Black Hills Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Black Hills Bundle

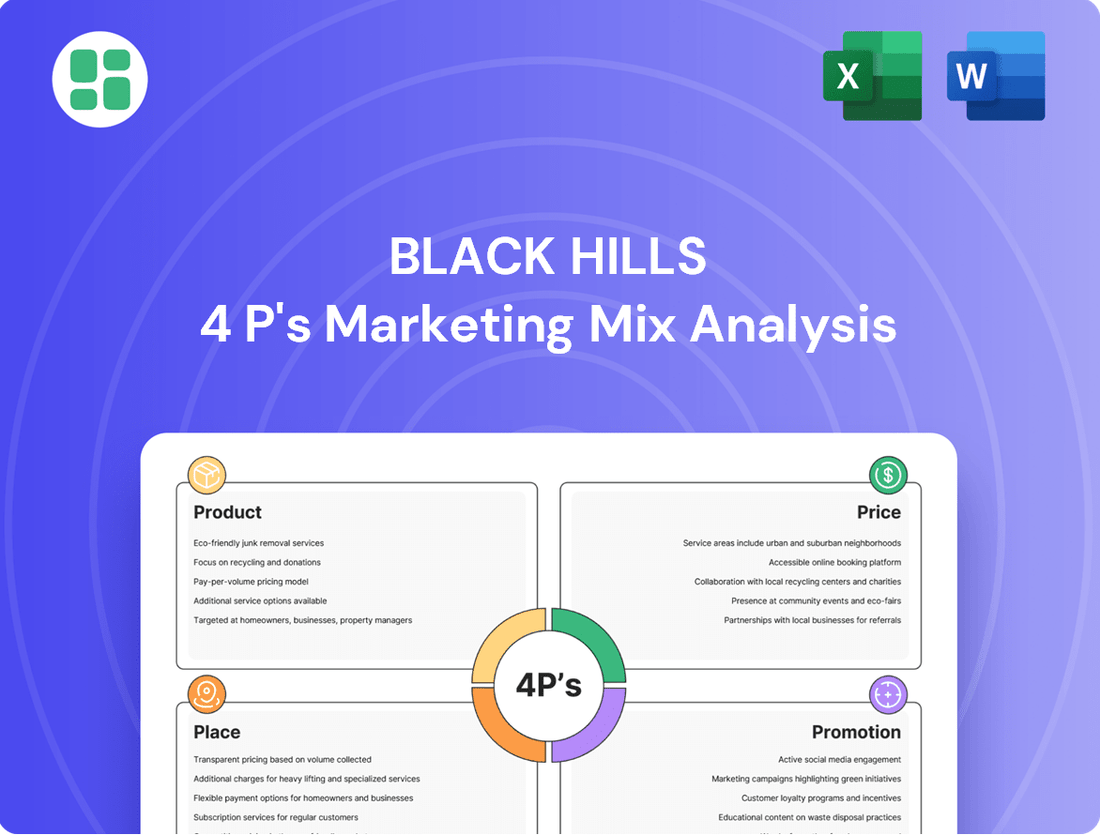

Uncover the strategic brilliance behind Black Hills' marketing efforts with a comprehensive 4Ps analysis. This deep dive explores their product innovation, pricing strategies, distribution channels, and promotional campaigns, revealing the secrets to their market success.

Go beyond the surface-level understanding and gain actionable insights into how Black Hills effectively leverages each element of the marketing mix. Discover their unique approach to product development, competitive pricing, strategic placement, and impactful promotion.

Ready to elevate your own marketing strategy? Access the complete, editable Black Hills 4Ps Marketing Mix Analysis and equip yourself with the knowledge to drive similar success for your business or academic pursuits.

Product

Regulated utility services are the heart of Black Hills Corporation's business, providing essential natural gas and electric power to roughly 1.35 million customers spanning eight states. This core offering is built on a commitment to safety, reliability, and affordability, ensuring that communities have the energy they need to thrive.

The company's product strategy centers on meeting these fundamental energy demands. In 2024, Black Hills invested significantly in infrastructure upgrades, with capital expenditures projected to reach approximately $1.3 billion for the year, focusing on enhancing the reliability and efficiency of its electric and natural gas delivery systems.

Black Hills Corporation's wholesale power generation segment acts as a crucial product offering beyond its retail utility services. This division leverages the company's substantial generation assets, including natural gas and renewable sources, to supply electricity to other utilities and wholesale markets. In 2024, the company continued to focus on optimizing its generation portfolio, with a significant portion of its energy mix derived from natural gas, complemented by growing investments in wind and solar power.

This wholesale activity diversifies Black Hills' revenue streams, providing an additional layer of financial stability. For instance, in the first quarter of 2025, wholesale power sales contributed a notable percentage to the company's overall operating income, demonstrating its importance. This strategic approach allows Black Hills to capitalize on market price fluctuations and secure long-term power purchase agreements, thereby enhancing its financial performance and operational flexibility.

Black Hills Corporation's upstream operations in natural gas, oil, and coal are a cornerstone of its integrated energy strategy. This diversification allows the company to control key resources, enhancing supply chain reliability for its energy services. For instance, in 2023, Black Hills Energy's Wyoming operations produced approximately 1.5 million tons of coal, directly feeding its power generation facilities.

This in-house production of natural gas, oil, and coal provides a significant advantage in managing costs and ensuring consistent resource availability. It reduces reliance on external suppliers, offering a buffer against market volatility. The company's commitment to this diversified resource base underpins its ability to deliver stable energy solutions to its customers.

Renewable Energy and Sustainability Initiatives

Black Hills Corporation is making significant strides in renewable energy and sustainability. A key move was their 2024 acquisition of a renewable natural gas facility located in Iowa, showcasing a tangible commitment to diversifying their energy portfolio. This strategic acquisition is part of a broader effort to embrace cleaner energy sources.

Beyond renewable natural gas, the company is actively investigating cutting-edge technologies aimed at emission reduction. These include exploring the potential of coal-to-hydrogen conversion and carbon sequestration methods. These forward-thinking projects underscore Black Hills’ dedication to a more sustainable energy future.

These initiatives represent a clear strategic pivot for Black Hills Corporation, aiming to build a more resilient and environmentally conscious energy infrastructure. The company's investments signal a proactive approach to navigating the evolving energy landscape and meeting increasing demands for sustainability.

Key highlights of their sustainability push include:

- 2024 Acquisition: Secured a renewable natural gas facility in Iowa, expanding their clean energy footprint.

- Advanced Technology Exploration: Investigating coal-to-hydrogen and carbon sequestration to lower emissions.

- Strategic Shift: Demonstrating a clear move towards a more sustainable and resilient energy future.

- Emission Reduction Focus: Actively pursuing projects designed to minimize their environmental impact.

Energy Efficiency Programs and Customer Choice

Black Hills Corporation's product strategy includes energy efficiency programs designed to empower customers and encourage responsible energy use. These initiatives, such as the 'Green Forward' program, offer rebates and support for customers looking to manage their energy consumption and lower utility bills.

These programs directly benefit customers by providing tangible savings and promoting sustainable practices. For instance, in 2024, Black Hills Energy reported that its energy efficiency programs helped customers save over 50,000 MWh of electricity, equivalent to powering approximately 9,000 homes for a year.

- Customer Empowerment: Programs like Green Forward provide tools and incentives for customers to actively manage their energy usage.

- Cost Reduction: Rebates and efficiency upgrades directly translate to lower energy bills for participating households and businesses.

- Sustainability Focus: These offerings align with broader environmental goals by reducing overall energy demand and supporting a cleaner energy future.

- Value Proposition: Offering these programs enhances Black Hills Corporation's commitment to delivering value and supporting community well-being.

Black Hills Corporation offers a diversified product portfolio centered on essential energy services, including regulated electric and natural gas utilities serving over 1.35 million customers. This core offering is augmented by wholesale power generation, leveraging a mix of natural gas and growing renewable assets, and upstream resource production for enhanced supply chain control. The company is also actively expanding into renewable natural gas and exploring advanced emission reduction technologies like coal-to-hydrogen conversion, alongside customer-focused energy efficiency programs designed to promote responsible usage and cost savings.

| Product Offering | Description | Key Data/Initiatives (2024/2025) |

|---|---|---|

| Regulated Utility Services | Electric and natural gas delivery to residential, commercial, and industrial customers. | Serving approx. 1.35 million customers across 8 states. Capital expenditures projected at $1.3 billion in 2024 for infrastructure upgrades. |

| Wholesale Power Generation | Supplying electricity to other utilities and wholesale markets. | Utilizes natural gas, wind, and solar assets. Wholesale power sales contributed significantly to Q1 2025 operating income. |

| Upstream Resource Production | In-house production of natural gas, oil, and coal. | In 2023, Wyoming operations produced 1.5 million tons of coal. Enhances cost management and resource reliability. |

| Renewable Energy & Sustainability | Expansion into clean energy sources and emission reduction technologies. | Acquired a renewable natural gas facility in Iowa (2024). Investigating coal-to-hydrogen and carbon sequestration. |

| Energy Efficiency Programs | Customer programs encouraging responsible energy use and savings. | Programs like 'Green Forward' offer rebates. In 2024, helped customers save over 50,000 MWh of electricity. |

What is included in the product

This analysis provides a comprehensive examination of the Black Hills' marketing strategies, detailing its Product offerings, pricing structures, distribution channels (Place), and promotional activities.

It's designed for professionals seeking a thorough understanding of the Black Hills' market positioning and competitive landscape.

This Black Hills 4P's Marketing Mix Analysis simplifies complex strategies into actionable insights, relieving the pain of overwhelming data for clear decision-making.

It provides a concise, visual overview of the 4Ps, easing the burden of understanding marketing effectiveness for busy stakeholders.

Place

Black Hills Corporation's extensive service territory spans eight states, reaching approximately 1.35 million natural gas and electric utility customers across more than 800 communities. This vast network highlights the company's commitment to providing essential energy services to a broad and diverse customer base.

Managing such a wide geographical footprint requires a sophisticated and robust infrastructure network. The company's operational reach ensures reliable energy delivery, making its services accessible to a significant portion of the population within its service areas.

Black Hills Corporation's integrated transmission and distribution systems form the backbone of its energy delivery. This expansive network of electric transmission lines and natural gas pipelines is crucial for reliably supplying energy directly to customers across its service territories.

The company consistently prioritizes capital investments to maintain and enhance these vital infrastructure assets. For instance, the $350 million Ready Wyoming electric transmission expansion project, completed in 2024, significantly upgraded and expanded their electric transmission capabilities in Wyoming, demonstrating a commitment to modernizing the grid.

These ongoing investments are not just about upkeep; they are fundamental to ensuring the safety and reliability of energy delivery. By upgrading aging infrastructure and expanding capacity, Black Hills is preparing its systems to meet the growing energy demands of the future and to integrate new energy sources effectively.

Black Hills Corporation actively utilizes digital platforms to streamline customer interactions, offering convenient online account management, bill payment, and service requests. These digital tools provide customers with 24/7 access to their energy usage data and account information, enhancing transparency and control. This digital presence is crucial in today's market, as evidenced by the increasing adoption of online services across all sectors; for instance, in 2024, over 80% of utility customers are expected to interact with their providers digitally at least once a month.

Local Service Centers and Field Operations

Black Hills Corporation's commitment to customer service is underscored by its extensive network of local service centers and dedicated field operations teams. These centers are the frontline for addressing customer needs, from outage response to routine maintenance, ensuring reliable energy delivery across their service territories. This localized presence is key to their operational efficiency and community engagement.

The company's investment in these local operations directly impacts its ability to provide timely support. For instance, during 2024, Black Hills Energy reported that its field crews responded to numerous service interruptions, with response times often being a critical factor in customer satisfaction. This hands-on approach fosters trust and reinforces the company's role as a dependable utility provider.

- Local Service Centers: Strategically located to serve specific geographic areas, facilitating quicker customer interaction and issue resolution.

- Field Operations Teams: Highly trained personnel equipped to handle infrastructure maintenance, repairs, and emergency response, ensuring service continuity.

- Community Integration: Local teams build relationships within the communities they serve, enhancing understanding of local needs and challenges.

- Operational Responsiveness: The decentralized structure allows for rapid deployment of resources during outages or other critical events, minimizing downtime.

Strategic Interconnections and Wholesale Market Access

Black Hills Corporation's strategic interconnections are crucial for its wholesale market access, enabling participation in broader energy markets. These connections are key to optimizing energy flow and ensuring a reliable supply. For instance, the Ready Wyoming initiative, a significant infrastructure project, not only bolsters system resilience but also directly expands market access, a move expected to contribute to long-term price stability for its customer base.

These interconnections translate into tangible benefits for the company and its customers:

- Enhanced Market Reach: Facilitates participation in wholesale power markets, increasing revenue opportunities.

- Price Stability: Expanded market access, as seen with projects like Ready Wyoming, aims to mitigate price volatility for customers.

- Operational Efficiency: Optimizes energy transmission and distribution, ensuring efficient supply chain management.

- Resilience and Reliability: Infrastructure improvements supporting these interconnections bolster overall system reliability.

Black Hills Corporation's expansive service territory, covering eight states and serving approximately 1.35 million customers, is a critical component of its marketing strategy. This vast geographical reach necessitates a robust and localized infrastructure to ensure reliable energy delivery across diverse communities. The company's commitment to maintaining and upgrading this extensive network, including the $350 million Ready Wyoming electric transmission expansion completed in 2024, directly supports its ability to serve its broad customer base effectively.

Preview the Actual Deliverable

Black Hills 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This Black Hills 4P's Marketing Mix Analysis is fully complete and ready for immediate use. You're viewing the exact version of the analysis you'll receive, ensuring transparency and quality for your business needs.

Promotion

Black Hills Corporation prioritizes its public image, actively communicating its dedication to safe, reliable, and affordable energy. This is achieved through strategic public relations, including press releases detailing financial performance, operational progress, and key business developments. For instance, in Q1 2024, the company reported a net income of $78.5 million, underscoring its operational stability and financial health to stakeholders.

Transparent communication is a cornerstone of their strategy, fostering public trust and a clear understanding of their corporate mission. This approach extends to community engagement and stakeholder relations, ensuring a consistent narrative around their commitment to responsible energy provision and growth. In 2023, Black Hills invested $1.3 billion in capital expenditures, a significant portion allocated to infrastructure upgrades and renewable energy projects, which were communicated to the public to highlight their forward-looking strategy.

Black Hills Corporation actively engages with its communities, demonstrating a strong commitment to corporate social responsibility. In 2024, the company reported an economic impact of approximately $1.5 billion, underscoring its significant contribution to local economies. This commitment is further evidenced by substantial charitable giving and dedicated energy assistance programs designed to support those in need within its service territories.

Employee volunteerism is another key aspect of Black Hills' community engagement strategy. These initiatives not only strengthen local ties but also highlight the company's dedication to being a positive and supportive presence where it operates. By investing in its communities, Black Hills aims to foster goodwill and build lasting relationships.

As a regulated utility, Black Hills Corporation prioritizes clear and consistent communication with regulatory bodies and its investors. This commitment is evident in their diligent SEC filings, comprehensive annual reports, and regular investor calls, all designed to offer transparent financial data and strategic insights.

For instance, in their Q1 2024 earnings call, Black Hills highlighted their ongoing capital expenditure programs, a key focus for both regulators and investors, and reaffirmed their 2024 earnings per share guidance, demonstrating a commitment to predictable performance.

This proactive approach to investor relations, including providing detailed operational updates and financial performance metrics, is crucial for building and maintaining shareholder confidence and ensuring a stable valuation in the market.

Customer Education and Safety Campaigns

Black Hills Corporation actively engages in customer education and safety campaigns, a crucial component of their marketing efforts. These initiatives are designed to inform customers about responsible energy use and safety practices. For instance, in 2023, the company reported investing millions in infrastructure upgrades aimed at enhancing safety and reliability, which inherently supports these educational goals by ensuring the integrity of the systems they educate on.

The company's commitment extends to promoting energy efficiency, helping customers manage their consumption and costs. They also emphasize safety protocols for natural gas and electricity, a vital aspect given the nature of their services. These campaigns are not just about compliance; they are about building trust and ensuring the well-being of the communities they serve. Their 2024 projections continue to highlight investments in customer-facing technologies that will further enable educational outreach.

Key aspects of their customer education and safety focus include:

- Energy Efficiency Programs: Offering tips and resources for customers to reduce energy usage and lower bills.

- Safety Awareness: Educating on the safe handling and awareness of natural gas and electricity.

- Program Availability: Informing customers about available assistance programs and rebates.

- Proactive Communication: Maintaining open channels for customer inquiries and safety alerts.

Sustainability Reporting and Environmental Stewardship

Black Hills Corporation actively showcases its commitment to environmental stewardship through its regular publication of Corporate Sustainability Reports. These reports provide transparent updates on the company's progress toward its climate goals, including specific emission reduction targets and investments in green technologies. For instance, in their 2023 report, Black Hills detailed a 15% reduction in greenhouse gas emissions intensity compared to a 2019 baseline, underscoring their tangible efforts.

This consistent reporting strategy serves as a key promotional tool, reinforcing Black Hills Corporation's dedication to environmental responsibility and its forward-looking vision for a sustainable energy landscape. The company highlights its investments in renewable energy projects, such as the recent expansion of its wind energy portfolio, which now accounts for over 30% of its generation capacity, and its ongoing exploration of carbon capture technologies. These initiatives demonstrate a proactive approach to operating responsibly and sustainably.

Key aspects highlighted in their sustainability reporting include:

- Emission Reduction Progress: Detailed metrics on year-over-year reductions in greenhouse gas emissions, aiming for a 40% decrease by 2030.

- Renewable Energy Investments: Information on capital expenditures allocated to solar, wind, and battery storage projects. In 2024, the company committed $500 million to renewable infrastructure.

- Carbon Capture Exploration: Updates on pilot programs and research into carbon capture, utilization, and storage (CCUS) technologies.

- Stakeholder Engagement: Transparency regarding dialogue with environmental groups and community stakeholders on sustainability initiatives.

Black Hills Corporation's promotional efforts focus on building a strong public image through transparent communication about its financial health and operational achievements. In Q1 2024, the company reported a net income of $78.5 million, showcasing its stability to stakeholders. Their 2023 capital expenditures reached $1.3 billion, with a significant portion directed towards infrastructure and renewables, a key message to the public about their growth strategy.

Price

Black Hills Corporation's pricing, or regulated rate structures, are meticulously overseen by state public utility commissions. These commissions ensure rates cover operational and capital expenses, allowing for a fair return on investment. For example, recent approvals in Colorado are set to recover substantial system upgrades, impacting customer bills.

Black Hills Corporation employs cost recovery mechanisms, or riders, to adjust customer bills for specific, fluctuating expenses like fuel and purchased power. This allows for quicker recovery of costs compared to traditional rate cases. For instance, the company's Clean Energy Plan Rider in Colorado helps manage costs associated with its transition to cleaner energy sources.

Capital investment and infrastructure costs are a significant component of Black Hills Corporation's pricing strategy. The company has outlined a substantial capital expenditure plan, with approximately $4.7 billion projected for the period of 2025 through 2029.

These investments are essential for maintaining and upgrading Black Hills' vast energy network, ensuring its safety, reliability, and ability to meet future demand. The expenses associated with these critical infrastructure improvements are directly reflected in the rates charged to customers, making them an intrinsic part of the company's pricing structure.

Energy Efficiency Rebates and Assistance Programs

Black Hills Corporation actively supports customer affordability through energy efficiency rebates and participation in energy assistance programs. These efforts are designed to ease the financial strain on households and foster more sustainable energy use. For instance, in 2023, the company provided over $2.5 million in energy efficiency rebates across its service territories, directly reducing customer bills and promoting the adoption of energy-saving technologies.

These initiatives are a key component of their pricing strategy, demonstrating a commitment to customer welfare. By encouraging customers to invest in efficiency, Black Hills helps them lower their overall energy consumption and costs. This dual approach of direct financial assistance and long-term cost reduction through efficiency highlights a proactive stance on managing customer expenses.

- Energy Efficiency Rebates: In 2023, Black Hills distributed over $2.5 million in rebates for upgrades like efficient appliances and insulation.

- Energy Assistance Programs: The company actively partners with state and federal programs to help low-income customers manage their energy bills.

- Customer Cost Management: These programs aim to reduce the average customer's annual energy expenditure by an estimated 5-10% through efficiency improvements.

- Sustainable Consumption: By incentivizing efficiency, Black Hills promotes a reduction in overall energy demand, aligning with environmental goals.

Market Demand and Economic Conditions

While Black Hills Corporation operates within a regulated framework, market demand and economic conditions significantly shape its pricing strategies. Customer growth, particularly the burgeoning demand from data centers, directly impacts the need for increased energy capacity, influencing future rate adjustments. For instance, in 2023, Black Hills Corporation reported a significant increase in capital expenditures focused on infrastructure upgrades to meet growing customer needs, a trend expected to continue into 2024 and 2025.

The volatility of energy commodity prices, such as natural gas and coal, also plays a crucial role in Black Hills' financial planning and rate setting. These fluctuations necessitate careful forecasting and strategic hedging to ensure stable and competitive pricing for its customers. The company's 2024 earnings guidance, released in early 2024, reflected an anticipation of continued commodity price sensitivity.

- Customer Growth: Black Hills Corporation's service territories are experiencing steady population and economic growth, driving increased energy consumption.

- Data Center Demand: The expansion of data centers in regions served by Black Hills is a key driver of new load growth, requiring significant infrastructure investment.

- Commodity Price Volatility: Fluctuations in natural gas prices, a primary fuel source for Black Hills, directly impact operating costs and necessitate careful rate management.

- Regulatory Environment: While regulated, the company must demonstrate that its proposed rates reflect market realities and economic conditions to gain approval.

Black Hills Corporation's pricing is fundamentally determined by regulated rate structures approved by state public utility commissions, ensuring costs are covered and a fair return is achieved. These structures are dynamic, incorporating riders for fluctuating expenses like fuel and purchased power, and significant capital investments, such as the projected $4.7 billion for 2025-2029, directly influence customer rates.

| Pricing Component | Description | Impact on Customers |

| Regulated Rates | State utility commission approved structures | Ensures cost recovery and fair return on investment |

| Cost Recovery Riders | Mechanisms for fluctuating fuel and power costs | Allows for quicker bill adjustments based on market changes |

| Capital Investments | Infrastructure upgrades and maintenance (e.g., $4.7B for 2025-2029) | Directly reflected in rates to fund essential network improvements |

| Customer Affordability Programs | Energy efficiency rebates and assistance programs | Aims to reduce overall customer energy expenditures |

4P's Marketing Mix Analysis Data Sources

Our Black Hills 4P's Marketing Mix Analysis is meticulously constructed using a blend of official company disclosures, direct consumer insights, and comprehensive market research. We leverage data from brand websites, retail partner platforms, pricing databases, and recent advertising campaign reports.