question Mark' category within the BCG matrix.

While the RNG market is experiencing significant growth, Black Hills' current market share in production is minimal. This low share in a high-potential market necessitates substantial investment to increase production capacity and establish a stronger competitive foothold.

Black Hills is investing in coal to hydrogen technology, a promising area for decarbonization. This includes testing carbon sequestration, which is crucial for making hydrogen production cleaner. These are considered "question marks" because while they have high growth potential, they are still in early stages of development with uncertain commercial success and very little market share right now.

Black Hills Corporation's venture into utility-scale battery storage, exemplified by its 50 MW project in Colorado, signifies a strategic move into the rapidly expanding sector of grid modernization. This investment taps into a high-growth area crucial for enhancing energy grid flexibility and reliability.

Despite the promising growth trajectory, these battery storage projects are nascent within Black Hills' broader operational framework. They represent a minor segment of the company's total generation capacity, positioning them squarely in the Question Mark quadrant of the BCG matrix. This classification underscores the need for continued development and seamless integration to determine their long-term market viability and contribution.

Early-Stage Renewable Energy Power Purchase Agreements (PPAs)

Black Hills Corporation's strategic focus on early-stage renewable energy power purchase agreements (PPAs) positions them within the Stars quadrant of the BCG Matrix. These new solar and wind PPA commitments are critical for meeting evolving clean energy mandates and represent significant growth potential. For instance, in 2024, the company announced plans to acquire a 120 MW solar project, demonstrating active pursuit of new renewable capacity.

- Growth Potential: Early-stage PPAs for solar and wind are classified as Stars due to their high growth prospects in the expanding renewable energy sector.

- Investment Required: These ventures demand substantial capital for project development and execution, reflecting their resource-intensive nature.

- Market Share: While offering future market share gains, the financial impact and market presence of these nascent agreements are still in the development phase.

- Strategic Importance: Securing these PPAs is vital for Black Hills to achieve its clean energy targets and adapt to market shifts towards sustainability.

Expansion into Untapped High-Growth Customer Segments/Geographies

While Black Hills Corporation's data center investments are showing strong growth, indicating a 'Star' status, the company is also actively looking for new frontiers. This involves identifying customer segments or geographic areas that are currently underserved but show significant potential for rapid expansion. These are markets where Black Hills might not have a dominant presence today but could build one with focused strategic efforts.

These emerging opportunities are crucial for future growth, much like how early investments in renewable energy are now paying off. For instance, in 2024, Black Hills continued to assess the potential for expanding its energy infrastructure into rapidly developing exurban areas or specialized industrial parks that are attracting new businesses. The company understands that nurturing these nascent markets requires dedicated capital and a tailored approach to service delivery.

- Targeting Underserved Exurban Growth: Black Hills is evaluating expansion into exurban communities experiencing population booms, often driven by remote work trends. These areas present opportunities for new residential and small commercial energy demand.

- Specialized Industrial Park Development: The company is exploring partnerships to support the energy needs of newly established or expanding industrial parks focused on sectors like advanced manufacturing or logistics, which are experiencing high growth rates.

- Strategic Geographic Pockets: Black Hills is analyzing specific geographic pockets within or adjacent to its existing service territories that are showing accelerated economic development, indicating a potential for future high-demand energy customers.

- Investment for Future Stars: Success in these expansion efforts could transform these current opportunities into future 'Stars' within Black Hills' portfolio, similar to the current performance of its data center segment.

Black Hills' investments in renewable natural gas (RNG) production and coal-to-hydrogen technology represent classic 'Question Marks' in the BCG matrix. These ventures are characterized by high market growth potential but currently hold a low market share for Black Hills.

The company's 2024 acquisition of an Iowa-based RNG facility and its ongoing testing of carbon sequestration for hydrogen production highlight this strategy. These initiatives require significant investment to scale up and establish a competitive position in emerging energy sectors.

Similarly, Black Hills' entry into utility-scale battery storage, such as its 50 MW project in Colorado, also falls into the Question Mark category. While the grid modernization sector is expanding rapidly, these projects are nascent within Black Hills' operations, demanding further development to determine their long-term market viability.

| Initiative | Market Growth | Black Hills Market Share | Investment Need | BCG Category |

|---|---|---|---|---|

| Renewable Natural Gas (RNG) Production | High | Low | High | Question Mark |

| Coal to Hydrogen Technology | High | Low | High | Question Mark |

| Utility-Scale Battery Storage (e.g., 50 MW Colorado) | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and expert commentary to ensure reliable, high-impact insights.