Ayala Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayala Bundle

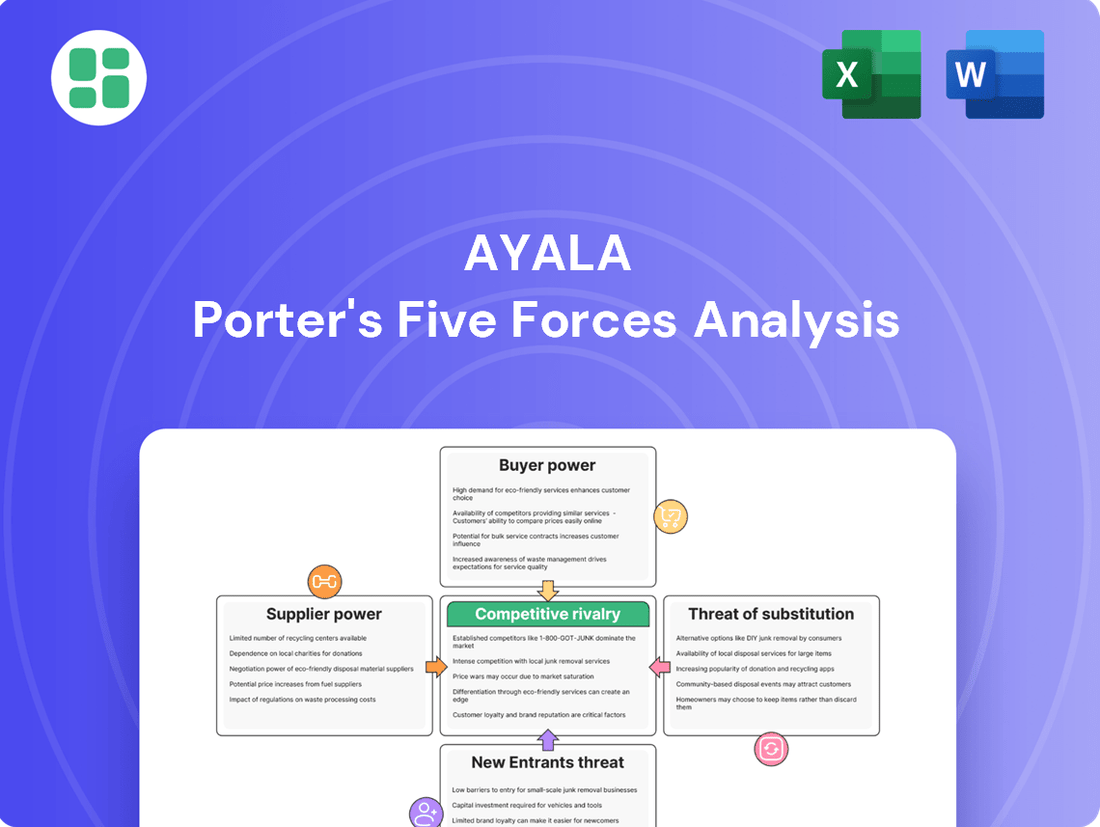

Ayala's Porter's Five Forces analysis reveals the intricate competitive landscape it navigates, highlighting the power of buyers and the intensity of rivalry. Understanding these forces is crucial for any business aiming to thrive in dynamic markets.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Ayala’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Ayala Corporation's broad business interests, from property development to telecommunications and energy, mean it works with a vast range of suppliers. This wide reach typically weakens the leverage of any individual supplier, as a supply issue in one area is unlikely to cripple the entire operation. For instance, Ayala Land's extensive construction projects might source materials from multiple providers, lessening dependence on any one quarry or manufacturer.

The criticality of inputs for Ayala's diverse business segments significantly shapes supplier bargaining power. For instance, in its real estate segment, securing prime land parcels is paramount, and a concentrated ownership of such land can grant suppliers considerable leverage. Similarly, specialized, high-tech equipment essential for telecommunications infrastructure projects, often sourced from a limited number of global manufacturers, can also empower suppliers.

Conversely, for more standardized or commoditized inputs across Ayala's portfolio, the company's substantial scale and significant purchasing volume likely translate to stronger bargaining power. This means Ayala can often negotiate more favorable terms due to its ability to influence demand for these less specialized resources.

Supplier concentration can significantly influence bargaining power. For Ayala Corporation, in niche sectors like advanced technology for its industrial or healthcare businesses, a limited number of specialized suppliers can wield considerable influence. This means those suppliers can potentially dictate terms or pricing.

Conversely, in its vast real estate and construction segments, Ayala benefits from a more fragmented supplier base within the Philippines. With many contractors and material suppliers available, the bargaining power of any single supplier is naturally diminished, allowing Ayala to negotiate more favorable terms.

Switching Costs

Switching costs for Ayala Corporation can vary significantly based on the nature of the input or service. For readily available items like generic office supplies or standard construction materials, the cost and effort to switch suppliers are typically low, limiting supplier power in these areas.

However, when it comes to specialized inputs, such as core technology partners in the telecommunications sector or critical financial software providers, the switching costs can be substantial. These costs often include integration expenses, retraining personnel, and potential operational disruptions during the transition, thereby amplifying the bargaining power of suppliers in these specific segments.

For instance, in 2024, a major Philippine telecommunications firm might face millions of dollars in costs to migrate from one core network provider to another, including hardware, software licenses, and extensive testing. This significant investment makes it difficult for Ayala to switch providers easily, giving the existing technology supplier considerable leverage.

- Low Switching Costs: Generic office supplies, standard construction materials.

- High Switching Costs: Core technology partners (e.g., telecommunications network equipment), specialized financial software.

- Impact: High switching costs increase supplier bargaining power by making it costly and disruptive for Ayala to change suppliers.

- Example: Migrating a telecommunications core network in 2024 could incur millions in integration and operational costs.

Threat of Forward Integration

The threat of suppliers integrating forward into Ayala's core businesses, such as real estate development or telecommunications, is generally quite low. Suppliers of raw materials or components typically do not possess the substantial capital, intricate industry knowledge, or established customer relationships necessary to compete effectively in these complex sectors.

For instance, a supplier of steel for construction or network equipment for Globe Telecom would face immense hurdles in replicating Ayala Land's integrated property development model or Globe's extensive subscriber base and infrastructure. Ayala's significant market share and brand equity in its various industries act as powerful deterrents to any potential supplier integration attempts.

- Low Capital & Expertise Barrier: Suppliers often lack the billions in capital required for large-scale real estate projects or the advanced technological expertise for telco operations.

- Market Access Challenges: Entering Ayala's established markets would require overcoming significant customer acquisition costs and brand loyalty.

- Diversification Advantage: Ayala's conglomerate structure provides a buffer, as suppliers would need to replicate capabilities across multiple distinct and highly competitive industries.

The bargaining power of suppliers for Ayala Corporation is influenced by supplier concentration and switching costs. In sectors with few specialized suppliers, like advanced technology, their leverage is higher. Conversely, Ayala's scale and purchasing volume in commoditized markets reduce supplier power. In 2024, the Philippine infrastructure sector saw material costs fluctuate, impacting suppliers' ability to dictate terms.

| Factor | Ayala's Position | Impact on Supplier Power | 2024 Relevance |

|---|---|---|---|

| Supplier Concentration | Low in commoditized sectors, high in specialized tech | High concentration increases power | Limited suppliers for telco tech can command higher prices. |

| Switching Costs | Low for standard goods, high for specialized tech | High costs empower suppliers | Migrating telco core networks in 2024 could cost millions, locking in providers. |

| Forward Integration Threat | Generally low due to capital and expertise barriers | Low threat | Suppliers lack capital to enter Ayala's complex markets. |

What is included in the product

Ayala's Five Forces analysis dissects the competitive intensity within its operating industries, examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Instantly identify and address competitive threats with a dynamic visualization of all five forces.

Customers Bargaining Power

Ayala Corporation's customer base is remarkably diverse, encompassing individual homebuyers and bank clients, as well as large corporations requiring telecom and power services. This broad segmentation inherently weakens the bargaining power of any single customer group, as their differing needs and price sensitivities make unified action unlikely.

For instance, in 2024, Globe Telecom, a key Ayala subsidiary, served millions of individual mobile subscribers alongside enterprise clients, each with distinct service demands and price expectations. This wide reach prevents any one segment from dictating terms due to the sheer variety of customer profiles and their varying importance to the company's overall revenue streams.

Customer price sensitivity is a key factor in assessing bargaining power. For Ayala Corporation, this varies greatly depending on the product or service. For instance, in its telecommunications segment, Globe Telecom, customers are generally more sensitive to pricing for basic mobile plans and internet services, which directly impacts their monthly expenses.

In contrast, Ayala Land's premium real estate developments or its industrial solutions through AC Industrials often command less price sensitivity. Here, buyers are more focused on long-term value, quality of construction, brand reputation, and unique features, diminishing the direct impact of price on their purchasing decisions and thus reducing their bargaining power.

In 2024, the Philippine economy has seen a moderate inflation rate, making consumers more watchful of their spending, especially on essential services. This could heighten price sensitivity for Globe's more basic offerings, potentially increasing customer bargaining power in that specific segment.

The availability of alternatives significantly impacts the bargaining power of customers across Ayala Corporation's diverse business segments. In real estate, for instance, customers can choose from numerous other major developers, a factor that pressures Ayala Land to maintain competitive pricing and high service standards.

Similarly, the banking sector, where Bank of the Philippine Islands (BPI) operates, is characterized by a multitude of local and international banks, all vying for customer loyalty. This competitive landscape empowers customers with choices, driving BPI to continuously enhance its product offerings and digital services.

In telecommunications, Globe Telecom faces intense competition from other major network providers. This intense rivalry means customers can easily switch providers if they find better deals or service quality, compelling Globe to invest heavily in network expansion and customer retention strategies. For example, as of early 2024, the Philippine telecommunications market saw continued competition with significant investments in 5G technology by all major players, directly responding to customer demand for faster and more reliable services.

Switching Costs for Customers

Switching costs for customers can significantly influence their bargaining power. For services like banking or real estate development, the effort involved in paperwork and time investment can create moderate to high switching costs. However, for essential services such as utilities or within integrated community living environments, the costs can be considerably higher, encompassing not just financial outlays but also lifestyle adjustments and the disruption of established routines.

Ayala Corporation's strategic emphasis on developing integrated ecosystems is designed to enhance customer loyalty and increase this stickiness. By offering a range of interconnected services and amenities within its developments, Ayala aims to make it less appealing and more costly, in terms of convenience and lifestyle, for customers to switch to competitors.

- Moderate to High Switching Costs: Changing service providers can involve significant effort, time, and potential financial implications for customers.

- Integrated Ecosystems Increase Stickiness: Ayala's strategy of creating interconnected services within its developments aims to lock in customers by raising the perceived cost of leaving.

- Infrastructure and Lifestyle Factors: For utilities and community living, switching costs extend beyond mere financial transactions to include the disruption of established infrastructure and lifestyle patterns.

Customer Information and Transparency

The digital age has significantly amplified customer information and market transparency. Platforms offering comparative services and readily available reviews empower consumers to make more informed choices, directly impacting their bargaining power. This is evident across various sectors where customers can easily benchmark offerings, from real estate listings to financial products and telecommunication plans.

For Ayala Corporation, this heightened transparency means customers can readily compare its services and pricing against competitors. For instance, in the real estate sector, online portals provide detailed property information and price comparisons, allowing potential buyers to negotiate more effectively. Similarly, financial comparison websites enable consumers to scrutinize and select the most advantageous products, putting pressure on providers like Ayala to remain competitive.

- Increased Information Access: Digital platforms provide customers with unprecedented access to data on pricing, features, and competitor offerings.

- Comparative Shopping: Services that facilitate easy comparison of products and services, such as those for telecommunications or financial instruments, empower customers.

- Informed Decision-Making: Customers can now make more strategic purchasing decisions based on comprehensive information, potentially leading to greater price sensitivity and demand for better value.

- Negotiating Leverage: The ability to easily identify and switch to alternatives with better terms or prices significantly strengthens the customer's position in negotiations.

The bargaining power of customers for Ayala Corporation is generally moderate, influenced by the diverse nature of its businesses and the competitive landscape. While some segments, like basic telecommunications, see higher price sensitivity and easier switching, others, such as premium real estate, experience lower price sensitivity due to factors like brand reputation and long-term value. The company's strategy of creating integrated ecosystems aims to increase customer stickiness, thereby mitigating some of this power.

| Factor | Ayala Segment | Impact on Customer Bargaining Power | 2024 Relevance |

| Price Sensitivity | Globe Telecom (Basic Plans) | High | Moderate inflation increases sensitivity for essential services. |

| Price Sensitivity | Ayala Land (Premium Properties) | Low | Focus on long-term value and quality over immediate price. |

| Availability of Alternatives | BPI (Banking) | High | Numerous local and international banks offer choice. |

| Availability of Alternatives | Globe Telecom | High | Intense competition from other major network providers. |

| Switching Costs | Ayala Land (Real Estate) | Moderate to High | Paperwork, time investment, and disruption of lifestyle. |

| Switching Costs | Globe Telecom | Low to Moderate | Easier to switch providers for mobile plans. |

Full Version Awaits

Ayala Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of Ayala provides a deep dive into the competitive landscape, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You're previewing the final version—precisely the same document that will be available to you instantly after buying.

Rivalry Among Competitors

Ayala Corporation operates in sectors characterized by significant market concentration, where a handful of major companies dominate. This structure intensifies competition as these key players vie for market share and customer loyalty.

In real estate, Ayala Land faces robust competition from giants like SM Prime Holdings, a major player in mall development and residential projects. This rivalry means constant innovation and strategic pricing are necessary to maintain an edge.

The telecommunications landscape sees Globe Telecom locked in a tight race, primarily with PLDT and the emerging DITO Telecommunity, creating a near-duopoly. This dynamic forces continuous investment in network upgrades and competitive service offerings.

Within the banking sector, Bank of the Philippine Islands (BPI) competes directly with other large universal banks, making differentiation through customer service and digital innovation crucial for sustained growth and market position.

Ayala Corporation's operating sectors, notably real estate and financial services, are experiencing robust growth, with the Philippine economy projected to expand by 5.7% in 2024 according to the World Bank. This positive economic environment, fueled by urbanization and a growing middle class, generally tempers intense rivalry by offering ample opportunities for all players.

However, this very growth acts as a magnet, intensifying competition as firms vie for a larger slice of the expanding market. Ayala's own significant investments in expansion and digital initiatives, aiming to capture this growth, directly contribute to this dynamic, pushing rivals to also invest heavily, thereby fueling rivalry.

Ayala Corporation actively pursues product and service differentiation as a core competitive strategy. In real estate, this is evident through its development of integrated communities that offer a holistic living experience, combining residential, commercial, and recreational spaces. For instance, Ayala Land's Vertis North in Quezon City exemplifies this, blending residential towers with a mall, offices, and a central park, aiming to create self-sustaining urban environments.

In the financial services sector, Ayala's subsidiaries, like BPI, focus on differentiating through innovative digital banking solutions and personalized financial products. BPI's mobile app, for example, has consistently ranked high for user experience and feature set, including advanced budgeting tools and seamless transaction capabilities. This focus on user-centric technology aims to attract and retain customers in a crowded market.

Globe Telecom, another key Ayala subsidiary, differentiates itself through its network quality and diverse service offerings, including broadband and mobile solutions. As of early 2024, Globe reported significant investments in expanding its 5G network coverage across the Philippines, aiming to provide superior speeds and reliability. This commitment to infrastructure development is crucial as competitors also strive to enhance their network capabilities, making continuous innovation and brand loyalty paramount.

High Fixed Costs and Exit Barriers

Ayala Corporation's competitive landscape is significantly shaped by high fixed costs and substantial exit barriers across its key sectors. For instance, its real estate ventures, like those in the Ayala Land portfolio, demand massive upfront capital for land acquisition and development, with projects often spanning years. Similarly, Globe Telecom, Ayala's telecommunications arm, requires continuous, heavy investment in network infrastructure, including cell towers and fiber optics, to maintain service quality and expand coverage. In 2024, the telecommunications industry globally continued to see substantial capital expenditures, with companies investing billions in 5G network rollouts, a trend directly impacting Ayala's competitive pressures.

These considerable fixed costs, coupled with the specialized nature of assets and regulatory complexities, make it exceptionally difficult and costly for companies to exit these markets. This lack of flexibility compels firms, including Ayala's subsidiaries, to maintain aggressive competition even when market conditions are unfavorable. The imperative to recoup these large, sunk investments often leads to price wars or intense service upgrades, directly impacting profitability and intensifying rivalry among established players.

- Real Estate Development: Ayala Land's projects involve significant capital outlays for land, construction, and infrastructure, creating high upfront costs.

- Telecommunications Infrastructure: Globe Telecom's network expansion and upgrades, particularly for 5G, represent ongoing, substantial fixed investments.

- Power Generation: ACEN Corporation's renewable energy projects require large capital commitments for plant construction and grid connection.

- Exit Barriers: The specialized nature of assets, long investment cycles, and regulatory requirements in these sectors elevate the difficulty and cost of exiting, thus intensifying competition.

Strategic Alliances and Acquisitions

Strategic alliances and acquisitions are a significant factor in the Philippine competitive landscape, driving growth and consolidation. Ayala Corporation actively participates in these activities, enhancing its market reach and operational capabilities. This pursuit of strategic partnerships and mergers intensifies rivalry as competitors also leverage similar tactics to fortify their market standing and expand their service offerings.

For instance, in 2024, the telecommunications sector, a key area for Ayala, saw ongoing consolidation efforts. Competitors are constantly evaluating opportunities to merge or acquire smaller players to gain market share and technological advantages. This dynamic creates a more concentrated market, where larger entities with stronger financial backing and broader networks can exert greater influence, thereby increasing the intensity of competition.

- Ayala's strategic moves often involve acquiring stakes in emerging technology firms or forming joint ventures to enter new markets.

- Competitors respond by seeking similar alliances or acquiring companies with complementary services to avoid being left behind.

- The Philippine Stock Exchange Index (PSEi) performance reflects this, with significant M&A activity often correlating with increased trading volumes and investor interest in specific sectors.

- These strategic maneuvers directly impact pricing strategies and service innovation as companies strive to differentiate themselves or achieve economies of scale.

The competitive rivalry within Ayala Corporation's operating sectors is intense, driven by market concentration and the strategies employed by major players. Ayala Land, Globe Telecom, and BPI all face significant competition, necessitating continuous innovation and investment to maintain market share and customer loyalty.

The Philippine economy's projected 5.7% growth in 2024, as noted by the World Bank, fuels this rivalry by presenting a larger market pie that all companies are eager to capture. This growth encourages substantial investments from all participants, including Ayala's own expansion initiatives, thereby intensifying the competition.

High fixed costs and substantial exit barriers across sectors like real estate and telecommunications compel companies to compete aggressively to recoup their investments. For instance, Globe's ongoing 5G network expansion in 2024 requires billions in capital expenditure, a significant commitment that locks companies into sustained competition.

| Ayala Subsidiary | Key Competitors | Competitive Dynamics | 2024 Data/Trend |

|---|---|---|---|

| Ayala Land | SM Prime Holdings | Intense rivalry in mall development and residential projects; focus on integrated communities. | Continued expansion of mixed-use developments. |

| Globe Telecom | PLDT, DITO Telecommunity | Near-duopoly in telecommunications; fierce competition on network upgrades and service offerings. | Significant investments in 5G network rollout; focus on broadband expansion. |

| Bank of the Philippine Islands (BPI) | Other large universal banks | Competition driven by digital innovation, customer service, and personalized financial products. | Emphasis on enhancing mobile banking app features and user experience. |

SSubstitutes Threaten

The threat of substitutes in the real estate sector, particularly for a company like Ayala Land, is significant. These substitutes aren't just other property developers but also alternative ways people can fulfill their housing and investment needs. Renting, for instance, offers flexibility and lower upfront costs compared to buying, making it an attractive option, especially during uncertain economic times. In 2024, the rental market continued to see robust demand, with average rental yields in prime urban areas remaining competitive, potentially drawing capital away from property purchases.

Beyond traditional renting, informal housing solutions or even investing in different asset classes that offer comparable returns without the commitment of property ownership represent further substitutes. For example, the rise of fractional ownership platforms or investments in publicly traded real estate investment trusts (REITs) can provide exposure to the property market with greater liquidity and lower entry barriers. If economic conditions tighten or consumer preferences shift towards more mobile lifestyles, these alternatives could gain further traction, impacting demand for Ayala Land's core offerings.

The growing prevalence of fintech and digital financial services presents a significant threat to BPI, Ayala's banking arm. Companies like GCash, in which Ayala itself holds a stake, offer streamlined, often lower-cost alternatives for transactions and even basic banking functions. This convenience and accessibility can draw customers away from traditional bank offerings.

In 2024, the digital payments landscape in the Philippines continued its rapid expansion. For instance, GCash reported a substantial increase in its user base and transaction volumes, reflecting a clear shift in consumer preference towards digital channels. This trend directly challenges incumbent banks like BPI to enhance their own digital platforms to remain competitive and retain market share.

Over-the-Top (OTT) communication services, such as Viber and WhatsApp, present a significant threat to Globe Telecom. These platforms directly substitute traditional voice and SMS services, which have historically been core revenue drivers for telcos.

In 2024, the continued growth of these OTT services directly erodes Globe's revenue from legacy offerings. For instance, a substantial portion of mobile users now prefer messaging apps for communication over standard SMS, impacting Globe's SMS revenue streams.

This shift forces Globe to accelerate its transition to a data-centric business model, focusing on mobile data consumption and developing new digital services to offset declining voice and SMS revenues. The company's strategy increasingly involves offering bundled data packages and investing in digital content and platforms.

Distributed Energy and Energy Efficiency

Distributed energy resources, such as rooftop solar, and energy efficiency improvements are increasingly acting as substitutes for traditional grid electricity. This trend reduces reliance on large-scale power providers like ACEN. For instance, by the end of 2023, solar PV capacity in the Philippines, a key market for ACEN, saw significant growth, with distributed generation contributing to this shift.

The decreasing cost of solar technology and battery storage makes self-sufficiency more attractive for consumers and businesses. This can directly impact the demand for power from conventional utilities. In 2024, the global average cost of solar photovoltaic power continued its downward trajectory, making it more competitive with grid prices.

- Decreasing costs of solar PV and battery storage technologies.

- Growing consumer and business interest in energy independence.

- Government incentives and policies supporting distributed generation.

- Advancements in smart grid technologies enabling better integration of renewables.

Non-Traditional Education and Healthcare Models

Ayala's expansion into education and healthcare confronts significant substitution threats. Online learning platforms, for instance, offer flexible and often lower-cost alternatives to traditional schooling, potentially drawing students away from Ayala's educational ventures. In 2024, the global e-learning market was valued at over $300 billion and is projected to grow substantially, indicating a strong demand for these accessible educational models.

Similarly, the healthcare sector sees robust competition from vocational training centers that can produce skilled healthcare workers more rapidly and affordably than extensive university programs. Public healthcare initiatives and community health centers also represent powerful substitutes, particularly for basic and preventive care, often at little to no cost for users. These alternatives can erode Ayala's market share if its offerings are perceived as less accessible or more expensive.

- Online Learning Growth: The global e-learning market surpassed $300 billion in 2024, highlighting a significant substitution threat to traditional education models.

- Vocational Training Efficiency: Vocational centers can offer faster and more cost-effective training for healthcare professionals, challenging university-based programs.

- Public Healthcare Accessibility: Government-funded or community-based healthcare services provide a low-cost alternative, particularly for essential medical needs.

- Ayala's Response: Continuous adaptation and clear differentiation in quality and integrated services are crucial for Ayala to maintain its competitive edge against these substitutes.

The threat of substitutes for ACEN's energy generation is growing, particularly from distributed energy resources like rooftop solar and advancements in energy efficiency. These alternatives reduce the need for traditional, large-scale power providers. By the end of 2023, the Philippines saw a notable increase in solar PV capacity, with distributed generation playing a key role in this shift, directly impacting demand for grid electricity.

The decreasing costs of solar technology and battery storage are making energy independence more appealing for both consumers and businesses. This trend is further amplified by government incentives that support distributed generation, making self-sufficiency a more viable option. In 2024, the global average cost of solar photovoltaic power continued its downward trend, making it increasingly competitive with traditional grid electricity prices.

| Substitute Type | Key Drivers | Impact on ACEN | 2024 Data/Trend |

|---|---|---|---|

| Distributed Solar PV | Decreasing costs, energy independence | Reduced demand for grid electricity | Global solar PV costs continued to fall |

| Energy Efficiency | Consumer/business adoption, cost savings | Lower overall energy consumption | Growing focus on sustainable building practices |

| Battery Storage | Cost reductions, grid integration | Enables higher renewable penetration, potential for off-grid solutions | Significant investment in battery technology |

Entrants Threaten

Ayala Corporation faces a low threat of new entrants in its core sectors due to substantial capital requirements. Industries like real estate development and telecommunications, where Ayala is a major player, necessitate billions in initial investment for land acquisition, infrastructure build-out, and regulatory compliance. For instance, telecommunications infrastructure alone can cost tens of billions of pesos to establish and maintain.

The sheer scale of capital needed to compete effectively acts as a significant deterrent. Few companies can mobilize the financial resources required to match Ayala's existing footprint and operational capacity. This high barrier to entry means that only well-established, financially robust entities could realistically consider entering these markets, thereby protecting Ayala's market position.

The telecommunications sector in the Philippines, for instance, demands significant capital investment and adherence to stringent licensing requirements from the National Telecommunications Commission (NTC). In 2024, the NTC continued to emphasize robust compliance for new entrants, particularly concerning spectrum allocation and service quality standards, making entry a costly and protracted process.

Ayala Corporation's deeply entrenched economies of scale present a significant hurdle for potential new entrants. For instance, in its real estate segment, the sheer volume of ongoing projects allows Ayala Land to negotiate better material prices and optimize construction logistics, driving down per-unit costs. This cost advantage is difficult for smaller, newer developers to replicate quickly.

Furthermore, Ayala's decades of operational experience have fostered refined processes and deep market understanding, particularly in utilities and banking. Newcomers would face a steep learning curve and substantial investment to build comparable efficiency and brand trust, making it challenging to compete on cost or service quality from the outset.

Strong Brand Recognition and Customer Loyalty

Ayala's formidable brand recognition and deeply ingrained customer loyalty present a significant barrier to new entrants. For instance, in the telecommunications sector, Globe Telecom, a key Ayala subsidiary, consistently reports high customer satisfaction scores, a testament to years of investment in service quality and brand building. In 2023, Globe maintained a net promoter score (NPS) of 55, indicating a strong base of loyal customers who are less likely to switch to a new provider, even with competitive pricing.

New players entering Ayala's diverse markets, such as banking or real estate, would need to overcome the trust and familiarity that Ayala has cultivated over its long history. This requires substantial capital outlay not just for infrastructure, but for extensive marketing campaigns and customer acquisition efforts. Consider the banking sector where BPI, another Ayala company, boasts over 10 million customers, a figure built over 170 years. A new bank would struggle to replicate this scale of trust and customer base quickly.

- Established Brand Equity: Ayala's brands are recognized and trusted across multiple industries, making it difficult for newcomers to gain immediate traction.

- Customer Loyalty: Long-standing relationships and positive customer experiences translate into high retention rates, reducing the appeal of new, unproven alternatives.

- High Acquisition Costs: New entrants must invest heavily in marketing and promotions to build brand awareness and attract customers away from established players like Ayala.

- Reputational Capital: Ayala's history of reliability and corporate social responsibility enhances its brand appeal, creating a significant hurdle for any new competitor aiming to build a similar reputation.

Access to Distribution Channels and Networks

Ayala Corporation's formidable presence across key sectors like real estate, banking, and telecommunications presents a significant barrier to entry. Its established distribution channels and extensive networks, built over decades, are not easily replicated by newcomers.

For instance, Ayala Land's nationwide sales teams and deep community engagement in real estate development create a powerful advantage. Similarly, Bank of the Philippine Islands (BPI) benefits from its vast branch network and ATM infrastructure, a critical asset in serving a diverse customer base.

In telecommunications, Globe Telecom's extensive cell site and fiber optic infrastructure represent a substantial capital investment and a critical competitive differentiator. New entrants would require massive capital outlay and considerable time to build comparable reach.

- Real Estate Distribution: Ayala Land's extensive network of sales offices and customer relationships offers a significant advantage over new developers.

- Banking Reach: BPI's over 1,100 branches and 1,600 ATMs as of late 2023 provide unparalleled physical access for customers.

- Telecommunication Infrastructure: Globe's comprehensive fiber network and numerous cell sites are essential for delivering reliable connectivity, a difficult asset for competitors to match.

The threat of new entrants for Ayala Corporation is generally low across its core businesses. This is primarily due to the significant capital requirements needed to establish operations in sectors like telecommunications and real estate development. For example, building a telecommunications network requires billions of pesos for infrastructure and spectrum licensing.

Ayala's established economies of scale further deter new players. In real estate, Ayala Land benefits from bulk purchasing power and optimized construction processes, leading to lower per-unit costs that are hard for new entrants to match. This cost advantage is a critical barrier.

Brand equity and customer loyalty also play a crucial role. Globe Telecom, for instance, enjoys high customer satisfaction, making it difficult for new telecom providers to attract subscribers. Similarly, BPI's long history and extensive customer base in banking create a strong competitive moat.

| Ayala Business Segment | Key Barrier to Entry | Example Data Point (2023/2024) |

|---|---|---|

| Telecommunications (Globe) | Capital Investment & Licensing | Estimated P30-40 billion annual capital expenditure for network upgrades and expansion. |

| Real Estate (Ayala Land) | Economies of Scale & Land Acquisition | Ayala Land's P100 billion capital spending plan for 2024-2028 indicates ongoing scale advantage. |

| Banking (BPI) | Brand Trust & Customer Base | BPI served over 10 million customers in 2023, a testament to its established reputation. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, company annual filings (10-K, 10-Q), and reputable financial news outlets to capture current competitive dynamics.