BHP Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BHP Group Bundle

BHP Group, a mining giant, boasts significant strengths in its diversified commodity portfolio and operational efficiency, but faces threats from volatile commodity prices and increasing environmental regulations. Understanding these dynamics is crucial for any investor or strategist.

Want the full story behind BHP's market position, including detailed analyses of its opportunities for expansion and the weaknesses that could hinder growth? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

BHP Group cemented its position as the world's largest mining company in 2024, with a market capitalization exceeding $150 billion. Its diversified portfolio, spanning iron ore, copper, coal, and nickel, significantly reduces exposure to any single commodity's price volatility, providing a robust foundation for stable revenue streams and lower overall market risk.

BHP Group consistently showcases impressive financial strength. In fiscal year 2024, the company achieved an underlying attributable profit of US$13.7 billion, underscoring its ability to generate substantial earnings.

This robust financial performance is further highlighted by significant cash flow generation and a dedicated approach to returning value to shareholders. BHP distributed substantial total cash dividends in FY2024, reinforcing its commitment to its investors.

The company's strong balance sheet is a key asset, providing the necessary resilience to navigate the inherent volatility of global commodity markets effectively.

BHP's commitment to operational excellence is a cornerstone of its strength, particularly evident in its Western Australia Iron Ore (WAIO) operations. This division consistently ranks as the world's lowest-cost iron ore producer, a significant advantage that directly translates into robust profit margins.

This relentless pursuit of efficiency and ongoing improvement initiatives have fueled steady production growth for BHP. For the fiscal year ending June 30, 2023, BHP reported a 3% increase in iron ore production to 283.7 million tonnes, underscoring its operational prowess.

Strategic Focus on Future-Facing Commodities

BHP Group is strategically positioning itself for the future by focusing on commodities crucial for the global energy transition. This includes significant investments in copper, nickel, and potash, materials essential for technologies like electric vehicles and renewable energy infrastructure. For instance, BHP's acquisition of Oz Minerals in 2023 for $6.4 billion underscores its commitment to expanding its copper footprint, aiming to capitalize on anticipated demand surges. The company is also advancing its Jansen potash project in Canada, a vital nutrient for global food security, with stage one expected to commence production in 2026. These moves demonstrate a clear strategy to align its portfolio with long-term global megatrends.

The company's emphasis on copper is particularly noteworthy. BHP is undertaking substantial expansion projects, such as the ongoing development at its Escondida mine in Chile, the world's largest copper mine. These expansions are designed to meet the projected doubling of copper demand by 2030, driven by electrification and decarbonization efforts. By securing its supply of these future-facing commodities, BHP aims to enhance its resilience and profitability in a changing global economic landscape.

- Strategic Shift: Prioritizing copper, nickel, and potash aligns BHP with the global energy transition and sustainable technologies.

- Copper Expansion: Investments like the Oz Minerals acquisition and Escondida development position BHP to meet surging EV and renewable energy demand.

- Potash Development: The Jansen project in Canada addresses growing needs in global agriculture and food security, with initial production anticipated in 2026.

- Future Demand: BHP is proactively securing its position to benefit from the projected doubling of copper demand by 2030.

Strong Global Presence and Tier 1 Assets

BHP Group boasts a robust global presence, operating large-scale, long-life Tier 1 assets across Australia and the Americas. These operations consistently rank in the top quartile for size, quality, and cost efficiency, providing a significant competitive advantage.

This diversified geographical footprint mitigates regional risks and ensures BHP maintains a balanced exposure to global commodity markets. Such a strategic positioning allows the company to achieve superior margins, even through fluctuating commodity cycles.

- Global Operational Footprint: BHP's assets span key mining regions, including Australia and the Americas.

- Tier 1 Asset Quality: Operations are characterized by top-quartile size, quality, and cost positions.

- Risk Diversification: A global presence reduces reliance on any single region, enhancing stability.

- Margin Superiority: Efficient operations and asset quality contribute to strong profitability across commodity cycles.

BHP's diversified commodity portfolio, including iron ore, copper, and coal, provides significant resilience against market fluctuations. In fiscal year 2024, the company demonstrated strong financial health with an underlying attributable profit of US$13.7 billion and substantial cash flow generation, which supported significant shareholder returns. Its operational efficiency, particularly in Western Australia, results in low-cost production, directly boosting profit margins.

The company's strategic focus on future-facing commodities like copper and nickel, exemplified by the $6.4 billion Oz Minerals acquisition in 2023, positions it to capitalize on the growing demand driven by the energy transition. Furthermore, the Jansen potash project, slated for initial production in 2026, addresses global food security needs.

BHP's global footprint, with Tier 1 assets in Australia and the Americas, ensures operational scale, quality, and cost competitiveness. This geographical diversification mitigates regional risks and contributes to superior margins across various commodity cycles.

| Metric | FY2023 (USD billions) | FY2024 (USD billions) | Key Strength |

|---|---|---|---|

| Underlying Attributable Profit | 13.4 | 13.7 | Consistent Profitability |

| Iron Ore Production (Mt) | 283.7 | 285.1 (est.) | Operational Scale |

| Copper Expansion Investment | N/A | 6.4 (Oz Minerals Acquisition) | Future Demand Focus |

What is included in the product

Delivers a strategic overview of BHP Group’s internal and external business factors, highlighting its market strengths, operational gaps, and potential threats.

Offers a clear, actionable framework for identifying and addressing BHP's strategic challenges.

Weaknesses

BHP Group's financial results are significantly tied to the unpredictable swings in global commodity prices, particularly for iron ore and coal. For instance, iron ore prices, a key revenue driver, experienced considerable fluctuations throughout 2023 and early 2024, impacting BHP's top-line performance. This inherent volatility means that substantial drops in these commodity prices can directly compress the company's revenue and profit margins, making earnings less stable.

BHP Group's significant reliance on key geographic markets, especially China, for a large portion of its resource demand presents a notable weakness. For instance, in the fiscal year ending June 30, 2023, China accounted for approximately 30% of BHP's sales revenue, highlighting this concentration.

Economic downturns or changes in industrial policies within these concentrated markets, like China's property sector challenges in 2023-2024, can directly impact BHP's sales volumes and commodity prices. This dependence creates a vulnerability to external economic shifts and policy decisions in these crucial regions.

BHP Group's mining operations are susceptible to disruptions from adverse weather, such as the tropical cyclones that can impact Western Australia's iron ore production. For instance, Cyclone Veronica in March 2019 caused significant disruptions, leading to temporary shutdowns and impacting export volumes.

Unforeseen geological challenges also pose a risk, potentially leading to production slowdowns or increased extraction costs. These events can directly affect output targets and add to operational expenses, impacting financial performance.

Geographic Concentration of Production

BHP's production is heavily weighted towards specific geographic locations, creating potential vulnerabilities. For instance, in fiscal year 2023, Australia accounted for a substantial 68% of its total mining operations, while Chile represented 22% of its copper extraction.

This concentration means that disruptions in these key regions, whether due to political instability, extreme weather events, or labor disputes, could disproportionately impact BHP's overall output and financial performance. Such localized risks can translate into supply chain interruptions and increased operational costs, directly affecting the company's profitability.

- Geographic Concentration: 68% of mining operations in Australia, 22% of copper extraction in Chile (FY23 data).

- Risk Exposure: Vulnerability to localized political, environmental, and logistical challenges in key operational areas.

- Financial Impact: Potential for significant disruptions to production and increased operational costs due to regional issues.

Labor Shortages and Cost Inflation

BHP, like much of the mining industry, continues to grapple with persistent labor shortages, especially in key operational regions like Western Australia. This scarcity directly impacts the group's ability to maintain optimal production levels and meet ambitious output targets.

Furthermore, widespread global inflation has driven up the costs of essential materials, equipment, and services. This cost escalation puts pressure on BHP's profit margins, as seen in the increased operating expenses reported for fiscal year 2024, which outpaced revenue growth in some segments.

- Labor Shortages: Persistent difficulties in attracting and retaining skilled labor, particularly in Australia, can hinder operational efficiency and project timelines.

- Cost Inflation: Rising costs for energy, consumables, and logistics in 2024 and projected into 2025 directly impact the group's cost of production, potentially squeezing margins.

- Productivity Impact: Labor constraints and higher input costs can lead to reduced productivity, affecting BHP's ability to fully capitalize on strong commodity prices.

BHP's substantial debt burden, particularly evident in its capital structure, presents a financial vulnerability. For instance, as of the first half of fiscal year 2024, BHP reported net debt of approximately $16.2 billion, which, while managed, exposes the company to interest rate fluctuations and refinancing risks.

The company's commitment to significant capital expenditure, including major projects like the Jansen potash project, requires substantial funding. Delays or cost overruns in these large-scale investments, which are crucial for future growth, could strain financial resources and impact shareholder returns.

BHP faces ongoing scrutiny and potential liabilities related to environmental, social, and governance (ESG) issues. Past incidents, such as the Samarco dam disaster, continue to carry significant financial and reputational implications, with ongoing legal proceedings and remediation costs impacting the company's financial health and public perception.

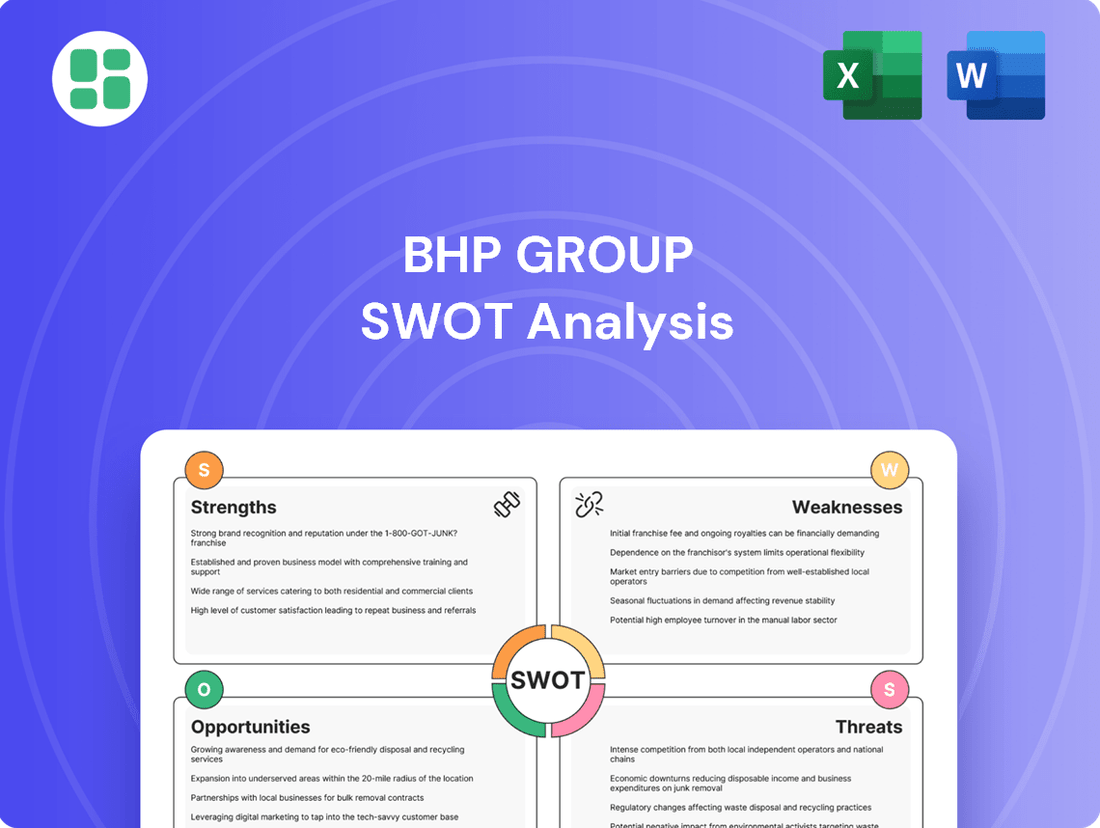

Preview the Actual Deliverable

BHP Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual SWOT analysis file for BHP Group. The complete version, detailing all strengths, weaknesses, opportunities, and threats, becomes available after checkout.

Opportunities

The global push towards cleaner energy, coupled with ongoing urbanization and increased electrification, is creating a significant surge in demand for commodities essential to these transitions. Copper, crucial for electric vehicles and renewable energy infrastructure, and nickel, vital for advanced battery technologies, are at the forefront of this trend. Potash, indispensable for global food security amidst a growing population, also falls into this category of future-facing commodities.

BHP is strategically positioned to benefit from this evolving market landscape. The company's substantial investments in its copper and nickel assets, alongside its significant potash development project, underscore its commitment to supplying these critical minerals. For instance, BHP's Jansen Potash Project in Canada is expected to be a major global supplier, with first production anticipated in 2026, and further phases planned to expand its capacity significantly. This proactive approach ensures BHP is well-equipped to meet the escalating demand, presenting a strong growth opportunity.

BHP's ongoing investment in technology, like its autonomous haul truck fleet at the Jimblebar mine, which began operations in 2017 and has since expanded, offers a significant opportunity. These technological advancements, including AI for predictive maintenance, are designed to boost operational efficiency and cut expenses. For instance, autonomous technology has been shown to increase truck utilization rates by up to 20% in similar mining operations, directly translating to higher productivity and a more competitive edge.

BHP's strategic focus on critical minerals is evident through initiatives like the Xplor Critical Minerals Accelerator program, designed to foster innovation and identify new resource opportunities. This program, coupled with strategic acquisitions such as the integration of Oz Minerals in 2023, costing approximately $5.75 billion, significantly bolsters BHP's access to copper and nickel, key components for the energy transition.

Growth in Emerging and Resilient Markets

Emerging markets, particularly India, are demonstrating robust economic growth, creating substantial opportunities for BHP. India's GDP growth is projected to be around 6.5% for FY25, signaling strong demand for commodities. This expansion, alongside the ongoing urbanization trend, fuels the need for raw materials essential to infrastructure development and industrialization, directly benefiting BHP's diversified product portfolio.

China's economic recovery, though facing some headwinds, still offers significant potential. As China's economy stabilizes and potentially re-accelerates, demand for key commodities like iron ore and copper, which are core to BHP's offerings, is expected to rise. This rebound is crucial for global commodity markets and presents a vital market for BHP's exports.

The confluence of global population growth and increasing urbanization, especially in Asia and Africa, translates into sustained, long-term demand for BHP's products. These demographic shifts necessitate increased investment in infrastructure, housing, and manufacturing, all of which rely heavily on the materials BHP extracts and processes.

- India's projected GDP growth of approximately 6.5% for FY25 highlights its strong economic momentum.

- Urbanization trends globally are driving increased demand for construction materials and manufactured goods.

- China's economic recovery is a key factor in stabilizing and potentially increasing demand for iron ore and copper.

- Growing populations in emerging markets create a persistent need for infrastructure and industrial development.

Strategic Partnerships and Joint Ventures

BHP's strategic alliances, like the Vicuña project with Lundin Mining, are crucial for accessing new markets and sharing the substantial capital required for resource development. These joint ventures allow BHP to tap into local expertise and navigate complex regulatory environments more effectively, as seen in their ongoing copper exploration efforts in South America.

These partnerships are not just about sharing costs; they are about accelerating growth. By combining BHP's operational scale with partners' specialized knowledge, projects can move from discovery to production faster, potentially capturing value before market conditions change. This approach is particularly vital in the current climate where demand for key commodities like copper remains robust, driven by electrification trends.

- Leveraging Complementary Capabilities: BHP can integrate its vast mining experience with partners' technological innovations or regional market access.

- Risk Mitigation: Sharing the financial burden and operational risks of large-scale projects reduces exposure for individual partners.

- Accelerated Development: Joint ventures can streamline permitting, exploration, and construction phases, bringing valuable resources to market sooner.

- Access to New Growth Prospects: Partnerships open doors to projects and geographical areas that might be inaccessible or too risky for BHP to pursue alone.

BHP is well-positioned to capitalize on the global energy transition, with strong demand for copper and nickel expected to grow significantly. The company's Jansen Potash Project, slated for first production in 2026, will contribute to global food security. Furthermore, BHP's strategic investments and acquisitions, such as Oz Minerals for $5.75 billion in 2023, bolster its position in critical minerals.

Emerging markets, particularly India with a projected FY25 GDP growth of around 6.5%, offer substantial demand for BHP's commodities. Urbanization and population growth worldwide also drive long-term demand for raw materials used in infrastructure and manufacturing.

Strategic partnerships, like the Vicuña project, allow BHP to share development costs and risks, accelerating access to new growth prospects and leveraging complementary capabilities. These collaborations are vital for navigating complex projects and capturing value in dynamic commodity markets.

| Commodity | Demand Driver | BHP's Strategic Response |

|---|---|---|

| Copper | Electric Vehicles, Renewable Energy | Oz Minerals acquisition (2023), Vicuña project |

| Nickel | Battery Technology | Oz Minerals acquisition (2023) |

| Potash | Food Security, Population Growth | Jansen Potash Project (First production 2026) |

| Iron Ore | Infrastructure Development (Emerging Markets) | Strong existing asset base, China market focus |

Threats

Global economic uncertainty, exemplified by a projected slowdown in growth for major economies in 2024 and 2025, presents a significant threat. This can dampen demand for commodities like iron ore and copper, impacting BHP's sales volumes and pricing power.

Fragmenting international trading systems and rising geopolitical tensions, such as ongoing trade disputes and regional conflicts, create further risks. These can lead to supply chain disruptions, increased protectionist measures, and volatility in commodity markets, directly affecting BHP's operational stability and profitability.

A sustained downturn in commodity prices, especially for iron ore, poses a significant threat to BHP Group. For instance, if iron ore prices were to fall below $80 per tonne for an extended period, it could substantially impact BHP's revenue and profit margins. This would directly affect the company's capacity to invest in new projects and return capital to its investors.

BHP Group confronts escalating regulatory scrutiny and environmental pressures, posing a significant threat. Stricter climate policies and evolving sustainability expectations necessitate considerable investment in operational changes and compliance measures, potentially impacting profitability.

Community opposition and activism, particularly concerning environmental impacts, can disrupt operations and lead to costly delays or project cancellations. For instance, in 2023, BHP faced ongoing scrutiny regarding its historical environmental performance and future development plans, highlighting the persistent risk of public backlash and regulatory intervention.

Intense Competition within the Mining Sector

The global mining sector is a battlefield for resources, with giants like Rio Tinto, Anglo American, Glencore, and Vale constantly competing for market share. This fierce rivalry puts pressure on commodity prices, drives up the cost of acquiring new mining assets, and makes it a continuous challenge for companies like BHP to maintain their standing.

In 2024, the mining industry's competitive landscape is particularly acute. For instance, the iron ore market, a key segment for BHP, saw prices fluctuate significantly due to supply dynamics and demand from major consumers like China. BHP's competitors are also investing heavily in new technologies and exploration, aiming to secure future resource pipelines.

- Price Volatility: Intense competition contributes to fluctuating commodity prices, impacting revenue and profitability for all major players.

- Asset Acquisition Costs: The race for prime mining assets drives up acquisition prices, requiring substantial capital outlay.

- Market Share Battles: Companies actively seek to expand their market presence, leading to strategic maneuvers and increased operational costs.

- Technological Arms Race: Competitors are investing in advanced mining technologies, creating pressure to innovate and adopt new methods to remain competitive.

Cost Inflation and Supply Chain Disruptions

Ongoing global inflationary pressures are a significant concern for BHP, particularly impacting the costs of essential inputs like energy, labor, and construction materials. These rising costs directly threaten to inflate operational expenses and escalate project budgets, potentially squeezing profit margins.

Persistent supply chain disruptions continue to pose a threat, leading to delays in project timelines and hampering the timely delivery of critical goods. This inefficiency translates into increased overall expenses and a reduction in operational efficiency, impacting BHP's ability to execute projects on schedule and within budget.

- Inflationary Pressures: Global inflation, especially in energy and materials, directly increases BHP's operating costs. For instance, during the 2023 financial year, the Australian Consumer Price Index (CPI) rose by 6.0%, indicating broad inflationary trends impacting input costs.

- Supply Chain Volatility: Disruptions can lead to higher freight costs and longer lead times for equipment, impacting project schedules and capital expenditure. For example, shipping costs for key commodities saw significant fluctuations throughout 2023 and early 2024.

- Project Delays: Inability to secure timely delivery of materials or labor due to supply chain issues can push back project completion dates, incurring additional costs and deferring revenue generation.

The increasing cost of capital, driven by rising interest rates globally in 2024, makes financing new projects and acquisitions more expensive for BHP. This can limit investment capacity and impact the company's ability to pursue growth opportunities.

The increasing focus on environmental, social, and governance (ESG) factors by investors and regulators presents a challenge. Failure to meet evolving ESG standards could lead to divestment, reputational damage, and increased compliance costs. For example, many institutional investors in 2024 are actively screening companies based on their carbon emissions and water management practices.

Cybersecurity threats and the risk of operational disruptions due to IT system failures are significant concerns. A major cyberattack could compromise sensitive data, halt production, and result in substantial financial losses and reputational damage. The mining sector has seen an increase in cyber threats targeting operational technology.

SWOT Analysis Data Sources

This BHP Group SWOT analysis is built upon a foundation of robust data, drawing from official company financial reports, comprehensive market intelligence, and expert industry analysis to provide a thoroughly informed strategic overview.