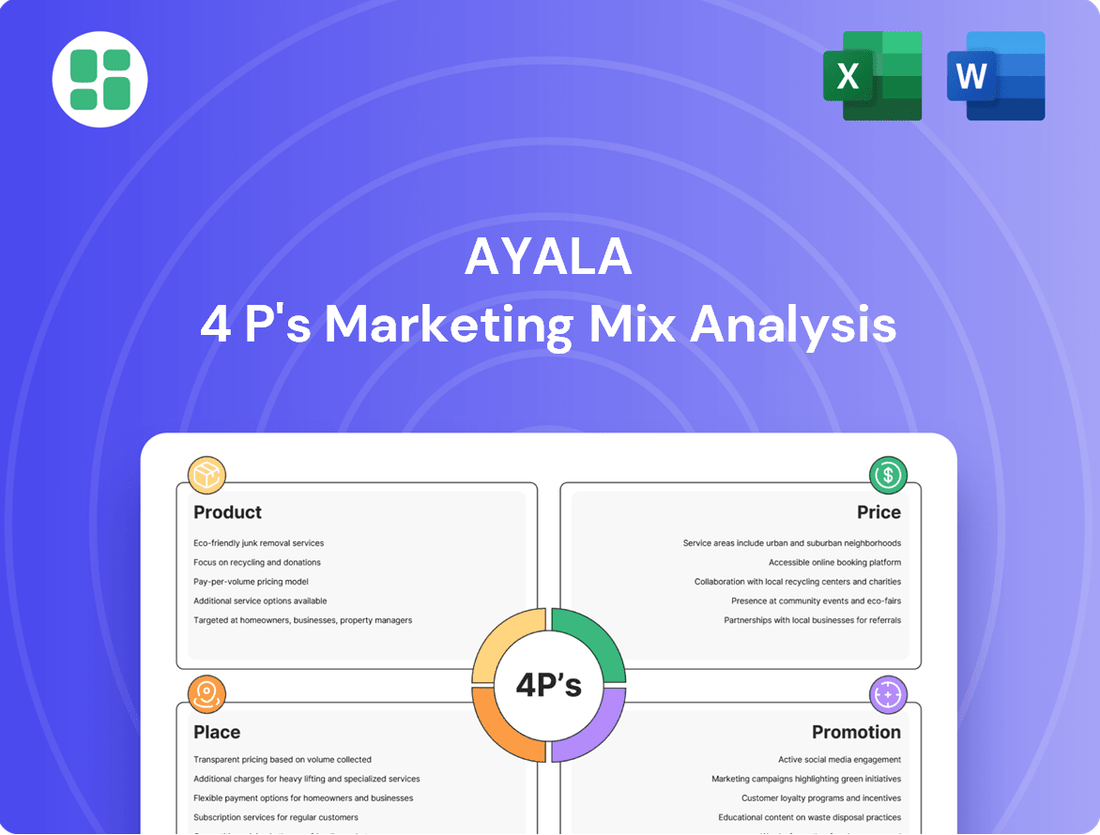

Ayala Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayala Bundle

Discover how Ayala leverages its product innovation, strategic pricing, extensive distribution, and impactful promotions to dominate its market. This analysis goes beyond the surface, revealing the core components of their marketing success.

Unlock the secrets behind Ayala's marketing prowess with our comprehensive 4Ps analysis, covering Product, Price, Place, and Promotion. Gain actionable insights and a ready-to-use framework to elevate your own strategies.

Product

Ayala Corporation's product strategy is defined by its diverse and integrated offerings, a key aspect of its marketing mix. The company doesn't just offer individual products; it develops comprehensive ecosystems. This includes everything from physical assets like residential condominiums and commercial office spaces to essential services such as banking through BPI, telecommunications via Globe, and power generation, including a growing focus on renewable energy. For instance, Globe's 5G network expansion in 2024 aims to enhance connectivity across their diverse service offerings, demonstrating a commitment to integrated value.

This broad portfolio allows Ayala to cater to a wide spectrum of customer needs, from individual homeowners to large corporations and communities. Their approach involves creating large-scale, integrated developments that seamlessly blend residential, commercial, and leisure components, fostering self-sustaining environments. This strategy ensures that customers can access multiple essential services and products from a single, trusted provider, enhancing convenience and overall value. As of early 2025, Ayala Land's ongoing projects continue this trend of integrated community development, reflecting sustained investment in this diversified product strategy.

Ayala Land, a major player in the Philippine real estate sector, is significantly boosting its retail leasing capacity. The company intends to launch between three to five new malls each year, alongside acquiring additional retail spaces through the expansion and refurbishment of its current mall properties. This aggressive expansion underscores their commitment to growing their market presence.

Looking ahead to 2025, Ayala Land has announced plans to introduce P100 billion in new developments. These projects will span residential, commercial, and industrial sectors, with a notable emphasis on the premium market segment. This substantial investment signals a strategic focus on high-value offerings and future growth.

The company's development strategy centers on creating comprehensive, master-planned communities designed to enhance residents' quality of life. A key aspect of this vision involves seamlessly integrating natural elements and wellness features, particularly within their retail environments. This approach aims to create more engaging and holistic living and shopping experiences.

Ayala's financial services, primarily through BPI, are heavily focused on innovation, particularly the integration of physical and digital experiences. BPI plans to open 70 new hybrid branches in 2025 as part of a five-year plan to modernize its entire branch network. This 'phygital' approach aims to blend traditional in-person service with advanced digital tools, enhancing customer convenience and offering specialized advisory services.

BPI's diverse product portfolio includes consumer banking, lending, asset management, payments, and insurance, serving both individual and corporate clients. This broad offering, combined with their innovative branch strategy, positions Ayala's financial services to meet evolving customer needs in the digital age.

Telecommunications and Digital Solutions

Globe Telecom is actively investing in its Product strategy by enhancing its telecommunications and digital solutions. A key focus is the expansion and upgrading of its network infrastructure, including the deployment of 5G technology and fiber optics. For instance, by the end of 2023, Globe had already activated thousands of new 5G sites, significantly boosting network capacity and coverage across the Philippines.

Beyond core connectivity, Globe is diversifying its product offerings into a broader digital ecosystem. This includes venturing into fintech with GCash, digital health services, and various entertainment platforms, aiming to capture a wider share of consumer spending. GCash, a prime example, reported over 100 million registered users by early 2024, showcasing the success of this diversification.

Globe's product strategy also targets specific market segments, notably the enterprise sector and the youth demographic. For enterprises, they offer tailored digital solutions and connectivity. For the youth, innovative mobile data packages and engaging digital content are key, reflecting a deep understanding of evolving consumer needs. This targeted approach is crucial for sustained growth in the competitive telecom landscape.

- Network Enhancement: Continued rollout of 5G sites and fiber optic upgrades to improve coverage and speed.

- Digital Ecosystem Expansion: Growth in fintech (GCash), digital health, and entertainment services.

- Segmented Offerings: Tailored solutions for enterprise clients and innovative data packages for the youth market.

- Customer Engagement: Initiatives to deepen user interaction and loyalty across all digital platforms.

Renewable Energy and Healthcare Expansion

Ayala's expansion into renewable energy, primarily through ACEN Corporation, is a significant product strategy. ACEN is aggressively growing its renewable capacity, aiming for an additional 1.2 gigawatts by 2025. This expansion is geographically diverse, with key projects in the Philippines, Australia, and Laos, focusing on solar and wind technologies.

The healthcare sector, represented by AC Health, also forms a crucial product offering. AC Health has ambitious growth targets, aspiring to become a $2 billion enterprise by 2035. This growth will be driven by both organic expansion, such as building new facilities, and strategic acquisitions of existing hospitals.

- Renewable Energy Capacity: ACEN targets 1.2 GW additional operational capacity by 2025.

- Geographic Focus: Major projects in the Philippines, Australia, and Laos.

- Healthcare Enterprise Value: AC Health aims for $2 billion by 2035.

- Healthcare Network Expansion: Plans include 1,150 retail pharmacies, 300 clinics, and 10 hospitals by 2028.

Ayala Corporation's product strategy is characterized by its diversified and integrated approach, offering a wide range of essential goods and services. This spans real estate developments, financial services, telecommunications, energy, and healthcare, all designed to create interconnected value for customers. The company emphasizes creating comprehensive ecosystems, from smart cities to digital platforms, ensuring a holistic customer experience.

Ayala Land is significantly expanding its retail footprint, aiming to launch 3-5 new malls annually and refurbish existing ones. By 2025, P100 billion in new developments are planned across residential, commercial, and industrial sectors, with a focus on premium offerings and integrated communities that blend living, working, and leisure. This includes integrating natural elements and wellness features into retail spaces.

BPI is modernizing its branch network, planning to open 70 new hybrid branches in 2025 as part of a five-year modernization plan. This 'phygital' strategy combines in-person service with digital tools to enhance customer convenience and advisory services across its diverse financial products, including consumer banking, lending, and insurance.

Globe Telecom is investing heavily in network infrastructure, expanding its 5G sites and fiber optics. By the end of 2023, thousands of new 5G sites were activated. Globe is also diversifying into a digital ecosystem, with GCash reaching over 100 million registered users by early 2024, alongside ventures in digital health and entertainment.

ACEN Corporation is targeting an additional 1.2 gigawatts of renewable energy capacity by 2025, with projects in the Philippines, Australia, and Laos. AC Health aims to become a $2 billion enterprise by 2035, driven by organic growth and strategic acquisitions, planning to expand its network to 1,150 pharmacies, 300 clinics, and 10 hospitals by 2028.

| Product Area | Key Initiatives (2024-2025) | Target/Metric | Status/Update |

| Real Estate (Ayala Land) | New Mall Launches | 3-5 new malls annually | Ongoing expansion |

| New Developments | P100 billion investment by 2025 | Planned | |

| Financial Services (BPI) | Hybrid Branch Openings | 70 new branches in 2025 | Part of 5-year modernization |

| Telecommunications (Globe) | 5G Site Activations | Thousands activated by end of 2023 | Ongoing network enhancement |

| GCash User Base | Over 100 million registered users by early 2024 | Significant growth | |

| Renewable Energy (ACEN) | Additional Capacity Target | 1.2 GW by 2025 | Geographically diverse projects |

| Healthcare (AC Health) | Network Expansion Goal | 1,150 pharmacies, 300 clinics, 10 hospitals by 2028 | Strategic growth plan |

| Enterprise Value Target | $2 billion by 2035 | Long-term aspiration |

What is included in the product

This analysis provides a comprehensive breakdown of Ayala's marketing strategies, examining its Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

It's designed for professionals seeking a deep understanding of Ayala's market positioning, offering a benchmark for competitive analysis and strategic planning.

Provides a clear, actionable framework for identifying and addressing potential marketing challenges, alleviating the pain of uncertainty in strategy development.

Place

Ayala Corporation's extensive physical network is a cornerstone of its marketing strategy, with real estate developments creating integrated communities and commercial hubs across the Philippines. This vast footprint encompasses over 53 estates, featuring a diverse range of residential, retail, office, hospitality, and industrial logistics projects, ensuring broad market reach and customer accessibility.

Complementing this, Bank of the Philippine Islands (BPI), an Ayala subsidiary, is actively enhancing its physical presence through a phygital transformation. By rolling out more hybrid branches, BPI is blending physical accessibility with digital convenience, aiming to serve a wider customer base across the nation, reflecting the group's commitment to a robust physical infrastructure.

Ayala Corporation strategically employs diverse distribution channels to cater to its varied business segments. For its real estate ventures, this includes a robust direct sales force, partnerships with real estate brokers, and on-site sales offices located within their developments, ensuring broad market reach.

In financial services, Ayala leverages a hybrid approach, combining the trust of traditional bank branches with the efficiency of digital platforms and accessible self-service kiosks, reflecting evolving customer preferences.

Ayala's telecommunications arm, Globe Telecom, ensures widespread accessibility through a network of physical stores, comprehensive online channels, and a continuously growing number of cell sites, facilitating seamless mobile and broadband service delivery across the Philippines.

Ayala leverages digital platforms to boost accessibility. Globe Telecom's 5G network, with coverage reaching over 97% of the population by early 2024, and its expanding digital solutions ecosystem are key to meeting escalating online demands. This digital push ensures a broader reach for Ayala's services.

BPI's digital banking, accessible through its mobile app and online portal, complements its extensive network of over 1,100 branches. This dual approach allows customers to bank conveniently, whether in person or digitally, reflecting a commitment to serving a diverse customer base.

The group’s digital presence extends its market reach significantly, tapping into a growing tech-savvy demographic. This strategic focus on digital channels allows Ayala to cater to evolving consumer preferences and maintain a competitive edge in an increasingly connected marketplace.

Logistical Efficiency for Utilities

For Ayala Corporation's power arm, ACEN, logistical efficiency in 'place' centers on the strategic development and operation of renewable energy assets. This includes a geographically diverse portfolio of power plants and grids, both within the Philippines and in international markets such as Australia, Laos, India, and the United States, ensuring reliable electricity delivery.

ACEN's approach to 'place' emphasizes not just generation but also the efficient transmission and distribution of power. Their investments in grid infrastructure and smart grid technologies are crucial for integrating intermittent renewable sources and minimizing energy losses. By 2025, ACEN aims to significantly expand its renewable energy capacity, with a substantial portion of its growth targeting international markets to diversify risk and capture global demand.

- Geographic Diversification: ACEN operates renewable energy projects across the Philippines, Australia, India, Laos, and the United States, as of early 2024.

- Capacity Expansion: The company has a robust pipeline of projects, targeting a significant increase in its renewable energy capacity by 2025, with a strong focus on international markets.

- Grid Integration: Investments in grid modernization and smart grid technologies are key to ensuring efficient delivery and minimizing losses in their distributed energy network.

Healthcare Network Expansion

AC Health is strategically growing its healthcare network, integrating hospitals, clinics, and pharmacies nationwide. This expansion aims to significantly increase access to essential medical services for a larger segment of the Philippine population. For instance, by the end of 2024, AC Health projects to operate over 20 hospitals and more than 100 clinics, demonstrating a substantial increase in their physical presence.

This broadens their reach, making healthcare more accessible. Their commitment to sustainability is also evident through partnerships like the one with ACEN RES, powering their medical facilities with renewable energy. This initiative supports operational efficiency and aligns with environmental, social, and governance (ESG) principles, a growing consideration for investors and consumers alike.

- Network Growth: AC Health is on track to operate over 20 hospitals and 100+ clinics by year-end 2024.

- Service Accessibility: Expansion targets broader reach and improved access to healthcare for Filipinos.

- Sustainable Operations: Partnership with ACEN RES to integrate renewable energy into medical facilities.

- Financial Impact: Increased network capacity is expected to drive revenue growth, with projections indicating a 15% rise in patient volume for new facilities in their first year of operation.

Ayala Corporation's 'Place' strategy is multifaceted, leveraging extensive physical networks and increasingly sophisticated digital platforms. Their real estate arm creates integrated communities, while BPI enhances its phygital branch network. Globe Telecom ensures broad accessibility through stores and a robust 5G network, with over 97% population coverage by early 2024.

ACEN's global renewable energy portfolio, spanning the Philippines, Australia, India, Laos, and the US as of early 2024, underscores its commitment to geographically diversified and efficient power delivery, aiming for significant capacity expansion by 2025.

AC Health is aggressively expanding its healthcare footprint, targeting over 20 hospitals and 100 clinics by the end of 2024, significantly improving service accessibility across the Philippines. This expansion is projected to boost patient volume by 15% in new facilities within their first year.

| Business Unit | Key 'Place' Strategy Elements | Geographic Reach (as of early 2024) | Key 2024/2025 Data/Targets |

|---|---|---|---|

| Ayala Land | Integrated communities, commercial hubs | Philippines-wide | Over 53 estates |

| BPI | Hybrid branches, digital platforms | Philippines-wide | Over 1,100 branches |

| Globe Telecom | Physical stores, online channels, cell sites | Philippines-wide | 5G coverage >97% population (early 2024) |

| ACEN | Renewable energy asset development, grid integration | Philippines, Australia, India, Laos, US | Capacity expansion by 2025, focus on international markets |

| AC Health | Hospital, clinic, pharmacy network expansion | Philippines-wide | >20 hospitals, >100 clinics by end-2024; 15% patient volume increase in new facilities |

Preview the Actual Deliverable

Ayala 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Ayala's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Ayala Corporation's integrated corporate branding is a cornerstone of its marketing strategy, effectively communicating its dedication to sustainable value creation and national development. This robust brand identity is meticulously cultivated through various channels, ensuring a consistent message of long-term commitment and responsible business practices.

The company's annual integrated reports serve as a critical tool in this branding effort, showcasing performance across strategic, financial, and sustainability dimensions. These reports, which often detail significant ESG achievements, reinforce Ayala's reputation with a diverse stakeholder base, including investors and the broader public.

Ayala's consistent recognition in the FTSE4Good Index Series, a testament to its strong Environmental, Social, and Governance (ESG) performance, further solidifies its corporate image. For instance, in 2023, Ayala was again recognized for its robust ESG practices, a key factor for global investors seeking sustainable investments. This external validation significantly enhances its appeal to a market increasingly focused on responsible corporate citizenship.

Ayala Corporation's diverse business units execute highly specific promotional campaigns. For instance, Ayala Land focuses on promoting its mall redevelopments by highlighting the creation of vibrant community spaces and enhanced experiential offerings, aiming to attract shoppers seeking more than just retail.

BPI, on the other hand, emphasizes its successful 'phygital' strategy, blending physical and digital banking channels, and consistently showcases its high customer satisfaction ratings, which reached 90% in early 2024, to build trust and loyalty.

Globe Telecom actively targets the youth and small business sectors with promotions centered on improved digital services and engaging customer interaction. In 2024, Globe reported a significant increase in its subscriber base, driven by these targeted digital initiatives.

Ayala's various subsidiaries actively utilize digital marketing and social media to connect with their audiences. This includes targeted online advertising, engaging content, and direct social media interaction, especially appealing to younger, digitally-connected demographics.

Globe Telecom, a key Ayala company, exemplifies this with its emphasis on digital solutions. Their collaborations with tech giants like Google Cloud and AWS underscore a commitment to robust digital marketing strategies, enabling sophisticated customer segmentation and two-way communication.

In 2024, Globe reported a significant increase in its digital customer base, with over 90% of its transactions occurring through digital channels. This trend highlights the effectiveness of their digital-first approach in reaching and engaging a broad spectrum of consumers.

Public Relations and Investor Relations

Ayala's Public Relations and Investor Relations efforts are crucial for shaping its corporate narrative and fostering trust. The company actively engages stakeholders through various channels, aiming for transparency in its strategic direction and financial health. This proactive communication strategy is designed to manage its reputation effectively and build strong relationships within the investment community.

Key initiatives include regular communication with analysts and investors. For instance, Ayala regularly conducts quarterly analyst briefings and annual stockholders' meetings. These events serve as vital platforms for disseminating financial performance updates and strategic insights. In 2024, Ayala's commitment to transparency was evident in its consistent reporting and engagement with shareholders, aiming to provide a clear picture of its business operations and future outlook.

Ayala leverages news releases and sustainability reports to communicate significant milestones and its commitment to environmental, social, and governance (ESG) principles. These reports are essential for informing the public and investors about the company's social impact and governance practices. For example, Ayala's 2024 sustainability report highlighted progress in its carbon reduction targets and community development programs, underscoring its dedication to responsible business practices.

- Analyst Briefings: Ayala regularly hosts quarterly analyst briefings to discuss financial results and strategic updates, fostering informed investment analysis.

- Shareholder Engagement: Annual stockholders' meetings provide a direct forum for communication between Ayala's management and its investors.

- Information Dissemination: News releases and comprehensive sustainability reports ensure broad access to information on company performance and ESG initiatives.

- Transparency Focus: The company prioritizes clear and consistent communication to manage its corporate image and build investor confidence.

Community Engagement and Sustainability Initiatives

Ayala's promotional strategy significantly leverages its community engagement and sustainability initiatives to build brand loyalty and enhance its corporate image. These efforts highlight a deep-seated commitment to the Filipino people and environmental preservation, resonating with a growing segment of socially conscious consumers and investors.

Key examples include Ayala Foundation's robust scholarship programs, which have supported thousands of Filipino students, fostering future leaders and contributing to national development. For instance, in 2023, Ayala Foundation continued its legacy of educational support, with its scholarship programs benefiting over 1,000 students across various disciplines, underscoring its long-term investment in human capital.

Furthermore, AC Health's proactive transition to renewable energy sources for its healthcare facilities demonstrates tangible environmental stewardship. By 2024, AC Health aims to power a significant portion of its operations with solar energy, reducing its carbon footprint by an estimated 15% compared to 2022 levels. These initiatives are actively promoted through various channels, reinforcing Ayala's purpose-driven narrative and fostering positive public perception.

- Ayala Foundation Scholarships: Continued investment in education, supporting over 1,000 students in 2023.

- AC Health Renewable Energy: Targeting a 15% reduction in carbon footprint by 2024 through solar power adoption.

- Social and Environmental Stewardship: Promoting initiatives that build goodwill and align with a purpose-driven brand identity.

Ayala's promotional efforts are multifaceted, blending corporate branding with targeted campaigns from its subsidiaries. These initiatives aim to enhance brand loyalty and corporate image by highlighting community engagement and sustainability, resonating with socially conscious consumers and investors.

The company's integrated reports and consistent recognition in indices like FTSE4Good solidify its reputation for responsible business practices. Subsidiaries like Ayala Land, BPI, and Globe Telecom execute specific promotions focusing on community spaces, digital banking, and enhanced digital services, respectively, supported by strong digital marketing and public relations efforts.

Ayala's commitment to ESG principles is actively promoted through initiatives like the Ayala Foundation's scholarship programs and AC Health's adoption of renewable energy. These actions underscore a purpose-driven narrative, reinforcing positive public perception and investor confidence.

| Company/Initiative | Promotional Focus | Key Data/Achievement (2023-2024) |

|---|---|---|

| Ayala Corporation | Integrated Corporate Branding, ESG | FTSE4Good Index recognition (2023); Consistent integrated reporting |

| Ayala Land | Mall Redevelopments, Community Spaces | Focus on enhanced experiential offerings |

| BPI | 'Phygital' Banking Strategy | 90% customer satisfaction (early 2024) |

| Globe Telecom | Digital Services, Youth/SME focus | Increased subscriber base (2024); Over 90% digital transactions (2024) |

| Ayala Foundation | Scholarship Programs | Supported over 1,000 students (2023) |

| AC Health | Renewable Energy in Facilities | Targeted 15% carbon footprint reduction by 2024 |

Price

Ayala Corporation's pricing strategy is deeply rooted in value-based principles, adapting to the distinct characteristics of each business segment. This approach is evident in their real estate ventures, where high-end developments command premium pricing, while their affordable housing projects adopt a more competitive stance to capture a wider market. This segmentation ensures alignment with brand perception and accessibility for diverse customer bases.

The company's financial performance underscores the effectiveness of this value-driven pricing. Ayala reported record core earnings in 2024, a testament to their ability to extract value across their portfolio, even when some smaller segments faced challenges. This demonstrates a successful navigation of market demands and a robust strategy for profit generation.

In competitive sectors like telecommunications, Globe Telecom's pricing strategies are heavily influenced by market dynamics and rival offerings. They focus on value-added data packages and innovative digital solutions to attract and retain customers, a strategy that saw their mobile data revenue grow by 17% year-on-year in the first nine months of 2024, reaching PHP 93.3 billion.

For financial services, Bank of the Philippine Islands (BPI) maintains competitive pricing for its loans, interest rates, and fees. This approach reflects its strong financial performance, including a 20% increase in net income to PHP 39.5 billion for the first nine months of 2024, and its expanded customer base, which grew by 9% to over 11 million accounts in the same period.

ACEN's pricing for energy, especially in regulated markets like power, is carefully managed within established frameworks. This ensures stability while also reflecting the long-term value and sustainability inherent in their renewable energy ventures.

The company's substantial capital expenditures, such as the reported $2.2 billion investment in new projects in 2023, underscore a commitment to future growth. These significant investments are designed to yield long-term returns, which will inevitably shape how their pricing structures evolve over time.

Flexible Financing and Payment Options

Ayala Land understands that affordability is key to property ownership. They offer a range of flexible financing and payment options designed to suit diverse buyer needs. This includes strong partnerships with major banks, ensuring that prospective homeowners and businesses can access suitable loan products and payment schemes.

For instance, Bank of the Philippine Islands (BPI), a key Ayala Corporation subsidiary, provides a wide array of financial solutions. These often feature adaptable payment terms and various credit facilities, making it easier for a broad spectrum of clients to acquire Ayala Land properties. In 2023, BPI reported a net income of PHP 49.4 billion, reflecting its robust capacity to support significant property financing.

- Bank Partnerships: Ayala Land collaborates with leading financial institutions to offer competitive mortgage and financing packages.

- Flexible Payment Terms: Buyers can often choose from extended payment periods, deferred payment schemes, and customizable down payment structures.

- BPI's Role: As a major banking partner, BPI offers diverse loan products with flexible terms and credit options, supporting buyer accessibility.

- 2023 Financial Strength: BPI's substantial net income of PHP 49.4 billion in 2023 underscores its financial capacity to facilitate property transactions.

Strategic Capital Allocation and Investment

Ayala Corporation's strategic capital allocation directly influences its pricing power and market positioning. The company plans significant investments, with P230 billion allocated to bolster its diverse businesses. This substantial capital injection, including P95 billion for Ayala Land in 2025, signals a commitment to growth and operational efficiency.

These investments are designed to fortify existing business units and drive rationalization, with the overarching goal of ensuring most, if not all, subsidiaries achieve positive equity earnings. This financial strengthening is crucial for supporting future revenue streams and refining pricing strategies across its portfolio.

- Capital Expenditure: P230 billion overall for business support.

- Ayala Land Investment: P95 billion earmarked for 2025.

- Objective: Strengthen business units and achieve positive equity earnings.

- Impact: Influences future revenue generation and pricing models.

Ayala Corporation's pricing strategy is fundamentally value-based, adapting to each segment's market realities. This is evident in real estate, where premium pricing for high-end projects contrasts with competitive pricing for affordable housing, aiming for broad market appeal.

In telecommunications, Globe Telecom's pricing is market-driven, focusing on value-added data and digital services. This strategy contributed to a 17% year-on-year mobile data revenue growth, reaching PHP 93.3 billion in the first nine months of 2024.

For financial services, BPI offers competitive loan and deposit rates, supported by a 20% net income increase to PHP 39.5 billion in the first nine months of 2024, reflecting its capacity to offer attractive pricing.

ACEN's energy pricing, particularly in regulated markets, adheres to established frameworks, balancing stability with the long-term value of renewable energy.

| Business Segment | Pricing Approach | Key Financial Data (2024 YTD) |

|---|---|---|

| Real Estate (Ayala Land) | Value-based, premium for high-end, competitive for affordable | N/A (specific pricing data not publicly detailed) |

| Telecommunications (Globe) | Market-driven, value-added services | Mobile data revenue: PHP 93.3 billion (+17% YoY) |

| Financial Services (BPI) | Competitive rates and fees | Net income: PHP 39.5 billion (+20% YoY) |

| Energy (ACEN) | Regulated pricing, long-term value | N/A (specific pricing data not publicly detailed) |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Ayala is grounded in a comprehensive review of their official corporate communications, including annual reports and investor presentations. We also leverage insights from market research reports, industry publications, and publicly available data on their real estate projects and pricing strategies.