BHP Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BHP Group Bundle

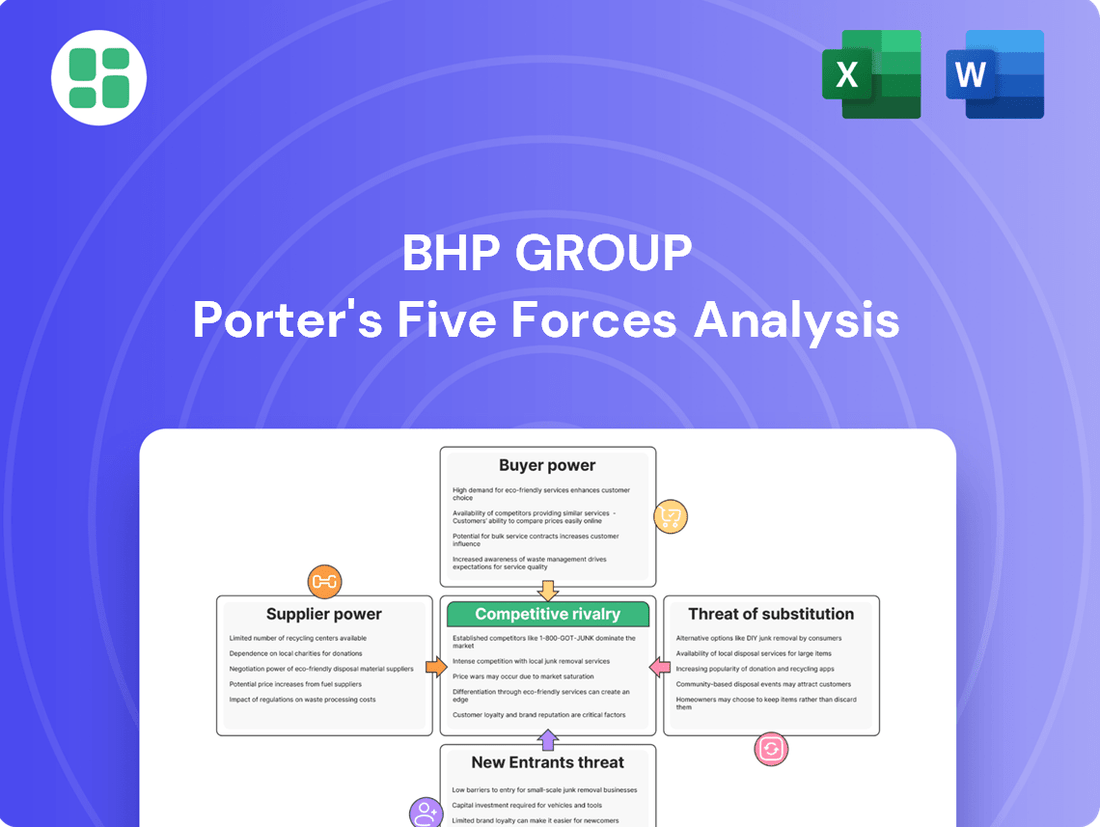

BHP Group operates in a highly competitive landscape shaped by powerful forces like intense rivalry and significant buyer power. Understanding these dynamics is crucial for navigating the global resources market.

The complete report reveals the real forces shaping BHP Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

BHP Group's dependence on specialized mining equipment, provided by a limited number of global manufacturers like Caterpillar and Komatsu, significantly strengthens supplier bargaining power. These suppliers operate in a concentrated market, allowing them to dictate terms and prices. For instance, the high cost and complexity of these machines mean switching suppliers is often prohibitive for BHP.

The bargaining power of skilled labor for BHP Group is significantly influenced by the availability of specialized talent in mining. In 2024, the global mining industry continues to face a shortage of experienced engineers, geologists, and heavy equipment operators, particularly in remote or challenging operational areas. This scarcity empowers these skilled workers, as BHP and its peers must compete for their expertise.

BHP Group's mining operations are significantly impacted by the bargaining power of suppliers for critical inputs like energy and logistics. The cost of fuel and electricity, essential for powering heavy machinery and processing plants, can fluctuate dramatically. For instance, in 2024, global energy prices remained a key concern for resource companies, directly affecting operational expenditures.

Furthermore, the availability and cost of robust logistics infrastructure, including port services for exporting commodities, are vital. Often, these services are concentrated in the hands of a few regional providers, creating an oligopolistic market. This concentration allows suppliers to exert considerable influence over pricing and service availability, a factor BHP must continually manage across its diverse global asset base.

Environmental Technology Providers

As BHP Group increasingly prioritizes sustainable resource extraction, the demand for specialized environmental technology providers is on the rise. This growing need for eco-friendly mining solutions creates a concentrated market where suppliers can wield significant influence. For instance, in 2023, the global market for mining technology, which includes environmental solutions, was valued at approximately USD 12.5 billion, with a projected compound annual growth rate of over 8% through 2028, indicating a strong but still developing sector.

The nascent nature of the 'green mining technologies' market means there are often limited alternatives for large mining operations like BHP. This concentration allows these specialized environmental technology providers to command higher prices and dictate terms for their innovative solutions. Consequently, suppliers in this niche can exert considerable bargaining power, potentially impacting the cost and pace of BHP's sustainability initiatives and the adoption of new environmental practices.

- Concentrated Market: The 'green mining technologies' sector is still developing, with a limited number of key players offering specialized solutions.

- Growing Demand: BHP's commitment to sustainability fuels an increasing need for eco-friendly mining equipment and services.

- Pricing Power: The lack of widespread alternatives for advanced environmental technologies allows suppliers to influence pricing significantly.

- Impact on Initiatives: High supplier bargaining power can affect the cost-effectiveness and implementation speed of BHP's environmental strategies.

High Switching Costs

BHP Group's reliance on specialized, large-scale mining equipment and integrated software systems means significant upfront investment and complex operational integration. For instance, the capital expenditure for a single large haul truck can run into millions of dollars, and integrating these into existing fleet management and mine planning software requires extensive customization.

Once these systems are in place, switching to a new supplier presents considerable challenges. These include substantial financial penalties for early termination of contracts, the cost of operational downtime during transition, and the expense of retraining personnel on new equipment and software. These factors create a strong lock-in effect, enhancing the bargaining power of BHP's existing suppliers.

- High Switching Costs: Significant upfront investment in specialized mining equipment and integrated software systems.

- Operational Integration: Complex integration of new technologies into existing operational frameworks.

- Financial and Operational Penalties: Substantial costs associated with contract termination, downtime, and retraining when switching suppliers.

The bargaining power of suppliers for BHP Group is notably high due to the specialized nature of mining inputs and the concentrated market for these goods and services. For example, the global market for mining machinery, a critical input for BHP, is dominated by a few major players. This concentration means suppliers can often dictate terms, especially for custom-built or technologically advanced equipment. The high switching costs associated with these specialized assets further solidify supplier leverage, as BHP faces significant financial and operational hurdles when considering alternative providers.

| Supplier Category | Key Characteristics | Impact on BHP | 2024 Data/Trend |

|---|---|---|---|

| Specialized Mining Equipment Manufacturers | Limited number of global suppliers (e.g., Caterpillar, Komatsu), high capital cost, complex integration | Strong pricing power, high switching costs | Continued demand for advanced, efficient machinery, with lead times potentially increasing for new orders. |

| Energy and Fuel Providers | Volatile global commodity prices, geopolitical influences | Direct impact on operational costs, potential for price increases | Global energy prices remained a significant factor in operational expenditures for mining companies in 2024. |

| Logistics and Port Services | Oligopolistic regional markets, essential for commodity export | Influence over transport costs and service availability | Concentration in key export regions can lead to limited negotiation leverage for BHP. |

| Green Mining Technology Providers | Nascent market, specialized solutions, growing demand | Potential for higher pricing, influence on sustainability initiatives | The market for mining technology, including environmental solutions, saw strong growth, with suppliers in high demand. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to BHP Group's position in the global mining and metals industry.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's five forces, allowing for proactive strategic adjustments.

Customers Bargaining Power

BHP Group's core offerings, including iron ore, copper, and coal, are fundamentally commodities. This means they are largely interchangeable on the global stage, with little to distinguish one producer's product from another's. For instance, in 2023, the price of iron ore was heavily influenced by global supply and demand dynamics, rather than unique product features offered by BHP.

Because these commodities are so similar, customers, such as steel manufacturers or energy companies, tend to focus on price as the primary purchasing criterion. This significantly limits BHP's leverage to charge premium prices, as buyers can easily switch to a competitor offering a lower cost. The global market for these resources is vast, with numerous suppliers competing, further amplifying this price sensitivity.

BHP Group's customer base is primarily composed of large industrial buyers, including steel mills, power generators, and manufacturers. These entities typically purchase in substantial volumes, giving them considerable bargaining power.

These sophisticated buyers employ advanced procurement strategies and possess deep market intelligence. This allows them to effectively negotiate for better pricing and more favorable contract terms, directly impacting BHP's revenue and profit margins.

For instance, in 2024, major steel producers often secured long-term contracts for iron ore with pricing mechanisms that reflect global spot market volatility, limiting BHP's ability to dictate terms on significant portions of its sales.

Customers of BHP Group, particularly in the iron ore, copper, and coal markets, benefit from a wide array of global supply alternatives. Major diversified mining companies such as Rio Tinto and Vale are significant competitors, offering comparable products. This broad availability directly curtails BHP's ability to unilaterally dictate prices, as customers can readily switch to other providers if BHP's terms become unfavorable.

Economic Cycles & Demand Fluctuations

The demand for BHP's foundational commodities like iron ore and copper is intrinsically linked to the ebb and flow of the global economy, industrial output, and major infrastructure projects. When economies contract or industrial activity slows, customer demand naturally weakens, amplifying their leverage. For instance, a global economic slowdown in 2023 could lead to reduced steel production, directly impacting iron ore demand and giving steelmakers more bargaining power over BHP.

This inherent cyclicality means that BHP must prioritize cost control to maintain its competitive edge, even when demand is robust. The company's ability to manage its production costs is crucial for profitability during downturns. In 2023, for example, BHP reported a significant portion of its iron ore production operating at the lower end of the global cost curve, a testament to its focus on efficiency.

- Cyclical Demand: BHP's core products are subject to significant demand swings based on global economic health.

- Customer Leverage: Economic downturns empower customers by reducing demand and increasing their negotiating strength.

- Cost Efficiency Imperative: Maintaining low production costs is vital for BHP to remain competitive during periods of softened demand.

- 2023 Cost Performance: BHP's iron ore operations in 2023 demonstrated strong cost management, with a substantial percentage of production in the lowest cost quartile globally.

Limited Backward Integration Threat

The threat of customers backward integrating into mining is significantly limited for major players like BHP. The sheer scale of capital required for establishing mining operations, often running into billions of dollars, presents an enormous hurdle. For instance, developing a new copper mine can easily cost over $2 billion, a sum most industrial consumers cannot readily deploy.

Furthermore, the specialized knowledge and extensive lead times, typically 5-10 years from exploration to production, make backward integration an impractical endeavor for most customers. This complexity means that customers are unlikely to bypass established miners. In 2023, the average payback period for new mining projects remained substantial, reinforcing the difficulty of quick entry.

- Immense Capital Outlay: Establishing large-scale mining operations requires billions in investment, a prohibitive cost for most industrial customers.

- Specialized Expertise: Mining demands highly technical skills in geology, engineering, and resource management, which customers typically lack.

- Long Lead Times: Developing new mining projects can take 5-10 years, making it an unviable option for customers seeking immediate supply chain control.

- Regulatory Hurdles: Navigating complex environmental and mining regulations adds further significant barriers to entry.

BHP Group's customers, primarily large industrial entities like steel manufacturers and power generators, wield significant bargaining power due to the commodity nature of iron ore, copper, and coal. These buyers operate in global markets and possess substantial purchasing volumes, enabling them to negotiate favorable pricing and contract terms. The ease with which they can switch between suppliers, given the interchangeability of the commodities, further strengthens their position. For example, in 2024, major steel producers have continued to leverage long-term contracts with pricing mechanisms tied to volatile spot markets, limiting BHP's pricing autonomy.

The bargaining power of BHP's customers is also influenced by market conditions and the cyclicality of demand for its core products. During economic downturns, when industrial activity and demand for commodities like iron ore weaken, customers gain increased leverage. This was evident in 2023, where a slowdown in global manufacturing directly impacted iron ore demand, allowing steelmakers to negotiate from a stronger position. BHP's focus on cost efficiency, such as its 2023 iron ore operations being in the lowest cost quartile globally, is a direct response to this customer leverage.

The threat of backward integration by customers is minimal for BHP. The immense capital investment, typically billions of dollars, required to establish mining operations, coupled with the 5-10 year lead times and specialized expertise needed, makes this an impractical strategy for most industrial buyers. For instance, the cost to develop a new copper mine often exceeds $2 billion, a prohibitive barrier for potential integrators.

| Customer Bargaining Power Factor | Impact on BHP | Supporting Data/Example (2023-2024) |

|---|---|---|

| Commodity Interchangeability | Limits pricing power; customers can easily switch suppliers. | Iron ore prices in 2023 were driven by global supply/demand, not product differentiation. |

| Large Purchase Volumes | Customers can negotiate better terms due to scale. | Steel mills and power generators buy vast quantities, increasing their leverage. |

| Market Intelligence & Procurement Strategies | Customers effectively negotiate pricing and contract terms. | Sophisticated buyers utilize advanced strategies to secure favorable deals. |

| Availability of Global Alternatives | Reduces BHP's ability to dictate terms. | Competitors like Rio Tinto and Vale offer comparable products, providing customer choice. |

| Economic Cyclicality & Demand Fluctuations | Weakens customer demand, increasing their negotiating strength during downturns. | Economic slowdowns in 2023 reduced steel production, boosting customer leverage. |

| Low Likelihood of Backward Integration | Mitigates a significant threat to BHP's market position. | New mine development costs exceeding $2 billion and 5-10 year lead times are prohibitive. |

Preview the Actual Deliverable

BHP Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for BHP Group, detailing the competitive landscape and strategic positioning within the mining and metals industry. The document you see here is the exact, fully formatted report you will receive immediately after purchase, providing actionable insights without any placeholders or alterations.

Rivalry Among Competitors

BHP Group faces fierce competition from other global diversified miners like Rio Tinto, Vale, Glencore, and Anglo American. These giants possess comparable vast asset portfolios and vie for market share across the same key commodities, such as iron ore, copper, and coal.

The intense rivalry is driven by the significant scale of operations and the direct overlap in product offerings among these major players. For instance, in the iron ore market, BHP and Rio Tinto are often seen as direct competitors, with their production levels and export volumes closely monitored by investors and analysts.

In 2024, the global mining industry continues to be characterized by this high degree of competition. Companies are constantly investing in new projects, technology, and efficiency to maintain or improve their competitive standing, impacting pricing and profitability across the sector.

The inherent volatility of global commodity prices significantly fuels competitive rivalry within the sector, particularly when markets experience downturns. This instability forces companies like BHP to intensely fight for market share, aiming to preserve profitability and crucial cash flow, which in turn escalates pressure on managing operational expenses.

BHP's demonstrated capacity to sustain robust profit margins even amidst these market swings highlights its strong competitive standing and operational resilience. For instance, in the fiscal year ending June 30, 2023, BHP reported an underlying EBITDA of $29.2 billion, showcasing its ability to navigate price fluctuations effectively.

BHP's competitive rivalry is shaped by a strong drive for cost leadership, a common theme in the mining industry. This involves maximizing economies of scale from their extensive, long-life resource assets, which is a significant advantage.

The company's unwavering focus on operational efficiency and stringent cost management is fundamental to its competitive positioning. For instance, in the fiscal year 2023, BHP reported a record iron ore production of 281 million tonnes, demonstrating their ability to leverage scale while maintaining cost discipline.

This dedication to operational excellence ensures BHP's profitability even when commodity prices experience downturns. Their disciplined approach to capital allocation and cost control, evident in their consistent performance, allows them to navigate market volatility effectively.

Limited Product Differentiation

For bulk commodities such as iron ore and thermal coal, BHP faces significant competitive rivalry due to very limited product differentiation. This means that customers perceive the products from different suppliers as largely interchangeable, pushing competition to focus heavily on price and the dependability of supply. For instance, in the iron ore market, while there are slight variations in ore grade, the core product is largely undifferentiated, intensifying price wars among major global players.

This low differentiation forces companies like BHP to compete primarily on cost efficiency and logistical prowess. The market dynamics mean that any significant price advantage can quickly attract customers, leading to a constant pressure to reduce operational expenses. In 2024, the global iron ore market continued to see intense competition, with prices fluctuating based on demand from major steel-producing nations and the supply levels from key exporters.

- Price Sensitivity: Customers in the bulk commodity sector are highly sensitive to price, making it a primary driver of purchasing decisions.

- Supply Reliability: Beyond price, ensuring consistent and reliable delivery is crucial for maintaining customer relationships in these markets.

- Operational Efficiency: BHP's ability to manage production costs and logistics efficiently directly impacts its competitiveness against rivals.

- Market Share Dynamics: Intense rivalry can lead to shifts in market share if one producer gains a significant cost or supply advantage.

Strategic Portfolio Shifts and Growth Investments

Major mining companies are actively reshaping their portfolios, pouring capital into commodities like copper and nickel, often referred to as 'future-facing' materials. This strategic maneuvering involves divesting less profitable or non-core assets to bolster their long-term competitive standing.

BHP Group's substantial investments in copper and potash projects exemplify this trend. For instance, in the fiscal year 2023, BHP reported capital expenditure of $10.1 billion, with significant portions allocated to growth projects, including its Jansen potash project in Canada and continued development in its copper assets. This strategic focus aims to secure future revenue streams and diversify away from traditional commodities.

- Strategic Investments: BHP's Jansen Potash project, with an estimated total investment of $7.5 billion (as of its latest updates), highlights a major commitment to future-facing commodities.

- Copper Focus: The company is also investing heavily in its copper assets, such as the Spence mine in Chile and the Olympic Dam expansion in Australia, to capitalize on anticipated demand growth.

- Portfolio Optimization: These investments are often coupled with divestments of legacy or lower-margin assets, allowing for a more streamlined and growth-oriented operational structure.

- Competitive Landscape: Rivals like Rio Tinto and Vale are undertaking similar portfolio shifts, intensifying competition for prime resource assets and future market share in key commodities.

Competitive rivalry is a defining characteristic for BHP Group, primarily due to the industry's structure and the nature of its products. The company operates in markets where large, established players like Rio Tinto, Vale, and Glencore are direct competitors, often offering similar commodities such as iron ore and copper. This intense competition is further fueled by the low differentiation of bulk commodities, making price and supply reliability the key battlegrounds.

In 2024, the global mining sector continues to exhibit high rivalry, with companies like BHP heavily focused on operational efficiency and cost leadership to maintain their edge. For instance, BHP's fiscal year 2023 saw record iron ore production at 281 million tonnes, underscoring a strategy of leveraging scale while controlling costs. This commitment to efficiency is crucial as commodity price volatility can quickly escalate competitive pressures, forcing companies to fight for market share and protect profitability.

The strategic shift towards 'future-facing' commodities like copper and nickel is also intensifying competition. BHP's significant investments, such as the Jansen Potash project with an estimated total investment of $7.5 billion, and continued copper asset development, reflect a broader industry trend. Rivals are pursuing similar portfolio adjustments, creating a competitive race for prime resource assets and future market dominance in these growing sectors.

| Competitor | Key Overlapping Commodities | FY2023 Revenue (Approximate USD Billions) | Key Strategic Focus |

|---|---|---|---|

| Rio Tinto | Iron Ore, Copper, Aluminium | $54.5 | Copper and Aluminium growth, decarbonization |

| Vale | Iron Ore, Nickel, Copper | $42.8 | Iron ore recovery, nickel expansion, ESG |

| Glencore | Coal, Copper, Nickel, Zinc | $215.8 | Diversified commodities trading and production, energy transition |

| Anglo American | Platinum Group Metals, Copper, Iron Ore | $30.4 | Portfolio optimization, focus on PGM and copper |

SSubstitutes Threaten

The increasing emphasis on metal recycling, particularly for copper and steel, poses a growing threat to the demand for newly mined materials. This trend is driven by environmental concerns and the desire for more sustainable resource management. As recycling capabilities mature, they offer a viable alternative to primary extraction.

Advancements in recycling technologies and the expansion of collection networks are making secondary metal sources more competitive. For instance, by 2024, the global copper recycling rate is projected to be a significant factor in supply, potentially meeting a substantial portion of demand and lessening reliance on new mining operations.

Advances in materials science are continuously offering viable substitutes for traditional metals. For instance, the increasing use of advanced polymers and composites in the automotive sector, where they can offer lighter weight and comparable strength, directly impacts demand for steel and aluminum, key commodities for companies like BHP. In 2024, the global advanced composites market is projected to reach over $25 billion, demonstrating a significant shift towards alternative materials.

Design innovations also play a crucial role by enabling manufacturers to create products requiring less raw material. Techniques like additive manufacturing (3D printing) allow for more efficient material usage and the creation of complex geometries that might not be possible with traditional metalworking. This trend could gradually reduce the overall volume of commodity metals needed, posing a threat to established suppliers.

The accelerating global transition to renewable energy sources presents a significant threat of substitutes for BHP's thermal coal business. As countries commit to decarbonization goals, the demand for coal in power generation is projected to fall sharply. For instance, the International Energy Agency (IEA) forecasts that coal power generation will decline by 40% by 2030 in developed economies as renewables gain market share.

Technological Advancements Reducing Material Consumption

Technological advancements are a significant threat of substitutes for BHP Group, as they can decrease the need for raw materials. Innovations in areas like renewable energy and electric vehicles are constantly evolving, potentially reducing the demand for certain minerals that BHP extracts. For example, the growing popularity of LFP batteries in EVs, which use less nickel and cobalt, directly impacts the market for these metals.

The push for greater efficiency in manufacturing and product design also contributes to this threat. Companies are finding ways to use fewer materials or to substitute them with more readily available or cost-effective alternatives. This ongoing trend means that demand for traditional commodities, while still substantial, faces pressure from technological substitution.

Consider these points:

- Advancements in battery technology: The shift towards LFP batteries, favored for their cost-effectiveness and safety, is reducing demand for cobalt and nickel. In 2023, LFP battery installations accounted for a significant portion of new electric vehicle battery capacity, particularly in China.

- Material efficiency in manufacturing: Innovations in 3D printing and advanced material science allow for the creation of lighter and stronger components using less raw material, impacting demand for metals like steel and aluminum.

- Digitalization and dematerialization: The shift towards digital services and cloud computing can reduce the need for physical infrastructure and the associated material inputs over the long term.

Substitution in Infrastructure and Construction

While steel, a core product for BHP, is indispensable for much of large-scale infrastructure and heavy construction, the threat of substitutes, though generally low, does exist in specific areas. For instance, advanced composites and engineered timber are finding niche applications in construction, offering alternatives to traditional steel components.

However, for the foundational structural elements where steel's strength, durability, and cost-effectiveness are paramount, the substitution threat remains minimal. In 2024, the global construction market continued to heavily rely on steel, with demand driven by infrastructure projects and urban development, underscoring steel's entrenched position.

- Steel's dominance in large infrastructure projects persists.

- Niche applications for composites and engineered timber are emerging.

- Steel's inherent properties limit widespread substitution in core structural uses.

- Global construction trends in 2024 reinforce steel's essential role.

The threat of substitutes for BHP Group's products is primarily driven by technological advancements and the increasing viability of recycled materials. While direct substitution for all of BHP's commodities is challenging, certain sectors are seeing shifts. For example, the automotive industry's move towards lighter materials like advanced composites, projected to reach over $25 billion globally in 2024, impacts demand for steel and aluminum.

Furthermore, the growing emphasis on sustainability fuels metal recycling, offering alternatives to newly mined resources. Copper recycling, in particular, is expected to play a significant role in supply by 2024. Even in construction, where steel's dominance is strong, niche applications for engineered timber and composites are emerging, although steel's foundational role remained critical in 2024's global construction market.

| Commodity/Area | Substitute | Impact/Trend | Year |

|---|---|---|---|

| Steel/Aluminum (Automotive) | Advanced Composites | Market projected over $25 billion, offering lighter weight | 2024 |

| Copper | Recycled Copper | Significant factor in supply, reducing reliance on new mining | Projected 2024 |

| Steel (Construction) | Engineered Timber, Composites | Niche applications emerging, but steel's core role persists | 2024 |

Entrants Threaten

The mining sector, particularly for large-scale operations like those BHP Group engages in, presents exceptionally high capital requirements. Developing a new mine can easily cost billions of dollars, encompassing everything from initial exploration and feasibility studies to the construction of processing plants and extensive infrastructure. For instance, the Jansen Potash project, a significant undertaking, is projected to cost around USD 7 billion, illustrating the scale of investment needed.

These immense upfront costs act as a substantial barrier, effectively deterring most potential new entrants. The sheer financial muscle required to even begin the process means only well-established corporations or those with access to significant, patient capital can realistically consider entering the market. This financial hurdle significantly limits the threat of new competitors emerging.

The sheer length of time it takes to get a new mine operational is a huge barrier. We're talking about many years, often 10 to 20, from finding a deposit to actually producing minerals commercially. This means new companies need a lot of patience and deep pockets to keep their investment tied up for so long without any income.

The threat of new entrants into the mining sector, particularly for companies like BHP Group, is significantly mitigated by the limited availability of high-quality mineral reserves. Most economically viable deposits worldwide are already under the control of established major players. For instance, in 2024, the exploration success rate for new discoveries remains low, with many junior miners struggling to find and secure viable projects.

Acquiring rights to new, world-class mineral reserves is an increasingly costly and complex endeavor. This scarcity of prime assets creates a substantial barrier, making it difficult for new companies to establish competitive operations without significant capital and established relationships. The difficulty in securing land access and permits further compounds this challenge for potential entrants.

Economies of Scale and Established Infrastructure

BHP, like other major mining conglomerates, benefits immensely from economies of scale. This means their sheer size allows them to produce and process materials at a much lower cost per unit than a smaller, newer company could hope to achieve. Think about the massive investments in specialized equipment, research and development, and skilled labor that BHP has already made over decades. For a new entrant to even begin to compete, they'd need to commit billions in upfront capital just to get to a comparable operational level, a hurdle that deters many.

The established infrastructure and intricate global supply chains that incumbent players like BHP have painstakingly built over years represent another formidable barrier. These include everything from owned or leased mines, processing plants, rail lines, ports, and long-standing relationships with logistics providers and customers. A new company would have to replicate or secure access to this complex network, which is both costly and time-consuming. For instance, in 2023, BHP's capital expenditure was approximately $7.6 billion, a significant portion of which likely supported and expanded its existing infrastructure, further solidifying its competitive advantage.

- Economies of Scale: BHP's vast production volumes lead to lower per-unit costs in mining, processing, and logistics.

- Established Infrastructure: Existing assets like mines, processing facilities, and transportation networks create significant upfront investment barriers for new entrants.

- Capital Intensity: The mining sector requires immense capital for exploration, development, and operational setup, making it difficult for newcomers to match incumbent scale and efficiency.

- Market Penetration Challenges: New entrants face difficulties in achieving the market share and distribution efficiencies that established players like BHP have cultivated.

Complex Regulatory and Environmental Hurdles

The mining industry, including giants like BHP Group, faces significant barriers to entry due to complex regulatory and environmental hurdles. Navigating the intricate web of environmental protection laws, social license to operate requirements, and lengthy permitting processes across various global jurisdictions demands substantial investment and specialized knowledge. For instance, in 2024, new mining projects often face years of environmental impact assessments and community consultations before breaking ground, a significant deterrent for smaller, less resourced entrants.

These challenges are compounded by the need for extensive legal and technical expertise to comply with diverse and frequently updated regulations. The financial commitment required to meet these standards, coupled with the inherent uncertainty of regulatory approval, creates a formidable barrier. Newcomers must also contend with the social license to operate, ensuring community buy-in and addressing environmental concerns, which can be a lengthy and resource-intensive process.

- Stringent Environmental Regulations: Compliance with evolving environmental standards requires significant capital expenditure for pollution control and land rehabilitation.

- Complex Permitting Processes: Obtaining necessary permits can take several years, involving detailed studies and approvals from multiple government agencies.

- Social License to Operate: Gaining and maintaining community acceptance and addressing social impacts are critical and often costly prerequisites.

- High Initial Capital Outlay: The combined costs of regulatory compliance, environmental management, and community engagement represent a substantial barrier to entry for new players.

The threat of new entrants for BHP Group is notably low, primarily due to the colossal capital requirements inherent in the mining industry. Developing a new mine can cost billions, as exemplified by the Jansen Potash project's projected USD 7 billion expenditure. This immense financial barrier, coupled with the lengthy 10-20 year timeline from discovery to production, deters most potential competitors. Furthermore, the scarcity of high-quality, economically viable mineral reserves, with exploration success rates remaining low in 2024, means prime assets are already controlled by established players like BHP, making it difficult for newcomers to secure competitive operations.

| Barrier Type | Description | Example/Data Point |

|---|---|---|

| Capital Intensity | Extremely high upfront investment needed for exploration, development, and infrastructure. | Jansen Potash project cost: ~USD 7 billion. |

| Time to Market | Long lead times from discovery to commercial production. | 10-20 years for new mine development. |

| Resource Scarcity | Limited availability of high-quality, economically viable mineral deposits. | Low exploration success rates in 2024. |

| Economies of Scale | Established players have lower per-unit costs due to large-scale operations. | BHP's significant investments in specialized equipment and R&D. |

| Infrastructure & Supply Chains | Existing networks of mines, processing plants, and logistics are costly to replicate. | BHP's 2023 capital expenditure of ~$7.6 billion likely supported existing infrastructure. |

| Regulatory & Environmental Hurdles | Complex laws, permitting, and social license requirements. | New projects in 2024 face years of environmental impact assessments and community consultations. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for BHP Group is built upon a robust foundation of data, drawing from BHP's annual reports, investor presentations, and sustainability reports. We also incorporate industry-specific data from reputable sources like S&P Global Market Intelligence and Wood Mackenzie to provide a comprehensive view of the competitive landscape.