B&G Foods Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B&G Foods Bundle

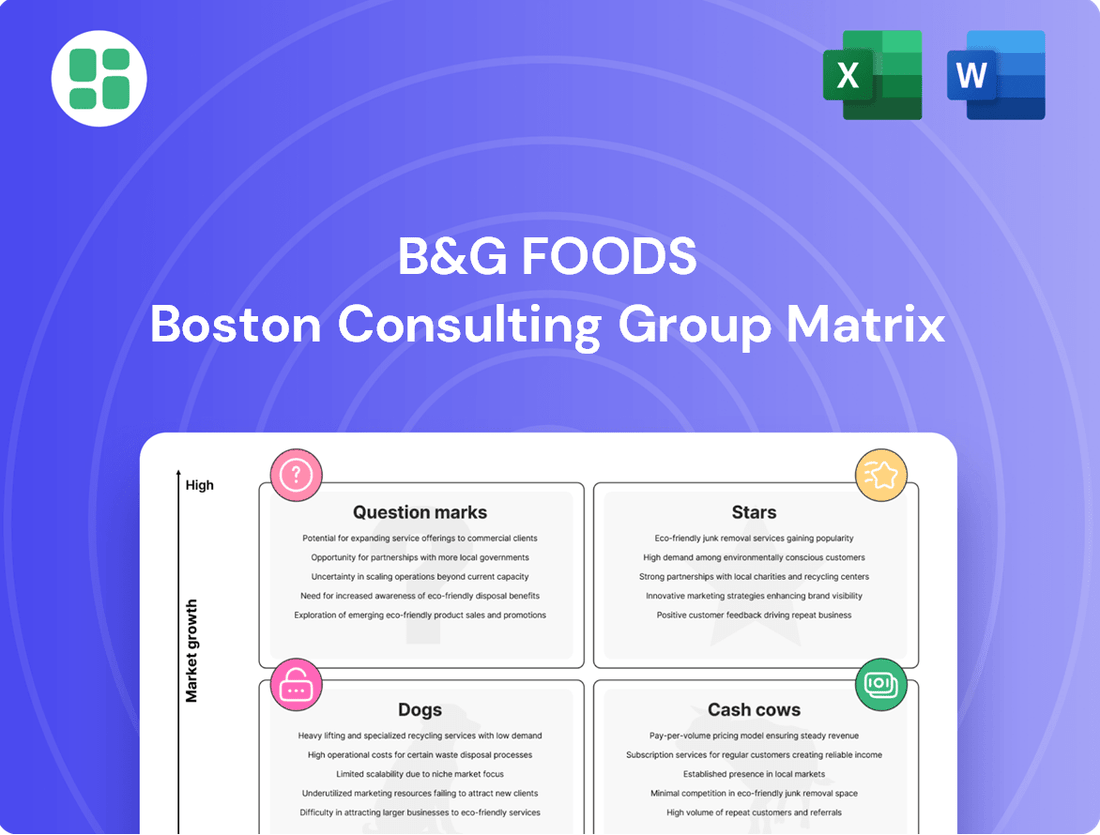

Curious about B&G Foods' product portfolio performance? This glimpse into their BCG Matrix highlights potential Stars and Cash Cows, but what about the Dogs and Question Marks that could be impacting overall growth?

Unlock the full strategic picture by purchasing the complete B&G Foods BCG Matrix. Gain detailed quadrant placements, understand market share dynamics, and receive actionable insights to optimize your investment decisions and product strategy.

Don't miss out on the complete breakdown; it's your shortcut to identifying opportunities and mitigating risks within B&G Foods' diverse product lines.

Stars

B&G Foods' portfolio includes emerging specialty brands that, despite modest current revenue contributions, show promise for high growth. These niche brands are tapping into expanding consumer segments, such as the plant-based and health-conscious markets, indicating potential for future market share gains.

While B&G Foods experienced an overall sales decline, these specialty brands represent areas of potential competitive advantage. For instance, brands focusing on organic or allergen-free products are resonating strongly with specific consumer groups, suggesting a path to future revenue growth and market differentiation.

The Spices & Flavor Solutions segment shows promise as a potential star, boosted by the growing consumer interest in fresh produce and proteins. This trend indicates a strong market pull for innovative flavorings that enhance these categories.

Despite a dip in Q1 and Q2 2025, attributed to volume challenges and increased costs, strategic investments in new flavor profiles and functional ingredients are key. For instance, B&G Foods' focus on expanding its Mrs. Dash line with new blends could capture market share. The company reported that its Spices & Seasonings segment, which includes these solutions, saw net sales of $378.7 million in 2023, a slight increase from the previous year, underscoring the segment's resilience and growth potential.

B&G Foods has a robust history of expanding through strategic acquisitions. Future targets that are complementary branded businesses in high-growth segments are prime candidates to become Stars. These brands would already hold a significant market share within expanding categories, enabling B&G Foods to amplify their growth by leveraging its established distribution and operational capabilities.

The company's stated aim to build key platforms for future acquisition growth underscores a deliberate and proactive search for such opportunities. For instance, in 2023, B&G Foods completed the acquisition of the frozen breakfast foods business of High Ridge Brands for $120 million, a move designed to bolster its presence in a growing segment of the food industry.

E-commerce & Direct-to-Consumer Growth

B&G Foods' strategic expansion into e-commerce and direct-to-consumer (DTC) channels presents a significant growth opportunity, potentially positioning it as a star within its business portfolio. This digital shift taps into a rapidly expanding market for online grocery shopping, a sector that saw substantial acceleration in recent years.

The company's ability to effectively leverage these channels could translate into increased revenue and improved profitability. As of early 2024, online grocery sales continue to be a dominant force in retail, with projections indicating sustained growth throughout the year and beyond. For B&G Foods, capturing a meaningful share of this market for its established brands is key.

- E-commerce Growth: The U.S. online grocery market was valued at approximately $100 billion in 2023 and is expected to grow at a CAGR of over 10% through 2028.

- DTC Potential: Direct-to-consumer models allow for greater control over brand messaging, customer relationships, and potentially higher margins by cutting out intermediaries.

- Investment Focus: Success in these channels necessitates robust investment in digital marketing capabilities and efficient supply chain and logistics infrastructure to meet consumer demand for convenience.

- Brand Portfolio Synergy: B&G Foods can leverage its diverse brand portfolio, offering a wide range of products through these digital platforms, catering to varied consumer needs and preferences.

Premium/Niche Food Segments

Certain premium or niche food segments within B&G Foods' portfolio show potential as Stars. These are areas like specialized organic or gourmet offerings, and allergen-free products. Consumers in these markets are often less sensitive to price changes and are willing to pay a premium for specific attributes.

For example, B&G Foods’ acquisition of Crispy Green’s Crispy Fruit snacks in 2021 bolstered its presence in the healthy snacking category, a segment experiencing robust growth. In 2024, the healthy snack market is projected to continue its upward trajectory, with organic and natural snack segments leading the charge.

- Premium/Niche Food Segments: These are high-growth, high-market-share areas.

- Growth Drivers: Increased consumer demand for organic, gourmet, and specialized dietary options.

- B&G Foods' Position: Strategic acquisitions and brand development in these niches.

- Market Data: The global healthy snacks market was valued at over $85 billion in 2023 and is expected to grow significantly through 2030.

B&G Foods' "Star" products are those in high-growth, high-market-share categories, often driven by evolving consumer preferences for health and specialty foods. These brands, including those in the Spices & Flavor Solutions segment and premium/niche offerings, demonstrate strong potential for future revenue expansion. For instance, the U.S. online grocery market, a key channel for these brands, was valued at approximately $100 billion in 2023 and is expected to grow robustly.

The company's strategic focus on expanding its digital presence, particularly in e-commerce and direct-to-consumer (DTC) channels, positions several brands as potential stars. This digital shift aligns with market trends showing sustained growth in online grocery shopping, with projections indicating continued acceleration. B&G Foods' ability to capture market share in these channels, supported by investments in digital marketing and logistics, is crucial for their star performance.

Acquisitions also play a vital role in identifying and nurturing stars. By targeting complementary branded businesses in high-growth segments, B&G Foods aims to integrate brands that can leverage its established infrastructure. The acquisition of the frozen breakfast foods business of High Ridge Brands in 2023 for $120 million exemplifies this strategy, aiming to bolster presence in a growing market segment.

The Spices & Seasonings segment, which saw net sales of $378.7 million in 2023, is a prime example of a star performer, benefiting from increased consumer interest in enhancing home-cooked meals. Similarly, the healthy snacking category, bolstered by acquisitions like Crispy Green’s Crispy Fruit snacks, is a significant growth area, with the global healthy snacks market valued at over $85 billion in 2023.

| B&G Foods Potential Stars | Key Growth Drivers | 2023 Market Data/Examples | B&G Foods' Strategic Action |

|---|---|---|---|

| Spices & Flavor Solutions | Consumer interest in home cooking, culinary exploration | Net sales of $378.7 million for Spices & Seasonings segment in 2023 | Focus on new flavor profiles, Mrs. Dash line expansion |

| Premium/Niche Foods (e.g., Organic, Allergen-Free) | Demand for health-conscious, specialized dietary options | Global healthy snacks market valued over $85 billion in 2023 | Acquisition of Crispy Green’s Crispy Fruit snacks (2021) |

| E-commerce & DTC Channels | Growth of online grocery shopping, demand for convenience | U.S. online grocery market valued at ~$100 billion in 2023 | Investment in digital marketing and logistics capabilities |

| Acquired Brands in High-Growth Segments | Strategic market expansion, leveraging existing platforms | Acquisition of High Ridge Brands' frozen breakfast foods business ($120M in 2023) | Proactive search for complementary branded businesses |

What is included in the product

This BCG Matrix overview highlights B&G Foods' portfolio, identifying growth opportunities and areas for strategic divestment.

A clear B&G Foods BCG Matrix overview instantly clarifies strategic priorities, relieving the pain of indecision.

This B&G Foods BCG Matrix provides a visually digestible roadmap, easing the burden of complex portfolio management.

Cash Cows

Crisco, a venerable name in cooking oils and shortening, represents a classic Cash Cow for B&G Foods. Its established market presence and strong brand recognition in a mature category mean it commands a significant share, consistently generating revenue.

Despite fluctuations in commodity prices, such as the recent impact of lower soybean oil costs on pricing, Crisco remains a reliable income stream. This stability is a hallmark of a Cash Cow, requiring minimal marketing spend to sustain its position and deliver predictable cash flow.

Ortega Mexican Foods, a prominent player in the mature yet stable U.S. Mexican-style food market, functions as a Cash Cow for B&G Foods. Its leadership position, bolstered by strong brand loyalty and extensive distribution networks, ensures consistent and predictable revenue streams.

Products like taco shells, salsas, and seasonings are household staples, contributing to Ortega's reliable cash generation. In 2023, B&G Foods reported net sales for its Mexican Foods segment, which includes Ortega, reaching $356.8 million, demonstrating the brand's significant contribution to the company's overall financial performance. This segment's stability allows B&G Foods to allocate capital to other areas of its business.

Cream of Wheat, a breakfast staple with deep roots and significant brand loyalty, operates within a mature, slow-growing market. This positioning suggests it holds a substantial market share, functioning as a classic cash cow for B&G Foods.

Given its established presence, Cream of Wheat likely demands minimal marketing investment to sustain its dedicated consumer base, thereby generating consistent, predictable revenue streams. For instance, in 2024, the hot cereal market, while mature, continued to show resilience, with established brands like Cream of Wheat benefiting from consumer preference for familiar, comforting options.

The steady profits generated by Cream of Wheat are crucial, providing B&G Foods with the financial flexibility to allocate capital towards growth initiatives or to support other brands within its portfolio.

Polaner Fruit Spreads

Polaner Fruit Spreads represents a classic Cash Cow for B&G Foods within the mature fruit spreads market. Its long-standing presence and established brand recognition contribute to a loyal customer base, ensuring consistent sales and profitability. This stability means Polaner can generate reliable cash flow for the company with minimal investment, allowing B&G Foods to allocate resources elsewhere.

The fruit spreads category, while mature, benefits from consistent consumer demand for breakfast and baking staples. Polaner's ability to maintain its market position in this environment underscores its strength as a cash-generating asset. For instance, in 2024, the broader jam and preserves market in the US continued to show resilience, with sales often driven by premium or specialty offerings, a segment Polaner has historically engaged with.

- Brand Strength: Polaner benefits from decades of consumer trust and familiarity, a key advantage in the competitive spreads market.

- Market Maturity: Operating in a stable, albeit slow-growing, market allows Polaner to generate predictable revenue streams.

- Profitability: The brand's established position enables B&G Foods to extract significant profits with relatively low reinvestment needs.

- Cash Generation: Polaner's consistent sales contribute positively to B&G Foods' overall cash flow, supporting other business initiatives.

B&M Baked Beans

B&M Baked Beans, a venerable name in canned goods, operates within the mature and stable baked beans market. This segment, characterized by consistent demand but limited expansion, is ideal for a cash cow.

The brand likely holds a significant market share due to its established regional recognition and a dedicated customer following. This strong position in a low-growth environment is a hallmark of a successful cash cow, generating predictable revenue streams.

For B&G Foods, B&M Baked Beans serves as a reliable source of income. These consistent returns are crucial for funding investments in higher-growth ventures within the company's broader portfolio.

- Market Segment Maturity: Baked beans represent a mature market, indicating stable demand but minimal growth potential.

- Brand Loyalty and Market Share: B&M benefits from strong regional recognition and a loyal consumer base, likely translating to a high market share.

- Cash Flow Generation: The brand's position as a cash cow provides consistent financial returns, essential for supporting other business units.

B&G Foods' portfolio includes several strong Cash Cows, brands that hold a significant share in mature markets and generate consistent, predictable revenue with minimal investment. These brands are vital for funding growth in other areas of the company.

Brands like Crisco, Ortega Mexican Foods, Cream of Wheat, Polaner Fruit Spreads, and B&M Baked Beans exemplify this category. They benefit from established brand loyalty and operate in markets with stable, if slow, growth.

For instance, B&G Foods' Mexican Foods segment, heavily featuring Ortega, reported net sales of $356.8 million in 2023. This highlights the substantial and reliable income these mature brands provide.

These Cash Cows are essential for B&G Foods' financial stability, allowing the company to maintain operations and invest in opportunities with higher growth potential.

| Brand | Market Category | BCG Matrix Role | Key Characteristics | 2023 Segment Sales (if applicable) |

| Crisco | Cooking Oils & Shortening | Cash Cow | Established presence, strong brand recognition, mature market | N/A (part of Oils & Spreads) |

| Ortega Mexican Foods | Mexican-style Foods | Cash Cow | Market leadership, brand loyalty, extensive distribution | $356.8 million (Mexican Foods Segment) |

| Cream of Wheat | Breakfast Cereal | Cash Cow | Breakfast staple, deep roots, significant brand loyalty | N/A (part of Hot Cereals) |

| Polaner Fruit Spreads | Fruit Spreads | Cash Cow | Long-standing presence, loyal customer base, consistent demand | N/A (part of Spreads) |

| B&M Baked Beans | Canned Goods (Baked Beans) | Cash Cow | Regional recognition, dedicated following, stable demand | N/A (part of Canned Soups & Stouffer's) |

What You See Is What You Get

B&G Foods BCG Matrix

The B&G Foods BCG Matrix preview you see is the exact, fully formatted report you will receive after purchase, offering immediate strategic insights into their product portfolio.

This preview accurately represents the comprehensive B&G Foods BCG Matrix analysis that will be delivered to you upon completing your purchase, ensuring no surprises and full usability.

What you are viewing is the finalized B&G Foods BCG Matrix document, ready for immediate download and application in your strategic planning or presentations once acquired.

Rest assured, the B&G Foods BCG Matrix report displayed here is precisely the same high-quality, analysis-ready file you will get after your purchase, designed for professional use.

Dogs

B&G Foods' strategic divestiture of brands like Don Pepino, Sclafani, and Le Sueur (U.S. canned peas) clearly places them in the Dogs quadrant of the BCG Matrix. These brands historically exhibited low market share within mature, low-growth categories, often characterized by seasonality, making them less attractive for future investment.

The company explicitly cited high working capital requirements and a lack of strategic alignment as reasons for their sale, underscoring their nature as cash traps. In 2023, B&G Foods continued to streamline its portfolio, focusing on brands with stronger growth potential and reduced capital intensity, aiming to boost overall profitability and deleverage its balance sheet.

B&G Foods divested its Green Giant U.S. shelf-stable business in the fourth quarter of 2023. This action strongly suggests the product line was classified as a 'Dog' in the BCG Matrix, characterized by low market share in a slow-growing industry. The sale, which occurred after a period of underperformance, allowed B&G Foods to streamline its operations and focus on more promising segments.

Within B&G Foods' diverse portfolio, certain older, smaller legacy brands are showing signs of struggle. These brands, operating in mature or declining market segments, are likely experiencing reduced sales and market share. For instance, in 2023, B&G Foods reported a net sales decrease, partly attributed to challenges within its legacy brands.

These underperforming brands often demand significant management attention and marketing investment but yield minimal returns, effectively tying up valuable company resources. This resource drain can hinder the growth of more promising segments of the business. While B&G Foods has not publicly identified specific brands for divestiture in this category, their ongoing underperformance positions them as potential candidates for future portfolio streamlining.

Certain Frozen & Vegetables Segment Products

Certain Frozen & Vegetables Segment Products within B&G Foods' portfolio, particularly those under the Green Giant frozen brand, are showing signs of being Dogs in the BCG Matrix. These products have faced significant headwinds, contributing to sales drops and adjusted EBITDA losses in the first half of 2025.

The challenges stem from several factors, including increased trade promotion spending, rising raw material and production costs, and the impact of tariffs. These pressures have eroded profitability for specific underperforming product lines within the segment.

- Sales Decline: The Frozen & Vegetables segment, including Green Giant frozen, saw sales drops in Q1 and Q2 2025.

- Profitability Issues: Adjusted EBITDA losses were recorded in the same periods, indicating a struggle to generate profit.

- Cost Pressures: Higher trade promotion spending, increased raw material and production costs, and tariffs are key drivers of these financial difficulties.

- Underperforming Lines: Specific product lines within the segment are experiencing declining volumes and profitability, characteristic of Dog products.

Brands with Significant Impairment Charges

B&G Foods reported significant impairment charges in 2024, totaling $576.7 million. This figure primarily impacted intangible trademark assets for several brands, including Green Giant, Victoria, Static Guard, and McCann's.

These substantial write-downs signal a notable decrease in the anticipated future cash flows and market value of these specific brands. This situation aligns with the characteristics of 'Dogs' in the BCG matrix, suggesting they possess low market share and operate within slow-growth markets.

- Green Giant: Impairment charge of $197.7 million.

- Victoria: Impairment charge of $161.1 million.

- Static Guard: Impairment charge of $100.5 million.

- McCann's: Impairment charge of $36.9 million.

B&G Foods' strategic divestitures and significant impairment charges clearly indicate the presence of 'Dog' category brands within its portfolio. These brands, characterized by low market share in mature or declining markets, have historically struggled to generate substantial returns and often require significant resources without commensurate upside.

The company's 2024 impairment charges, totaling $576.7 million, particularly impacted brands like Green Giant ($197.7 million), Victoria ($161.1 million), and Static Guard ($100.5 million), underscoring their diminished market value and future earning potential. These write-downs align with the typical profile of 'Dogs' in the BCG matrix, which are often candidates for divestiture or restructuring to free up capital for more promising ventures.

The divestiture of the Green Giant U.S. shelf-stable business in late 2023 further exemplifies this strategy, as this product line was likely identified as a 'Dog' due to underperformance and slow market growth. B&G Foods' ongoing efforts to streamline its portfolio by shedding these underperforming assets demonstrate a commitment to enhancing overall profitability and financial health.

| Brand | 2024 Impairment Charge | BCG Category Indication |

|---|---|---|

| Green Giant | $197.7 million | Dog |

| Victoria | $161.1 million | Dog |

| Static Guard | $100.5 million | Dog |

| McCann's | $36.9 million | Dog |

Question Marks

B&G Foods' question marks are its new product innovations in emerging categories. These are products entering fast-growing markets where the company currently holds a small market share, such as plant-based alternatives or functional beverages. For example, in 2024, the company continued to explore opportunities in the rapidly expanding refrigerated plant-based foods sector, a segment projected to grow significantly in the coming years.

These emerging categories require substantial investment in research and development, marketing, and distribution to build brand awareness and capture market share. The success of these question marks hinges on B&G Foods' ability to effectively compete against established players and capitalize on evolving consumer trends. The company's strategic focus on these areas aims to transform them into future stars in its product portfolio.

B&G Foods' portfolio likely includes recently acquired brands that operate in fast-growing categories but haven't yet established a dominant position under the company's umbrella. These brands represent potential question marks within the BCG matrix, demanding significant strategic attention and investment.

For these acquired brands to transition from question marks to stars, B&G Foods must prioritize substantial investment in integration and market expansion. This includes optimizing supply chains, enhancing marketing efforts, and potentially product development to capture a larger share of their high-growth markets.

B&G Foods might consider expanding brands like Ortega or Green Giant into emerging markets such as Southeast Asia or parts of Africa. These regions often show robust economic growth and increasing disposable incomes, presenting a high-growth potential scenario. However, B&G's current market share in these areas is likely minimal, placing these ventures squarely in the question mark category of the BCG matrix.

Successfully navigating these international markets would necessitate substantial investment. For instance, understanding nuanced local tastes, like preferences for specific spice profiles in Ortega products or different vegetable preparations for Green Giant, is crucial. Establishing reliable distribution channels, potentially through partnerships with local distributors, would also be a significant undertaking. In 2023, global food and beverage market growth was estimated around 5%, but emerging markets often outpace this average, with some showing double-digit growth, highlighting the potential reward for overcoming these initial hurdles.

Segments with High Input Cost Volatility and Tariff Exposure

The Spices & Flavor Solutions segment at B&G Foods grapples with significant input cost volatility and tariff exposure. This has directly impacted its earnings, notably causing a decline in EBITDA. While the broader spices category shows promise, specific product lines within this segment are particularly vulnerable. These are the ones heavily reliant on global commodity prices that fluctuate wildly, such as black pepper and garlic, and are also subject to changing tariff landscapes.

These particular product lines, despite their inherent growth potential, are currently categorized as question marks within the BCG matrix framework. Their profitability is being squeezed by these cost pressures, and their effective market share is consequently low. This situation highlights a key challenge for B&G Foods: managing the profitability of high-potential but cost-sensitive product categories.

- Input Cost Volatility: Raw material costs for key spices like black pepper and garlic have experienced significant fluctuations, impacting segment margins.

- Tariff Exposure: Changes in international trade policies and tariffs directly affect the landed cost of imported spices and flavor ingredients.

- EBITDA Decline: The combination of rising costs and tariff impacts has led to a noticeable decrease in the segment's EBITDA.

- Question Mark Status: High growth potential is currently overshadowed by profitability challenges, positioning specific product lines as question marks in the BCG matrix.

Revitalized Brands with New Marketing Strategies

B&G Foods may seek to rejuvenate its older brands that have experienced a dip in market share. This revitalization often involves launching fresh marketing campaigns or introducing new product variations, aiming to propel these brands back onto a high-growth path. These efforts place these brands in the question mark category of the BCG matrix, as their future success remains uncertain and necessitates significant investment to recapture market relevance.

For instance, if a brand like Green Giant, which has faced sales challenges, were to undergo a significant marketing overhaul, it would represent a question mark. In 2023, B&G Foods reported net sales of $2.02 billion, a slight decrease from $2.04 billion in 2022, highlighting the pressure on some of its established brands to perform. The company's strategy might involve targeting younger demographics with digital-first campaigns or developing innovative product lines, such as plant-based options, to appeal to evolving consumer preferences.

- Revitalization Efforts: B&G Foods may invest in marketing and product innovation for underperforming legacy brands.

- BCG Matrix Placement: These revitalized brands would be classified as question marks due to uncertain market reception and required investment.

- Financial Context (2023): B&G Foods' net sales of $2.02 billion indicate the need to boost performance in certain brand portfolios.

- Strategic Focus: Targeting new consumer segments and adapting product offerings are key strategies for these question mark brands.

B&G Foods' question marks encompass new product innovations in fast-growing but low-share markets, such as plant-based foods, and revitalized legacy brands facing uncertain market reception. These ventures, including potential expansion into emerging international markets like Southeast Asia for brands like Ortega, require substantial investment to build awareness and capture market share. The company's 2023 net sales of $2.02 billion underscore the imperative to successfully transform these question marks into future revenue drivers.

| Category | Market Growth | B&G Foods' Market Share | Strategic Focus | BCG Status |

| Plant-Based Foods | High | Low | R&D, Marketing, Distribution | Question Mark |

| Emerging Markets (e.g., SE Asia for Ortega) | High | Minimal | Localization, Distribution Partnerships | Question Mark |

| Revitalized Legacy Brands (e.g., Green Giant) | Uncertain (post-revitalization) | Declining (pre-revitalization) | Marketing Campaigns, Product Innovation | Question Mark |

| Spices & Flavor Solutions (Specific Lines) | Moderate to High | Low (due to cost pressures) | Cost Management, Tariff Mitigation | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including B&G Foods' financial reports, industry growth rates, and competitor sales figures to accurately position each business unit.