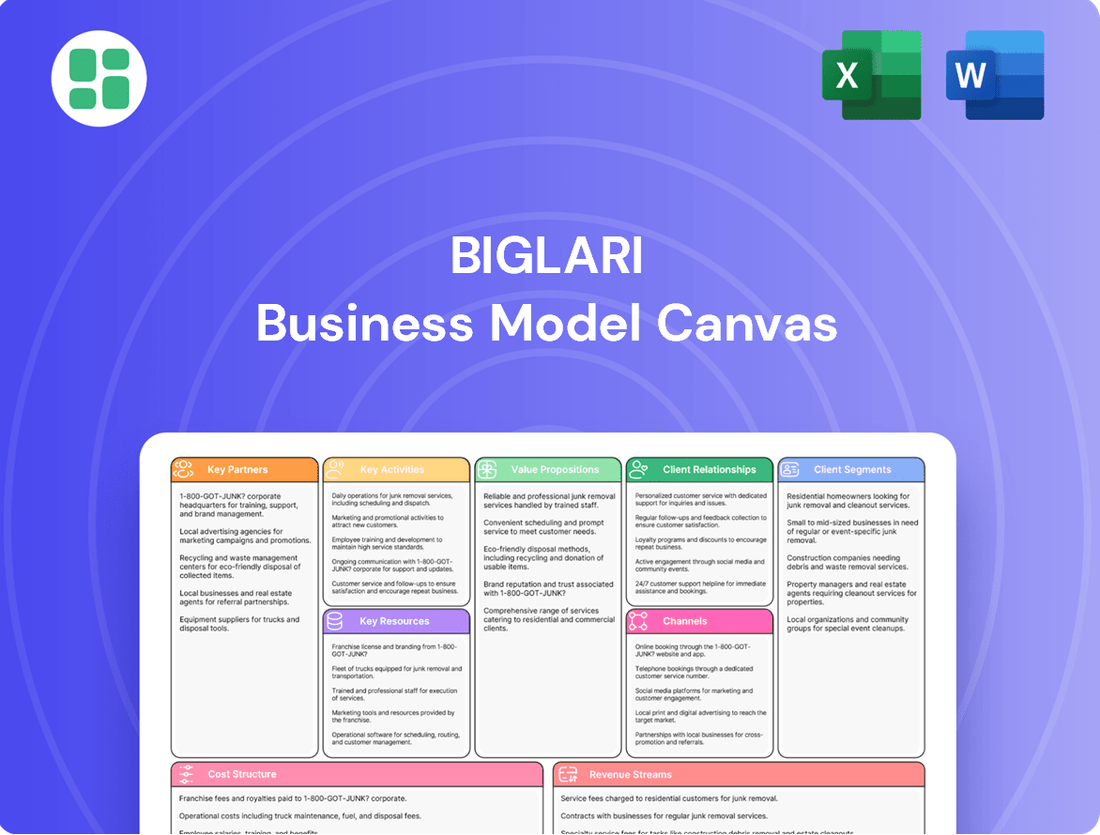

Biglari Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Biglari Bundle

Discover the core components of Biglari's remarkable business strategy with our comprehensive Business Model Canvas. This detailed breakdown illuminates how they connect with customers, deliver value, and generate revenue. Get the full picture to fuel your own strategic thinking.

Partnerships

Biglari Holdings heavily leans on its franchise partners, especially within its restaurant division, which includes brands like Steak n Shake and Western Sizzlin. These partners are crucial for expanding the brand's footprint and ensuring smooth day-to-day operations across numerous locations.

The franchise model for Steak n Shake stands out due to its accessibility; it requires a notably low initial investment from prospective operators, making it an attractive opportunity for many entrepreneurs.

In 2024, Biglari Holdings continued to emphasize this franchise-driven approach. For instance, Steak n Shake reported that a significant portion of its locations were operated by franchisees, contributing to its widespread presence and revenue generation.

Biglari Holdings cultivates essential supplier and vendor relationships across its diverse portfolio. For its restaurant segments, like Steak 'n Shake, this means partnering with food and beverage providers to ensure quality ingredients. In its oil and gas operations, the company relies on suppliers for critical parts and equipment.

These partnerships are fundamental to operational integrity and cost-effectiveness. For instance, in 2024, Biglari Holdings' focus on supply chain stability directly impacts its ability to maintain consistent service and manage inventory efficiently across its varied business units, from dining to energy services.

Biglari Holdings relies on financial institutions for crucial support, securing lines of credit and facilitating investment activities. These relationships are fundamental to the company's approach of building and managing a varied collection of businesses.

Access to capital from these partners is vital for Biglari Holdings, enabling both internal expansion and the pursuit of strategic acquisitions. For instance, in 2024, Biglari Holdings reported total assets of $1.1 billion, underscoring the need for robust financial backing to manage and grow such a portfolio.

Reinsurance Providers

Biglari Holdings relies on reinsurance providers to underwrite its insurance businesses, such as First Guard and Southern Pioneer. These partnerships are essential for managing the financial impact of significant claims, thereby safeguarding the company's capital reserves and ensuring its ability to meet its obligations.

This strategic use of reinsurance allows Biglari to transfer a portion of its underwriting risk to other insurance companies. For example, in 2024, the insurance sector continued to see a robust market for reinsurance, with global gross written premiums in reinsurance expected to remain strong, reflecting the ongoing need for risk diversification among primary insurers.

- Risk Diversification: Reinsurance allows Biglari to spread its risk across multiple entities, reducing its exposure to any single catastrophic event.

- Capital Efficiency: By ceding a portion of risk, Biglari can operate with a more efficient capital structure, freeing up resources for other investments.

- Solvency Protection: Reinsurance is a cornerstone of solvency management, ensuring the company can absorb large losses without jeopardizing its financial stability.

Investment Management Collaborators

Biglari Holdings, while largely managing its investments internally through Sardar Biglari and The Lion Fund, may engage external investment management collaborators for specialized opportunities. These alliances can inject unique expertise and supplementary capital, crucial for navigating a diverse investment landscape. For instance, in 2024, Biglari Holdings continued to leverage its concentrated investment strategy, but the potential for such partnerships remains a key element in its operational framework.

These collaborations are designed to enhance the company's ability to identify and capitalize on a wider array of investment prospects, thereby contributing to sustained long-term value creation. By pooling resources and knowledge, Biglari Holdings can broaden its reach and deepen its analytical capabilities.

- Strategic Alliances: Potential for partnerships with other investment firms or advisors to access specialized market insights and deal flow.

- Capital Augmentation: Collaborations can provide additional capital for larger or more complex investment opportunities, diversifying funding sources beyond internal reserves.

- Expertise Enhancement: Accessing external expertise can bolster due diligence processes and strategic decision-making for specific asset classes or markets.

Biglari Holdings' key partnerships are diverse, spanning franchise operators, suppliers, financial institutions, reinsurers, and potentially investment collaborators.

Franchise partners, particularly for Steak n Shake, are vital for expansion and day-to-day operations, with a significant number of locations operated by franchisees in 2024. Strong supplier relationships ensure quality ingredients and operational efficiency across segments like restaurants and oil and gas.

Financial institutions provide essential credit lines and investment capital, supporting Biglari's asset base, which stood at $1.1 billion in 2024. Reinsurers are critical for underwriting insurance businesses, managing risk, and protecting capital reserves, a practice bolstered by a strong global reinsurance market in 2024.

| Partnership Type | Key Function | 2024 Relevance |

|---|---|---|

| Franchise Operators | Brand expansion, operational management | Significant portion of Steak n Shake locations operated by franchisees |

| Suppliers & Vendors | Quality ingredients, equipment, operational efficiency | Supply chain stability for restaurants and oil/gas operations |

| Financial Institutions | Capital access, credit lines, investment facilitation | Supported $1.1 billion in total assets |

| Reinsurance Providers | Risk transfer, solvency protection for insurance | Leveraged strong global reinsurance market |

What is included in the product

A detailed, strategy-driven business model canvas for Biglari Capital, outlining customer segments, value propositions, and revenue streams with actionable insights.

The Biglari Business Model Canvas offers a structured approach to identify and address operational inefficiencies, acting as a pain point reliever by clarifying resource allocation and customer relationships.

Activities

Biglari Holdings actively pursues the acquisition and integration of businesses, a cornerstone of its growth strategy. This involves a meticulous process of identifying promising companies across diverse industries, aiming to enhance its overall portfolio and achieve greater financial resilience.

In 2024, Biglari Holdings continued its focus on strategic acquisitions. While specific recent acquisition figures are proprietary, the company's historical approach emphasizes acquiring businesses with strong intrinsic value and potential for operational improvement, as demonstrated by its past successful integrations.

The integration phase is critical, focusing on realizing synergies and optimizing operations post-acquisition. This ensures that newly acquired entities contribute effectively to Biglari Holdings' long-term value creation objectives and revenue diversification efforts.

Biglari Holdings actively manages its restaurant subsidiaries, Steak n Shake and Western Sizzlin, across both company-operated locations and a vast franchise network. This oversight encompasses crucial areas like enhancing operational efficiency, innovating menus, streamlining supply chains, and maintaining a uniform, high-quality customer experience across all outlets.

A significant operational shift for Biglari has been the strategic transition towards a franchise partner model. This move aims to leverage franchisee capital and local market expertise, as evidenced by Steak n Shake's ongoing refranchising efforts, which saw a substantial portion of company-owned stores transitioned to franchisees in recent years, including over 100 units in 2023 alone.

Biglari's insurance operations, primarily through First Guard and Southern Pioneer, hinge on robust underwriting and claims processing. Underwriting involves meticulously assessing risks to ensure policy pricing accurately reflects potential liabilities. This is a core activity for profitability, as demonstrated by First Guard's combined ratio, which improved significantly in recent periods.

Efficient claims processing is equally vital, directly impacting customer loyalty and operational costs. Timely and fair claim resolution builds trust and reduces the administrative burden associated with prolonged disputes. For instance, Southern Pioneer’s focus on streamlined claims handling contributes to its competitive edge in the market.

Capital Allocation and Investment Management

Capital allocation and investment management are central to Biglari Capital's strategy. Sardar Biglari personally oversees the deployment of capital across the company's diverse holdings and marketable securities, aiming to enhance per-share intrinsic value. This hands-on approach ensures that resources are directed towards opportunities with the highest potential for growth and profitability.

The performance of The Lion Fund, a significant component of Biglari Capital's investment activities, directly reflects the effectiveness of its capital allocation decisions. For instance, as of the first quarter of 2024, The Lion Fund reported total assets under management of $722 million, demonstrating the scale of capital being managed. The fund's investment strategy focuses on concentrated, long-term holdings in undervalued companies.

- Centralized Decision Making: Sardar Biglari makes all significant capital allocation and investment decisions.

- Objective: Maximize per-share intrinsic value by deploying capital intelligently.

- Key Performance Indicator: The Lion Fund's performance is a crucial metric.

- 2024 Data Point: The Lion Fund had $722 million in assets under management in Q1 2024.

Oil and Gas Exploration and Production

Biglari Holdings, through its subsidiaries Southern Oil and Abraxas Petroleum, actively participates in the oil and gas sector. Their core activities encompass the exploration for new reserves, the production of extracted resources, and the subsequent sale of these commodities.

This operational focus necessitates continuous capital allocation towards maintaining and enhancing infrastructure, alongside rigorous management of operational expenses to safeguard profitability. The financial performance of this segment is inherently tied to the fluctuating global energy markets.

- Exploration: Identifying and assessing potential oil and natural gas reserves.

- Production: Extracting crude oil and natural gas from acquired properties.

- Sales: Marketing and selling produced oil and natural gas to customers.

For instance, Abraxas Petroleum reported total production of approximately 1.7 million barrels of oil equivalent (BOE) in 2023, with average daily production around 4,658 BOE per day. This highlights the scale of their ongoing production efforts.

Biglari Holdings' key activities center on strategic acquisitions and the active management of its diverse business segments, including restaurants, insurance, and oil and gas. A significant focus is placed on optimizing operations, transitioning to franchise models where beneficial, and prudent capital allocation to maximize shareholder value.

| Business Segment | Key Activities | 2023/2024 Data Points |

|---|---|---|

| Restaurant Operations (Steak n Shake, Western Sizzlin) | Acquisition, integration, operational efficiency, menu innovation, franchise management | Over 100 Steak n Shake units refranchised in 2023; ongoing franchise transition. |

| Insurance Operations (First Guard, Southern Pioneer) | Underwriting, claims processing, risk assessment | First Guard's combined ratio improved significantly in recent periods. |

| Investment Management (Biglari Capital, The Lion Fund) | Capital allocation, investment in marketable securities, portfolio management | The Lion Fund had $722 million in assets under management in Q1 2024. |

| Oil & Gas (Southern Oil, Abraxas Petroleum) | Exploration, production, sales | Abraxas Petroleum produced approximately 1.7 million BOE in 2023. |

What You See Is What You Get

Business Model Canvas

This preview showcases the exact Biglari Business Model Canvas you will receive upon purchase. It's not a sample; it's a direct representation of the comprehensive document you'll be downloading. You'll gain full access to this meticulously crafted analysis, ready for your immediate use and strategic planning.

Resources

Biglari Holdings' strong brand portfolio is a cornerstone of its business model, prominently featuring Steak n Shake. This iconic American chain, renowned for its signature steakburgers and milkshakes, commands significant customer loyalty and recognition. In 2023, Steak n Shake reported approximately $290 million in net sales, highlighting the enduring appeal of its established brand equity.

Biglari Holdings boasts considerable financial capital, with a significant portion derived from investment profits, enabling strategic flexibility. As of the first quarter of 2024, the company reported cash and cash equivalents of $169.3 million, alongside marketable securities valued at $660.8 million, totaling $830.1 million in readily available financial resources.

This robust financial position, managed through entities like The Lion Fund, empowers Biglari Holdings to pursue new acquisitions, make strategic investments in promising ventures, and provide essential support for its ongoing operational activities.

Sardar Biglari's role as Chairman and CEO is a cornerstone of Biglari Holdings, bringing a wealth of experience in capital allocation and mergers and acquisitions. His strategic vision is crucial for identifying and executing turnaround strategies for acquired businesses, directly impacting the holding company's diversified portfolio and overall direction.

This centralized financial decision-making, driven by experienced leadership, is a defining characteristic of Biglari Holdings' operational model. This approach allows for swift and decisive actions in managing the company's various ventures, aiming to optimize performance across the board.

Physical Assets and Real Estate

Biglari Holdings' restaurant operations rely heavily on tangible physical assets, including owned restaurant properties and essential equipment. These assets are fundamental to delivering the intended customer experience and underpinning the entire operational model, even as the company explores shifts towards self-service technologies.

These real estate holdings serve a dual purpose: they provide crucial collateral for financing and represent a significant component of the company's investment value. As of the end of 2023, Biglari Holdings reported significant investments in property and equipment, reflecting the capital-intensive nature of their restaurant portfolio.

- Owned Restaurant Properties: Biglari Holdings maintains ownership of a substantial number of its restaurant locations, providing long-term control and potential for appreciation.

- Restaurant Equipment: This includes everything from kitchen appliances and dining furniture to point-of-sale systems, all vital for daily operations.

- Collateral Value: The owned real estate offers a stable asset base that can be leveraged for debt financing, supporting growth initiatives.

- Investment Value: Beyond operational utility, these physical assets contribute to the overall net asset value of the company.

Proprietary Operating Systems and Processes

Biglari Holdings, particularly through its Steak n Shake subsidiary, leverages proprietary operating systems and processes to drive operational excellence. These systems are designed to boost efficiency and ensure a consistent customer experience across all locations.

Key technological advancements include the implementation of digital menu boards and self-payment kiosks. These innovations streamline the ordering process, reduce wait times, and allow for dynamic pricing and promotional displays. For instance, by mid-2024, Steak n Shake had continued its rollout of these technologies, aiming to improve customer throughput and reduce labor costs associated with order taking.

Furthermore, the company has focused on optimizing food assembly processes. This standardization ensures that every meal is prepared consistently, upholding quality standards and enhancing kitchen productivity. These internal improvements are critical for maintaining brand integrity and driving profitability.

The strategic deployment of these proprietary systems directly impacts key performance indicators:

- Enhanced Efficiency: Streamlined processes contribute to faster service times, a critical factor in the quick-service restaurant industry.

- Cost Reduction: Automation through kiosks and optimized workflows can lead to lower labor expenses and reduced waste.

- Improved Consistency: Standardized operating procedures ensure a predictable and high-quality product for every customer.

- Data-Driven Insights: Digital systems provide valuable data on customer behavior and operational performance, enabling continuous improvement.

Biglari Holdings' key resources are a blend of strong brand recognition, substantial financial backing, and strategically managed physical assets. The company's financial strength, evidenced by $830.1 million in cash and marketable securities as of Q1 2024, allows for significant operational flexibility and investment capacity. This financial acumen, coupled with ownership of restaurant properties and equipment, forms a solid foundation for its business operations.

| Resource Category | Specific Examples | Financial Year/Period | Value/Significance |

|---|---|---|---|

| Financial Capital | Cash and Cash Equivalents | Q1 2024 | $169.3 million |

| Financial Capital | Marketable Securities | Q1 2024 | $660.8 million |

| Tangible Assets | Owned Restaurant Properties | End of 2023 | Significant investment, provides collateral and operational base |

| Tangible Assets | Restaurant Equipment | End of 2023 | Essential for operations, supports customer experience |

Value Propositions

Steak n Shake's core value for restaurant patrons is the consistent delivery of high-quality, classic American steakburgers and their iconic hand-dipped milkshakes. This commitment to a familiar and satisfying taste profile forms a significant part of their appeal.

The brand actively leverages its heritage, emphasizing freshness and a dedication to taste that resonates with customers looking for a nostalgic and dependable fast-casual dining experience. This focus on tradition and quality aims to build lasting customer loyalty.

In 2024, Steak n Shake continued to refine its menu and operational efficiency, aiming to enhance the customer experience while managing costs. For instance, efforts to streamline kitchen operations were a key focus to ensure the consistent quality patrons expect.

Biglari Holdings presents a compelling franchise opportunity for Steak n Shake, requiring a mere $10,000 initial investment. This low barrier to entry is designed to attract a wide range of aspiring entrepreneurs.

Franchise partners benefit from an exceptional profit-sharing model, receiving 50% of the net profits. This structure transforms operators into true owner-operators, directly linking their efforts to significant earning potential.

This approach is specifically crafted to draw in skilled and driven individuals who are eager to build their own successful businesses within the established Steak n Shake brand.

Biglari Holdings, through its subsidiaries First Guard and Southern Pioneer, offers specialized property and casualty insurance, with a strong focus on commercial trucking. This niche specialization ensures tailored and dependable protection for businesses operating in this sector, a critical aspect for risk management. For instance, in 2023, the commercial auto insurance market saw significant premium growth, indicating strong demand for such specialized coverages.

Long-Term Value Creation for Shareholders

Biglari Holdings focuses on generating enduring value for its shareholders by strategically deploying capital across a portfolio of well-managed companies. This approach is designed to foster sustained growth in intrinsic value per share over the long haul.

The company's strategy involves identifying and acquiring businesses that offer attractive returns, thereby diversifying its holdings and mitigating risk. This intelligent capital allocation is central to its long-term value creation promise.

- Long-Term Focus: Commitment to decades-long value growth rather than short-term gains.

- Intelligent Capital Allocation: Strategic deployment of resources into remunerative opportunities.

- Diversified Holdings: Acquisition of well-managed businesses across various sectors.

- Intrinsic Value Growth: Aiming to increase the fundamental worth of the company per share.

For instance, in 2024, Biglari Holdings continued its strategy of reinvesting earnings and seeking accretive acquisitions. The company's financial reports for the period ending December 31, 2024, indicated a steady increase in book value per share, a key metric for assessing long-term value creation.

Strategic Oversight and Capital Support for Subsidiaries

Biglari Holdings offers its subsidiaries robust strategic oversight coupled with centralized financial backing. This approach allows for decentralized operational management, fostering agility within each business unit.

The company's capital allocation expertise is a key benefit, ensuring subsidiaries have the financial resources to pursue growth and maintain stability. For instance, in 2024, Biglari Holdings continued to manage its diverse portfolio, which includes interests in sectors like insurance and restaurants, with a focus on optimizing capital deployment across its various ventures.

- Strategic Direction: Biglari Holdings provides overarching strategic guidance to its subsidiary companies.

- Financial Expertise: Centralized financial support and capital allocation expertise are key value propositions.

- Operational Autonomy: Subsidiaries benefit from decentralized operational management, allowing for tailored business unit strategies.

- Portfolio Synergy: The structure aims to foster growth and stability across the entire Biglari Holdings portfolio.

Biglari Holdings' value proposition centers on its disciplined, long-term approach to capital allocation and business management. The company seeks to acquire and operate businesses that exhibit strong fundamentals and offer attractive returns, aiming to consistently increase intrinsic value per share.

This strategy is evident in its diverse holdings, including the Steak n Shake franchise model, which offers a low-entry investment of $10,000 and a lucrative 50% net profit share for franchisees. Furthermore, its insurance subsidiaries, like First Guard, provide specialized commercial trucking insurance, a sector experiencing robust demand, as highlighted by premium growth in 2023.

Biglari Holdings' commitment to shareholder value is underscored by its focus on reinvesting earnings and pursuing accretive acquisitions, as demonstrated by the steady increase in book value per share reported for the period ending December 31, 2024.

The company also provides significant strategic oversight and financial backing to its subsidiaries, enabling operational autonomy and fostering growth across its portfolio.

| Business Segment | Key Value Proposition | 2024 Data/Context |

|---|---|---|

| Steak n Shake Franchising | Low initial investment ($10,000) and high profit share (50% net profits) for franchisees. | Continued focus on operational efficiency and menu refinement to enhance customer experience and manage costs. |

| Insurance (First Guard, Southern Pioneer) | Specialized property and casualty insurance, particularly for commercial trucking. | Operates in a market with strong demand for specialized coverages, as evidenced by premium growth in the commercial auto sector in 2023. |

| Overall Holdings | Intelligent capital allocation, long-term focus on intrinsic value growth, and diversified holdings. | Reported a steady increase in book value per share for the period ending December 31, 2024, reflecting sustained value creation. |

Customer Relationships

In the restaurant segment, Biglari's customer relationships are primarily transactional, prioritizing speed and efficiency. This focus is evident in their adoption of self-service models, aiming to streamline the ordering and payment process for a quick and convenient customer experience. For instance, by mid-2024, many quick-service restaurants, including those within Biglari's portfolio, reported increased adoption rates for digital ordering platforms, with some seeing over 60% of transactions originating online or via app.

Biglari Holdings cultivates strong relationships with its franchise partners through a supportive and collaborative approach. This partnership model provides extensive training programs, continuous operational assistance, and essential administrative services to ensure franchisee success.

The company's commitment extends to equipping operators with the necessary tools and guidance, fostering an environment where individual businesses can thrive. This dedicated support structure is a cornerstone of the franchise model.

A key element driving this supportive partnership is the profit-sharing model. This structure inherently aligns the interests of Biglari Holdings with those of its franchise partners, creating a shared incentive for mutual growth and profitability.

For insurance policyholders, Biglari Holdings cultivates a direct and responsive service relationship. This involves clear communication channels for managing policies, processing claims efficiently, and providing ongoing customer support. In 2024, the company's focus on this direct engagement aims to foster trust and loyalty, ensuring clients feel secure and well-supported through timely assistance.

Transparent Investor Relations

Biglari Holdings prioritizes transparent investor relations to foster trust and informed decision-making. This commitment is demonstrated through consistent communication channels, ensuring shareholders are well-apprised of the company's performance and strategic maneuvers.

The company regularly disseminates financial information, including comprehensive annual and quarterly reports, alongside timely press releases. This practice keeps stakeholders updated on operating results and the impact of investment activities.

- Regular Financial Reporting: Biglari Holdings provides annual and quarterly reports, offering detailed insights into financial health.

- Press Releases: Key developments and performance updates are communicated promptly via press releases.

- Transparency on Performance: The company aims for clarity regarding operational outcomes and investment gains or losses.

- Informed Stakeholders: This communication strategy ensures investors remain knowledgeable about the company's financial standing and strategic trajectory.

Decentralized Operational Management

Biglari Holdings fosters a decentralized approach to subsidiary management, granting operational autonomy to its various business units. This empowers local leadership to make day-to-day decisions, fostering agility and responsiveness to market conditions. For instance, in 2024, its subsidiaries like Steak n Shake continued to navigate evolving consumer preferences through localized marketing and operational adjustments.

While day-to-day operations are decentralized, strategic capital allocation and significant investment decisions are firmly managed at the holding company level. This centralized control ensures alignment with Biglari Holdings' overarching financial strategy and long-term growth objectives. This structure allows for efficient deployment of capital across the portfolio, maximizing returns on investment.

- Decentralized Operations: Subsidiaries have autonomy in daily management and decision-making.

- Centralized Capital Allocation: Major investment decisions and capital deployment are controlled by the holding company.

- Strategic Alignment: This model balances subsidiary agility with the holding company's strategic direction.

- 2024 Focus: Subsidiaries like Steak n Shake adapted operations to market demands, reflecting the decentralized management style.

Biglari Holdings cultivates diverse customer relationships, from transactional interactions in its restaurant segment to supportive partnerships with franchisees and direct engagement with insurance policyholders. This multifaceted approach aims to build loyalty and ensure satisfaction across its varied business interests.

For investors, transparency and consistent financial reporting are paramount, fostering trust and informed decision-making. The company's commitment to clear communication ensures stakeholders are well-informed about performance and strategic direction.

The company's customer relationship strategy balances operational efficiency with personalized support, reflecting a commitment to stakeholder value across all its ventures.

Channels

The core of Biglari's restaurant segment revenue streams originates from its extensive network of company-operated and franchised Steak n Shake and Western Sizzlin restaurants. These brick-and-mortar establishments function as the primary touchpoints for customer engagement and direct sales, embodying the brand's presence.

The company is actively pursuing a strategic shift, increasing its reliance on franchised locations. This transition aims to broaden the brand's footprint and leverage the capital and operational expertise of franchise partners, thereby expanding its market reach more efficiently.

As of the first quarter of 2024, Steak n Shake reported 359 company-operated restaurants and 237 franchised locations, indicating a significant presence across both models. This dual-channel approach allows for direct control over a substantial portion of the business while simultaneously fostering growth through franchising.

Biglari Holdings significantly leverages digital and online platforms to streamline operations and connect with customers and investors. Their corporate website serves as a central hub for investor relations and company information, ensuring transparency and accessibility.

Steak n Shake, a key subsidiary, has embraced digital transformation by integrating online ordering capabilities through its website and mobile app, allowing for convenient customer transactions.

Furthermore, Steak n Shake's adoption of digital menu boards and self-service kiosks in its restaurants enhances the in-person customer experience, speeding up service and offering greater control over orders. In 2024, digital sales channels are expected to continue their growth trajectory, reflecting a broader industry trend towards online engagement.

Biglari Holdings leverages a dual-pronged distribution strategy for its insurance offerings, utilizing both a network of insurance agents and brokers alongside direct sales channels for its subsidiaries, First Guard and Southern Pioneer. This comprehensive approach aims to maximize market penetration and policyholder acquisition.

In 2024, the effectiveness of these distribution networks remains paramount for driving premium growth. For instance, the success of its insurance segment, which includes First Guard and Southern Pioneer, is directly tied to its ability to efficiently reach and serve a diverse customer base through these established channels.

SEC Filings and Investor Communications

Biglari Holdings leverages SEC filings, including annual 10-K and quarterly 10-Q reports, as its primary conduit for transparent financial disclosure. These documents provide a comprehensive overview of the company's performance and strategic direction, adhering to strict regulatory standards.

Investor communications are further augmented by press releases, which disseminate timely corporate updates and financial highlights to the market. This ensures that stakeholders are kept informed of significant developments.

The company's official website acts as a central repository for all investor-related information, offering easy access to SEC filings, press releases, and other pertinent corporate data. For instance, in their 2024 filings, Biglari Holdings detailed significant operational adjustments and capital allocation strategies.

- SEC Filings: Essential for regulatory compliance and detailed financial reporting (10-K, 10-Q).

- Press Releases: Used for timely dissemination of corporate news and financial results.

- Company Website: Serves as a central hub for investor information and resources.

- Transparency: These channels collectively ensure open communication with investors.

Industry Publications and Media Outlets

Industry Publications and Media Outlets function as a crucial channel within the Biglari Business Model Canvas, specifically for the Maxim brand. This segment focuses on delivering content and licensing opportunities through a variety of media products, including magazines and digital platforms. The direct reach to its audience via print and digital publications is a key aspect of this channel.

This channel also serves as a significant revenue generator through brand licensing and other media-related ventures. For instance, in 2024, the media industry continued its digital transformation, with many publications seeing growth in their digital subscription models. Maxim, as a lifestyle brand, leverages these trends to expand its reach and monetize its content.

- Content Delivery: Maxim utilizes its magazines and digital platforms to deliver lifestyle content directly to its target demographic.

- Brand Licensing: The brand extends its reach and revenue streams through licensing agreements for various products and media.

- Digital Presence: A strong emphasis is placed on digital publications and online engagement to capture a wider audience in 2024.

- Revenue Streams: This channel contributes to overall revenue through subscriptions, advertising, and licensing fees.

Biglari's restaurant operations utilize both company-owned locations and franchised outlets as primary customer interaction points. This dual-channel approach allows for direct sales and brand presence, while also facilitating expansion through franchise partnerships.

Digital channels are increasingly important, with Steak n Shake leveraging online ordering via its website and app, alongside in-store kiosks. This enhances customer convenience and operational efficiency, reflecting a broader industry shift towards digital engagement in 2024.

The insurance segment employs a multi-channel strategy, using both insurance agents/brokers and direct sales to reach customers. This ensures broad market penetration and efficient policy acquisition for subsidiaries like First Guard and Southern Pioneer.

Investor relations are managed through SEC filings, press releases, and the company website, ensuring transparency and accessibility of financial data and corporate updates for stakeholders in 2024.

Maxim, the lifestyle brand, uses industry publications and digital platforms for content delivery and brand licensing. This channel generates revenue through subscriptions, advertising, and licensing, capitalizing on digital trends in 2024.

| Channel | Description | Key Activities | 2024 Relevance |

|---|---|---|---|

| Company-Operated Restaurants | Directly owned and managed Steak n Shake and Western Sizzlin locations. | Sales, customer service, brand experience. | Core revenue generation and brand control. |

| Franchised Restaurants | Steak n Shake and Western Sizzlin locations operated by franchisees. | Brand expansion, leveraging franchisee capital and expertise. | Strategic growth driver, increasing market footprint. |

| Digital Platforms (Steak n Shake) | Website and mobile app for online ordering and customer engagement. | Convenient transactions, digital menu boards, kiosks. | Enhancing customer experience and operational efficiency. |

| Insurance Distribution | Network of agents/brokers and direct sales for First Guard and Southern Pioneer. | Policy acquisition, market penetration, customer service. | Driving premium growth and reaching diverse customer bases. |

| Investor Communications | SEC filings, press releases, company website. | Financial disclosure, corporate updates, investor relations. | Ensuring transparency and stakeholder information flow. |

| Media & Licensing (Maxim) | Magazines, digital platforms, brand licensing agreements. | Content delivery, brand extension, revenue generation. | Monetizing content and expanding brand reach in the digital age. |

Customer Segments

Biglari Holdings' Steak 'n Shake brand, a cornerstone of its business model, is firmly rooted in serving the mass market. This segment is defined by consumers who prioritize value and a familiar, quality dining experience. Think families on a budget, students, and individuals seeking a reliable, affordable meal. The appeal lies in offering classic American diner fare, like burgers and milkshakes, at accessible price points.

In 2024, Steak 'n Shake continued its efforts to resonate with this broad consumer base. The company's strategy often involves menu innovation and promotional activities designed to attract a wide demographic. For instance, value-driven combo meals and family-friendly promotions are key to capturing the attention of mass-market diners who are sensitive to price but still expect good taste and service.

Aspiring restaurant owner-operators represent a key customer segment for Steak n Shake's franchise model. These individuals are often entrepreneurs at heart or experienced restaurant managers looking to transition into ownership with a manageable initial investment. The company's franchise partner program is specifically designed to attract individuals with proven talent and a strong ambition to run their own establishment.

This segment is drawn to the opportunity to leverage an established brand and proven operational system. For instance, in 2024, the demand for franchise opportunities remained robust, with many seeking business models that offer a clear path to profitability and operational support. Steak n Shake's program aims to provide this by offering a framework for success, reducing the typical risks associated with starting a new business from scratch.

First Guard Insurance Company focuses on the commercial trucking sector, offering specialized property and casualty insurance. This niche market demands unique coverage designed for the risks faced by truckers and associated businesses.

In 2024, the commercial trucking industry continued to be a vital component of the U.S. economy, with freight volumes remaining robust. This sustained activity underscores the ongoing need for specialized insurance solutions like those provided by First Guard.

Southern Pioneer Insurance Company also operates within the property and casualty insurance space, serving a broader segment of this market. This diversification allows for a wider reach and potentially different risk profiles.

Long-Term Value Investors

Long-term value investors, both individual shareholders and institutional funds, are drawn to Biglari Holdings due to its structure as a diversified holding company. These investors prioritize the steady growth of intrinsic value over the fleeting movements of short-term market sentiment. They are looking for a company that strategically allocates capital to enhance the underlying worth of its various businesses.

Biglari Holdings' appeal to this segment is further solidified by its commitment to a growth-oriented capital allocation strategy. For instance, in 2023, Biglari Holdings reported a net income of $172.2 million, demonstrating its ability to generate profits that can be reinvested for future expansion. This focus on long-term wealth creation aligns perfectly with the objectives of value-oriented investors.

- Diversified Portfolio: Offers exposure to a range of industries, mitigating single-sector risk.

- Growth-Oriented Capital Allocation: Focuses on reinvesting profits to enhance long-term business value.

- Intrinsic Value Focus: Appeals to investors who look beyond short-term market volatility.

- Track Record of Profitability: Demonstrated by a net income of $172.2 million in 2023, supporting value creation.

Oil and Gas Industry Participants

The oil and gas industry participants, such as Southern Oil and Abraxas Petroleum, cater to a customer base primarily composed of industrial buyers, refiners, and energy trading companies. These entities procure crude oil and natural gas for their operational needs.

The market dynamics for these participants are significantly shaped by global supply and demand trends. For instance, in early 2024, crude oil prices saw fluctuations, with WTI futures trading around $75-$80 per barrel, reflecting geopolitical tensions and production adjustments.

- Key Customers: Industrial buyers, refineries, energy trading firms.

- Products Sold: Crude oil, natural gas.

- Market Drivers: Global supply and demand, geopolitical events, economic activity.

- 2024 Market Context: Volatile pricing influenced by production policies and global demand outlook.

Biglari Holdings' customer segments are diverse, reflecting its varied business interests. Steak 'n Shake targets the mass market with value-conscious consumers and aspiring owner-operators seeking a proven franchise model. First Guard and Southern Pioneer Insurance focus on specific needs within the property and casualty insurance market, particularly commercial trucking.

Long-term value investors are attracted to the company's overall structure and capital allocation strategy, seeking intrinsic value growth. Finally, participants in the oil and gas sector serve industrial buyers and energy firms, navigating volatile commodity markets.

| Business Segment | Primary Customer Segment | Key Characteristics | 2024 Relevance/Data |

|---|---|---|---|

| Steak 'n Shake | Mass Market Consumers | Value-driven, families, students seeking affordable, familiar dining. | Continued focus on value promotions and accessible menu pricing. |

| Steak 'n Shake | Aspiring Owner-Operators | Entrepreneurs, experienced managers seeking established brand and operational support. | Demand for franchise opportunities remains strong for proven business models. |

| First Guard Insurance | Commercial Trucking Sector | Businesses requiring specialized property and casualty insurance for trucking risks. | Robust freight volumes in 2024 highlight ongoing need for specialized coverage. |

| Southern Pioneer Insurance | Broader P&C Market | Individuals and businesses seeking property and casualty insurance solutions. | Diversified strategy to capture a wider range of insurance needs. |

| Biglari Holdings (Overall) | Long-Term Value Investors | Individual and institutional investors prioritizing intrinsic value growth and capital allocation. | Net income of $172.2 million in 2023 underscores profitability and reinvestment potential. |

| Oil & Gas (Southern Oil, Abraxas) | Industrial Buyers, Refiners, Energy Traders | Procure crude oil and natural gas for operational needs. | WTI crude futures trading around $75-$80/barrel in early 2024, reflecting market volatility. |

Cost Structure

Restaurant operations are the backbone of Biglari's cost structure, encompassing food procurement, employee wages, and occupancy costs like rent and utilities. For company-operated locations, these direct expenses are paramount to profitability. In 2024, the restaurant industry, in general, continued to grapple with rising food costs, with some reports indicating increases of 5-10% for key ingredients compared to the previous year.

Franchise units also contribute to this cost category, though Biglari's direct outlay for these locations is primarily through royalties and fees. Efficiently managing these operational expenses across all units is a constant focus for Biglari, as it directly impacts the bottom line and the overall health of the business model.

Biglari Holdings incurs significant expenses related to acquiring new businesses and managing its diverse investment portfolio. These costs encompass thorough due diligence processes, various transaction fees associated with deal closures, and the initial operational outlays for newly integrated subsidiaries.

For instance, in 2023, Biglari Holdings reported a net loss of $14.6 million, a notable shift from a net gain of $38.5 million in 2022, highlighting the impact of investment performance on its overall financial health. This fluctuation underscores the inherent risks and costs involved in their acquisitive growth strategy.

Biglari's insurance operations involve significant costs in underwriting, including actuarial analysis and policy administration. A substantial portion of these expenses is dedicated to paying out claims to policyholders, which is a direct reflection of the insurance risk taken on.

For instance, in 2024, the insurance industry generally saw combined ratios (a measure of profitability) fluctuating, with some segments experiencing pressure from increased claims frequency or severity. Effective risk assessment and meticulous claims management are therefore paramount for Biglari to maintain profitability within its insurance segment by controlling these inherent costs.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses represent the corporate overhead necessary for managing Biglari Holdings' diversified portfolio. This includes significant costs related to executive compensation, administrative support for the holding company itself, and essential professional services like legal and accounting.

These centralized functions are critical for the overall strategic direction and operational oversight of all subsidiaries. For instance, Biglari Holdings' 2023 annual report highlighted that its G&A expenses, excluding certain operating segments, amounted to approximately $23.8 million. This figure underscores the investment in maintaining a robust corporate infrastructure to support its various business interests, which include insurance and restaurant operations.

- Corporate Overhead: Costs associated with the central office functions of Biglari Holdings.

- Executive Compensation: Salaries and benefits for the senior leadership team overseeing the entire organization.

- Administrative Support: Staff and resources dedicated to managing the holding company's operations.

- Professional Fees: Expenses for legal counsel, auditors, and other essential advisory services.

Capital Expenditures and Maintenance

Biglari Holdings consistently allocates significant capital to maintain and enhance its physical assets. This includes ongoing investments in restaurant renovations and equipment upgrades across its Steak n Shake and Cracker Barrel segments. For instance, in 2023, Steak n Shake continued its remodel program, with a focus on improving the customer experience and operational efficiency.

Beyond its restaurant operations, Biglari Holdings also makes substantial capital expenditures in its oil and gas ventures. These investments are vital for drilling new wells, maintaining existing infrastructure, and exploring new reserves. Such outlays are fundamental to ensuring long-term operational viability and potential growth within the energy sector.

- Restaurant Renovations: Ongoing upgrades to physical locations to enhance customer experience and operational efficiency.

- Equipment Purchases: Investments in new and updated kitchen and service equipment to maintain quality and productivity.

- Oil and Gas Property Investments: Capital deployed for drilling, infrastructure maintenance, and exploration in the energy segment.

Biglari's cost structure is multifaceted, covering direct restaurant operations, investment activities, insurance underwriting, and corporate overhead. For company-operated restaurants, food, labor, and occupancy are key expenses, with industry-wide food cost increases noted in 2024. Investment costs involve due diligence and transaction fees, impacting overall profitability as seen in Biglari Holdings' 2023 net loss. Insurance operations incur underwriting and claims expenses, with a focus on risk management to control costs.

General and administrative expenses, including executive compensation and professional services, support the holding company's diverse portfolio. In 2023, these G&A expenses were approximately $23.8 million, excluding certain operating segments. Capital expenditures are also significant, covering restaurant renovations and oil and gas ventures, crucial for maintaining and growing these segments.

| Cost Category | Key Components | 2023 Impact/Notes |

|---|---|---|

| Restaurant Operations | Food procurement, employee wages, rent, utilities | Industry food costs up 5-10% in 2024. Steak n Shake remodels ongoing. |

| Investment Activities | Due diligence, transaction fees, initial integration costs | Biglari Holdings reported a net loss of $14.6M in 2023, reflecting investment performance. |

| Insurance Underwriting | Actuarial analysis, policy administration, claims payout | Focus on risk assessment and claims management to control costs. |

| General & Administrative (G&A) | Executive compensation, administrative support, professional fees | Approx. $23.8M in 2023 (excluding certain segments) for corporate overhead. |

| Capital Expenditures | Restaurant renovations, equipment upgrades, oil & gas investments | Investments in physical assets and exploration for long-term viability. |

Revenue Streams

Revenue streams for Biglari Holdings, specifically from company-operated units, are primarily driven by the direct sale of food and beverages at their Steak n Shake and Western Sizzlin locations. This is a classic retail model, where income is directly correlated with the number of customers visiting the restaurants and how much each customer spends on average.

For instance, in the first quarter of 2024, Steak n Shake company-operated stores reported a 1.6% increase in same-store sales compared to the prior year. This growth indicates a positive trend in customer spending and traffic within these directly managed establishments, contributing significantly to the overall revenue picture.

Franchise partner fees and a 50% share of net profits represent a substantial revenue driver for Steak n Shake. This structure effectively transfers operational burdens and financial risks to the franchise partners.

This arrangement ensures a consistent and predictable profit stream for the parent company. For instance, in 2023, Biglari Holdings reported that its franchise operations contributed significantly to overall revenue, with the profit-sharing model proving particularly lucrative.

Biglari Holdings taps into traditional franchise royalties and fees from its Steak n Shake and Western Sizzlin locations. These revenue streams are generally calculated as a percentage of the franchisees' gross sales, offering a predictable income tied to the operational success of individual restaurants.

Insurance Premiums Earned

Biglari Holdings' insurance segment, encompassing First Guard and Southern Pioneer, derives its core revenue from insurance premiums. These premiums are the payments customers make for coverage. The success of this revenue stream hinges on both the sheer number of policies sold and the financial health of the underwriting process itself, meaning how effectively the company manages claims relative to the premiums collected.

For instance, in 2024, the insurance sector continued to be a significant contributor to Biglari Holdings. The company's ability to attract and retain policyholders directly impacts the volume of premiums earned. Underwriting profitability, a key metric, reflects the company's skill in assessing risk and pricing policies appropriately, ensuring that collected premiums adequately cover potential claims and expenses while generating a profit.

Key factors influencing earned premiums include:

- Policy Volume: The total number of insurance policies in force.

- Premium Rates: The price charged for each policy, influenced by risk assessment and market conditions.

- Underwriting Profitability: The net result of premiums earned minus claims incurred and underwriting expenses.

Investment Gains and Returns

Biglari Capital's primary revenue stream, investment gains, stems from its management of marketable securities, predominantly through The Lion Fund. This includes both profits realized from selling investments and increases in value that haven't yet been sold (unrealized gains). While this segment can fluctuate, it has historically been a vital contributor to the company's overall profitability.

For instance, in 2024, Biglari Capital reported significant investment gains. The company's investment portfolio, which includes a substantial stake in The Lion Fund, generated substantial returns. These gains are a direct reflection of successful asset allocation and market timing, underscoring the importance of this revenue channel.

- Investment Gains: Revenue generated from the appreciation and sale of marketable securities within Biglari Capital's investment portfolio.

- The Lion Fund: A key vehicle through which these investment gains are managed and realized.

- Volatility: Acknowledges that this revenue stream can be subject to market fluctuations, impacting its consistency.

- Historical Significance: Highlights the consistent and substantial contribution of investment gains to the company's net earnings over time.

Biglari Holdings generates revenue through multiple distinct channels, reflecting its diversified business model. These streams are primarily categorized into restaurant operations, franchise fees, and insurance premiums, with investment gains from its capital management arm also playing a crucial role.

The company's restaurant segment, particularly Steak n Shake, benefits from direct sales of food and beverages, further augmented by franchise royalties and profit-sharing agreements. In the first quarter of 2024, Steak n Shake company-operated stores saw a 1.6% rise in same-store sales, demonstrating ongoing customer engagement.

The insurance division, including First Guard and Southern Pioneer, relies on premiums collected from policyholders, with underwriting profitability being a key determinant of success. Investment gains from Biglari Capital's management of marketable securities, notably through The Lion Fund, also contribute significantly, as evidenced by substantial returns reported in 2024.

| Revenue Stream | Primary Source | Key Drivers | 2024 Data/Trend |

|---|---|---|---|

| Restaurant Sales (Company-Operated) | Food & Beverage Sales | Customer Traffic, Average Spend | Steak n Shake same-store sales up 1.6% (Q1 2024) |

| Franchise Operations | Royalties, Profit Sharing | Franchisee Sales Performance | Consistent profit stream reported in 2023 |

| Insurance Premiums | Policy Premiums | Policy Volume, Premium Rates, Underwriting Profitability | Sector significant contributor in 2024 |

| Investment Gains | Marketable Securities Appreciation/Sale | Market Performance, Asset Allocation | Substantial returns reported by Biglari Capital in 2024 |

Business Model Canvas Data Sources

The Biglari Business Model Canvas is meticulously constructed using a blend of financial disclosures, market research reports, and internal operational data. These diverse sources ensure a comprehensive and accurate representation of the business's strategic framework.