B&G Foods Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B&G Foods Bundle

B&G Foods masterfully navigates the market by offering a diverse portfolio of well-known brands, each strategically priced to appeal to value-conscious consumers. Their extensive distribution network ensures widespread availability, while targeted promotions effectively build brand loyalty.

Ready to unlock the full strategic blueprint behind B&G Foods' marketing success? Get instant access to a comprehensive, editable 4Ps analysis that details their product innovation, pricing architecture, distribution channels, and promotional campaigns.

Product

B&G Foods boasts a remarkably diverse food portfolio, a key strength in its marketing mix. This breadth spans numerous categories, from shelf-stable staples like canned vegetables and pasta sauces to frozen items such as breakfast foods and desserts. This wide selection caters to a vast spectrum of consumer needs and preferences, ensuring relevance across different meal occasions and dietary habits.

The company’s product diversification is a strategic advantage, allowing it to capture market share across various grocery aisles and foodservice channels. For instance, in 2023, B&G Foods continued to manage its extensive brand portfolio, which includes well-recognized names like Green Giant, Creamette, and Mrs. Dash. This broad product offering helps to buffer against market fluctuations that might impact a single category.

B&G Foods' product strategy heavily relies on its extensive portfolio of well-known household brands, a significant driver of consumer trust and market penetration. The company boasts over 50 brands, ensuring strong consumer familiarity and preference in the highly competitive food industry.

These established brands, many with decades of history, cultivate deep consumer loyalty, directly contributing to B&G Foods' substantial market share and brand equity. For instance, brands like Green Giant and Ortega are staples in many kitchens, representing consistent quality and value to consumers.

This strong brand equity is instrumental in fostering repeat purchases and attracting new customers, as consumers often gravitate towards trusted names. In 2023, B&G Foods reported net sales of $2.03 billion, with its diverse brand portfolio playing a pivotal role in this performance.

B&G Foods strategically leverages both shelf-stable and frozen food categories to serve a broad consumer base across the United States, Canada, and Puerto Rico. This dual approach addresses varied consumer needs for convenience and longevity. For instance, in the first quarter of 2024, B&G Foods reported net sales of $479.4 million, demonstrating the ongoing demand for their diverse product offerings.

Shelf-stable products, such as their popular canned vegetables and sauces, offer consumers extended pantry life and immediate usability, fitting seamlessly into busy schedules. Conversely, their frozen food lines cater to the desire for freshness and quick meal solutions, a growing trend in 2024. This product segmentation allows B&G Foods to capture a wider market share by meeting different consumption occasions and preferences.

Quality and Convenience Focus

B&G Foods' product strategy heavily emphasizes both quality and convenience, aiming to satisfy evolving consumer needs. Their product development pipeline prioritizes taste, nutritional integrity, and user-friendliness, reflecting the growing demand for quick yet healthy meal options. This commitment to ease of preparation and wholesome ingredients is a cornerstone of their market approach.

Food safety and consistent quality are paramount in B&G Foods' operations. This dedication not only builds trust with their existing customer base but also serves as a key differentiator in attracting new consumers within the highly competitive food sector. For instance, in their 2024 fiscal year, B&G Foods reported a net sales increase of 3.1% to $2.2 billion, underscoring the market's positive reception to their product offerings.

- Quality Assurance: B&G Foods implements rigorous quality control measures throughout its supply chain to ensure product safety and consistency.

- Convenience Features: Products are often designed for quick preparation, catering to busy lifestyles and the demand for ready-to-eat or easily assembled meals.

- Nutritional Focus: While convenience is key, the company also strives to offer products that meet contemporary nutritional expectations, balancing taste with healthier profiles.

- Customer Retention: The dual focus on quality and convenience is a significant driver in maintaining customer loyalty and attracting new market segments.

Catering to Multiple Customer Segments

B&G Foods strategically designs its product portfolio to address the unique demands of three key customer segments: retail, foodservice, and industrial clients. This multi-pronged approach allows the company to adapt its offerings, from packaging and sizing to specific formulations, ensuring optimal suitability for each market channel.

For the retail sector, B&G Foods emphasizes consumer-friendly packaging and convenient sizes, making its products appealing and accessible to everyday shoppers. In contrast, foodservice and industrial customers benefit from bulk packaging and specialized ingredient options tailored to their operational needs. This adaptability is crucial for B&G Foods' success, enabling it to capture market share across the entire food industry value chain.

For instance, B&G Foods' acquisition of the WTR portfolio in 2017, which includes brands like Crisco and Smucker's Baking Mixes, significantly expanded its reach into both retail and foodservice channels. In 2023, the company reported approximately 65% of its net sales coming from its retail segment, with foodservice and industrial segments making up the remainder, showcasing the balanced approach to serving diverse customer needs.

- Retail Segment: Focus on consumer-friendly packaging and convenient sizes.

- Foodservice Segment: Provision of bulk packaging and specialized ingredients for restaurants and institutions.

- Industrial Segment: Supply of ingredients and products for further processing or manufacturing.

- Market Penetration: Strategic flexibility allows B&G Foods to effectively serve diverse market needs and maximize sales potential.

B&G Foods' product strategy centers on a vast portfolio of over 50 established brands, fostering deep consumer loyalty and broad market penetration. This diverse offering, spanning shelf-stable and frozen categories, caters to varied consumer needs for convenience and quality. For example, in fiscal year 2024, B&G Foods reported net sales of $2.2 billion, a testament to the market's embrace of their product range.

The company prioritizes both quality assurance through rigorous controls and convenience with products designed for quick preparation. This dual focus, exemplified by brands like Green Giant and Mrs. Dash, drives customer retention and attracts new segments. B&G Foods' commitment to nutritional integrity also aligns with evolving consumer preferences for healthier options.

B&G Foods strategically segments its product approach across retail, foodservice, and industrial channels. Retail benefits from consumer-friendly packaging, while foodservice and industrial clients receive bulk options and specialized ingredients. In 2023, approximately 65% of net sales originated from the retail segment, highlighting its significance.

| Product Strategy Focus | Key Characteristics | Examples/Data |

| Brand Portfolio Depth | Over 50 established brands, consumer trust, market penetration | Green Giant, Creamette, Mrs. Dash |

| Category Breadth | Shelf-stable (canned goods, sauces) and frozen (breakfast, desserts) | Caters to diverse meal occasions |

| Quality & Convenience | Rigorous quality control, quick preparation features, nutritional balance | Drives customer loyalty and retention |

| Channel Segmentation | Retail (consumer packaging), Foodservice/Industrial (bulk, specialized) | ~65% of 2023 net sales from retail |

What is included in the product

This analysis provides a comprehensive breakdown of B&G Foods' marketing mix, examining their product portfolio, pricing strategies, distribution channels, and promotional activities.

It offers insights into how B&G Foods leverages its 4Ps to maintain market position and drive growth in the competitive food industry.

Simplifies complex marketing strategies by clearly outlining B&G Foods' Product, Price, Place, and Promotion, alleviating the pain of understanding their market approach.

Offers a concise and actionable overview of B&G Foods' 4Ps, resolving the challenge of quickly assessing their marketing effectiveness for busy executives.

Place

B&G Foods boasts an extensive retail distribution network, reaching consumers through major supermarket chains, mass merchants, and warehouse clubs. This broad accessibility is crucial for their product lines. In 2023, B&G Foods' products were available in over 50,000 retail locations across the United States, Canada, and Puerto Rico, underscoring their commitment to widespread availability.

B&G Foods' commitment extends beyond grocery aisles, reaching into dedicated foodservice channels. They supply a variety of products to restaurants, cafeterias, and institutional kitchens, adapting to the unique needs of these commercial clients. This involves bulk packaging and tailored logistics to ensure timely delivery for businesses that prepare meals on a large scale.

This strategic focus on foodservice diversifies B&G Foods' revenue, providing a crucial income stream separate from direct-to-consumer retail sales. For example, in their 2023 fiscal year, B&G Foods reported net sales of $2.04 billion, with a portion of this originating from their foodservice operations, demonstrating the segment's contribution to their overall market presence.

B&G Foods extends its reach beyond retail by supplying ingredients and components to other food manufacturers and processors. This industrial customer segment, a crucial part of their B2B strategy, facilitates large-volume transactions and often necessitates tailored product specifications and logistical arrangements.

This industrial sales channel allows B&G Foods to optimize its production capacity and secure a broader presence within the overall food industry supply chain. For instance, in 2023, B&G Foods reported net sales of $2.08 billion, a portion of which is attributable to these industrial partnerships, demonstrating the scale of their operations beyond direct consumer sales.

Broad Geographic Reach

B&G Foods boasts a substantial geographic reach, primarily across the United States, Canada, and Puerto Rico. This expansive distribution network is crucial for tapping into diverse consumer preferences and market segments. In 2023, the company's net sales were reported at $2.0 billion, underscoring the impact of this broad market presence.

Managing this wide geographic footprint requires a sophisticated logistics and supply chain infrastructure. This ensures products are available where and when consumers want them, a key factor in the competitive packaged food sector. The company's commitment to efficient distribution supports its ability to maintain strong brand visibility across these key North American markets.

- United States: Primary market for B&G Foods' extensive product portfolio.

- Canada: Significant market presence with established distribution channels.

- Puerto Rico: Key territory contributing to the company's international sales.

- 2023 Net Sales: $2.0 billion, reflecting the scale of operations across its geographic reach.

Optimized Inventory and Logistics

B&G Foods' place strategy hinges on optimizing its vast distribution network. For instance, in 2023, the company managed a portfolio of over 50 brands, each requiring tailored logistics to reach diverse retail environments, from large supermarkets to smaller convenience stores. This necessitates sophisticated inventory management to balance product availability with the costs associated with warehousing and transportation across North America.

The company's approach to logistics is critical for maintaining product integrity, especially for its frozen and refrigerated items. Efficient warehousing and transportation networks are designed to ensure timely delivery and minimize spoilage, directly impacting product freshness and consumer trust. B&G Foods' commitment to operational efficiency in its supply chain is a key driver of both customer satisfaction and overall profitability.

- Inventory Management: B&G Foods utilizes advanced systems to track inventory across its numerous SKUs, aiming to reduce holding costs while preventing stockouts.

- Warehousing and Distribution: The company operates a network of distribution centers strategically located to serve its customer base efficiently.

- Transportation Optimization: Efforts are continuously made to streamline transportation routes and modes, leveraging economies of scale to lower freight expenses.

- Channel Strategy: B&G Foods adapts its place strategy to suit different retail channels, ensuring optimal product placement and accessibility for consumers.

B&G Foods' "Place" strategy is deeply rooted in its expansive and multi-faceted distribution network. This network ensures their diverse product portfolio, encompassing over 50 brands as of 2023, reaches consumers efficiently across various channels. The company's success relies on strategically placing products where consumers shop, from major grocery chains to specialized foodservice operations.

| Distribution Channel | Key Characteristics | 2023 Relevance |

|---|---|---|

| Retail (Supermarkets, Mass Merchants) | Broad consumer access, high volume sales. | Primary channel, leveraging over 50,000 locations. |

| Foodservice (Restaurants, Institutions) | Bulk packaging, tailored logistics for commercial clients. | Diversifies revenue, supports large-scale food preparation. |

| Industrial (Food Manufacturers) | Ingredient supply, large-volume transactions, custom specifications. | Optimizes production, integrates into broader food supply chain. |

What You See Is What You Get

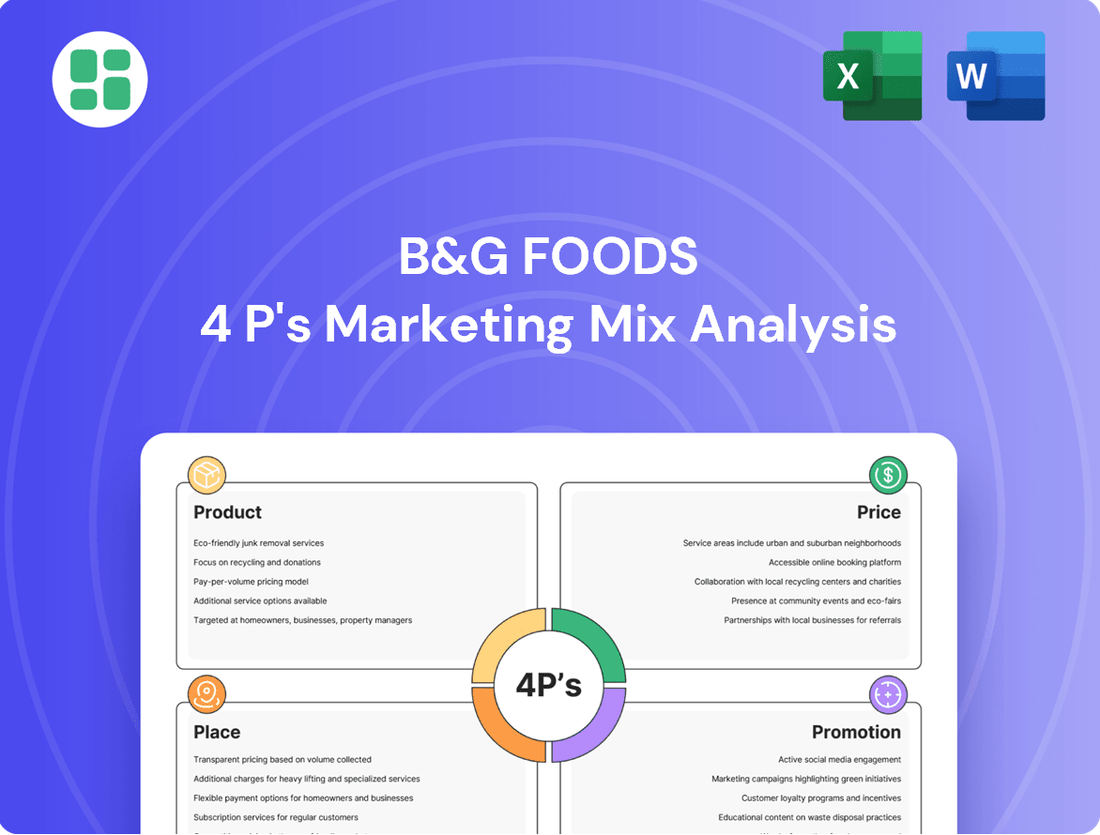

B&G Foods 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive B&G Foods 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. You'll gain immediate access to this complete, ready-to-use analysis upon checkout.

Promotion

B&G Foods’ advertising strategy centers on its established brands, aiming to capitalize on their existing recognition and consumer trust. Recent financial reports indicate a decrease in consumer marketing expenses in Q1 2025 compared to the same period in 2024, yet the company remains committed to brand investment.

These campaigns often spotlight the heritage, quality, and versatility of specific products within their portfolio. By utilizing diverse media channels, B&G Foods reinforces brand loyalty and attracts new customers by effectively communicating product benefits and leveraging the equity of their well-known household names.

B&G Foods actively partners with retailers, a key component of its promotional strategy. This includes in-store displays, special offers, and joint marketing efforts designed to capture consumer attention at the point of purchase.

In the second quarter of 2025, B&G Foods reported an increase in its trade spending. This investment aims to secure better shelf placement and offer more competitive pricing, directly impacting consumer purchasing behavior and boosting sales volume.

These collaborations are vital for B&G Foods to ensure its brands stand out amidst intense competition. By working hand-in-hand with retailers, the company maximizes product visibility and drives immediate sales, reinforcing its market presence.

B&G Foods actively utilizes digital and social media to connect with today's consumers, cultivate brand loyalty, and introduce new offerings. Their strategy includes content creation, partnerships with influencers, and precise advertising on platforms frequented by their target demographic.

In 2023, B&G Foods reported a significant portion of its marketing spend allocated to digital channels, reflecting the growing importance of online engagement. For instance, their social media campaigns for brands like Green Giant often feature user-generated content and interactive contests, driving measurable increases in brand awareness and product trial.

These digital efforts enable B&G Foods to deliver tailored messages and foster two-way communication, strengthening consumer bonds and gathering crucial market insights. This digital-first approach is indispensable for maintaining brand visibility and relevance in the current marketplace.

Sales s and Discounts

B&G Foods frequently utilizes sales promotions like coupons, rebates, and temporary price reductions to boost demand and encourage new product trials. However, the company has acknowledged that a high volume of trade promotions can negatively impact its gross margins. For instance, in the first quarter of 2024, B&G Foods reported a gross margin of 25.8%, a slight decrease from 26.4% in the same period of 2023, partly attributed to promotional activities.

These tactical promotions serve multiple purposes, including clearing excess inventory, generating short-term sales increases, and supporting the launch of new product variations. Such incentives are particularly effective at attracting consumers who are sensitive to price changes and at driving impulse purchases, thereby contributing to market share maintenance.

- Promotional Tactics: B&G Foods employs coupons, rebates, and price reductions to stimulate sales.

- Margin Impact: Over-reliance on trade promotions has been identified as a factor affecting gross margins.

- Sales Objectives: Promotions are used to manage inventory, drive short-term sales, and introduce new products.

- Consumer Response: Incentives attract price-sensitive buyers and encourage impulse buys, bolstering market share.

Public Relations and Corporate Communications

B&G Foods actively engages in public relations and corporate communications to shape its brand and connect with stakeholders. This includes managing its corporate image and highlighting community involvement. The company's commitment to transparency is evident in its January 2024 release of its first Corporate Social Responsibility (CSR) Report, detailing Environmental, Social, and Governance (ESG) objectives and charitable alliances.

This strategic focus on PR and communications is designed to foster trust and credibility. A strong corporate reputation benefits B&G Foods by positively influencing consumers, investors, and other key stakeholders. Such efforts indirectly bolster product sales and reinforce favorable brand perceptions.

- January 2024: B&G Foods published its inaugural Corporate Social Responsibility (CSR) Report, detailing ESG goals and philanthropic initiatives.

- Investor Relations: Active engagement with investors through earnings calls and reports aims to communicate financial performance and strategic direction.

- Community Engagement: Supporting local communities through various programs and partnerships enhances brand goodwill.

- Brand Perception: Consistent and positive corporate messaging contributes to a stronger overall brand image, influencing consumer purchasing decisions.

B&G Foods employs a multi-faceted promotional strategy, leveraging digital marketing, retailer partnerships, and direct consumer incentives. Their digital efforts, which saw a significant portion of marketing spend in 2023, focus on social media engagement and influencer collaborations to boost brand awareness and product trial.

Retailer collaborations, including in-store displays and special offers, are critical for point-of-purchase visibility. In Q2 2025, B&G Foods increased trade spending to secure better shelf placement and competitive pricing, directly influencing sales volume.

Sales promotions like coupons and rebates are used to drive demand and encourage trial, though the company notes that excessive trade promotions can impact gross margins, as seen in the Q1 2024 gross margin of 25.8% compared to 26.4% in Q1 2023.

The company also prioritizes public relations and corporate communications, releasing its first CSR Report in January 2024 to enhance brand image and stakeholder trust, which indirectly supports product sales.

Price

B&G Foods employs a value-based pricing strategy, setting prices according to what customers perceive as valuable, not just production costs. This means they factor in brand strength, quality, and convenience, especially for their well-known brands like Green Giant and Mrs. Dash. For instance, in their 2024 investor reports, B&G highlighted the strong consumer loyalty to their heritage brands, justifying premium pricing.

This strategy allows B&G Foods to capture a higher willingness-to-pay from consumers who associate their products with reliability and established quality. By focusing on the benefits delivered, such as convenience in meal preparation or trusted ingredients, they aim to maximize profitability while remaining competitive in the grocery aisle.

B&G Foods meticulously evaluates competitor pricing and market standing when establishing prices for its extensive product portfolio. The company actively monitors the competitive landscape, especially in crowded segments, to inform its pricing strategies.

Facing heightened competition across various categories, B&G Foods adjusts its pricing to maintain competitiveness. This means prices for items like frozen vegetables, specialty sauces, and spices are regularly reviewed to align with market dynamics and consumer expectations.

Through strategic pricing, B&G Foods effectively positions its diverse brands. Whether aiming for a premium perception or emphasizing everyday value, these pricing tactics help carve out distinct market segments for their offerings.

B&G Foods employs segment-specific pricing, tailoring costs for retail, foodservice, and industrial markets. Retail pricing accounts for consumer packaging, marketing, and retailer markups, whereas foodservice and industrial pricing are often volume-based and negotiated through contracts.

For example, B&G Foods adjusted pricing for products like Crisco oil to reflect fluctuating raw material costs, specifically noting lower soybean oil prices in recent periods. This strategic pricing ensures alignment with the unique purchasing dynamics and operational requirements of each distinct customer group.

Promotional Pricing Tactics

B&G Foods actively employs promotional pricing to boost sales and react to market shifts. This includes tactics like temporary price reductions and deals for buying multiple items. For instance, in the first quarter of 2024, the company noted an increase in trade spending, which often translates to consumer-facing promotions and potentially lower shelf prices.

These strategic, short-term price adjustments are designed to achieve several goals. They aim to spark consumer interest in new products, drive immediate sales volume, and help manage inventory levels efficiently. This approach is particularly vital in the crowded grocery sector where visibility and impulse buys are key.

The effectiveness of these promotions can be seen in their impact on sales volume and market share. For example, during periods of heightened promotional activity, B&G Foods often experiences a lift in unit sales, demonstrating the consumer's responsiveness to perceived value. The company's financial reports often highlight the role of promotional programs in achieving sales targets.

- Temporary Discounts: B&G Foods uses these to attract price-sensitive consumers and encourage immediate purchases.

- Multi-Buy Offers: Encouraging larger basket sizes, these promotions like buy-one-get-one or tiered discounts are common.

- Trade Spending: Increased investment in promotional activities with retailers, aiming to secure favorable shelf placement and consumer visibility.

- Sales Stimulation: The primary goal is to drive demand, introduce new products, and clear excess inventory.

Consideration of Economic Factors

B&G Foods navigates its pricing strategy through the lens of prevailing economic factors. Inflationary pressures and shifts in consumer purchasing power directly impact how the company sets prices for its diverse product portfolio. For instance, during 2023, B&G Foods noted that while certain input costs moderated, they still had to contend with the overall economic climate affecting consumer spending habits.

The company's pricing is a dynamic response to these economic shifts. In early 2024, B&G Foods indicated that it had implemented pricing adjustments, partly to reflect changes in raw material costs. However, the impact of tariffs on certain imported ingredients, a factor that can increase operational expenses, also plays a role in their pricing considerations.

Balancing profitability with consumer affordability is a constant challenge for B&G Foods. During periods of economic uncertainty, like the inflationary environment experienced through 2023 and into 2024, maintaining price points that resonate with consumers while ensuring healthy margins requires careful strategic maneuvering. This adaptive pricing approach allows B&G Foods to weather economic downturns and seize opportunities when market conditions are more favorable.

- Inflationary Impact: Consumer Price Index (CPI) data for food and beverages in the US showed continued elevated levels in late 2023 and early 2024, directly influencing B&G Foods' cost of goods sold and pricing decisions.

- Raw Material Cost Fluctuations: Commodity prices, such as those for grains and dairy, experienced volatility in 2023, forcing B&G Foods to adjust pricing to offset these changes.

- Consumer Purchasing Power: Real disposable income trends in 2023 and early 2024 indicated a mixed picture for consumers, requiring B&G Foods to consider price sensitivity in its product categories.

- Tariff Effects: The ongoing impact of tariffs on specific imported food ingredients can add an additional layer of cost, necessitating price adjustments to maintain profitability.

B&G Foods' pricing strategy is multifaceted, balancing perceived value, competitive positioning, and economic realities. They leverage value-based pricing for heritage brands, ensuring prices reflect quality and convenience, as noted in their 2024 investor discussions regarding brand loyalty.

The company actively monitors competitors and market dynamics, adjusting prices for products like frozen vegetables and sauces to remain competitive. This adaptive approach is crucial in crowded grocery segments where consumer expectations and market shifts are constant.

Promotional pricing, including temporary discounts and multi-buy offers, is a key tactic to stimulate sales and manage inventory. B&G Foods' Q1 2024 report indicated increased trade spending, often a precursor to consumer promotions.

Economic factors like inflation and raw material costs significantly influence B&G Foods' pricing. For instance, they adjusted prices for products like Crisco oil in response to fluctuating soybean oil costs in recent periods, demonstrating a direct link between input costs and consumer prices.

| Pricing Tactic | Description | Example/Impact |

|---|---|---|

| Value-Based Pricing | Setting prices based on customer perception of value, not just cost. | Justifies premium pricing for heritage brands like Green Giant due to strong consumer loyalty (2024 reports). |

| Competitive Pricing | Monitoring rivals and market standing to set prices. | Regularly reviewed for items like frozen vegetables and sauces to align with market dynamics. |

| Promotional Pricing | Short-term price reductions and deals to boost sales. | Increased trade spending in Q1 2024 suggests more consumer-facing promotions to drive volume. |

| Cost-Plus/Dynamic Pricing | Adjusting prices based on input cost fluctuations and economic conditions. | Crisco oil pricing adjusted for lower soybean oil costs; influenced by inflation and tariffs. |

4P's Marketing Mix Analysis Data Sources

Our B&G Foods 4P analysis is grounded in comprehensive data from SEC filings, annual reports, and investor presentations to understand product portfolios and pricing strategies. We also leverage e-commerce data, retail audits, and industry reports to analyze distribution channels and promotional activities.