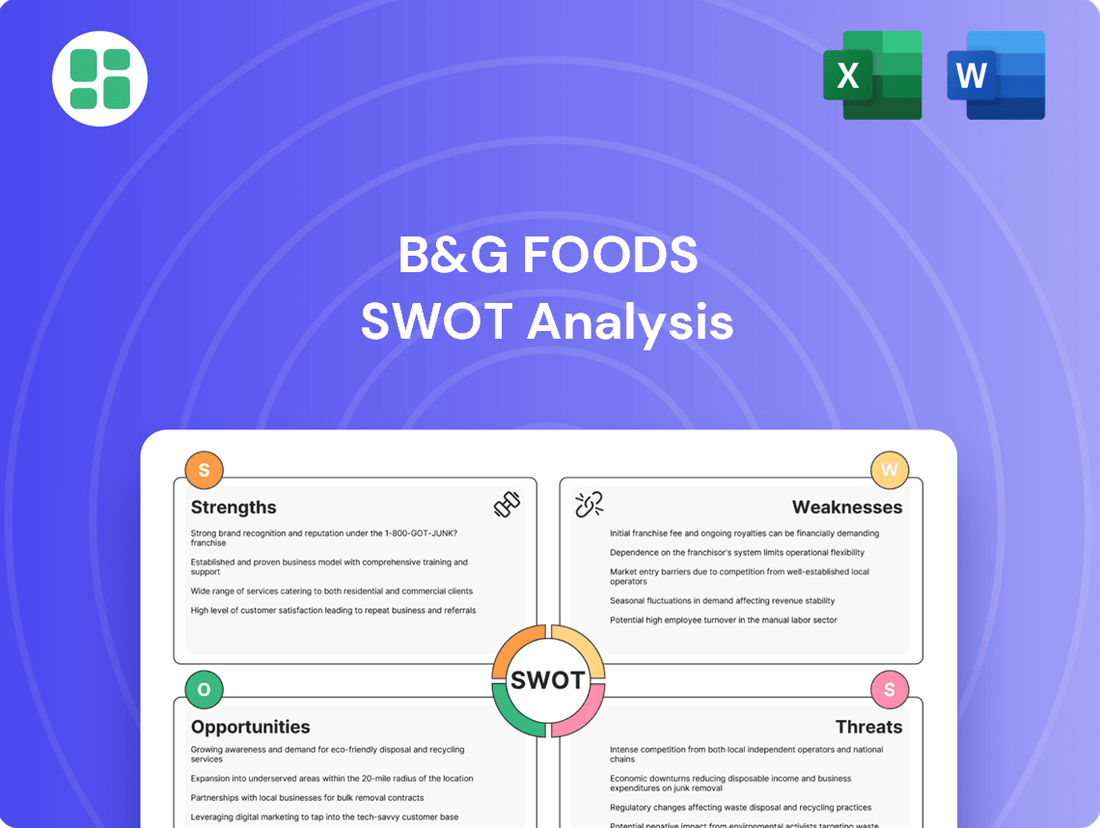

B&G Foods SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B&G Foods Bundle

B&G Foods leverages strong brand recognition and a diverse portfolio, but faces challenges in supply chain disruptions and intense competition. Our full SWOT analysis dives deep into these factors, revealing crucial market dynamics and potential growth avenues.

Want the full story behind B&G Foods' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

B&G Foods boasts a robust and varied collection of over 50 recognized brands, spanning both shelf-stable and frozen food sectors. This extensive offering, featuring names like Crisco and Clabber Girl, significantly reduces the risk tied to any single product and broadens its appeal to a diverse consumer market. For instance, in 2023, B&G Foods reported net sales of $2.0 billion, with its diversified portfolio contributing to this revenue stream.

B&G Foods boasts an extensive distribution network that is a significant strength, reaching across the United States, Canada, and Puerto Rico. This broad coverage ensures their products are available to a wide array of customers, from grocery stores to restaurants and industrial clients.

This robust infrastructure allows for efficient product placement and accessibility, a crucial factor in the competitive consumer packaged goods market. For instance, in the first quarter of 2024, B&G Foods reported net sales of $499.6 million, underscoring the reach of their distribution capabilities.

B&G Foods is actively optimizing its portfolio, a key strength as it moves away from a purely acquisition-driven growth model. This strategic shift involves divesting brands that don't align with its core, higher-margin shelf-stable businesses. For instance, the divestiture of brands like Don Pepino and Sclafani in 2024 exemplifies this focused approach.

This portfolio reshaping is designed to enhance overall financial health and sharpen the company's strategic direction. By shedding lower-margin assets, B&G Foods can concentrate resources on brands with greater profit potential, a move that analysts anticipate will bolster its competitive standing in the evolving food industry.

Commitment to Debt Reduction

B&G Foods is prioritizing debt reduction in fiscal 2025, a strategic move to address the financial strain from past acquisitions. The company intends to leverage proceeds from divestitures and its free cash flow to actively lower its outstanding long-term debt and improve its net leverage ratio. This commitment is vital for strengthening its financial foundation and increasing its capacity for future growth opportunities.

As of the first quarter of 2024, B&G Foods reported a total debt of approximately $2.1 billion. The company's stated goal for fiscal 2025 is to reduce this figure by at least $100 million through targeted debt repayment strategies. This deleveraging effort aims to bring the company's net leverage ratio closer to its target of below 4.0x.

- Debt Reduction Priority: B&G Foods has identified debt reduction as a key strategic objective for fiscal 2025, aiming to improve its financial health.

- Funding Sources: The company plans to utilize proceeds from ongoing divestitures and its generated excess cash flow to achieve its debt reduction targets.

- Financial Flexibility: By focusing on deleveraging, B&G Foods seeks to enhance its financial flexibility, making it better positioned for future investments and strategic initiatives.

- Leverage Improvement: The commitment to reducing long-term debt is expected to lower the company's net leverage ratio, a key metric for financial stability.

Established Customer Relationships

B&G Foods benefits from deeply entrenched customer relationships built over its long operational history. These connections span across retail, foodservice, and industrial clients, providing a stable foundation for sales and distribution. For instance, in 2023, B&G Foods reported that approximately 70% of its net sales were generated from its top ten customers, underscoring the strength of these partnerships.

These established ties are crucial for maintaining consistent product placement and securing valuable shelf space in a competitive retail environment. The trust built through these long-standing relationships can also foster collaborative opportunities for product development and innovation, allowing B&G Foods to better tailor offerings to specific market needs.

The company's ability to consistently deliver reliable products and service has solidified its position with key partners. This strength translates into:

- Secured Distribution Channels: Ensuring products reach consumers reliably.

- Reduced Customer Acquisition Costs: Leveraging existing trust for new product launches.

- Enhanced Market Resilience: Providing a buffer against competitive pressures.

- Collaborative Growth Opportunities: Working with partners on tailored solutions.

B&G Foods possesses a diverse brand portfolio, encompassing over 50 recognized names in both shelf-stable and frozen categories. This wide array of products, including popular brands like Crisco and Clabber Girl, mitigates the risk associated with any single item and broadens its market appeal. In 2023, the company achieved net sales of $2.0 billion, with this diversified offering forming a significant part of that revenue.

The company's extensive distribution network is a key strength, reaching across the United States, Canada, and Puerto Rico. This broad coverage ensures their products are accessible to a wide range of customers, from grocery stores to foodservice and industrial clients, facilitating efficient product placement in a competitive market. Net sales in the first quarter of 2024 were $499.6 million, reflecting this extensive reach.

B&G Foods is strategically optimizing its brand portfolio by divesting non-core or lower-margin assets, a move away from solely acquisition-driven growth. This focus on higher-margin, shelf-stable businesses, exemplified by the 2024 divestitures of brands like Don Pepino, aims to improve financial health and sharpen strategic direction.

The company is prioritizing debt reduction in fiscal 2025, planning to use divestiture proceeds and free cash flow to lower its outstanding long-term debt and improve its net leverage ratio. As of Q1 2024, total debt was approximately $2.1 billion, with a fiscal 2025 target to reduce it by at least $100 million, aiming for a net leverage ratio below 4.0x.

Deeply entrenched customer relationships, built over years of operation, provide a stable sales and distribution foundation for B&G Foods. These relationships with retail, foodservice, and industrial clients are crucial for consistent product placement and shelf space. In 2023, approximately 70% of net sales came from its top ten customers, highlighting the strength of these partnerships.

| Strength | Description | Supporting Data (2023/Q1 2024) |

|---|---|---|

| Diverse Brand Portfolio | Over 50 recognized brands across shelf-stable and frozen categories. | $2.0 billion net sales in 2023. |

| Extensive Distribution Network | Presence in the United States, Canada, and Puerto Rico. | $499.6 million net sales in Q1 2024. |

| Portfolio Optimization | Divesting non-core brands to focus on higher-margin businesses. | Divestiture of brands like Don Pepino in 2024. |

| Debt Reduction Focus | Prioritizing debt reduction for improved financial health. | Targeting $100 million reduction in fiscal 2025; $2.1 billion total debt as of Q1 2024. |

| Strong Customer Relationships | Long-standing partnerships with key clients. | Approximately 70% of 2023 net sales from top ten customers. |

What is included in the product

Delivers a strategic overview of B&G Foods’s internal and external business factors, highlighting its established brands and market penetration while also noting potential challenges from evolving consumer preferences and competitive pressures.

Highlights B&G Foods' competitive advantages and potential threats for targeted strategic adjustments.

Weaknesses

B&G Foods faces a persistent challenge with its high debt levels, which have historically constrained its financial maneuverability and amplified interest costs. This leverage, even with strategic divestitures aimed at reduction, continues to be a significant concern.

The substantial debt burden may hinder B&G Foods' capacity for aggressive investment in organic growth initiatives or its agility in adapting to evolving market dynamics. The company has stated its objective to substantially lower its pro forma net leverage ratio within the coming year, a critical target for improving financial health.

B&G Foods, as a food manufacturer, faces significant vulnerability to the fluctuating prices of key inputs like raw materials, packaging, and energy. These price swings directly affect the company's cost of goods sold, potentially squeezing gross profit margins if not adequately mitigated. For instance, in the first quarter of 2024, B&G Foods reported that increased input costs, including higher commodity prices, negatively impacted its gross profit.

B&G Foods operates in a fiercely competitive packaged food landscape, contending with established giants, agile smaller companies, and the burgeoning threat of private label brands. This intense rivalry directly impacts pricing power and necessitates significant investment in promotions to simply hold ground.

The company has explicitly acknowledged this pressure, noting in its 2024 and 2025 outlooks that it experienced intensified competition across several key product categories. This ongoing market share battle requires constant adaptation and strategic maneuvering to avoid erosion of its position.

Declining Sales in Core Categories

B&G Foods has seen a downturn in sales for some of its key product lines, often found in the traditional center aisles of grocery stores. This trend is impacting the company's overall financial performance.

The decrease in net sales, including the base business, is a significant concern. This decline stems from a combination of lower sales volumes and adjustments to net pricing, alongside shifts in the types of products customers are buying.

- Net Sales Decline: Q1 and Q2 2025 results indicated a drop in net sales compared to the same periods in 2024.

- Volume Reduction: A primary driver of this weakness is the reduced quantity of products being purchased by consumers.

- Pricing and Mix Impact: Net pricing adjustments and unfavorable product mix also contributed to the sales dip.

Challenges in Adapting to Evolving Consumer Preferences

B&G Foods faces a significant hurdle in keeping pace with the swift evolution of consumer tastes, which increasingly favor fresh, minimally processed, organic, and plant-based options. This shift poses a direct challenge to its extensive portfolio, which includes many traditional shelf-stable and processed food items. For instance, while B&G Foods has brands like Green Giant, which can tap into vegetable consumption, the broader portfolio needs strategic adaptation to align with these emerging trends.

Revitalizing older, established brands to resonate with modern consumers while simultaneously innovating to meet new demands is a complex undertaking. The company's ability to adapt its vast product lines to these evolving preferences is critical. A failure to innovate effectively could see B&G Foods lose market relevance, impacting its competitive standing in the dynamic food industry.

- Shifting Consumer Demands: Growing preference for fresh, organic, and plant-based foods.

- Portfolio Adaptation: Challenge in aligning a broad range of traditional products with new trends.

- Brand Revitalization: Need to innovate and update older brands to maintain appeal.

- Market Relevance: Risk of decreased market share if innovation lags behind consumer preferences.

B&G Foods' significant debt load remains a primary weakness, impacting its financial flexibility and increasing interest expenses. The company's stated goal to reduce its net leverage ratio in 2024 highlights the urgency of addressing this burden.

Intense competition within the packaged food sector, including from private labels, erodes pricing power and necessitates substantial promotional spending. B&G Foods has acknowledged this pressure, noting increased competition in key categories throughout 2024 and 2025.

A notable weakness is the decline in sales for many of its traditional center-aisle products, driven by lower volumes and an unfavorable product mix. This trend, evident in early 2025 results, points to a need for portfolio recalibration.

Finally, B&G Foods struggles to align its extensive portfolio with evolving consumer preferences for fresh, organic, and plant-based foods, risking a loss of market relevance if innovation falters.

Preview the Actual Deliverable

B&G Foods SWOT Analysis

This preview reflects the real B&G Foods SWOT analysis document you'll receive—professional, structured, and ready to use. You're viewing an actual excerpt, so what you see is exactly what you'll get in the full, detailed report. Purchase unlocks the entire in-depth version for your strategic planning needs.

Opportunities

The increasing consumer preference for healthier, organic, and plant-based foods is a clear avenue for B&G Foods. This trend is not just a niche; in 2024, the plant-based food market continued its robust expansion, with projections indicating further growth into 2025, driven by health and environmental consciousness.

B&G Foods can leverage this opportunity by either innovating within its current portfolio, perhaps reformulating existing products or introducing new lines, or by strategically acquiring emerging brands that already cater to these demands. For instance, a successful acquisition in the plant-based sector could immediately tap into a growing market segment.

By developing or enhancing product offerings that resonate with wellness and sustainability values, B&G Foods can attract a broader consumer base, including younger demographics who are particularly attuned to these factors. This strategic alignment with market trends is crucial for sustained growth and market relevance in the coming years.

The persistent consumer shift to online grocery shopping and direct-to-consumer (DTC) models presents a significant opportunity for B&G Foods. In 2024, e-commerce continued its upward trajectory in the food sector, with online grocery sales projected to reach over $200 billion in the US alone.

B&G Foods can capitalize on this by bolstering its e-commerce infrastructure, refining its digital marketing strategies, and actively pursuing DTC initiatives. This strategic focus can enhance product accessibility and unlock new avenues for revenue generation, directly addressing evolving consumer purchasing habits.

While B&G Foods is currently prioritizing divestitures to strengthen its financial position, its long-term vision involves a return to strategic acquisitions. Once deleveraging efforts are successful and the brand portfolio is streamlined, the company is well-positioned to pursue targeted M&A opportunities. This could involve acquiring brands that fit into high-growth food categories or enhance its existing market share.

B&G Foods possesses a proven track record in integrating acquired businesses, a capability that will be crucial for future growth. By focusing on brands that complement its existing portfolio and align with evolving consumer preferences, the company can leverage its expertise to drive synergistic value. For instance, if B&G Foods successfully reduces its net debt to EBITDA ratio, as indicated by analyst targets aiming for below 3.5x by late 2025, it will regain financial flexibility for such strategic moves.

Product Innovation and Renovation

B&G Foods has a significant opportunity in continuous product innovation and renovation. Introducing new flavor profiles, convenient packaging solutions, and enhanced nutritional content for their established brands can effectively revitalize consumer demand. For instance, refreshing Green Giant's frozen vegetable lines with new seasoning blends or offering single-serve pouches for Ortega taco shells could attract a broader customer base.

Renovating existing products to align with current consumer preferences, such as reducing sodium or incorporating plant-based ingredients, is crucial. This strategy can help counteract sales declines in legacy categories and maintain the relevance of their portfolio. The company could explore reformulating some of its canned vegetable products to meet evolving health standards and consumer expectations for cleaner labels.

Introducing entirely new product lines that tap into emerging food trends can also be a powerful growth driver. This keeps the overall brand portfolio fresh and competitive in a dynamic market. B&G Foods might consider expanding into the ready-to-eat meal or plant-based snack categories, leveraging the brand equity of their existing, trusted names.

Key opportunities include:

- Flavor Expansion: Launching new, trendy flavor profiles for brands like Mrs. Dash or Ortega, potentially incorporating global influences.

- Nutritional Enhancements: Reformulating products to reduce sugar, sodium, or artificial ingredients, appealing to health-conscious consumers.

- Packaging Innovation: Developing more convenient and sustainable packaging options, such as resealable bags or single-serving formats, for brands like Cream of Wheat.

- New Product Lines: Diversifying into high-growth segments like plant-based alternatives or premium convenience foods under existing brand umbrellas.

Leveraging Cost Reduction and Efficiency Initiatives

B&G Foods is aggressively pursuing cost reduction and efficiency improvements, anticipating substantial savings in 2025. This strategic focus is designed to boost incremental adjusted EBITDA growth.

By streamlining operations and optimizing its cost base, B&G Foods aims to bolster profitability. This enhanced financial health will generate more capital for crucial strategic investments, supporting long-term growth initiatives.

These initiatives are particularly vital for margin improvement given the current challenging market conditions. For instance, the company has highlighted its commitment to driving efficiencies across its supply chain and manufacturing processes.

- Targeted Cost Savings: B&G Foods anticipates significant cost savings in 2025, directly contributing to adjusted EBITDA growth.

- Operational Efficiency Gains: Improvements in operational efficiency are expected to enhance overall profitability.

- Capital for Investment: Optimized cost structures will free up capital for strategic investments in growth areas.

- Margin Enhancement: These efforts are critical for bolstering margins in a competitive market environment.

B&G Foods can capitalize on the growing demand for healthier and plant-based options, a market segment that saw continued expansion throughout 2024 with strong projections for 2025. The company also has a significant opportunity to enhance its e-commerce presence and explore direct-to-consumer models, aligning with the persistent shift in consumer purchasing habits observed in 2024, where online grocery sales in the US alone were expected to exceed $200 billion.

Furthermore, B&G Foods can leverage its proven acquisition integration capabilities once its deleveraging efforts are complete, targeting brands in high-growth food categories. The company's focus on product innovation, including new flavors, nutritional enhancements, and packaging solutions, offers a clear path to revitalize existing brands and attract a broader consumer base. For instance, the company is actively pursuing cost reduction and efficiency improvements, anticipating substantial savings in 2025 to drive incremental adjusted EBITDA growth.

Threats

The food industry is a battlefield of brands, and B&G Foods faces a relentless onslaught from both established competitors and the rapidly growing private label offerings by retailers. This intense rivalry directly impacts pricing power and necessitates significant investment in promotions, which can squeeze profit margins. For instance, in Q1 2024, B&G Foods noted that the competitive environment and promotional activity were key factors influencing their performance.

Retailers' private label brands are becoming increasingly sophisticated and appealing to consumers, offering a cost-effective alternative to national brands. This trend directly challenges B&G Foods' market share and forces the company to constantly innovate and justify its price points. The company explicitly identified this intensifying competition and private label growth as a major threat in its 2023 annual report, highlighting the ongoing pressure on its business model.

Persistent inflation and volatility in the prices of agricultural commodities, packaging, and energy continue to be a significant threat to B&G Foods' profitability. For instance, the Producer Price Index for food manufacturing saw an increase of 5.8% in the twelve months ending April 2024, indicating ongoing cost pressures.

Rising input costs, if not fully offset by pricing actions or productivity gains, can compress gross margins. B&G Foods reported a gross profit margin of 24.5% in Q1 2024, a slight decrease from 25.1% in Q1 2023, partly attributable to these cost pressures.

This remains an external factor largely beyond the company's direct control, requiring strategic sourcing and operational efficiency to mitigate its impact on financial performance.

A significant long-term threat for B&G Foods stems from evolving consumer tastes, with a noticeable shift away from traditional, processed, and shelf-stable food items. This trend sees consumers increasingly favoring fresh, organic, and minimally processed alternatives, potentially impacting demand for a substantial portion of B&G's existing product lines.

Failing to swiftly and effectively pivot its extensive portfolio to align with these changing preferences poses a risk of B&G Foods' products becoming less appealing. This could lead to diminished sales and a weakened market standing, especially as competitors offering healthier or more natural options gain traction.

For instance, the global market for organic food alone was projected to reach over $300 billion by 2025, highlighting the substantial growth in this segment that B&G Foods must address to remain competitive.

Supply Chain Disruptions and Geopolitical Instability

Global supply chains continue to be a significant concern, with events like extreme weather, ongoing geopolitical tensions, and persistent labor shortages posing ongoing risks. For B&G Foods, any major interruption in their supply, production, or delivery systems could result in delays, empty shelves, and higher operating expenses, ultimately affecting both product availability and the company's bottom line.

The company's reliance on a complex global network means that disruptions can have a cascading effect. For instance, a shortage of key ingredients due to a regional drought or a trade dispute could halt production lines. In 2024, the food industry, in general, saw increased logistics costs, with some reports indicating a rise of 5-10% in shipping expenses compared to the previous year, directly impacting companies like B&G Foods.

- Vulnerability to Weather: Extreme weather events, such as hurricanes or prolonged droughts, can damage agricultural output and disrupt transportation routes essential for sourcing raw materials.

- Geopolitical Risks: International conflicts or trade sanctions can restrict the availability of certain ingredients or increase import costs, impacting B&G Foods' product portfolio and pricing strategies.

- Labor Market Challenges: Shortages in the workforce, from agricultural labor to truck drivers, can impede the smooth operation of the supply chain, leading to production slowdowns and delivery delays.

Economic Downturns and Reduced Consumer Purchasing Power

Economic downturns, marked by high inflation and reduced consumer purchasing power, pose a significant threat to B&G Foods. As consumers face tighter budgets, they are increasingly likely to opt for more affordable food choices, including private label brands, which can directly impact B&G Foods' sales volumes and profitability. This shift is particularly concerning for the company's premium or specialty product lines, as value becomes the primary driver for purchasing decisions.

Fiscal 2024 highlighted this challenge, with consumers actively adjusting to elevated price points across the grocery sector. This environment can lead to a decline in demand for B&G Foods' offerings if they are perceived as less cost-effective compared to alternatives. The company's ability to maintain pricing power while managing input costs will be crucial in navigating these economic headwinds.

- Inflationary Pressures: Persistent high inflation erodes consumer discretionary income, forcing trade-downs to cheaper alternatives.

- Shift to Private Labels: Retailers' private label brands often present a more budget-friendly option, directly competing with B&G Foods' portfolio.

- Reduced Demand for Premium Products: Consumers may cut back on specialty or premium food items during economic uncertainty, impacting B&G Foods' higher-margin products.

- Impact on Sales Volumes: A sustained economic slowdown could lead to a noticeable decrease in the overall volume of goods sold by B&G Foods.

The intensifying competition, particularly from private label brands, coupled with persistent inflation in commodity and energy prices, continues to pressure B&G Foods' margins. For instance, the Producer Price Index for food manufacturing saw an increase of 5.8% in the twelve months ending April 2024, directly impacting input costs.

Shifting consumer preferences towards fresh and organic options represent a significant long-term threat, potentially diminishing demand for a portion of B&G's portfolio. The global organic food market's projected growth to over $300 billion by 2025 underscores this trend.

Supply chain vulnerabilities, including weather disruptions, geopolitical instability, and labor shortages, can lead to increased operating expenses and reduced product availability. Logistics costs in the food industry saw a general rise of 5-10% in 2024.

Economic downturns further exacerbate these challenges, as consumers trade down to more affordable options, impacting sales volumes and potentially forcing B&G Foods to adjust pricing strategies.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of reliable data, drawing from B&G Foods' official financial statements, comprehensive market research reports, and expert industry commentary to ensure an accurate and actionable strategic assessment.