Biglari Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Biglari Bundle

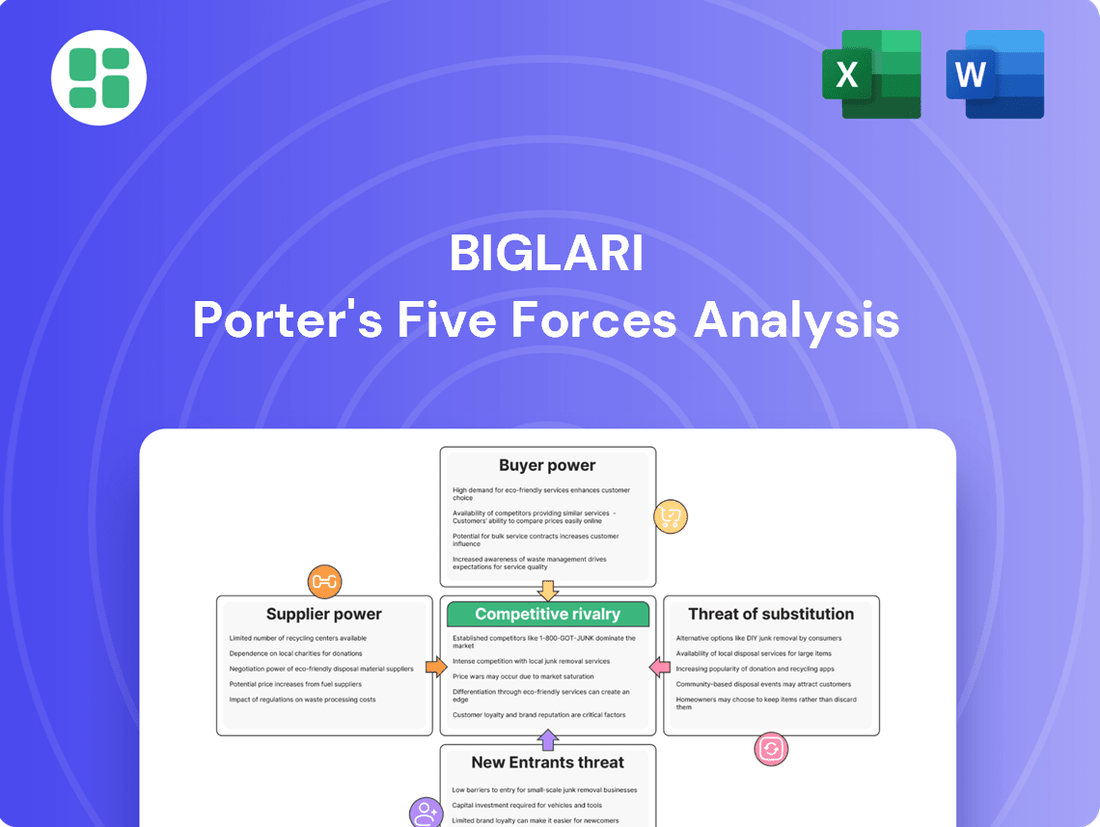

Biglari's competitive landscape is shaped by five powerful forces: the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry. Understanding these dynamics is crucial for any strategic decision-making.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Biglari’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

A concentrated supplier base significantly amplifies supplier bargaining power. For Biglari Holdings, especially its Steak n Shake operations, this means that if only a handful of companies provide essential ingredients like beef or dairy, or specialized kitchen equipment, those suppliers can dictate terms. This can translate directly into higher input costs for Biglari, squeezing profit margins.

The recent decision to transition Steak n Shake’s fries to 100% all-natural beef tallow by February 2025 highlights this dynamic. This shift suggests a potential reliance on a more specialized, and possibly limited, set of suppliers for this specific ingredient. If these suppliers are few in number, their leverage over Biglari increases, potentially impacting the cost and availability of this key menu item.

Biglari Holdings faces substantial switching costs when changing suppliers, encompassing financial expenses, operational disruptions, and retraining needs. For instance, if Biglari were to switch its primary food service suppliers for its Steak n Shake or Western Sizzlin' brands, the investment in new equipment, integration of different product lines, and ensuring consistent quality could be considerable. These high costs effectively anchor Biglari to its existing suppliers, granting them increased leverage.

Suppliers who offer unique or proprietary products, like specialized insurance software crucial for Biglari's operations or distinctive cuts of meat for its restaurant ventures, wield significant bargaining power. This differentiation allows them to dictate terms and prices, as their offerings are not easily substituted by competitors.

For instance, if a significant portion of Biglari's food costs in 2024 were tied to a specific, high-quality supplier of premium beef, that supplier's ability to differentiate its product would directly impact Biglari's profitability through potentially higher input costs.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Biglari's operating industries, such as a major food supplier opening its own restaurant chain or a data analytics firm launching its own insurance services, significantly enhances supplier bargaining power. This potential competition compels Biglari to cultivate strong supplier relationships and potentially concede on pricing or other terms to preempt such a move.

For instance, in the restaurant sector, a large meat supplier with established distribution networks could leverage its scale to enter the fast-casual market, directly challenging Biglari's brands. Similarly, in financial services, a data provider might develop its own underwriting capabilities, bypassing intermediaries like Biglari. This dynamic forces Biglari to consider the strategic implications of its supplier choices and maintain favorable terms to mitigate the risk of direct competition from its supply chain.

- Forward Integration Risk: Suppliers in Biglari's key sectors, like food service or insurance, possess the capability to establish their own customer-facing operations.

- Competitive Pressure: A credible threat of a supplier opening a competing business forces Biglari to negotiate from a weaker position.

- Strategic Considerations: Biglari must weigh the cost of potentially less favorable supplier terms against the risk of direct competition from its own suppliers.

Importance of Biglari to Supplier's Business

The relative importance of Biglari Holdings as a customer significantly influences the bargaining power of its suppliers. If Biglari represents a substantial portion of a supplier's total revenue, that supplier might be more amenable to negotiating favorable pricing and terms. Conversely, if Biglari is a minor client for a large supplier, its leverage in negotiations is considerably reduced.

For example, in 2023, Biglari Holdings' total revenue was $717.6 million. The proportion of this revenue that any single supplier contributes would determine how much weight Biglari carries in that supplier's business considerations. A supplier heavily reliant on Biglari would likely have less power to dictate terms compared to a supplier with a diversified customer base.

- Supplier Dependence: The degree to which a supplier's sales are concentrated with Biglari Holdings is a key factor.

- Revenue Contribution: If Biglari constitutes a large percentage of a supplier's revenue, the supplier's bargaining power over Biglari is diminished.

- Customer Size: A small customer to a large supplier typically faces less favorable terms due to the supplier's greater market power.

The bargaining power of suppliers for Biglari Holdings is influenced by several factors, including the concentration of suppliers, switching costs, product differentiation, the threat of forward integration, and Biglari's importance as a customer. For instance, if a few suppliers dominate the market for essential goods, they can command higher prices. Biglari's 2023 revenue of $717.6 million indicates its scale, but the impact on individual suppliers depends on their reliance on Biglari as a client.

| Factor | Impact on Biglari | Example Scenario |

|---|---|---|

| Supplier Concentration | High power for few suppliers | Limited beef suppliers for Steak n Shake |

| Switching Costs | Supplier lock-in | High costs to change food service providers |

| Product Differentiation | Supplier pricing leverage | Unique insurance software or premium beef |

| Forward Integration Threat | Supplier competition risk | Meat supplier opening a restaurant |

| Biglari's Customer Importance | Supplier negotiation leverage | Biglari as a small client for a large supplier |

What is included in the product

Uncovers the five key forces shaping Biglari's competitive environment, including industry rivalry, buyer and supplier power, the threat of new entrants, and substitute products.

Easily identify and address competitive threats by visually mapping the intensity of each of Porter's Five Forces.

Customers Bargaining Power

Customer price sensitivity is a major factor for Steak n Shake, particularly given the crowded fast-casual and casual dining markets. When consumers can easily find similar offerings at comparable or lower prices, their willingness to pay a premium diminishes significantly.

Biglari's approach, emphasizing value through competitive pricing at Steak n Shake, directly acknowledges this customer power. This strategy, driven by a focus on operational efficiency and cost control, aims to capture market share by appealing to budget-conscious diners, demonstrating that customers’ choices heavily influence pricing strategies.

For instance, in 2023, the average check size at casual dining restaurants in the US remained relatively stable, with many consumers actively seeking deals and promotions. This environment means that Steak n Shake's ability to maintain low prices is crucial for retaining its customer base, as any significant price hikes could lead customers to seek alternatives.

The bargaining power of customers is significantly influenced by the availability of substitutes and alternatives. For a company like Steak n Shake, customers have a vast array of dining choices. This includes other burger joints, various fast-food establishments, casual dining restaurants, and even the option to prepare meals at home.

This abundance of alternatives empowers customers. If they are unhappy with Steak n Shake's pricing, the quality of their food, or the level of service provided, they can readily shift their business to a competitor. For instance, the fast-casual dining sector, which includes brands like Five Guys and Shake Shack, saw substantial growth in 2024, with many consumers actively exploring these options for perceived better value or unique offerings.

For many industries, including dining and insurance, customers face minimal costs when deciding to switch to a competitor. For instance, a restaurant patron can simply walk into another establishment, and an insurance policyholder can typically change providers at their policy renewal date without significant financial penalties or complex procedures.

This ease of switching significantly amplifies customer bargaining power. In 2024, the average consumer spent approximately $3,500 annually on dining out, making even small price differences or service improvements a strong motivator to change. Similarly, the insurance industry saw millions of policy changes annually, reflecting this customer agency.

Customer Information and Transparency

Customers today have unprecedented access to information, significantly boosting their bargaining power. Online reviews, price comparison tools, and readily available competitor data empower consumers to make more informed purchasing decisions. For instance, in the restaurant sector, platforms like Yelp and Google Reviews allow diners to easily compare menus, prices, and service quality across various establishments, directly influencing their choices and pushing restaurants to offer competitive value.

This transparency extends to industries like insurance, where online aggregators have revolutionized how consumers shop for policies. These platforms enable individuals to compare quotes from multiple providers side-by-side, driving down prices as insurers compete for business. In 2024, the average consumer spent approximately 10 hours researching major purchases online, a figure that highlights the impact of readily available information on their decision-making process and their ability to negotiate better terms.

- Increased Information Access: Customers can easily find reviews, compare prices, and view competitor offerings online.

- Industry Impact: In restaurants, apps facilitate menu and price comparisons; in insurance, aggregators offer rate transparency.

- Consumer Behavior: The ease of information gathering strengthens customers' ability to seek the best value and negotiate.

- Data Point: In 2024, consumers dedicated around 10 hours to online research for significant purchases, underscoring the influence of accessible data.

Fragmented Customer Base

While individual customers often possess significant bargaining power due to low switching costs and numerous available alternatives, Biglari Holdings operates within markets characterized by a highly fragmented customer base. This diffusion of consumers prevents them from coalescing into organized groups capable of exerting substantial collective pressure on pricing or terms.

For instance, in the casual dining sector, where Biglari Holdings has significant interests, customer purchasing decisions are largely individual. This lack of unified action means that even though any single customer could easily choose a competitor, their inability to organize collectively diminishes the overall bargaining power of the customer segment as a whole.

The fragmentation of the customer base effectively dilutes the potential for widespread demands that could significantly impact Biglari Holdings' profitability. This dynamic is a key factor in how the company navigates competitive landscapes.

Key aspects of this fragmented customer base include:

- Low Individual Switching Costs: Customers can easily move between brands with minimal effort or expense.

- Numerous Alternatives: The market typically offers a wide variety of competing products or services.

- Lack of Collective Organization: Customers are dispersed and do not typically form groups to negotiate terms.

- Mitigated Collective Power: The inability to organize prevents customers from leveraging their individual power into a unified force.

The bargaining power of customers is a significant force, particularly in industries with many alternatives and low switching costs. For Steak n Shake, customers have numerous dining options, from fast food to other casual dining establishments, and the ability to prepare meals at home. This abundance of choices empowers consumers to readily shift their patronage if dissatisfied with pricing, quality, or service.

The ease with which customers can switch providers, often with minimal financial or procedural hurdles, amplifies their influence. For example, in 2024, the average consumer spent roughly $3,500 on dining out, making them sensitive to even minor price variations or service improvements that might encourage a switch.

Furthermore, enhanced access to information, through online reviews and price comparison tools, strengthens customer negotiation power. In 2024, consumers spent an average of 10 hours researching major purchases, demonstrating how readily available data allows them to seek the best value and terms.

Despite individual customer power, Biglari Holdings benefits from a fragmented customer base in sectors like casual dining. This means customers, while able to switch easily, generally do not organize collectively to exert unified pressure on pricing or terms, thus diluting their overall bargaining strength.

| Factor | Description | Impact on Biglari Holdings | 2024 Data Point |

|---|---|---|---|

| Availability of Substitutes | Numerous dining options available to consumers. | Increases customer ability to switch. | Fast-casual sector growth indicates active exploration of alternatives. |

| Switching Costs | Minimal costs for customers to change dining choices. | Amplifies customer bargaining power. | Average annual dining spend of $3,500 makes consumers price-sensitive. |

| Information Access | Easy access to reviews, prices, and competitor data online. | Empowers informed decision-making and negotiation. | Consumers spent ~10 hours researching major purchases online. |

| Customer Organization | Fragmented customer base, lacking collective action. | Dilutes overall customer bargaining power. | Individual purchasing decisions dominate the casual dining market. |

Preview Before You Purchase

Biglari Porter's Five Forces Analysis

This preview showcases the complete Biglari Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase. Rest assured, there are no placeholders or missing sections; you get the full, actionable insights instantly.

Rivalry Among Competitors

Biglari Holdings operates within industries characterized by a substantial number and variety of competitors. For instance, Steak n Shake contends with a crowded fast-food market, facing off against giants like McDonald's and Wendy's, as well as popular fast-casual brands such as Shake Shack and Five Guys. This intense competition extends to its insurance operations, where it must navigate a landscape populated by both massive, financially robust corporations and smaller, more localized insurance providers.

The restaurant industry, especially the fast-casual sector, is quite mature, meaning growth isn't as rapid as it once was. This maturity naturally ramps up the competition as established businesses fight harder for every customer. For instance, Steak n Shake's annual revenue saw a slight dip in 2024, and while its Q1 2025 revenue improved, it still lagged behind the broader US restaurant industry's growth pace.

When an industry experiences slow growth, companies often resort to more aggressive strategies to gain an edge. This can manifest as intense price wars or heightened marketing campaigns, as businesses try to capture a larger slice of a relatively static market. This dynamic puts pressure on all players, including those like Steak n Shake, to constantly innovate and differentiate.

In the restaurant industry, product and service differentiation is key to standing out. Steak n Shake has historically relied on its classic American diner feel, its signature 'Steakburgers,' and hand-dipped milkshakes. More recently, they've introduced beef tallow fries, a move aimed at enhancing flavor and appealing to a specific consumer preference.

However, the challenge lies in the fact that many competitors offer similar menu items and dining experiences. This makes it difficult for Steak n Shake to establish a truly unique selling proposition that can be sustained over the long term, impacting its ability to maintain a strong competitive advantage.

Exit Barriers

High exit barriers, such as specialized assets like restaurant properties or insurance systems, and contractual obligations like franchise agreements or long-term insurance policies, can trap companies in an industry even when profits are minimal. This forces struggling firms to continue competing, intensifying rivalry as they fight for survival instead of exiting gracefully.

For instance, in the restaurant sector, the significant investment in physical locations and brand development creates substantial exit barriers. A restaurant chain with numerous owned or long-leased properties faces considerable costs if it decides to close down, often requiring sale or lease termination, which can be a lengthy and unprofitable process. This situation can lead to prolonged price wars or aggressive marketing campaigns as these firms attempt to maintain market share and cover fixed costs, thereby impacting the profitability of all players.

Consider the insurance industry where specialized IT systems and long-term policy commitments represent significant exit hurdles. Companies are bound by regulatory requirements and customer contracts that make a swift departure difficult and costly. In 2024, the average time for an insurance company to wind down operations can extend over several years, involving the management of outstanding claims and policy obligations, further contributing to sustained competitive pressure.

- Specialized Assets: Restaurant properties, specialized kitchen equipment, and unique branding elements are difficult to redeploy or sell at full value, increasing exit costs.

- Contractual Obligations: Franchise agreements, long-term leases, and customer insurance policies create ongoing commitments that are expensive and complex to terminate.

- Emotional/Psychological Barriers: Management’s reluctance to admit failure or abandon a legacy business can also act as an informal exit barrier.

- Governmental/Regulatory Barriers: Certain industries, like banking or insurance, have strict regulations that can complicate or prevent a company from exiting the market easily.

Brand Identity and Loyalty

Steak n Shake benefits from a long history and a widely recognized brand, which can foster initial customer attraction. However, the restaurant sector is notoriously competitive, making it difficult to cultivate and sustain deep brand loyalty. Consumers can easily switch between numerous dining options, and competitors frequently employ aggressive marketing tactics to capture market share.

The effectiveness of Steak n Shake's unique franchising model and its ongoing operational adjustments are critical factors in its ability to stand out and compete. For instance, in 2023, Steak n Shake reported a net sales increase of 7.6% compared to 2022, reaching $967.5 million, indicating some success in its strategic initiatives.

- Brand Recognition: Steak n Shake's established presence provides a foundational advantage.

- Industry Challenges: High customer mobility and intense competitor marketing pressure loyalty.

- Strategic Importance: Franchising and operational changes are vital for competitive positioning.

- Financial Performance: A 7.6% net sales increase in 2023 suggests positive momentum from strategic shifts.

Competitive rivalry within Biglari's operating sectors is fierce due to numerous players and market saturation. For Steak n Shake, this means contending with established fast-food giants and popular fast-casual chains. The insurance sector also presents a crowded field with both large corporations and smaller, localized providers.

The maturity of the restaurant industry, particularly fast-casual, intensifies competition as companies vie for limited growth. Steak n Shake's 2024 revenue saw a slight decrease, and while Q1 2025 showed improvement, it still lagged the industry's overall growth pace.

In slow-growth environments, companies often engage in aggressive pricing and marketing to gain market share. This pressure forces continuous innovation and differentiation, a challenge for Steak n Shake as many competitors offer similar products and dining experiences.

High exit barriers, such as specialized assets and contractual obligations, keep even struggling firms competing, thus intensifying rivalry. For instance, restaurant properties and long-term insurance contracts make exiting costly, leading to prolonged competition and impacting industry profitability.

| Company/Sector | Key Competitors | Competitive Intensity Factors | Relevant 2023/2024 Data |

|---|---|---|---|

| Steak n Shake (Restaurant) | McDonald's, Wendy's, Shake Shack, Five Guys | Market Saturation, Mature Industry, Product Similarity | Net Sales Increase: 7.6% (2023) |

| Biglari Insurance Operations | Large Insurance Corporations, Localized Providers | Numerous Players, Financial Robustness of Competitors | Industry Exit Time (2024): Several years for winding down operations |

SSubstitutes Threaten

For Steak n Shake, the threat of substitutes is significant. Customers seeking a quick meal or a casual dining experience have a vast array of alternatives. These include other fast-food chains, casual dining restaurants, and even quick-service options like sandwich shops and pizza parlors.

Beyond direct restaurant competitors, the availability of grocery store meals, ready-to-eat options, and meal kits presents a strong substitute. In 2024, the meal kit delivery market alone is projected to reach over $20 billion globally, indicating a substantial shift towards convenient home-based dining solutions that bypass traditional restaurants.

Furthermore, the increasing popularity of home cooking, driven by economic considerations and a desire for healthier or more customized meals, also acts as a powerful substitute. Many consumers can prepare a steak-based meal at home for a fraction of the cost of dining out, directly impacting demand for establishments like Steak n Shake.

The threat of substitutes is significant when alternatives offer a comparable or superior value at a lower cost. For a restaurant like Steak n Shake, this means customers might choose a more affordable burger from a fast-food competitor or opt for home-cooked meals if the overall value proposition, considering price and experience, doesn't justify the expense.

In 2023, the fast-casual dining segment, which includes competitors like Shake Shack and Five Guys, saw continued growth, with many chains offering premium burger experiences at price points that can be competitive with sit-down establishments. For example, a meal at Shake Shack could range from $15-$25 per person, directly challenging Steak n Shake's pricing if perceived quality is similar or better.

Customer willingness to switch to substitutes is heavily influenced by evolving factors such as convenience, burgeoning health trends, and shifting consumer preferences. For instance, the increasing demand for plant-based alternatives in the food industry, with the global plant-based food market projected to reach over $74 billion by 2027, highlights a significant shift driven by health and ethical considerations.

The proliferation of sophisticated delivery services across a vast spectrum of culinary options directly amplifies the propensity for consumers to substitute traditional dine-in restaurant experiences. In 2024, online food delivery services saw continued robust growth, with platforms like DoorDash and Uber Eats reporting substantial increases in order volumes and revenue, indicating a strong consumer preference for the convenience of at-home dining.

Switching Costs for Customers to Substitutes

The threat of substitutes for Steak n Shake is significant due to the remarkably low switching costs for customers. For consumers, transitioning to an alternative dining option or preparing meals at home requires minimal effort or financial outlay. This ease of substitution directly impacts Steak n Shake's pricing power and market share.

In 2024, the fast-casual and casual dining sectors continue to see robust competition. For instance, casual dining restaurants, which often offer similar menu items, present a direct substitute. The convenience of fast food chains also poses a threat, as they cater to consumers seeking quick and affordable meals. Furthermore, the growing trend of home cooking, supported by meal kit services and readily available ingredients, provides another accessible substitute.

- Low Switching Costs: Customers can easily opt for other burger joints, pizza places, or even prepare meals at home with minimal inconvenience.

- Ubiquity of Alternatives: The market is saturated with dining options, from national fast-food chains to local eateries, all offering comparable products.

- Price Sensitivity: Given the low switching costs, customers are highly sensitive to price differences, making Steak n Shake vulnerable to competitors offering lower prices.

Innovation in Substitute Industries

Innovation in industries offering substitute products or services presents a significant threat to Biglari Holdings. For its restaurant segment, the rise of gourmet food trucks and sophisticated meal delivery platforms, like DoorDash and Uber Eats, provides consumers with convenient and often more affordable alternatives. For instance, the U.S. food delivery market was valued at approximately $30 billion in 2023, a figure expected to grow, directly impacting traditional restaurant patronage.

In the insurance sector, Biglari's potential exposure to substitutes is also considerable. Emerging fintech solutions offering streamlined digital insurance policies or even a resurgence in self-insurance models for businesses could siphon off market share. The increasing adoption of insurtech, projected to reach over $10 billion globally by 2024, highlights the rapid pace of innovation creating new competitive pressures.

- Gourmet food trucks and meal delivery services offer convenient, often lower-cost alternatives to traditional sit-down restaurants.

- Fintech innovations in insurance are simplifying policy acquisition and management, potentially disintermediating traditional insurers.

- The growing U.S. food delivery market, valued around $30 billion in 2023, directly competes with Biglari's restaurant operations.

- The global insurtech market's projected growth to over $10 billion by 2024 signals a significant threat from new digital insurance models.

The threat of substitutes for Steak n Shake remains a critical consideration. Customers have a wide array of options for dining out or eating at home, often at competitive price points. The ease with which consumers can switch to alternatives, coupled with evolving consumer preferences for convenience and value, directly impacts Steak n Shake's market position.

In 2024, the food service landscape continues to be shaped by innovations in delivery and the enduring appeal of home-cooked meals. For instance, the U.S. food delivery market, estimated at approximately $30 billion in 2023, offers consumers convenient alternatives to dine-in experiences. Similarly, the global meal kit delivery market, projected to exceed $20 billion in 2024, empowers consumers to prepare meals at home, directly competing with casual dining establishments.

| Substitute Category | Examples | Key Differentiators | 2023/2024 Market Data |

| Fast Food Chains | McDonald's, Burger King, Wendy's | Speed, Price, Ubiquity | U.S. Fast Food Market: ~$200 billion (2023 est.) |

| Casual Dining | Applebee's, Chili's, Olive Garden | Sit-down experience, Broader menu | U.S. Casual Dining Market: ~$70 billion (2023 est.) |

| Meal Kits & Home Cooking | HelloFresh, Blue Apron, Grocery Stores | Convenience, Customization, Cost-effectiveness | Global Meal Kit Market: ~$20 billion (2024 proj.) |

| Food Delivery Platforms | DoorDash, Uber Eats, Grubhub | Convenience, Variety of cuisines | U.S. Food Delivery Market: ~$30 billion (2023 est.) |

Entrants Threaten

Entering the restaurant sector, particularly with a physical presence like Steak n Shake, demands significant financial outlay for property, building, machinery, and initial running costs. While Steak n Shake offers a franchise partner approach with a modest $10,000 operator investment, traditional franchising still necessitates considerable capital.

For instance, in 2024, establishing a new, full-service restaurant can easily cost anywhere from $200,000 to over $1 million, depending on location and scale. The insurance industry presents even more formidable capital hurdles due to the need for underwriting reserves and meeting stringent regulatory compliance mandates, often running into millions of dollars.

Established brands, like Steak n Shake with its 89-year legacy, benefit from significant brand loyalty and recognition. This deep-rooted customer trust makes it challenging for new entrants to attract customers, as they lack the established reputation and familiarity that consumers associate with older, well-known companies. Building this level of brand equity requires substantial investment and time.

For restaurants, securing prime locations and efficient supply chains presents a significant hurdle for newcomers. Similarly, in the insurance sector, building robust distribution networks encompassing agents, brokers, and online platforms is crucial for market penetration.

New entrants in industries like food service or insurance face substantial challenges in establishing the necessary distribution channels. For instance, a new restaurant chain would need to invest heavily in acquiring desirable real estate and setting up reliable logistics for its ingredients and products.

Biglari Holdings, with its existing infrastructure, holds a distinct advantage. New companies attempting to enter these markets would need to replicate this established network, a costly and time-consuming endeavor, thereby limiting the threat of new entrants.

Regulatory and Legal Barriers

The restaurant and insurance industries face significant regulatory and legal barriers that can stifle new entrants. These include stringent health and safety standards, evolving labor laws, and the necessity of obtaining various licenses. For instance, the insurance sector presents particularly complex hurdles, such as the requirement to secure an insurance license, a process Biglari Reinsurance successfully navigated by obtaining one in Bermuda in 2024. These established compliance requirements act as a substantial deterrent to those considering entering these markets.

These regulatory landscapes create a formidable entry barrier. For example, in 2023, the U.S. restaurant industry saw an increase in compliance costs related to food safety and labor regulations. Similarly, the insurance industry, as demonstrated by Biglari Reinsurance's 2024 Bermuda licensing, necessitates specialized legal and financial expertise to meet solvency and operational requirements. Such upfront investments and ongoing compliance burdens effectively limit the number of new players who can realistically enter the market.

- Health and Safety Standards: Restaurants must adhere to strict food handling and sanitation regulations.

- Labor Laws: Compliance with minimum wage, overtime, and workplace safety laws is mandatory.

- Licensing Requirements: Obtaining necessary business and operational licenses, like insurance licenses, is a critical step.

- Industry-Specific Regulations: The insurance sector, in particular, has complex solvency and capital requirements.

Economies of Scale and Experience

Existing players, such as Biglari Holdings, leverage significant economies of scale in their operations. This translates to lower per-unit costs in areas like purchasing supplies, executing marketing campaigns, and managing day-to-day business activities. For instance, in 2024, the restaurant industry continued to see consolidation, with larger chains benefiting from bulk purchasing power that smaller, newer establishments simply cannot match.

Furthermore, established companies possess a wealth of accumulated experience and refined operational efficiencies. This hard-won knowledge allows them to operate more smoothly and cost-effectively than a new entrant. Newcomers must invest considerable time and resources to reach similar levels of efficiency, creating an inherent cost disadvantage from the outset.

- Economies of Scale: Biglari Holdings benefits from lower per-unit costs in purchasing, marketing, and operations due to its size.

- Experience Curve: Established players have developed operational efficiencies and knowledge that new entrants must acquire, creating a cost gap.

- Market Entry Barriers: The cost and time required for new entrants to match existing players' scale and experience act as a significant barrier.

- Competitive Disadvantage: New entrants face an immediate cost disadvantage compared to incumbents with established economies of scale and experience.

The threat of new entrants is generally low for Biglari Holdings due to substantial capital requirements, strong brand loyalty, and established distribution networks. For instance, establishing a new full-service restaurant in 2024 could cost between $200,000 and over $1 million, a significant hurdle for newcomers. Furthermore, regulatory compliance, such as obtaining insurance licenses like Biglari Reinsurance did in Bermuda in 2024, adds further complexity and expense.

The significant upfront investment needed for physical locations, equipment, and initial operations, coupled with the time and cost to build brand recognition, deters many potential new competitors. Established players also benefit from economies of scale, as seen in the 2024 restaurant industry's trend towards consolidation, where larger chains leverage bulk purchasing power. These factors combined create substantial barriers to entry, protecting incumbent businesses.

Porter's Five Forces Analysis Data Sources

Our Biglari Porter's Five Forces analysis is built upon a foundation of comprehensive data, including publicly available financial statements, investor presentations, and industry-specific market research reports. We also integrate insights from reputable news outlets and trade publications to capture current market dynamics and competitive pressures.