BHP Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BHP Group Bundle

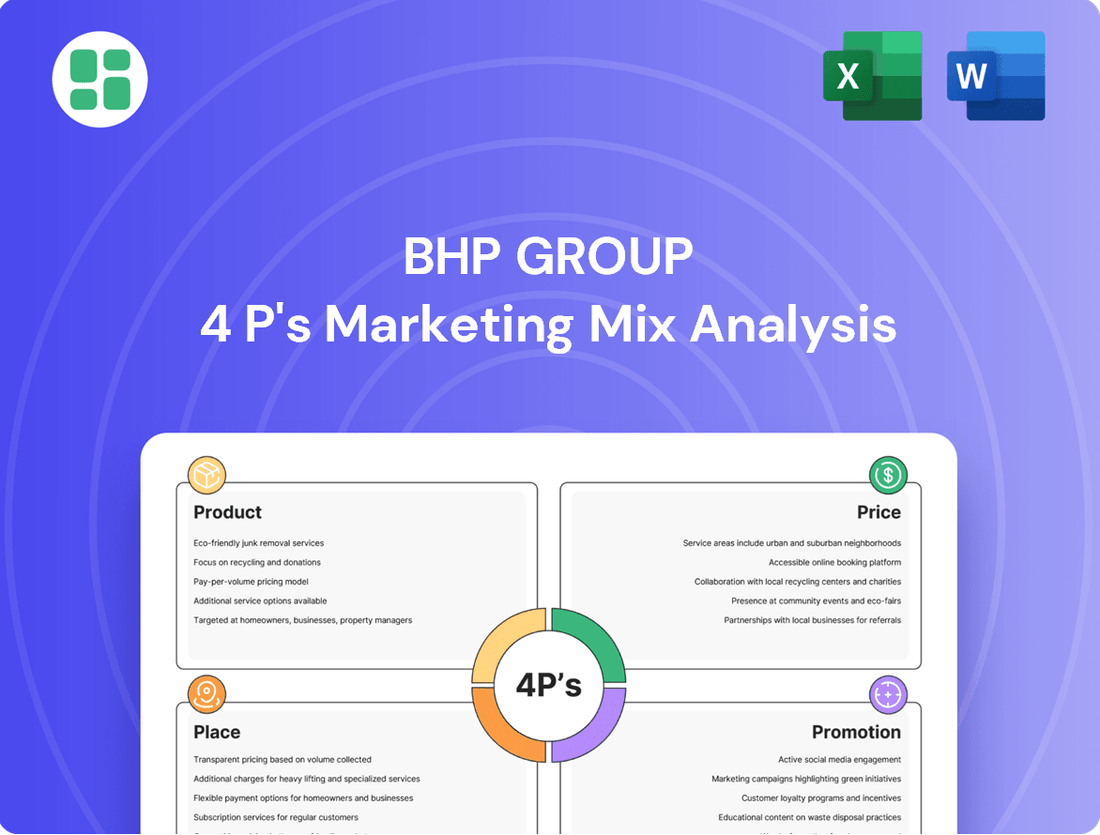

BHP Group's marketing mix is a powerful engine driving its global success, from its diverse product portfolio of essential commodities to its strategic pricing and vast distribution networks. Understanding how these elements interlock offers invaluable insights into market leadership.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for BHP Group. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

BHP Group's product portfolio centers on essential commodities like iron ore, copper, metallurgical coal, and nickel. These are foundational materials driving global industry, with BHP strategically prioritizing these long-life assets to guarantee a steady supply of critical resources. For instance, in the fiscal year 2023, BHP's iron ore production reached 252 million tonnes, underscoring its significant scale in this market.

The company's product strategy emphasizes resilience and adaptability to shifting global demand. This includes a focus on future-facing commodities such as copper, vital for electrification, and potash, crucial for food security. BHP's commitment to these sectors is evident in its ongoing investments, aiming to meet the growing needs of a developing world.

BHP's high-grade iron ore, primarily from its Western Australia Iron Ore (WAIO) operations, is a cornerstone of its product strategy. This high-quality ore is essential for steel production globally, with operations like South Flank consistently exceeding expectations. In fiscal year 2023, WAIO achieved a record production of 293 million tonnes, underscoring its significant contribution to BHP's portfolio and its position as a reliable supplier of premium iron ore.

BHP's "Future-Facing Copper for Electrification" product highlights copper's central role in the company's strategy. In fiscal year 2023, BHP's copper production reached 1.74 million tonnes, a testament to strong performance at its Chilean and Australian assets. This positions BHP to capitalize on the accelerating global shift towards electrification.

The demand for copper is being significantly boosted by renewable energy installations and the burgeoning electric vehicle (EV) market. For instance, an electric vehicle typically requires around 60-80 kg of copper, a substantial increase compared to internal combustion engine vehicles. BHP's investments, including the ongoing Jansen Potash project which indirectly supports its broader commodity strategy, underscore its commitment to supplying this essential metal.

Specialized Metallurgical Coal for Steelmaking

BHP supplies premium metallurgical coal, a critical component for traditional blast furnace steel production. This specialized coal, distinct from thermal coal used for power generation, boasts unique characteristics essential for creating coke, the backbone of steel manufacturing. BHP Mitsubishi Alliance (BMA) focuses on producing high-grade hard coking coal to cater to this vital industrial need.

In 2023, BMA's metallurgical coal production reached approximately 37.5 million tonnes, underscoring its significant contribution to the global steel industry. The demand for high-quality coking coal remains robust, driven by the ongoing need for steel in infrastructure and manufacturing worldwide. BHP's strategic focus on this segment positions it as a key supplier in a market where product quality directly impacts steel output efficiency and quality.

- Product: High-quality metallurgical (coking) coal.

- Key Application: Essential ingredient for coke production in blast furnace steelmaking.

- Supplier: Primarily BHP Mitsubishi Alliance (BMA).

- Market Position: Focus on higher-quality hard coking coal to meet industrial demands.

Growing Presence in Potash and Nickel

BHP is strategically expanding its product portfolio to capitalize on anticipated demand shifts, notably by increasing its presence in potash. The Jansen Potash project in Saskatchewan, Canada, is a cornerstone of this strategy, with construction advancing well. This significant investment positions BHP to become a substantial global potash supplier, addressing the growing need for fertilizers essential for food security. The project is expected to commence production in 2026, with full production capacity targeted by 2027.

While BHP's Western Australia Nickel operations faced temporary suspension due to market conditions, the company retains its strategic interest in nickel, a critical component for electric vehicle batteries. This demonstrates a forward-looking approach, ensuring exposure to commodities vital for the energy transition. BHP continues to evaluate opportunities in other future-facing resources, including copper, which is also essential for electrification and renewable energy infrastructure.

- Jansen Potash Project: On track for first production in 2026, aiming for full capacity by 2027.

- Nickel Strategy: Maintaining exposure to nickel for battery markets despite operational suspensions.

- Future Commodities: Actively exploring growth in potash and copper, key materials for global decarbonization efforts.

BHP's product strategy is anchored in high-quality, essential commodities that fuel global industry and the energy transition. Its core offerings include iron ore, copper, metallurgical coal, and nickel, with a growing emphasis on future-facing materials like potash. The company's commitment to these sectors is backed by significant production volumes and strategic investments, ensuring its role as a key supplier in critical global markets.

| Commodity | Fiscal Year 2023 Production | Key Application | Strategic Importance |

|---|---|---|---|

| Iron Ore | 252 million tonnes | Steel production | Foundation of portfolio, high-grade WAIO operations |

| Copper | 1.74 million tonnes | Electrification, EVs, renewables | Future-facing, essential for energy transition |

| Metallurgical Coal | ~37.5 million tonnes (BMA) | Coke production for steelmaking | Premium hard coking coal, vital for industry |

| Potash | Projected 2026 start | Fertilizers, food security | New growth area, Jansen project |

| Nickel | Operational suspensions, strategic interest | EV batteries | Maintaining exposure for future markets |

What is included in the product

This analysis offers a professional breakdown of BHP Group's marketing mix, examining its Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It's ideal for professionals seeking to understand BHP's market positioning and benchmark it against industry best practices.

This BHP Group 4P's Marketing Mix Analysis provides a clear, concise overview of how the company addresses customer needs, alleviating the pain point of complex market strategies for busy executives.

It offers a simplified framework to understand BHP's product, price, place, and promotion, making it easier for stakeholders to grasp their market approach and identify potential areas for improvement.

Place

BHP Group's extensive global supply chain is a cornerstone of its operations, utilizing vast rail networks and port infrastructure to move bulk commodities like iron ore and coal from mine to market. For instance, in the fiscal year 2023, BHP's Western Australia Iron Ore operations achieved a record rail performance, moving 304 million tonnes, underscoring the efficiency of their logistics. This robust network is crucial for timely delivery and global customer access.

BHP Group's direct sales strategy targets major industrial customers globally, with a strong focus on key markets like China, Japan, South Korea, and India. This approach bypasses intermediaries, allowing for more direct control over the sales process and customer interaction.

In the 2024 financial year, BHP reported that its direct sales to industrial customers were a cornerstone of its revenue generation, particularly for commodities like iron ore and metallurgical coal. For instance, the company's sales to China, its largest market, remained robust, reflecting the ongoing demand from its steel manufacturing sector.

This direct engagement enables BHP to offer tailored resource solutions, understanding and meeting the specific operational requirements of large-scale manufacturers. These long-term supply agreements foster deep, collaborative relationships, ensuring consistent demand and providing valuable market feedback.

BHP's global operations are strategically located to efficiently serve key demand centers, particularly in the booming Asia-Pacific region. This proximity allows for reduced transportation costs and faster delivery times for its essential commodities like iron ore and copper, vital for manufacturing and infrastructure development. For instance, BHP's extensive port facilities in Western Australia are crucial for supplying the vast Chinese market, a primary consumer of its iron ore, ensuring a consistent flow of materials to support their industrial output.

Optimized Inventory Management for Bulk Commodities

BHP's approach to inventory management for bulk commodities is critical, ensuring they can meet global demand efficiently. They meticulously manage vast quantities of raw materials, from initial extraction at mine sites to storage at port facilities, all aimed at seamless delivery to customers worldwide.

This strategic inventory control helps BHP navigate the inherent volatility in commodity markets. By maintaining optimal stock levels, they can respond effectively to shifts in demand and supply, mitigating potential disruptions and ensuring consistent product availability.

- Strategic Stockpiling: BHP maintains significant stockpiles at key operational hubs and export terminals, balancing the cost of holding inventory against the risk of stockouts.

- Supply Chain Visibility: Advanced tracking systems provide real-time data on inventory levels across the entire supply chain, enabling proactive management.

- Demand Forecasting: Sophisticated analytics are used to predict customer demand, informing production and shipping schedules to align supply with market needs.

Digital Platforms for Enhanced Client Engagement

BHP Group has significantly invested in digital platforms to streamline operations and bolster client engagement. These advancements are crucial for managing relationships with their vast corporate clientele in the mining and metals sector.

These digital tools, including advanced supply chain management systems, enable more efficient order processing and real-time tracking of shipments. This transparency directly enhances the client experience by providing greater predictability and control over their supply chains. For instance, in 2023, BHP reported a significant increase in the adoption rate of their digital client portals, with over 85% of key accounts actively utilizing the platform for order management and inquiries.

The focus on digital interaction aims to improve service delivery by offering faster response times and more accessible support. This digital transformation is key to maintaining a competitive edge, particularly as clients increasingly expect seamless, technology-driven interactions. BHP's ongoing commitment to these platforms underscores their strategy to differentiate through superior service in a traditionally commodity-focused market.

- Digital Client Portals: Facilitating efficient order processing and tracking.

- Supply Chain Management Systems: Enhancing transparency and predictability for corporate clients.

- Improved Service Delivery: Aiming for faster response times and accessible support through digital channels.

- Client Adoption Rates: Over 85% of key accounts utilized digital platforms for order management in 2023.

BHP's global operational footprint is a critical component of its 'Place' strategy, ensuring proximity to major demand centers, particularly in the Asia-Pacific region. This strategic positioning minimizes logistical costs and delivery times for key commodities like iron ore and copper. For example, their extensive port infrastructure in Western Australia directly serves the significant demand from China, a primary consumer of their iron ore, ensuring a consistent supply for their industrial needs.

BHP's extensive rail networks and port facilities are central to its 'Place' strategy. In fiscal year 2023, their Western Australia Iron Ore operations achieved a record 304 million tonnes moved via rail, highlighting the efficiency of their logistics in connecting mines to global markets. This robust infrastructure ensures timely delivery and broad customer access worldwide.

BHP's strategic inventory management, including significant stockpiling at operational hubs and export terminals, is key to meeting global demand efficiently. This approach, supported by advanced tracking systems for supply chain visibility and sophisticated demand forecasting, ensures consistent product availability and navigates market volatility effectively.

The company's digital transformation, including client portals and advanced supply chain management systems, enhances operational efficiency and client engagement. In 2023, over 85% of key accounts actively used these digital platforms for order management, demonstrating a strong adoption rate and improved service delivery.

What You Preview Is What You Download

BHP Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of BHP Group's 4Ps (Product, Price, Place, Promotion) is fully complete and ready for your immediate use. You can confidently purchase knowing you're getting the exact, detailed marketing mix strategy.

Promotion

BHP Group prioritizes strong investor relations and financial communications, actively engaging with investors through detailed annual reports and regular financial result announcements. For the fiscal year ending June 30, 2024, BHP reported underlying EBITDA of $31.4 billion, demonstrating their commitment to transparently sharing financial performance.

This proactive approach ensures that a wide range of stakeholders, from individual investors to financial professionals, receive clear insights into BHP's operational achievements, financial stability, and forward-looking strategies. Such clear communication is vital for building trust and supporting the company's objective of delivering sustained shareholder returns.

BHP actively highlights its dedication to sustainable and responsible resource development, with significant investments in decarbonization and environmental stewardship. This commitment is a core part of their marketing, showcasing efforts to minimize their ecological footprint and contribute positively to the communities where they operate.

The company transparently communicates its progress through detailed sustainability reports and climate transition action plans. These documents outline specific targets and achievements in reducing operational greenhouse gas emissions, demonstrating a clear strategy for environmental responsibility and fostering social value, which resonates with increasingly eco-conscious investors and stakeholders.

BHP Group actively engages in key global industry events like the Bank of America Global Metals, Mining and Steel Conference and the BMO Global Metals, Mining & Critical Minerals Conference. These forums are crucial for showcasing BHP's expertise and thought leadership in the resources sector.

In 2023, BHP's participation in such conferences reinforced its commitment to transparency and dialogue, allowing its executives to share perspectives on critical minerals supply chains and the energy transition. This strategic presence helps shape market understanding and investor confidence.

Strategic Corporate Public Relations

BHP Group actively manages its corporate reputation through strategic public relations. The company issues frequent media releases, detailing operational updates and significant corporate activities. This ensures transparency and helps build trust with the public and its investors.

This proactive communication strategy is crucial for managing stakeholder perceptions, especially concerning major projects and financial performance. For instance, in the fiscal year ending June 30, 2024, BHP reported a significant increase in underlying EBITDA, a figure often highlighted in their investor communications and public statements.

- Media Outreach BHP regularly engages with global news outlets to disseminate information on operational achievements and strategic decisions.

- Reputation Management Proactive PR efforts aim to foster positive public perception and maintain stakeholder confidence.

- Key Information Dissemination The company communicates crucial updates, such as progress on sustainability initiatives and financial results, to a broad audience.

- Stakeholder Confidence Building Consistent and transparent communication reinforces trust among investors, employees, and the communities in which BHP operates.

Direct Engagement with Governments and Communities

Beyond typical advertising, BHP actively engages with governments and local communities to ensure its operations are responsible and to maintain its social license to operate. This involves clear communication regarding its economic contributions and community investments.

BHP's commitment to addressing social and environmental impacts directly supports its brand and operational integrity. For instance, in fiscal year 2023, BHP reported a total of $14.3 billion in economic contributions globally, with a significant portion directed towards community programs and local procurement, fostering goodwill and operational stability.

- Transparent Reporting: BHP publishes detailed reports on its economic contributions, including taxes, royalties, and payments to suppliers, often exceeding billions annually. In FY23, its total tax and royalty payments reached $10.5 billion.

- Community Investment: The company invests in local communities through various programs focused on education, health, and economic development. In FY23, BHP invested $110 million in community programs and partnerships.

- Stakeholder Dialogue: BHP maintains ongoing dialogue with government bodies and community representatives to address concerns and build collaborative relationships, crucial for long-term project viability.

- Social License: These direct engagements are fundamental to securing and maintaining the social license to operate, ensuring community acceptance and support for its mining activities.

BHP's promotional efforts focus heavily on transparent financial reporting and investor relations, with detailed annual reports and regular financial updates. For the fiscal year ending June 30, 2024, BHP reported underlying EBITDA of $31.4 billion, underscoring their commitment to clear communication with stakeholders.

The company also emphasizes its dedication to sustainability and responsible resource development, highlighting investments in decarbonization and environmental stewardship. This commitment is communicated through detailed sustainability reports and climate transition action plans, showcasing specific targets and achievements in reducing greenhouse gas emissions.

BHP actively participates in key global industry events, such as the Bank of America Global Metals, Mining and Steel Conference, to showcase its expertise and thought leadership. Their presence in 2023 reinforced transparency and dialogue, particularly concerning critical minerals and the energy transition.

Furthermore, BHP manages its corporate reputation through strategic public relations, issuing frequent media releases on operational updates and corporate activities to build trust. This proactive approach is vital for managing stakeholder perceptions, especially concerning major projects and financial performance, as seen with their reported increase in underlying EBITDA for FY24.

| Promotion Aspect | Key Activities | Data Point (FY23/FY24 unless specified) |

| Investor Relations & Financial Communication | Annual Reports, Financial Result Announcements, Investor Briefings | Underlying EBITDA FY24: $31.4 billion |

| Sustainability & ESG Communication | Sustainability Reports, Climate Transition Action Plans, ESG Disclosures | Commitment to decarbonization and environmental stewardship |

| Industry Engagement & Thought Leadership | Participation in Global Conferences (e.g., BMO, Bank of America) | Showcasing expertise in critical minerals and energy transition |

| Public Relations & Reputation Management | Media Releases, Operational Updates, Corporate Activity Dissemination | Proactive communication to build trust and manage perceptions |

Price

BHP's pricing strategy is intrinsically tied to the volatile global commodity markets. For instance, the price of iron ore, a cornerstone of BHP's revenue, is heavily influenced by demand from China's steel industry and global infrastructure spending. In early 2024, iron ore prices hovered around $100-$120 per tonne, reflecting these complex dynamics.

The company's substantial production capacity, particularly in iron ore and copper, gives it a unique position. BHP's output can, in turn, influence global supply levels, creating a feedback loop that impacts market prices. For example, a significant production increase or decrease by BHP can shift the balance of supply and demand, affecting the pricing of these essential commodities worldwide.

BHP Group strategically balances long-term contracts with spot market sales for its commodities. A significant portion of its iron ore sales, for instance, are locked in via long-term agreements with key industrial customers, ensuring stable revenue. This approach provides a predictable income base, mitigating some of the volatility inherent in commodity markets.

These long-term contracts offer BHP a degree of price stability, a crucial element for financial planning and investment. For example, in fiscal year 2023, BHP's iron ore sales volume was approximately 282 million tonnes, with a substantial portion likely covered by these forward-looking agreements, providing a foundational revenue stream.

Complementing these secured sales, BHP also engages in spot market transactions. This allows the company to capitalize on favorable price fluctuations, selling at prevailing market rates when conditions are advantageous. This dual strategy enhances revenue potential by capturing upside price movements while maintaining a core of predictable income.

BHP Group actively pursues cost leadership, particularly evident in its Western Australia Iron Ore operations, aiming to be the lowest-cost producer. This strategy is crucial for navigating the inherent volatility of commodity prices.

In the fiscal year ending June 30, 2023, BHP reported a free cash flow of $23.2 billion, underscoring its ability to generate significant cash even amidst fluctuating market conditions. This operational efficiency translates into robust profit margins, providing a competitive edge.

Impact of Macroeconomic Factors and Demand Outlook

BHP's commodity prices are heavily influenced by global economic health and industrial demand, with China and India being key drivers. The burgeoning renewable energy sector also presents significant demand for BHP's products, impacting pricing strategies.

The company actively tracks macroeconomic indicators to forecast market changes. For instance, in the fiscal year ending June 30, 2024, BHP's iron ore production reached 280.5 Mt, reflecting its response to demand signals.

- Global economic growth: Directly correlates with industrial activity and commodity consumption.

- China's economic performance: Remains a critical factor, influencing demand for iron ore and copper.

- Renewable energy transition: Drives demand for copper and nickel, essential for green technologies.

Strategic Capital Allocation and Shareholder Returns

BHP's approach to capital allocation is a cornerstone of its shareholder return strategy. The company prioritizes investments in growth, particularly in commodities like copper and potash, which are seen as crucial for the future. This balanced approach ensures long-term value creation while also rewarding investors.

A key element of this strategy is the commitment to a minimum 50% dividend payout ratio. This policy demonstrates BHP's confidence in its financial performance and its dedication to returning a significant portion of its profits directly to shareholders. For example, in the fiscal year 2023, BHP declared a record final dividend of USD 1.00 per share, totaling USD 6.5 billion for the full year, underscoring this commitment.

- Disciplined Capital Deployment: BHP focuses on investing in projects with strong returns, ensuring efficient use of capital.

- Future-Facing Commodities: Significant investment is directed towards copper and potash, aligning with global demand trends.

- Shareholder Returns: A commitment to a minimum 50% dividend payout ratio ensures shareholders benefit from the company's profitability.

- Financial Health: The robust dividend policy reflects BHP's strong financial position and operational performance.

BHP's pricing strategy is deeply intertwined with global commodity markets, where prices for iron ore and copper fluctuate based on demand from key economies like China and the growth of sectors such as renewable energy. For instance, iron ore prices in early 2024 ranged between $100-$120 per tonne, reflecting these market dynamics.

The company leverages its substantial production scale to influence supply and, consequently, prices. This is complemented by a dual approach of long-term contracts for revenue stability and spot market sales to capitalize on favorable price movements, as seen with its fiscal year 2023 iron ore production of approximately 282 million tonnes.

BHP actively pursues cost leadership to maintain profitability amidst price volatility. Its fiscal year ending June 2023 saw a free cash flow of $23.2 billion, demonstrating operational efficiency and strong profit margins.

The company's capital allocation prioritizes investments in future-facing commodities like copper and potash, alongside a commitment to a minimum 50% dividend payout ratio, exemplified by the fiscal year 2023 dividend of USD 6.5 billion.

| Commodity | Approx. Price (Early 2024) | BHP FY23 Production (Mt) | BHP FY23 Revenue (USD Bn) |

|---|---|---|---|

| Iron Ore | $100-$120/tonne | 282 | 42.5 |

| Copper | $7,500-$8,500/tonne | 1,635 (kt) | 16.2 |

4P's Marketing Mix Analysis Data Sources

Our BHP Group 4P's Marketing Mix Analysis is built on a foundation of official company disclosures, including annual reports and investor presentations, alongside comprehensive industry research and competitive market intelligence. This ensures our insights into Product, Price, Place, and Promotion accurately reflect BHP's strategic positioning and operational execution.