Ayala Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayala Bundle

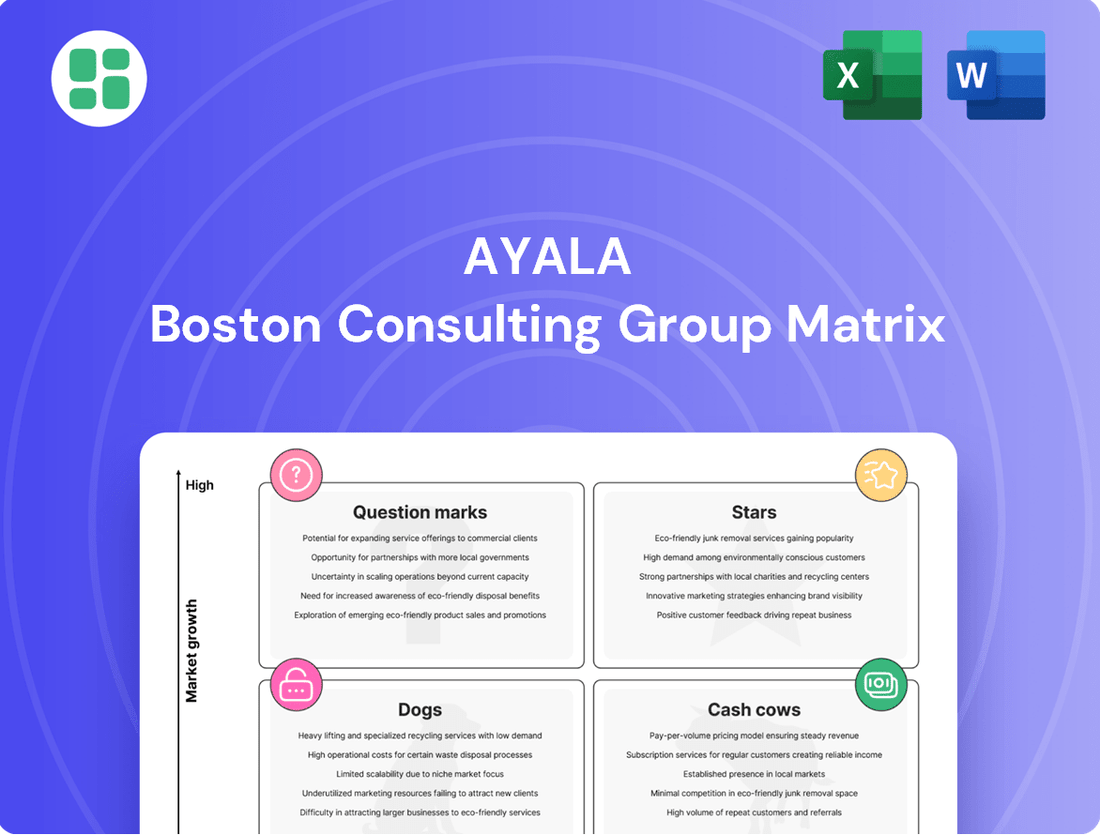

Understand the strategic positioning of a company's products with the Ayala BCG Matrix, categorizing them as Stars, Cash Cows, Dogs, or Question Marks. This foundational insight is crucial for effective resource allocation and growth planning. Purchase the full report to unlock detailed quadrant analysis, actionable recommendations, and a clear roadmap for optimizing your product portfolio and driving future success.

Stars

ACEN, Ayala's renewable energy business, is a strong contender in the BCG matrix, often seen as a Star. In 2024, ACEN demonstrated robust performance with a 27% surge in net income, reaching ₱9.36 billion. This growth was fueled by a significant 25% expansion in its renewable energy output.

The company's aggressive capacity expansion strategy is a key indicator of its Star status. ACEN boasts 7.0 GW of attributable renewables capacity, with 3.3 GW already operational and an additional 2.3 GW under construction. This substantial pipeline positions ACEN for continued market leadership in the rapidly growing renewable energy sector.

Further strengthening its market position, ACEN secured 160 MW of renewable energy mid-merit contracts through Meralco's competitive selection process. This achievement underscores ACEN's ability to secure long-term revenue streams and reinforces its role as a significant player in the Philippines' energy transition.

Ayala Land's premium residential segment, spearheaded by brands like Ayala Land Premier and Alveo, is a powerhouse within the company's portfolio. In 2024, this segment contributed significantly to the company's financial performance, reflecting robust demand in the luxury and upscale property markets.

Residential revenues surged by 23% to ₱94.9 billion in 2024, a testament to the strength of Ayala Land's offerings. The premium brands alone secured 64% of total sales reservations, which amounted to ₱127.1 billion, marking a healthy 12% increase year-on-year.

This segment enjoys a commanding market share in a sector that continues to expand. While new project launches require substantial investment, they translate into considerable sales, underscoring the segment's position as a cash generator and a key growth driver for Ayala Land.

Ayala Land's commercial and industrial lots are a strong contender in the BCG matrix, likely positioned as a Star or a Cash Cow. Revenues from this segment surged by 34% to ₱14.6 billion in 2024. This impressive growth was fueled by high demand for properties located outside the bustling Metro Manila area.

The robust performance is further supported by ongoing infrastructure development nationwide and the increasing trend of decentralization. These factors create a favorable environment for commercial and industrial lot sales, solidifying its status as a high-growth segment within Ayala Land's portfolio.

BPI's Digital Banking and Microfinance Initiatives (BanKo)

BPI's digital banking and microfinance initiatives, particularly through BPI Direct BanKo, are demonstrating robust expansion. This segment is characterized by substantial customer acquisition and increasing loan volumes, positioning it as a high-growth area within the bank's portfolio.

In 2024, BanKo achieved a significant milestone by extending ₱21.7 billion in new loans, marking a substantial 45.4% increase compared to the previous year. This impressive growth underscores the expanding reach and demand for its financial services.

Furthermore, BPI's digital transformation efforts are evident in the user adoption of its banking applications. The BanKo app alone registered 500,000 new users in 2024, highlighting a strong uptake in digital financial services and a growing digital-first customer base.

These developments suggest that BPI's focus on financial inclusion and digital banking is successfully tapping into new market segments. The innovative solutions offered by BanKo are resonating with customers, indicating a promising future for growth and market penetration.

- Loan Disbursements: ₱21.7 billion in new loans extended by BanKo in 2024.

- Year-on-Year Loan Growth: 45.4% increase in new loans for BanKo in 2024.

- Digital User Acquisition: 500,000 new registered users on the BanKo app in 2024.

- Market Position: Strong potential in financial inclusion and digital banking, capturing new market segments.

AC Mobility's Electric Vehicle (EV) Market Share

AC Mobility, the automotive division of Ayala, is a clear leader in the burgeoning electric vehicle (EV) sector. As of 2024, they command an impressive 85% market share in new EVs, a testament to their strong presence. Unit sales have surged by 46%, reaching 23,483 vehicles, highlighting rapid adoption and demand for their offerings.

Despite a net loss in the overall segment, largely attributed to initial ramp-up expenses, AC Mobility's dominance in the high-growth EV market firmly places it in the Star category of the Ayala BCG Matrix. This strategic positioning is further reinforced by substantial investments in expanding their charging infrastructure. They have established 215 charging points across 86 locations, signaling a commitment to supporting and capitalizing on the future of electric mobility.

- Market Dominance: AC Mobility holds an 85% market share in new EVs as of 2024.

- Sales Growth: Unit sales increased by 46% to 23,483 in the same period.

- Infrastructure Investment: The company operates 215 charging points across 86 locations.

- Strategic Positioning: Dominant EV market share designates AC Mobility as a Star in the BCG Matrix, despite current ramp-up costs.

Stars in the Ayala BCG Matrix represent business units with high market share in high-growth industries. ACEN, with its significant renewable energy capacity and secured contracts, and Ayala Land's premium residential segment, demonstrated by strong sales reservations and revenue growth, are prime examples. AC Mobility's commanding 85% market share in the rapidly expanding EV sector, despite initial losses, also firmly places it in the Star category.

| Business Unit | Market Growth | Market Share | 2024 Performance Highlights |

| ACEN | High | High | 27% net income surge; 25% renewable output expansion; 7.0 GW capacity. |

| Ayala Land (Premium Residential) | High | High | 23% residential revenue growth to ₱94.9 billion; 64% of sales reservations. |

| AC Mobility | High | Very High (EV Sector) | 85% EV market share; 46% unit sales increase; 215 charging points. |

What is included in the product

The Ayala BCG Matrix analyzes its business units as Stars, Cash Cows, Question Marks, or Dogs to guide investment and resource allocation.

A clear visual representation of business unit performance, eliminating the pain of uncertainty in strategic resource allocation.

Cash Cows

Bank of the Philippine Islands (BPI) stands as a quintessential cash cow within the Ayala portfolio. In 2024, BPI achieved a remarkable 20% year-on-year increase in net income, reaching ₱62.0 billion, while revenues climbed 23% to ₱170.14 billion, underscoring its consistent profitability and strong market position.

With a client base expanding to 16 million, including over five million new clients in 2024, and retaining its top Net Promoter Score among full-scale banks, BPI exhibits robust customer loyalty and a dominant market presence, further solidifying its cash cow status.

Ayala Land's shopping centers represent a classic cash cow within its business portfolio. In 2024, this segment saw revenues climb by 9% to ₱23.0 billion, a testament to the strength of its established properties and the successful launch of new ventures such as One Ayala and AyalaMalls Manila Bay.

This segment thrives on the stability and high profit margins characteristic of mature retail real estate markets. Consistent foot traffic and well-structured leasing agreements ensure a predictable and substantial cash flow, allowing Ayala Land to focus on operational efficiency and infrastructure upgrades to further optimize earnings.

Ayala Land's office leasing segment is a quintessential Cash Cow. In 2024, its revenues climbed 9% to ₱12.9 billion, underscoring its stable and substantial contribution.

As a dominant player in prime office spaces, especially within key business districts, this segment generates reliable cash flow through enduring lease agreements. Its maturity as a market segment necessitates minimal aggressive marketing, thereby supporting excellent profit margins.

Globe Telecom's Mobile Data Business

Globe Telecom's mobile data business is a prime example of a Cash Cow within the Ayala BCG Matrix. This segment consistently generates substantial revenue and profits, requiring minimal investment for continued growth. Its strong market position and the essential nature of mobile data services ensure a stable and predictable income stream for the company.

- Globe's mobile data revenues hit a record ₱97.4 billion in 2024, a 7% increase year-over-year.

- This segment now represents 83% of all mobile revenues, highlighting its dominance.

- With 37.4 million data users out of 60.9 million subscribers, Globe commands a significant share in a mature market.

- The consistent high revenue generation and profitability solidify its Cash Cow status.

Generika Drugstore (under AC Health)

Generika Drugstore, a key player in the Philippine pharmaceutical retail sector and a subsidiary of AC Health, operates as a prime example of a Cash Cow in the BCG Matrix. As of 2024, the company boasts a significant footprint with 880 Generika and St. Joseph Drug pharmacies strategically located across the country.

Despite the pharmaceutical retail market not exhibiting explosive growth, Generika's established brand recognition and its commitment to providing affordable generic medicines ensure a steady stream of revenue. This consistent performance solidifies its position as a reliable cash generator within AC Health's diverse business units.

- Market Presence: 880 Generika and St. Joseph Drug pharmacies as of 2024.

- Revenue Generation: Consistent cash flow due to focus on affordable generics.

- Market Position: Pioneer in generic retail pharmacy, ensuring strong brand loyalty.

- Strategic Role: Stable cash generator within AC Health's portfolio, funding other ventures.

Cash Cows are business units or products that have a high market share in a slow-growing industry. They generate more cash than they consume, providing a stable income stream that can be used to fund other ventures. These entities typically require low investment for maintenance and offer predictable returns.

Ayala's portfolio features several strong Cash Cows. These businesses are characterized by their maturity, established market presence, and consistent profitability. They are vital for the group's financial stability, allowing for strategic reinvestment and expansion into other areas.

The consistent performance of these Cash Cows underscores their importance in Ayala's overall business strategy, providing the financial muscle needed for growth and innovation across its diverse holdings.

| Business Unit | 2024 Revenue (₱ Billion) | Year-on-Year Growth | Key Metric |

|---|---|---|---|

| BPI | 170.14 | 23% | Net Income: ₱62.0 Billion (20% YoY growth) |

| Ayala Land Shopping Centers | 23.0 | 9% | Stable foot traffic and leasing agreements |

| Ayala Land Office Leasing | 12.9 | 9% | Enduring lease agreements in prime locations |

| Globe Telecom Mobile Data | 97.4 | 7% | 83% of total mobile revenue |

| Generika Drugstore | N/A (Subsidiary of AC Health) | N/A | 880 pharmacies nationwide |

Delivered as Shown

Ayala BCG Matrix

The Ayala BCG Matrix preview you are currently viewing is the complete, unwatermarked document you will receive immediately after your purchase. This means you're seeing the exact strategic framework, including all quadrants and detailed analysis, that you can directly apply to your business planning. Rest assured, this is the final, professionally formatted report ready for immediate use, without any demo content or hidden limitations.

Dogs

Integrated Micro-Electronics, Inc. (IMI), a significant component of AC Industrials, experienced a revenue dip to $1.1 billion in 2024, down from $1.3 billion the previous year. The core operations of IMI reported a net loss of $24.6 million, indicating considerable financial strain.

Despite ongoing rationalization initiatives, IMI continues to grapple with substantial challenges in the intensely competitive global manufacturing sector. These headwinds contribute to its position as a low-growth, low-market-share entity, often characterized as a cash trap due to its inability to generate meaningful returns on invested capital.

Ayala Education's traditional education institutions, focusing on established brick-and-mortar schools, might be classified as Dogs within the BCG matrix. This classification arises if these ventures operate in a mature or declining market segment with low growth prospects and limited opportunities for expansion. For instance, if a particular school faces declining student enrollment due to demographic shifts or increased competition without a clear differentiation strategy, it could become a cash drain rather than a contributor to overall growth.

The inherent nature of traditional education can present challenges in achieving rapid scalability or significant market share gains, especially when competing against more agile or digitally focused competitors. If these traditional models are not actively innovating or adapting to evolving educational demands, they may struggle to generate substantial returns, potentially operating at break-even or requiring ongoing investment simply to maintain their current standing.

Ayala Land's office-for-sale projects appear to be in the 'Cash Cow' or potentially 'Dog' quadrant of the BCG matrix. Revenues from these projects saw an 18% dip in 2024, reaching ₱3.465 billion. This decline is attributed to reduced recognition from nearly finished developments, signaling a mature or possibly shrinking market for new office sales.

The decrease in revenue suggests that new bookings are not sufficiently compensating for the completion of existing projects. This scenario points to a low-growth environment for this particular segment of Ayala Land's portfolio, potentially indicating a loss of market momentum in the office-for-sale sector.

Certain Legacy Infrastructure Projects

Certain legacy infrastructure projects within Ayala Corporation's diverse portfolio might be categorized as Dogs in the BCG Matrix. These are typically older assets, perhaps in mature markets, that no longer represent high-growth areas or possess a strong competitive edge. While they might still generate some revenue, their potential for significant expansion or market leadership is limited, and they may require consistent investment for upkeep.

These projects could be characterized by lower returns on capital compared to other business units. For instance, if an older toll road concession experiences declining traffic volumes due to new transportation alternatives or urban development shifts, it might fit this description. Such assets often operate in stable but non-expanding markets, making it challenging to achieve substantial growth or a dominant market share.

The financial performance of such legacy assets in 2024-2025, while not explicitly flagged as underperforming in public disclosures, would likely reflect these characteristics. Conglomerates like Ayala often manage a mix of assets, and understanding the strategic positioning of each is key.

- Low Growth Potential: Mature infrastructure assets with limited scope for expansion or market penetration.

- Limited Competitive Advantage: Facing competition or obsolescence in established markets.

- Ongoing Maintenance Costs: Requiring capital for upkeep without significant return on investment potential.

- Mature Market Saturation: Operating in sectors where demand growth has plateaued or declined.

Small, Niche Retail Formats (Non-Core to Ayala Land's Main Malls)

Within Ayala Land's extensive real estate portfolio, certain smaller, niche retail formats or older, less prime retail spaces could be categorized as Dogs in the BCG matrix. These might include specialized concept stores or retail outlets in less frequented areas that face challenges in attracting consistent customer traffic and maintaining a significant market share. Their performance often lags behind the company's core mall operations, requiring ongoing operational costs without generating substantial returns or exhibiting strong growth potential.

These "Dog" assets might represent a small fraction of Ayala Land's total retail revenue. For instance, while Ayala Land's mall segment reported a significant contribution to its overall revenue, the performance of these smaller formats would be disproportionately lower. As of 2024, the company continues to optimize its property portfolio, and such underperforming assets are typically subject to strategic review, potentially leading to divestment or repositioning to unlock value.

- Low Market Share: These niche formats often struggle to capture a substantial portion of the retail market due to their specialized nature or less-than-ideal locations.

- Low Growth Prospects: The competitive retail landscape and changing consumer preferences limit the potential for significant revenue growth from these outlets.

- Operational Costs: Despite minimal returns, these properties still incur maintenance and operational expenses, impacting overall profitability.

- Strategic Review: Ayala Land regularly assesses its property assets; underperforming "Dog" segments are candidates for potential divestment or repurposing to align with strategic objectives.

Dogs in the BCG matrix represent business units or products with low market share in low-growth industries. These entities typically generate just enough cash to cover their own costs, or they may even require cash infusions to maintain their position. For Ayala Corporation, these could be older, less competitive business units or products that are not generating significant returns.

For example, Integrated Micro-Electronics, Inc. (IMI), a part of AC Industrials, reported a net loss of $24.6 million in 2024 on revenues of $1.1 billion, highlighting its struggle in a competitive market. Similarly, certain niche retail formats within Ayala Land may have low market share and limited growth prospects, requiring ongoing operational costs without substantial returns.

These "Dog" segments often necessitate a strategic decision: either divest them to free up resources or attempt a turnaround if there's a viable path to improvement. The focus is on minimizing losses and redeploying capital to more promising areas of the business.

Question Marks

AC Health's foray into emerging healthcare technologies and digital health platforms positions it squarely in the 'Question Marks' quadrant of the BCG Matrix. These ventures are characterized by operating in a high-growth, rapidly evolving market, a key indicator for potential future success.

While specific market share data for these nascent digital health initiatives isn't widely publicized, their nature suggests they are still building traction against established players. This aligns with the 'Question Mark' profile of having low relative market share in a high-growth industry.

The company's ambitious expansion targets, aiming for 10 hospitals, 300 clinics, and 1150 pharmacies by 2027, underscore a significant investment in its overall healthcare ecosystem, including these new technology arms. By 2035, AC Health aspires to be a $2 billion enterprise, a goal heavily reliant on the successful development and scaling of these innovative ventures.

These digital health and technology initiatives require substantial capital outlay, a common trait of 'Question Marks' that need investment to grow. The potential upside is considerable, with the possibility of these ventures maturing into 'Stars' if they capture significant market share in the burgeoning digital health space.

Ayala Land is actively expanding its portfolio with new integrated estates, a strategic move reflecting its commitment to high-growth regions. Notably, 64% of its project launches in 2024 are situated outside Metro Manila, demonstrating a deliberate effort to tap into broader market potential. An example of this is ALP's Enara in Nuvali Heights, a development that signifies the company's forward-looking approach to urban and suburban planning.

These nascent developments, while located in promising, high-growth areas, are currently in their foundational stages. This means they possess a low market share at present and necessitate significant capital infusion for their development and market penetration. Their trajectory within the BCG matrix will heavily depend on their ability to achieve swift market acceptance and maintain consistent demand, which are crucial for their evolution into future Stars.

AC Education's digital learning platforms, supported by strategic partnerships such as the U-Go Scholarship Program via Ayala Foundation, position it within the burgeoning EdTech sector. This aligns with Ayala's broader strategic interest in education, a market experiencing significant growth.

While the EdTech market presents high growth potential, AC Education's newer digital ventures likely hold a low current market share. Consequently, these initiatives would require substantial investment to achieve scalability and capture a significant portion of this expanding market, placing them in the question mark quadrant of the BCG matrix.

AC Ventures' Early-Stage Investments

AC Ventures, the venture capital arm of Ayala Corporation, strategically targets early-stage companies with substantial growth potential across diverse sectors. These investments, by their nature, are categorized as 'Question Marks' within the BCG Matrix framework. They operate in nascent markets with significant upside but also carry considerable risk and often possess a small market share.

These ventures require ongoing capital infusion to foster development and market penetration. The success of these 'Question Marks' hinges on their ability to capture market share and achieve profitability, transforming them into 'Stars' or, conversely, potentially becoming 'Dogs' if they falter. While specific 2024-2025 investment details for individual startups remain proprietary, AC Ventures' broader portfolio reflects a commitment to innovation and future market leaders.

- High Growth Potential: AC Ventures focuses on startups in sectors like fintech, healthtech, and sustainable solutions, areas projected for significant expansion.

- Market Uncertainty: Early-stage investments are inherently volatile, with a high failure rate, making their future market share unpredictable.

- Capital Intensive: These ventures typically consume substantial capital for research, development, and market entry before generating significant returns.

- Strategic Alignment: Investments are often aligned with Ayala Corporation's long-term strategic goals of diversification and digital transformation.

Ayala's Forays into Emerging Industrial Technologies

Ayala Corporation's strategic investments in emerging industrial technologies position them within the 'Question Marks' category of the BCG Matrix. These ventures, such as their involvement in advanced manufacturing and smart infrastructure solutions, represent nascent markets with significant growth potential. However, they currently hold a low market share and demand substantial capital infusion for development and scaling.

For example, Ayala's focus on digital transformation within its industrial segments, including the adoption of Industry 4.0 principles, aligns with this classification. These initiatives require considerable R&D spending and market development efforts. The success of these ventures hinges on Ayala's ability to effectively penetrate these evolving markets and achieve economies of scale.

- High Growth Potential: Investments in areas like advanced robotics and sustainable energy solutions for industrial applications target rapidly expanding sectors.

- Low Market Share: Despite potential, these new technological forays typically start with a small footprint in established or emerging industrial landscapes.

- High Investment Needs: Significant capital is allocated to research, development, infrastructure, and market entry for these innovative industrial technologies.

- Strategic Importance: These 'Question Marks' are crucial for Ayala's long-term diversification and competitiveness in the evolving industrial technology space.

Question Marks represent business units or products operating in high-growth markets but with low relative market share. These ventures require significant investment to increase market share and move towards becoming Stars. Failure to do so can result in them becoming Dogs.

Ayala Corporation's strategic investments in emerging industrial technologies, such as advanced robotics and smart infrastructure, exemplify Question Marks. These are nascent markets with substantial growth potential, yet they currently hold a low market share, necessitating significant capital infusion for development and scaling.

For instance, Ayala’s focus on digital transformation within its industrial segments, including Industry 4.0 principles, requires considerable R&D spending and market development. The success of these ventures hinges on effectively penetrating evolving markets and achieving economies of scale.

AC Ventures, as a venture capital arm, actively targets early-stage companies in sectors like fintech and healthtech, which are inherently Question Marks due to their high growth potential, market uncertainty, and substantial capital needs.

| Ayala Corporation Business Unit | BCG Category | Market Growth Rate | Relative Market Share | Capital Investment Needs |

|---|---|---|---|---|

| AC Health - Digital Health Platforms | Question Mark | High | Low | High |

| Ayala Land - New Integrated Estates (Outside Metro Manila) | Question Mark | High | Low | High |

| AC Education - Digital Learning Platforms | Question Mark | High | Low | High |

| AC Ventures - Early-Stage Tech Startups | Question Mark | High | Low | High |

| Ayala Corp - Emerging Industrial Technologies | Question Mark | High | Low | High |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.