B&G Foods Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B&G Foods Bundle

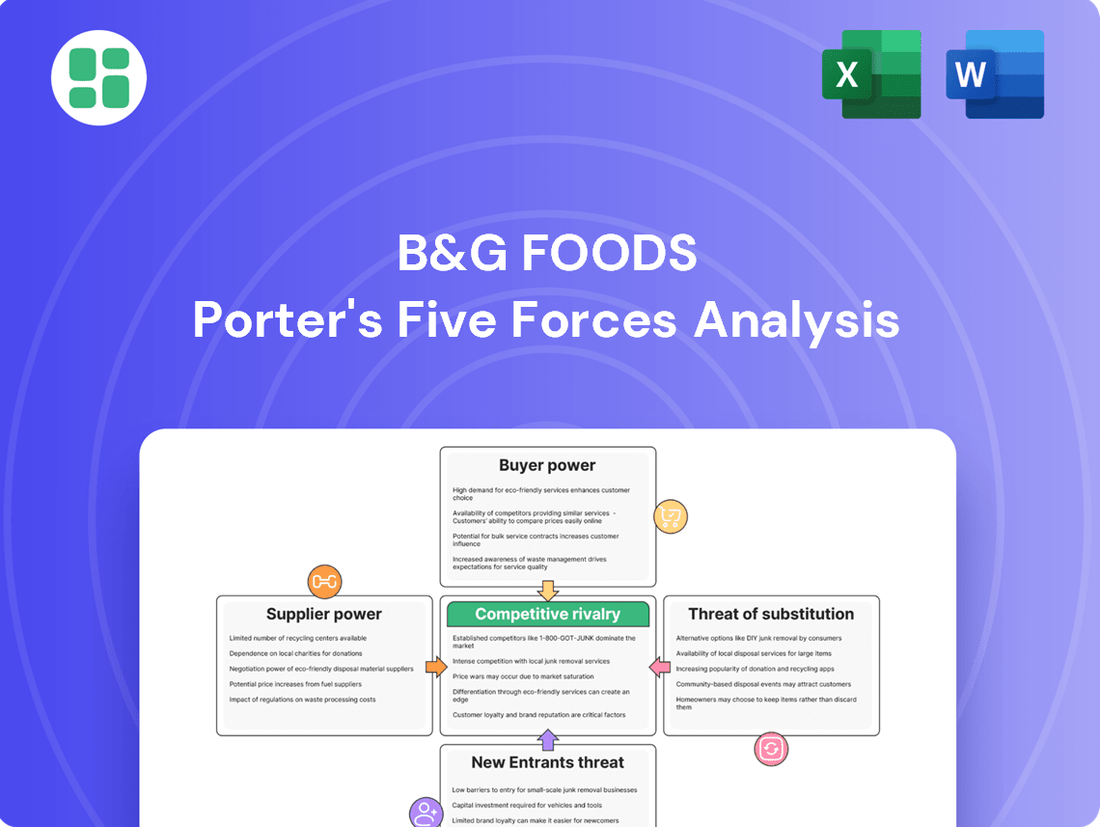

B&G Foods navigates a competitive landscape shaped by powerful buyer bargaining, intense rivalry among established players, and the constant threat of substitutes. Understanding these forces is crucial for any stakeholder looking to grasp the company's strategic position.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore B&G Foods’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration is a key factor in assessing B&G Foods' bargaining power of suppliers. If a few large suppliers dominate the market for essential raw materials like agricultural produce, spices, or packaging, their leverage over B&G Foods increases significantly. This can translate into higher input costs and less favorable contractual terms for the company.

For instance, the global food supply chain in 2024 continues to grapple with volatility. Prices for key commodities such as cocoa experienced substantial increases, with futures trading around $7,000 per metric ton in early 2024, a stark rise from previous years. Similarly, citrus and coffee markets have faced their own supply chain pressures, impacting availability and cost for food manufacturers like B&G Foods.

The uniqueness of inputs for B&G Foods significantly impacts supplier bargaining power. If B&G Foods relies on specialized or proprietary ingredients, like unique spice blends or patented processing techniques, suppliers providing these inputs hold considerable leverage. This specialization makes it difficult for B&G Foods to switch suppliers without incurring substantial costs or compromising product quality, thus allowing suppliers to dictate terms and potentially charge higher prices.

Conversely, if B&G Foods sources largely commoditized inputs such as sugar, flour, or standard packaging materials, its bargaining power increases. The availability of numerous suppliers for these common goods means B&G Foods can negotiate more favorable pricing and terms by leveraging competition among suppliers. For instance, in 2024, the global sugar market experienced price fluctuations, but the sheer number of producers generally kept individual supplier leverage in check for large buyers like B&G Foods.

B&G Foods faces significant switching costs when changing suppliers, which in turn bolsters supplier bargaining power. These costs can include substantial investments in retooling manufacturing equipment to accommodate new ingredient specifications, the complex and time-consuming process of re-certifying all ingredients for food safety compliance, and the disruption to established, efficient logistical networks. For example, in 2023, B&G Foods reported that changes in ingredient costs and availability impacted their gross profit margins, highlighting the sensitivity to supplier relationships and the inherent difficulties in rapid supplier transitions.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into B&G Foods' operations, essentially becoming competitors, is a significant consideration. If a key supplier were to start manufacturing or distributing food products themselves, they could bypass B&G Foods, directly impacting B&G's market position and potentially increasing their leverage over B&G's remaining needs.

This scenario, while less common in the food industry, represents a potent increase in supplier bargaining power. For instance, a major ingredient supplier with strong manufacturing capabilities could decide to launch its own branded food products, directly competing with B&G Foods for shelf space and consumer attention. This would transform a supplier relationship into a direct competitive threat.

- Potential for Supplier Competition: Suppliers could leverage their existing infrastructure and expertise to enter the food manufacturing or distribution sectors.

- Increased Bargaining Leverage: If suppliers can effectively compete, their ability to dictate terms to B&G Foods would rise dramatically.

- Industry Example: While specific instances are rare, imagine a large agricultural cooperative that also processes its produce deciding to launch its own line of canned goods, directly challenging B&G Foods' existing product lines.

Impact of Input Costs on B&G Foods' Profitability

The bargaining power of suppliers significantly impacts B&G Foods' profitability by dictating input costs. Fluctuations in raw materials, energy, and labor directly affect production expenses and profit margins. In 2024, inflationary pressures across the food industry, from agricultural commodities to utilities and labor, have amplified supplier leverage, enabling them to pass on higher costs. B&G Foods' Q1 2025 earnings report highlighted these challenges, with increased raw material costs specifically impacting segments like Spices & Flavor Solutions.

This heightened supplier power translates into several key considerations for B&G Foods:

- Increased Cost of Goods Sold: Higher prices for ingredients, packaging, and energy directly reduce gross profit margins.

- Reduced Pricing Flexibility: To maintain margins, B&G Foods may need to pass these costs onto consumers, potentially impacting sales volume.

- Supply Chain Vulnerability: Reliance on a few key suppliers for critical inputs can create vulnerabilities if those suppliers exert significant price control.

- Impact on Operating Income: The inability to fully offset rising input costs can lead to a decline in operating income and overall profitability.

The bargaining power of suppliers is a critical force for B&G Foods, directly influencing input costs and overall profitability. Factors like supplier concentration, input uniqueness, switching costs, and the threat of forward integration all contribute to the leverage suppliers hold.

In 2024, B&G Foods, like many in the food industry, faced persistent inflationary pressures. For example, the cost of certain packaging materials saw increases of 5-10% compared to 2023. This dynamic grants suppliers greater ability to pass on their own rising costs for raw materials, energy, and labor, thereby squeezing B&G Foods' profit margins.

The company's reliance on specific ingredients or proprietary blends can also empower certain suppliers. If B&G Foods cannot easily substitute an ingredient, that supplier gains leverage. Switching costs, including retooling and recertification, further solidify this supplier power, making it challenging for B&G Foods to quickly change sourcing partners.

| Factor | Impact on B&G Foods | 2024 Data/Consideration |

|---|---|---|

| Supplier Concentration | Higher concentration = more supplier power | Dominance of a few large agricultural commodity producers |

| Uniqueness of Inputs | Unique inputs = more supplier power | Reliance on specialized spice blends or proprietary processing |

| Switching Costs | High switching costs = more supplier power | Significant investment in retooling and recertification |

| Threat of Forward Integration | Potential for suppliers to become competitors | Rare, but a major risk if a supplier enters the branded food market |

What is included in the product

This analysis examines the competitive forces impacting B&G Foods, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the influence of substitutes on its market position.

Instantly understand B&G Foods' competitive landscape with a clear, one-sheet summary of all five forces—perfect for quick decision-making.

Customers Bargaining Power

B&G Foods faces significant bargaining power from its customers, particularly large retail chains like Walmart and Kroger, which often represent a substantial portion of its sales. For instance, in 2023, B&G Foods reported that its largest customer accounted for approximately 12.9% of its net sales, highlighting the concentration of its customer base.

This concentration means that these major retailers wield considerable leverage. They can demand lower prices, more favorable payment terms, or significant promotional support, directly impacting B&G Foods' profitability and pricing strategies. The ongoing consolidation within the retail sector further amplifies this customer power.

Customer switching costs for B&G Foods are generally low, particularly for its retail and foodservice clients. The food industry is characterized by a wide array of similar products and readily available private label alternatives from major retailers. This ease of switching means customers can readily move to competitors offering lower prices or perceived better value, directly impacting B&G Foods' ability to dictate terms.

In 2024, the competitive landscape for packaged foods, B&G Foods' primary market, continued to be intense. Data from industry analysts indicated that private label brands captured an increasing share of the grocery market, often 20% or more in key categories, presenting a significant alternative for B&G Foods' retail customers. This trend amplifies the pressure on B&G Foods to maintain competitive pricing and product differentiation to mitigate customer churn.

Customer price sensitivity is a significant factor for B&G Foods. In 2024, with ongoing inflationary pressures, consumers are keenly focused on value, making them more likely to switch brands or opt for private labels if prices rise too sharply. This heightened sensitivity directly impacts B&G Foods' ability to pass on increased costs.

The packaged food sector, in particular, has seen consumers actively seeking out deals and promotions. This trend puts considerable pressure on retailers, who in turn, exert downward price pressure on manufacturers like B&G Foods. For instance, reports from early 2024 indicated that private label sales continued to gain market share, a direct consequence of consumer price consciousness.

Threat of Backward Integration by Customers

The bargaining power of customers for B&G Foods is significantly influenced by the threat of backward integration, particularly from large retail chains. These powerful customers, like Walmart or Kroger, have the financial resources and market access to develop their own private label brands, effectively competing with B&G Foods' established products. This capability allows them to control production, reduce costs, and capture more of the profit margin, thereby increasing their leverage over B&G Foods.

The increasing market share of private label goods directly amplifies this threat. In 2023, private label brands continued to gain traction, accounting for approximately 20% of total U.S. grocery sales, a trend that shows no signs of slowing. Retailers can leverage this by offering private label alternatives that mimic B&G Foods' offerings, often at a lower price point. This forces B&G Foods to either compete on price, squeezing margins, or risk losing shelf space and sales volume to these in-house brands.

- Retailer Dominance: Major grocery chains, which represent a substantial portion of B&G Foods' customer base, possess considerable market power.

- Private Label Growth: The ongoing expansion of private label products by retailers presents a direct challenge, offering consumers comparable quality at lower prices.

- Cost Control: Backward integration allows retailers to bypass B&G Foods, gaining control over manufacturing costs and potentially offering more competitive pricing.

- Shelf Space Leverage: Retailers can use their control over shelf space to favor their private label offerings, diminishing the visibility and sales potential of B&G Foods' branded products.

Availability of Substitute Products for Customers

The availability of numerous substitute products significantly impacts B&G Foods' bargaining power with its customers. Consumers can easily switch to competitor brands, private label options offered by retailers, or even fresh, unprocessed alternatives. This abundance of choice means customers can readily find similar products at different price points or with varying attributes, thereby diminishing B&G Foods' ability to dictate terms.

In 2024, the grocery sector continued to see robust competition, with private label brands gaining market share. For instance, Nielsen data indicated that private label sales represented approximately 19% of the total U.S. grocery market in early 2024, a figure that has been steadily growing. This trend directly challenges established brands like those under B&G Foods' umbrella, as it provides consumers with lower-cost alternatives that directly compete on price and often on quality.

- High Availability of Substitutes: Customers have a wide array of choices, including national brands, private labels, and fresh alternatives, limiting B&G Foods' pricing power.

- Private Label Growth: The increasing market share of private label brands (around 19% in early 2024 US grocery market) offers consumers cost-effective substitutes.

- Consumer Preference Shifts: Changing tastes towards value or specific dietary needs (e.g., organic, gluten-free) further expand the substitute landscape, weakening brand loyalty.

- Impact on Pricing: The ease with which consumers can switch brands due to readily available substitutes pressures B&G Foods to maintain competitive pricing, thus reducing their leverage.

B&G Foods faces substantial customer bargaining power, primarily from large retail chains. These powerful buyers can demand lower prices, favorable terms, and promotional support, directly impacting B&G Foods' profitability. The consolidation within the retail sector further amplifies this leverage, as fewer, larger entities control significant market share.

Customer switching costs are minimal for B&G Foods, especially for its retail and foodservice clients. The food industry offers a plethora of similar products and readily available private label alternatives. This ease of switching allows customers to readily shift to competitors offering better value, diminishing B&G Foods' ability to set terms.

The threat of backward integration by retailers is a significant concern. Large chains can develop their own private label brands, effectively competing with B&G Foods. This allows them to control production costs and increase their leverage. In 2023, private labels captured around 20% of U.S. grocery sales, a trend that continues to empower retailers.

The availability of numerous substitute products, including national brands, private labels, and fresh alternatives, significantly limits B&G Foods' pricing power. Consumer preference shifts towards value and specific dietary needs further expand this substitute landscape, weakening brand loyalty and pressuring B&G Foods to maintain competitive pricing.

| Factor | Impact on B&G Foods | 2024 Context |

|---|---|---|

| Customer Concentration | High leverage for major retailers | Largest customer accounted for ~12.9% of net sales in 2023 |

| Switching Costs | Low for retail/foodservice clients | Easy access to private label and competitor brands |

| Private Label Growth | Direct competition, price pressure | Private labels held ~19-20% of U.S. grocery market in early 2024 |

| Backward Integration Threat | Retailers can bypass B&G Foods | Retailers possess financial capacity to develop in-house brands |

Preview the Actual Deliverable

B&G Foods Porter's Five Forces Analysis

This preview showcases the complete B&G Foods Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. You're looking at the actual document, ensuring that what you see is precisely what you'll receive immediately after purchase, fully formatted and ready for your strategic planning needs.

Rivalry Among Competitors

B&G Foods faces intense competition due to the sheer volume and variety of companies in the shelf-stable and frozen food sectors. This includes giants like Kraft Heinz and Conagra Brands, alongside numerous smaller, specialized brands that can quickly adapt to consumer trends.

The market is further intensified by the presence of private label offerings from major retailers, which often compete directly on price. For instance, in 2024, private label sales in the U.S. grocery market continued to show strong growth, capturing a significant share of consumer spending in many food categories.

The food industry, particularly the segments B&G Foods operates within, presents a mixed growth landscape. While some niche or emerging food categories might experience robust expansion, many traditional packaged food markets are more mature. This maturity often translates into intensified competition, as companies like B&G Foods must fight harder for existing market share rather than benefiting from broad market growth.

In 2024, the broader Consumer Packaged Goods (CPG) market, which encompasses many of B&G Foods' product lines, is generally characterized by moderate growth. However, this growth is often accompanied by volume challenges, meaning that while sales value might increase, the actual quantity of products sold may not see significant gains. This dynamic further fuels competitive rivalry as companies strive to capture every available unit of demand.

B&G Foods relies on its portfolio of established brands, aiming to differentiate itself through brand recognition and perceived quality. However, the grocery landscape is increasingly populated by private label brands that can mimic product quality and features at a lower price point. This dynamic makes it difficult for B&G Foods to maintain significant product differentiation solely on these factors, often pushing competition towards price.

Exit Barriers for Competitors

Competitors in the food industry, including those in B&G Foods' space, often face significant hurdles when trying to exit the market. These can include specialized manufacturing equipment that has limited resale value or high fixed costs tied to production facilities.

For instance, the food processing sector often involves substantial investments in plant and machinery, making closure a costly affair. These assets, while essential for operation, can be difficult to divest without substantial loss.

- Specialized Assets: Food manufacturers often possess highly specific machinery for processes like canning, freezing, or packaging, which are not easily repurposed or sold to other industries.

- High Fixed Costs: Maintaining and eventually decommissioning large manufacturing plants incurs significant fixed costs, including labor, utilities, and environmental compliance, even when operations cease.

- Brand Legacy and Goodwill: Established brands have built considerable goodwill and market presence over years, representing intangible assets that are difficult to liquidate and represent a sunk cost for exiting firms.

Strategic Commitments of Competitors

Competitors in the food industry are making significant long-term strategic investments. For instance, many are actively pursuing mergers and acquisitions, with the sector witnessing substantial deal volumes. Companies are also heavily investing in new product development and expanding their production capacities to capture market share.

These strategic commitments translate into aggressive marketing campaigns and a focus on portfolio repositioning. For example, in 2024, major food conglomerates continued to divest non-core brands and acquire businesses in high-growth categories like plant-based foods and healthy snacks. This ongoing activity requires B&G Foods to constantly adapt its strategies to remain competitive.

- Ongoing M&A Activity: The food industry consistently sees strategic mergers and acquisitions as companies aim to consolidate, gain scale, or enter new markets.

- Portfolio Repositioning: Rivals are actively divesting underperforming brands and investing in high-growth segments, such as premium or health-focused food products.

- Capacity Expansion and Innovation: Competitors are committing capital to expand manufacturing capabilities and invest in research and development for new product launches.

- Aggressive Marketing: Significant marketing budgets are allocated to build brand awareness and drive consumer demand, often through digital channels and influencer partnerships.

Competitive rivalry within the food industry, impacting B&G Foods, is exceptionally fierce. This is driven by a crowded marketplace featuring both large, established players and agile niche brands, all vying for consumer attention. The prevalence of private label brands, which often match product quality at lower price points, further intensifies this rivalry, particularly in 2024 where private label market share continued its upward trend.

The mature nature of many packaged food markets means companies like B&G Foods must aggressively defend existing market share rather than capitalize on broad market expansion. This dynamic is further fueled by competitors’ substantial, long-term investments in capacity expansion, innovation, and aggressive marketing campaigns, as evidenced by ongoing M&A activity and portfolio repositioning strategies observed throughout 2024.

| Competitive Factor | Impact on B&G Foods | 2024 Market Trend Example |

|---|---|---|

| Number of Competitors | High rivalry, price pressure | Continued consolidation and new entrants in niche segments |

| Private Label Competition | Erosion of brand loyalty, price sensitivity | Increased market share for private labels across various food categories |

| Product Differentiation | Challenging due to similar offerings | Focus on health, convenience, and sustainability as key differentiators |

| Exit Barriers | High, leading to continued operation and competition | Specialized food manufacturing assets retain value but are difficult to repurpose |

SSubstitutes Threaten

The threat of substitutes for B&G Foods' products is significant, particularly concerning the price-performance trade-off. Consumers are increasingly scrutinizing the value proposition of packaged and frozen goods when compared to alternatives.

Fresh ingredients for home cooking, for instance, can offer a more appealing price point and perceived quality, especially as inflation impacts grocery budgets. In 2024, many consumers are actively seeking ways to reduce food expenses, making the cost savings associated with preparing meals from scratch a powerful draw against pre-packaged options.

Furthermore, restaurant meals and private label brands also present strong competitive alternatives. These options can sometimes offer a comparable or even superior performance for a lower price, intensifying the pressure on B&G Foods to maintain competitive pricing and perceived value in its product portfolio.

Consumer willingness to switch to alternatives is a significant factor for B&G Foods. In 2024, the growing demand for fresh, plant-based, and organic foods presents a clear substitute. For instance, the plant-based food market alone was projected to reach over $7 billion in the US by 2024, directly challenging traditional packaged goods.

Economic pressures also fuel this substitution. When consumers feel the pinch, they often trade down to less expensive brands or opt for making items from scratch. This increased interest in home cooking, partly driven by cost-saving measures in 2024, means consumers might bypass B&G Foods' prepared items for ingredients they can assemble themselves.

The threat of substitutes for B&G Foods' products is significant, primarily due to the widespread availability and increasing awareness of alternative food options. Customers can easily access and learn about alternatives like scratch-cooked meals, which offer customization and perceived freshness. In 2024, the growth in the home cooking segment, fueled by ongoing interest in culinary exploration, directly competes with pre-packaged goods.

Meal kits, offering convenience and curated ingredients, also pose a strong substitute threat. Competitors actively market new food trends and healthy eating options, further educating consumers about choices beyond B&G Foods' traditional offerings. The proliferation of private label brands in grocery stores provides readily accessible and often lower-priced alternatives, directly impacting B&G Foods' market share.

Switching Costs for Customers to Substitutes

The threat of substitutes for B&G Foods' products is generally high due to low switching costs for consumers. In the grocery aisle, customers can easily opt for a different brand or even an entirely different type of food product on their next shopping trip without facing significant inconvenience or financial penalties. This ease of transition means that if B&G Foods' pricing or product offerings become less attractive, consumers can readily shift their loyalty.

Consider the vast array of choices available in categories where B&G Foods operates, such as canned vegetables, sauces, and snacks. For instance, a consumer might switch from B&G Foods' Green Giant canned peas to a competitor's brand or even fresh peas if the price difference is negligible or a promotion is compelling. This dynamic is further amplified by the prevalence of private label brands, which often offer comparable quality at a lower price point, acting as direct substitutes.

The low switching costs are a critical factor in the competitive landscape for B&G Foods. In 2023, the U.S. grocery market saw private label brands capture a record 21.5% of dollar share, according to Circana data. This trend highlights consumer willingness to switch to less expensive alternatives, directly impacting B&G Foods' ability to retain market share without constant innovation and competitive pricing.

- Low Switching Costs: Consumers face minimal barriers when moving from B&G Foods products to alternatives.

- Brand Loyalty Erosion: The ease of switching makes brand loyalty less sticky, particularly in price-sensitive categories.

- Private Label Competition: The increasing market share of private label brands (21.5% dollar share in U.S. groceries in 2023) intensifies the threat of substitutes.

Technological Advancements Enabling Substitutes

Technological advancements are increasingly creating viable substitutes for B&G Foods' traditional offerings. The rise of direct-to-consumer meal kits, for instance, provides consumers with convenient, pre-portioned ingredients and recipes, directly challenging the need for shelf-stable pantry staples. In 2024, the meal kit industry continued its growth trajectory, with companies like HelloFresh and Blue Apron reporting strong customer acquisition and retention rates, indicating a sustained consumer preference for these convenient alternatives.

Furthermore, innovations in food preparation appliances, such as high-speed blenders and multi-functional ovens, empower consumers to create fresh, customized meals more easily at home. This reduces reliance on pre-packaged or frozen foods. The market for smart kitchen appliances saw significant growth in 2024, with sales increasing by an estimated 15% year-over-year, signaling a consumer shift towards home-based culinary solutions.

Emerging food delivery models also act as potent substitutes. On-demand services offering freshly prepared meals from a variety of restaurants can bypass the need for consumers to purchase and prepare food items from grocery stores. The food delivery sector in 2024 remained robust, with major platforms reporting billions of dollars in revenue, highlighting the convenience factor that directly competes with traditional grocery shopping and B&G Foods' product categories.

These evolving consumer behaviors and technological enablers present a significant threat:

- Direct-to-Consumer Meal Kits: Growing market share in 2024, offering convenience and customization.

- Advanced Food Preparation Appliances: Enabling home cooks to create fresh meals, reducing reliance on packaged goods.

- Innovative Food Delivery Models: Providing convenient access to freshly prepared meals, bypassing traditional grocery purchases.

- Plant-Based and Alternative Proteins: Technological improvements are making these substitutes more appealing and accessible, potentially impacting demand for traditional processed foods.

The threat of substitutes for B&G Foods' products is substantial, driven by consumers' increasing preference for fresh ingredients and home cooking, especially in 2024's cost-conscious environment. The convenience of meal kits and the accessibility of restaurant delivery further intensify this pressure. The rise of private label brands, capturing 21.5% of dollar share in U.S. groceries in 2023, underscores the ease with which consumers switch to more economical alternatives.

| Substitute Category | Key Drivers | Impact on B&G Foods |

| Fresh Ingredients / Home Cooking | Cost savings, perceived health benefits, culinary exploration (growing in 2024) | Direct competition with packaged goods, potential volume loss |

| Meal Kits | Convenience, portion control, variety, direct-to-consumer models | Bypasses traditional grocery purchases, appeals to time-strapped consumers |

| Restaurant Delivery / Prepared Meals | Convenience, immediate gratification, variety of cuisines | Offers a complete meal solution, reducing need for grocery items |

| Private Label Brands | Lower price points, comparable quality, increased shelf space | Erodes brand loyalty, pressures pricing strategies (21.5% U.S. grocery dollar share in 2023) |

Entrants Threaten

Starting a food manufacturing and distribution business requires a substantial financial outlay. This includes setting up production facilities, acquiring specialized machinery, and building a robust supply chain network. For instance, a modern food processing plant can easily cost tens of millions of dollars to construct and equip.

These considerable capital requirements act as a significant hurdle for potential new entrants looking to compete in the food industry where B&G Foods operates. The sheer scale of investment needed can deter many aspiring companies, thereby limiting the threat of new competitors.

B&G Foods, like many established players in the consumer packaged goods sector, benefits significantly from economies of scale. This means their large-scale production allows them to spread fixed costs over a greater output, leading to lower per-unit costs. For instance, in 2023, B&G Foods reported net sales of $2.0 billion, indicating a substantial operational footprint that new entrants would find difficult to replicate quickly.

The sheer volume of raw materials B&G Foods purchases gives them considerable bargaining power with suppliers. This bulk purchasing often translates into lower ingredient costs compared to smaller, newer companies. This cost advantage is a significant barrier, as it makes it challenging for new entrants to compete on price and achieve similar profit margins, especially in the highly competitive grocery market.

Furthermore, B&G Foods possesses well-established and efficient distribution networks. These networks ensure their products reach consumers across various retail channels effectively and at a lower logistical cost per unit. Building a comparable distribution system requires substantial investment and time, presenting another hurdle for potential new competitors seeking to enter the market.

Brand loyalty is a major barrier for new entrants wanting to compete with B&G Foods. Their portfolio includes established names like Green Giant and Ortega, which have built strong customer recognition over many years. This existing brand equity means newcomers must invest heavily in marketing and time to even begin building a comparable level of trust and preference.

Access to Distribution Channels

New companies entering the food industry face substantial challenges in securing access to crucial distribution channels. Established players like B&G Foods have built strong, long-standing relationships with major grocery chains and food service providers, making it difficult for newcomers to gain shelf space.

The limited availability of prime shelf real estate in supermarkets, coupled with significant slotting fees – which can range from a few thousand to tens of thousands of dollars per SKU per year – acts as a major barrier. For instance, in 2024, the average slotting fee for a new product in a major US supermarket chain could easily exceed $20,000, making market entry prohibitively expensive for many startups.

- Limited Shelf Space: Major retailers allocate finite shelf space, prioritizing proven performers and existing partners.

- Slotting Fees: These upfront payments required by retailers to stock new products represent a significant financial hurdle.

- Established Relationships: Existing distributors and retailers often favor established brands with proven sales records and marketing support.

- Distribution Network Costs: Building an effective distribution network from scratch requires substantial investment in logistics and warehousing.

Government Policy and Regulations

Government policies and regulations significantly shape the threat of new entrants in the food industry. Strict compliance with health and safety standards, such as those enforced by the Food and Drug Administration (FDA), requires substantial upfront investment in facilities, processes, and quality control. For instance, the FDA's Food Safety Modernization Act (FSMA) mandates preventive controls, increasing operational complexity and costs for any new player seeking to enter the market.

Labeling requirements, including nutritional information and ingredient transparency, also present a barrier. Companies must invest in accurate testing and compliant packaging, adding to the initial capital expenditure. In 2024, the ongoing scrutiny of food additives and allergen labeling continues to demand rigorous adherence, making it more challenging for smaller, less capitalized firms to navigate these complexities compared to established entities like B&G Foods, which have robust systems in place.

Environmental regulations, covering aspects like waste management and sustainable sourcing, further increase the cost of entry. New entrants must factor in compliance with these standards, which can involve significant capital outlay for environmentally friendly practices and certifications.

- FDA compliance costs: New food producers must invest heavily in meeting FDA regulations, impacting profitability.

- Labeling complexity: Accurate nutritional and ingredient labeling requires specialized testing and packaging, adding to initial expenses.

- Environmental standards: Adherence to waste management and sustainability regulations necessitates upfront capital for compliant operations.

- Barriers to entry: These combined regulatory hurdles create substantial barriers, deterring potential new competitors from entering the food production market.

The threat of new entrants for B&G Foods is relatively low due to significant capital requirements, estimated in the tens of millions for a modern food processing plant, and the need for established distribution networks. New companies also face high slotting fees, potentially exceeding $20,000 per SKU in 2024, and the challenge of building brand loyalty against established names like Green Giant.

Regulatory compliance, including FDA standards and complex labeling requirements, adds further substantial costs and operational hurdles for newcomers. These combined factors create considerable barriers, making it difficult and expensive for new companies to effectively compete with established players like B&G Foods in the consumer packaged goods market.

| Barrier Type | Description | Estimated Cost/Impact (2024 Data) |

| Capital Requirements | Setting up production facilities and machinery | Tens of millions of dollars for a modern plant |

| Distribution Access | Securing shelf space and building logistics | High slotting fees (e.g., >$20,000 per SKU) |

| Brand Equity | Building customer trust against established brands | Significant marketing investment required |

| Regulatory Compliance | Meeting FDA, labeling, and environmental standards | Increased operational costs and complexity |

Porter's Five Forces Analysis Data Sources

Our B&G Foods Porter's Five Forces analysis is built upon a foundation of comprehensive data, including B&G Foods' annual reports, SEC filings, and investor presentations. We also incorporate industry-specific data from market research firms like IBISWorld and Mintel, alongside broader economic indicators from sources such as the Bureau of Labor Statistics.