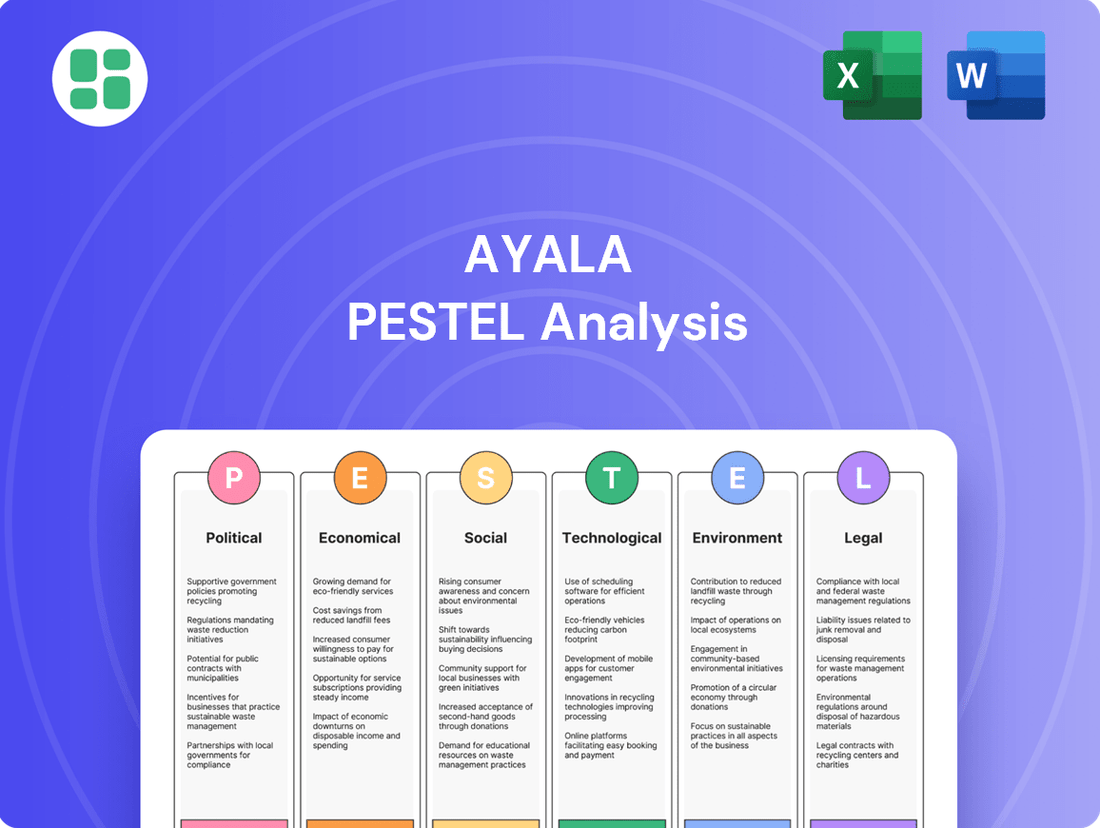

Ayala PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayala Bundle

Gain a strategic advantage by understanding the external forces shaping Ayala's future. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting the conglomerate. Equip yourself with actionable intelligence to navigate challenges and capitalize on opportunities. Download the full PESTLE analysis now for a comprehensive overview.

Political factors

Ayala Corporation's extensive investments in infrastructure, real estate, and energy, sectors requiring significant long-term capital, are directly influenced by the stability of the political landscape and the predictability of government policies. A consistent policy environment is crucial for these capital-intensive ventures to thrive.

Chairman Jaime Augusto Zobel de Ayala has repeatedly highlighted the critical need for the sanctity of contracts and sustained policy stability to foster greater investment and encourage robust public-private partnerships. This underscores the direct link between political assurance and the company's strategic growth initiatives.

Ayala Corporation, a conglomerate with diverse interests, navigates a complex web of regulations across its key sectors. In real estate, for instance, the Department of Human Settlements and Urban Development (DHSUD) sets guidelines for housing development, impacting project approvals and pricing. For its financial services arm, the Bangko Sentral ng Pilipinas (BSP) imposes capital adequacy ratios and other prudential measures, influencing lending capacity and profitability. The telecommunications sector, dominated by Globe Telecom, operates under the purview of the National Telecommunications Commission (NTC), which regulates spectrum allocation and service quality standards.

Changes in these regulatory landscapes, including shifts in tax policies or new environmental statutes, can materially affect Ayala's bottom line. For example, a proposed increase in corporate income tax rates, as discussed in legislative proposals in late 2024, could reduce net earnings across its subsidiaries. Ayala's proactive engagement with government bodies and its strategic alignment with national development priorities, such as supporting infrastructure growth and digital transformation, are crucial for mitigating regulatory risks and capitalizing on opportunities.

Ayala Corporation's engagement in Public-Private Partnerships (PPPs) is a significant political factor, especially in crucial sectors like infrastructure, healthcare, and education. These collaborations allow Ayala to leverage its private capital and expertise to address public sector needs.

A robust and supportive government framework for PPPs is essential for Ayala's success in these ventures. Such frameworks ensure fair competition and provide clear guidelines for private sector involvement, enabling effective deployment of capital and resources to solve public service challenges.

Ayala anticipates that continued strengthening of PPP frameworks will foster a more conducive environment for private sector participation. This is vital for projects that require substantial upfront investment and long-term commitment, aligning private interests with public good.

Foreign Investment Policies

Ayala Corporation's international ventures and pursuit of foreign partnerships are significantly shaped by government policies on foreign investment. These regulations dictate the ease of entry, ownership structures, and capital repatriation for overseas entities. For instance, the Philippine government's efforts to attract foreign direct investment (FDI) through incentives and streamlined processes directly impact Ayala's ability to secure international capital and expertise for its diverse projects.

The Philippine business landscape's receptiveness to substantial foreign partnerships and investment, especially from key economies like the United States, is a crucial consideration for Ayala's expansion. As of early 2024, the Philippines has been actively promoting investment in sectors like renewable energy and digital infrastructure, areas where Ayala is actively expanding. The country's commitment to improving its investment climate, including addressing concerns about foreign ownership limits in certain industries, is vital for Ayala's strategic growth.

- FDI Inflows: Philippine FDI inflows reached $9.1 billion in 2023, showing a growing international interest, which Ayala can leverage.

- Ease of Doing Business: The Philippine government's ongoing reforms aim to improve its ranking in global ease of doing business indices, directly benefiting companies like Ayala seeking foreign partnerships.

- Sectoral Focus: Government push for investment in digital transformation and green energy aligns with Ayala's strategic priorities, creating favorable conditions for foreign collaborations.

Anti-Corruption and Governance Initiatives

The Philippine government's ongoing commitment to anti-corruption measures and strengthening corporate governance significantly shapes the operating landscape for businesses like Ayala Corporation. These initiatives foster a more transparent and equitable business environment, which is crucial for long-term investment and sustainable growth.

Ayala Corporation's consistent inclusion in the FTSE4Good Index Series underscores its proactive approach to these governance factors. For instance, in 2024, the index continued to recognize Ayala for its robust corporate governance and strong anti-corruption policies, reflecting adherence to international best practices in environmental, social, and governance (ESG) performance.

- Government Stance: The administration has prioritized anti-corruption drives and the enhancement of corporate governance standards to attract foreign investment and improve the country's ease of doing business rankings.

- Ayala's ESG Commitment: Ayala Corporation and its key subsidiaries have maintained their position on the FTSE4Good Index Series, a testament to their strong performance in areas including anti-bribery and corruption policies, as well as board independence and shareholder rights.

- Impact on Business: Improved governance and reduced corruption reduce operational risks, enhance investor confidence, and can lead to lower borrowing costs and better access to capital for Ayala's diverse business units.

Political stability and predictable government policies are paramount for Ayala's capital-intensive sectors like infrastructure and real estate. Chairman Jaime Augusto Zobel de Ayala emphasizes the need for contract sanctity and policy consistency to foster public-private partnerships and investment.

Ayala navigates a complex regulatory environment, with entities like the DHSUD for real estate and BSP for financial services setting crucial guidelines. Changes in tax laws or environmental statutes, such as potential corporate income tax adjustments discussed in late 2024, can significantly impact earnings.

The government's framework for Public-Private Partnerships (PPPs) is vital for Ayala's involvement in infrastructure, healthcare, and education, ensuring fair competition and effective capital deployment. Additionally, government policies on foreign investment, including efforts to attract FDI and streamline processes, directly influence Ayala's ability to secure international capital and expertise.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Ayala, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential opportunities and threats for Ayala's diverse business portfolio.

The Ayala PESTLE Analysis offers a structured framework to proactively identify and address external threats and opportunities, thereby alleviating the pain of unexpected market shifts and guiding strategic decision-making.

Economic factors

Ayala Corporation's performance is intrinsically linked to the Philippine economy's trajectory. The nation's GDP growth reached 5.6% in 2023, demonstrating a solid recovery and resilience amidst global economic headwinds. This positive economic climate directly benefits Ayala's key sectors.

Looking ahead to 2024 and 2025, the outlook remains favorable. Projections suggest continued GDP expansion, likely driven by strong domestic demand and government infrastructure spending. Ayala's banking arm, BPI, and its real estate developments are well-positioned to capitalize on this robust economic activity and rising consumer confidence.

Inflation and interest rate shifts are crucial for Ayala Corporation, particularly impacting its banking subsidiary, Bank of the Philippine Islands (BPI). For instance, BPI reported a 11% increase in net income to PHP 22.4 billion in the first half of 2024, even as operating expenses grew due to inflation. This highlights BPI's resilience, but the broader economic environment necessitates careful management.

Ayala's extensive capital expenditure plans across its diverse businesses, from property development to infrastructure, are directly sensitive to interest rate movements. Higher borrowing costs can significantly affect the feasibility and profitability of these long-term investments. The company actively monitors these economic indicators to optimize its financing strategies and ensure the financial viability of its growth initiatives.

Consumer spending remains a cornerstone for Ayala Corporation's diverse portfolio, particularly impacting its real estate and retail segments. The company's retail redevelopment strategies, such as those seen in its mall expansions, are directly tied to the continued strength of consumer demand. For instance, in 2024, the Philippine economy was projected to see a consumption growth of around 6.0%, underscoring the importance of this driver for Ayala Malls.

Urbanization trends further amplify these influences, shaping both consumer behavior and business opportunities. As more people move into urban centers, the demand for Ayala Land's residential and commercial developments increases. This demographic shift also fuels the growth of Globe Telecom's GCash, a leading fintech platform, as urban dwellers increasingly adopt digital payment solutions. GCash reported over 100 million registered users by early 2024, highlighting the accelerating digital adoption in urbanized areas.

Capital Expenditure and Funding Environment

Ayala is gearing up for substantial investments, with a projected capital expenditure of P230 billion for 2025. This significant outlay is intended to fuel the growth of its established business segments and nurture new, promising ventures.

The success of these ambitious expansion plans hinges critically on Ayala's capacity to secure diverse funding sources. This includes leveraging relationships with both local and global financial institutions, as well as tapping into the resources offered by multilateral organizations and the broader capital markets.

- Planned 2025 Capital Expenditure: P230 billion.

- Funding Sources: Domestic and international banks, multilaterals, capital markets.

- Objective: Expand core businesses and support emerging ventures.

Foreign Exchange Rate Volatility

Ayala Corporation's extensive international operations and reliance on foreign currency financing expose it to significant foreign exchange rate volatility. Fluctuations in exchange rates can directly affect the peso-denominated value of its overseas revenues and the cost of imported goods or services, impacting profitability. For instance, a stronger Philippine Peso (PHP) against currencies where Ayala has substantial investments, like the USD or AUD, could translate to lower reported earnings when converted back to PHP.

Managing these currency exposures is crucial for maintaining Ayala's financial stability. Despite a robust balance sheet, the company actively employs hedging strategies to mitigate potential losses arising from adverse currency movements. As of the first quarter of 2024, Ayala's consolidated revenues reached PHP 145.5 billion, with a significant portion generated from international markets, highlighting the ongoing relevance of FX management.

- Impact on Revenues: A strengthening PHP can decrease the peso value of foreign currency earnings. For example, if Ayala's US dollar-denominated earnings remain constant, a PHP 50/$1 exchange rate versus PHP 55/$1 would result in a roughly 10% reduction in reported peso revenues.

- Cost of Goods Sold: Conversely, a weaker PHP can increase the cost of imported raw materials or equipment, thereby impacting the cost of sales for its subsidiaries.

- Financing Costs: Foreign currency debt servicing becomes more expensive when the PHP depreciates, adding to financial expenses.

- Strategic Hedging: Ayala's proactive approach to currency risk management, including the use of forward contracts and options, aims to lock in exchange rates for future transactions, providing a degree of certainty in its financial planning.

The Philippine economy's continued growth, projected at around 6.0% for 2024, directly fuels consumer spending, a key driver for Ayala's real estate and retail segments. Urbanization further bolsters this, increasing demand for Ayala Land's developments and driving digital adoption for Globe's GCash, which surpassed 100 million users by early 2024.

Preview Before You Purchase

Ayala PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ayala PESTLE analysis provides an in-depth look at the external factors influencing the conglomerate's operations. You'll gain valuable insights into the Political, Economic, Social, Technological, Legal, and Environmental landscape affecting Ayala.

Sociological factors

The Philippines continues to boast a youthful demographic, with a median age of 25.4 years as of 2023 projections, and a growth rate of approximately 1.4% annually. This young population fuels demand for housing, healthcare, and educational services, aligning perfectly with Ayala Land's strategy of developing master-planned communities and AC Health's expansion plans to reach more Filipinos.

Urbanization is accelerating, with over 67% of the Philippine population expected to reside in urban areas by 2025. This trend creates substantial opportunities for Ayala's integrated developments, offering convenience and accessibility, while AC Health can leverage this by establishing more health facilities in densely populated urban centers.

Filipino consumers are increasingly prioritizing convenience, with a noticeable surge in demand for digital services and products that offer strong value. This shift is evident in the growing adoption of online shopping and mobile payment solutions across the archipelago.

Ayala Corporation's strategic investments are directly addressing these evolving preferences. For instance, their significant push into digital transformation, including e-commerce platforms and partnerships like the one with Anko for affordable home goods, demonstrates a clear response to the market's demand for accessible and convenient options. This aligns with the broader trend where Filipinos, particularly the younger demographic, seek seamless digital experiences in their daily transactions.

The Philippines faces a clear demand for better healthcare, with a recognized need for more investment in infrastructure and services. This presents a significant opportunity for companies like Ayala.

Ayala's subsidiary, AC Health, is actively addressing this by expanding its network of hospitals and multi-specialty clinics. Their ambitious goal is to become a dominant player in the Philippine healthcare sector by 2035, aiming to cater to a substantial portion of the nation's population and capitalize on this growing demand.

Education and Human Capital Development

The quality of education and the availability of a skilled workforce are foundational for a nation's progress. Ayala recognizes this, actively investing in education through its subsidiary iPeople. This strategic focus aims to bridge existing gaps in human capital development.

Ayala's commitment extends to forging partnerships with various academic institutions. Furthermore, a significant emphasis is placed on integrating digital transformation within learning environments. These initiatives are designed to equip the future workforce with relevant and in-demand skills.

For instance, in 2024, iPeople's network of schools, including the University of Makati and the Malayan Colleges Laguna, continues to adapt curricula to align with industry needs. The group reported a 15% increase in enrollment for STEM-related courses in the academic year 2023-2024, reflecting a growing demand for technical expertise.

Key aspects of Ayala's educational investments include:

- Partnerships with Universities: Collaborations to ensure curriculum relevance and faculty development.

- Digital Transformation in Learning: Implementing technology to enhance educational delivery and accessibility.

- Focus on STEM Education: Prioritizing science, technology, engineering, and mathematics to build a future-ready workforce.

- Skills Gap Analysis: Ongoing efforts to identify and address critical skill shortages in the Philippine economy.

Social Equity and Inclusive Growth

Ayala Corporation's dedication to the Filipino people is evident in its strategic alignment with national development priorities, striving for sustainable practices that generate enduring value. This commitment translates into tangible social impact, particularly through its push for financial inclusion.

A prime example is GCash, which has become a cornerstone of digital finance in the Philippines. As of early 2024, GCash boasts over 70 million registered users, facilitating billions of transactions and significantly expanding access to financial services for previously unbanked populations. This focus on accessibility directly addresses social equity by empowering more Filipinos to participate in the formal economy.

Furthermore, Ayala's involvement in affordable housing and community development projects directly contributes to social equity by addressing critical needs for shelter and improved living conditions. These initiatives are designed to foster inclusive growth, ensuring that economic progress benefits a wider segment of society.

- Financial Inclusion: GCash, with over 70 million users by early 2024, is a key driver of financial inclusion in the Philippines.

- Community Development: Ayala actively engages in affordable housing and community upliftment projects.

- Sustainable Practices: The corporation integrates sustainability into its business models to ensure long-term societal benefit.

- National Alignment: Ayala's ventures are strategically linked to the Philippines' development needs, promoting inclusive growth.

Sociological factors significantly shape Ayala Corporation's strategy in the Philippines. The nation's young demographic, with a median age around 25.4 years, drives demand for housing and education, areas where Ayala Land and iPeople are actively investing. Furthermore, the increasing urbanization, projected to reach over 67% by 2025, creates opportunities for integrated developments and urban healthcare access through AC Health.

Filipino consumers increasingly value convenience and digital solutions, a trend Ayala is capitalizing on through platforms like GCash, which had over 70 million users by early 2024, and its e-commerce initiatives. The company also addresses the clear demand for improved healthcare by expanding AC Health's network, aiming for dominance by 2035. Ayala's commitment to education, particularly in STEM, through iPeople, aims to develop a skilled workforce, with a 15% enrollment increase in STEM courses reported for the 2023-2024 academic year.

| Sociological Factor | Ayala's Strategic Alignment | Key Data/Initiatives (2024/2025 Focus) |

|---|---|---|

| Youthful Demographics | Demand for housing, education, healthcare | Median age ~25.4; Ayala Land developments, iPeople schools, AC Health expansion |

| Urbanization | Integrated urban living, accessible services | >67% urban by 2025; Ayala Land's master-planned communities, AC Health urban clinics |

| Consumer Preference for Convenience & Digital | Digital platforms, e-commerce | GCash >70M users (early 2024); Anko partnership for home goods |

| Healthcare Demand | Expansion of healthcare services | AC Health aims for dominance by 2035; expanding hospital/clinic network |

| Human Capital Development | Education investment, STEM focus | iPeople; 15% STEM enrollment increase (2023-2024); curriculum alignment |

Technological factors

Ayala Corporation is actively pursuing a group-wide digital transformation, integrating artificial intelligence and data analytics across its various business segments. This strategic push aims to modernize existing operations and foster the development of innovative digital solutions for new ventures.

For instance, in 2023, Ayala Land reported significant investments in digital infrastructure and customer relationship management systems to enhance property development and sales experiences. Globe Telecom, another key Ayala subsidiary, continues to expand its 5G network, reaching over 17 million households by the end of 2023, which is crucial for enabling digital services and innovations across the group.

The rapid expansion of fintech, notably through Ayala's subsidiary Globe Telecom's GCash, is a key technological force. GCash has solidified its position as a leader in digital payments and financial services, demonstrably increasing financial inclusion across the Philippines.

As of early 2024, GCash boasts over 100 million registered users, a testament to its widespread adoption and the growing reliance on digital financial platforms. This growth is fueled by continuous innovation in services like digital loans, investments, and insurance, making financial management more accessible.

Ayala Land is actively embedding smart city solutions and sustainable practices into its projects, aiming for resilient, low-carbon urban environments. This strategic focus includes significant investments in electric vehicle (EV) charging infrastructure, with plans to expand charging points across its developments, and enhancing public transport connectivity within its master-planned communities.

For instance, in 2024, Ayala Land continued its commitment to green building, with several of its projects pursuing or maintaining certifications like LEED and BERDE, reflecting a tangible effort to reduce environmental impact. The company's push for smart city integration is also evident in its development of integrated transport hubs and digital infrastructure, anticipating the evolving needs of urban living and promoting efficient resource management.

Telecommunications and Connectivity Infrastructure

Ayala's Globe Telecom is a cornerstone of the Philippines' digital advancement, offering vital telecommunications and connectivity services. This infrastructure is fundamental to Ayala's own digital transformation initiatives and supports the broader economic digitalization across the nation.

Continued, substantial investment in network infrastructure is paramount. This ensures Globe can meet the escalating demand for reliable internet access and a growing array of digital services, a trend amplified by the increasing adoption of cloud computing and mobile-first strategies in 2024 and projected into 2025.

- Network Expansion: Globe Telecom's ongoing capital expenditures, reaching billions of dollars annually, are focused on expanding 5G coverage and enhancing fiber-to-the-home capabilities.

- Data Growth: By the end of 2024, mobile data traffic in the Philippines is expected to surpass 10 exabytes, underscoring the critical need for robust network capacity.

- Digital Services: Investments are also directed towards developing digital platforms and services, including e-wallets and digital health solutions, leveraging the improved connectivity.

Adoption of AI and Data Analytics

Ayala Corporation is making significant strides in adopting AI and data analytics, recognizing their potential to drive business growth and innovation. The company has established AC Analytics, a dedicated team focused on building data maturity and enhancing analytics capabilities across its diverse portfolio, particularly for its newer ventures.

This strategic investment in AI and data science is designed to unlock new efficiencies and foster the development of novel solutions. For instance, in 2023, Ayala Land's digital transformation efforts, which heavily leverage data analytics, contributed to a 28% increase in their recurring revenue streams, showcasing the tangible benefits of these technological adoptions.

- AI and Data Analytics Investment: Ayala has formed AC Analytics to boost data maturity and analytics capacity.

- Efficiency Gains: The focus aims to improve operational efficiency across business units.

- New Solution Development: AI and analytics are key to creating innovative products and services.

- Real-World Impact: Ayala Land's data-driven digital transformation saw a 28% rise in recurring revenue in 2023.

Ayala's technological focus centers on digital transformation, leveraging AI, data analytics, and robust connectivity. Globe Telecom's expansion of its 5G network and fiber-to-the-home services is critical, aiming to reach millions more households by 2025 and support the nation's digital economy. Investments in fintech, particularly through GCash, are driving financial inclusion, with over 100 million users by early 2024, offering a wide range of digital financial services.

Ayala Land is integrating smart city solutions and sustainable technologies, including EV charging infrastructure and enhanced public transport, into its developments. This includes a commitment to green building certifications, aiming for resilient urban environments. The group's strategic investment in AI and data analytics, exemplified by AC Analytics, is designed to boost operational efficiency and foster the development of new digital solutions, as seen in Ayala Land's 28% recurring revenue increase in 2023 from its digital transformation efforts.

| Technological Factor | Ayala's Action/Investment | Impact/Data (2023-2025 Projection) |

| Digital Transformation & AI | Group-wide adoption, AC Analytics team | Enhancing efficiency, driving innovation; Ayala Land saw 28% recurring revenue growth in 2023. |

| Connectivity & Network Expansion | Globe Telecom's 5G and Fiber-to-the-Home | Targeting over 17 million households reached by end-2023, with continued expansion expected through 2025. Mobile data traffic projected to exceed 10 exabytes by end-2024. |

| Fintech & Digital Payments | GCash (Globe Telecom subsidiary) | Over 100 million registered users by early 2024, increasing financial inclusion with services like digital loans and investments. |

| Smart City & Sustainable Tech | Ayala Land's property developments | Integration of EV charging infrastructure and smart city solutions; continued pursuit of green building certifications (LEED, BERDE) in 2024. |

Legal factors

Ayala Corporation places a significant emphasis on robust corporate governance, regularly publishing its Integrated Annual Corporate Governance Report. This commitment ensures alignment with leading international standards, including the ASEAN Corporate Governance Scorecard, demonstrating a dedication to transparency and accountability.

The company's sustained inclusion in the prestigious FTSE4Good Index Series, a testament to its strong governance, risk management, and environmental, social, and governance (ESG) practices, underscores its adherence to high ethical and operational benchmarks.

Ayala Land's extensive real estate operations are heavily influenced by a complex web of land use regulations, zoning ordinances, and environmental permitting processes. Navigating these legal frameworks is paramount for the successful execution of its large-scale integrated communities and urban redevelopment initiatives.

For instance, in 2023, the Philippine government continued to emphasize sustainable development and stricter environmental compliance, impacting project approvals and land utilization strategies for major developers like Ayala Land. This means ensuring all developments align with updated building codes and environmental impact assessments, a process that can influence project timelines and costs.

Ayala Corporation, through its significant stake in the Bank of the Philippine Islands (BPI), operates within a highly regulated financial services sector. The Bangko Sentral ng Pilipinas (BSP) sets the rules, influencing everything from capital requirements to how BPI can offer new digital financial products. For instance, BSP's ongoing focus on cybersecurity and consumer protection in digital transactions directly shapes BPI's investment in technology and its product rollout strategies.

Data Privacy and Cybersecurity Laws

Ayala Corporation's extensive operations in telecommunications (through Globe Telecom) and financial services necessitate strict adherence to data privacy and cybersecurity regulations. The Philippine Data Privacy Act of 2012, for instance, mandates robust measures for collecting, processing, and storing personal data. Failure to comply can result in significant penalties and reputational damage, impacting customer trust and business continuity.

In 2023, Globe Telecom reported a substantial increase in data-related incidents, highlighting the ongoing challenges in cybersecurity. Ayala's commitment to protecting customer information, which is critical given the sensitive nature of financial and communication data, involves continuous investment in advanced security protocols and employee training. This focus is essential to mitigate risks associated with data breaches and maintain regulatory compliance across its diverse business units.

- Data Privacy Act of 2012: Ayala must comply with the stringent requirements of this Philippine law governing personal data.

- Cybersecurity Investments: Significant capital is allocated to fortify systems against evolving cyber threats, protecting millions of customer records.

- Reputational Risk: Data breaches can severely damage Ayala's brand image, particularly in its highly regulated financial and telecommunications sectors.

- Regulatory Fines: Non-compliance can lead to substantial financial penalties, impacting profitability and operational stability.

Environmental Regulations and ESG Reporting Requirements

Ayala Corporation is actively enhancing its environmental compliance and sustainability reporting practices. This includes aligning with internationally recognized frameworks such as the GHG Protocol and the Task Force on Climate-related Financial Disclosures (TCFD). The company is also preparing for the adoption of the new ISSB IFRS Standards, which are designed to create a global baseline for sustainability disclosures.

The regulatory landscape in the Philippines is also evolving, with the Philippine Securities and Exchange Commission (SEC) planning to mandate sustainability reporting for large publicly-listed companies. This requirement is expected to be in effect by 2026-2027, compelling companies like Ayala to report in accordance with IFRS S1 and S2. This move signifies a growing emphasis on transparency and accountability regarding environmental, social, and governance (ESG) performance within the Philippine market.

Ayala's proactive approach to these evolving legal factors positions it favorably to meet future compliance obligations and investor expectations for robust ESG disclosure. The company's commitment to these standards is crucial for maintaining its reputation and access to capital in an increasingly sustainability-conscious global financial environment.

Key developments include:

- GHG Protocol and TCFD Alignment: Ayala is integrating these global standards into its reporting to enhance the comparability and reliability of its climate-related disclosures.

- ISSB IFRS Standards Adoption: The company is preparing for the implementation of the International Sustainability Standards Board (ISSB) standards, aiming for comprehensive and consistent sustainability reporting.

- Philippine SEC Mandate: Large publicly-listed companies in the Philippines, including Ayala, will soon be required by the SEC to report using IFRS S1 and S2 by 2026-2027.

- Focus on ESG Transparency: These legal and regulatory shifts underscore a broader trend towards greater transparency and accountability in corporate ESG performance.

Ayala Corporation's operations are significantly shaped by Philippine legal frameworks, particularly concerning corporate governance and data privacy. The company’s adherence to the Data Privacy Act of 2012 is crucial, especially for its telecommunications and financial services arms, where protecting customer data is paramount. Recent incidents in 2023 highlighted the ongoing cybersecurity challenges, necessitating continuous investment in security protocols to avoid substantial penalties and reputational damage.

Environmental factors

Ayala Corporation is actively pursuing net-zero greenhouse gas emissions by 2050, a commitment that mirrors the global imperative to combat climate change and adhere to the Paris Agreement. This ambitious target necessitates a robust approach to greenhouse gas (GHG) accounting and the establishment of science-based targets across its diverse portfolio of businesses.

The company is implementing concrete mitigation and adaptation strategies to achieve its climate goals. For instance, Ayala Land, a key subsidiary, has invested significantly in renewable energy sources for its developments and is enhancing its water management systems to adapt to changing weather patterns. In 2023, Ayala Land reported a 15% increase in its use of renewable energy across its commercial properties.

These initiatives are crucial for managing climate-related risks, such as extreme weather events that could impact operations and supply chains. By integrating climate resilience into its business model, Ayala aims to ensure long-term sustainability and maintain stakeholder confidence in its environmental stewardship. This strategic focus is increasingly vital for attracting investment and securing a competitive edge in a world prioritizing sustainability.

Ayala is actively pursuing a significant shift towards renewable energy as a core component of its environmental strategy. This commitment is clearly demonstrated by its power subsidiary, ACEN, which has ambitious goals. ACEN is aiming to achieve a substantial 20-gigawatt renewable capacity by the year 2030, showcasing a strong drive towards clean energy generation.

Furthermore, Ayala Land is integrating renewable energy solutions into its real estate developments. A notable achievement is that a significant portion of its commercial gross leasable area is now powered by renewable energy sources. This practical application of green energy underscores Ayala's dedication to reducing its carbon footprint across its diverse business operations.

Ayala Land is making significant strides in waste management, aiming for a Zero Waste to Landfill target by 2030. This commitment is demonstrated through active diversion programs for plastics, food waste, and residual waste across its operations.

These initiatives are not just about environmental responsibility; they embody resource efficiency and circular economy principles, which are becoming increasingly central to sustainable business models. For instance, pilot programs are exploring innovative ways to repurpose materials, reducing reliance on virgin resources and minimizing environmental impact.

Sustainable Building and Green Infrastructure

Ayala Land is a frontrunner in sustainable urban development, holding numerous green certifications from prestigious bodies like LEED, BERDE, WELL, and EDGE. This commitment is evident in their holistic approach, which embeds environmental responsibility throughout the entire lifecycle of their projects, from initial planning and construction to ongoing property management.

Their dedication to green building practices is not just about compliance but a core business strategy. For instance, Ayala Land's portfolio includes a significant number of buildings designed to minimize environmental impact and enhance occupant well-being. In 2023, Ayala Land’s sustainability initiatives continued to gain traction, with ongoing investments in renewable energy sources for its developments and a focus on water conservation technologies.

- LEED Certified Projects: Ayala Land has consistently pursued Leadership in Energy and Environmental Design (LEED) certifications for its commercial and residential buildings, aiming for higher levels of environmental performance.

- BERDE Registered Developments: The company actively engages with the Building for Ecologically Responsive Design Excellence (BERDE) program, a national green building rating system in the Philippines.

- WELL Building Standards: Several of Ayala Land's properties are designed and operated to meet WELL Building Standards, focusing on human health and wellness within the built environment.

- EDGE Certification: The Excellence in Design for Greater Efficiencies (EDGE) certification is also a key benchmark, ensuring resource efficiency in new construction projects.

Water and Biodiversity Conservation

Ayala Corporation's commitment extends beyond carbon emissions to vital areas like water and biodiversity conservation. Recognizing their critical role in long-term sustainability, the company is actively engaged in programs designed to protect and enhance these natural resources.

A key initiative is Ayala Corporation's Project Kasibulan. This program focuses on reforestation and biodiversity conservation, directly addressing the need to secure essential natural resources. The goal is to achieve net-positive environmental outcomes, demonstrating a proactive approach to ecological stewardship.

These efforts are crucial as global biodiversity loss continues to be a significant concern. For instance, the 2024 Global Biodiversity Outlook report highlights ongoing pressures on ecosystems worldwide. Ayala’s proactive stance through Project Kasibulan is therefore timely and impactful.

Key aspects of Ayala's conservation efforts include:

- Reforestation efforts: Planting native tree species to restore degraded lands and enhance forest cover.

- Biodiversity monitoring: Implementing programs to track and protect local flora and fauna.

- Water resource management: Initiatives aimed at responsible water usage and watershed protection within their operational areas.

- Community engagement: Collaborating with local communities to promote sustainable practices and raise awareness about conservation.

Ayala Corporation is deeply committed to environmental sustainability, targeting net-zero greenhouse gas emissions by 2050. This aligns with global climate goals and requires robust GHG accounting and science-based targets across its diverse business units.

The company is actively implementing mitigation and adaptation strategies, with subsidiaries like Ayala Land investing in renewable energy and improving water management. For example, Ayala Land saw a 15% increase in renewable energy use for its commercial properties in 2023, showcasing a tangible shift towards cleaner operations.

Ayala's power subsidiary, ACEN, aims for a significant 20-gigawatt renewable capacity by 2030, underscoring a strong push for clean energy generation. Ayala Land is also integrating renewables into its developments, with a substantial portion of its commercial gross leasable area now powered by these sources, directly reducing its carbon footprint.

Furthermore, Ayala Land is pursuing a Zero Waste to Landfill target by 2030, employing diversion programs for plastics, food waste, and residual waste. These efforts embody resource efficiency and circular economy principles, with pilot programs exploring material repurposing to minimize reliance on virgin resources.

Ayala Land is a leader in sustainable urban development, holding multiple green certifications including LEED, BERDE, WELL, and EDGE. These certifications reflect a holistic approach to environmental responsibility throughout project lifecycles, from planning to property management.

Ayala's environmental commitment also extends to water and biodiversity conservation through initiatives like Project Kasibulan, focused on reforestation and biodiversity protection to achieve net-positive environmental outcomes.

| Environmental Initiative | Target/Goal | Status/Progress | Year |

| Net-Zero GHG Emissions | 2050 | Ongoing | 2024/2025 |

| ACEN Renewable Capacity | 20 GW | Target for 2030 | 2024/2025 |

| Ayala Land Zero Waste to Landfill | 2030 | Ongoing diversion programs | 2024/2025 |

| Ayala Land Renewable Energy Use (Commercial Properties) | Increased 15% | Achieved in 2023 | 2023 |

PESTLE Analysis Data Sources

Our PESTLE analysis for Ayala is meticulously constructed using a blend of official government publications, reputable financial institutions, and leading industry research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the conglomerate.