B&G Foods PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B&G Foods Bundle

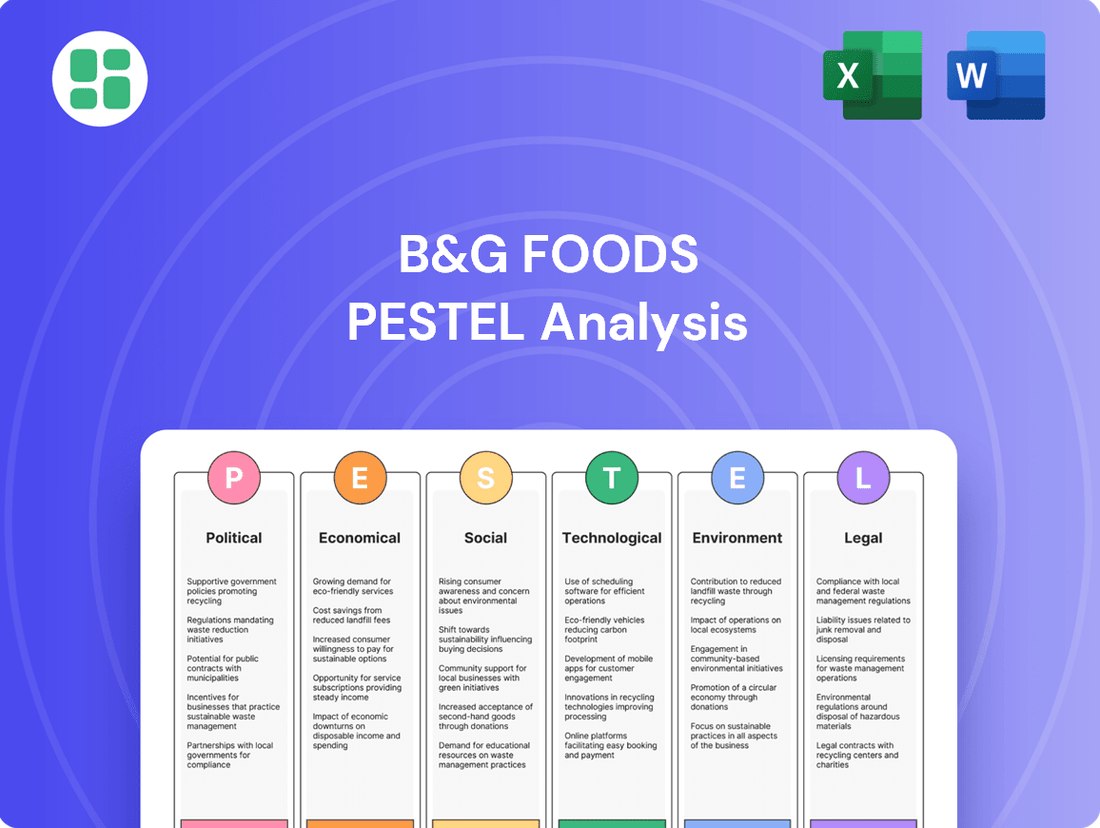

Navigate the complex external forces impacting B&G Foods with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are shaping the company's strategic landscape. Gain the foresight needed to anticipate challenges and capitalize on opportunities.

Unlock actionable intelligence on B&G Foods's operating environment. Our PESTLE analysis dives deep into technological advancements, environmental regulations, and legal frameworks affecting the food industry. Equip yourself with the knowledge to make informed decisions and strengthen your market position.

Don't get left behind in the dynamic food sector. Download our meticulously researched PESTLE analysis of B&G Foods to gain a competitive edge. Discover critical insights that can inform your investment strategies and business planning, ensuring you're always one step ahead.

Political factors

Shifts in global trade policies, particularly the implementation of new tariffs, directly affect B&G Foods by altering the cost of essential imported ingredients. For instance, the potential reintroduction of protectionist trade measures, like those seen in earlier 'America First' initiatives, could raise import duties on vital raw materials. This would inevitably increase supply chain expenses and necessitate a strategic review of B&G Foods' global sourcing operations to maintain competitive pricing.

Government subsidies for agricultural products significantly impact the cost of raw materials for food manufacturers like B&G Foods. For instance, in the US, the USDA's Commodity Credit Corporation (CCC) provides billions in support annually, influencing prices for key ingredients such as corn and soybeans, which are foundational to many food products.

Changes in subsidy levels can directly alter B&G Foods' procurement expenses. If subsidies for a particular crop decrease, the cost of that ingredient for B&G Foods may rise, necessitating adjustments in production costs and potentially affecting their pricing strategies across their extensive range of shelf-stable and frozen food items.

Political initiatives, such as the 'Make America Healthy Again' movement, are increasing scrutiny on food additives and manufacturing processes. This could lead to significant changes in regulations like the 'generally recognized as safe' (GRAS) rule, impacting the food industry broadly.

These potential regulatory shifts demand that companies like B&G Foods invest in product reformulation and ensure strict compliance. For instance, the FDA's ongoing review of certain food additives could necessitate costly product overhauls for B&G Foods, potentially affecting their 2024 and 2025 financial outlook.

Food Labeling and Advertising Regulations

Government stances on food labeling are constantly shifting. For instance, new definitions for what constitutes a 'healthy' claim are being introduced, and front-of-package labeling systems, like the one adopted in Canada, are becoming more prevalent. These changes mean companies like B&G Foods must adapt their product packaging and marketing strategies to remain compliant.

Complying with these evolving regulations is crucial for consumer transparency, but it's not without its challenges. B&G Foods will likely face significant costs associated with updating packaging, reformulating products to meet new claims, and ensuring all marketing materials accurately reflect current standards. This necessitates a thorough review of all product claims and advertising.

- Regulatory Landscape: Canada's front-of-package nutrition labeling system, implemented in January 2022, requires specific symbols on foods high in saturated fat, sodium, and sugars.

- Cost of Compliance: Industry estimates suggest that packaging redesign and reformulation can cost millions of dollars for large food manufacturers.

- Consumer Trust: Clearer labeling aims to build consumer trust, but missteps in compliance can lead to reputational damage and potential fines.

Geopolitical Stability in Sourcing Regions

Political instability in key sourcing regions can significantly disrupt B&G Foods' supply chains. For example, ongoing conflicts in Eastern Europe, a major supplier of certain grains and oils, led to a notable increase in commodity prices throughout 2024. This geopolitical tension directly impacts B&G Foods' cost of goods sold, necessitating a strong focus on supply chain resilience.

The food industry, including B&G Foods, experienced elevated raw material costs in 2024 due to a confluence of geopolitical events. Reports indicate that the average cost of key ingredients like edible oils and grains saw an increase of 15-20% compared to 2023, directly attributable to supply chain disruptions stemming from regional conflicts and trade policy shifts.

- Supply Chain Vulnerability: Political instability in sourcing countries creates a direct risk of raw material shortages.

- Price Volatility: Geopolitical events directly contribute to fluctuating ingredient costs, impacting B&G Foods' profitability.

- Resilience as a Priority: Companies like B&G Foods are increasingly investing in diversifying suppliers and building robust inventory management to mitigate these risks.

- Impact on 2024 Costs: The food sector saw an estimated 18% rise in essential commodity prices in 2024 due to these political factors.

Government regulations surrounding food safety and labeling continue to evolve, directly impacting B&G Foods' operational costs and product development strategies. For instance, the FDA's ongoing scrutiny of certain food additives could necessitate costly reformulations for B&G Foods, potentially affecting their 2024 and 2025 financial performance.

Shifting trade policies and potential tariffs on imported ingredients present a significant challenge, increasing supply chain expenses and requiring B&G Foods to adapt its global sourcing. Political instability in key sourcing regions, such as Eastern Europe, also contributed to an estimated 18% rise in essential commodity prices in 2024, impacting the cost of goods sold.

Government subsidies for agricultural products, like those from the USDA's Commodity Credit Corporation, influence the cost of foundational ingredients for B&G Foods. Changes in these subsidy levels can directly alter procurement expenses, forcing adjustments in production costs and pricing strategies.

The increasing prevalence of front-of-package nutrition labeling systems, like Canada's, requires B&G Foods to invest in packaging redesign and ensure product compliance, with industry estimates suggesting millions in costs for large manufacturers.

What is included in the product

This PESTLE analysis of B&G Foods examines how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal shifts, influence the company's strategic landscape.

It provides actionable insights for stakeholders to navigate market dynamics and capitalize on emerging opportunities within the food industry.

A concise PESTLE analysis of B&G Foods, distilled into actionable insights, helps alleviate the pain of information overload during strategic planning.

This PESTLE analysis provides a clear, summarized version of external factors affecting B&G Foods, simplifying complex market dynamics for easy referencing during meetings and presentations.

Economic factors

Persistent inflation and elevated food prices are significantly impacting consumer spending power. This economic pressure forces consumers to adjust their purchasing patterns, often opting for more affordable options or private label brands, which directly affects sales volumes for companies like B&G Foods.

In fiscal year 2024, B&G Foods experienced a net sales decline of 1.5% to $2.18 billion, reflecting these consumer shifts. Furthermore, the company reported a reduction in adjusted EBITDA for Q2 2025, underscoring the profitability challenges posed by this economic environment.

B&G Foods, like many in the food manufacturing sector, continues to navigate ongoing supply chain challenges. These include persistently elevated logistics costs and the potential for shortages of key raw materials, impacting the industry's operational stability.

These pressures directly affect B&G Foods' ability to manage rising input expenses, potentially squeezing gross profit margins. The company must implement strategic adjustments in its procurement strategies and distribution networks to mitigate these impacts.

For instance, in the first quarter of 2024, B&G Foods reported that increased input costs, including those related to supply chain disruptions, contributed to a decline in its gross profit margin compared to the previous year, underscoring the financial implications of these factors.

Changes in interest rates directly affect B&G Foods' borrowing costs. For instance, if the Federal Reserve raises its benchmark rate, B&G Foods' interest expenses on its variable-rate debt would likely increase, squeezing profit margins. This makes managing existing debt and financing new ventures more expensive.

The company's strategic priority to reduce net leverage, aiming for a target range of 3.0x to 3.5x net debt to adjusted EBITDA as of their 2023 investor day, highlights the critical role of capital costs. Lowering debt reduces interest payments, freeing up cash flow that can be reinvested in the business, such as for acquisitions or marketing initiatives.

As of Q1 2024, B&G Foods reported a net leverage ratio of 3.7x, indicating continued efforts are needed to reach their target. This ongoing focus underscores the sensitivity of their financial health to prevailing interest rate environments and their commitment to a more robust balance sheet.

Portfolio Shaping and Divestitures

B&G Foods is strategically reshaping its portfolio by divesting non-core brands. This economic maneuver is designed to bolster margins, enhance cash flow, and sharpen the company's financial focus. For instance, in 2023, the company completed the divestiture of its Green Giant frozen business, a move expected to yield approximately $700 million in net cash proceeds. This initiative is a key component of their long-term strategy to cultivate a more streamlined business, targeting improved adjusted EBITDA as a percentage of net sales.

The ongoing portfolio adjustments are directly impacting B&G Foods' financial performance and strategic direction. By shedding underperforming or non-essential assets, the company aims to unlock greater value and improve its overall financial health. This includes a focus on brands that demonstrate stronger growth potential and higher profitability. The economic rationale behind these divestitures is to concentrate resources on core competencies, thereby driving more sustainable and profitable growth.

- Portfolio Optimization: B&G Foods is actively divesting brands to enhance its overall financial profile.

- Margin Improvement: The strategy targets higher profit margins by focusing on core, higher-performing brands.

- Cash Flow Generation: Divestitures are expected to free up capital and improve cash flow dynamics.

- Strategic Focus: This economic strategy aims to create a more streamlined business with enhanced long-term value creation potential.

Exchange Rate Fluctuations

Exchange rate fluctuations present a significant economic factor for B&G Foods, given its operations in the United States, Canada, and Puerto Rico. Changes in currency values can directly impact the company's reported net sales and cost of goods sold, especially for items manufactured outside the U.S. For instance, a stronger U.S. dollar relative to the Canadian dollar can reduce the reported value of Canadian sales when converted back to U.S. dollars.

These currency headwinds have demonstrably affected B&G Foods' financial performance. In the first quarter of 2024, the company reported that unfavorable foreign currency movements resulted in a negative impact on net sales. This trend continued into the second quarter of 2024, where foreign currency translation adversely affected reported sales by approximately $6 million.

The impact of these fluctuations can be seen in specific financial reporting periods:

- Q1 2024: Unfavorable foreign currency movements contributed to a decline in reported net sales.

- Q2 2024: Foreign currency translation negatively impacted reported sales by roughly $6 million.

- Full Year 2024 Outlook: B&G Foods anticipated a potential negative impact from foreign currency on its full-year net sales, though specific figures are subject to ongoing market volatility.

Persistent inflation and elevated food prices continue to impact consumer spending power, leading to shifts towards more affordable options. This economic reality directly influences B&G Foods' sales volumes, as evidenced by their fiscal year 2024 net sales decline of 1.5% to $2.18 billion and a reduction in adjusted EBITDA for Q2 2025.

Supply chain disruptions and rising input costs remain a concern, squeezing gross profit margins. B&G Foods reported in Q1 2024 that increased input costs contributed to a decline in their gross profit margin compared to the prior year.

Interest rate changes affect B&G Foods' borrowing costs, with a Q1 2024 net leverage ratio of 3.7x indicating ongoing efforts to reach their target range of 3.0x to 3.5x.

The company's strategic divestitures, like the 2023 Green Giant frozen business sale for approximately $700 million, aim to bolster margins and sharpen financial focus.

Foreign currency fluctuations, particularly with the Canadian dollar, negatively impacted B&G Foods' reported sales by about $6 million in Q2 2024.

| Economic Factor | Impact on B&G Foods | Supporting Data (2024/2025) |

| Inflation & Food Prices | Reduced consumer spending power, shift to private labels | FY 2024 Net Sales: $2.18 billion (-1.5%); Q2 2025 Adjusted EBITDA reduction |

| Supply Chain Costs | Elevated logistics and raw material costs, margin pressure | Q1 2024: Increased input costs impacted gross profit margin |

| Interest Rates | Higher borrowing costs, focus on leverage reduction | Q1 2024 Net Leverage Ratio: 3.7x (Target: 3.0x-3.5x) |

| Portfolio Optimization | Divestiture of non-core brands to improve margins and cash flow | 2023 Green Giant divestiture: ~$700 million net cash proceeds |

| Exchange Rates | Negative impact on reported sales from currency translation | Q2 2024: ~$6 million negative impact from foreign currency |

Full Version Awaits

B&G Foods PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive B&G Foods PESTLE Analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting B&G Foods.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights for strategic planning.

Sociological factors

Consumers are increasingly prioritizing health and wellness, leading to a surge in demand for food options that are less processed, plant-based, or offer distinct nutritional advantages. This shift is a significant sociological trend impacting the food industry.

B&G Foods needs to actively respond to this by evolving its product offerings and focusing innovation on healthier choices. Transparency regarding ingredients is also becoming a critical factor for consumers making purchasing decisions.

For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162 billion by 2030, demonstrating the scale of this consumer preference. Similarly, the global functional foods market was estimated at $195.7 billion in 2023 and is expected to grow substantially.

The ongoing preference for eating at home, fueled by the increasing expense of dining out and a general need for convenience, creates a dynamic environment for B&G Foods. This trend is substantial, with consumer spending on food away from home seeing a notable increase, making at-home meal preparation a more attractive alternative for many households.

B&G Foods' extensive range of shelf-stable and frozen products aligns well with this consumer behavior, offering ready-to-prepare or easily incorporated meal components. For instance, the company's brands often feature in grocery aisles catering to busy consumers seeking quick meal solutions, a segment that experienced significant growth throughout 2024.

However, the market for convenient meal solutions is intensely competitive, with numerous brands vying for consumer attention and loyalty. B&G Foods must continue to innovate and effectively market its offerings to stand out amidst this crowded landscape, as consumers increasingly expect both convenience and quality.

Consumers are increasingly focused on getting the most for their money, especially with ongoing economic uncertainties. This value-seeking behavior means they're actively looking for products that offer good quality at a lower price point, often turning to private-label brands or opting for promotions. For instance, in early 2024, grocery inflation remained a concern for many households, pushing them towards more economical choices.

B&G Foods must adapt to this trend by ensuring its pricing remains competitive and by considering strategic promotional activities. This could involve offering multi-buy discounts or highlighting the cost-effectiveness of its products compared to alternatives. The company's ability to resonate with budget-conscious shoppers will be key to maintaining market share.

Increased Awareness of Food Origins and Traceability

Consumers are increasingly demanding transparency regarding where their food comes from and how it's produced. This societal trend directly influences food companies like B&G Foods, requiring them to invest in robust traceability systems and highlight ethical sourcing. For example, a 2024 survey indicated that 72% of consumers consider food origin important when making purchasing decisions.

This heightened awareness of food origins and supply chain integrity is a significant sociological factor impacting B&G Foods. Companies that can effectively communicate their sourcing practices and ensure traceability are likely to build stronger consumer trust and loyalty. This shift means more scrutiny on ingredients, labor practices, and environmental impact throughout the value chain.

- Growing demand for transparency: Consumers want to know the journey of their food from farm to table.

- Impact on brand loyalty: Companies demonstrating ethical sourcing and traceability often see increased consumer trust.

- Supply chain investment: Businesses are compelled to invest in technologies and processes that support detailed product tracking.

- Ethical sourcing as a differentiator: Sustainable and fair labor practices are becoming key selling points for food products.

Demographic Shifts and Changing Dietary Needs

Global population growth, projected to reach nearly 9.7 billion by 2050 according to UN estimates, coupled with evolving demographics, significantly shapes food consumption. An aging global population, for instance, often necessitates different nutritional considerations and product formats. B&G Foods needs to adapt its portfolio to cater to these changing health and convenience needs.

Furthermore, increasing cultural diversity within markets presents both challenges and opportunities. As populations become more heterogeneous, there's a growing demand for a wider array of ethnic and specialty food products. B&G Foods' strategy must acknowledge and leverage these diverse dietary preferences, potentially through product innovation or targeted marketing campaigns.

Consider these key demographic and dietary trends impacting B&G Foods:

- Aging Population: Globally, the proportion of people aged 65 and over is expected to nearly double by 2050, increasing demand for foods that support health and are easy to prepare.

- Cultural Diversification: Immigration and global travel are leading to more diverse palates, driving demand for authentic international flavors and ingredients.

- Health and Wellness Focus: Consumers, particularly older demographics, are increasingly seeking products with specific nutritional benefits, such as lower sodium, added fiber, or plant-based ingredients.

- Convenience Needs: Busy lifestyles, common across many age groups, continue to fuel demand for ready-to-eat or easily prepared meals and snacks.

Sociological factors significantly influence consumer behavior, pushing B&G Foods to adapt its product development and marketing strategies. The increasing demand for transparency in food sourcing and production is a prime example, with a 2024 survey indicating that 72% of consumers consider food origin important. This trend necessitates investments in traceability and clear communication about ethical practices.

The growing emphasis on health and wellness, evidenced by the global plant-based food market's projected growth to $162 billion by 2030, also compels B&G Foods to innovate. Simultaneously, the preference for at-home dining, driven by economic factors and convenience, plays to the strengths of B&G Foods' product portfolio.

Demographic shifts, such as an aging global population and increasing cultural diversity, present both challenges and opportunities for B&G Foods. Catering to the distinct nutritional needs of older adults and embracing the demand for diverse ethnic flavors will be crucial for sustained growth and market relevance in the coming years.

Technological factors

The manufacturing sector, including food production, is increasingly embracing automation and robotics. This trend is driven by the need to boost efficiency, combat persistent labor shortages, and elevate food safety standards. For instance, in 2024, the global industrial robotics market was projected to reach over $70 billion, highlighting significant investment in these technologies.

B&G Foods can strategically integrate advanced automation, such as AI-powered quality control systems and robotic packaging lines, to streamline operations. This adoption can lead to substantial cost reductions through optimized resource allocation and reduced waste, thereby strengthening B&G Foods' competitive position in the evolving food manufacturing landscape.

The digitalization of B&G Foods' supply chain, integrating technologies such as blockchain and big data analytics, is crucial for optimizing inventory in real-time and bolstering traceability from origin to consumer. This technological shift is paramount for enhancing operational transparency and minimizing waste.

By adopting these advancements, B&G Foods can more effectively meet evolving and increasingly rigorous food safety regulations. For instance, the global food traceability market was valued at approximately $1.5 billion in 2023 and is projected to grow significantly, indicating a strong industry trend towards greater transparency.

B&G Foods is leveraging big data and analytics to unlock deeper consumer insights. By analyzing vast datasets, the company can identify evolving preferences, track purchasing habits, and spot emerging market trends. This granular understanding is crucial for refining product development and tailoring marketing campaigns for maximum impact.

In 2024, the food industry's reliance on data analytics for consumer understanding is projected to grow significantly. Companies that effectively utilize these tools can anticipate shifts in demand with greater accuracy. For B&G Foods, this translates to more efficient inventory management and a reduced risk of stockouts or overstocking, directly impacting profitability.

Innovation in Food Processing and Product Development

Technological progress in food processing, like high-pressure processing (HPP) and precision fermentation, presents significant opportunities for B&G Foods. These advancements allow for extended shelf life, better nutrient preservation, and the creation of novel product forms. For instance, HPP is increasingly used for ready-to-eat meals and beverages, enhancing safety and quality without heat.

B&G Foods' investment in research and development for these innovative food technologies is crucial for differentiation in a competitive market. By adopting cutting-edge methods, the company can better cater to changing consumer preferences for healthier, more sustainable, and convenient food options. This focus on innovation directly addresses the growing demand for functional foods and plant-based alternatives.

Consider the impact of automation and AI in manufacturing. In 2024, the food processing industry saw increased adoption of AI for quality control and predictive maintenance, potentially leading to operational efficiencies for companies like B&G Foods. Furthermore, advancements in packaging technology, such as active and intelligent packaging, can further extend product freshness and provide consumers with more information.

- HPP Adoption: High-pressure processing is gaining traction, with the global market projected to reach approximately $4.4 billion by 2027, indicating strong consumer acceptance and industry investment.

- Precision Fermentation Growth: This technology, used to produce proteins and other ingredients, is expected to see substantial growth, potentially reaching tens of billions of dollars in the coming years, offering B&G Foods new ingredient sourcing opportunities.

- AI in Food Manufacturing: Early reports from 2024 suggest that AI implementation in food production can reduce waste by up to 15% and improve quality control accuracy.

- Sustainable Packaging Innovation: B&G Foods can leverage advancements in biodegradable and recyclable packaging materials to meet consumer demand for eco-friendly products.

E-commerce and Digital Sales Channels

The rise of e-commerce and digital sales channels is fundamentally reshaping the grocery landscape. B&G Foods must prioritize its online presence, as consumers increasingly opt for the convenience of digital grocery shopping. This shift demands significant investment in user-friendly e-commerce platforms and efficient delivery logistics to meet evolving consumer expectations.

Direct-to-consumer (DTC) models are also gaining traction, allowing brands to connect directly with their customer base. For B&G Foods, developing or enhancing DTC capabilities can foster brand loyalty and provide valuable consumer data. By 2024, online grocery sales in the US were projected to reach over $200 billion, highlighting the immense opportunity in this space.

- E-commerce Growth: Online grocery sales are a rapidly expanding segment, requiring B&G Foods to maintain and improve its digital storefronts.

- DTC Opportunities: Direct-to-consumer strategies offer a pathway for increased customer engagement and brand control.

- Logistics Investment: Robust supply chain and delivery infrastructure are crucial for successful online sales and customer satisfaction.

- Digital Marketing: Effective digital marketing strategies are essential to drive traffic to e-commerce platforms and build brand awareness online.

Technological advancements are fundamentally reshaping food production and distribution. Automation, including AI in quality control, saw significant adoption in 2024, aiming to boost efficiency and reduce waste, with AI potentially cutting waste by up to 15%. Innovations like High-Pressure Processing (HPP) are expanding, with its market projected to reach $4.4 billion by 2027, enhancing food safety and shelf life.

B&G Foods can leverage these technologies to streamline operations and improve product quality. Investing in precision fermentation, a market poised for substantial growth, offers new ingredient sourcing avenues. The company must also enhance its digital presence, as online grocery sales in the US surpassed $200 billion in 2024, and direct-to-consumer models foster brand loyalty and data collection.

| Technology Area | 2024/2025 Trend | Impact on B&G Foods | Market Projection/Data |

|---|---|---|---|

| Automation & AI | Increased adoption for efficiency and quality control | Streamlined operations, reduced waste, improved product consistency | AI can reduce waste by up to 15% (2024 reports) |

| Food Processing Innovations (HPP) | Growing use for safety and extended shelf life | Enhanced product quality and marketability | HPP market projected to reach $4.4 billion by 2027 |

| Precision Fermentation | Emerging technology for novel ingredients | New ingredient sourcing opportunities, potential for innovative products | Market expected to reach tens of billions in coming years |

| E-commerce & Digitalization | Rapid growth in online grocery sales | Need for robust online platforms and logistics, DTC opportunities | US online grocery sales exceeded $200 billion in 2024 |

Legal factors

B&G Foods must navigate the complexities of the Food Safety Modernization Act (FSMA), which mandates stringent food safety standards. This includes adherence to updated traceability rules and enhanced scrutiny of Foreign Supplier Verification Programs (FSVP), impacting their global supply chain operations.

Ensuring FSMA compliance demands rigorous record-keeping and thorough supplier risk assessments. B&G Foods needs robust food safety plans to prevent costly penalties and maintain consumer trust, a critical factor in the competitive food industry.

In 2024 and continuing into 2025, both the U.S. Food and Drug Administration (FDA) and Health Canada are actively updating food labeling regulations. These changes include revised definitions for what constitutes a 'healthy' food product, the introduction of front-of-package nutrition labeling systems, and more stringent rules for declaring allergens. For B&G Foods, this means a critical need to stay abreast of these evolving legal requirements across its North American markets to ensure full compliance and avoid penalties.

A complex web of state-level regulations is emerging, impacting food chemicals and packaging. For instance, several states have enacted bans on specific synthetic food dyes, requiring companies like B&G Foods to potentially reformulate products to meet these varying standards. This creates a significant compliance challenge, as what's permissible in one state might not be in another.

Furthermore, the rise of extended producer responsibility (EPR) laws for packaging adds another layer of legal complexity. These laws, which are gaining traction across different states, aim to shift the financial and operational burden of managing post-consumer packaging back to producers. B&G Foods must navigate these diverse EPR mandates, which could involve adapting packaging materials or investing in recycling infrastructure to meet state-specific requirements.

Corporate Sustainability Reporting Directives (CSRD)

New regulations like the EU's Corporate Sustainability Reporting Directive (CSRD) are now mandating detailed sustainability disclosures for a vast number of companies, extending beyond environmental impacts to encompass social and governance (ESG) metrics. This directive, which began applying to large companies in fiscal year 2024, is designed to increase transparency and comparability in sustainability reporting across the EU.

While originating in the EU, the CSRD's reach extends to non-EU companies with significant operations or listings within the European Union, potentially impacting B&G Foods' global operations and its extensive supply chain partnerships. Companies are required to report according to European Sustainability Reporting Standards (ESRS), which are quite comprehensive.

The implications for B&G Foods include a need for robust data collection and reporting across its value chain. Failure to comply can lead to reputational damage and potential market access issues within the EU.

- CSRD Scope: Affects approximately 50,000 companies in the EU, including many non-EU companies with substantial EU activities.

- Reporting Standards: Mandates adherence to the detailed European Sustainability Reporting Standards (ESRS).

- Data Requirements: Requires disclosure on a wide range of ESG topics, including climate change, biodiversity, human rights, and employee well-being.

Consumer Protection and Advertising Laws

B&G Foods operates under a stringent legal framework that mandates truthful advertising and robust consumer protection. This means all marketing claims, particularly those related to health benefits or environmental impact, must be backed by verifiable evidence to avoid misleading consumers. For instance, the Federal Trade Commission (FTC) actively polices deceptive advertising practices, and companies found in violation can face significant penalties. The increasing consumer interest in sustainability also brings 'green claims' under scrutiny, requiring companies like B&G Foods to substantiate any environmental assertions made about their products.

The regulatory landscape continues to evolve, with a growing emphasis on transparency and consumer rights. In 2024, regulatory bodies continued to monitor advertising for unsubstantiated health claims, a critical area for food manufacturers. B&G Foods must navigate these requirements carefully to maintain consumer trust and avoid legal repercussions.

- Truthful Advertising: B&G Foods must ensure all product claims are accurate and substantiated, aligning with FTC guidelines.

- Green Claims Substantiation: Environmental marketing assertions require concrete evidence to prevent misleading consumers about product sustainability.

- Health Claims Verification: Claims regarding health benefits must be supported by scientific evidence, adhering to FDA and FTC regulations.

- Consumer Protection Laws: Compliance with broad consumer protection legislation is essential to avoid fines and reputational damage.

B&G Foods faces evolving food labeling regulations in 2024-2025, with updated definitions for 'healthy' and new front-of-package nutrition labeling systems across North America. State-level regulations are also emerging, banning specific synthetic food dyes and requiring product reformulation. Furthermore, extended producer responsibility (EPR) laws for packaging are gaining traction, potentially impacting B&G Foods' material choices and recycling investments.

The EU's Corporate Sustainability Reporting Directive (CSRD), applicable from fiscal year 2024, mandates detailed ESG disclosures, affecting non-EU companies like B&G Foods with significant EU operations. Compliance with European Sustainability Reporting Standards (ESRS) is required, necessitating robust data collection across the value chain to avoid reputational damage and market access issues within the EU.

Truthful advertising remains paramount, with bodies like the FTC scrutinizing unsubstantiated health and green claims. B&G Foods must ensure all marketing assertions are evidence-based to maintain consumer trust and avoid penalties. The increasing consumer focus on sustainability means environmental claims require concrete substantiation.

| Legal Factor | Description | Implication for B&G Foods | Relevant Year(s) |

| Food Safety Modernization Act (FSMA) | Stringent food safety standards, traceability rules, Foreign Supplier Verification Programs (FSVP). | Requires rigorous record-keeping, supplier risk assessments, and robust food safety plans. | Ongoing |

| Evolving Food Labeling Regulations | Updated 'healthy' definitions, front-of-package nutrition labeling, enhanced allergen declarations. | Need to adapt product labeling and marketing to comply with FDA and Health Canada requirements. | 2024-2025 |

| State-Level Chemical & Packaging Bans | Bans on specific synthetic food dyes, variations in packaging regulations. | Potential need for product reformulation and adaptation to diverse state-specific compliance mandates. | Ongoing |

| Extended Producer Responsibility (EPR) for Packaging | Shifting financial and operational burden of post-consumer packaging management to producers. | Requires navigation of diverse EPR mandates, potentially involving packaging material changes or infrastructure investment. | Increasingly prevalent |

| Corporate Sustainability Reporting Directive (CSRD) | Mandatory detailed ESG disclosures based on European Sustainability Reporting Standards (ESRS). | Requires robust data collection and reporting across the value chain for EU market access and reputation. | Applicable from FY 2024 |

| Truthful Advertising & Consumer Protection | FTC policing of deceptive advertising, substantiation of health and green claims. | Ensuring all marketing claims are accurate and evidence-based to avoid penalties and maintain consumer trust. | Ongoing |

Environmental factors

Growing regulatory pressure and consumer demand are pushing food processing and manufacturing sectors towards ambitious food waste reduction targets, with some regions already implementing binding goals. For instance, the European Union's Farm to Fork Strategy aims to halve food waste by 2030, a significant driver for companies like B&G Foods.

B&G Foods will likely need to invest in advanced waste-tracking systems to accurately monitor and minimize excess production, ensuring compliance with these evolving environmental mandates. This focus on efficiency not only addresses sustainability concerns but can also lead to cost savings through reduced material and disposal expenses.

Consumers are increasingly prioritizing environmentally friendly packaging, driving demand for materials with recycled content, enhanced recyclability, and compostability. This shift presents a significant challenge for B&G Foods as they navigate the need to adopt these sustainable alternatives, which must also meet stringent state regulations and evolving consumer expectations, potentially leading to increased operational costs.

New regulations are compelling companies like B&G Foods to be more transparent about their environmental impact. California's Climate Corporate Data Accountability Act and the SEC's proposed climate disclosure rules are prime examples, mandating the reporting of greenhouse gas emissions across Scope 1, 2, and 3. This means B&G Foods needs to accurately measure and publicly share its carbon footprint.

This increased scrutiny is a significant driver for decarbonization efforts throughout B&G Foods' entire value chain. From sourcing raw materials to manufacturing and distribution, the company will be incentivized to implement strategies that reduce its overall environmental impact to meet these new reporting standards and stakeholder expectations.

Water Usage and Management

B&G Foods, as a significant player in the food manufacturing industry, relies heavily on water for its production processes, from ingredient washing to sanitation. This inherent dependence makes water scarcity and quality critical environmental factors that can directly impact its operations and supply chain stability. For instance, in 2024, regions where B&G Foods operates may face increased water stress due to climate change, potentially leading to higher operational costs or even temporary disruptions if water sources are compromised.

Adopting robust and sustainable water management practices is becoming paramount for B&G Foods not only to mitigate these operational risks but also to demonstrate a commitment to environmental responsibility. Such practices can include water recycling initiatives, investing in water-efficient technologies, and ensuring responsible wastewater discharge. Reports from 2023 highlighted that companies with strong water stewardship programs often experience lower utility costs and enhanced brand reputation among environmentally conscious consumers.

The company's approach to water management directly influences its ability to meet regulatory requirements and consumer expectations for sustainability.

- Water Intensity: Food processing, in general, can be water-intensive, requiring B&G Foods to monitor and optimize its water usage per unit of production.

- Water Quality Risks: Ensuring consistent access to clean water is vital for product safety and quality, making contamination a significant environmental concern.

- Regulatory Compliance: Evolving water quality standards and discharge permits necessitate ongoing investment in wastewater treatment and monitoring systems.

- Climate Change Impact: Increased frequency of droughts or floods in key operational areas poses a direct threat to water availability and infrastructure.

Impact of Climate Change on Agricultural Supply Chains

Climate change presents a substantial threat to B&G Foods by disrupting agricultural supply chains. Rising global temperatures and unpredictable rainfall patterns, as seen in the increasing frequency of extreme weather events in 2024, directly impact crop yields and the quality of raw ingredients essential for B&G's product portfolio.

These environmental shifts necessitate a proactive approach to sourcing. B&G Foods must develop and implement more resilient strategies to secure its supply of key agricultural commodities, which are already experiencing price volatility. For instance, the average global temperature in 2024 was notably higher than the pre-industrial average, affecting harvests worldwide.

Supporting sustainable agricultural practices is crucial for mitigating these risks. This includes investing in farming methods that enhance soil health, conserve water, and reduce greenhouse gas emissions. Such initiatives not only build resilience but also align with growing consumer demand for sustainably produced food products, a trend projected to continue its upward trajectory through 2025.

- Increased Volatility: Extreme weather events, intensified by climate change, led to an estimated 10-15% reduction in yields for certain staple crops in key agricultural regions during the 2024 harvest season.

- Raw Material Costs: The scarcity and reduced quality of certain agricultural inputs are projected to increase procurement costs for B&G Foods by an average of 5-8% in the coming year.

- Supply Chain Disruptions: Climate-related events, such as droughts and floods, caused significant logistical challenges in 2024, impacting transportation and delivery times for perishable goods.

- Consumer Demand: Surveys from late 2024 indicate that over 60% of consumers are willing to pay a premium for food products sourced through sustainable and climate-resilient farming practices.

Environmental regulations are tightening, pushing companies like B&G Foods toward significant food waste reduction, with the EU targeting a 50% cut by 2030. This necessitates investments in waste-tracking systems for efficiency and compliance, potentially lowering costs. Consumers increasingly favor eco-friendly packaging, requiring B&G Foods to adopt sustainable alternatives that meet regulations and consumer expectations, which may increase operational expenses.

PESTLE Analysis Data Sources

Our PESTLE Analysis for B&G Foods is informed by a comprehensive review of government publications, economic indicators from institutions like the Bureau of Labor Statistics, and industry-specific market research reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.