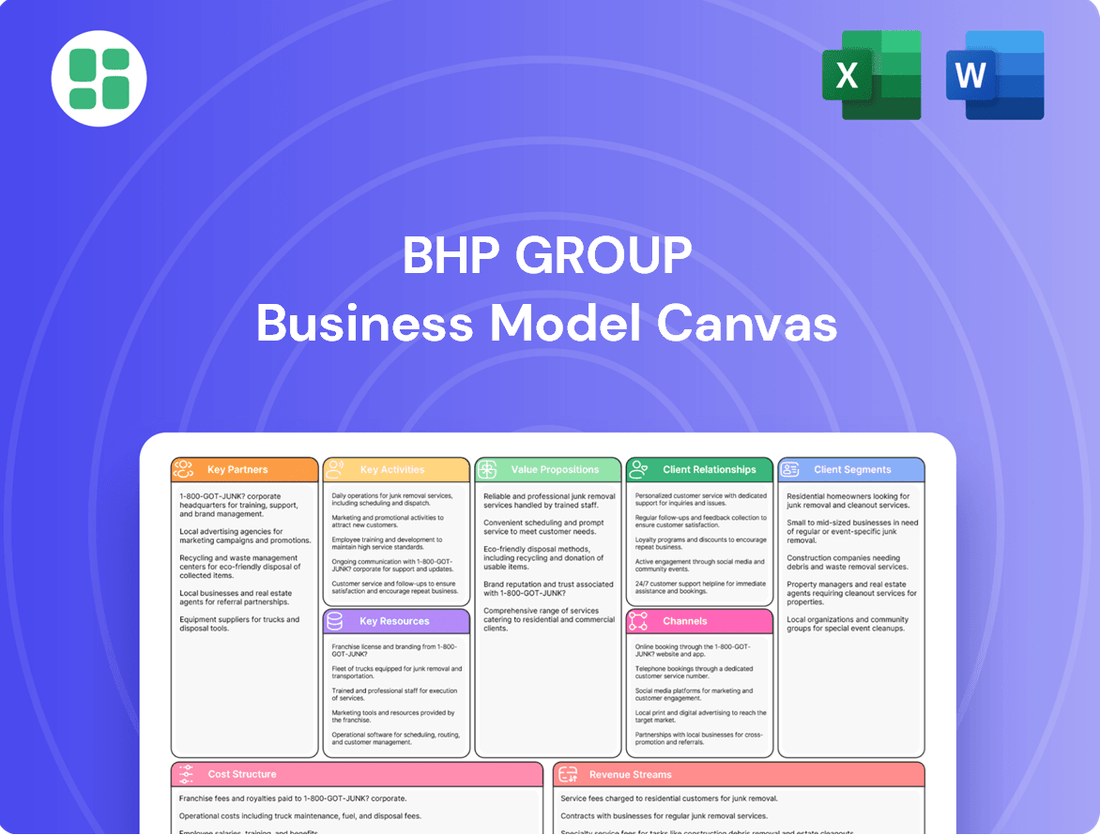

BHP Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BHP Group Bundle

Unlock the strategic blueprint behind BHP Group’s operations with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and key resources, offering a clear view of how they navigate the global resources market. Discover how BHP builds and delivers value, and gain insights to fuel your own strategic thinking.

Partnerships

BHP is actively cultivating strategic alliances with leading global technology firms, such as ABB, through multi-year global framework agreements. These partnerships are instrumental in driving industrial automation, electrification, and digitalization across BHP's operations, thereby enhancing project execution, day-to-day functioning, and maintenance strategies.

A central tenet of these collaborations is the acceleration of operational decarbonisation initiatives. By integrating advanced technological solutions, BHP aims to significantly reduce its greenhouse gas emissions, a critical step towards its ambitious target of achieving net zero operational emissions by 2050. For instance, in 2023, BHP announced investments in electrification projects and renewable energy sources to power its operations.

BHP actively pursues joint ventures to fuel growth and diversify its commodity portfolio. A notable example is its 50/50 partnership with Lundin Mining, creating Vicuña Corp. This collaboration targets the development of the Filo del Sol and Josemaria copper projects in Argentina, a strategic move to bolster BHP's presence in essential future-facing commodities.

Further illustrating this strategy, the BHP Mitsubishi Alliance (BMA) represents a significant joint venture focused on steelmaking coal operations in Queensland. This alliance underscores BHP's commitment to leveraging partnerships for operational efficiency and market access in key resource sectors.

BHP Group actively pursues technology and innovation collaborations, leveraging programs like BHP Xplor and BHP Ventures to secure access to transformative technologies. A significant recent development, as of June 2025, is a strategic alliance with Chinese heavy machinery manufacturer XCMG.

This partnership is specifically designed to co-develop advanced mining fleet solutions. The aim is to establish new industry benchmarks in safety, operational efficiency, and environmental sustainability, with a particular focus on integrating hybrid and electric mining equipment into their operations.

Equipment and Supply Chain Partnerships

BHP diversifies its equipment supply chain through strategic global framework agreements with key manufacturers, such as XCMG. These partnerships extend beyond mere procurement to encompass joint development of advanced mining solutions. For instance, this includes next-generation heavy hauling equipment and AI-driven drilling innovations, crucial for optimizing BHP's extensive operations.

These collaborations are vital for bolstering supply chain resilience, particularly in the face of global logistical challenges. By working closely with manufacturers, BHP aims to ensure a consistent and reliable supply of essential machinery. In 2024, BHP's capital expenditure on property, plant, and equipment was significant, underscoring the importance of these equipment partnerships.

- Global Framework Agreements: BHP establishes long-term partnerships with leading equipment manufacturers like XCMG.

- Joint Development: Collaborations focus on co-creating next-generation mining equipment, including heavy haulers and AI-driven drills.

- Supply Chain Resilience: These alliances are critical for ensuring a stable and dependable supply of essential mining machinery.

- Sustainable Sourcing: Partnerships also support the implementation of more sustainable sourcing practices within the supply chain.

Community and Indigenous Collaborations

BHP actively cultivates partnerships with communities, recognizing them as vital for achieving enduring social, environmental, and economic benefits. This collaborative approach is central to their business model, ensuring shared value creation.

Indigenous peoples are specifically identified as crucial partners and stakeholders. BHP's commitment to fostering social value is evident in their engagement strategies and procurement practices, aiming for mutual prosperity and deep local connection.

- Indigenous Procurement: In the 2023 financial year, BHP achieved a record Indigenous procurement spend of $1.2 billion, underscoring their dedication to economic empowerment for Indigenous communities.

- Community Investment: The company invests significantly in community programs, focusing on areas like education, health, and infrastructure, with a substantial portion directed towards Indigenous communities.

- Partnership Frameworks: BHP establishes formal partnership agreements with Indigenous groups to guide collaboration on projects, ensuring their rights and interests are respected and integrated into operational planning.

- Social Value Creation: These collaborations are designed to deliver tangible social value, moving beyond compliance to create sustainable positive impacts that benefit both BHP and the communities in which they operate.

BHP's key partnerships are crucial for innovation and operational efficiency. Collaborations with technology leaders like ABB drive automation and decarbonization, with a focus on net-zero emissions by 2050. Joint ventures, such as the one with Lundin Mining for copper projects, expand its commodity portfolio. Furthermore, strategic alliances with manufacturers like XCMG co-develop advanced mining fleet solutions, enhancing supply chain resilience and sustainability.

| Partnership Type | Key Partners | Focus Area | Impact/Goal |

|---|---|---|---|

| Technology & Automation | ABB | Industrial automation, electrification, digitalization | Enhanced project execution, operational efficiency, decarbonization |

| Joint Ventures | Lundin Mining (Vicuña Corp.) | Copper project development (Filo del Sol, Josemaria) | Growth, commodity diversification |

| Manufacturing & Equipment Development | XCMG | Advanced mining fleet solutions (hybrid/electric equipment) | Industry benchmarks in safety, efficiency, sustainability; supply chain resilience |

| Community & Indigenous Relations | Indigenous communities | Social value creation, economic empowerment | Mutual prosperity, local connection, sustainable positive impacts |

What is included in the product

This Business Model Canvas outlines BHP Group's strategy for extracting and processing natural resources, focusing on key customer segments like industrial manufacturers and energy consumers, delivered through global supply chains and value propositions centered on reliable, high-quality commodity supply.

The BHP Group Business Model Canvas serves as a pain point reliever by offering a clear, one-page snapshot that simplifies the complexity of their global operations, making strategic alignment and problem-solving more efficient.

Activities

BHP's core activities revolve around extracting and processing vast quantities of minerals. This includes exploring for new deposits, developing them into producing mines, and then extracting and processing the raw materials. These are the fundamental building blocks of global industry.

The company focuses on major commodities like iron ore, copper, metallurgical coal, and nickel. These are essential for manufacturing, construction, and the transition to cleaner energy sources. For instance, in the fiscal year 2023, BHP's iron ore production reached 283 million tonnes.

BHP operates massive, long-lasting mines across the world. Key examples include its Western Australia Iron Ore (WAIO) operations, a significant contributor to global steelmaking, and the Escondida copper mine in Chile, one of the world's largest copper producers. These assets are crucial for supplying raw materials to meet consistent global demand.

BHP's core activities include a significant focus on developing commodities essential for the future. This involves strategic investments in materials like copper and potash, which are crucial for global trends such as electrification and sustainable agriculture.

A prime example is the Jansen potash project in Canada, representing a US$10.6 billion investment. This massive undertaking is slated for its first production in 2026, underscoring BHP's commitment to securing its position in the future commodity landscape.

BHP's commitment to operational excellence is a cornerstone of its business. In 2024, the company continued to prioritize cost discipline, exemplified by a notable 12% reduction in unit costs at its Escondida copper mine.

Furthermore, BHP's Western Australia Iron Ore (WAIO) operations solidified its standing as the world's lowest-cost iron ore producer, a testament to ongoing efficiency improvements.

These achievements are driven by strategic investments in technology aimed at enhancing supply chain efficiency, from the initial extraction at the mine site all the way to the port, directly translating into improved production outcomes.

Sustainability and Decarbonisation Initiatives

BHP Group is deeply invested in sustainability and decarbonisation, aiming for net zero operational greenhouse gas emissions (Scopes 1 and 2) by 2050. This commitment drives their innovation in developing and deploying new technologies. For instance, in FY23, BHP reported a 10% reduction in its operational GHG intensity compared to its FY20 baseline, reaching 88.4 kg CO2e/t saleable product.

Key activities include strategic partnerships for environmentally sound equipment and a strong focus on water stewardship and biodiversity. BHP's climate portfolio investments reached $1.1 billion by the end of FY23, supporting projects like carbon capture and storage and renewable energy integration across its operations.

- Decarbonisation Technology Development: Investing in and piloting technologies like hydrogen-powered haul trucks and electric drilling rigs to reduce Scope 1 and 2 emissions.

- Partnerships for Green Equipment: Collaborating with suppliers and technology providers to develop and implement lower-emission mining and transport equipment.

- Water Stewardship: Implementing strategies to reduce water consumption and improve water quality in operational areas, with a goal to reduce freshwater intensity by 15% by FY25 from an FY20 baseline.

- Biodiversity Management: Protecting and enhancing biodiversity in areas surrounding its operations, including commitments to net positive impact for biodiversity by 2030.

Exploration and Resource Development

BHP Group's key activity of exploration and resource development involves a significant commitment to finding and unlocking new mineral deposits. This focus is crucial for their long-term growth strategy, ensuring a robust pipeline of future projects. They actively seek out opportunities across their core commodities, which include copper, iron ore, and coal.

The company leverages cutting-edge technology, including advanced data analytics and artificial intelligence, to enhance the success rate of its exploration efforts. For instance, AI is being used to analyze vast geological datasets, aiding in the identification of promising copper deposits in regions like Australia and the United States. This technological integration aims to make exploration more efficient and effective.

- Exploration Investment: BHP allocated approximately $500 million to exploration and evaluation activities in the fiscal year 2023, a notable increase reflecting their commitment to resource discovery.

- Copper Focus: Significant exploration efforts are directed towards copper, a key component in the transition to cleaner energy, with new targets identified in South Australia and Arizona.

- Project Pipeline: The company maintains a diversified project pipeline designed to sustain production and growth across its commodity portfolio, with several projects progressing through feasibility studies and development phases.

- Technological Advancement: Continued investment in data analytics and AI is a cornerstone of their exploration strategy, aiming to improve geological understanding and reduce discovery costs.

BHP's key activities are centered on the responsible extraction and processing of essential minerals. This involves exploring for new deposits, developing them into productive mines, and then extracting and processing the raw materials to supply global industries. They focus on major commodities like iron ore, copper, and metallurgical coal, crucial for manufacturing and the energy transition.

In fiscal year 2023, BHP's iron ore production reached 283 million tonnes, highlighting their significant output. The company operates large-scale, long-life mines, such as the Western Australia Iron Ore operations and the Escondida copper mine in Chile, ensuring a consistent supply of raw materials to meet global demand.

BHP is also strategically investing in future-focused commodities like copper and potash, essential for electrification and sustainable agriculture. The Jansen potash project in Canada, a US$10.6 billion investment, exemplifies this commitment, with first production expected in 2026.

Operational excellence is a core activity, with a focus on cost discipline and efficiency improvements. In 2024, unit costs at the Escondida copper mine saw a 12% reduction. WAIO maintained its position as the world's lowest-cost iron ore producer, driven by technological investments in supply chain efficiency.

| Key Activity | Description | FY23/24 Data Point | Strategic Importance |

| Mineral Extraction & Processing | Mining and refining of iron ore, copper, coal, nickel. | 283 million tonnes iron ore production (FY23). | Supplies foundational materials for global industry. |

| Exploration & Resource Development | Discovering and developing new mineral deposits. | ~$500 million exploration investment (FY23). | Ensures long-term growth and project pipeline. |

| Decarbonisation & Sustainability | Reducing operational emissions and promoting environmental stewardship. | 10% reduction in operational GHG intensity (FY23 vs FY20). | Addresses climate risk and enhances social license. |

| Operational Excellence | Improving efficiency and cost discipline in operations. | 12% reduction in unit costs at Escondida copper mine (2024). | Maximizes profitability and competitive advantage. |

Full Version Awaits

Business Model Canvas

The BHP Group Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing a direct representation of the comprehensive analysis that will be yours, including all key components and insights. You'll gain immediate access to this same, fully detailed Business Model Canvas, ready for your strategic planning and decision-making.

Resources

BHP’s key resources include a globally significant portfolio of long-life, low-cost mining assets. These are anchored by major iron ore operations in Western Australia, such as the South Flank mine, which produced 346 million tonnes in the 2023 financial year.

The company also boasts substantial copper reserves, notably the Escondida mine in Chile, the world's largest copper producer, and the Spence mine. In the 2023 financial year, Escondida's attributable production was 1,048 kt, and Spence contributed 233 kt.

Furthermore, BHP holds significant metallurgical coal assets in Queensland, Australia, essential for steelmaking. These high-quality reserves provide a stable foundation for the company’s production and revenue streams, ensuring long-term operational capacity.

BHP Group's extensive global infrastructure and logistics are foundational to its business model, encompassing a vast network of owned and operated assets. This includes critical components like dedicated rail lines and port facilities, which are essential for moving raw materials from mines to customers worldwide. In 2023, BHP continued to invest in these vital supply chain links, recognizing their importance for operational efficiency and cost competitiveness.

This integrated logistics network is a key resource, enabling the efficient and reliable transportation of BHP's mined commodities, such as iron ore and copper, from remote production sites to global markets. The company's strategic investments in infrastructure hubs are designed to further enhance performance by creating greater economies of scale and ensuring timely delivery, a crucial factor in maintaining market leadership.

Strong financial capital and a healthy balance sheet are foundational to BHP Group's business model. This robust financial footing, evidenced by industry-leading margins and consistent cash flow, enables substantial investments in future growth initiatives and provides a crucial buffer against economic downturns.

BHP's financial strength directly supports its ability to fund major capital expenditures for new projects, maintain attractive shareholder returns, and navigate the inherent volatility of commodity markets. As of December 31, 2024, the company reported total assets amounting to $102.362 billion, underscoring its significant financial capacity.

Highly Skilled Workforce and Technical Expertise

BHP's operations are powered by a vast global team of over 90,000 employees and contractors. This extensive workforce brings together specialized skills in areas crucial to mining, such as geology, engineering, and advanced operational management. The company's commitment to developing and retaining this talent is a cornerstone of its business model, ensuring a high level of technical proficiency across all functions.

The deep technical expertise within BHP’s ranks is a significant competitive differentiator. This know-how is applied to optimize extraction processes, manage complex logistical challenges, and drive innovation in a demanding industry. For instance, in 2024, BHP continued to invest in training and development programs aimed at enhancing the skills of its personnel, particularly in areas like automation and sustainable mining practices.

- Global Talent Pool: Over 90,000 employees and contractors worldwide.

- Key Disciplines: Geology, engineering, operations, commercial, and technical support.

- Competitive Advantage: Deep technical know-how and focus on operational excellence.

- Investment in Skills: Ongoing commitment to training and development for workforce enhancement.

Advanced Technology and Intellectual Property

BHP Group's commitment to advanced technology and intellectual property is a cornerstone of its operational strategy. The company actively integrates cutting-edge innovations like artificial intelligence (AI) and sophisticated data analytics. These technologies are crucial for enhancing operational efficiency, bolstering safety protocols, and driving the company's decarbonisation efforts.

The practical application of AI is evident in areas such as processing plants, where it contributes to significant water and energy savings. Furthermore, machine learning algorithms are being deployed to improve the discovery of new mineral deposits, a critical factor for future resource security. For instance, in 2023, BHP reported using advanced analytics to identify potential new ore bodies, aiming to extend the life of its mines.

- AI-driven operational optimization: Reducing water and energy consumption in processing plants.

- Machine learning for exploration: Enhancing the efficiency and success rate of discovering new mineral deposits.

- Ventures for external technology access: Strategic investments and partnerships to acquire disruptive technologies.

- Intellectual property development: Protecting and leveraging proprietary technological advancements.

BHP's key resources extend beyond physical assets to include its extensive global infrastructure and logistics network. This integrated system, featuring dedicated rail lines and port facilities, ensures efficient movement of commodities like iron ore and copper. In 2023, continued investment in these supply chain links underscored their importance for cost competitiveness and market reach.

Financial capital is another critical resource, with BHP maintaining a strong balance sheet. This financial robustness, evidenced by substantial total assets of $102.362 billion as of December 31, 2024, enables significant investment in growth and resilience against market volatility.

Furthermore, BHP leverages advanced technology and intellectual property, including AI and data analytics, to optimize operations, enhance safety, and drive decarbonisation. Machine learning is actively used to improve mineral exploration, as seen in 2023's efforts to identify new ore bodies.

Finally, BHP's vast global talent pool of over 90,000 employees and contractors, possessing deep technical expertise in areas like geology and engineering, represents a significant competitive advantage.

| Resource Category | Specific Examples/Data (as of FY23 or latest available) | Significance |

|---|---|---|

| Mining Assets | South Flank (Iron Ore): 346 Mt produced in FY23 Escondida (Copper): 1,048 kt attributable production in FY23 Spence (Copper): 233 kt attributable production in FY23 |

Long-life, low-cost foundation for production. |

| Infrastructure & Logistics | Owned and operated rail lines and port facilities | Enables efficient and reliable global commodity transport. |

| Financial Capital | Total Assets: $102.362 billion (as of Dec 31, 2024) | Supports investment, growth, and market navigation. |

| Human Capital | Employees & Contractors: Over 90,000 globally | Drives operational excellence and technical innovation. |

| Technology & IP | AI & Data Analytics for exploration and operational efficiency | Enhances discovery, reduces costs, and supports sustainability. |

Value Propositions

BHP ensures a steady and substantial flow of vital global resources, including iron ore, copper, coal, and nickel. These materials are fundamental building blocks for sectors like steel production, energy generation, and manufacturing worldwide. In the fiscal year 2023, BHP reported record iron ore production of 280.7 million tonnes, underscoring its capacity to meet significant demand.

BHP is actively contributing to the energy transition by supplying essential commodities like copper and nickel. These metals are vital for the growth of renewable energy technologies, electric vehicles, and the broader electrification infrastructure needed for decarbonisation. For instance, in fiscal year 2023, BHP’s copper production reached 1,705 kt, a key material for wind turbines and solar panels.

The company is also committed to making its mining operations more sustainable. This includes reducing greenhouse gas emissions from its own operations and those of its suppliers. BHP has set ambitious targets, aiming for a 30% reduction in Scope 1 and 2 greenhouse gas emissions by fiscal year 2030 compared to fiscal year 2020 levels, demonstrating its dedication to supporting global decarbonisation efforts.

BHP's focus on operational excellence and cost leadership means customers get competitive prices and dependable product quality. This is crucial for industrial clients who rely on a steady, efficient supply of raw materials.

In 2024, BHP consistently demonstrated its commitment to low unit costs, particularly in its iron ore operations. For instance, their Escondida mine achieved a strong cost performance, contributing to their overall competitive advantage in the market.

This cost discipline not only benefits customers through stable pricing but also strengthens BHP's position by ensuring a resilient and efficient supply chain, even amidst market volatility.

Sustainable and Responsible Resource Development

BHP's dedication to sustainable and responsible resource development is a cornerstone of its value proposition, assuring customers and stakeholders of its commitment to environmental stewardship, social responsibility, and robust community engagement.

This focus on ethical practices and social value resonates strongly in today's market, where Environmental, Social, and Governance (ESG) factors are increasingly prioritized by investors and consumers alike. For instance, in the 2023 financial year, BHP reported a 15% reduction in its Scope 1 and 2 greenhouse gas intensity compared to its 2020 baseline, demonstrating tangible progress in its environmental management efforts.

The company’s approach to resource development is designed to enhance the appeal of its products in a market that is rapidly evolving to value sustainability. This includes significant investments in biodiversity programs and water management strategies across its operations.

- Environmental Stewardship: BHP invests in programs aimed at reducing its environmental footprint, such as emissions reduction targets and water conservation initiatives.

- Social Performance: The company emphasizes strong relationships with local communities, contributing to social development and ensuring responsible operational impacts.

- Community Engagement: BHP actively engages with stakeholders to understand and address community needs, fostering trust and mutual benefit.

- ESG Market Appeal: By integrating ESG principles, BHP enhances its brand reputation and product desirability in a market increasingly driven by sustainability concerns.

Diverse Portfolio and Global Reach

BHP's diverse portfolio spans essential commodities like iron ore, copper, and coal, operating across continents including Australia and the Americas. This global presence and varied product mix inherently offer a natural hedge against fluctuations in any single commodity's price, a key strength for investors and customers alike.

This broad commodity exposure and extensive geographic reach allow BHP to serve a wide array of industrial sectors globally. For instance, in the fiscal year ending June 30, 2023, BHP reported revenue of $53.8 billion, underscoring its significant market penetration and the demand for its diverse offerings.

- Global Operations: BHP maintains significant operations in key regions like Western Australia for iron ore and the Americas for copper, ensuring a widespread production base.

- Commodity Diversification: The company's portfolio includes iron ore, copper, metallurgical coal, and potash, reducing reliance on any single market.

- Market Reach: BHP supplies essential raw materials to major industrial hubs across Asia, Europe, and the Americas, catering to diverse customer needs.

- Resilient Supply Chain: Its expansive operational footprint and product range contribute to a robust and resilient supply chain, vital for global industrial activity.

BHP provides a reliable supply of fundamental global resources like iron ore and copper, crucial for industries such as steel and renewable energy. In fiscal year 2023, their iron ore production reached 280.7 million tonnes, highlighting their capacity to meet substantial demand.

The company actively supports the energy transition by supplying copper and nickel, essential for electric vehicles and renewable technologies, with 1,705 kt of copper produced in fiscal year 2023.

BHP prioritizes operational efficiency and cost leadership, ensuring competitive pricing and dependable product quality for industrial customers reliant on raw material consistency.

BHP's commitment to sustainability and responsible resource development enhances its market appeal, with a 15% reduction in Scope 1 and 2 greenhouse gas intensity reported by the 2023 financial year.

Customer Relationships

BHP Group prioritizes long-term strategic agreements with major industrial clients, typically lasting 10 to 15 years. These enduring partnerships ensure consistent demand for BHP's commodities, offering crucial market stability and predictability for both the supplier and its customers.

For instance, in fiscal year 2023, BHP's focus on these strategic relationships contributed to a robust sales performance, with iron ore sales volumes reaching 283.9 million tonnes and copper sales at 1,610 kt. This long-term approach underpins the company's revenue streams amidst fluctuating commodity prices.

BHP Group's Key Account Management is crucial for its major industrial clients in steel, energy, and manufacturing. This strategy focuses on building strong, long-term partnerships by deeply understanding each client's unique requirements.

Dedicated account teams work to deliver customized solutions and guarantee unwavering supply quality, a testament to BHP's commitment to its most significant customers. For example, in 2023, BHP's focus on these relationships contributed to its robust performance in its iron ore division, a key supplier to the global steel industry.

BHP actively collaborates with customers and partners on joint engineering projects, developing bespoke mining equipment and tailored solutions. This partnership approach ensures that offerings align with changing operational needs and shared objectives, such as enhancing efficiency and promoting sustainability.

Supply Chain Resilience and Support

BHP Group actively strengthens its supply chain by fostering partnerships and localizing support services. This approach enhances maintenance capabilities across its worldwide mining operations, directly benefiting customers by ensuring more reliable and timely product deliveries.

This strategic focus on resilience is crucial for maintaining customer trust and operational continuity. For instance, in the fiscal year 2023, BHP reported significant investments in local supplier development programs, aiming to build a more robust and responsive supply network.

- Partnerships: Collaborating with key suppliers to improve service delivery and innovation.

- Localization: Increasing the proportion of locally sourced goods and services to reduce lead times and enhance responsiveness.

- Maintenance Capabilities: Investing in training and technology to bolster on-site maintenance, minimizing disruptions.

- Customer Assurance: Providing greater certainty of supply through a more resilient and adaptable supply chain.

Commitment to Social Value and ESG Performance

BHP's customer relationships are increasingly built on a foundation of shared commitment to social value and robust Environmental, Social, and Governance (ESG) performance. This goes beyond mere product supply, fostering partnerships that prioritize sustainability and responsible operations.

Customers, particularly those in developed markets, are actively seeking suppliers who demonstrate strong ESG credentials. For instance, in 2024, a significant percentage of BHP's customers indicated that ESG factors were becoming a key consideration in their purchasing decisions, influencing their preference for suppliers aligned with their own sustainability goals.

- Shared Sustainability Goals: BHP actively engages with customers on decarbonisation pathways and the creation of social value, aligning business objectives with societal needs.

- Growing ESG Influence: Customer purchasing decisions are increasingly influenced by a supplier's commitment to ESG principles, driving demand for responsible sourcing.

- Transparency and Reporting: BHP's enhanced ESG reporting and transparent communication on climate-related risks and opportunities strengthen trust and loyalty with environmentally conscious customers.

- Value Beyond Product: The company aims to deliver value through its commitment to ethical conduct and positive social impact, fostering deeper, more resilient customer relationships.

BHP's customer relationships are characterized by long-term strategic agreements, key account management, and a growing emphasis on shared sustainability goals. This multifaceted approach ensures supply chain resilience and fosters loyalty by aligning with evolving customer priorities, particularly concerning ESG performance.

In 2024, a notable trend is the increasing influence of ESG factors on customer purchasing decisions, with many clients actively seeking suppliers with strong sustainability credentials. BHP's commitment to transparency and responsible operations, including its investments in local supplier development programs in fiscal year 2023, directly supports these evolving customer expectations.

| Customer Relationship Aspect | Description | Supporting Data/Example |

|---|---|---|

| Long-Term Agreements | Securing consistent demand through 10-15 year contracts with major industrial clients. | FY23 iron ore sales: 283.9 million tonnes; FY23 copper sales: 1,610 kt. |

| Key Account Management | Deeply understanding and catering to unique client needs in steel, energy, and manufacturing. | Dedicated teams provide customized solutions and guarantee supply quality. |

| Collaborative Projects | Partnering on engineering initiatives for bespoke equipment and tailored solutions. | Focus on enhancing efficiency and promoting sustainability through joint development. |

| ESG Alignment | Building relationships based on shared commitment to social value and ESG performance. | FY23 investments in local supplier development programs to enhance supply chain resilience. |

Channels

BHP's direct sales and marketing teams are the backbone of its customer relationships, particularly with large industrial buyers. These teams are responsible for the entire sales cycle, from initial contact to final contract negotiation for key commodities like iron ore, copper, and metallurgical coal. In the 2023 financial year, BHP's marketing segment generated revenue of $49.9 billion, highlighting the significant scale of these direct sales operations.

These specialized teams manage complex, long-term agreements with major global manufacturers and energy companies, ensuring consistent demand for BHP's products. Their expertise in commodity markets and client needs allows for tailored solutions and strengthens BHP's competitive position. For instance, their efforts directly contributed to securing significant volumes of iron ore sales to major steel producers in Asia.

BHP Group leverages a vast global logistics and shipping network to move its mined commodities, from iron ore and copper to coal, across continents. This intricate system is crucial for connecting its production sites to customers, ensuring the efficient flow of bulk materials. In 2024, BHP's operational efficiency heavily depends on managing this complex web of transportation.

The company's logistics strategy encompasses managing its own port facilities, extensive rail infrastructure, and chartering a significant fleet of ocean vessels. This integrated approach aims to optimize transit times and costs for bulk shipments, a key factor in maintaining competitiveness in the global commodities market.

BHP Group actively engages with commodity trading desks, a crucial element in its revenue generation strategy. This interaction allows BHP to navigate global commodity markets, ensuring efficient sales of its diverse product portfolio, which includes iron ore, copper, coal, and nickel.

These trading desks provide BHP with the flexibility to complement its long-term sales agreements with opportunistic spot market transactions. For instance, in fiscal year 2023, BHP's revenue from operations reached $53.8 billion, with a significant portion being influenced by the dynamic pricing within these global commodity markets.

Integrated Supply Chain Operations

BHP's channels are intrinsically linked to its vast operational network, functioning as a direct conduit from resource extraction to global delivery. The efficiency of its mining, processing, and extensive transportation infrastructure, including rail and shipping, directly translates into the effectiveness of its product channels, guaranteeing both reliability and significant volume.

In 2024, BHP continued to leverage its integrated logistics to optimize product flow. For instance, the company's Western Australia Iron Ore (WAIO) operations, a cornerstone of its business, rely on a sophisticated network of mines, concentrators, and a dedicated rail system connecting to port facilities. This seamless integration allows for the efficient movement of millions of tonnes of iron ore annually, directly impacting its market reach and customer fulfillment.

- Pit to Port Efficiency: BHP's operational infrastructure, from mining sites to export terminals, acts as a primary channel, ensuring direct and controlled product delivery.

- Logistics as a Competitive Advantage: The company's investment in and management of rail, port, and shipping capabilities enhance its ability to serve global markets reliably and at scale.

- 2024 Operational Throughput: BHP's ability to move large volumes, exemplified by its iron ore operations, underscores the strength of its integrated channel strategy in meeting demand.

Digital Platforms for Information and Engagement

BHP leverages its corporate website and dedicated investor portals as key digital channels. These platforms are crucial for disseminating transparent financial results, detailed operational reviews, and comprehensive sustainability reports to its stakeholders.

These digital touchpoints are vital for fostering stakeholder engagement and building trust, particularly for a predominantly business-to-business (B2B) entity like BHP. For instance, in fiscal year 2023, BHP reported underlying EBITDA of $29.0 billion, showcasing the scale of operations communicated through these channels.

- Corporate Website: Serves as the primary hub for all public-facing information.

- Investor Portals: Offer detailed financial statements, annual reports, and presentations.

- Sustainability Reports: Provide crucial data on environmental, social, and governance (ESG) performance.

- Stakeholder Engagement: Facilitates two-way communication and feedback mechanisms.

BHP's channels are a robust blend of direct sales, sophisticated logistics, and strategic market engagement. Its direct sales teams manage key commodity contracts, while its extensive logistics network ensures efficient global product movement. BHP's 2023 financial year saw its marketing segment generate $49.9 billion in revenue, underscoring the effectiveness of these direct and logistics-driven channels.

The company's engagement with commodity trading desks provides market flexibility, complementing long-term agreements with spot market opportunities. This strategic interaction is vital for navigating dynamic global prices, as evidenced by BHP's fiscal year 2023 revenue from operations reaching $53.8 billion.

In 2024, BHP's integrated logistics, including its Western Australia Iron Ore operations, continue to be a critical channel, moving millions of tonnes of product efficiently. This operational throughput directly supports its market reach and customer fulfillment.

BHP utilizes its corporate website and investor portals as key digital channels for transparent communication of financial results and operational reviews. These platforms are essential for stakeholder engagement, especially given the B2B nature of its business.

| Channel Type | Description | Key Metrics/Examples |

| Direct Sales & Marketing | BHP's internal teams managing customer relationships and contract negotiations. | FY23 Marketing Revenue: $49.9 billion; Securing large volume iron ore sales to Asian steel producers. |

| Logistics & Shipping | BHP's management of rail, port facilities, and chartering vessels for commodity transport. | FY24 Operational efficiency dependent on managing this network; WAIO operations moving millions of tonnes of iron ore annually. |

| Commodity Trading Desks | Engagement with trading platforms for market access and price optimization. | FY23 Revenue from Operations: $53.8 billion; Opportunistic spot market transactions. |

| Digital Channels (Website, Portals) | Online platforms for information dissemination and stakeholder engagement. | FY23 Underlying EBITDA: $29.0 billion; Publication of financial results, operational reviews, and ESG reports. |

Customer Segments

Global steel manufacturers represent a cornerstone customer segment for BHP, driving substantial demand for its iron ore and metallurgical coal. These companies are the backbone of global infrastructure and construction, requiring a consistent and high-quality supply of raw materials to fuel their production processes.

In 2024, BHP's iron ore sales volume was a key driver of its financial performance, with the company continuing to be a major supplier to steelmakers in Asia and beyond. Metallurgical coal, essential for steelmaking, also saw significant demand from this segment, underpinning BHP's integrated value chain.

Energy and power generation companies are key customers for BHP, historically relying on thermal coal for electricity production. While BHP has been divesting some coal assets, the demand for copper from this sector is growing significantly as it's crucial for renewable energy infrastructure like wind turbines and solar farms.

Automotive and Electric Vehicle (EV) manufacturers represent a vital and expanding customer base for BHP Group, particularly for its nickel and copper products. As the global automotive industry accelerates its transition to electrification, demand for these 'future-facing commodities' is surging. Nickel is a key component in high-performance EV batteries, while copper is essential for wiring, motors, and charging infrastructure. In 2024, the automotive sector's reliance on these materials underscores BHP's strategic alignment with global decarbonization efforts.

Chemical and Fertilizer Industries

BHP Group's potash division directly serves the chemical and fertilizer industries. In this segment, potash is a critical component for agricultural fertilizers, directly impacting crop yields and contributing to global food security. For instance, in 2024, the demand for fertilizers remained robust due to ongoing efforts to boost agricultural productivity worldwide.

Beyond agriculture, potash also plays a role in various industrial applications. These include its use in the manufacturing of glass, where it contributes to specific properties. The industrial demand for potash, while smaller than agricultural use, provides a consistent market for BHP's output.

- Agricultural Fertilizers: Essential for enhancing crop yields and supporting food security initiatives.

- Industrial Applications: Used in sectors such as glass manufacturing.

- Market Demand: Driven by both global food production needs and industrial processes.

- 2024 Relevance: Continued strong demand in both agricultural and industrial sectors.

Diverse Industrial and Manufacturing Sectors

BHP Group's diverse industrial and manufacturing customer segments extend beyond its primary focus, supplying essential base metals like copper and nickel to a wide array of industries. These sectors utilize BHP's products for everything from automotive components to construction materials, underscoring the broad applicability of its resource offerings.

This broad customer base contributes significantly to BHP's revenue diversification. For instance, in the fiscal year 2023, BHP reported a remarkable underlying EBITDA of $24.1 billion, with its Minerals Americas segment, which includes copper and nickel operations, playing a substantial role. The demand from these varied manufacturing clients helps stabilize earnings through different economic cycles.

- Broad Industrial Applications: BHP's metals are critical inputs for sectors such as automotive manufacturing, electronics, aerospace, and general industrial machinery.

- Revenue Diversification: Servicing these diverse industrial clients provides BHP with a more stable and varied revenue stream, less susceptible to fluctuations in any single end-market.

- Economic Indicator: Demand from these manufacturing sectors can serve as an economic indicator, reflecting broader industrial activity and growth trends.

- Global Reach: BHP's ability to supply metals globally supports international manufacturing supply chains, solidifying its position as a key supplier.

BHP's customer segments are diverse, ranging from global steel manufacturers to emerging EV producers. The company's iron ore and metallurgical coal are vital for steel production, a sector that saw continued strong demand in 2024. Additionally, BHP supplies copper and nickel to the automotive and electric vehicle industries, crucial for battery technology and infrastructure. Its potash division serves the agricultural sector, supporting global food security through fertilizer production.

| Customer Segment | Key Products Supplied | 2024 Relevance/Data Point |

|---|---|---|

| Global Steel Manufacturers | Iron Ore, Metallurgical Coal | Continued major supplier to Asian steelmakers; metallurgical coal demand remained robust. |

| Automotive & EV Manufacturers | Nickel, Copper | Nickel and copper are critical for EV batteries and charging infrastructure; demand surged in 2024. |

| Chemical & Fertilizer Industries | Potash | Essential for agricultural fertilizers, supporting global food production; demand remained strong in 2024. |

| Energy & Power Generation | Copper (growing), Thermal Coal (divesting) | Copper is vital for renewable energy infrastructure; demand for copper is increasing. |

| Industrial & Manufacturing | Copper, Nickel | Used in electronics, construction, and machinery; contributed to BHP's FY23 underlying EBITDA of $24.1 billion. |

Cost Structure

BHP's operating costs are heavily influenced by direct expenses in mining and processing. These include significant outlays for energy, essential consumables, ongoing maintenance, and the substantial cost of freight and logistics.

Global inflation and the fluctuating prices of commodity-linked raw materials directly impact these expenses. For the fiscal year 2023, BHP reported underlying EBITDA of $24.1 billion, with operating costs representing a key component of their financial performance.

BHP Group's cost structure heavily features substantial capital expenditure (CapEx) to fuel its mining and resource operations. This investment is crucial for the development of new mines, the expansion of existing ones, and the ongoing maintenance of its extensive infrastructure.

Looking ahead, BHP has signaled significant CapEx commitments. For fiscal years 2026 and 2027, the company anticipates an annual investment of approximately US$11 billion. A key focus of this expenditure will be on future-facing commodities, notably copper and potash, reflecting a strategic shift towards materials essential for the global energy transition.

Labour and employee-related costs are a significant part of BHP's expenses, reflecting its extensive global workforce. In the fiscal year 2023, employee wages, salaries, and benefits amounted to $8.3 billion. This figure underscores the substantial investment in human capital necessary to operate its vast mining and resource extraction activities.

The company also incurs considerable costs related to contractors and outsourced services, which are crucial for project execution and specialized tasks. These costs, alongside direct employee expenses, contribute to the overall labor expenditure. For instance, contractor costs in FY23 were $3.2 billion, highlighting the reliance on external expertise.

Furthermore, BHP faces the ongoing challenge of labor and skills shortages in key operational areas. This dynamic can lead to increased competition for talent, potentially driving up wages and recruitment costs. The company's ability to attract and retain skilled workers directly impacts its operational efficiency and cost management strategies.

Royalties and Taxes

BHP faces substantial expenses through royalties and taxes levied by governments in its operational regions. These payments are a direct cost of doing business and can significantly impact profitability.

- Royalties and Taxes: BHP's cost structure includes significant outlays for royalties and taxes paid to governments across its global operations.

- FY2024 Tax Rate: In fiscal year 2024, BHP reported a global adjusted effective tax rate of 32.5%.

- Impact of Royalties: When revenue and production-based royalties are factored in for FY2024, the effective rate escalates to 41.7%.

- Jurisdictional Variation: The specific rates and structures of these payments vary considerably depending on the country and the type of mineral being extracted.

Sustainability and Decarbonisation Investments

BHP's cost structure is significantly influenced by its commitment to sustainability and decarbonisation. These initiatives involve substantial expenditures on environmental compliance, rehabilitation of operational sites, and investment in social programs aimed at community development and stakeholder engagement.

Key cost drivers include the development and deployment of new technologies to reduce greenhouse gas emissions. For instance, BHP is investing in electrifying its mining fleet and implementing advanced energy recovery systems. These efforts are crucial for meeting its ambitious climate targets.

- Environmental Compliance and Rehabilitation: Costs associated with meeting stringent environmental regulations and restoring land post-operation.

- Social Programs: Expenditures on community development, health, education, and Indigenous engagement initiatives.

- Decarbonisation Technology Investments: Capital outlays for electric mining equipment, renewable energy sources, and energy efficiency upgrades.

- Research and Development: Funding for innovation in low-carbon mining solutions and sustainable practices.

BHP's cost structure is dominated by operational expenses, including energy, consumables, maintenance, and logistics, all of which are sensitive to global inflation and commodity prices. Significant capital expenditure is also a core component, with the company planning approximately US$11 billion annually for FY2026-2027, focusing on copper and potash. Labour costs, including wages, salaries, and benefits, reached $8.3 billion in FY2023, supplemented by $3.2 billion in contractor costs, highlighting the substantial investment in its workforce and external services.

| Cost Category | FY2023 Data | FY2024 Data |

|---|---|---|

| Employee Costs | $8.3 billion | Not specified |

| Contractor Costs | $3.2 billion | Not specified |

| Global Adjusted Effective Tax Rate | Not specified | 32.5% |

| Effective Tax Rate (incl. royalties) | Not specified | 41.7% |

| Projected Annual CapEx (FY26-27) | Not specified | US$11 billion |

Revenue Streams

Iron ore sales represent a cornerstone of BHP Group's revenue generation, positioning the company as a dominant global supplier in this vital commodity market.

In the fiscal year 2023, BHP reported record iron ore production, with its Western Australia operations contributing significantly to this achievement, driving substantial earnings for the company. For instance, in the fiscal year ending June 30, 2023, BHP's iron ore production reached 280.7 million tonnes (Mt).

While this strong production volume translates into significant financial performance, it's important to note that iron ore prices are subject to considerable volatility, influenced by global demand, supply dynamics, and macroeconomic factors, which can impact the consistency of this revenue stream.

Copper sales are a rapidly expanding and crucial revenue source for BHP Group. In the first half of fiscal year 2025, copper's contribution to the Group's Underlying EBITDA reached an impressive 39%.

This significant growth is directly supported by record copper production from key operations, including the Escondida and Spence mines. The increasing demand for copper, particularly driven by the global energy transition, is a primary catalyst for this strong performance.

BHP's metallurgical coal sales are a significant revenue driver, with the product primarily destined for the global steelmaking industry. This stream is bolstered by consistent output from key assets such as the BHP Mitsubishi Alliance (BMA), which is a major producer.

For the fiscal year ending June 30, 2024, BHP reported metallurgical coal sales volumes of 108.7 million tonnes, demonstrating the scale of this revenue stream. The company's operational efficiency, despite potential weather disruptions, ensures a steady supply to market.

Potash Sales (Future Stream)

BHP's Jansen Potash Project, currently in its development phase, is projected to become a significant future revenue source. Production is slated to begin in 2026, marking a crucial diversification for the company.

Upon commencing operations, the sale of potash will target key global markets. These sales will primarily serve the agricultural sector, crucial for fertilizer production, and the chemical industry, where potash has various industrial applications.

- Projected Production Start: 2026

- Primary Markets: Agriculture and Chemical Industries

- Strategic Impact: Diversification of BHP's commodity portfolio

- Estimated Project Cost: Approximately $7.5 billion for Stage 1

Nickel Sales

Nickel sales are a crucial revenue stream for BHP Group, especially as nickel is a key component in batteries for electric vehicles, positioning it as a future-facing commodity. Despite operational challenges, the company views nickel as strategically important for long-term growth.

In the 2023 financial year, BHP's Nickel West operations contributed significantly to its overall performance, although the company did temporarily suspend some operations due to prevailing market conditions. BHP's strategy involves preserving the option to restart these operations when nickel prices become more favorable, underscoring its commitment to this sector.

- Future-Facing Commodity: Nickel's demand is intrinsically linked to the growth of the electric vehicle market, a key driver for BHP's nickel business.

- Strategic Importance: BHP maintains its commitment to nickel assets like Nickel West, even with temporary suspensions, signaling its long-term value perception.

- Market Sensitivity: The revenue generated from nickel sales is subject to global commodity price fluctuations, impacting short-term financial performance.

BHP Group diversifies its revenue through a portfolio of essential commodities, with iron ore and copper forming the current bedrock of its earnings. Metallurgical coal remains a significant contributor, supplying the global steel industry, while the upcoming Jansen Potash Project signals a strategic expansion into the agricultural and chemical sectors. Nickel sales, though subject to market volatility, are viewed as a crucial component for future growth, particularly with the rise of electric vehicles.

| Commodity | FY23 Sales Volume | FY24 Sales Volume | FY25 H1 EBITDA Contribution | Key Markets |

| Iron Ore | 280.7 Mt (FY23) | (Not specified for FY24) | (Not specified for FY25 H1) | Global Steel Industry |

| Copper | (Not specified for FY23) | (Not specified for FY24) | 39% (FY25 H1) | Energy Transition, Electrical Applications |

| Metallurgical Coal | 108.7 Mt (FY24) | (Not specified for FY23) | (Not specified for FY25 H1) | Global Steelmaking |

| Potash | N/A (Projected Start 2026) | N/A | N/A | Agriculture, Chemical Industry |

| Nickel | (Not specified for FY23) | (Not specified for FY24) | (Not specified for FY25 H1) | Electric Vehicle Batteries, Industrial Applications |

Business Model Canvas Data Sources

The BHP Group Business Model Canvas is informed by a comprehensive blend of internal financial statements, operational performance data, and extensive market research. These sources provide a robust foundation for understanding customer segments, value propositions, and revenue streams.