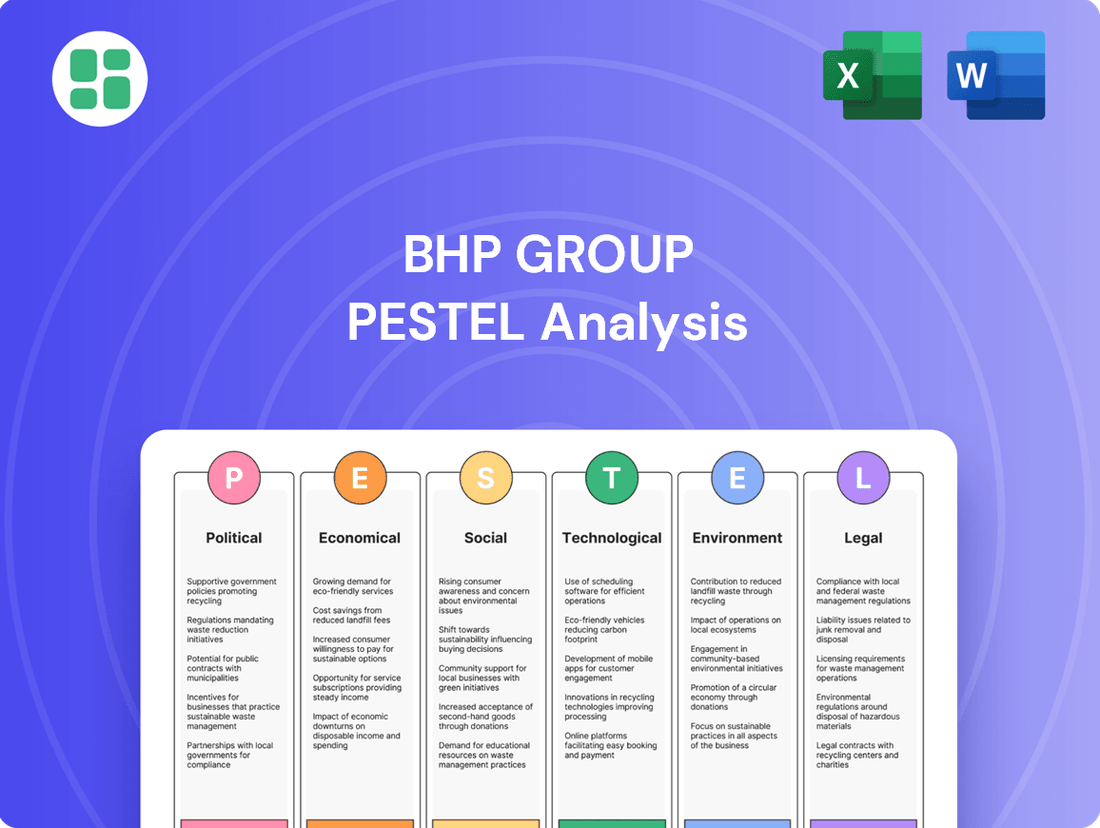

BHP Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BHP Group Bundle

Uncover the intricate web of political, economic, social, technological, legal, and environmental factors shaping BHP Group's future. Our PESTLE analysis provides a critical roadmap for understanding the external forces that could impact your investments and strategies. Gain a competitive advantage by downloading the full, expertly crafted report today.

Political factors

BHP Group's extensive global operations are significantly shaped by a complex web of government policies and regulations. These span critical areas like mining codes, stringent environmental standards, and diverse taxation frameworks in each jurisdiction. For instance, in 2023, changes to royalty rates in Queensland, Australia, directly influenced BHP's capital allocation, prompting a strategic shift towards optimizing existing assets rather than pursuing new development in that specific area.

The mining industry, by its nature, requires substantial long-term capital investment. Consequently, political stability and the clarity and predictability of regulatory environments are paramount for companies like BHP. Uncertainty in these areas can deter major projects, impacting future production and profitability. For example, ongoing discussions around resource nationalism in various countries can create significant headwinds for foreign investment in the sector.

Global geopolitical tensions, particularly the ongoing conflicts and trade disputes, significantly impact BHP's international operations. These tensions can lead to supply chain disruptions and affect commodity demand. For instance, the ongoing trade friction between major economies can result in tariffs, directly influencing the cost and availability of key minerals BHP exports.

Shifting trade policies and the rise of resource nationalism in certain nations present substantial risks for BHP. These policies can alter market access and increase operational complexities. In 2024, several countries have signaled a greater inclination towards controlling their natural resources, potentially impacting BHP's investment decisions and the stability of its mining concessions.

BHP's strategic planning actively incorporates the monitoring of these geopolitical and trade dynamics. The company understands that events like the potential for new trade agreements or the escalation of existing trade wars have a profound influence on mineral markets. This proactive approach is crucial for maintaining its competitive edge and navigating the volatile global economic landscape.

Resource nationalism remains a significant political factor, with governments increasingly seeking a larger stake in their natural resource wealth. This can translate into higher taxes and royalties, impacting profitability for global mining giants like BHP. For instance, in 2023, several African nations continued to review or implement changes to their mining codes, aiming to secure greater economic benefits from their mineral endowments.

The concept of sovereign risk is directly tied to these nationalist policies. When countries assert greater control over their resources, the operational and financial stability for foreign investors can be jeopardized. BHP, with its extensive global operations, is exposed to varying degrees of this risk across different jurisdictions, where political shifts can lead to sudden policy changes affecting asset valuations and future investment decisions.

Furthermore, the heightened scrutiny on corporate accountability, exemplified by the ongoing legal and financial repercussions from the 2015 Samarco dam collapse in Brazil, underscores this trend. The significant fines and remediation costs incurred by BHP in relation to this incident demonstrate the substantial financial and reputational risks associated with environmental and social governance failures, amplified by national regulatory oversight.

Climate Policy and Decarbonization Mandates

Governments globally are intensifying climate policies and decarbonization mandates, directly influencing BHP's operational emissions and its broader value chain. For instance, Australia's Safeguard Mechanism, which sets emissions baselines for major industrial facilities, compels companies like BHP to invest substantially in sustainable practices or acquire carbon credits to meet compliance.

BHP is actively adapting to these pressures by channeling significant capital into renewable energy projects and electrification initiatives. These investments are crucial for achieving its ambitious emission reduction targets, such as its goal to reduce its operational greenhouse gas emissions by at least 30% by FY2030 compared to FY2020 levels.

- Australia's Safeguard Mechanism requires industrial facilities to keep emissions below a set baseline.

- BHP's FY2030 Target aims for a 30% reduction in operational greenhouse gas emissions from an FY2020 baseline.

- Investment in Renewables includes projects like the development of a 175 MW solar farm to power its Queensland operations.

International Relations and Investment Treaties

BHP's extensive global footprint means its operations and investments are deeply intertwined with a multitude of international treaties and bilateral investment agreements. These pacts govern everything from asset protection to the repatriation of profits, making them critical for operational stability.

Fluctuations in these international frameworks, or even disputes between sovereign nations, can directly impact the security of BHP's assets and its capacity to move capital across borders. For instance, a breakdown in a bilateral investment treaty could introduce new risks for foreign direct investment in a particular region.

- Geopolitical Risk: BHP's diversified operations across Australia, the Americas, and Asia expose it to varying levels of geopolitical risk, influenced by international relations and trade pacts.

- Treaty Impact: Changes to international investment treaties, such as those governing resource extraction or taxation, can significantly alter the financial landscape for BHP's projects. For example, the renegotiation of mining agreements in certain jurisdictions could affect profit margins.

- Regulatory Uncertainty: Navigating a complex web of international legal and political relationships is essential for BHP to ensure the smooth flow of its global operations and to mitigate potential legal challenges or expropriation risks.

Political stability and clear regulatory frameworks are crucial for BHP's long-term investments, as policy shifts can significantly impact profitability and project viability. Resource nationalism, evident in 2023 with African nations reviewing mining codes, means governments seek greater control, potentially leading to higher taxes and altered investment conditions.

Geopolitical tensions and trade disputes, like ongoing friction between major economies, directly affect BHP's global supply chains and commodity demand through tariffs and market access changes. In 2024, several countries are emphasizing control over natural resources, influencing BHP's investment strategies and the security of its mining concessions.

Climate policies and decarbonization mandates are intensifying globally, compelling BHP to invest in sustainable practices and emission reduction technologies. For instance, Australia's Safeguard Mechanism requires compliance, driving BHP's commitment to its FY2030 target of a 30% reduction in operational greenhouse gas emissions from an FY2020 baseline.

| Political Factor | Impact on BHP | Example/Data (2023-2024) |

|---|---|---|

| Resource Nationalism | Increased taxes, royalties, and altered investment conditions | African nations reviewing mining codes in 2023 for greater economic benefit. |

| Geopolitical Tensions/Trade Disputes | Supply chain disruptions, impact on commodity demand, tariffs | Ongoing trade friction between major economies affecting mineral exports. |

| Climate Policies/Decarbonization | Mandatory investments in sustainable practices, emission reduction targets | Australia's Safeguard Mechanism; BHP's goal to reduce operational GHG emissions by 30% by FY2030 (vs FY2020). |

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces shaping BHP Group's global operations.

It provides a strategic framework for understanding macro-environmental influences, enabling informed decision-making and proactive risk management.

A concise, actionable summary of BHP Group's PESTLE analysis, designed to quickly identify and address external challenges, thereby relieving the pain point of strategic uncertainty.

Economic factors

BHP Group's financial health is intrinsically linked to the fluctuating prices of key commodities like iron ore, copper, coal, and nickel. For instance, in early 2024, copper prices saw a positive trend, buoyed by strong demand from the electric vehicle and renewable energy sectors, reaching over $9,000 per tonne at times. Conversely, iron ore prices experienced greater volatility throughout 2024, with significant swings impacting BHP's share price performance.

The economic vitality of major commodity consumers like China and India significantly influences demand for BHP's offerings. China's economic recovery, while showing some initial positive signs in early 2024, remains a key variable.

India presents a more robust picture, consistently demonstrating strong structural growth and acting as a significant driver for commodity consumption. This ongoing demand is crucial for BHP's revenue streams.

The speed of industrialization and infrastructure expansion within these nations directly correlates with BHP's sales volumes and long-term growth potential. For instance, India's infrastructure spending is projected to reach $1.4 trillion by 2027, according to government estimates, a key indicator for commodity demand.

Global inflation, especially in labor and operational expenses, poses a substantial hurdle for BHP's overall cost management. Despite broader inflationary trends, BHP has shown resilience, maintaining unit cost increases below 3% at its key operations through diligent cost control measures.

However, ongoing wage inflation and new legislative requirements, such as the push for equal pay for labor hire workers in Australia, are introducing permanent cost increases that will impact the company's financials moving forward.

Currency Fluctuations

BHP, as a global mining giant, is significantly exposed to currency fluctuations, with the US dollar being a primary concern. A strengthening US dollar in 2024, for instance, can reduce the value of revenues earned in other currencies when translated back into dollars, potentially impacting BHP's reported earnings and contributing to share price volatility.

Managing this foreign exchange risk is a continuous and critical financial task for BHP. The company actively employs hedging strategies and financial instruments to mitigate the adverse effects of currency movements on its financial performance and profitability. This proactive approach is essential for maintaining financial stability in a volatile global economic landscape.

- US Dollar Strength Impact: A stronger US dollar in 2024 has presented challenges for BHP by diminishing the value of non-US dollar revenues.

- Earnings Conversion: The conversion of earnings from various operating currencies into USD can lead to lower reported profits when the dollar is appreciating.

- Share Price Sensitivity: Currency headwinds have been a factor contributing to share price pressures for BHP during periods of significant dollar appreciation in 2024.

- Risk Management: BHP's ongoing financial strategy includes robust management of foreign exchange exposure through various financial tools.

Global Energy Transition and Demand Shift

The global shift towards cleaner energy sources is a major economic driver, directly impacting commodity demand. This transition is creating a dual-market scenario where traditional commodities like coal face declining demand, while future-facing commodities are experiencing significant growth.

BHP is actively managing this shift by increasing its exposure to commodities crucial for decarbonization. For instance, the company is investing heavily in copper, a key component in electric vehicles and renewable energy technologies, and potash, vital for food security in a growing global population.

The International Energy Agency (IEA) projects that global electricity demand from EVs will reach 1,000 terawatt-hours (TWh) by 2030, a substantial increase from 2023 levels, highlighting the growing need for copper. Furthermore, the demand for nickel, another essential battery metal, is expected to nearly double by 2030, reaching approximately 5.5 million tonnes.

- Demand for copper is projected to rise significantly due to its use in electric vehicles and renewable energy infrastructure.

- Nickel demand is also expected to see substantial growth, driven by its critical role in battery technology.

- BHP's strategic investments in copper and potash align with these evolving global demand trends.

- The energy transition necessitates a re-evaluation of commodity portfolios to capitalize on emerging market opportunities.

Commodity prices remain a central economic factor for BHP, with iron ore and copper experiencing notable fluctuations in 2024. Copper prices, supported by EV and renewable energy demand, reached over $9,000 per tonne at times, while iron ore saw more significant swings. China's economic recovery and India's robust structural growth are key drivers of demand, with India's infrastructure spending projected to hit $1.4 trillion by 2027. Global inflation, particularly in labor costs, presents ongoing challenges, though BHP has managed unit cost increases below 3% through cost control, while facing permanent increases from wage inflation and new regulations.

Currency fluctuations, especially the US dollar's strength in 2024, impact BHP's reported earnings by reducing the value of non-dollar revenues. The global energy transition is reshaping commodity demand, boosting prospects for copper and nickel while pressuring coal. BHP's investments in copper and potash reflect this strategic shift, aligning with projected growth in EV electricity demand and battery metal needs.

| Commodity | 2024 Price Trend (Early) | Demand Drivers | BHP Strategic Focus |

|---|---|---|---|

| Copper | Positive, >$9,000/tonne | EVs, Renewables | Increased Investment |

| Iron Ore | Volatile | China/India Infrastructure | Core Business |

| Nickel | Strong Growth Expected | Battery Technology | Increased Exposure |

| Potash | Stable Demand | Food Security | Increased Investment |

Preview Before You Purchase

BHP Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of BHP Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its global operations. Understand the critical external forces shaping BHP's strategic landscape.

Sociological factors

BHP prioritizes its social license to operate, fostering strong community relations through ongoing engagement and collaborative partnerships. The company's commitment is demonstrated through its social investment strategy, aiming for sustainable social, environmental, and economic benefits, with substantial voluntary investments made in FY2024.

The repercussions of negative social impacts, exemplified by the Samarco dam disaster, underscore the critical need for proactive community management, as such events can trigger lengthy legal disputes and significant reputational harm.

BHP Group is prioritizing workforce diversity and inclusion, viewing it as crucial for enhancing safety and operational efficiency. The company has seen a notable increase in female representation, achieving over 37% by June 2024, and has successfully balanced its global leadership ranks.

This commitment is further demonstrated through targeted training and educational programs designed to equip employees with the skills necessary for future job market demands.

BHP views Indigenous peoples as vital partners, focusing on co-created initiatives. In FY2024, the company advanced 149 such projects, many centered on environmental stewardship, highlighting a commitment to shared value creation and respecting traditional knowledge.

The company's dedication to economic empowerment is evident in its record Indigenous procurement spend during FY2024. This financial commitment not only supports Indigenous businesses but also reinforces BHP's approach to fostering genuine partnerships and cultural respect.

Health and Safety Standards

BHP places paramount importance on the health and safety of its employees and the communities where it operates. The company actively monitors and mitigates risks, with a clear objective to minimize serious injuries and occupational illnesses. For instance, in fiscal year 2023, BHP reported a Total Recordable Injury Frequency Rate (TRIFR) of 3.98 per million hours worked, a slight increase from 3.87 in FY2022, highlighting the ongoing focus on improvement.

These safety initiatives are frequently integrated with technological advancements and a strong emphasis on operational discipline. This approach underscores BHP's dedication to responsible resource extraction and its commitment to fostering a secure working environment. The company invests in new technologies and training programs to further enhance safety protocols across its global operations.

BHP's safety performance is a key indicator of its operational excellence and social license to operate. The company's continuous efforts in this area are crucial for maintaining stakeholder trust and ensuring sustainable business practices. Their ongoing commitment aims to achieve zero harm, a target that drives significant investment in safety systems and cultural development.

Key aspects of BHP's health and safety focus include:

- Risk Management: Proactive identification and mitigation of workplace hazards.

- Injury Reduction: Setting targets to decrease life-altering injuries and illnesses.

- Technological Integration: Utilizing advanced technologies to improve safety monitoring and response.

- Operational Discipline: Reinforcing safe work practices and adherence to procedures.

Public Perception and ESG Expectations

Public perception and evolving Environmental, Social, and Governance (ESG) expectations are increasingly shaping investor sentiment and the operational viability of major corporations like BHP. There's significant pressure on BHP to showcase robust ESG performance, especially concerning climate change mitigation, upholding human rights, and ensuring ethical supply chains. The company's 2023 Sustainability Report, for instance, detailed efforts to reduce greenhouse gas emissions, with a target of a 30% reduction in operational emissions by FY2030 compared to FY2020 levels.

BHP's commitment to transparency is evident in its annual reporting, where it outlines progress and future goals in ESG areas. This focus aims to foster trust and accountability with stakeholders, including investors who increasingly prioritize sustainability. For example, in the fiscal year ending June 30, 2023, BHP reported a 13% reduction in its Scope 1 and 2 greenhouse gas emissions intensity compared to the previous year.

- Climate Change: BHP aims to achieve net-zero Scope 1 and 2 emissions by 2050.

- Human Rights: The company is committed to respecting human rights throughout its operations and supply chains.

- Supply Chain Ethics: BHP is actively working to enhance transparency and ethical practices within its global supply network.

- Investor Sentiment: Strong ESG performance is directly linked to attracting and retaining investment in the current market landscape.

BHP's social license to operate hinges on strong community engagement and investment, with significant voluntary social investments made in FY2024. The company prioritizes workforce diversity, achieving over 37% female representation by June 2024. Furthermore, BHP actively partners with Indigenous peoples, advancing 149 co-created initiatives in FY2024, many focused on environmental stewardship.

Technological factors

BHP is making substantial investments in automation and digital transformation to boost safety, productivity, and efficiency across its global mining sites. For instance, the company is deploying autonomous trucks in its coal operations, a move that significantly reduces human exposure to hazardous environments and improves operational consistency.

These technological advancements are crucial for optimizing infrastructure and leveraging data. BHP's commitment is underscored by initiatives like establishing an Industry AI Hub in Singapore, aiming to tackle complex, enterprise-wide challenges and enhance decision-making through advanced analytics.

The company reported that its operational improvements from technology and automation contributed to a US$400 million improvement in underlying EBITDA in FY23, demonstrating a tangible financial benefit from these digital transformation efforts.

BHP is leveraging advanced technologies like 3D seismic surveys, adapted from the oil and gas sector, to pinpoint high-grade mineral deposits with greater efficiency and sustainability. This approach aims to de-risk exploration and accelerate the discovery of future resource potential.

The company is actively trialing innovations such as thermal probe and robotic lance technology, alongside autonomous drilling systems. These advancements are designed to enhance extraction precision, minimize human exposure to hazardous environments, and significantly reduce the overall environmental footprint of mining operations.

BHP is making significant strides in decarbonization, with a focus on renewable energy. By the end of fiscal year 2023, they had secured 100% renewable electricity for their Australian operations, a crucial step in reducing operational emissions.

Electrification is another key area, with BHP piloting electric haul trucks and trolley assist technology at its Queensland mines, aiming to cut diesel consumption. They are also exploring ammonia as a fuel for their shipping operations, a move that could drastically reduce emissions in their supply chain.

Furthermore, BHP is investing in innovative steelmaking processes, such as the NeoSmelt project, which aims to lower the carbon intensity of steel production, directly tackling Scope 3 emissions. This commitment to technological advancement underscores their strategy to align with a low-carbon future.

Data Analytics and Artificial Intelligence (AI)

BHP is actively integrating data analytics and artificial intelligence (AI) across its operations to drive significant transformation. This strategic push aims to refine operational models, boost production at scale, and embed AI capabilities throughout its value chain. For instance, BHP's investment in an AI hub in Singapore highlights its commitment to leveraging advanced technologies for enhanced safety protocols, increased productivity, and more efficient mineral exploration.

The company recognizes that the full impact of AI on the mining sector is still emerging, suggesting a forward-looking approach to technological adoption. This focus on AI is expected to unlock new efficiencies and potentially uncover previously inaccessible resources, positioning BHP at the forefront of technological innovation in the industry.

- AI Hub in Singapore: BHP's establishment of an AI hub signifies a concrete investment in leveraging advanced analytics for operational improvement and future resource discovery.

- Enterprise-wide Transformation: The company's strategy involves a broad application of data analytics and AI, aiming to optimize everything from production models to safety procedures.

- Unrealized Potential: BHP's leadership acknowledges that the complete benefits of AI in mining are yet to be fully harnessed, indicating ongoing development and investment in this area.

Supply Chain Digitization and Transparency

Technological advancements are revolutionizing BHP's global supply chains, fostering unprecedented transparency and efficiency. Digital platforms and sophisticated data analytics are crucial for navigating the complexities of logistics, enhancing product traceability, and actively mitigating risks associated with modern slavery. These technological integrations are vital for building more robust and ethically sound supply chains, directly addressing the growing demands from stakeholders for responsible sourcing practices.

BHP is actively investing in digital solutions to achieve this. For instance, in 2023, the company reported continued progress in its digital transformation initiatives, with a focus on supply chain visibility. These efforts are supported by partnerships with technology providers specializing in blockchain and AI for supply chain management. The mining industry, in general, saw significant investment in supply chain technology in 2024, with an estimated global spend of over $20 billion on digital transformation projects aimed at improving efficiency and transparency.

- Enhanced Traceability: Digital tools allow for real-time tracking of raw materials from origin to destination, ensuring compliance and quality.

- Risk Mitigation: Advanced analytics help identify and address potential ethical and operational risks within the supply chain.

- Operational Efficiency: Automation and data-driven insights streamline logistics, reducing costs and delivery times.

- Stakeholder Confidence: Greater transparency builds trust with investors, customers, and regulatory bodies regarding responsible practices.

BHP's strategic investments in automation and AI are reshaping its operations, with a notable US$400 million improvement in underlying EBITDA in FY23 attributed to these technological advancements. The company is actively deploying autonomous trucks and piloting electric haul trucks, aiming to enhance safety and reduce operational costs.

The establishment of an Industry AI Hub in Singapore underscores BHP's commitment to leveraging advanced analytics for complex problem-solving and improved decision-making across its value chain. This focus on AI is expected to unlock new efficiencies and potentially uncover previously inaccessible resources, positioning BHP at the forefront of technological innovation in the mining sector.

Technological integration is also revolutionizing BHP's supply chains, with digital platforms and data analytics enhancing transparency and efficiency. By the end of fiscal year 2023, BHP had secured 100% renewable electricity for its Australian operations, a significant step in its decarbonization strategy, supported by ongoing technological innovation.

Legal factors

BHP operates under stringent mining and environmental regulations across its global sites, encompassing strict permitting processes, waste disposal protocols, and land reclamation mandates. Failure to comply can lead to substantial penalties, operational halts, and severe reputational harm. For instance, in its 2023 Sustainability Report, BHP highlighted ongoing investments in environmental management systems to meet these evolving legal requirements.

BHP Group operates in sectors where product liability and stringent safety standards are paramount. Given its core business in minerals and petroleum, the company must adhere to a complex web of international regulations governing the quality, transportation, and end-use of its commodities. Failure to meet these standards can result in significant legal liabilities and reputational damage.

In 2024, the global mining and energy industries continue to face increasing scrutiny regarding safety protocols and environmental impact. BHP's commitment to responsible sourcing and product stewardship is therefore a critical component of its risk management strategy. This includes ensuring that its products are handled safely throughout the supply chain, from extraction to delivery to customers.

The company's proactive approach to product safety and liability aims to build and maintain customer trust. This focus on the entire product lifecycle, aligning with its broader sustainability objectives, is essential for mitigating potential legal challenges and ensuring long-term operational viability in a highly regulated global market.

BHP's extensive global operations necessitate strict adherence to a complex web of labor laws governing wages, working conditions, and industrial relations. Failure to comply can result in significant penalties and operational disruptions.

Recent legal shifts, such as Australia's push for equal pay between direct hires and labor-hire employees, directly impact BHP. This has already contributed to an estimated 10% increase in labor costs for some operations, as seen in the 2024 financial year reporting, and heightens the risk of industrial disputes impacting productivity.

Litigation and Legal Disputes

BHP faces substantial legal hurdles, most prominently a £36 billion lawsuit in the UK stemming from the 2015 Samarco dam disaster in Brazil. This complex case has already seen court rulings on contempt of court, significantly scrutinizing transnational corporate accountability.

The company's engagement in numerous other legal proceedings necessitates careful management of both the financial repercussions and the damage to its reputation. These ongoing disputes underscore the critical need for robust legal risk management within BHP's operations.

- Samarco Dam Collapse Lawsuit: A £36 billion claim in the UK, impacting BHP's financial and reputational standing.

- Transnational Accountability: The Samarco case is a key test for holding global corporations legally responsible across borders.

- Broader Legal Exposure: BHP is involved in multiple other legal challenges requiring ongoing resource allocation and risk mitigation.

Taxation Laws and Royalty Regimes

BHP's financial results are closely tied to the tax and royalty structures in the countries where it operates. For instance, changes in fiscal policies, like the higher coal royalties implemented in Queensland, can directly influence investment choices and overall profitability.

BHP is committed to transparency regarding its financial contributions to governments. In the fiscal year ending June 30, 2023, BHP reported total government payments amounting to $26.9 billion globally. This figure underscores the significant impact of taxation and royalty regimes on the company's bottom line and its role as a major economic contributor.

- Taxation and Royalty Impact: Government fiscal policies, including tax rates and royalty payments, directly influence BHP's profitability and investment decisions.

- Queensland Coal Royalties: Recent increases in coal royalties in Queensland serve as a prime example of how policy shifts can affect operational costs and future investments.

- Government Payments Transparency: BHP publicly discloses its total payments to governments, highlighting its commitment to transparency in its economic contributions.

- FY23 Government Payments: In the fiscal year ending June 30, 2023, BHP's total payments to governments worldwide reached $26.9 billion.

BHP faces significant legal risks stemming from its operations, including a substantial £36 billion lawsuit in the UK related to the 2015 Samarco dam disaster in Brazil, highlighting transnational corporate accountability challenges. The company must also navigate complex international regulations concerning product liability and safety standards for its minerals and petroleum products, with non-compliance leading to severe penalties. Furthermore, evolving labor laws, such as Australia's push for equal pay for labor-hire employees, are projected to increase operational costs, as evidenced by an estimated 10% rise in labor costs in some BHP operations during FY24, potentially impacting productivity and increasing the risk of industrial disputes.

| Legal Risk Area | Specific Example/Impact | Financial/Operational Implication |

|---|---|---|

| Environmental & Permitting | Stringent global mining and environmental regulations | Penalties, operational halts, reputational damage |

| Product Liability & Safety | Adherence to international standards for minerals and petroleum | Legal liabilities, reputational damage |

| Labor Laws | Equal pay legislation in Australia | Estimated 10% increase in labor costs (FY24), risk of industrial disputes |

| Litigation | £36 billion Samarco dam disaster lawsuit (UK) | Significant financial and reputational impact, scrutiny of transnational accountability |

| Taxation & Royalties | Changes in fiscal policies (e.g., Queensland coal royalties) | Influence on investment choices and profitability; FY23 government payments totaled $26.9 billion |

Environmental factors

Climate change presents a significant environmental hurdle for BHP Group. The company has set a target to slash its Scope 1 and 2 emissions by 30% by fiscal year 2030, using fiscal year 2020 as a baseline. This commitment is detailed in its Climate Transition Action Plan 2024.

BHP's strategy to achieve these reductions involves several key initiatives. These include boosting its use of renewable energy sources, electrifying its operational equipment and processes, and actively working to mitigate Scope 3 emissions, particularly those linked to steelmaking and the transportation sector.

Water is fundamental to BHP's mining and processing activities, making responsible stewardship crucial, particularly in arid or water-stressed operational areas. The company's commitment is detailed in its Water Stewardship Position Statement, focusing on minimizing freshwater use and managing discharge responsibly.

In fiscal year 2023, BHP reported that its direct water withdrawal was 236,398 megaliters, with a significant portion of this coming from non-freshwater sources. The company actively works with communities to address shared water challenges, aiming to reduce reliance on freshwater and ensure sustainable water management practices across its global operations.

BHP acknowledges its substantial role in biodiversity and land management, a direct consequence of its mining operations. The company has committed to a 2030 goal of achieving nature-positive outcomes by expanding areas managed under restorative practices.

This commitment translates into tangible actions like conservation initiatives, land restoration projects, and careful land use planning across all stages of its assets. For instance, BHP reported in its 2023 ESG report that it was managing 13.6 million hectares for conservation and rehabilitation, a significant portion of its operational footprint.

Waste and Tailings Management

Effective waste and tailings management is a paramount environmental and safety consideration for BHP. The company is committed to adhering to rigorous standards, notably the Global Industry Standard on Tailings Management, to mitigate the risk of environmental incidents. This commitment is underscored by the severe repercussions of past failures, such as the Samarco dam collapse, highlighting the continuous imperative for robust risk mitigation strategies.

BHP's approach to tailings management in 2024 and 2025 focuses on implementing best practices and continuous improvement. The company's investments in tailings storage facility upgrades and monitoring technologies reflect this dedication. For instance, as of their FY2023 reporting, BHP continued to invest in its tailings management programs, with specific figures often detailed in their sustainability reports, showing a clear financial commitment to safety and environmental stewardship.

The company's strategy includes:

- Implementing advanced monitoring systems for tailings storage facilities to detect potential issues early.

- Investing in research and development for innovative and safer tailings disposal methods.

- Engaging with stakeholders to ensure transparency and alignment on tailings management practices.

- Adhering to regulatory requirements and industry best practices across all its operations.

Pollution Control and Emissions (Air, Water, Soil)

BHP is actively managing pollution across its diverse operations, focusing on air quality, water purity, and soil integrity. This commitment extends to reducing greenhouse gas emissions as a key component of their environmental stewardship strategy.

The company is investing in technologies and practices to curb methane emissions, a significant contributor to climate change. For instance, in fiscal year 2023, BHP reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions intensity by 12% compared to its 2020 baseline, demonstrating progress in this area.

- Air Emissions: BHP implements stringent controls on particulate matter and sulfur dioxide emissions from its mining and processing activities.

- Water Management: The group focuses on responsible water use and discharge, aiming to minimize the impact on local water sources. For example, their Olympic Dam operation in South Australia utilizes recycled water for dust suppression.

- Soil Contamination: Remediation efforts and preventative measures are in place to address potential soil contamination at current and former operational sites.

BHP is actively addressing climate change by targeting a 30% reduction in Scope 1 and 2 emissions by FY2030 from a FY2020 baseline, as outlined in its Climate Transition Action Plan 2024. This involves increasing renewable energy use and electrifying operations. Water stewardship is also critical, with BHP reporting 236,398 megaliters of direct water withdrawal in FY2023, emphasizing the use of non-freshwater sources and community collaboration in water-stressed regions.

The company is committed to nature-positive outcomes by 2030, expanding restorative land management practices and managing 13.6 million hectares for conservation and rehabilitation as of FY2023. Furthermore, BHP prioritizes robust waste and tailings management, adhering to the Global Industry Standard on Tailings Management and investing in monitoring systems and R&D for safer disposal methods.

BHP reported a 12% reduction in its Scope 1 and 2 greenhouse gas emissions intensity in FY2023 compared to its 2020 baseline, demonstrating progress in pollution reduction, including methane emissions. Stringent controls are in place for air emissions, with a focus on responsible water use, exemplified by the Olympic Dam operation's recycled water usage for dust suppression.

PESTLE Analysis Data Sources

Our PESTLE Analysis for BHP Group is built on a comprehensive review of data from international organizations like the IMF and World Bank, alongside reports from leading financial news outlets and industry-specific publications. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting BHP.