BHP Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BHP Group Bundle

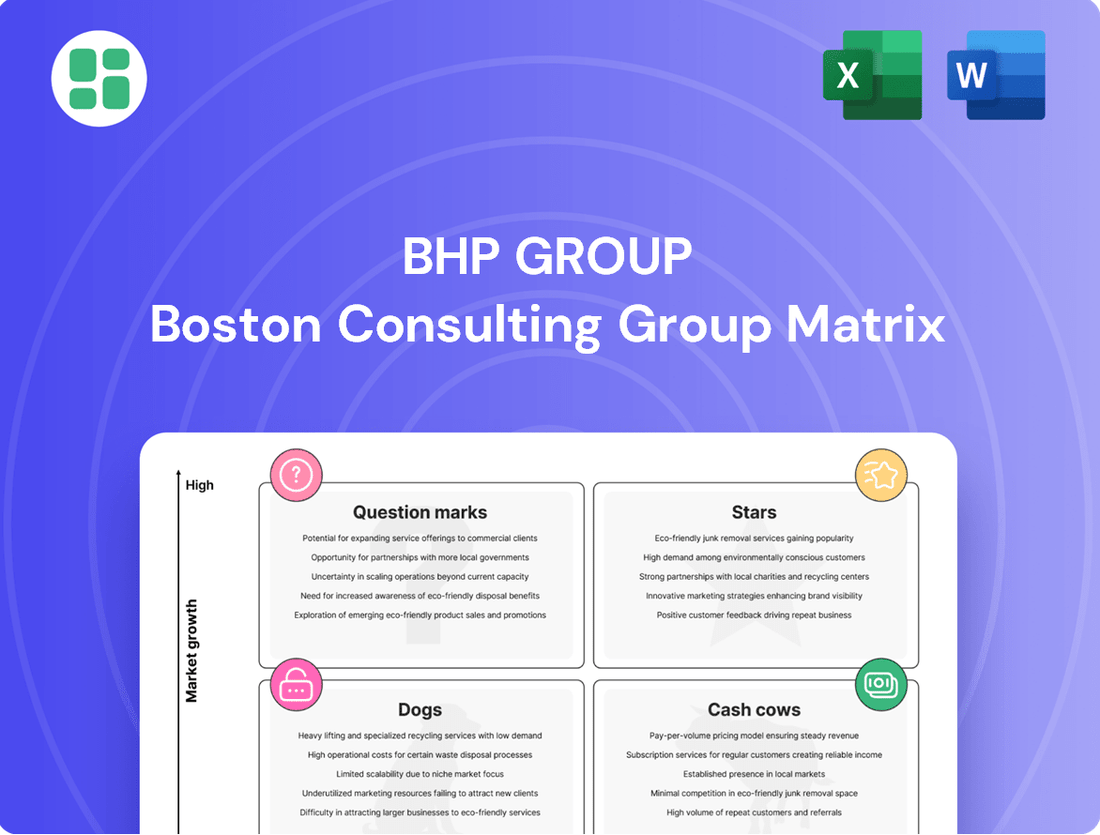

Explore the strategic positioning of BHP Group's diverse portfolio through its BCG Matrix. Understand which of its mining and commodity assets are market leaders (Stars), consistent revenue generators (Cash Cows), underperforming (Dogs), or require further investment to grow (Question Marks). This preview offers a glimpse into the critical insights needed for informed capital allocation.

Ready to transform your understanding of BHP's strategic landscape? Purchase the full BCG Matrix report to unlock detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing your investment decisions and product strategies within the global resources sector.

Stars

BHP's copper assets, especially its South Australian operations like Olympic Dam and its significant Chilean holdings including Escondida, are firmly positioned as Stars in the BCG matrix. These assets benefit from robust global demand fueled by the ongoing electrification and decarbonization efforts worldwide.

The demand for copper is experiencing a significant uplift, driven by its critical role in electric vehicles, renewable energy installations, and the expansion of power grids. This trend is expected to continue its upward trajectory in the coming years, supporting the strong market position of these copper assets.

BHP is actively investing in its copper future, with a substantial capital expenditure plan. For instance, a $13 billion investment pipeline in Chile is earmarked to boost copper production, with the ambitious goal of potentially doubling current output by the mid-2030s, underscoring the strategic importance of these Star assets.

BHP's high-quality metallurgical coal, particularly from its BHP Mitsubishi Alliance (BMA), is a Star. Despite broader coal market challenges, this segment is vital for the dominant blast furnace-basic oxygen furnace (BF-BOF) steelmaking process, especially in rapidly developing regions like India and Southeast Asia. BHP is strategically increasing output from its premium metallurgical coal assets to meet global demand for steel decarbonization initiatives that rely on higher-grade inputs.

BHP's Western Australia Iron Ore (WAIO) operations are a prime example of a Star in the BCG matrix. Its world-leading low-cost production and ongoing capacity expansion efforts, aiming for 330 million tonnes per annum, solidify its position.

In the fiscal year 2023, WAIO achieved record production of 293.9 million tonnes, underscoring its strong operational performance and market leadership. This sustained excellence in a foundational commodity, even with a maturing Chinese market, positions WAIO as a critical growth driver for BHP.

Advanced Exploration Prospects (e.g., Oak Dam)

BHP's advanced exploration projects, like the Oak Dam prospect adjacent to its Olympic Dam operations, are crucial for its future growth. These ventures are designed to uncover substantial, high-grade mineral deposits, potentially extending the operational life and boosting production from its existing top-tier assets.

Investing in these early-stage discoveries is a strategic move to secure a robust pipeline of high-growth opportunities. This aligns with BHP's focus on commodities essential for the future, ensuring long-term market leadership and a strong competitive position.

- Oak Dam Prospect: Located in South Australia, near the existing Olympic Dam mine.

- Resource Potential: Early indications suggest significant copper and gold mineralization.

- Strategic Alignment: Supports BHP's strategy of securing future-facing commodities and extending the life of world-class assets.

- Investment Focus: Represents a key element in BHP's portfolio of high-potential, long-term growth projects.

Strategic Partnerships in Future-Facing Commodities

BHP Group's strategic partnerships in future-facing commodities clearly position them as a Star in the BCG Matrix. Their exploration of opportunities, such as the collaboration with BYD, a global leader in electric vehicles and batteries, highlights a deliberate move into high-growth, high-demand sectors. This proactive engagement aims to secure future market share and integrate BHP into the evolving clean energy supply chains.

These alliances are crucial for several reasons:

- Securing Demand: Partnerships help guarantee off-take agreements for critical minerals essential for battery production and renewable energy technologies.

- Supply Chain Integration: By working with key players like BYD, BHP integrates itself further up the value chain, moving beyond raw material extraction.

- Market Leadership: Active participation in these emerging ecosystems allows BHP to establish a strong presence and potential leadership in high-growth segments of the commodities market.

- Innovation and Technology Access: Collaborations can provide access to new technologies and innovative approaches in mineral processing and application, further solidifying their Star status.

BHP's copper assets, particularly in South Australia and Chile, are Stars due to surging global demand from electrification. Investments like the $13 billion Chilean expansion aim to double copper output by the mid-2030s. Similarly, high-quality metallurgical coal from BMA is a Star, supporting steel production in growth regions.

Western Australia Iron Ore (WAIO) is another Star, boasting world-leading low-cost production and a target of 330 million tonnes per annum. In fiscal year 2023, WAIO achieved a record 293.9 million tonnes, highlighting its market leadership and contribution to BHP's growth.

BHP's strategic partnerships, such as with BYD, solidify its Star status in future-facing commodities. These alliances secure demand for critical minerals and integrate BHP further up the value chain, positioning it for leadership in high-growth segments.

Exploration projects like Oak Dam are crucial for future growth, aiming to discover high-grade deposits and extend the life of existing assets. These investments are key to BHP's strategy of securing a pipeline of high-potential, long-term growth opportunities in essential commodities.

| Asset/Segment | BCG Category | Key Drivers | Recent Performance/Investment |

| Copper (Olympic Dam, Chile) | Star | Electrification, decarbonization demand | $13B investment in Chile to potentially double output by mid-2030s |

| Metallurgical Coal (BMA) | Star | Steel production in developing regions, decarbonization initiatives | Increasing output from premium assets |

| Western Australia Iron Ore (WAIO) | Star | Low-cost production, ongoing expansion | Record 293.9M tonnes production in FY23; targeting 330M tpa |

| Exploration (Oak Dam) | Star | Securing future-facing commodities, extending asset life | Potential for significant copper and gold mineralization |

| Strategic Partnerships (e.g., BYD) | Star | Clean energy supply chains, battery materials | Integration into evolving energy ecosystems |

What is included in the product

The BHP Group BCG Matrix analyzes its diverse portfolio, identifying which business units to invest in, hold, or divest based on market share and growth.

A clear BCG Matrix visualization for BHP Group's portfolio simplifies complex strategic decisions, acting as a pain point reliever for resource allocation.

Cash Cows

BHP's Pilbara iron ore operations are a classic example of a Cash Cow within the BCG Matrix. Their massive scale, coupled with remarkably low operating costs and a commanding position in the global market, consistently yield significant free cash flow. This segment is the bedrock of BHP's financial stability.

Even with forecasts suggesting an expanding surplus in the iron ore market for 2024-2025, BHP's status as the world's most cost-efficient producer guarantees sustained profitability. For instance, in the fiscal year ending June 30, 2023, BHP reported underlying EBITDA from its Iron Ore segment of $27.1 billion, showcasing its immense cash-generating power.

The substantial financial strength derived from these operations is crucial. It allows BHP to strategically invest in and support the development of its other business units that have higher growth potential, while also ensuring consistent and attractive returns for its shareholders.

The BHP Mitsubishi Alliance (BMA) metallurgical coal operations represent a significant Cash Cow for BHP Group. These high-quality assets continue to deliver robust cash flows, fueled by consistent global demand for steelmaking, especially for the premium coals BMA produces.

Despite BHP's strategic divestments in some coal assets, the core BMA operations remain a stable performer. In fiscal year 2023, BMA's metallurgical coal production was approximately 48.9 million tonnes, underscoring its substantial output and market presence.

The mature segments of BHP's Chilean copper operations, exemplified by the Escondida mine, are firmly established Cash Cows. These operations benefit from decades of investment and optimization, leading to significant competitive advantages and consistently high profit margins. For instance, in the fiscal year ending June 30, 2023, Escondida, a key asset in BHP's Chilean portfolio, continued to be a major contributor to the company's copper output, underscoring its role as a stable cash generator.

Global Marketing and Logistics Network

BHP's global marketing and logistics network functions as a Cash Cow within its BCG Matrix. This extensive system efficiently links its substantial resource base to customers across the globe, generating consistent revenue with minimal need for additional investment. The network's established infrastructure and supply chain expertise allow BHP to optimize costs and secure favorable pricing for its commodities.

This operational strength provides a durable competitive advantage. BHP's ability to distribute and sell its products effectively in diverse markets, without requiring significant capital outlays for maintenance or expansion, underscores its Cash Cow status. For instance, in the fiscal year ending June 30, 2023, BHP reported revenues of approximately $53.8 billion, a significant portion of which is attributable to the efficient global reach facilitated by this network.

- Global Reach: Connects BHP's resource assets to over 100 countries.

- Cost Efficiency: Minimizes transportation and handling costs, boosting profit margins.

- Market Access: Ensures reliable delivery and sales channels for commodities like iron ore and copper.

- Revenue Generation: Contributes steadily to BHP's overall financial performance through optimized sales and logistics.

Royalty Streams and Joint Venture Income

Royalty streams and dividends from established joint ventures represent a significant component of BHP Group's Cash Cow quadrant. These income sources, often stemming from past investments and strategic alliances in mature assets, require minimal ongoing operational effort or capital infusion from BHP. For instance, BHP's stake in the Cerrejón mine in Colombia, though subject to complex ownership structures and evolving market conditions, historically provided royalty-like income. As of the fiscal year ending June 30, 2024, BHP's financial reports highlight the consistent, albeit sometimes fluctuating, contribution of these non-operational income streams.

These low-maintenance revenue streams are crucial for providing stable cash flow, bolstering BHP's financial resilience. They are a testament to the enduring value of its diversified portfolio and successful past partnerships. The income generated from these sources allows BHP to fund other strategic initiatives or return capital to shareholders without the direct operational risks associated with its primary mining activities.

- Stable Cash Flow: Royalty and JV income offers predictable earnings.

- Low Maintenance: Minimal operational involvement is required from BHP.

- Returns on Past Investments: These streams capitalize on earlier strategic decisions.

- Diversification: They add a layer of financial stability beyond direct operations.

BHP's Pilbara iron ore operations are a prime example of a Cash Cow, consistently generating substantial free cash flow due to their scale and low operating costs. Despite market forecasts of an expanding iron ore surplus for 2024-2025, BHP's position as a cost leader ensures continued profitability. In fiscal year 2023, this segment reported an underlying EBITDA of $27.1 billion, highlighting its significant cash-generating capacity.

The BHP Mitsubishi Alliance (BMA) metallurgical coal operations also function as a Cash Cow, delivering robust cash flows supported by steady global demand for steelmaking. Even with strategic divestments, BMA's core assets remain strong performers. In fiscal year 2023, BMA produced approximately 48.9 million tonnes of metallurgical coal, demonstrating its considerable output and market influence.

Mature Chilean copper operations, particularly the Escondida mine, are established Cash Cows for BHP. Decades of investment and optimization have created significant competitive advantages and high profit margins. Escondida continued to be a major contributor to BHP's copper output in fiscal year 2023, reinforcing its role as a stable cash generator.

BHP's global marketing and logistics network acts as a Cash Cow by efficiently connecting its resource base to global customers, generating consistent revenue with minimal new investment. This established infrastructure optimizes costs and secures favorable commodity pricing. In fiscal year 2023, BHP's overall revenues reached approximately $53.8 billion, with this network playing a crucial role in achieving that figure.

| Segment | BCG Category | FY23 Underlying EBITDA (USD Billion) | FY23 Production/Revenue Metric | Key Characteristic |

|---|---|---|---|---|

| Pilbara Iron Ore | Cash Cow | 27.1 | N/A (Revenue driver) | Low operating costs, market leadership |

| BHP Mitsubishi Alliance (BMA) Coal | Cash Cow | N/A (Part of Coal segment) | 48.9 million tonnes (FY23) | High-quality metallurgical coal, stable demand |

| Chilean Copper (e.g., Escondida) | Cash Cow | N/A (Part of Copper segment) | Major contributor to copper output (FY23) | Optimized assets, high profit margins |

| Global Marketing & Logistics | Cash Cow | N/A (Revenue enabler) | Approx. $53.8 billion (Total FY23 Revenue) | Efficient distribution, cost optimization |

What You See Is What You Get

BHP Group BCG Matrix

The BHP Group BCG Matrix preview you are viewing is the identical, final document you will receive upon purchase. This comprehensive analysis, showcasing BHP's business units within the BCG framework, is fully formatted and ready for immediate strategic application. You can confidently expect the same in-depth insights and professional presentation in the version you download. No watermarks or demo content will obscure the strategic clarity provided.

Dogs

BHP Group's divestment of its energy coal assets, including the Blackwater and Daunia mines, places them squarely in the Dogs category of the BCG Matrix. These operations faced a challenging market characterized by declining long-term demand due to global decarbonization trends and mounting environmental, social, and governance (ESG) pressures.

The decision to exit these assets reflects a strategic move to streamline BHP's portfolio and concentrate on commodities with stronger future growth prospects. Continued investment in these coal mines was viewed as unviable for sustainable long-term value creation, particularly given the significant capital required for potential turnarounds.

BHP's Western Australia Nickel operations, temporarily suspended in July 2024 due to market oversupply and price drops, are currently categorized as Dogs in the BCG Matrix. These assets reported an underlying EBITDA loss, highlighting their status as cash traps within a challenging, oversupplied market where their market share is limited.

Despite plans for a review by February 2027 and ongoing investment in facility maintenance, the current situation signifies a low-performing asset offering minimal immediate returns. The market oversupply, exacerbated by global economic factors, has significantly impacted the profitability and viability of these operations.

Within BHP Group's diverse operations, certain legacy infrastructure assets may fall into the 'Dogs' category of the BCG Matrix. These are often older facilities, like some of its more mature coal mines or older processing plants, that are becoming less efficient. For instance, while specific mine closure dates are strategic, the general trend in the coal sector sees older, less productive mines facing scrutiny. These assets require significant upkeep and are not aligned with BHP's stated strategic focus on higher-growth commodities like copper and nickel.

Non-Core Exploration Projects with Low Prospectivity

Non-core exploration projects with low prospectivity represent ventures that, after initial assessment, fail to demonstrate significant resource potential or face challenging geological or political landscapes. These projects, while part of a company's broader exploration strategy, can become drains on capital if they do not show a clear path to economic viability. BHP, like other major resource companies, would typically scale back or cease further investment in these areas, allowing them to be relinquished.

In 2024, a company like BHP would likely have several such projects in its portfolio. While specific numbers for non-core, low-prospectivity projects are not publicly detailed in the BCG matrix format, the general principle applies. For instance, if an exploration license in a politically unstable region or an area with known difficult extraction challenges yields minimal promising results during initial geological surveys, it would be classified here. The focus shifts to conserving resources for more promising opportunities.

- Low Prospectivity: Projects where initial geological surveys indicate a low probability of discovering commercially viable mineral deposits.

- Unfavorable Conditions: Ventures located in regions with significant political risk, unstable regulatory environments, or extreme operational challenges that outweigh potential rewards.

- Capital Preservation: BHP's strategy would involve minimizing further expenditure, potentially allowing exploration licenses to lapse rather than continuing to fund unpromising ventures.

- Resource Reallocation: Funds and personnel previously allocated to these low-prospectivity projects would be redirected to higher-potential exploration targets or core business activities.

High-Cost, Low-Quality Ore Bodies (within larger operations)

Within BHP Group's extensive portfolio, certain high-cost, low-quality ore bodies, even within otherwise robust operations, might be categorized as Dogs in a BCG Matrix analysis. These segments often face challenges such as declining ore grades or increased processing difficulties, which inevitably lead to higher per-unit production costs and a dampening effect on overall profitability. For instance, specific zones within the Escondida mine, while a flagship asset, could exhibit such characteristics due to geological complexities.

The strategic approach for these segments involves a careful balancing act. The aim is to mitigate their negative impact on the broader operational performance. This often entails implementing selective mining practices to extract only the higher-value material or considering the early closure of these specific, underperforming sections to free up capital and resources.

- Selective Mining: Focusing extraction on higher-grade pockets within the low-quality ore body to improve the average grade of material processed.

- Processing Optimization: Implementing advanced or specialized processing techniques to more efficiently extract valuable minerals from lower-grade ores, though this can increase capital expenditure.

- Cost Reduction Initiatives: Aggressively pursuing operational efficiencies and cost-saving measures specifically within these challenging segments.

- Phased or Early Closure: Strategically planning the cessation of operations in these segments to minimize ongoing losses and redeploy assets.

BHP's divestment of its energy coal assets, including the Blackwater and Daunia mines, places them in the Dogs category due to declining demand and ESG pressures. These operations were seen as unviable for long-term value creation, especially given the capital needed for turnarounds.

BHP's Western Australia Nickel operations, temporarily suspended in July 2024 due to market oversupply and price drops, are currently Dogs. These assets reported an underlying EBITDA loss, marking them as cash traps in an oversupplied market with limited market share.

While specific numbers for non-core, low-prospectivity exploration projects are not publicly detailed in a BCG matrix format, the principle applies. For example, an exploration license in a politically unstable region or an area with known difficult extraction challenges yielding minimal promising results would be classified here, with focus shifting to conserving resources.

Certain high-cost, low-quality ore bodies within BHP's operations, like specific zones in Escondida, can be categorized as Dogs. These segments face challenges such as declining ore grades and increased processing difficulties, leading to higher per-unit production costs and reduced profitability.

Question Marks

The Jansen Potash Project is a classic Question Mark for BHP Group. This massive, multi-billion dollar undertaking targets a commodity with robust long-term demand, fueled by the critical need for global food security and a growing world population.

Currently under construction, Jansen's first stage is anticipated to commence production around mid-2027. However, the project has encountered cost escalations and potential timeline adjustments for its second stage, highlighting the inherent uncertainties associated with such large-scale new ventures.

BHP's substantial ongoing investment is crucial to navigate these challenges and transform Jansen from a Question Mark into a potential Star performer. The ultimate market share and profitability of this venture remain to be fully determined, underscoring the high-risk, high-reward nature of this strategic initiative.

BHP's early-stage ventures in commodities like lithium and other emerging battery metals would likely be classified as Question Marks in the BCG Matrix. These sectors are experiencing rapid growth, but BHP's current market share is minimal, reflecting their nascent stage within the company's broader portfolio.

These ventures demand substantial investment and successful development to carve out a significant market presence. For instance, while specific figures for BHP's direct lithium exploration are not widely publicized, the global lithium market is projected to grow considerably, with demand driven by electric vehicle expansion. In 2024, the demand for battery metals remains a key focus for diversified miners looking to align with decarbonization trends.

BHP's commitment to decarbonization is evident in its investments in emerging technologies like green steel and carbon capture. For instance, BHP announced in 2023 a partnership with Fortescue Future Industries to explore green steel production, aiming to reduce emissions from steelmaking. These ventures, while vital for future sustainability, represent high-risk, high-reward opportunities within the BCG matrix.

These nascent technologies, such as carbon capture, utilization, and storage (CCUS), are capital-intensive and currently in early development. BHP's 2023 sustainability report highlighted ongoing R&D in CCUS, but commercial viability and widespread adoption remain uncertain. If successful and scalable, these could evolve into Stars, driving future growth; however, failure to achieve market traction could relegate them to Dogs.

Digital Transformation and Automation Initiatives

BHP's large-scale digital transformation and automation initiatives, while promising significant efficiency gains, represent a substantial investment with outcomes still unfolding. These projects, such as the deployment of autonomous haul trucks and advanced data analytics across their mining operations, require considerable capital outlay and extensive organizational adaptation. The full realization of their return on investment and market impact is currently under evaluation, making their placement in a BCG matrix complex.

These initiatives are designed to boost productivity and reduce operational costs. For instance, BHP has been a leader in adopting autonomous mining technology, with significant deployments in Western Australia. These efforts are critical for maintaining a competitive edge in a capital-intensive industry. However, the inherent risks of technology adoption, integration challenges, and the long lead times for realizing benefits mean these are not yet guaranteed successes.

- Investment in Automation: BHP has invested billions in automation, including autonomous haulage systems, aiming to improve safety and efficiency.

- Efficiency Gains: Early reports suggest productivity improvements of up to 20% in areas with autonomous operations.

- ROI Assessment: The full financial return on these digital transformation projects is still being assessed as they are rolled out across various sites.

- Competitive Advantage: Successful implementation is expected to solidify BHP's position as a technologically advanced and cost-efficient producer.

New Market Entry Strategies (e.g., specific regional expansions)

BHP Group's approach to new market entry, particularly in regions with nascent demand for its commodities, focuses on meticulous research and phased investment. This strategy is crucial for navigating diverse regulatory landscapes and establishing robust supply chains. For instance, exploring opportunities in emerging African markets for copper, where demand is projected to rise with industrialization, requires understanding local mining laws and infrastructure development needs.

Successful penetration in these "question mark" markets hinges on building strong local partnerships and demonstrating a commitment to sustainable practices. BHP's 2024 strategic outlook emphasizes agility in adapting to evolving geopolitical and economic conditions, which is paramount for ventures in less established territories. The company's ability to secure resources and build operational capacity efficiently will be key to converting potential into market share.

Key considerations for BHP in these new market entries include:

- Regulatory Due Diligence: Thoroughly assessing and complying with local mining, environmental, and labor laws in target regions.

- Infrastructure Assessment: Evaluating existing transportation, energy, and port facilities to determine necessary upgrades or new developments.

- Stakeholder Engagement: Building relationships with local communities, governments, and potential customers to ensure social license to operate and secure demand.

- Phased Investment: Committing capital incrementally based on market development and the achievement of specific operational milestones.

BHP's exploration into new and rapidly developing commodity markets, such as those for battery metals, places them firmly in the Question Mark category of the BCG Matrix. These ventures are characterized by high growth potential but also significant uncertainty regarding market share and profitability. BHP's strategic investments in these areas, like its focus on copper and nickel, aim to capitalize on the global energy transition.

These emerging opportunities require substantial capital outlay and a long-term perspective to overcome inherent risks. For instance, the demand for nickel, a key component in electric vehicle batteries, saw significant price volatility in 2023 and 2024, underscoring the unpredictable nature of these markets. BHP's success in these areas will depend on its ability to secure competitive resource positions and efficiently scale production.

The success of these Question Mark ventures is critical for BHP's future portfolio diversification and growth. While specific investment figures for individual exploration projects are often proprietary, BHP's overall capital expenditure on exploration and evaluation was approximately $1.3 billion in the 2023 financial year, with a significant portion allocated to future-facing commodities.

BCG Matrix Data Sources

Our BHP Group BCG Matrix is built on a foundation of robust data, integrating publicly available financial reports, industry analysis, and internal operational metrics to provide a comprehensive view of their business units.