Biglari Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Biglari Bundle

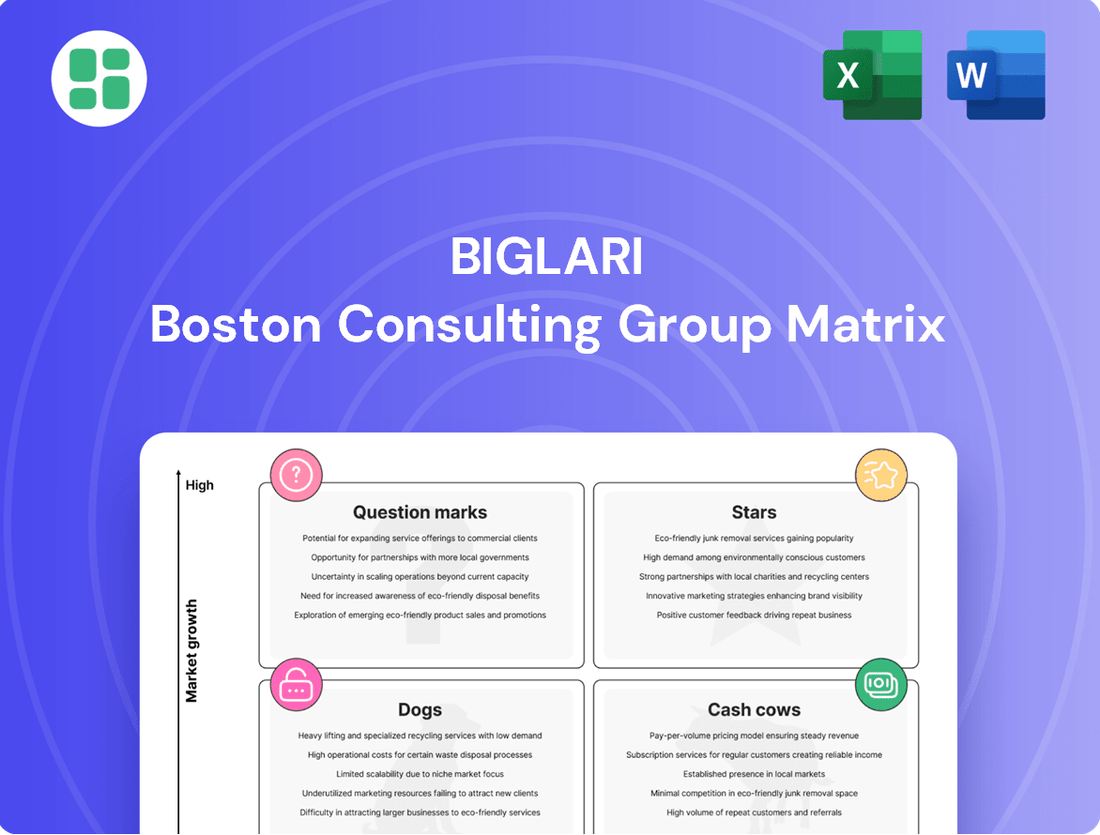

Unlock the strategic potential of Biglari's portfolio with this BCG Matrix preview. See where their ventures are positioned as Stars, Cash Cows, Dogs, or Question Marks, and understand the implications for future growth. Purchase the full BCG Matrix for a comprehensive analysis, including detailed quadrant placements and actionable insights to optimize your own business strategy.

Stars

Steak n Shake's operational overhaul, featuring self-order kiosks and adjusted hours, has boosted productivity by an impressive 114% as of 2024. This strategic shift has significantly enhanced unit economics, demonstrating a successful turnaround for the brand.

In the first quarter of 2025, Steak n Shake's consistent same-store sales growth outpaced competitors, contributing substantially to Biglari Holdings' overall performance surge. This rebound signals a strong market position and the potential for increased market share in the competitive fast-casual dining sector.

Biglari Holdings is strategically investing in advanced technologies for Steak n Shake, including face pay at kiosks and updated digital menuboards. This focus on tech, such as AI-driven customer service and automated ordering, mirrors a wider industry push to boost efficiency and customer satisfaction. For instance, the quick-service restaurant sector saw technology investments grow significantly, with some companies reporting over a 15% increase in tech spending in 2024 alone to streamline operations.

The franchise partner model, which transforms former managers into owner-operators, is a cornerstone of Steak n Shake's strategy, demonstrably improving unit economics. This model is designed to place all corporate stores under owner-operator control, a transition that, if it gains momentum, could significantly expand the brand's presence without requiring direct capital investment from Biglari.

While the conversion pace saw a slowdown in 2023, the long-term objective remains clear. Accelerating this shift to decentralized ownership presents a substantial opportunity for market penetration and enduring profitability. This approach leverages the commitment of owner-operators to drive growth and operational efficiency across the Steak n Shake network.

Focus on Core, High-Demand Menu Offerings

Steak n Shake's strategic decision to streamline its menu, emphasizing core items like steakburgers, fries, and shakes, which account for approximately 88% of its total sales, significantly sharpens operational efficiency. This focus allows the company to concentrate on excelling within high-demand segments of the fast-casual dining sector.

By dedicating resources to these popular and profitable offerings, Steak n Shake is better positioned to solidify its market standing and drive sales momentum in its most crucial product categories.

- Menu Simplification: Core items like steakburgers, fries, and shakes represent nearly 90% of Steak n Shake's sales.

- Operational Efficiency: This focus allows for improved operational execution and resource allocation.

- Market Strength: Concentrating on high-demand items strengthens the brand's competitive position.

- Sales Growth: The strategy aims to drive increased sales through popular and profitable offerings.

Leveraging Strong Q1 2025 Operating Performance

Biglari Holdings showcased remarkable financial strength in the first quarter of 2025, with pre-tax operating earnings soaring by 75% year-over-year to $9.99 million. This significant uptick represents the company's most robust quarterly operational performance since its strategic restructuring in 2023. The impressive results underscore the company's ability to leverage its core business segments, particularly Steak n Shake, to drive substantial earnings growth.

This sustained operational excellence is a key indicator for Biglari Holdings' position within a BCG Matrix framework. The strong performance suggests that segments like Steak n Shake are likely performing as Stars, characterized by high growth and high market share.

- Strong Q1 2025 Earnings: Biglari Holdings reported a 75% increase in pre-tax operating earnings to $9.99 million in Q1 2025.

- Post-Restructuring Peak: This marks the highest quarterly operational performance since the company's 2023 restructuring.

- Steak n Shake's Contribution: The strong operational momentum is partly attributed to the performance of Steak n Shake.

- Indicator of Star Status: The sustained operational excellence positions these segments for continued growth and market leadership, aligning with Star characteristics in a BCG Matrix.

Stars in the Biglari BCG Matrix represent business units with high growth and high market share, demanding significant investment to maintain their position. Steak n Shake's operational turnaround, marked by a 114% productivity boost in 2024 and consistent same-store sales growth in early 2025, strongly suggests it has achieved Star status. The brand's strategic focus on core menu items, technological integration, and a successful franchise partner model are key drivers of this high-performance segment.

| Metric | Value | Period | Significance |

|---|---|---|---|

| Steak n Shake Productivity Increase | 114% | 2024 | Operational overhaul success |

| Biglari Holdings Pre-Tax Operating Earnings Growth | 75% | Q1 2025 (YoY) | Strong overall financial performance |

| Core Menu Item Sales Contribution | ~88% | 2024 | Menu simplification effectiveness |

| Investment in Technology | Significant | Ongoing | Enhancing customer experience and efficiency |

What is included in the product

The Biglari BCG Matrix analyzes a company's portfolio by categorizing business units into Stars, Cash Cows, Question Marks, and Dogs based on market growth and share.

It provides strategic guidance on resource allocation, recommending investment in Stars and Question Marks while managing or divesting Cash Cows and Dogs.

The Biglari BCG Matrix provides a clear, visual roadmap for strategic decision-making, alleviating the pain of resource allocation uncertainty.

Cash Cows

Biglari Holdings' insurance businesses, namely First Guard and Southern Pioneer Property & Casualty Insurance, are positioned within a mature industry. This sector typically sees stable, moderate growth. The insurance industry in the US is showing signs of improved profitability, with non-life insurers anticipating lower combined ratios in 2024 and 2025. Higher interest rates are also positively impacting investment yields for these companies.

These insurance operations are consistent generators of significant cash flow for Biglari Holdings. For instance, in the first quarter of 2024, Biglari Holdings reported that its insurance segment contributed positively to overall earnings, reflecting the stable cash-generating nature of these businesses despite the mature market dynamics.

Steak n Shake, despite a decrease in its number of locations, continues to be a recognizable force in the restaurant sector. In 2024, it posted pre-tax operating earnings of $20.1 million, demonstrating its enduring profitability.

The brand's revamped operational approach has led to better financial performance per unit and increased efficiency. This strategic shift solidifies Steak n Shake's role as a key profit driver for Biglari Holdings.

With its strong brand recognition and a concentrated effort on operational effectiveness, Steak n Shake functions as a dependable source of consistent revenue for the company.

Western Sizzlin, acquired by Biglari Holdings in 2010, has proven to be a robust cash cow. Through 2024, it generated a remarkable $30.6 million in cash distributions, far surpassing its initial acquisition cost.

This consistent performance highlights Western Sizzlin as a mature and stable business, reliably contributing significant cash flow to its parent company. Its enduring financial strength solidifies its position as a valuable cash-generating asset within Biglari Holdings' portfolio.

The Lion Fund's Investment Profits

Biglari Holdings' investment activities, notably The Lion Fund, were a significant contributor to its financial performance by the close of 2024. The fund's fair value reached $790.0 million, primarily driven by investment profits.

These profits, though subject to market fluctuations, serve as a crucial, albeit indirect, capital source. This capital can be strategically redeployed into Biglari's various operating segments or distributed to its shareholders.

- The Lion Fund's fair value reached $790.0 million by year-end 2024.

- Profits from The Lion Fund are a substantial, though volatile, capital source.

- This capital can be reallocated to operating businesses or returned to shareholders.

Maxim Inc. (Licensing and Media)

Maxim Inc., operating in the licensing and media space, fits the profile of a cash cow within the Biglari Holdings portfolio. This sector is generally mature, suggesting stable but not explosive growth potential. Such businesses are known for generating consistent revenue streams, which are valuable for any holding company seeking diversified earnings. While precise 2024 figures for Maxim Inc. are not publicly itemized in a way that allows for direct analysis of its cash flow contribution, its established presence indicates a reliable, albeit modest, contributor to Biglari Holdings' overall financial stability.

Cash cows like Maxim Inc. are crucial for funding growth initiatives in other parts of a business. They represent established revenue generators that require minimal investment to maintain their operations. This allows capital to be reallocated to areas with higher growth potential or strategic importance.

- Mature Market: Maxim Inc. operates in a well-established licensing and media market.

- Steady Revenue: Businesses in this category typically provide consistent, low-growth revenue.

- Cash Contribution: Maxim Inc. likely serves as a reliable cash contributor to Biglari Holdings.

- Diversification: Its presence adds to the diversified earnings of the parent company.

Cash cows are established businesses that generate consistent profits with minimal investment. Biglari Holdings' insurance segments, First Guard and Southern Pioneer, are prime examples, benefiting from a stable industry and improved insurer profitability in 2024-2025. Steak n Shake, despite a reduced footprint, reported $20.1 million in pre-tax operating earnings for 2024, showcasing its enduring cash-generating ability through operational efficiencies. Western Sizzlin, acquired in 2010, has been a standout, distributing $30.6 million in cash by 2024, far exceeding its acquisition cost.

| Business Unit | Category | 2024 Financial Highlight | Market Characteristic |

|---|---|---|---|

| First Guard & Southern Pioneer | Insurance | Stable cash flow, benefiting from higher interest rates and improved industry profitability | Mature, stable growth |

| Steak n Shake | Restaurant | $20.1 million pre-tax operating earnings | Mature, consistent revenue |

| Western Sizzlin | Restaurant | $30.6 million in cash distributions | Mature, robust cash generation |

Delivered as Shown

Biglari BCG Matrix

The Biglari BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after your purchase. This means you get the exact same strategic analysis, professionally formatted and ready for immediate application in your business planning. Rest assured, there are no hidden watermarks or incomplete sections; what you see is precisely what you will download and utilize.

Dogs

A portion of Steak n Shake's company-operated restaurants are still facing difficulties with low sales and minimal profits. These underperforming locations consume valuable resources and negatively impact the brand's overall financial health.

Biglari Holdings has recognized the difficulty in turning around these specific units, classifying them as prime candidates for strategic changes such as transformation, sale, or outright closure. This approach aligns with the BCG Matrix's classification of 'Dogs,' which typically require careful management or divestment to free up capital for more promising ventures.

Traditional Steak n Shake franchises are experiencing a significant slowdown in growth. In 2023, the company saw the fewest conversions of company-operated restaurants to the franchise model. This trend continued into 2024, with a further retraction in the number of traditional franchise units.

This low market adoption for the traditional franchise expansion strategy suggests it's not effectively driving market share growth or delivering expected returns. The company itself has acknowledged that revitalizing this area of growth will require considerable time.

Abraxas Petroleum Corporation, as part of Biglari Holdings' portfolio, likely falls into the question mark category of the BCG matrix. While operating in the oil and gas sector, this segment has experienced significant volatility. Biglari Holdings reported a decline in pre-tax operating earnings across its businesses in 2024, suggesting potential challenges for Abraxas.

Given the historical volatility and the overall earnings dip in 2024, Abraxas Petroleum may represent a low-growth, low-market share asset. Without clear recent positive growth indicators, it’s difficult to position it as a star or cash cow. The capital invested here might not be yielding optimal returns compared to its potential or other holdings.

Inefficient Legacy Operating Models

Inefficient legacy operating models within Biglari Holdings' portfolio represent businesses or segments that haven't kept pace with modernization efforts seen in other parts of the company, like Steak n Shake. These older structures can hinder performance.

Such segments often struggle with sustained low profitability and a minimal market share, particularly within mature industries where competition is fierce and adaptation is key. For example, if a legacy business operates with outdated technology or manual processes, its cost structure will likely be higher than competitors, impacting margins.

These challenges necessitate significant strategic intervention, which could involve substantial investment in modernization, a complete overhaul of operational processes, or ultimately, divestment to free up capital and management focus for more promising ventures. The financial implications can be substantial, with underperforming assets weighing down overall company valuation.

- Low Profitability: Legacy models often result in thinner profit margins due to higher operating costs and inability to scale efficiently.

- Minimal Market Share: In mature markets, outdated models struggle to compete, leading to a shrinking or stagnant market presence.

- Need for Intervention: Significant capital investment or a complete restructuring of operations is typically required to revitalize these segments.

- Divestment Consideration: If revitalization proves unfeasible or too costly, selling off these inefficient units becomes a strategic option.

Any Businesses with Sustained Net Losses

Businesses experiencing sustained net losses, like those Biglari Holdings might encounter, are categorized as Dogs in the BCG Matrix. These entities drain resources without contributing positively to the company's overall financial health. For instance, if a subsidiary consistently reports negative net income, it falls into this underperforming category.

Biglari Holdings, in its 2024 reporting, did acknowledge net losses, largely attributed to investment performance. However, within the BCG framework, the focus for Dogs is on the operational viability of individual business units. A sustained operating loss in any specific subsidiary, regardless of broader company performance, would firmly place that unit in the Dog quadrant.

Such businesses are essentially cash sinks. They require ongoing capital infusions to operate but fail to generate sufficient returns to justify the investment. This makes them prime candidates for rigorous strategic evaluation, with divestment often being the most logical path to unlock capital and improve the performance of the entire portfolio.

Consider the implications:

- Cash Drain: Sustained operating losses mean the business consumes more cash than it generates.

- Low Market Share & Low Growth: Dogs typically operate in slow-growing markets and hold a small market share.

- Divestment Consideration: Companies often look to sell or discontinue these units to reallocate resources to more promising ventures.

Businesses classified as Dogs in the BCG Matrix are characterized by low market share and low growth prospects. These segments typically consume significant resources without generating substantial returns, often operating at a loss. For Biglari Holdings, units like underperforming Steak n Shake restaurants that are difficult to turn around exemplify this category.

| Business Segment | BCG Category | Key Characteristics | 2024 Data/Observations |

|---|---|---|---|

| Underperforming Steak n Shake Units | Dogs | Low sales, minimal profits, require strategic change (transformation, sale, closure) | Continue to face difficulties, consuming resources and impacting overall financial health. |

| Legacy Operating Models | Dogs | Inefficient, low profitability, minimal market share, often require modernization or divestment | Struggle with higher operating costs due to outdated technology or manual processes. |

| Businesses with Sustained Net Losses | Dogs | Cash sinks, require ongoing capital infusion, fail to generate sufficient returns | Biglari Holdings acknowledged net losses in 2024, partly due to investment performance; specific operating units with sustained losses would fall here. |

Question Marks

Biglari's insurance divisions are positioned to capitalize on the burgeoning AI in insurance market, which is expected to grow substantially. This sector represents a significant opportunity for innovation and expansion, with projections indicating a market value of $4.7 billion by 2032.

Meanwhile, Steak n Shake's embrace of technologies like face pay and advanced digital menuboards reflects a strategic move into the rapidly evolving restaurant automation landscape. These are considered high-growth areas, though Biglari's current penetration is minimal.

These new technology integrations, while promising high growth potential, currently represent a low market share for Biglari. Consequently, they necessitate substantial investment to achieve scalability and establish a stronger market presence.

Strategic expansion into untapped geographic markets for Biglari Holdings, such as taking its revitalized Steak n Shake concept or its insurance businesses into new territories, would classify these ventures as Stars within the BCG Matrix framework. These initiatives would target markets with high growth potential but would begin with a low initial market share, necessitating significant capital outlay to establish a foothold and capture market dominance.

Biglari's existing businesses are poised to innovate by launching new product lines, such as exploring plant-based menus in their restaurant division to tap into the growing demand for sustainable food options. This strategic move targets a high-growth market, but with an initial low market share, necessitating substantial investment in marketing and product development to gain traction and achieve profitability.

Targeted, Smaller Acquisitions in Niche Growth Sectors

Biglari Holdings' strategy emphasizes targeted, smaller acquisitions in niche growth sectors, aligning with a focus on advancing operating earnings. This approach suggests a proactive search for nascent companies, often startups, that exhibit significant growth potential despite a currently low market share. These ventures require considerable investment and strategic direction to mature into what could be considered future 'Stars' within a portfolio.

For instance, Biglari Holdings has historically shown an interest in sectors with strong secular tailwinds. In 2024, sectors like artificial intelligence, renewable energy components, and specialized software-as-a-service (SaaS) platforms continued to demonstrate robust growth. Companies operating within these niches, even with modest initial revenues, could represent attractive targets for the holding company's acquisition strategy.

- Focus on High-Growth Niches: Biglari Holdings prioritizes acquiring smaller companies in sectors poised for substantial expansion.

- Potential for Future Stars: These acquisitions, though starting small, are strategically chosen for their capacity to become market leaders.

- Capital and Strategic Investment: Significant capital allocation and expert guidance are crucial for nurturing these nascent businesses.

- Advancing Operating Earnings: The ultimate goal is to enhance the company's overall financial performance through these strategic additions.

Refinement and Broader Application of Operational Efficiencies

The substantial productivity improvements seen at Steak n Shake, following its operational restructuring, offer a compelling blueprint. These gains, which could translate into significant cost savings and improved customer throughput, are ripe for adaptation across Biglari Holdings' diverse restaurant and service ventures. This strategic replication is a key element in driving portfolio-wide growth.

Consider the potential for smaller brands within the Biglari portfolio to benefit from the refined operational playbook developed at Steak n Shake. By applying these high-efficiency methodologies, even to a limited extent, these businesses could see a marked improvement in their bottom line. This cross-pollination of best practices is a powerful, yet often underutilized, growth lever.

- Steak n Shake's turnaround efforts have demonstrably improved operational metrics.

- The potential exists to scale these efficiencies to other Biglari Holdings brands.

- This strategy targets high growth by enhancing existing, lower-penetration assets.

- Refining and applying successful models is a low-risk, high-reward approach to portfolio expansion.

Question Marks represent ventures with high growth potential but currently low market share. These are Biglari's emerging opportunities, requiring significant investment to develop. They are the seeds of future Stars, demanding strategic focus and capital infusion to grow.

Biglari's investment in AI within its insurance divisions and the adoption of advanced technologies like face pay at Steak n Shake exemplify Question Marks. These areas, while showing promise for future growth, currently represent a small portion of Biglari's overall market presence.

The company's strategy of acquiring smaller, niche companies in high-growth sectors like AI and specialized software in 2024 also fits the Question Mark profile. These nascent businesses, despite their growth trajectory, begin with a limited market share, necessitating substantial investment to scale.

The potential for Steak n Shake's operational efficiencies to be replicated across other Biglari brands, particularly those with lower market penetration, also aligns with the Question Mark strategy. This approach aims to elevate underperforming assets into high-growth areas through strategic application of proven models.

| Biglari Holdings Venture | Market Growth Potential | Current Market Share | BCG Category | Investment Need |

|---|---|---|---|---|

| AI in Insurance | High | Low | Question Mark | Substantial |

| Steak n Shake Automation | High | Low | Question Mark | Significant |

| Niche Tech Acquisitions (2024) | High | Low | Question Mark | High |

| Operational Efficiencies Replication | High | Low (for target brands) | Question Mark | Moderate |

BCG Matrix Data Sources

Our BCG Matrix is powered by extensive market research, encompassing financial statements, industry growth rates, and competitor performance data to deliver actionable strategic insights.