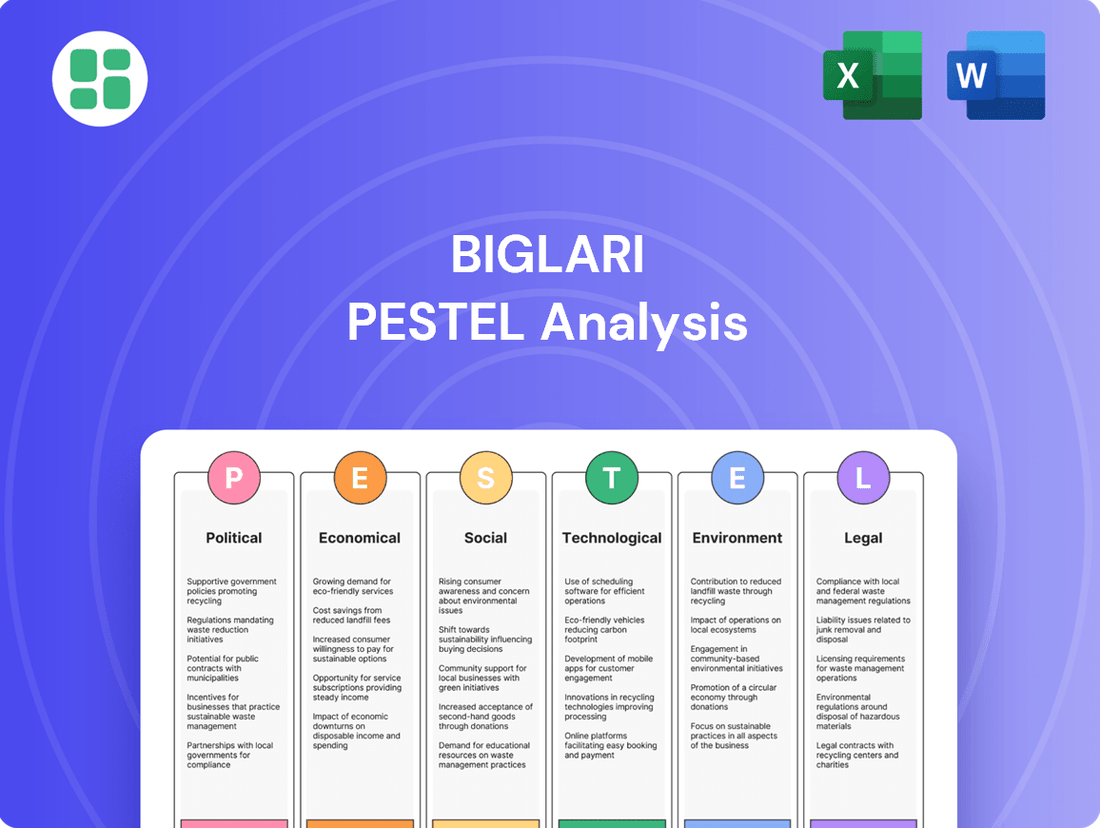

Biglari PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Biglari Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting Biglari's strategic direction. This comprehensive PESTLE analysis provides the essential intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now for actionable insights to inform your investment decisions and competitive strategy.

Political factors

Biglari Holdings, especially its Steak n Shake division, faces significant influence from shifting government regulations concerning food safety and product labeling. For instance, the U.S. Food and Drug Administration (FDA) continuously updates its guidelines on allergen declarations and nutritional transparency, impacting how restaurants must present information to consumers. These evolving standards often require costly menu redesigns and operational overhauls to ensure compliance, as seen in the increased scrutiny of ingredient sourcing and potential cross-contamination risks.

Changes in labor laws, such as minimum wage hikes, directly impact Biglari's restaurant segment's operating expenses. For instance, a federal minimum wage increase to $15 per hour, as proposed in some legislative discussions, could significantly raise payroll costs. This necessitates careful management of staffing levels and potentially exploring more automation to maintain profitability.

New requirements for employee benefits or scheduling flexibility can also add to Biglari's operational burden. These policy shifts may require adjustments in pricing strategies or operational efficiencies to offset increased costs and preserve profit margins. Adapting to these evolving state and federal mandates is crucial for sustained financial performance.

Biglari Holdings, as a diversified entity, is significantly influenced by trade policies impacting its supply chains. For instance, Steak n Shake's reliance on imported food ingredients means that tariffs or trade disputes could directly increase costs. In 2024, global supply chain disruptions, exacerbated by geopolitical tensions, led to an average increase of 5-10% in freight costs for many industries, a factor Biglari must navigate.

Industry-Specific Regulatory Scrutiny

The insurance sector, a key component of Biglari Holdings' operations, is subject to persistent regulatory oversight. Evolving mandates concerning solvency requirements, data privacy standards, and market conduct profoundly impact operations. For instance, in 2024, the National Association of Insurance Commissioners (NAIC) continued to refine its solvency modernization efforts, emphasizing risk-based capital frameworks, which directly affect how insurers like those within Biglari must manage their financial reserves.

Regulators are placing greater emphasis on ensuring fairness, transparency in dealings, and robust data security. This heightened focus means Biglari must continually adapt its business practices and compliance strategies. The increasing stringency around data protection, influenced by regulations such as the California Consumer Privacy Act (CCPA) and its subsequent amendments, necessitates significant investment in cybersecurity and data governance. Failure to comply can lead to substantial penalties, impacting profitability and operational continuity.

- Solvency Requirements: Ongoing refinements to risk-based capital (RBC) models by bodies like the NAIC in 2024 require insurers to maintain adequate capital against specific risks, impacting Biglari's capital allocation strategies.

- Data Privacy: Adherence to evolving data privacy laws, such as the CCPA and potential federal legislation, demands robust data handling protocols and security measures, with non-compliance risking significant fines.

- Market Conduct: Regulators are scrutinizing sales practices, advertising, and claims handling to ensure consumer protection, requiring Biglari's insurance entities to maintain high standards of transparency and ethical conduct.

- Compliance Costs: The continuous adaptation to these regulatory shifts necessitates ongoing investment in compliance infrastructure and personnel, adding to operational expenses for Biglari's insurance segments.

Political Influence and Public Health Initiatives

Government-led public health initiatives, such as campaigns promoting healthier eating or discouraging certain food additives, directly influence consumer preferences and demand for specific menu items at Steak n Shake. Biglari Holdings must actively monitor these evolving trends and potentially adapt its offerings to align with public health goals, thereby avoiding negative public perception. For instance, in 2024, the U.S. Department of Health and Human Services continued its focus on reducing sodium intake, a factor relevant to fast-casual dining.

Political stances on health and wellness can indirectly shape the entire restaurant landscape. Regulations concerning food labeling, nutritional information disclosure, and even marketing practices for food products are often influenced by political agendas. By staying ahead of these potential regulatory shifts, Biglari Holdings can better position Steak n Shake for sustained success.

- Government Health Campaigns: Initiatives promoting reduced sugar and processed food consumption gained traction in 2024, impacting consumer choices in the fast-food sector.

- Nutritional Labeling Regulations: Evolving political discussions around front-of-package nutrition labeling could require menu adjustments.

- Food Additive Scrutiny: Political pressure to restrict or ban certain artificial ingredients may necessitate menu reformulation.

Government policy shifts, particularly concerning labor and food safety, directly impact Biglari Holdings' operational costs and compliance requirements. For instance, ongoing debates around minimum wage increases and evolving FDA regulations on ingredient transparency in 2024 necessitate continuous adaptation in restaurant operations and supply chain management.

Trade policies and geopolitical stability are critical for Biglari's supply chain, especially for its restaurant division. Tariffs or disruptions, as seen with increased freight costs averaging 5-10% in 2024 due to global tensions, can directly affect ingredient costs and availability.

The insurance sector within Biglari Holdings is heavily influenced by regulatory frameworks like those from the NAIC, which in 2024 continued to refine risk-based capital models, impacting capital allocation. Furthermore, stringent data privacy laws, such as CCPA, demand significant investment in cybersecurity, with non-compliance risking substantial financial penalties.

Public health initiatives and political discourse around nutrition, such as campaigns to reduce sodium intake in 2024, can shape consumer preferences and menu development for Steak n Shake. This requires Biglari to monitor trends and potentially reformulate offerings to align with public health goals and avoid negative perceptions.

What is included in the product

The Biglari PESTLE Analysis provides a comprehensive examination of how external macro-environmental factors influence the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering strategic insights.

A clear, actionable breakdown of the Biglari PESTLE factors, offering a structured approach to identifying and mitigating potential business disruptions.

Economic factors

Inflationary pressures are a significant headwind for Biglari Holdings, especially impacting its restaurant operations. In 2024, the U.S. experienced persistent inflation, with the Consumer Price Index (CPI) showing a notable increase, directly translating to higher costs for food ingredients, labor wages, and essential utilities. These rising operational expenses can directly compress profit margins for Biglari's restaurant brands if not offset by strategic price adjustments or operational efficiencies.

The insurance segment of Biglari Holdings is also susceptible to these economic forces. Higher inflation means increased severity in insurance claims, as the cost to repair or replace damaged property, particularly in the construction and automotive sectors, escalates. This can lead to greater payouts for the insurance subsidiaries, potentially impacting their profitability and underwriting results throughout 2024 and into 2025.

Consumer spending habits are a critical driver for Steak n Shake's performance, as dining out is largely discretionary. In early 2024, reports indicated that while overall consumer spending showed resilience, there was a noticeable shift towards value-oriented options amidst persistent inflation. This means Biglari Holdings needs to carefully consider how its pricing and offerings align with consumers' evolving willingness and ability to spend on dining experiences.

Disposable income levels directly impact how often consumers choose to visit restaurants like Steak n Shake. As of the latest available data in late 2024, while wage growth has been present, the real disposable income for many households has been squeezed by rising costs for essentials such as housing and groceries. This necessitates that Biglari Holdings actively monitors these trends and potentially adjusts its menu or promotional strategies to remain attractive to a broader consumer base.

Interest rate fluctuations directly impact Biglari Holdings' financial health. Rising rates increase borrowing costs for the company and its portfolio businesses, potentially squeezing margins. Conversely, lower rates can reduce debt servicing expenses, offering a tailwind.

Market volatility, often tied to interest rate shifts, creates significant swings in investment returns. Biglari Holdings' net earnings are particularly sensitive to these gains and losses. For instance, the company's Q2 2025 results showcased this, with investment gains helping to offset previous losses and boost overall profitability.

Competitive Landscape and Market Saturation

The restaurant and insurance sectors, where Biglari Holdings operates, are intensely competitive. In 2024, the U.S. restaurant industry faced significant headwinds, with profit margins for many establishments hovering around 3-6%, making differentiation crucial. Similarly, the insurance market is crowded, with major players constantly innovating to capture and retain customers, especially during economic slowdowns.

Economic downturns often exacerbate competition, potentially triggering aggressive pricing strategies or heightened marketing investments as companies fight for a shrinking customer base. For Biglari Holdings, this necessitates a sustained focus on brand distinctiveness and unique value propositions to secure its position in these well-established and often saturated markets.

Key competitive considerations for Biglari Holdings include:

- Brand Differentiation: Maintaining unique selling propositions across its restaurant brands is vital to stand out.

- Market Saturation: Navigating industries with many established players requires strategic innovation.

- Economic Sensitivity: Adapting to economic fluctuations that can intensify competitive pressures.

- Customer Retention: Implementing strategies to keep customers loyal amidst aggressive market competition.

Economic Growth and Business Expansion Opportunities

Periods of robust economic growth create fertile ground for Biglari Holdings to pursue strategic expansion. This can manifest as growing its current restaurant and insurance operations, or through targeted acquisitions of complementary businesses. A healthy economy typically translates to increased disposable income, directly benefiting consumer discretionary spending on dining out and boosting demand for insurance services.

The company's overarching objective of long-term value creation is intrinsically tied to its ability to effectively identify and seize these growth opportunities presented by favorable economic conditions. For instance, during periods of sustained GDP expansion, Biglari Holdings can leverage increased consumer confidence to fuel business development.

- Economic Growth Impact: Strong economic growth, characterized by rising GDP and employment, directly fuels consumer spending, benefiting Biglari's restaurant segment.

- Insurance Sector Demand: A thriving economy often correlates with increased business activity and personal wealth, driving demand for insurance products.

- Investment Opportunities: Periods of economic expansion provide opportunities for Biglari to deploy capital into new ventures or acquire underperforming assets at attractive valuations.

- 2024-2025 Outlook: Projections for 2024 and 2025 indicate continued, albeit potentially moderating, economic expansion in key markets, suggesting ongoing potential for Biglari's strategic initiatives.

Economic factors significantly shape Biglari Holdings' performance, influencing everything from operational costs to consumer demand. Persistent inflation in 2024, with the CPI showing a notable increase, directly impacts Biglari's restaurant segment by raising ingredient and labor costs. Similarly, the insurance arm faces higher claim severities due to escalating repair costs, affecting profitability in 2024 and into 2025.

Consumer spending, a key driver for Steak n Shake, has shown resilience but a shift towards value options in early 2024 due to inflation. This trend, coupled with squeezed disposable incomes from rising essential costs, necessitates strategic pricing and promotional adjustments by Biglari Holdings to remain competitive.

Interest rate hikes in 2024 increased borrowing costs for Biglari, impacting margins, while market volatility affected investment returns, as seen in Q2 2025 earnings where investment gains offset losses. The competitive landscape in both restaurants and insurance intensified, with profit margins in the restaurant sector around 3-6% in 2024, demanding strong brand differentiation.

| Economic Factor | Impact on Biglari Holdings | 2024-2025 Data/Outlook |

|---|---|---|

| Inflation | Increased operational costs (restaurants), higher claim severities (insurance) | Persistent inflation, CPI increase in 2024. |

| Consumer Spending | Affects restaurant traffic, shift to value options | Resilient but value-seeking consumer behavior in early 2024. |

| Disposable Income | Influences dining frequency, necessitates pricing adjustments | Squeezed by rising essential costs in late 2024. |

| Interest Rates | Impacts borrowing costs and investment returns | Rising rates increased borrowing costs; market volatility affected investment gains in Q2 2025. |

| Competition | Intensified pricing and marketing pressures | Restaurant profit margins around 3-6% in 2024; crowded insurance market. |

What You See Is What You Get

Biglari PESTLE Analysis

The Biglari PESTLE analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real preview of the Biglari PESTLE analysis product you’re buying—delivered exactly as shown, no surprises. It covers all the essential political, economic, social, technological, legal, and environmental factors impacting the company.

The content and structure shown in this preview is the same Biglari PESTLE analysis document you’ll download after payment, providing a comprehensive overview for strategic decision-making.

Sociological factors

Consumer tastes are shifting, with a growing emphasis on health-conscious choices. This includes a significant rise in demand for plant-based options and a greater awareness of specific dietary needs, such as gluten-free or low-sodium meals. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $160.5 billion by 2030, demonstrating a clear trend Biglari Holdings must consider for Steak n Shake's menu.

These evolving dietary preferences directly impact restaurant concepts. Steak n Shake, like other quick-service establishments, needs to actively monitor and adapt its menu to remain competitive and attractive to a wider audience. Failing to cater to these trends could mean missing out on substantial market segments and potential revenue growth.

Modern consumers, particularly those in the 18-34 age bracket, overwhelmingly prioritize convenience. A 2024 survey indicated that 70% of diners are more likely to choose a restaurant that offers easy online ordering and delivery. This directly impacts Biglari Holdings' Steak n Shake, as seamless mobile ordering and efficient curbside pickup are no longer optional but essential for customer retention and acquisition.

The restaurant and service sectors, where Biglari Holdings operates, are particularly sensitive to workforce demographics. In 2024, the U.S. Bureau of Labor Statistics reported that the leisure and hospitality sector, a key area for Biglari's subsidiaries like Steak 'n Shake, experienced a significant job opening rate, indicating persistent labor demand. This highlights ongoing challenges in attracting and retaining staff, exacerbated by evolving generational expectations around work-life balance and compensation.

Shifts in generational work ethics, with younger workers often prioritizing flexibility and purpose, directly influence staffing models. For Biglari's operations, this translates to a need for adaptable scheduling and potentially higher labor costs to remain competitive in securing skilled employees. The increasing competition for talent across industries further strains labor availability, impacting operational efficiency and service quality.

Social Media and Brand Reputation

Social media's pervasive influence means public opinion can rapidly shape brand reputation for Steak n Shake and other Biglari Holdings entities. In 2024, platforms like TikTok and Instagram saw significant user engagement with restaurant content, with viral trends directly impacting foot traffic for many brands. Negative sentiment or widespread consumer complaints can quickly translate into declining sales and damaged brand perception, making proactive reputation management essential.

For instance, a poorly handled customer service issue shared widely on X (formerly Twitter) in early 2025 could reach millions within hours, necessitating swift and transparent responses. Biglari Holdings must actively monitor social channels and engage with customers to mitigate potential reputational damage. This includes addressing feedback, responding to concerns, and fostering positive interactions online.

- 2024 Social Media Engagement: Over 70% of consumers reported that social media influenced their dining choices, highlighting the critical role of online presence.

- Reputation Management Costs: Companies may allocate significant budgets in 2024-2025 for social media monitoring and crisis communication teams.

- Viral Content Impact: A single viral video showcasing a positive or negative experience at a Steak n Shake location can generate millions of views and influence thousands of potential customers.

Health and Wellness Trends Post-Pandemic

The lingering effects of the pandemic have significantly amplified consumer focus on hygiene, health, and safety within dining establishments. This heightened awareness means that businesses like Steak n Shake must consistently showcase stringent cleanliness measures. Furthermore, adapting to this societal shift necessitates offering choices that appeal to patrons prioritizing healthier options.

This evolving consumer sentiment directly impacts operational strategies and how restaurants communicate their value proposition. For instance, a 2024 survey indicated that over 60% of consumers consider cleanliness a top factor when choosing a restaurant. This trend underscores the need for visible sanitation practices and potentially expanding menus with lighter fare or customizable healthy choices.

- Heightened Hygiene Expectations: Consumers now demand visible and verifiable cleanliness protocols in all dining settings.

- Demand for Health-Conscious Options: There's a growing preference for menu items that align with healthier lifestyle choices.

- Impact on Brand Perception: Restaurants that effectively address these concerns are likely to see improved customer loyalty and trust.

Societal expectations regarding health and wellness continue to shape consumer choices, with a notable increase in demand for plant-based and customizable meal options. In 2024, the global plant-based food market was valued at approximately $32.5 billion, with projections indicating continued robust growth. This trend necessitates that Steak n Shake, a Biglari Holdings entity, adapt its menu to cater to these evolving dietary preferences to maintain market relevance and capture new customer segments.

Convenience remains a paramount factor for modern consumers, particularly younger demographics. A 2024 study revealed that over 75% of individuals aged 18-34 consider ease of ordering and delivery crucial when selecting a restaurant. Biglari Holdings must therefore prioritize seamless digital ordering platforms and efficient delivery or pickup services for Steak n Shake to meet these expectations.

The labor market within the restaurant industry presents ongoing challenges, with high job opening rates persisting in 2024. For Biglari Holdings, this means Steak n Shake faces increased competition for talent, requiring competitive compensation and flexible work arrangements to attract and retain employees. Generational shifts in work ethics, emphasizing work-life balance, further complicate staffing efforts.

Public perception, heavily influenced by social media, can rapidly impact brand reputation. In 2024, social media engagement significantly influenced dining decisions, with over 70% of consumers reporting its impact. Biglari Holdings must actively manage Steak n Shake's online presence, addressing customer feedback promptly to mitigate reputational risks and foster positive brand sentiment.

Technological factors

The restaurant sector is rapidly embracing digital tools, making AI analytics, online ordering, digital menus, and self-service kiosks crucial for success. For Steak n Shake to stay competitive, Biglari Holdings needs to prioritize investments in these technologies to elevate customer interactions and streamline operations.

These advancements not only boost efficiency but also provide vital customer data, enabling more informed strategic choices. For instance, a 2024 report indicated that restaurants with robust online ordering systems saw a 20% increase in order volume compared to those without.

The food service industry is witnessing a significant surge in automation and robotics, promising enhanced operational efficiency. These technologies are being integrated into food preparation, cooking, and even customer service, leading to more consistent product quality and faster service times. For instance, by 2024, it's estimated that the global food robotics market will reach $4.4 billion, highlighting the rapid adoption.

Biglari Holdings can leverage this trend for its Steak n Shake brand to streamline kitchen operations and mitigate the impact of ongoing labor shortages. Implementing robotic arms for repetitive tasks like flipping burgers or automated fry stations could significantly reduce labor costs, which in 2023 averaged around 25-35% of revenue for fast-casual restaurants. This strategic adoption can also improve food safety and order accuracy.

Biglari Holdings can harness advanced data analytics and AI to deeply understand customer preferences at Steak n Shake, leading to more effective personalized marketing campaigns and tailored menu suggestions. This technological shift allows for predicting demand with greater accuracy, which is crucial for optimizing inventory and reducing waste.

In 2024, the restaurant industry saw a significant increase in the adoption of AI for customer relationship management, with many chains reporting improved customer retention rates. For Steak n Shake, this translates to a potential for enhanced customer loyalty by offering experiences and promotions that resonate more directly with individual diners.

Cybersecurity and Data Protection Technologies

Biglari Holdings, with its expanding digital footprint across restaurant operations, insurance services, and other ventures, faces escalating cybersecurity threats. Protecting sensitive customer data and proprietary information is paramount. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the significant financial and reputational risks involved.

To mitigate these risks and ensure compliance with evolving data privacy laws like GDPR and CCPA, Biglari Holdings must prioritize investments in advanced data protection technologies. This includes implementing robust encryption, multi-factor authentication, and continuous security monitoring systems. The company's commitment to safeguarding customer trust hinges on its ability to maintain the integrity and confidentiality of its digital assets.

- Cybersecurity Investment: Biglari Holdings needs to allocate resources towards cutting-edge cybersecurity solutions to protect against data breaches and cyberattacks.

- Regulatory Compliance: Adherence to data protection regulations is crucial, requiring sophisticated technologies to manage and secure personal information.

- Customer Trust: Maintaining customer confidence relies heavily on demonstrating a strong commitment to data security and privacy.

- Digital Transformation Risks: As digitalization accelerates, so does the exposure to cyber threats, making proactive technological defenses essential.

Innovation in Insurance Technology (Insurtech)

The insurance sector is undergoing a significant transformation driven by Insurtech innovations. Artificial intelligence is increasingly used for sophisticated risk analysis, while telematics offers dynamic pricing models based on actual usage. Blockchain technology is also being explored for streamlining claims processing and enhancing transparency.

For Biglari Holdings' insurance operations, adopting these technological advancements is crucial for staying competitive. Embracing AI can lead to more accurate underwriting, reducing potential losses. Telematics can personalize customer experiences and optimize pricing, while blockchain can improve the speed and security of claims settlements.

- Insurtech Market Growth: The global Insurtech market was valued at approximately $11.1 billion in 2023 and is projected to reach $34.1 billion by 2028, growing at a compound annual growth rate (CAGR) of 25.2% during this period.

- AI in Insurance: AI adoption in the insurance industry is expected to save insurers billions annually through improved efficiency in areas like claims processing and fraud detection.

- Telematics Adoption: Telematics insurance, or usage-based insurance (UBI), saw significant growth, with an estimated 40% of new auto policies in the U.S. expected to be UBI-based by 2025.

- Blockchain Use Cases: Pilot programs for blockchain in insurance have demonstrated potential for reducing claims processing times by up to 30% and cutting administrative costs.

The restaurant industry's embrace of AI and automation is reshaping operations, with online ordering and self-service kiosks becoming standard. Biglari Holdings must invest in these technologies for Steak n Shake to enhance customer experience and efficiency.

Automation in food preparation promises consistency and speed, a trend supported by the global food robotics market projected to reach $4.4 billion by 2024. This can help Biglari mitigate labor shortages and costs, which averaged 25-35% of revenue in fast-casual dining in 2023.

AI-driven customer analytics allow for personalized marketing and demand forecasting, crucial for inventory management and waste reduction. In 2024, restaurants using AI for CRM reported improved customer retention.

Biglari Holdings faces growing cybersecurity risks with its digital expansion; the global cost of cybercrime was projected to hit $10.5 trillion annually by 2025. Investing in robust data protection is essential for customer trust and regulatory compliance.

Legal factors

Biglari Holdings, particularly through its Steak n Shake operations, navigates a complex web of federal, state, and local food safety and health regulations. These rules cover everything from implementing Hazard Analysis and Critical Control Points (HACCP) plans to maintaining rigorous sanitation standards and ensuring responsible ingredient sourcing.

Failure to adhere to these mandates can result in severe consequences, including hefty fines, temporary or permanent operational shutdowns, and significant damage to the brand's reputation. For instance, in 2023, the U.S. Food and Drug Administration (FDA) continued to enforce strict guidelines on food labeling and allergen control, impacting restaurant supply chains.

Staying compliant is not merely a legal obligation but a fundamental business imperative for Biglari Holdings to maintain consumer trust and operational continuity in the competitive fast-casual dining sector.

The insurance sector is heavily regulated, with state and federal laws dictating everything from solvency standards to consumer protection and data privacy. For Biglari Holdings, staying compliant with frameworks like the NAIC model laws and the UK's Financial Conduct Authority (FCA) Consumer Duty is paramount for maintaining licenses and operational integrity.

As Steak n Shake shifts to a franchise-partner model, Biglari Holdings faces a complex legal landscape governed by franchise laws. Compliance with disclosure requirements, territorial rights, and dispute resolution clauses within franchise agreements is paramount for fostering a stable and expanding franchise network.

Privacy and Data Protection Laws

Biglari Holdings, operating in the restaurant sector and particularly in insurance, must navigate a complex landscape of privacy and data protection laws. These regulations, similar to the EU's GDPR or various US state-level data security statutes, mandate stringent handling of customer and sensitive personal information. Failure to comply can result in substantial financial penalties and severely damage consumer confidence.

For instance, in 2023, the US saw a significant increase in data breach notification laws, with 16 states having comprehensive requirements. Biglari's insurance segment, dealing with health and financial data, is especially vulnerable. The potential fines under these laws can be substantial; for example, GDPR violations can reach up to 4% of global annual revenue or €20 million, whichever is higher.

- US State Data Breach Notification Laws: As of late 2023, all 50 US states have laws requiring notification to individuals following a data breach.

- GDPR Impact: While Biglari is a US-based company, its operations or customer base could indirectly fall under GDPR if it handles data of EU residents, with fines up to €20 million or 4% of global annual turnover.

- CCPA/CPRA Enforcement: California's privacy laws, like the CCPA and its successor CPRA, impose significant obligations on businesses regarding consumer data rights and data security, with potential penalties for violations.

- Industry-Specific Regulations: Beyond general privacy laws, the insurance industry often faces sector-specific regulations concerning data handling and cybersecurity, adding another layer of compliance.

Intellectual Property and Brand Protection

Biglari Holdings places a strong emphasis on safeguarding its intellectual property, particularly its brand names and proprietary recipes, crucial for its Steak n Shake operations. This legal focus involves continuous vigilance against trademark infringement and the readiness to pursue legal avenues to maintain brand integrity and market differentiation.

Protecting these valuable assets is paramount for Biglari, as demonstrated by its active stance in defending its trademarks. For instance, in 2023, Biglari Holdings continued its legal efforts to protect the Steak n Shake brand, underscoring the financial and strategic importance of its intellectual property.

- Brand Protection: Biglari Holdings actively monitors for and litigates against any unauthorized use of its brand names, including Steak n Shake, to prevent dilution and maintain brand equity.

- Trademark Enforcement: Legal action is a key component of Biglari's strategy to preserve the distinctiveness and value of its trademarks in a competitive market.

- Proprietary Recipes: Safeguarding unique recipes is a legal imperative, preventing competitors from replicating the core offerings that define the Steak n Shake customer experience.

Biglari Holdings faces significant legal scrutiny regarding labor practices and employee relations, particularly within its restaurant divisions. Adherence to minimum wage laws, overtime regulations, and workplace safety standards, as enforced by bodies like the Department of Labor, is critical. In 2023, the U.S. saw continued focus on wage and hour compliance, with several high-profile settlements in the food service industry highlighting the financial risks of non-compliance.

The company's insurance segment is subject to extensive state and federal regulations covering solvency, consumer protection, and market conduct. Compliance with frameworks such as the NAIC model laws and specific state insurance department mandates is essential for maintaining operating licenses and financial stability. For example, insurance companies must adhere to strict capital reserve requirements, which were under review by regulators in 2023 for potential adjustments based on economic conditions.

Navigating the complexities of franchise law is paramount as Biglari Holdings transitions Steak n Shake to a franchise-partner model. This involves meticulous compliance with disclosure requirements, franchise agreement terms, and dispute resolution mechanisms to ensure a robust and legally sound franchise network. The Federal Trade Commission's Franchise Rule mandates specific pre-sale disclosures, a process that requires ongoing legal oversight.

Environmental factors

Environmental regulations continue to tighten, compelling companies like Biglari Holdings, particularly its Steak n Shake segment, to adopt more sustainable operations. This includes stricter rules around single-use plastics and packaging, pushing for biodegradable or recyclable materials.

These evolving mandates necessitate significant investment in eco-friendly alternatives and robust waste management systems, such as composting or advanced recycling programs. For instance, by 2025, many jurisdictions are expected to have phased out certain non-recyclable plastics commonly used in food service, impacting supply chains and operational costs.

Climate change poses significant threats to Biglari Holdings' supply chain, particularly for its Steak n Shake brand. Extreme weather events, such as prolonged droughts or severe floods, directly impact agricultural yields, affecting the availability and cost of key ingredients like beef and produce. For instance, the U.S. experienced its driest conditions in years across large agricultural regions in 2023, leading to increased feed costs for cattle, a direct input for Steak n Shake.

These disruptions extend to transportation networks, further complicating logistics and potentially increasing operational expenses. The Federal Highway Administration reported that severe weather events caused over 40% of all delays on major roads in 2022. Biglari Holdings must therefore prioritize climate resilience in its supply chain strategies to mitigate these risks, ensuring a stable supply of ingredients and managing price volatility effectively.

Biglari Holdings, with its diverse operations including restaurant chains, faces scrutiny over its energy consumption and carbon footprint. The energy required for cooking, heating, and cooling in its numerous locations contributes to its environmental impact.

Increasingly stringent environmental regulations and growing consumer preference for sustainable businesses are likely to compel Biglari to invest in energy-efficient technologies and explore renewable energy options. For instance, the U.S. restaurant industry alone accounted for approximately 2.5% of total U.S. greenhouse gas emissions in 2023, highlighting the sector's environmental significance.

Water Usage and Conservation Policies

Water scarcity and increasingly stringent conservation policies are becoming significant environmental considerations for businesses like Biglari Holdings, particularly impacting its Steak n Shake operations. Regions experiencing drought conditions may implement regulations that directly affect water availability and usage for restaurants, potentially increasing operational costs or requiring significant adjustments to service models.

Biglari Holdings is likely evaluating and implementing water-saving technologies and practices across its Steak n Shake locations. This proactive approach aims not only to comply with evolving local and state regulations but also to enhance its corporate image by demonstrating environmental stewardship. For instance, adopting low-flow fixtures in kitchens and restrooms, and optimizing water use in dishwashing and cleaning processes are key strategies.

The financial implications of water conservation for Biglari Holdings can be substantial. According to the EPA, commercial kitchens can significantly reduce water consumption through efficient equipment and practices. Reports from 2024 indicate that businesses investing in water-efficient technologies can see a reduction in water bills by as much as 10-20% annually, alongside a decrease in associated energy costs for heating water.

- Regulatory Compliance: Biglari Holdings must adhere to varying water usage restrictions and conservation mandates, which can differ significantly by state and municipality.

- Operational Adjustments: Implementing water-saving technologies, such as high-efficiency dishwashers and aerators on faucets, is crucial for reducing consumption.

- Cost Savings: Enhanced water conservation can lead to lower utility bills, a positive financial outcome for Steak n Shake locations.

- Environmental Responsibility: Demonstrating commitment to water conservation improves brand reputation and aligns with growing consumer demand for sustainable business practices.

Consumer Demand for Eco-Friendly Practices

Consumer demand for eco-friendly practices is a significant environmental factor influencing businesses like Biglari Holdings. A growing segment of consumers actively seeks out and supports companies demonstrating environmental responsibility and sustainable operations. This trend is not just about ethical consumption; it directly impacts brand perception and market share.

Biglari Holdings can leverage this by integrating greener initiatives across its restaurant brands and other operations. Examples include prioritizing locally sourced ingredients, which reduces transportation emissions, and adopting sustainable packaging solutions. These actions can significantly enhance brand image and attract environmentally conscious customers, a demographic that is increasingly influential in purchasing decisions.

Data from 2024 and early 2025 indicates a continued surge in this consumer preference. For instance, a 2024 Nielsen report found that 73% of global consumers would change their consumption habits to reduce their environmental impact. Furthermore, studies in the restaurant industry specifically show that restaurants with visible sustainability commitments often report higher customer loyalty and willingness to pay a premium.

- Growing Consumer Preference: A significant majority of consumers, often exceeding 70%, now prioritize brands with demonstrable environmental responsibility.

- Brand Image Enhancement: Adopting sustainable practices, such as local sourcing and eco-friendly packaging, directly improves a company's public image.

- Market Share Impact: Environmentally conscious consumers are more likely to choose and remain loyal to businesses that align with their values.

- Financial Benefits: While initial investment may be required, sustainable initiatives can lead to long-term cost savings and increased revenue through enhanced customer loyalty and premium pricing potential.

Environmental factors continue to shape Biglari Holdings' operational landscape, particularly for its Steak n Shake brand. Stricter regulations on single-use plastics and packaging are pushing for biodegradable alternatives, impacting supply chains and necessitating investments in sustainable materials by 2025.

Climate change presents tangible risks, with extreme weather events in 2023 impacting agricultural yields and increasing feed costs for cattle, a direct input for Steak n Shake. These disruptions also affect transportation networks, as severe weather accounted for over 40% of major road delays in 2022.

Water scarcity and conservation policies are also critical, with regions facing drought potentially imposing usage restrictions. Businesses investing in water-efficient technologies in 2024 saw water bill reductions of 10-20%, alongside decreased energy costs for water heating.

Consumer demand for eco-friendly practices is a powerful driver, with over 70% of consumers in a 2024 report indicating a willingness to change habits to reduce environmental impact. This trend favors companies like Biglari Holdings that integrate sustainability, potentially leading to higher customer loyalty and premium pricing.

PESTLE Analysis Data Sources

Our Biglari PESTLE Analysis is meticulously crafted using a diverse range of data sources, including official government publications, reputable financial news outlets, and leading industry analysis firms. This ensures a comprehensive and accurate understanding of the macro-environmental factors influencing Biglari's operations.