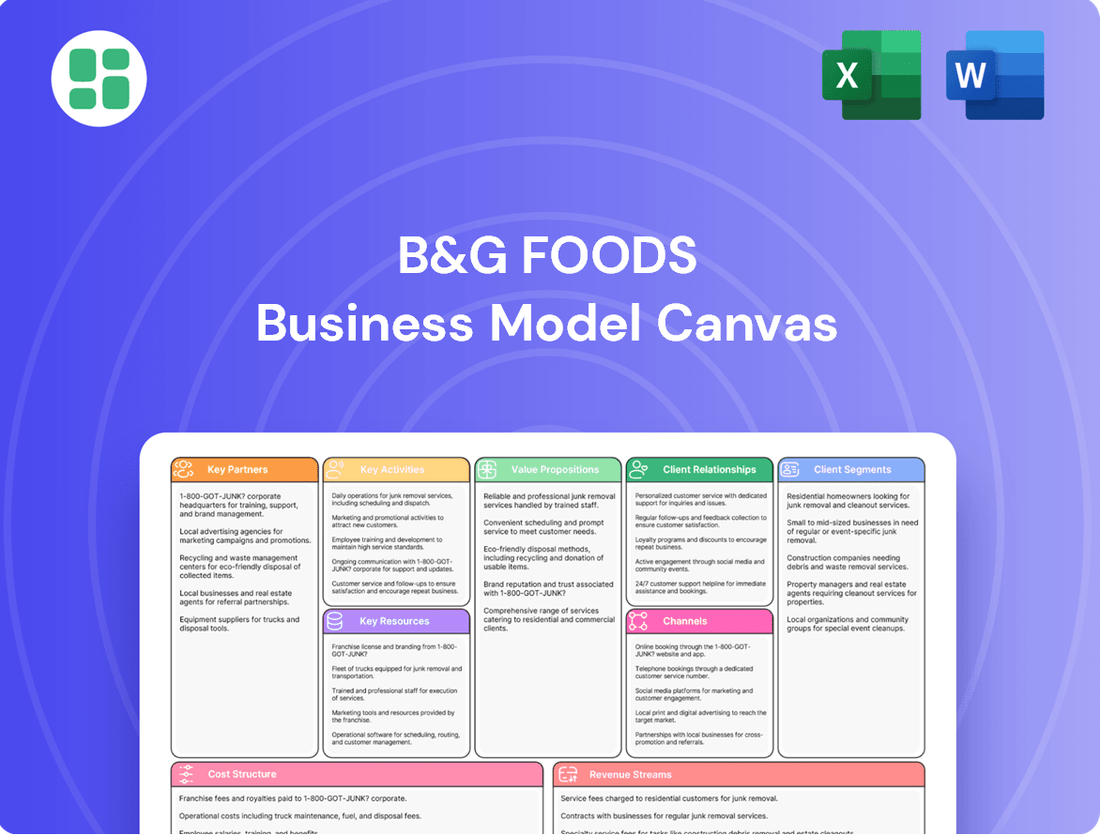

B&G Foods Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B&G Foods Bundle

Curious how B&G Foods masterfully navigates the competitive food industry? Our comprehensive Business Model Canvas breaks down their customer segments, value propositions, and revenue streams, offering a clear roadmap to their success. Unlock the full strategic blueprint for actionable insights.

Partnerships

B&G Foods’ key partnerships with raw material suppliers are crucial for its operations. These suppliers provide essential ingredients like spices, vegetables, and cooking oils, with specific sourcing from countries such as Vietnam and China for items like black pepper and garlic.

To navigate price volatility, B&G Foods utilizes strategies such as short-term supply contracts and advance commodity purchases. These measures aim to mitigate the impact of fluctuating raw material costs, which have been a significant factor in recent financial periods.

Indeed, raw material costs continued their upward trend through fiscal 2024 and into the first quarter of 2025. The company anticipates these elevated costs to persist throughout the entirety of fiscal year 2025, underscoring the importance of these supplier relationships and cost management strategies.

B&G Foods relies on key partnerships with packaging material suppliers for essential components such as glass jars, metal cans, cardboard, and plastic containers. These relationships are foundational to their operations, ensuring a steady supply of the materials needed to bring their diverse product portfolio to market.

The profitability of B&G Foods is directly tied to the cost of these packaging materials. For instance, in 2024, the global prices for key commodities like aluminum, used in cans, experienced volatility, impacting the cost structure for food manufacturers. Similarly, fluctuations in resin prices, which affect plastic packaging, can create significant cost pressures.

Consequently, B&G Foods must closely monitor and manage its relationships with packaging suppliers to mitigate the impact of price swings. Changes in the cost of glass, metal, and plastic can necessitate strategic decisions, including potential price adjustments for their consumer products to maintain healthy profit margins.

B&G Foods partners with co-packers and manufacturers to produce a portion of its diverse product portfolio, enhancing production flexibility and capacity. This strategy allows B&G Foods to efficiently manage manufacturing for specific brands or product lines without requiring extensive in-house capital investment. For instance, in 2023, the company continued to utilize these external partnerships to optimize its operational footprint.

Logistics and Distribution Partners

B&G Foods relies heavily on its logistics and distribution partners to ensure its diverse product portfolio reaches consumers efficiently across the United States, Canada, and Puerto Rico. These strategic alliances are fundamental to managing the complex supply chain from manufacturing to retail shelves.

The company has navigated significant challenges in this area, experiencing industry-wide increases in distribution costs. For instance, in the first quarter of 2024, B&G Foods noted that higher freight rates contributed to increased cost of goods sold, impacting overall profitability.

- Strategic Alliances: Essential for nationwide and international product movement.

- Distribution Network: Covers the United States, Canada, and Puerto Rico.

- Cost Pressures: Faced with rising freight rates impacting operational expenses.

- Q1 2024 Impact: Higher freight rates were a notable factor in increased costs.

Retail and Foodservice Customers

B&G Foods' key partnerships are deeply rooted in its extensive network of retail and foodservice customers, forming the backbone of its distribution strategy. These include major supermarket chains, mass merchants like Walmart, and warehouse clubs, all crucial for reaching a broad consumer base.

Walmart stands out as a particularly significant partner, representing a substantial portion of B&G Foods' sales across all its operating segments. This highlights the critical nature of these large retail relationships for driving sales volume and ensuring widespread product availability.

Beyond traditional retail, B&G Foods also relies on foodservice distributors to place its products in restaurants, institutions, and other food service channels. These partnerships are essential for market penetration and capturing different consumer consumption occasions.

- Key Retail Partners: Supermarket chains, mass merchants (e.g., Walmart), and warehouse clubs are primary distribution channels.

- Walmart's Significance: Identified as a major customer across all four of B&G Foods' operating segments, underscoring its importance for sales volume.

- Foodservice Distribution: Partnerships with foodservice distributors are vital for reaching institutional and restaurant markets.

- Market Access: These customer relationships are fundamental for securing shelf space and ensuring consistent sales performance.

B&G Foods collaborates with co-packers and contract manufacturers to expand its production capabilities and maintain flexibility. This strategic approach allows the company to efficiently manage manufacturing for certain brands or product lines, avoiding significant capital investments. For example, in fiscal 2023, B&G Foods continued to leverage these external manufacturing partnerships to optimize its operational footprint.

What is included in the product

This B&G Foods Business Model Canvas provides a comprehensive overview of their strategy, detailing customer segments, channels, and value propositions.

It reflects real-world operations, organized into 9 classic BMC blocks with insights and analysis of competitive advantages.

B&G Foods' Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of its core components, simplifying complex strategies for quick understanding and adaptation.

Activities

B&G Foods actively manufactures its wide array of shelf-stable and frozen food products across its network of facilities. This involves overseeing production for items such as canned vegetables, sauces, and spices, ensuring consistent quality and supply.

In 2024, B&G Foods continued to prioritize operational efficiency in its manufacturing processes. This focus is crucial for managing production costs effectively and maintaining the availability of its popular brands to consumers, a key element in its business model.

B&G Foods' brand management and marketing are central to its operations, focusing on nurturing its extensive portfolio of over 50 established brands. This involves significant investment in consumer marketing and trade spending to ensure strong brand recognition and encourage consumer loyalty.

In 2024, the company continued to prioritize keeping its brands resonant with changing consumer preferences. For instance, in the first quarter of 2024, B&G Foods reported net sales of $492.1 million, with a significant portion attributed to the performance of its core brands, demonstrating the ongoing impact of these marketing efforts.

B&G Foods' supply chain and inventory management are central to its operations, focusing on the efficient flow from raw material sourcing to final product delivery. This includes navigating price volatility for key commodities and maintaining optimal inventory levels to meet demand without excess holding costs.

The company actively employs strategies to mitigate supply chain risks, such as utilizing short-term supply contracts. This approach allows B&G Foods to adapt more readily to fluctuating commodity prices, a key factor in maintaining profitability for a company that reported net sales of $2.1 billion in 2023.

Strategic Portfolio Shaping and Acquisitions/Divestitures

B&G Foods is actively refining its brand portfolio by divesting underperforming assets. This includes selling brands like Don Pepino, Sclafani, and Le Sueur, which were identified as non-core or low-margin. This strategic move aims to streamline operations and focus resources on more profitable areas.

The company is also committed to growth through targeted acquisitions. B&G Foods seeks out complementary branded businesses that align with its strategic objectives, thereby expanding its market presence and product offerings. This dual approach of divestiture and acquisition is central to its portfolio shaping strategy.

- Divestitures: Sale of Don Pepino, Sclafani, and Le Sueur brands to optimize portfolio.

- Acquisitions: Pursuit of complementary branded businesses for growth.

- Strategic Focus: Enhancing profitability and market position through portfolio management.

- Financial Impact: Aiming to improve margins and reduce working capital intensity.

Research and Development (R&D) and Product Innovation

B&G Foods' commitment to Research and Development (R&D) and Product Innovation is a crucial, though often behind-the-scenes, element of its business model. This ongoing investment is essential for keeping its diverse portfolio of brands competitive and responsive to shifting consumer tastes and market trends. For instance, in 2023, the company continued to focus on product enhancements and new item introductions across its various segments, aiming to drive organic growth.

While specific R&D expenditure figures for B&G Foods aren't always broken out separately in every financial report, the emphasis on innovation is clear. This strategic focus allows B&G Foods to introduce updated versions of existing products or entirely new offerings that cater to evolving consumer demands, such as healthier options or convenient meal solutions. This proactive approach is vital for maintaining market relevance in the fast-paced food industry.

- Brand Refreshment: B&G Foods actively works to refresh its established brands, ensuring they resonate with current consumer preferences.

- New Product Introductions: The company aims to introduce new products that tap into emerging market trends and consumer needs.

- Adaptation to Consumer Preferences: R&D efforts are directed towards adapting products to meet changing demands, including health and wellness trends.

- Maintaining Market Share: Continuous innovation is key to defending and growing market share against competitors in the grocery sector.

B&G Foods' key activities encompass manufacturing, brand management, supply chain operations, portfolio optimization, and product innovation. The company actively produces a wide range of shelf-stable and frozen foods, while simultaneously investing in marketing to maintain brand recognition and consumer loyalty. Efficient supply chain and inventory management are critical for navigating commodity price volatility and meeting demand, with strategies like short-term contracts in place. Furthermore, B&G Foods strategically divests underperforming brands and pursues acquisitions to enhance its overall portfolio and profitability, all while focusing on R&D to refresh existing products and introduce new ones that align with evolving consumer preferences.

| Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Manufacturing | Producing shelf-stable and frozen food items. | Prioritizing operational efficiency to manage production costs. |

| Brand Management & Marketing | Nurturing over 50 established brands through consumer marketing and trade spending. | Keeping brands resonant with changing consumer preferences; Q1 2024 net sales were $492.1 million. |

| Supply Chain & Inventory Management | Ensuring efficient flow from raw materials to delivery, managing commodity prices. | Utilizing short-term supply contracts to adapt to fluctuating prices; 2023 net sales were $2.1 billion. |

| Portfolio Optimization | Divesting non-core brands (e.g., Don Pepino) and acquiring complementary businesses. | Streamlining operations and focusing resources on profitable areas. |

| R&D and Product Innovation | Refreshing existing brands and introducing new products to meet consumer demands. | Focus on product enhancements and new item introductions to drive organic growth. |

Preview Before You Purchase

Business Model Canvas

This preview offers a direct glimpse into the B&G Foods Business Model Canvas you will receive upon purchase. The structure, formatting, and content presented here are identical to the complete document you will gain access to. Rest assured, you are seeing the actual deliverable, not a sample or mockup, ensuring full transparency and immediate usability.

Resources

B&G Foods' portfolio is a cornerstone of its business, featuring over 50 beloved brands like Crisco, Green Giant, and Ortega. This extensive collection signifies robust intellectual property and deep consumer trust, translating into reliable sales and the ability to command favorable pricing.

In 2023, B&G Foods reported net sales of $2.0 billion, with its established brands forming the backbone of this revenue. The strong brand equity allows for consistent market presence and resilience, even in fluctuating economic conditions.

B&G Foods owns and operates numerous manufacturing and production facilities. These sites are vital for creating their extensive portfolio of shelf-stable and frozen food items. Controlling quality and production efficiency is paramount, and these facilities are key to achieving that.

The operational efficiency of these facilities directly influences B&G Foods' costs and, consequently, its profitability. As of the first quarter of 2024, the company reported total inventory valued at $506.6 million, reflecting the significant investment in raw materials and finished goods produced within these plants.

B&G Foods boasts an extensive distribution network covering the United States, Canada, and Puerto Rico. This allows them to efficiently serve a wide array of customers across retail, foodservice, and industrial sectors.

Their reach extends to major supermarket chains, mass merchants, and specialized distributors, ensuring their diverse product portfolio is readily available to consumers.

Skilled Human Capital

B&G Foods’ business model hinges on its skilled human capital, encompassing a broad range of expertise from manufacturing and supply chain management to marketing, sales, and administrative functions. The efficiency and knowledge of its employees are fundamental to both day-to-day operations and the successful execution of strategic growth plans.

The company places a strong emphasis on fostering a safe and healthy work environment, recognizing that employee well-being is directly linked to productivity and overall organizational success. This commitment is a cornerstone of their human capital strategy.

- Manufacturing Expertise: Employees in production facilities are crucial for maintaining product quality and operational efficiency, directly impacting the cost of goods sold.

- Supply Chain Proficiency: Skilled logistics and supply chain professionals ensure timely procurement of raw materials and efficient distribution of finished goods, minimizing disruptions and optimizing inventory levels.

- Marketing and Sales Acumen: The marketing and sales teams possess the insights needed to understand consumer trends and drive brand growth, contributing significantly to revenue generation.

- Commitment to Safety: B&G Foods reported investing in employee safety programs, aiming to reduce workplace incidents and foster a culture of care, which is vital for retaining talent and ensuring operational continuity.

Financial Capital and Access to Credit

B&G Foods relies heavily on its financial capital, encompassing both internally generated cash flow and external debt financing, to fuel its operations and strategic initiatives. In 2024, the company continued its focus on enhancing its operational cash flow generation.

Access to credit is a vital component, enabling B&G Foods to manage its working capital effectively and pursue strategic growth opportunities, including acquisitions and divestitures. The company's strategy involves actively working to improve its cash flow generation while simultaneously reducing its overall leverage.

- Financial Capital: B&G Foods utilizes cash flow from operations and debt financing to fund ongoing activities and strategic moves.

- Strategic Focus: The company prioritizes increasing cash flow and decreasing its debt levels.

- 2024 Performance Indicator: B&G Foods' ability to access credit markets and manage its debt-to-equity ratio remains a key financial metric.

B&G Foods' key resources are its diverse brand portfolio, extensive manufacturing facilities, robust distribution network, skilled workforce, and access to financial capital. These elements collectively enable the company to produce, market, and deliver a wide range of food products to consumers.

The company’s intellectual property, embodied in its over 50 brands, is a significant asset, driving consumer recognition and loyalty. Manufacturing capabilities ensure product quality and cost control, while the distribution network guarantees market reach. Human capital provides the expertise to manage operations and drive growth.

Financial capital, including operating cash flow and debt financing, supports ongoing operations and strategic investments. B&G Foods' focus on improving cash flow and managing debt is crucial for its financial health and future expansion. This multifaceted approach to resource management underpins its business model.

Value Propositions

B&G Foods' strength lies in its portfolio of trusted and recognized brands, fostering consumer loyalty and familiarity. This brand equity translates into reliable purchasing decisions for consumers. For instance, brands like Green Giant, Ortega, and Cream of Wheat have long-standing market presence, contributing to B&G Foods' consistent revenue streams. In 2023, B&G Foods reported net sales of $2.0 billion, a testament to the enduring appeal of its established brands.

B&G Foods' value proposition of convenience and accessibility is deeply embedded in its product portfolio. The company's focus on shelf-stable and frozen foods directly addresses the modern consumer's need for easy-to-prepare meals and dependable pantry items. This aligns with busy lifestyles where time-saving food solutions are paramount.

The company ensures broad accessibility through its extensive distribution network, reaching consumers across a wide array of retail channels. This widespread availability means B&G Foods' products are readily found in supermarkets, mass merchandisers, and even online platforms, making them a convenient choice for a diverse customer base.

For instance, in 2023, B&G Foods reported net sales of $2.0 billion, underscoring the significant market penetration and consumer demand for their convenient offerings. This scale of operation highlights their success in making their accessible product lines a staple in many households.

B&G Foods prioritizes delivering products that consistently meet and exceed consumer expectations for taste, safety, and overall performance. This unwavering dedication to quality is a cornerstone of their brand identity, fostering deep consumer trust across their diverse portfolio. For instance, in 2023, B&G Foods reported net sales of $2.0 billion, a testament to the sustained demand driven by their commitment to reliable product excellence.

Wide Range of Food Categories

B&G Foods boasts a remarkably diverse portfolio, spanning a wide array of food categories to meet varied consumer demands. This broad reach ensures that the company is a go-to source for many household staples and specialty items.

The company's extensive product range includes essentials like frozen and canned vegetables, flavorful sauces, and aromatic spices. Furthermore, they offer key baking ingredients and unique specialty food items, catering to a wide spectrum of culinary needs.

This extensive variety allows B&G Foods to effectively cater to a broad spectrum of dietary preferences and cooking styles. For instance, in 2024, their Green Giant brand continued to be a significant player in the frozen and canned vegetable market, a category valued at billions of dollars globally.

- Frozen and Canned Vegetables: A cornerstone of their offerings, with brands like Green Giant.

- Sauces and Spices: Including popular items from brands such as Ortega and Mrs. Dash.

- Baking Ingredients: Essential components for home bakers, often found under various acquired brands.

- Specialty Food Items: Niche products that cater to specific tastes and occasions.

Value for Money

B&G Foods consistently aims to strike a chord with consumers seeking quality without an exorbitant price tag. This strategy positions their diverse portfolio as a smart choice for everyday shoppers. For instance, in 2024, the company continued to emphasize its commitment to delivering reliable products at accessible price points, a crucial element in maintaining market share amidst fluctuating economic conditions.

While the company navigates ongoing cost pressures, the core value proposition remains rooted in offering products that provide tangible worth. This means consumers get good quality for the money they spend. B&G Foods understands that for many, especially those managing tighter budgets, this balance is paramount to brand loyalty.

- Value Focus: B&G Foods emphasizes providing quality products at reasonable prices.

- Consumer Appeal: This approach targets budget-conscious consumers looking for good value.

- Market Retention: Balancing quality and price is key to keeping customers, especially in challenging economic times.

B&G Foods' value proposition centers on providing a wide array of trusted, convenient, and accessible food products that offer excellent value. Their portfolio, featuring well-known brands, caters to diverse consumer needs and lifestyles, ensuring consistent demand. This commitment to quality and affordability underpins their strong market position.

The company's success is evident in its financial performance, with net sales reaching $2.0 billion in 2023. This figure highlights the significant consumer trust and purchasing behavior driven by B&G Foods' consistent delivery of value across its extensive product lines.

B&G Foods' diverse product categories, including frozen vegetables, sauces, spices, and baking ingredients, ensure broad market appeal. For instance, in 2024, their Green Giant brand remained a key player in the substantial global vegetable market, demonstrating the enduring demand for their accessible and quality offerings.

| Value Proposition | Key Brands/Examples | Supporting Data/Insight |

|---|---|---|

| Trusted & Recognized Brands | Green Giant, Ortega, Cream of Wheat | Long-standing market presence fosters consumer loyalty and consistent revenue. |

| Convenience & Accessibility | Shelf-stable and frozen foods | Addresses modern consumer need for easy-to-prepare, dependable pantry items. |

| Product Quality & Performance | Consistent taste, safety, and overall excellence | Builds deep consumer trust across a diverse portfolio. |

| Extensive Product Diversity | Frozen vegetables, sauces, spices, baking ingredients | Caters to a broad spectrum of culinary needs and preferences. |

| Value for Money | Quality products at reasonable prices | Appeals to budget-conscious consumers, crucial for market retention. |

Customer Relationships

B&G Foods' primary customer relationships with retail and foodservice partners are transactional. This means the focus is on the exchange of goods for payment, emphasizing efficiency in getting products to shelves and menus. Key elements include competitive pricing to attract and retain these partners, alongside strategic trade promotions designed to boost sales volume.

These crucial partnerships are managed through a combination of B&G Foods' direct sales teams and a network of independent brokers. This dual approach allows for broad market coverage and specialized attention to different customer segments. In 2023, B&G Foods reported net sales of $2.0 billion, underscoring the scale of these transactional relationships.

Maintaining these relationships hinges on ensuring smooth operational processes, from order placement to delivery. Favorable terms, including payment schedules and product availability, are paramount. The company's ability to consistently meet demand and offer attractive terms directly impacts the strength and longevity of its partnerships within the retail and foodservice sectors.

B&G Foods cultivates brand loyalty with end consumers primarily through the consistent quality of its products and robust marketing efforts. The company leverages the established heritage and recognition of its portfolio of well-known brands, such as Green Giant and Mrs. Dash, to build trust and preference. This deep-seated consumer affinity translates into predictable, recurring purchases, a cornerstone of sustained demand for B&G Foods' offerings.

B&G Foods employs dedicated key account managers to cultivate strong partnerships with its largest customers, such as major supermarket chains and mass merchants. These relationships are foundational, driving substantial sales volume for the company.

For instance, in 2024, B&G Foods continued to focus on collaborative planning and tailored strategies with these strategic partners to ensure optimal product placement and promotional support, directly impacting market share and revenue generation.

The company's approach involves understanding the unique operational needs and market demands of each key account, fostering a mutually beneficial relationship that maximizes distribution efficiency and sales opportunities across their extensive networks.

Self-Service and Information through Digital Presence

B&G Foods offers consumers robust self-service options via its extensive brand websites and corporate digital platforms. These resources empower customers to find product details, explore recipes, and learn more about the company's offerings independently. This digital engagement strategy allows for broad reach and accessibility, facilitating consumer interaction without requiring direct, personal assistance.

The company's digital presence is a cornerstone of its customer relationship strategy, enabling consumers to access information and engage with B&G Foods brands at their convenience. For instance, in 2024, B&G Foods continued to update and maintain its portfolio of brand websites, ensuring up-to-date product information and recipe content is readily available. This approach supports a significant portion of customer inquiries and brand exploration.

- Digital Information Hubs: Brand-specific websites serve as primary sources for product details, nutritional information, and usage ideas.

- Recipe Discovery: Consumers can easily find and save recipes, enhancing product utility and brand engagement.

- Corporate Transparency: The main B&G Foods website provides general company information, investor relations, and sustainability efforts, fostering trust.

- Accessibility: These self-service digital channels are available 24/7, catering to diverse consumer needs and preferences for information gathering.

Investor Relations and Stakeholder Communication

B&G Foods prioritizes investor relations and stakeholder communication by maintaining transparent and regular dialogue with its financial community. This commitment is crucial for building trust and ensuring stakeholders are well-informed about the company's performance and strategic trajectory.

Key communication channels include quarterly earnings calls, where management discusses financial results and answers analyst questions. For example, in their Q1 2024 earnings call, B&G Foods reported net sales of $475.9 million. These calls are vital for providing timely updates and insights.

- Quarterly Earnings Calls: Regular updates on financial performance and operational highlights.

- Annual Reports and SEC Filings: Comprehensive disclosure of financial health, risks, and strategic plans, such as the 10-K filings detailing the company's structure and operations.

- Investor Presentations: Detailed overviews of business strategy, market positioning, and future outlook.

- Shareholder Meetings: Opportunities for direct engagement and voting on corporate matters.

B&G Foods manages customer relationships with retail and foodservice partners through a mix of direct sales and brokers, focusing on transactional efficiency. For its key retail accounts, dedicated managers foster collaborative planning, ensuring optimal product placement and promotions. This strategy is vital for driving sales volume, as evidenced by B&G Foods' net sales of $2.0 billion in 2023.

Consumer relationships are built on brand loyalty through consistent quality and marketing, leveraging established brands like Green Giant. Digital self-service channels, including brand websites, provide product information and recipes, facilitating consumer engagement. In 2024, the company continued to enhance these digital platforms for accessibility.

| Relationship Type | Key Activities | 2023/2024 Data Points |

|---|---|---|

| Retail & Foodservice Partners | Transactional sales, trade promotions, key account management | Net Sales: $2.0 billion (2023) |

| End Consumers | Brand loyalty, product quality, digital engagement | Continued website updates and maintenance (2024) |

| Investors & Stakeholders | Transparent communication, earnings calls, financial reporting | Q1 2024 Net Sales: $475.9 million |

Channels

B&G Foods primarily distributes its wide array of products through traditional retail grocery channels. This includes major supermarket chains located throughout the United States, Canada, and Puerto Rico, ensuring widespread accessibility for consumers. In 2023, grocery stores accounted for a significant portion of B&G Foods' net sales, reflecting the enduring importance of this channel.

B&G Foods leverages mass merchants and warehouse clubs, like Walmart and Costco, to distribute its diverse portfolio. These channels are crucial for reaching consumers who prioritize value and bulk purchasing, significantly broadening B&G's market penetration beyond traditional supermarkets.

In 2023, B&G Foods' net sales were $2.0 billion, with a substantial portion attributed to sales through these high-volume retailers. This strategy allows the company to efficiently move large quantities of its products, such as Green Giant vegetables and Mrs. Dash seasonings, to a wide consumer base seeking cost-effective options.

B&G Foods leverages a network of specialized foodservice distributors to reach commercial kitchens and food processors. This channel is crucial for serving restaurants, institutions, and other industrial customers who require bulk ingredients and specialized food products.

In 2024, B&G Foods continued to rely on these partnerships to ensure efficient delivery and product availability for its foodservice segment. The company's strategy involves working with distributors who understand the unique demands of commercial food preparation and manufacturing, ensuring that B&G's diverse product portfolio meets these specific needs.

Specialty and Non-Food Outlets

B&G Foods leverages specialty distributors and non-food outlets to reach specific consumer segments. This strategy is particularly effective for niche products like certain spices or household essentials such as Static Guard, allowing for focused market penetration.

This channel diversification is crucial for capturing varied consumer purchasing occasions and expanding brand visibility beyond traditional grocery environments. For instance, in 2023, B&G Foods reported net sales of $1.9 billion, with a portion of this attributed to these specialized channels.

- Targeted Niche Markets: Reaching consumers who seek out specific, often premium or specialized, product categories not always found in mainstream retail.

- Household Product Distribution: Utilizing non-food outlets for items like Static Guard, which aligns with different shopping missions and product adjacencies.

- Sales Diversification: Capturing sales from different consumer behaviors and retail environments, contributing to overall revenue stability.

- Brand Exposure: Increasing brand presence in diverse retail settings, potentially attracting new customer bases.

E-commerce Platforms

B&G Foods leverages various e-commerce platforms to reach consumers, reflecting the increasing trend of online grocery purchasing. This channel is crucial for staying competitive in the evolving retail landscape.

The company's products are readily available on major online retail sites, ensuring accessibility for a broad customer base. This strategic online presence caters to the growing consumer demand for convenient, digital shopping experiences.

The importance of e-commerce for consumer packaged goods companies like B&G Foods cannot be overstated. For instance, in 2024, online grocery sales are projected to continue their upward trajectory, with many analysts predicting double-digit growth year-over-year.

- Online Sales Growth: E-commerce channels are a vital component of B&G Foods' distribution strategy, aligning with the significant expansion of online grocery shopping.

- Platform Availability: B&G Foods' products are accessible through numerous online retail platforms, broadening their market reach.

- Consumer Behavior Shift: The company's engagement with e-commerce directly addresses the fundamental shift in consumer purchasing habits towards digital channels.

- Market Importance: E-commerce represents a growing and increasingly important sales channel for the consumer packaged goods sector.

B&G Foods utilizes a multi-channel distribution strategy, encompassing traditional grocery, mass merchants, foodservice, specialty distributors, and e-commerce. This approach ensures broad market penetration and caters to diverse consumer purchasing behaviors.

In 2023, B&G Foods' net sales reached $1.9 billion, with a significant portion derived from these varied channels, highlighting their collective importance to the company's revenue generation.

The company's reliance on major supermarket chains remains a cornerstone of its distribution, complemented by strategic partnerships with mass merchants and online platforms to capture evolving consumer preferences.

B&G Foods also serves specialized markets through foodservice distributors and non-food outlets, demonstrating a commitment to reaching niche segments and diversifying sales beyond conventional retail environments.

| Channel | Key Characteristics | 2023 Relevance (Illustrative) |

|---|---|---|

| Traditional Grocery | Widespread accessibility, core consumer base | Significant portion of net sales |

| Mass Merchants/Warehouse Clubs | Value-driven, bulk purchasing | Broad market penetration, high volume |

| Foodservice | Commercial kitchens, industrial customers | Ensures availability for business clients |

| Specialty/Non-Food Outlets | Niche products, specific consumer segments | Targeted market penetration, brand exposure |

| E-commerce | Online grocery, digital convenience | Addresses evolving consumer behavior, growing importance |

Customer Segments

Retail consumers, comprising households throughout the United States, Canada, and Puerto Rico, represent B&G Foods' most substantial customer base. These individuals purchase products for their daily meals, prioritizing convenience, quality, and a diverse selection. For instance, in 2023, the average household grocery spending in the U.S. saw an increase, reflecting ongoing shifts in consumer behavior, particularly influenced by inflationary pressures on food prices.

Foodservice operators, encompassing a broad range of establishments from fast-casual restaurants to large hospital cafeterias, represent a critical customer segment for B&G Foods. These businesses, including chains like Applebee's and IHOP which have utilized B&G products, rely on consistent, high-quality ingredients for their daily operations. For instance, in 2023, the US foodservice industry generated over $900 billion in sales, highlighting the sheer volume and demand within this sector.

These operators typically purchase B&G Foods' products in bulk, prioritizing reliability and a steady supply chain to meet consumer demand. Their purchasing decisions are driven by factors such as product consistency, cost-effectiveness, and the ability of B&G's offerings to integrate seamlessly into their menu and kitchen workflows. The foodservice segment's dependence on B&G's portfolio underscores the importance of maintaining strong relationships and efficient distribution networks to serve these vital commercial kitchens.

B&G Foods also caters to industrial customers, including other food manufacturers and processors. These businesses integrate B&G Foods' ingredients and semi-finished products directly into their own production lines, often requiring highly specific product formulations and substantial order volumes. For instance, in 2023, B&G Foods reported that its specialty foods segment, which often includes ingredients for other manufacturers, contributed significantly to its overall revenue.

Value-Conscious Shoppers

Value-conscious shoppers represent a substantial segment of B&G Foods' customer base, particularly those sensitive to price changes and the impact of inflation. In 2024, with ongoing inflationary pressures, these consumers are actively seeking affordable options, influencing their purchasing decisions.

B&G Foods strives to provide products at accessible price points. However, the elevated inflation experienced in recent periods has prompted many of these shoppers to re-evaluate their buying habits, often prioritizing essential goods or seeking out promotions.

The company's strategy involves diligent cost management to ensure its offerings remain competitive within this price-sensitive market. This focus on operational efficiency is crucial for maintaining appeal to value-conscious consumers.

- Price Sensitivity: Value-conscious shoppers are highly attuned to price, making them susceptible to competitor pricing and promotional activities.

- Inflation Impact: Recent inflationary trends have intensified the focus on affordability for this segment, potentially shifting demand towards lower-priced alternatives.

- Cost Management Focus: B&G Foods' commitment to managing its own costs directly supports its ability to offer competitive pricing to this key customer group.

- Purchasing Pattern Adjustments: Consumers in this segment are likely to adjust their purchasing frequency or brand loyalty based on perceived value and price stability.

Consumers Seeking Established Brands

Consumers who prioritize and trust well-known, established brands represent a significant customer segment for B&G Foods. This group is drawn to the heritage and perceived reliability that iconic brands offer, making them less susceptible to switching to newer or private label alternatives. B&G Foods leverages the equity built in brands like Green Giant and Mrs. Dash to capture this market. For example, in 2023, B&G Foods reported that its top brands continued to drive sales, demonstrating the enduring appeal of established names.

B&G Foods' business model is deeply intertwined with its ability to appeal to these consumers. The company's strategy often involves acquiring and revitalizing legacy brands, recognizing their inherent value and customer loyalty. This approach allows B&G Foods to tap into existing consumer trust and reduce the marketing burden associated with building new brands from scratch. The company's portfolio includes many brands with decades of history, reinforcing this focus.

- Brand Loyalty: Consumers in this segment exhibit high brand loyalty, often purchasing familiar products repeatedly.

- Perceived Quality: Established brands are frequently associated with consistent quality and safety in the minds of these consumers.

- Heritage and Trust: The long history of these brands fosters a sense of trust and familiarity, influencing purchasing decisions.

- Market Stability: This segment provides a stable revenue base, as these consumers are less likely to be swayed by price promotions for competing products.

B&G Foods serves a diverse customer base, including retail consumers across North America who seek convenience and quality in their daily groceries. The company also caters to foodservice operators, such as restaurants and institutions, who rely on consistent, bulk ingredients. Industrial customers, including other food manufacturers, utilize B&G's products as components in their own production lines.

Value-conscious shoppers are a key segment, especially in 2024, as inflation impacts purchasing decisions. These consumers are actively seeking affordable options and are influenced by price and promotions. B&G Foods focuses on cost management to remain competitive for this group.

Consumers who trust established, well-known brands also form a significant portion of B&G Foods' customer base. The company leverages the equity of legacy brands, like Green Giant, to foster loyalty and provide a stable revenue stream. This segment values the perceived quality and heritage associated with familiar names.

| Customer Segment | Key Characteristics | B&G Foods' Approach | Relevant Data Point (2023/2024) |

|---|---|---|---|

| Retail Consumers | Daily grocery shoppers prioritizing convenience, quality, and variety. | Wide product portfolio, accessible distribution. | U.S. household grocery spending increased in 2023. |

| Foodservice Operators | Restaurants, hospitals, cafeterias needing bulk, consistent ingredients. | Reliable supply chain, product integration. | U.S. foodservice industry sales exceeded $900 billion in 2023. |

| Industrial Customers | Other food manufacturers requiring specific formulations and volumes. | Ingredient supply, custom solutions. | Specialty foods segment contributed significantly to revenue in 2023. |

| Value-Conscious Shoppers | Price-sensitive consumers impacted by inflation. | Cost management, competitive pricing, promotions. | Inflationary pressures intensified in 2024, influencing buying habits. |

| Brand Loyalists | Consumers trusting established, heritage brands. | Acquisition and revitalization of legacy brands. | Top brands continued to drive sales in 2023. |

Cost Structure

Raw material and packaging expenses represent significant variable costs for B&G Foods. These include agricultural commodities like soybean oil and black pepper, as well as packaging materials such as glass, cans, plastic, and cardboard. For instance, in the first quarter of 2024, B&G Foods reported that input cost inflation, particularly for ingredients and packaging, continued to be a factor impacting their margins, though they were actively working to mitigate these pressures.

Manufacturing and production costs are a significant component of B&G Foods' operational expenses, covering everything from factory labor and energy consumption to equipment upkeep and depreciation. For instance, in 2023, B&G Foods reported cost of goods sold at $3.4 billion, a substantial portion of which is directly attributable to these manufacturing activities. Effective management of these costs, particularly by optimizing plant efficiency and ensuring high capacity utilization, is crucial for profitability.

The company has acknowledged increased investments and associated costs, notably within its Green Giant U.S. Business. This strategic focus on enhancing production capabilities or expanding capacity in key areas can lead to higher upfront manufacturing expenses, impacting short-term cost structures but aiming for long-term operational advantages.

Distribution and logistics costs are a substantial component for B&G Foods, encompassing warehousing, transportation, and freight. These expenses are magnified by the company's extensive geographic distribution network, serving a wide customer base across North America.

Industry-wide increases in these operational costs have presented a challenge. For instance, the average cost of trucking a load in the US saw significant upward pressure throughout 2023 and into early 2024, impacting B&G Foods' bottom line. The company actively seeks strategies to mitigate these rising expenditures.

Selling, General & Administrative (SG&A) Expenses

Selling, General & Administrative (SG&A) expenses represent the operational overheads crucial for B&G Foods' market presence and internal functioning. These costs encompass vital areas like marketing and advertising campaigns to build brand awareness, salaries for the sales force driving revenue, general administrative functions, and investments in research and development for future product innovation.

The level of SG&A spending can be dynamic, directly influenced by the company's strategic decisions regarding marketing investments and its ongoing efforts to enhance operational efficiency. For instance, a ramp-up in promotional activities would likely lead to a temporary increase in these costs.

B&G Foods has demonstrated a commitment to managing and reducing its SG&A expenses. However, in the second quarter of 2025, these expenses saw an increase when viewed as a percentage of net sales. This uptick highlights the ongoing balancing act between investing in growth drivers and maintaining cost discipline.

- Marketing & Advertising: Costs associated with promoting B&G Foods' diverse brand portfolio.

- Sales Force Compensation: Salaries and commissions for personnel responsible for generating sales.

- General & Administrative: Overhead expenses covering executive salaries, legal, and other corporate functions.

- Research & Development: Investments in new product development and process improvements.

Interest Expense and Debt Servicing

Interest expense represents a substantial cost for B&G Foods due to its reliance on debt financing. In fiscal year 2024, the company has been actively working to deleverage its balance sheet, aiming to lower its net debt and improve its leverage ratios.

The increasing cost of borrowing has directly impacted B&G Foods’ bottom line. Higher blended interest rates throughout fiscal 2024 have led to a notable rise in the company's net interest expense.

- Significant Cost: Interest expense on long-term debt is a key component of B&G Foods' cost structure.

- Deleveraging Efforts: The company prioritizes reducing its net debt and leverage ratio.

- Impact of Rates: Higher blended interest rates in fiscal 2024 have increased net interest expense.

B&G Foods' cost structure is heavily influenced by its extensive supply chain and manufacturing operations. Key expenses include raw materials, packaging, production, distribution, and administrative overhead. The company actively manages these costs, seeking efficiencies while navigating market fluctuations.

In Q1 2024, B&G Foods noted ongoing input cost inflation, particularly for ingredients and packaging, which impacts their margins. The company's cost of goods sold in 2023 was $3.4 billion, underscoring the significance of manufacturing expenses. Distribution costs are also substantial, with trucking rates seeing upward pressure through 2023 and into early 2024.

| Cost Component | Key Drivers | Recent Trends (2023-2024) |

| Raw Materials & Packaging | Agricultural commodities, glass, plastic, cardboard | Inflationary pressures impacting margins |

| Manufacturing & Production | Labor, energy, equipment, plant efficiency | $3.4 billion Cost of Goods Sold (2023); focus on capacity utilization |

| Distribution & Logistics | Warehousing, transportation, freight | Increased trucking costs impacting bottom line |

| SG&A | Marketing, sales force, administration, R&D | Dynamic spending based on strategic investments; Q2 2025 saw an increase as a percentage of net sales |

| Interest Expense | Debt financing, interest rates | Higher blended interest rates in fiscal 2024 increased net interest expense |

Revenue Streams

B&G Foods primarily generates revenue by selling its diverse portfolio of branded shelf-stable and frozen food items to major retailers like supermarket chains, mass merchants, and warehouse clubs. This core business covers segments such as Specialty Foods, Meals, Frozen & Vegetables, and Spices & Flavor Solutions.

For the fiscal year 2024, B&G Foods reported net sales of $1.93 billion. However, the company experienced a dip in sales during the first two quarters of fiscal 2025.

B&G Foods also generates revenue by selling its products to foodservice operators, such as restaurants and institutions, and to industrial customers, including other food manufacturers. This strategy broadens their customer base beyond typical retail consumers, offering a more diversified revenue stream.

This segment of B&G Foods' business can involve selling products in bulk quantities or offering specialized product formulations tailored for these specific markets. For instance, in 2023, B&G Foods reported that its net sales were approximately $2.0 billion, with a significant portion attributed to its various sales channels, including foodservice and industrial.

While B&G Foods is primarily known for its strong portfolio of branded consumer staples, private label sales represent a complementary revenue stream. This segment leverages the company's extensive manufacturing and distribution infrastructure to produce goods for other retailers under their own brands.

In 2023, B&G Foods reported net sales of $2.0 billion. While specific figures for private label sales are not broken out separately in their public financial statements, this channel is understood to contribute to overall revenue by ensuring consistent factory utilization and generating additional volume, thereby enhancing operational efficiency.

Divestiture Proceeds (Strategic, Non-Recurring)

B&G Foods has recently realized substantial, one-time revenue from selling off brands that are not central to its core operations. For instance, the divestiture of the Green Giant U.S. shelf-stable line, along with brands like Don Pepino, Sclafani, and Le Sueur, has provided significant cash influx.

These divestiture proceeds are strategically allocated, primarily to pay down the company's long-term debt. This financial maneuver helps to strengthen the balance sheet and improve the company's overall financial health.

The sales also serve a critical role in portfolio reshaping. By divesting non-core assets, B&G Foods can focus its resources and attention on its more profitable and strategically important brands, aiming for greater efficiency and growth.

In 2023, B&G Foods reported approximately $100 million in net proceeds from the sale of its Green Giant U.S. shelf-stable vegetable business. This demonstrates the tangible impact of these strategic divestitures on the company's financial posture.

International Sales

B&G Foods generates revenue from international sales, with approximately 9.7% of its net sales in Q1 2025 originating from customers outside the United States. This international segment is largely driven by sales in Canada, demonstrating a significant geographical diversification of its revenue base.

- International Sales Contribution: In Q1 2025, international markets accounted for roughly 9.7% of B&G Foods' total net sales.

- Primary International Market: Canada represents the most significant contributor to B&G Foods' international revenue.

- Geographical Diversification: These international sales highlight the company's efforts to expand its market reach beyond its domestic operations.

- Revenue Stream Diversification: The presence of international sales contributes to a more diversified and potentially resilient revenue stream for the company.

B&G Foods' revenue streams are multifaceted, encompassing direct sales to major retailers, foodservice operators, and industrial clients, alongside private label manufacturing and strategic brand divestitures. International sales, particularly in Canada, also contribute to their global revenue footprint.

| Revenue Stream | 2024 Net Sales (Approx.) | Q1 2025 International Sales % |

|---|---|---|

| Retail Sales | $1.93 billion (Total Net Sales) | N/A |

| Foodservice & Industrial | N/A (Included in Total Net Sales) | N/A |

| Private Label | N/A (Contributes to Total Net Sales) | N/A |

| Brand Divestitures | ~$100 million (Green Giant U.S. shelf-stable in 2023) | N/A |

| International Sales | N/A (9.7% of Net Sales in Q1 2025) | 9.7% |

Business Model Canvas Data Sources

The B&G Foods Business Model Canvas is constructed using a blend of financial disclosures, market research reports, and internal operational data. These diverse sources ensure a comprehensive understanding of customer segments, value propositions, and revenue streams.