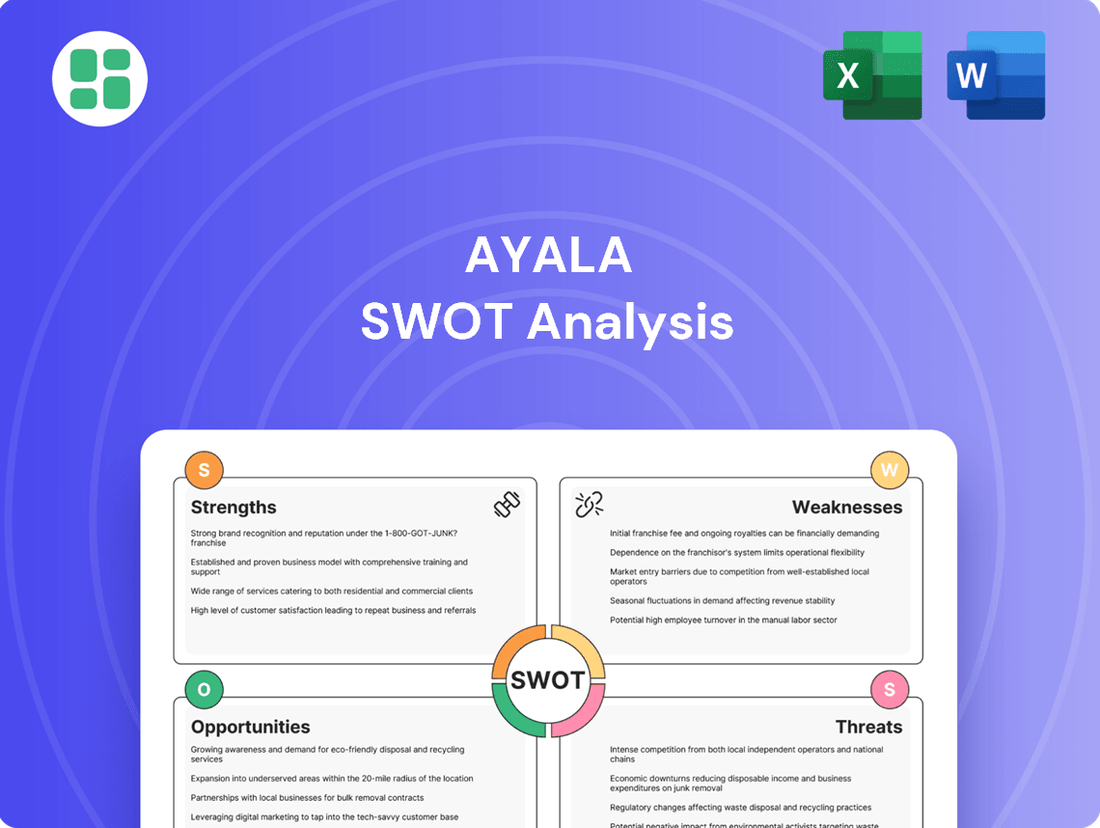

Ayala SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayala Bundle

Ayala's diverse portfolio, a key strength, positions it to weather economic shifts. However, understanding the specific vulnerabilities within each sector and the competitive landscape requires a deeper dive. Unlock the full picture and discover actionable strategies for navigating Ayala's market position.

Strengths

Ayala Corporation’s diversified business model, spanning real estate, financial services, telecommunications, and power, provides significant strength. This broad sector exposure acts as a buffer against volatility in any one industry, ensuring more consistent revenue generation. For instance, as of the first quarter of 2024, Ayala’s real estate arm, Ayala Land, reported a net income of PHP 7.1 billion, while Globe Telecom, its telecommunications unit, posted a core net income of PHP 6.3 billion for the same period, showcasing the stability derived from its varied operations.

Ayala Corporation's enduring presence as a Philippine conglomerate grants it substantial market leadership and a robust brand reputation. This translates into deep-seated customer trust and a significant competitive edge, simplifying capital acquisition and the formation of strategic alliances.

Ayala's dedication to sustainable business practices is a significant strength, attracting investors keen on environmental, social, and governance (ESG) factors. This commitment not only bolsters its corporate social responsibility image but also translates into tangible benefits like enhanced operational efficiency and a reduced risk of regulatory penalties. For instance, in 2024, Ayala Land reported a 15% increase in renewable energy usage across its developments, demonstrating a clear move towards greener operations.

Extensive Ecosystem and Integrated Communities

Ayala's strength lies in its extensive ecosystem, where integrated communities foster synergistic growth across its diverse segments, including real estate, retail, and utilities. This strategy creates multiple revenue streams and enhances customer loyalty within a self-sustaining environment.

This integrated approach is evident in projects like Vertis North in Quezon City, which combines residential, commercial, and retail spaces. As of early 2024, Ayala Land's total assets reached approximately PHP 1.4 trillion, underscoring the scale of its integrated developments.

- Synergistic Growth: Development of large-scale integrated communities allows for cross-segment benefits.

- Customer Loyalty: The cohesive ecosystem encourages repeat business and brand affinity.

- Multiple Revenue Streams: Diversified offerings within communities generate varied income sources.

- Enhanced Brand Value: Integrated developments strengthen Ayala's reputation for quality and comprehensive living solutions.

Robust Financial Health and Access to Capital

Ayala Corporation's robust financial health is a significant strength, underscored by its long operating history and diversified asset portfolio. This typically translates into healthy cash flows and well-managed debt, providing a stable foundation for ongoing investments and strategic growth initiatives.

For instance, as of the first quarter of 2024, Ayala Corporation reported a consolidated net income attributable to equity holders of the parent of PHP 10.5 billion, showcasing continued profitability. Furthermore, the company's access to capital remains strong, enabling it to pursue opportunities and navigate economic uncertainties effectively.

- Healthy Cash Flows: Ayala consistently generates strong operating cash flows, supporting its capital expenditure and dividend payments.

- Manageable Debt Levels: The company maintains a prudent approach to leverage, ensuring its debt obligations are sustainable.

- Access to Capital Markets: Ayala's established reputation allows it to readily access both debt and equity financing when needed for strategic projects.

- Financial Resilience: Its diversified revenue streams and strong balance sheet enhance its ability to withstand economic downturns.

Ayala's diversified business model across real estate, financial services, telecommunications, and power is a key strength, providing stability and consistent revenue. For example, in Q1 2024, Ayala Land's net income was PHP 7.1 billion, while Globe Telecom's core net income reached PHP 6.3 billion, demonstrating resilience through varied operations.

The conglomerate's strong market leadership and brand reputation in the Philippines foster customer trust and facilitate capital acquisition and strategic partnerships. This established presence is a significant competitive advantage.

Ayala's commitment to sustainability, evident in increased renewable energy use by Ayala Land in 2024, appeals to ESG-focused investors and improves operational efficiency. This focus enhances its corporate image and reduces regulatory risks.

The company's integrated ecosystem, seen in projects like Vertis North, generates synergistic growth and customer loyalty across its segments, creating multiple revenue streams. As of early 2024, Ayala Land's total assets were approximately PHP 1.4 trillion.

Ayala Corporation's robust financial health, characterized by healthy cash flows and manageable debt, supports its growth initiatives. In Q1 2024, consolidated net income attributable to equity holders was PHP 10.5 billion, highlighting its financial stability and access to capital markets.

| Segment | Q1 2024 Net Income (PHP Billion) | Contribution to Total |

|---|---|---|

| Ayala Land | 7.1 | ~67.6% |

| Globe Telecom | 6.3 | ~60.0% |

| Bank of the Philippine Islands (BPI) | 12.1 (H1 2024) | ~115.2% |

| ACEN Corporation | 5.1 (FY 2023) | ~48.6% |

What is included in the product

Analyzes Ayala’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential weaknesses into opportunities.

Weaknesses

Despite Ayala Corporation's efforts to diversify, a substantial portion of its business and income is still tied to the Philippine economy. This means the company is quite vulnerable to local economic ups and downs, like changes in inflation or interest rates, which can impact its performance.

For instance, the Philippine peso experienced depreciation against the US dollar throughout 2023 and into early 2024, a factor that can affect companies with significant dollar-denominated costs or revenues. This reliance on the domestic market means Ayala's financial results can be significantly influenced by the Philippines' specific economic conditions, including potential political instability or shifts in government policy.

Ayala Corporation's expansive and varied business portfolio, encompassing sectors from telecommunications to real estate and banking, naturally results in a complex organizational structure. This complexity can create significant coordination challenges across its numerous subsidiaries and increase overall overhead expenses.

Effectively managing such a diverse range of distinct business units demands sophisticated governance frameworks and intricate resource allocation strategies. For instance, in 2023, Ayala’s net income was PHP 32.7 billion, reflecting the scale of operations but also the inherent complexity in managing diverse revenue streams and capital deployments across its various segments.

Ayala's core businesses, such as real estate development, telecommunications, and power generation, are inherently capital intensive. These sectors demand significant upfront investment for land acquisition, infrastructure development, and ongoing technological advancements. For instance, Globe Telecom, a key Ayala subsidiary, consistently invests billions in network expansion and upgrades to maintain its competitive edge, with capital expenditures often exceeding PHP 50 billion annually in recent years.

This high capital requirement can strain financial resources, necessitating continuous access to substantial funding through debt or equity. Such a reliance on external financing can limit financial flexibility, especially during periods of economic downturn or rising interest rates. It also means that a significant portion of earnings must be reinvested back into the business, potentially impacting dividend payouts or the ability to pursue other strategic opportunities.

Regulatory and Policy Dependence

Ayala Corporation's extensive operations in highly regulated sectors such as telecommunications, power, and banking expose it to significant policy dependence. For instance, the Philippine telecommunications landscape, dominated by Ayala's Globe Telecom, is subject to government mandates on spectrum allocation and pricing, which can directly affect revenue streams. In 2024, the government's continued push for digital infrastructure development, while beneficial, also brings potential for new regulatory frameworks impacting network expansion and service offerings.

Changes in licensing requirements or industry-specific regulations can create substantial headwinds. For example, shifts in the energy sector's regulatory environment, affecting power generation and distribution, could impact ACEN Corporation's renewable energy projects. Ayala must continuously monitor and adapt to evolving policies to mitigate risks and maintain its competitive edge.

This reliance on government policy means that adverse regulatory shifts can curtail operational freedom and profitability. Ayala's financial services arm, BPI, also navigates a complex web of banking regulations, including capital adequacy ratios and consumer protection laws, which are subject to periodic review and amendment by the Bangko Sentral ng Pilipinas.

- Policy Sensitivity: Ayala's core businesses in telco, power, and banking are intrinsically linked to government regulations, creating a vulnerability to policy changes.

- Regulatory Adaptation Costs: Compliance with evolving regulations often necessitates significant investment, impacting operational costs and potentially delaying strategic initiatives.

- Impact on Profitability: Unfavorable regulatory adjustments, such as changes in tariff structures or licensing fees, can directly reduce profit margins across various subsidiaries.

Potential for Intra-Group Competition or Cannibalization

Ayala's diverse portfolio, encompassing sectors like telecommunications (Globe Telecom), real estate (Ayala Land), and banking (BPI), presents a risk of internal competition. For instance, concurrent developments in residential and commercial properties by Ayala Land could inadvertently compete for similar customer segments or land resources, potentially impacting individual project profitability.

This overlap necessitates careful strategic planning to avoid resource dilution and ensure each business unit maintains a distinct market focus. In 2024, Ayala's consolidated revenues reached PHP 431.7 billion, highlighting the scale at which such internal coordination challenges could manifest.

The conglomerate's broad reach means that strategic initiatives in one subsidiary might unintentionally undermine another's market position or growth objectives.

This can lead to suboptimal allocation of capital and management attention across the group.

Ayala's significant reliance on the Philippine economy makes it susceptible to local economic downturns and currency fluctuations, as seen with the peso's depreciation in 2023-2024 impacting dollar-denominated transactions.

The conglomerate's vast and varied business segments, from telco to real estate, create inherent organizational complexity, leading to coordination challenges and potentially higher overhead costs.

Capital-intensive industries like telecommunications and power generation require substantial ongoing investment, which can strain financial resources and limit flexibility, as demonstrated by Globe Telecom's consistent multi-billion peso capital expenditures annually.

Preview Before You Purchase

Ayala SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Ayala SWOT analysis, ensuring you know exactly what you're getting. Purchase unlocks the complete, in-depth report.

Opportunities

The Philippines' digital transformation is booming, with internet penetration reaching an estimated 76% by the end of 2024. This creates a prime opportunity for Ayala's telecommunications and technology businesses.

Ayala can capitalize on this by intensifying investments in 5G network expansion and fiber optic infrastructure. For instance, Globe Telecom, an Ayala subsidiary, has been actively deploying 5G in key urban areas, aiming for wider coverage by 2025.

Developing innovative digital services, such as enhanced cloud solutions and digital payment platforms, will further tap into the growing demand for online engagement and transactions, promising robust future revenue growth.

The Philippines' healthcare and education sectors present significant opportunities for Ayala. With rising disposable incomes and a growing middle class, Filipinos are increasingly prioritizing health and education. This trend is evident in the projected growth of the healthcare market, which was estimated to reach PHP 2.1 trillion in 2024, and the education sector's continued demand for quality services and digital integration.

Ayala is well-positioned to capitalize on this demand by expanding its healthcare facilities and educational institutions. For instance, AC Health continues to broaden its network of clinics and pharmacies, aiming to serve more communities. Similarly, AC Education is investing in digital learning platforms and expanding its reach, addressing the need for accessible and high-quality education across the archipelago.

The increasing global focus on sustainability and climate action presents a significant opportunity for Ayala. The company can expand its investments in renewable energy sources, such as solar and wind power, and further develop its green building projects, aligning with the growing demand for environmentally conscious infrastructure.

Ayala's commitment to sustainability, evident in its existing initiatives, positions it well to attract impact investors. For instance, in 2023, the global sustainable investment market reached an estimated $37.4 trillion, a testament to the growing investor appetite for ESG-aligned assets, which Ayala can tap into.

Investing further in eco-friendly technologies and practices can also lead to long-term operational cost reductions for Ayala. This strategic focus not only enhances its environmental credentials but also improves its financial resilience by mitigating risks associated with carbon emissions and resource scarcity.

Regional Expansion and International Partnerships

Ayala Corporation's strategic expansion into other dynamic Southeast Asian markets presents a significant opportunity. By leveraging its established expertise in integrated developments, particularly in real estate and infrastructure, Ayala can tap into the burgeoning economies of countries like Vietnam, Indonesia, and Malaysia. This diversification can mitigate risks associated with over-reliance on the Philippine market.

Forming strategic international partnerships is another key avenue for growth. Collaborating with established regional players can facilitate market entry, provide access to local knowledge and networks, and share the investment burden. For instance, partnerships in the renewable energy sector, a growing area in Southeast Asia, could align with Ayala's sustainability goals.

Ayala's financial services arm can also be a strong enabler for regional expansion. By offering innovative financial solutions tailored to emerging market needs, the company can support its own growth initiatives and those of its partners. This integrated approach, combining development expertise with financial backing, offers a competitive edge. In 2024, the ASEAN region is projected to see continued economic growth, with countries like Vietnam expecting GDP growth rates around 6-7%, providing fertile ground for expansion.

- Market Diversification: Expanding beyond the Philippines into high-growth Southeast Asian economies like Vietnam and Indonesia.

- Strategic Alliances: Forging partnerships with regional leaders to accelerate market penetration and share risks.

- Financial Services Leverage: Utilizing its financial expertise to support expansion and offer tailored solutions in new markets.

- Sectoral Opportunities: Capitalizing on growth sectors such as renewable energy and digital infrastructure across the region.

Urbanization and Infrastructure Development

The Philippines continues to experience rapid urbanization, with an increasing percentage of its population moving to cities. This trend fuels a substantial demand for infrastructure, including transportation networks, utilities, and public spaces. Ayala, with its established presence in both real estate and infrastructure sectors, is well-positioned to address these growing needs.

Ayala Land's strategic focus on integrated urban developments, such as mixed-use estates, directly aligns with the opportunities presented by urbanization. For instance, as of early 2024, the Philippine government has allocated significant budgets towards infrastructure projects, aiming to improve connectivity and support economic growth in urban centers. Ayala's ability to develop master-planned communities, offering housing, commercial spaces, and amenities, allows it to capture value from this demographic shift.

Key opportunities include:

- Capitalizing on increased demand for residential and commercial properties in urban hubs.

- Leveraging its expertise in developing large-scale, integrated urban projects.

- Participating in government-led infrastructure projects that support urban expansion.

- Developing affordable housing solutions to cater to a growing urban population.

Ayala is poised to benefit from the Philippines' ongoing digital transformation, with internet penetration expected to reach approximately 76% by the end of 2024, creating fertile ground for its telecommunications and technology ventures.

The company can further capitalize on this by expanding its 5G network and fiber optic infrastructure, mirroring Globe Telecom's ongoing deployment efforts. Developing innovative digital services, including cloud solutions and digital payments, will also tap into the increasing demand for online engagement and transactions.

The growing middle class and rising incomes in the Philippines are driving increased spending on healthcare and education, sectors where Ayala is actively expanding its presence through AC Health and AC Education. This aligns with the projected growth of the healthcare market, estimated at PHP 2.1 trillion in 2024.

Ayala's focus on sustainability presents a significant opportunity, especially as the global sustainable investment market reached an estimated $37.4 trillion in 2023. By investing in renewable energy and green buildings, Ayala can attract impact investors and achieve long-term operational cost reductions.

The company's strategic expansion into other Southeast Asian markets, such as Vietnam and Indonesia, which are projected to see continued economic growth in 2024, offers a path for diversification and risk mitigation. Partnerships with regional players and leveraging its financial services arm can further accelerate this international growth.

Rapid urbanization in the Philippines is fueling demand for infrastructure and real estate, areas where Ayala excels. The company's integrated urban developments, such as mixed-use estates, are well-aligned with government infrastructure spending and the need for master-planned communities.

| Opportunity Area | Key Driver | Ayala's Strategic Alignment | Market Data/Projection |

|---|---|---|---|

| Digital Transformation | High Internet Penetration | Telecommunications & Technology Expansion (Globe Telecom) | 76% Internet Penetration (Est. 2024) |

| Healthcare & Education | Rising Disposable Incomes | Network Expansion (AC Health, AC Education) | PHP 2.1 Trillion Healthcare Market (Est. 2024) |

| Sustainability | Global ESG Focus | Renewable Energy & Green Buildings | $37.4 Trillion Sustainable Investment Market (2023) |

| Regional Expansion | Southeast Asian Growth | Market Entry & Partnerships | Vietnam GDP Growth ~6-7% (2024) |

| Urbanization | Infrastructure Demand | Integrated Urban Developments | Increased Government Infrastructure Spending |

Threats

Ayala Corporation grapples with intense competition in its core business areas, facing formidable rivals both domestically and globally. This includes agile new entrants and entrenched industry giants, all vying for market share. For instance, in the telecommunications sector, Globe Telecom, a key Ayala subsidiary, contends with PLDT, which has been actively expanding its fiber network and 5G services, intensifying the battle for subscribers and revenue.

This escalating competitive landscape puts significant pressure on Ayala's profitability, potentially triggering price wars and eroding margins. To counter this, the conglomerate must prioritize continuous innovation and operational excellence. In 2023, Ayala's net income attributable to equity holders of the parent stood at PHP 34.1 billion, a figure that will be increasingly tested by aggressive competitor strategies across its diverse portfolio.

A significant economic slowdown in the Philippines, coupled with persistent high inflation, poses a considerable threat to Ayala's varied business interests. This could lead to reduced consumer spending and dampened business investment, directly impacting sectors like real estate and financial services. For instance, if inflation remains elevated, it erodes purchasing power, making big-ticket items like property less attractive and potentially slowing down loan origination in banking.

Rapid technological advancements, particularly in fintech and e-commerce, present a significant threat to Ayala's established business lines. The rise of agile disruptors offering innovative digital solutions could erode market share in sectors where Ayala has traditionally held strong positions. For instance, the digital payments landscape is rapidly evolving, with new players challenging incumbent financial services.

Geopolitical Risks and Regulatory Instability

Geopolitical tensions in Southeast Asia, a crucial region for Ayala Corporation's diverse portfolio, present a significant threat. For instance, ongoing territorial disputes or increased regional instability could disrupt supply chains and impact consumer demand across its various business segments, from telecommunications to infrastructure. Ayala's reliance on international trade and investment makes it particularly vulnerable to sudden policy shifts.

Sudden regulatory changes in key markets pose another substantial risk. For example, a shift in foreign investment policies in the Philippines or a neighboring country could directly affect Ayala's ability to expand or repatriate earnings. In 2024, the Philippines saw ongoing discussions around economic liberalization, which could bring both opportunities and unforeseen regulatory hurdles for conglomerates like Ayala. Changes in taxation or industry-specific regulations, such as those affecting renewable energy or digital infrastructure, could significantly impact profitability and necessitate costly strategic adjustments.

- Increased regional instability: Heightened geopolitical tensions in Southeast Asia could disrupt Ayala's extensive regional operations and impact market access.

- Unforeseen policy shifts: Sudden changes in foreign investment rules, taxation, or industry-specific regulations in countries where Ayala operates can adversely affect profitability.

- Impact on long-term planning: Regulatory uncertainty makes it challenging for Ayala to engage in effective long-term strategic planning and capital allocation.

Climate Change and Natural Disasters

As an archipelago, the Philippines faces significant threats from climate change, with an increasing frequency of typhoons and other extreme weather events impacting the nation. For Ayala, this translates to potential disruptions in its diverse operations, from infrastructure projects to property development.

These events can lead to direct damage to assets, increased operational costs due to repairs and business interruptions, and higher insurance premiums. For instance, the Philippines is consistently ranked among the countries most vulnerable to climate change impacts, with the World Risk Index 2023 placing it at number 18 out of 193 countries, highlighting the consistent exposure to natural hazards. This vulnerability directly affects the economic stability of the regions where Ayala has a substantial presence.

- Increased operational disruptions: Typhoons and floods can halt construction, damage power infrastructure, and affect logistics for various Ayala subsidiaries.

- Asset damage and higher insurance costs: Properties and infrastructure are at risk of damage, leading to increased repair expenses and escalating insurance premiums.

- Impact on economic stability: Extreme weather events can negatively affect consumer spending and overall economic activity in affected regions, indirectly impacting Ayala's businesses.

Ayala faces intense competition across its diverse sectors, with rivals like PLDT challenging Globe Telecom's market share. This rivalry can lead to price wars, impacting Ayala's profitability, which saw PHP 34.1 billion in net income in 2023. Furthermore, rapid technological advancements, particularly in fintech and e-commerce, introduce agile disruptors that threaten Ayala's established positions. Geopolitical instability in Southeast Asia and sudden regulatory shifts in its operating markets also pose significant risks, potentially disrupting operations and impacting earnings, as seen with ongoing discussions on economic liberalization in the Philippines during 2024.

SWOT Analysis Data Sources

This Ayala SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market research reports, and expert industry forecasts, ensuring a data-driven and accurate strategic assessment.