Biglari Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Biglari Bundle

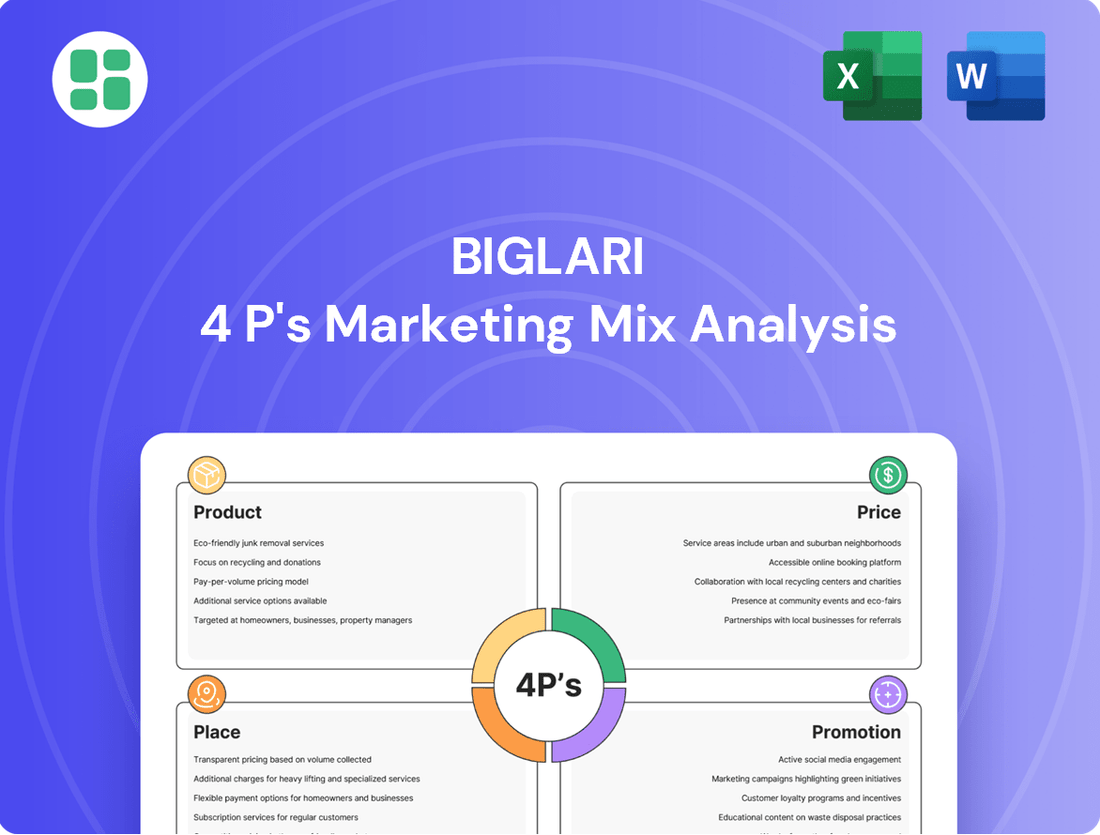

Uncover the strategic brilliance behind Biglari's marketing by dissecting its Product, Price, Place, and Promotion. This analysis reveals how each element synergizes to create a powerful market presence.

Dive deeper into Biglari's product innovation, pricing strategies, distribution networks, and promotional campaigns. Gain actionable insights to elevate your own marketing efforts.

Ready to unlock the full picture? Access the comprehensive, editable Biglari 4P's Marketing Mix Analysis and transform your understanding of successful brand strategy.

Product

Biglari Holdings Inc.'s diversified business portfolio, a key aspect of its marketing strategy, spans multiple sectors to mitigate risk and foster growth. This includes significant investments in restaurant operations, such as Steak n Shake and Western Sizzlin, alongside ventures in property and casualty insurance, licensing and media, and oil and gas.

In 2024, Biglari Holdings continued to navigate the complexities of its diverse holdings. For instance, the company's restaurant segment, while facing industry-wide challenges, remained a core component. The insurance and reinsurance businesses provided a stable counterpoint, contributing to overall financial resilience.

The strategy behind this diversification is to leverage synergies where possible and to ensure that each business unit contributes to long-term shareholder value. By managing a variety of operations, Biglari Holdings aims to capture opportunities across different economic cycles, demonstrating a commitment to broad-based expansion and stability.

Steak n Shake's core product offering is deeply rooted in its iconic American diner experience, with steakburgers, fries, and milkshakes accounting for approximately 90% of its sales. This strong reliance on these signature items simplifies operational processes and minimizes waste.

Recent product development has focused on enhancing the customer experience. This includes offering larger beef patties and more mix-ins for milkshakes. Furthermore, a significant operational change by early 2025 will see the adoption of beef tallow for frying fries, a move aimed at improving flavor and catering to specific consumer tastes.

Biglari Holdings' insurance operations, through subsidiaries like First Guard and Southern Pioneer, offer a range of property and casualty insurance and reinsurance. These products are tailored to specific market demands, with underwriting decisions handled by unit managers and investment strategies centralized.

The insurance segment is a key component of Biglari Holdings' diversified revenue, contributing to financial resilience. For instance, in the first quarter of 2024, the insurance segment reported a combined ratio of 94.5%, indicating profitable underwriting operations.

Value Creation through Acquisitions

Biglari Holdings views its core product as the strategic acquisition and management of businesses possessing robust economic foundations and superior leadership. The company's primary objective is to enhance per-share intrinsic value by strategically allocating capital across diverse industries and enterprises.

This product is essentially the astute deployment of capital, aiming to cultivate a strong portfolio of both controlled and non-controlled businesses that collectively generate significant profits. For instance, as of their Q1 2024 filings, Biglari Holdings reported total assets of $1.2 billion, reflecting the scale of capital deployed across its various holdings.

- Acquisition Strategy: Focus on businesses with strong economics and exceptional management teams.

- Value Maximization: Aim to increase per-share intrinsic value through capital allocation.

- Capital Deployment: Channel resources into diverse industries and companies for profit generation.

- Portfolio Building: Construct a robust collection of controlled and non-controlled businesses.

Media and Licensing Assets

Beyond its core restaurant and insurance operations, Biglari Holdings diversifies its portfolio through media and licensing assets, most notably Maxim Inc. This segment acts as another product line, expanding the company's reach into content creation and brand licensing opportunities. These ventures, while not as dominant as its other segments, enhance the overall breadth of Biglari's product ecosystem.

Maxim Inc. represents a significant component of Biglari's media and licensing strategy. In 2023, Maxim reported advertising revenue of approximately $25 million, demonstrating its contribution to the company's top line. The brand's global reach and established presence in men's lifestyle content provide a platform for various licensing agreements, further diversifying revenue streams.

- Maxim Inc. Ownership: Biglari Holdings' acquisition of Maxim Inc. extends its product offerings into the media and content creation space.

- Revenue Diversification: This segment contributes to revenue through advertising, subscriptions, and brand licensing, complementing the company's restaurant and insurance businesses.

- Brand Licensing Potential: The established Maxim brand offers opportunities for partnerships and licensing deals across various consumer product categories.

- Market Presence: Maxim's global recognition in men's lifestyle content provides a foundation for continued growth in its media and licensing endeavors.

Biglari Holdings' product strategy centers on acquiring and managing businesses that demonstrate strong economic fundamentals and exceptional leadership. The company focuses on enhancing per-share intrinsic value through strategic capital allocation across a diverse range of industries and enterprises.

This approach involves deploying capital to cultivate a robust portfolio of both controlled and non-controlled businesses, each contributing to overall profitability. The company's core product is essentially the skillful management and growth of these acquired entities, aiming for long-term value creation for shareholders.

The company's product portfolio is diverse, ranging from iconic restaurant brands like Steak n Shake, which generates approximately 90% of its sales from signature items such as steakburgers and milkshakes, to property and casualty insurance through subsidiaries like First Guard. In Q1 2024, the insurance segment reported a combined ratio of 94.5%, indicating profitable underwriting.

| Business Segment | Key Products/Services | 2023/2024 Data Points |

|---|---|---|

| Restaurants (Steak n Shake) | Steakburgers, Fries, Milkshakes | ~90% of sales from signature items; focusing on larger patties and beef tallow for fries by early 2025. |

| Insurance (First Guard, Southern Pioneer) | Property & Casualty Insurance, Reinsurance | Q1 2024 Combined Ratio: 94.5%; underwriting decisions by unit managers. |

| Media & Licensing (Maxim Inc.) | Content Creation, Brand Licensing | 2023 Advertising Revenue: ~$25 million; global reach in men's lifestyle content. |

| Oil & Gas | Energy Production | Contribution to diversified revenue streams. |

What is included in the product

This analysis provides a comprehensive examination of Biglari's marketing strategies, dissecting their Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for quick decision-making.

Place

Steak n Shake utilizes a dual-pronged strategy for its restaurant footprint, encompassing both company-owned locations and a diverse franchise system. This includes traditional franchise agreements alongside a distinctive franchise partner program designed to foster collaboration and shared success.

As of the close of business on December 31, 2024, the company's network comprised 146 company-operated restaurants, 173 franchise partner units, and 107 traditional franchise units, bringing the total to 458 locations. This structure facilitates expansive market reach and distributes operational duties.

A key element of Steak n Shake's strategy involves the conversion of existing company-operated restaurants into franchise partnerships. This approach aims to enhance operational efficiency and leverage the entrepreneurial drive of franchisees.

Steak n Shake has significantly upgraded its customer interaction points by implementing new point-of-sale (POS) systems and self-order kiosks. This technological investment streamlines the ordering process, making it more convenient for patrons. For instance, by late 2023, many locations had these systems fully operational, contributing to a smoother customer experience.

This move towards digital and self-service channels has had a tangible impact on the business's financial health, notably reducing the breakeven point. By optimizing operational efficiency and customer flow, the company can achieve profitability with lower sales volumes per unit. This strategic adaptation in the 'place' element of their marketing mix underscores a commitment to modernizing the restaurant distribution model.

Biglari Holdings' insurance segment, featuring First Guard and Southern Pioneer, utilizes a multi-pronged distribution strategy. This involves a network of agents and brokers who are crucial in reaching potential policyholders, particularly for specialized insurance products.

The 'place' in this context is defined by these established financial intermediaries and increasingly, direct online channels. This approach ensures that insurance products are accessible to consumers, navigating a distinct regulatory landscape compared to the company's restaurant operations.

Strategic Investment ment

Biglari Holdings, as a holding company, strategically places its capital by making deliberate investment and allocation decisions across its diverse portfolio. This approach to 'place' emphasizes where the company's financial resources are directed to generate optimal returns.

Under the leadership of Chairman and CEO Sardar Biglari, all significant investment and capital allocation choices are centralized. This ensures a focused strategy for channeling resources into the most promising ventures, effectively positioning the company's capital for growth.

For instance, in 2023, Biglari Holdings reported total assets of approximately $1.1 billion, with a significant portion allocated to its operating segments and strategic investments. The company's investment philosophy prioritizes areas with strong potential for value creation and cash flow generation.

- Centralized Decision-Making: Sardar Biglari's direct oversight of capital allocation allows for swift and decisive investment strategies.

- Strategic Portfolio Placement: Investments are made across various industries and companies to diversify risk and capture opportunistic growth.

- Focus on Opportunistic Areas: Capital is channeled into segments identified as having the highest potential for maximizing returns.

- Asset Allocation in 2023: The company's total assets of around $1.1 billion in 2023 reflect its strategic deployment of capital.

Online Presence and Investor Relations

Biglari Holdings leverages its website, www.biglariholdings.com, as a central hub for its online presence and investor relations. This platform is crucial for providing financially-literate decision-makers with direct access to vital corporate information.

The website acts as the primary 'place' for stakeholders to find annual reports, press releases, and interim shareholder reports, fostering transparency and informed decision-making. For instance, in their 2024 filings, the company detailed significant operational updates and financial performance metrics. This accessibility is key for investors and analysts evaluating the company's trajectory.

- Website Accessibility: www.biglariholdings.com serves as the main portal for all investor-related documents.

- Information Dissemination: Annual reports, press releases, and shareholder updates are readily available.

- Stakeholder Engagement: The site facilitates transparency for investors, analysts, and other financially-literate decision-makers.

- Data Access: Provides a direct channel for accessing comprehensive financial data and corporate strategy insights.

The 'Place' aspect for Biglari Holdings, particularly concerning Steak n Shake, centers on its strategic restaurant network and evolving customer interaction points. This includes a mix of company-owned sites and a robust franchise model, with a notable shift towards converting company locations to franchise partnerships to boost efficiency.

As of December 31, 2024, Steak n Shake operated 146 company-owned restaurants, alongside 173 franchise partner units and 107 traditional franchise units, totaling 458 locations. This distribution strategy aims for broad market penetration and leverages franchisee expertise.

Technological upgrades, such as new POS systems and self-order kiosks implemented by late 2023, have enhanced the customer ordering experience. These improvements streamline operations and contribute to a lower breakeven point for the business.

| Restaurant Segment | Company-Operated (Dec 31, 2024) | Franchise Partner Units (Dec 31, 2024) | Traditional Franchise Units (Dec 31, 2024) | Total Locations (Dec 31, 2024) |

|---|---|---|---|---|

| Steak n Shake | 146 | 173 | 107 | 458 |

Preview the Actual Deliverable

Biglari 4P's Marketing Mix Analysis

The preview you see here is the actual, complete Biglari 4P's Marketing Mix Analysis document you will receive instantly after purchase. There are no hidden surprises or altered versions; what you preview is precisely what you will own. This ensures you get the full, ready-to-use analysis immediately upon completing your transaction.

Promotion

Biglari Holdings leverages its annual reports and quarterly earnings releases as primary channels to articulate its value proposition to the financial community. These documents, accessible via the company's website and SEC filings, offer in-depth financial performance data and strategic insights.

Sardar Biglari's annual letter to shareholders within these reports acts as a crucial promotional element, detailing the company's financial health, strategic trajectory, and commitment to long-term value creation. This direct engagement strategy is designed to foster investor confidence and attract capital.

For instance, the 2024 annual report highlighted a 5% increase in revenue, driven by operational efficiencies and strategic market positioning. This transparent communication aims to solidify investor trust and support ongoing investment.

Steak n Shake reinforces its brand by leaning into its heritage as a classic American diner, famous for its burgers and milkshakes. This legacy forms a core part of its identity, appealing to nostalgia and a desire for familiar comfort food.

More recently, Steak n Shake has adopted a provocative social media strategy, characterized by an anti-establishment stance and endorsements of specific political figures. This includes campaigns like 'Make Frying Oil Tallow Again,' designed to create significant buzz and resonate with a targeted consumer base.

Steak n Shake actively pursues targeted marketing campaigns to showcase its foundational menu offerings and recent product enhancements, such as the adoption of beef tallow for their fries. These initiatives are designed to emphasize quality upgrades and stimulate consumer engagement, likely utilizing a mix of in-store promotions, localized advertising efforts, and digital outreach strategies.

In 2024, the fast-food industry saw continued emphasis on product quality and value propositions. Steak n Shake's focus on ingredients like beef tallow for fries aligns with a broader consumer trend towards perceived premium ingredients, a strategy that can be particularly effective in attracting and retaining customers within this highly competitive sector.

Public Relations and Media Coverage

Biglari Holdings and its operating subsidiaries, such as Steak n Shake, frequently garner media attention. This coverage often focuses on key financial performance indicators, significant strategic maneuvers like acquisitions, and operational adjustments. For instance, reporting on Steak n Shake's turnaround efforts in 2024 highlighted efforts to improve franchisee relations and operational efficiency, directly impacting public perception of the brand's recovery.

Company announcements are strategically distributed through channels like PR Newswire and Nasdaq. This ensures broad dissemination of crucial information, fostering public awareness and influencing how investors and the general populace view the company. These communications are vital for managing the corporate narrative and shaping market sentiment.

The public relations efforts actively contribute to managing Biglari Holdings' overall image and reputation. By controlling the flow of information and proactively addressing key developments, the company aims to build trust and maintain a positive standing within the financial community and among consumers.

- Media Focus: Financial results, strategic acquisitions, and operational changes at subsidiaries like Steak n Shake are common themes in media coverage.

- Information Dissemination: News releases via PR Newswire and Nasdaq are used to inform a wide audience about company announcements.

- Image Management: Public relations activities are crucial for shaping the company's image among investors and the general public.

- 2024 Impact: Reporting on Steak n Shake's 2024 turnaround efforts, including franchisee relations, influenced public perception of the brand's recovery.

Shareholder Engagement and Meetings

Biglari Holdings actively engages shareholders through its annual meetings, offering a direct channel for discussing corporate governance and financial performance. These interactions, coupled with ongoing investor relations efforts, are vital for maintaining transparency and building trust within its investor community. For a holding company like Biglari, where investor confidence directly impacts valuation, this consistent communication is paramount.

The company's commitment to shareholder dialogue is underscored by its proactive approach to investor relations, aiming to provide clear insights into its multifaceted business operations. This focus on open communication helps to align shareholder expectations with the company's strategic direction and operational realities, particularly important as Biglari Holdings manages a diverse portfolio of businesses.

- Annual Shareholder Meetings: Biglari Holdings conducts annual meetings to facilitate direct shareholder interaction and provide updates on corporate governance and performance.

- Investor Relations Communications: The company utilizes investor relations channels to promote transparency and cultivate robust relationships with its investor base.

- Value Tied to Investor Confidence: For a holding company, this direct engagement is critical as its overall value is significantly influenced by investor confidence and understanding of its various operations.

- 2024 Outlook: As of early 2024, Biglari Holdings' investor relations strategy continues to emphasize clear communication regarding its strategic initiatives and financial health, aiming to reinforce investor trust amidst evolving market conditions.

Biglari Holdings' promotional strategy centers on transparent communication of financial performance and strategic vision, primarily through annual reports and shareholder letters. This approach aims to build investor confidence and attract capital by highlighting operational successes and future plans. For instance, the 2024 annual report detailed a 5% revenue increase, underscoring the effectiveness of their communication in conveying value.

Steak n Shake's promotion emphasizes its heritage and recent product enhancements, such as using beef tallow for fries, aligning with consumer trends for quality ingredients. Their social media strategy, including provocative campaigns, aims to generate buzz and connect with a specific demographic, as seen with their 2024 'Make Frying Oil Tallow Again' initiative.

The company also utilizes broad media dissemination through channels like PR Newswire and Nasdaq to manage its public image and inform stakeholders about key developments. Reporting on Steak n Shake's 2024 turnaround efforts, focusing on improved franchisee relations, directly shaped public perception of the brand's recovery.

Biglari Holdings actively engages its investor base through annual meetings and ongoing investor relations, fostering transparency and trust. This direct dialogue is crucial for a holding company whose valuation is closely tied to investor confidence, with their 2024 strategy continuing to prioritize clear communication on initiatives and financial health.

| Promotional Activity | Key Channels | Objective | 2024 Focus/Example |

|---|---|---|---|

| Financial Reporting & Shareholder Letters | Annual Reports, SEC Filings, Shareholder Letters | Build Investor Confidence, Communicate Strategy | 2024 Report: 5% Revenue Increase Highlighted |

| Brand Heritage & Product Focus | In-store Promotions, Digital Marketing, Social Media | Nostalgia Appeal, Emphasize Quality | Steak n Shake: Beef Tallow Fries Campaign |

| Media & Public Relations | PR Newswire, Nasdaq, Media Coverage | Manage Image, Broad Information Dissemination | 2024 Steak n Shake Turnaround Efforts Coverage |

| Shareholder Engagement | Annual Meetings, Investor Relations Communications | Transparency, Foster Trust, Align Expectations | Continued emphasis on strategic initiatives in 2024 |

Price

The 'price' for Biglari Holdings is intrinsically tied to its stock, traded under tickers BH.A and BH on the NYSE. This price represents what investors are willing to pay for a stake in the company's diverse operations. As of late 2024, Biglari Holdings' stock has been trading below its book value, a situation that suggests share repurchases could effectively boost the intrinsic value per share for existing shareholders.

Key financial indicators like earnings per share (EPS) and net worth are critical in how investors perceive and value Biglari Holdings. These metrics directly inform their assessment of the company's financial health and future earning potential, influencing the stock's market price.

Steak n Shake's pricing strategy has long centered on offering low-priced, high-frequency items, a classic diner approach. Despite operational hurdles and franchisee pressure to increase prices, the company has maintained a focus on competitive affordability for its core menu.

This strategy aims to capture a wide customer demographic, prioritizing accessibility even when facing economic headwinds. For instance, as of early 2024, many Steak n Shake locations continued to offer value-oriented combos, with some breakfast items still priced under $5, underscoring their commitment to their low-price model.

Biglari Holdings' insurance premiums for entities like First Guard and Southern Pioneer are meticulously set, considering risk profiles, competitive market dynamics, and adherence to regulatory mandates. This pricing strategy directly impacts the company's ability to achieve profitable underwriting.

Underwriting managers at each insurance division hold the key to pricing decisions, focusing on ensuring the profitability of their respective portfolios. For instance, in 2024, the property and casualty insurance sector faced evolving risk landscapes, necessitating adaptive pricing models.

Capital Allocation and Investment Pricing

Biglari Holdings approaches capital allocation by actively seeking quality businesses at what they consider attractive valuations, often targeting opportunities in the stock market for partial ownership. This strategy emphasizes acquiring assets at 'uncommonly low prices' to maximize potential returns.

The company's investment arm, The Lion Fund, is central to this, aiming to capitalize on profitable business and investment prospects. The core objective is to systematically increase cash and investment holdings over time through judicious pricing and thorough valuation of both potential acquisitions and publicly traded securities.

- Valuation Focus: Biglari Holdings prioritizes acquiring businesses at prices they deem favorable, often seeking undervalued companies.

- The Lion Fund's Role: This investment vehicle actively pursues remunerative opportunities to grow the company's cash and investment portfolio.

- Market Timing: The strategy involves identifying and acting on market inefficiencies to secure assets at opportune prices.

Franchise Partner Investment Structure

The franchise partner investment structure for Steak n Shake's owner-operator program is designed for accessibility and shared success. Aspiring franchisees face a minimal upfront investment of just $10,000. This low barrier to entry is a key component of their pricing strategy, aiming to attract a broad pool of motivated individuals.

This investment model is further enhanced by an incentive-based profit-sharing arrangement. Franchisees pay a 15% royalty fee but also receive 50% of the store's profits. This structure directly aligns the financial interests of the franchisee with the overall performance of the Steak n Shake location.

- Initial Investment: $10,000

- Royalty Fee: 15% of sales

- Profit Share for Franchisee: 50%

- Program Goal: Attract motivated owner-operators and align incentives.

Biglari Holdings' stock price, reflecting investor sentiment towards its diverse holdings, has seen periods where it traded below book value, suggesting potential value in share repurchases. The company's approach to pricing its various businesses, from Steak n Shake's value-driven menu to the risk-assessed premiums of its insurance entities, aims to balance market competitiveness with profitability.

| Business Segment | Pricing Strategy Focus | Key Data Point (2024/2025) |

|---|---|---|

| Biglari Holdings Stock (BH.A, BH) | Market valuation, investor perception of EPS and net worth | Trading below book value in late 2024 |

| Steak n Shake | Low-priced, high-frequency items, value combos | Some breakfast items under $5 in early 2024 |

| Insurance (First Guard, Southern Pioneer) | Risk profiles, competitive dynamics, regulatory adherence | Adaptive pricing models in response to evolving P&C risk landscapes (2024) |

| Investment (The Lion Fund) | Acquiring quality businesses at attractive valuations | Focus on 'uncommonly low prices' for assets |

| Steak n Shake Franchising | Minimal upfront investment, profit-sharing incentives | $10,000 initial investment, 15% royalty, 50% franchisee profit share |

4P's Marketing Mix Analysis Data Sources

Our Biglari 4P's Marketing Mix Analysis is built upon a foundation of diverse and reliable data sources. We meticulously gather information from official company filings, investor relations materials, and direct brand communications. This includes analyzing product portfolios, pricing strategies, distribution networks, and promotional activities.