Biglari SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Biglari Bundle

Biglari Holdings, under the leadership of Sardar Biglari, presents a fascinating case study in strategic execution, marked by bold acquisitions and a unique operational philosophy. While its strengths lie in concentrated ownership and a relentless focus on shareholder value, understanding the full scope of its opportunities and potential threats requires a deeper dive.

Want the full story behind Biglari's distinctive market approach, its competitive advantages, and the potential headwinds it faces? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your own strategic planning and investment decisions.

Strengths

Biglari Holdings Inc. boasts a diversified business model, encompassing sectors like property and casualty insurance, media, restaurants (including Steak n Shake and Western Sizzlin), and oil and gas. This broad operational scope significantly mitigates risk by preventing over-reliance on any single industry's performance. For instance, in the first quarter of 2024, Biglari Holdings reported revenue from its insurance segment, which helps to offset potential volatility in its restaurant operations.

Biglari Holdings' core strength lies in its unwavering commitment to long-term value creation. This is achieved through a strategic approach to acquisitions and a disciplined method of allocating capital, all aimed at enhancing intrinsic value per share. This focus allows the company flexibility to invest in diverse industries where promising opportunities emerge.

Chairman Sardar Biglari consistently highlights the importance of building a robust foundation. This involves nurturing profitable businesses and making opportunistic investments, ensuring that resources are directed towards ventures that can sustain and grow shareholder value over extended periods. For instance, in 2023, Biglari Holdings continued to focus on its portfolio companies, aiming for operational improvements and strategic growth initiatives.

Biglari Holdings boasts a formidable balance sheet, highlighted by a substantial cash holding of approximately $1.4 billion as of December 2024. This significant liquidity offers considerable financial maneuverability, enabling the company to seize emerging market prospects or weather economic headwinds effectively. Such a robust financial foundation is paramount for a holding entity that thrives on strategic investments and acquisitions.

Proven Acquisition Strategy

Biglari Holdings has a well-established track record of expanding its operations through calculated acquisitions. This strategy involves identifying and integrating businesses that exhibit strong financial performance and capable leadership, showcasing a consistent ability to execute this growth plan. The company's approach prioritizes acquiring entire businesses, with a secondary focus on building stakes through stock market investments.

This proven acquisition strategy has been a cornerstone of Biglari's expansion. For instance, their full acquisition of Abraxas Petroleum in recent years exemplifies this ongoing diversification effort, integrating new assets and revenue streams into their portfolio. This approach allows them to capitalize on opportunities and enhance their overall market position.

- Consistent Growth Through Acquisitions: Biglari Holdings has a history of successfully acquiring and integrating businesses, demonstrating a core competency in strategic expansion.

- Diversification Strategy: The company actively pursues diversification by acquiring entire businesses and taking partial ownership stakes, as seen with Abraxas Petroleum.

- Focus on Strong Economics and Management: Acquisitions are carefully selected based on their underlying economic strength and quality of management, ensuring alignment with Biglari's operational standards.

Centralized Capital Control and Decentralized Operations

Biglari Holdings' strength lies in its centralized capital control combined with decentralized operations. This model allows for efficient capital allocation across its various businesses while granting operational autonomy to subsidiary management. This structure has proven effective in scaling the business with a lean corporate headquarters, as evidenced by their ability to manage a diverse portfolio with a relatively small central team.

This approach fosters a high degree of operational efficiency by empowering on-the-ground leadership. For instance, by retaining key personnel responsible for the success of acquired companies, Biglari Holdings ensures continuity and leverages existing expertise. This focus on operational autonomy, coupled with centralized financial oversight, is a core element of their strategic advantage.

The company's ability to effectively manage capital centrally is crucial for strategic investments and resource deployment. In 2023, Biglari Holdings reported total assets of $1.1 billion, demonstrating the scale of capital they manage. This centralized control ensures that capital is deployed where it can generate the highest returns across their portfolio, which includes businesses like Steak n Shake and Maxim.

- Centralized Capital Allocation: Enables strategic deployment of financial resources across the entire business portfolio.

- Decentralized Operational Autonomy: Empowers subsidiary management, fostering efficiency and retaining key talent.

- Lean Corporate Structure: Minimizes overhead at headquarters, allowing for scalable growth.

- Portfolio Management Efficiency: Optimizes performance by leveraging centralized financial oversight with localized operational expertise.

Biglari Holdings' diversified business model spans insurance, media, restaurants, and oil and gas, mitigating risk through varied revenue streams. For example, their insurance segment's performance in early 2024 provided a stable base, even as other sectors experienced fluctuations. This broad operational scope is a significant strength, allowing the company to navigate economic cycles more effectively.

A key strength is the company's substantial liquidity, with approximately $1.4 billion in cash as of December 2024. This robust financial position grants considerable flexibility for opportunistic acquisitions and weathering economic downturns, supporting their long-term value creation strategy.

Biglari Holdings excels at strategic acquisitions, consistently integrating businesses with strong economics and capable management. Their acquisition of Abraxas Petroleum is a prime example of this strategy, expanding their asset base and revenue diversity. This disciplined approach to growth underpins their expansion efforts.

The company's operational structure, characterized by centralized capital control and decentralized operations, fosters efficiency. This model empowers subsidiary management while ensuring strategic capital allocation, enabling scalable growth with a lean corporate headquarters.

| Financial Metric | Value (as of Dec 2024) | Significance |

|---|---|---|

| Cash and Equivalents | ~$1.4 billion | Provides significant financial flexibility and capacity for strategic investments. |

| Total Assets | ~$1.1 billion (as of 2023) | Indicates the scale of capital managed and deployed across diverse operations. |

What is included in the product

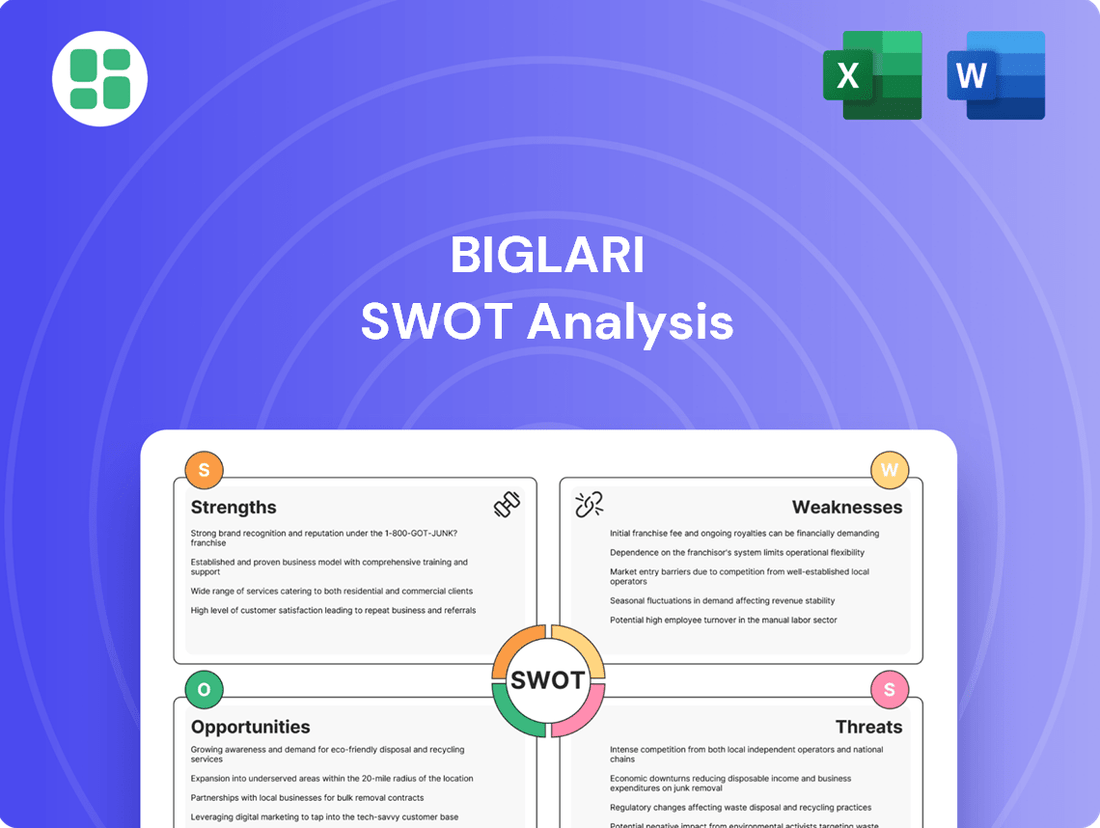

Delivers a strategic overview of Biglari’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

The Biglari SWOT Analysis offers a clear, actionable framework to identify and address critical business challenges, transforming potential weaknesses into strategic advantages.

Weaknesses

Biglari Holdings experienced a significant downturn in its operating performance, with pre-tax operating earnings from core businesses falling 25.9% to $102.52 per share in 2024, totaling $24.1 million in net operating earnings. Although the first quarter of 2025 showed a rebound in pre-tax operating earnings, this was overshadowed by a year-over-year revenue decrease in the second quarter and for the first half of 2025. This pattern indicates ongoing difficulties in achieving consistent revenue expansion from its primary business activities.

Biglari Holdings' reported net earnings are heavily swayed by its investment portfolio's performance, creating significant volatility. This was evident in Q1 2025, where a $33.3 million net loss stemmed largely from investment partnership setbacks, even as core operations showed improvement.

Management's practice of distinguishing investment gains or losses from operating earnings highlights how these market swings can mask the underlying health of the company's main businesses. Investors must look beyond these headline figures to understand the true operational results.

The Steak n Shake chain, a significant part of Biglari's operations, is still grappling with difficulties. Reports indicate ongoing unit closures and a noticeable drop in customer visits throughout 2024. This persistent underperformance in a core segment negatively impacts the company's overall financial health and how customers view the brand.

Despite efforts to refranchise company-operated locations, a number of these stores remained closed or were slated for sale as of the end of 2024. This ongoing transition process highlights the persistent operational hurdles within the restaurant segment, potentially hindering immediate improvements in performance metrics.

Concentrated Control and Governance Structure

Sardar Biglari's substantial control as Chairman and CEO, with approximately 74.3% of the voting interest as of December 31, 2024, concentrates decision-making power. This centralized structure, which exempts Biglari Holdings from certain NYSE governance standards like a nominating committee, could present challenges.

The lack of independent oversight in a controlled company environment raises potential concerns for minority shareholders. Specifically, issues such as succession planning and the possibility of conflicts of interest may arise due to this concentrated control.

- Concentrated Voting Power: Sardar Biglari held approximately 74.3% of the voting interest as of December 31, 2024.

- Exemption from Governance Rules: As a controlled company, Biglari Holdings is not subject to all NYSE corporate governance requirements.

- Potential Governance Risks: Centralized control may lead to challenges in succession planning and potential conflicts of interest for passive shareholders.

Material in Internal Controls

Biglari Holdings has acknowledged material weaknesses in its internal control over financial reporting as of March 1, 2025. This situation raises concerns about the potential for errors or inaccuracies in financial statements, which could impact decision-making.

These control deficiencies can lead to a greater risk of financial misstatements, potentially affecting the reliability of the company's reported performance. Such issues might also signal inefficiencies within the company's operational processes.

Effectively addressing these identified weaknesses is paramount for Biglari Holdings. It is essential for restoring and maintaining investor confidence and ensuring the integrity and accuracy of all financial reporting.

- Material Weaknesses Identified: Biglari Holdings reported material weaknesses in internal controls as of March 1, 2025.

- Risk of Misstatement: These weaknesses increase the likelihood of financial reporting errors.

- Investor Confidence: Remediation is critical for maintaining trust with stakeholders.

- Operational Efficiency: Addressing control issues can also improve business process effectiveness.

Biglari Holdings faces significant operational challenges, particularly with its Steak n Shake segment, which saw continued unit closures and declining customer traffic throughout 2024. The company's reliance on investment portfolio performance creates earnings volatility, as seen in the Q1 2025 net loss driven by investment partnership setbacks. Furthermore, material weaknesses in internal control over financial reporting as of March 1, 2025, raise concerns about the accuracy of financial statements.

| Metric | 2024 (or latest available) | Impact |

|---|---|---|

| Steak n Shake Unit Performance | Continued closures and traffic declines in 2024 | Negative impact on overall revenue and brand perception |

| Q1 2025 Net Earnings Driver | $33.3 million net loss from investment partnerships | Masks underlying operational performance, creates volatility |

| Internal Controls | Material weaknesses identified as of March 1, 2025 | Increased risk of financial misstatement, erodes investor confidence |

Full Version Awaits

Biglari SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive document offers a thorough examination of Biglari's strategic position. You'll gain access to the complete, actionable insights that informed this analysis.

Opportunities

Biglari Holdings' core strategy revolves around acquiring businesses, presenting a constant avenue for growth and diversification. The company actively seeks to purchase entire businesses or take stakes through the stock market, prioritizing those with robust financial performance and capable management teams.

This opportunistic acquisition strategy allows Biglari to expand its reach across various sectors. For instance, in 2024, the company continued to explore opportunities, building on its history of strategic purchases like the acquisition of Maxim Integrated Products in 2021 for approximately $1.9 billion, demonstrating its commitment to this growth model.

The ongoing shift of Steak n Shake restaurants to a franchise partner model presents a prime opportunity to boost profitability and trim operational expenses. This approach cultivates owner-operators who are deeply invested in their locations' success, potentially driving greater efficiency and a superior customer experience.

Biglari Holdings' strategy to refranchise its remaining company-operated units is a key move. As of the first quarter of 2024, the company had refranchised 389 Steak n Shake locations, with a goal to complete the transition of all company-operated restaurants. This focus aims to unlock value by empowering franchisees who have a direct stake in unit-level performance.

Biglari Holdings' robust financial position, bolstered by a strong balance sheet and significant cash reserves, positions it advantageously to pursue opportunities arising from market consolidation. This financial strength allows the company to act decisively when attractive acquisition targets emerge in various sectors.

The company's proactive engagement in the restaurant sector, exemplified by its offer to acquire the remaining shares of El Pollo Loco, underscores its strategic intent to leverage market consolidation. This move signals a willingness to deploy capital to enhance its portfolio and capitalize on potential synergies.

Leveraging Operational Efficiency

Biglari Holdings demonstrated impressive operational efficiency, achieving a record EBITDA margin of 41.6% in the second quarter of 2025, despite revenue headwinds. This highlights a core strength in cost management and operational execution.

This robust margin indicates a significant opportunity to translate operational prowess into enhanced profitability across all of Biglari's business units. By focusing on maintaining these high margins, the company can drive substantial long-term value creation for its shareholders.

- Record EBITDA Margin: 41.6% achieved in Q2 2025, showcasing exceptional cost control.

- Cross-Segment Leverage: Potential to apply efficient practices to diverse business segments for profit enhancement.

- Value Creation Driver: Sustaining high operational margins directly contributes to increasing shareholder value.

Share Repurchase Program to Enhance Value

Biglari Holdings' stock has at times traded below its book value, creating a prime opportunity for the company to buy back its own shares. This strategic move can significantly boost the intrinsic value per share for those shareholders who remain invested.

The company has actively pursued share repurchases, as evidenced by the increase in treasury stock during 2024. This demonstrates a commitment to actively managing shareholder equity and enhancing long-term value.

- Strategic Repurchases: Buying back shares when the stock is undervalued directly benefits remaining shareholders by increasing their ownership stake in the company's assets and earnings on a per-share basis.

- 2024 Treasury Stock Growth: An increase in treasury stock in 2024 indicates the company's execution of its share repurchase strategy, a positive signal for value enhancement.

- Intrinsic Value Enhancement: By reducing the number of outstanding shares, earnings per share and book value per share are mathematically improved, assuming the company's underlying business performance remains stable or improves.

Biglari Holdings is well-positioned to capitalize on market consolidation, leveraging its strong financial standing and cash reserves to pursue attractive acquisition targets across various sectors. The ongoing refranchising of Steak n Shake restaurants presents a significant opportunity to improve profitability and reduce operational costs by empowering invested owner-operators.

The company's ability to achieve a record EBITDA margin of 41.6% in Q2 2025 highlights exceptional operational efficiency, offering a chance to translate this strength into enhanced profitability across its diverse business units. Furthermore, the stock's trading below book value creates a prime opportunity for value-enhancing share repurchases.

| Opportunity Area | Description | Key Data/Action |

|---|---|---|

| Market Consolidation | Acquiring businesses or stakes during market consolidation. | Strong balance sheet and cash reserves enable decisive action. |

| Steak n Shake Refranchising | Shifting to a franchise partner model for restaurants. | 389 locations refranchised as of Q1 2024; goal to complete all company-operated units. |

| Operational Efficiency | Leveraging high operational margins across business units. | Record EBITDA margin of 41.6% achieved in Q2 2025. |

| Share Repurchases | Buying back stock when trading below book value. | Increase in treasury stock during 2024 indicates active execution of strategy. |

Threats

Biglari Holdings faces significant headwinds from intense industry competition across its core segments. In the quick-service restaurant space, Steak n Shake grapples with a landscape populated by numerous established and emerging brands, all vying for consumer attention and spending. Similarly, its insurance operations, primarily through First Guard Insurance Group, operate within a crowded and constantly evolving market where differentiation and customer retention are paramount.

This competitive pressure directly impacts Biglari's ability to maintain pricing power and market share. For instance, the quick-service restaurant industry in 2024 continues to see aggressive promotional activity and menu innovation from major players, forcing brands like Steak n Shake to invest heavily in marketing and operational efficiency to remain competitive. In the insurance sector, regulatory changes and the rise of InsurTech firms in 2025 are further intensifying the competitive landscape, potentially squeezing profit margins.

Economic downturns pose a significant threat to Biglari Holdings, particularly impacting Steak n Shake's reliance on discretionary consumer spending. A recession could lead to reduced dining out, directly affecting sales. For instance, during the COVID-19 pandemic's initial economic shock in early 2020, restaurant sales experienced sharp declines, a scenario that could be mirrored in future economic slowdowns.

Furthermore, Biglari's substantial investment portfolio is vulnerable to market volatility during economic contractions. A broad market downturn, such as the one experienced in 2022 where the S&P 500 declined by 19.4%, could result in significant unrealized or realized losses on these holdings, impacting the company's overall financial health and valuation.

Biglari Holdings operates in highly regulated sectors, including restaurants and insurance, exposing it to continuous risks from evolving government policies. For instance, potential increases in minimum wage laws or expanded health insurance mandates could directly inflate operational expenses, potentially squeezing profit margins in its restaurant divisions.

Changes in insurance regulations also pose a significant threat. State-specific laws governing how insurance subsidiaries can distribute dividends could limit capital availability for the parent company, impacting its financial flexibility and strategic investment capacity.

Brand Reputation and Operational Setbacks

The persistent operational issues at Steak n Shake, marked by unit closures and a tarnished public image, directly threaten Biglari Holdings' broader brand reputation. For instance, Steak n Shake's same-store sales saw a decline in the first quarter of 2024, continuing a trend that has negatively impacted investor confidence.

Further negative press or significant operational failures within the restaurant division could alienate customers and negatively affect the financial results of the entire corporation. Biglari Holdings reported a net loss in Q1 2024, partly attributable to ongoing challenges in its restaurant segment, underscoring this vulnerability.

- Ongoing Unit Closures: Steak n Shake has continued to close underperforming locations, a visible sign of operational strain.

- Negative Public Perception: Past service issues and store conditions have created lingering negative sentiment among consumers.

- Impact on Investor Confidence: Persistent operational setbacks can erode investor trust, potentially affecting share price and access to capital.

- Financial Performance Drag: Weakness in the restaurant segment directly impacts the consolidated financial results of Biglari Holdings.

Investment Portfolio Volatility

Biglari Holdings' reliance on investment income introduces significant portfolio volatility. For instance, the company reported a substantial investment loss in the first quarter of 2025, which directly impacted its overall profitability, overshadowing the performance of its operating segments.

This sensitivity to market fluctuations means that even strong operational results can be negated by investment downturns. Such unpredictability makes forecasting Biglari Holdings' total financial performance a challenging endeavor, as the company's net earnings are directly tied to the often-unpredictable movements of the financial markets.

- Investment Income Dependency: A significant portion of Biglari Holdings' earnings is derived from its investment portfolio, making it vulnerable to market swings.

- Q1 2025 Impact: The company experienced considerable investment losses in Q1 2025, leading to an overall net loss despite positive operational performance.

- Financial Unpredictability: This reliance on investment activities inherently introduces unpredictability into the company's total financial results, exposing it to market volatility.

Biglari Holdings faces significant threats from intense industry competition across its restaurant and insurance segments, with brands like Steak n Shake battling numerous rivals. Economic downturns also pose a risk, impacting discretionary spending and the value of its investment portfolio, as seen in the 19.4% S&P 500 decline in 2022. Regulatory changes in both sectors can increase costs and limit capital flow, while persistent operational issues at Steak n Shake, evidenced by unit closures and a Q1 2024 same-store sales decline, damage its reputation and financial performance.

SWOT Analysis Data Sources

This Biglari SWOT analysis is built upon a foundation of robust data, including the company's official financial filings, comprehensive market research reports, and expert analyses of the restaurant and insurance industries. These sources provide the necessary insights to accurately assess Biglari's internal capabilities and external market positioning.