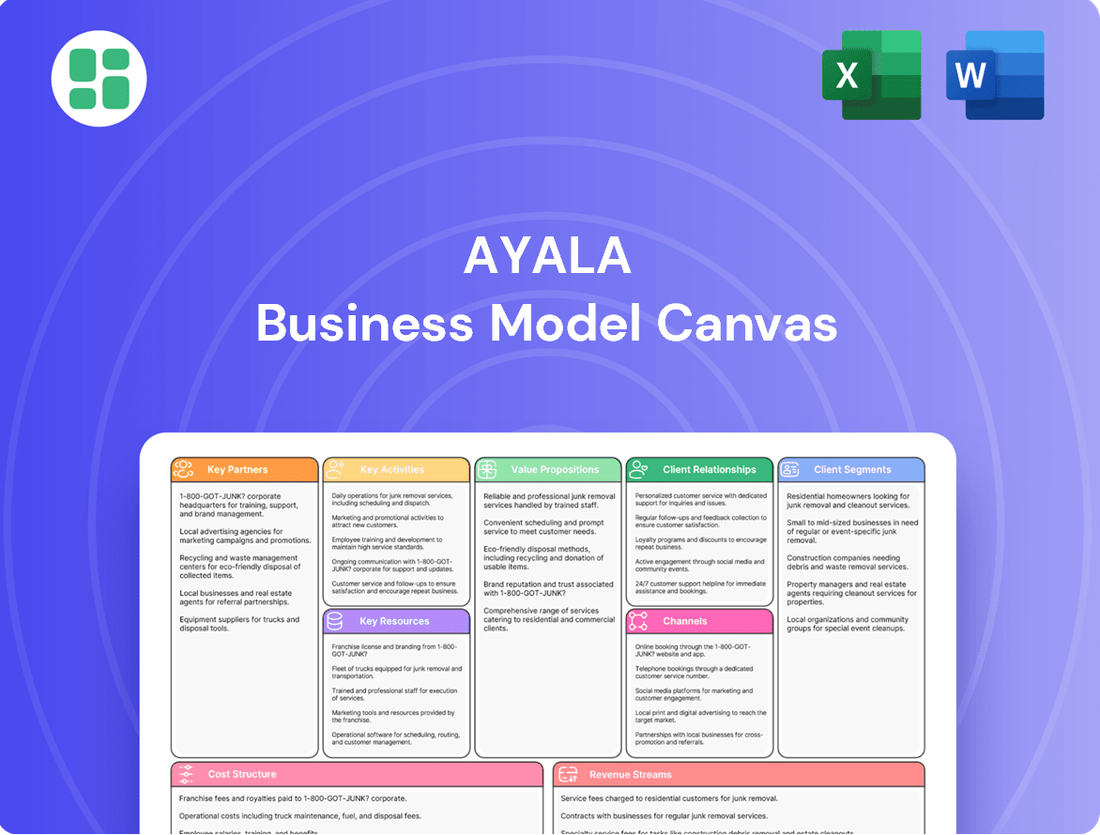

Ayala Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayala Bundle

Discover the intricate framework that fuels Ayala's enduring success. This comprehensive Business Model Canvas dissects their customer relationships, revenue streams, and key resources, offering a clear roadmap for strategic growth. Equip yourself with the insights to innovate and compete effectively.

Partnerships

Ayala Corporation actively pursues strategic joint ventures, a cornerstone of its business model, to broaden its market presence and enhance its operational capacities across diverse industries. These alliances are crucial for accessing specialized knowledge, securing necessary funding, and gaining entry into new or established markets.

For instance, in the consumer retail sector, Ayala has partnered with Mitsubishi Corporation and Anko, demonstrating a commitment to leveraging international expertise. Furthermore, its collaboration with A.P. Møller Capital in logistics highlights the strategic intent to build robust supply chain networks.

Ayala's financial health and growth are deeply intertwined with its key partnerships with financial institutions and investors. These collaborations are vital for securing the substantial capital required for its diverse and large-scale projects, from infrastructure development to real estate ventures. For instance, in 2024, Ayala Corporation successfully raised significant capital through various debt instruments and equity offerings, demonstrating the continued trust and support from the financial community.

The company actively cultivates strong relationships with a wide array of financial players, including major domestic and international banks, multilateral development agencies, and the broader capital markets. This robust network ensures consistent access to credit lines and diverse funding sources necessary to fuel its ambitious expansion plans and manage its significant capital expenditures. These partnerships are not just about traditional financing; Ayala has also strategically leveraged social loans, such as those secured in 2024 for its healthcare sector initiatives, underscoring a commitment to sustainable and impactful investments.

Ayala actively partners with government agencies and regulatory bodies to ensure compliance and foster sustainable growth. For instance, their collaboration with the Climate Change Commission in 2024 demonstrates a commitment to aligning business strategies with national climate action goals, securing necessary permits, and navigating complex regulatory frameworks.

Technology and Innovation Partners

Ayala actively partners with technology providers and innovative firms to bolster its digital infrastructure and roll out novel services. This strategic approach is clearly visible in its telecommunications and fintech sectors, where progress is intrinsically linked to technological collaborations.

For instance, Ayala's significant investments in companies like Mynt, the operator of GCash, underscore its commitment to digital solutions and financial technology. By teaming up with these tech-forward entities, Ayala ensures it stays at the forefront of digital transformation.

- Telecommunications: Partnerships with global tech giants for 5G deployment and network upgrades.

- Fintech: Collaborations with blockchain and AI specialists to enhance GCash's capabilities.

- Digital Transformation: Joint ventures with innovation hubs to explore emerging technologies like IoT and cloud computing.

Suppliers and Service Providers

Ayala's diverse operations rely on a strong network of suppliers and service providers for essential materials, equipment, and expertise. For instance, in its real estate segment, timely access to construction materials and specialized contracting services is crucial. Similarly, Ayala's telecommunications arm, Globe Telecom, depends on a steady supply of network infrastructure components and maintenance services to ensure service quality and expansion.

These partnerships are fundamental to maintaining operational efficiency and upholding the quality standards across Ayala's various business units. A well-managed supply chain directly impacts project timelines and the reliability of services offered to customers. For example, in 2023, Globe Telecom invested significantly in network upgrades, underscoring the importance of securing advanced equipment and skilled technical support from its key partners.

- Supplier Reliability: Ensuring consistent quality and timely delivery of raw materials and components for construction and manufacturing.

- Service Provider Expertise: Engaging specialized firms for infrastructure development, maintenance, and technological solutions.

- Supply Chain Resilience: Building robust relationships to mitigate disruptions and maintain operational continuity, especially in critical sectors like utilities and telecommunications.

Ayala's key partnerships are vital for accessing capital, technology, and market expertise, enabling its expansion across diverse sectors. Strategic alliances with financial institutions in 2024, including securing social loans for healthcare, underscore its commitment to growth and sustainability. Collaborations with global tech firms and innovation hubs are crucial for its digital transformation initiatives, particularly in fintech and telecommunications.

Furthermore, strong relationships with suppliers and service providers ensure operational efficiency and quality across its vast portfolio, from construction materials to advanced network components. These partnerships are instrumental in navigating complex regulatory environments and achieving national development goals, as seen in its work with government agencies on climate action.

| Partner Type | Example Partners | Strategic Importance | 2024/Recent Data Point |

|---|---|---|---|

| Financial Institutions | Major Banks, Development Agencies | Capital Access, Project Funding | Successful capital raising via debt/equity |

| Technology Providers | Global Tech Giants, AI Specialists | Digital Transformation, Service Enhancement | Investments in GCash operator Mynt |

| Suppliers & Service Providers | Construction Material Suppliers, Network Installers | Operational Efficiency, Quality Assurance | Globe Telecom's network upgrade investments |

| Government Agencies | Climate Change Commission | Regulatory Compliance, Sustainable Growth | Alignment with national climate goals |

What is included in the product

A detailed, pre-formatted Business Model Canvas that outlines Ayala's strategic approach to its diverse business units, covering all nine essential blocks with specific insights.

Simplifies complex business strategies into a clear, actionable framework, reducing the pain of strategic ambiguity.

Provides a structured approach to identifying and addressing key business challenges, alleviating the stress of unorganized planning.

Activities

Ayala Land, a cornerstone of the conglomerate, actively engages in the development, sale, and leasing of a wide array of properties. This includes integrated communities, residential projects, commercial centers, and hospitality establishments, reflecting a comprehensive approach to real estate.

Core to its operations are crucial activities like strategic land acquisition, meticulous master planning for its developments, and the execution of construction projects. Furthermore, Ayala Land is deeply involved in the ongoing property management of its extensive and varied portfolio.

The company's commitment extends to creating dynamic, mixed-use estates that span across the Philippines. For instance, in 2023, Ayala Land reported a net income of PHP 35.7 billion, underscoring the significant scale and success of its development and management endeavors.

Ayala's key financial services activities are primarily channeled through its universal bank, Bank of the Philippine Islands (BPI). These operations encompass a broad spectrum of services, from everyday retail banking and extensive corporate lending to specialized investment banking. This diverse offering allows Ayala to cater to a wide range of customer needs and business requirements.

Core to BPI's operations are activities such as accepting deposits, originating loans, managing wealth for clients, and providing expert financial advisory services. These fundamental banking functions form the backbone of the financial services segment, driving customer engagement and revenue generation. In 2024, BPI continued to demonstrate robust financial health, with its net income reaching PHP 49.4 billion for the first nine months of the year, underscoring its crucial role in Ayala's profitability.

Globe Telecom's core activities in telecommunications and digital solutions revolve around building and maintaining its robust network infrastructure, ensuring seamless service delivery for mobile, broadband, and enterprise clients. This includes continuous investment in expanding 5G coverage and enhancing fiber optic capabilities, critical for meeting the growing demand for high-speed internet. In 2023, Globe invested approximately PHP 87.7 billion in capital expenditures, a significant portion allocated to network upgrades, demonstrating their commitment to these key activities.

A crucial aspect of Globe's strategy is the provisioning of these services and providing exceptional customer support across all channels, from retail stores to digital platforms. Furthermore, a significant key activity is the ongoing development and promotion of its digital platforms, most notably GCash, the leading mobile wallet in the Philippines. GCash's expansion into various financial services, from payments to investments, is central to Globe's digital transformation and its push for greater digital financial inclusion among Filipinos.

Power Generation and Infrastructure Development

Ayala's energy arm, ACEN Corporation, is deeply involved in developing and operating a diverse portfolio of renewable energy projects. This includes significant investments in solar, wind, and geothermal power generation, aiming to bolster the country's clean energy capacity. As of early 2024, ACEN has a substantial operational capacity across the Philippines and is expanding its reach internationally.

Complementing its renewable energy focus, AC Infrastructure Holdings Corporation, another key Ayala subsidiary, actively manages and develops various essential infrastructure projects. These initiatives often go hand-in-hand with energy development, ensuring robust and reliable power distribution and connectivity. This dual focus underscores Ayala's strategic commitment to sustainable development and addressing the nation's increasing energy needs.

- ACEN's Renewable Capacity: ACEN Corporation had over 4,000 MW of attributable capacity in operation and under development as of the first half of 2024, with a significant portion being renewables.

- Diversified Energy Sources: The company's portfolio includes solar farms, wind power projects, and geothermal plants, contributing to a more resilient and sustainable energy mix.

- Infrastructure Support: AC Infrastructure's involvement in projects like water and transportation further supports the broader economic development driven by reliable energy infrastructure.

- Sustainability Goal: These activities are central to Ayala's sustainability agenda, aligning with national goals for reduced carbon emissions and increased energy security.

New Business Incubation and Portfolio Management

Ayala's key activities include incubating and scaling new ventures in high-growth areas like healthcare with AC Health, logistics through AC Logistics, and mobility solutions under AC Mobility. This strategic focus aims to diversify the company's revenue streams and tap into emerging market opportunities.

These incubation efforts involve significant strategic investments and operational adjustments. Ayala actively restructures and rationalizes these new businesses to guide them toward profitability and ensure they contribute positively to the group's long-term value creation. For instance, AC Health has been actively expanding its network of clinics and laboratories, aiming to capture a larger share of the growing healthcare market.

- Incubation of Emerging Sectors: Ayala actively nurtures new businesses in healthcare (AC Health), logistics (AC Logistics), and mobility (AC Mobility).

- Strategic Investments & Restructuring: This involves targeted capital allocation and operational improvements to foster growth and efficiency.

- Portfolio Diversification: The primary objective is to broaden the company's business interests and reduce reliance on any single sector, thereby strengthening its overall resilience and long-term value proposition.

- Focus on Profitability: Initiatives are geared towards ensuring these nascent ventures achieve sustainable profitability and contribute meaningfully to the group's financial performance.

Ayala Land's key activities center on property development, sales, and leasing, encompassing integrated communities, residential projects, and commercial centers. This involves strategic land acquisition, master planning, construction, and ongoing property management to create dynamic, mixed-use estates across the Philippines. In 2023, Ayala Land reported a net income of PHP 35.7 billion, highlighting the success of these operations.

Full Version Awaits

Business Model Canvas

The Ayala Business Model Canvas preview you see is the actual document you will receive upon purchase. This means the structure, content, and formatting are exactly as presented, ensuring no surprises. You'll gain full access to this comprehensive tool, ready for immediate use and customization.

Resources

Ayala Land's extensive land bank, strategically situated in prime Philippine locations, forms the bedrock of its real estate development endeavors. This portfolio encompasses a diverse range of properties, from sprawling master-planned estates and vibrant residential communities to bustling commercial centers and sought-after hospitality venues.

As of the first quarter of 2024, Ayala Land reported a robust land bank of 12,400 hectares, a testament to its long-term vision and capacity for sustained growth. This significant asset base not only supports current projects but also provides a substantial pipeline for future developments, underpinning a considerable portion of the company's overall asset value and future revenue potential.

Ayala's financial capital is a cornerstone of its business model, providing the necessary fuel for growth and strategic initiatives. This includes substantial retained earnings, a robust equity base, and proven access to diverse credit markets. In 2023, Ayala Corporation reported consolidated revenues of PHP 445.4 billion, demonstrating significant operational scale that contributes to its financial strength.

This strong financial foundation is crucial for funding large-scale projects and strategic investments across Ayala's varied business units, from real estate and banking to telecommunications and infrastructure. The company's ability to raise capital efficiently supports its ambitious expansion plans and strategic acquisitions, enabling substantial capital expenditures annually to drive future returns.

Ayala Corporation's enduring legacy, stretching back over 180 years, has cultivated a formidable brand reputation synonymous with quality, reliability, and a deep commitment to sustainability. This historical foundation is a critical intangible asset, underpinning its operations across various sectors.

This strong brand equity directly translates into significant customer trust, a vital component for its diverse business units, including real estate development (Ayala Land) and financial services (Bank of the Philippine Islands). In 2023, BPI reported a net income of PHP 49.4 billion, reflecting the trust customers place in its services.

Furthermore, this esteemed reputation acts as a powerful magnet for top talent, ensuring Ayala attracts and retains skilled professionals essential for innovation and growth. It also significantly smooths the path for forging strategic partnerships, as potential collaborators recognize the inherent value and stability associated with the Ayala name.

Human Capital and Expertise

Ayala's human capital is a bedrock of its business model, encompassing a vast and skilled workforce. This includes experienced management, specialized technical experts, and dedicated operational staff across its diverse portfolio of industries.

The group's collective expertise in sectors like real estate, banking, telecommunications, and energy is crucial for successfully executing intricate projects and consistently delivering superior services. This deep knowledge base allows Ayala to navigate complex market dynamics and capitalize on opportunities.

Continuous talent development is a core strategic priority for Ayala, ensuring its workforce remains at the forefront of industry innovation and best practices. This commitment to learning and growth fuels the company's long-term success and competitive edge.

- Skilled Workforce: Ayala employs a substantial number of individuals, leveraging their diverse skills in management, technical fields, and operations.

- Industry Expertise: Deep knowledge in real estate, banking, telecommunications, and energy enables effective project execution and service delivery.

- Talent Development: A strong focus on continuous learning and professional growth ensures the workforce remains adaptable and innovative.

- Project Execution: The human capital directly contributes to the successful implementation of large-scale and complex initiatives across Ayala's various business segments.

Advanced Technology and Infrastructure

Ayala's advanced technology and infrastructure are foundational to its operations. This includes proprietary technologies, robust IT infrastructure, and extensive telecommunications networks, which are vital for delivering digital services and maintaining efficient operations across its diverse businesses.

The company's commitment to renewable energy facilities also falls under this key resource, supporting efficient power generation and contributing to sustainability goals. These assets are not merely operational necessities but strategic advantages, enabling Ayala to adapt and thrive in a rapidly evolving digital landscape.

Continuous investment in these technological and infrastructural assets is paramount for Ayala to maintain its competitive edge and operational efficiency. For instance, in 2024, Ayala Corporation's IT and communications segment, Globe Telecom, continued its network expansion, aiming for wider 5G coverage and improved broadband speeds, reflecting ongoing capital expenditure in infrastructure.

- Proprietary Technologies: Development and deployment of unique technological solutions across business units.

- Robust IT Infrastructure: Ensuring secure, scalable, and efficient information technology systems.

- Telecommunications Networks: Significant investments in expanding and upgrading Globe Telecom's mobile and broadband infrastructure.

- Renewable Energy Facilities: Development and operation of solar, wind, and other renewable energy sources to power operations and contribute to the grid.

Ayala Land's extensive land bank, strategically situated in prime Philippine locations, forms the bedrock of its real estate development endeavors. This portfolio encompasses a diverse range of properties, from sprawling master-planned estates and vibrant residential communities to bustling commercial centers and sought-after hospitality venues.

As of the first quarter of 2024, Ayala Land reported a robust land bank of 12,400 hectares, a testament to its long-term vision and capacity for sustained growth. This significant asset base not only supports current projects but also provides a substantial pipeline for future developments, underpinning a considerable portion of the company's overall asset value and future revenue potential.

Ayala's financial capital is a cornerstone of its business model, providing the necessary fuel for growth and strategic initiatives. This includes substantial retained earnings, a robust equity base, and proven access to diverse credit markets. In 2023, Ayala Corporation reported consolidated revenues of PHP 445.4 billion, demonstrating significant operational scale that contributes to its financial strength.

Ayala Corporation's enduring legacy, stretching back over 180 years, has cultivated a formidable brand reputation synonymous with quality, reliability, and a deep commitment to sustainability. This historical foundation is a critical intangible asset, underpinning its operations across various sectors.

Ayala's human capital is a bedrock of its business model, encompassing a vast and skilled workforce. This includes experienced management, specialized technical experts, and dedicated operational staff across its diverse portfolio of industries.

Ayala's advanced technology and infrastructure are foundational to its operations. This includes proprietary technologies, robust IT infrastructure, and extensive telecommunications networks, which are vital for delivering digital services and maintaining efficient operations across its diverse businesses.

| Key Resource | Description | 2024 Data/Context |

| Land Bank | Extensive and strategically located land holdings for development. | 12,400 hectares as of Q1 2024. |

| Financial Capital | Access to substantial funding through retained earnings, equity, and credit markets. | PHP 445.4 billion in consolidated revenues for Ayala Corp. in 2023. |

| Brand Reputation | Over 180 years of established trust, quality, and sustainability. | Underpins customer trust in subsidiaries like BPI (PHP 49.4 billion net income in 2023). |

| Human Capital | Skilled workforce with expertise across diverse industries. | Continuous talent development is a strategic priority. |

| Technology & Infrastructure | Proprietary technologies, robust IT, and telecommunications networks. | Globe Telecom (Ayala's telco) continued network expansion in 2024. |

Value Propositions

Ayala Land crafts master-planned communities, blending homes, offices, shops, and recreation to foster complete living. These integrated developments champion sustainability, featuring abundant green spaces and advanced infrastructure, as seen in their commitment to reducing carbon emissions across their portfolio.

This focus on holistic environments significantly boosts resident well-being and ensures enduring value. For instance, Ayala Land's 2024 sustainability report highlights their ongoing efforts to achieve net-zero emissions by 2050, a testament to their long-term vision for these communities.

BPI delivers dependable and forward-thinking financial solutions designed for everyone, from individuals managing their savings to large corporations seeking funding. They offer a broad spectrum of banking services, emphasizing security and ease of access through their digital channels, ensuring customers have a seamless and stable financial experience.

In 2024, BPI continued to invest heavily in its digital transformation, aiming to provide a superior customer experience. This focus on innovation is crucial for meeting the evolving needs of their diverse client base, from personal banking to complex corporate finance requirements.

Globe Telecom's value proposition centers on enabling a seamless digital lifestyle through its robust telecommunications services. This includes providing reliable mobile data and high-speed broadband internet, essential for everyday communication, work, and entertainment.

Beyond basic connectivity, Globe empowers users with integrated digital solutions like GCash, a leading mobile wallet. As of early 2024, GCash boasts over 60 million registered users, highlighting its significant role in facilitating digital payments and financial inclusion across the Philippines.

The company's commitment is to empower its customers by making digital services accessible and dependable. This focus on reliability and ease of access ensures individuals and businesses can fully participate in and benefit from the digital economy.

Clean and Sustainable Energy Solutions

ACEN offers dependable and eco-friendly power, focusing on renewable sources like solar and wind. This approach bolsters energy security while promoting environmental responsibility, presenting a greener choice for both businesses and local communities.

Their dedication to achieving net-zero emissions directly supports worldwide sustainability objectives, making them a key player in the transition to a low-carbon economy. For instance, ACEN reported a significant increase in its renewable energy capacity, reaching over 4,000 MW by the end of 2023, with a clear roadmap to further expand this portfolio.

- Renewable Energy Focus: ACEN's primary value is providing clean energy through solar, wind, and geothermal power projects.

- Environmental Stewardship: They contribute to reducing carbon footprints and supporting global climate goals.

- Energy Security: By diversifying energy sources, ACEN enhances reliability and reduces dependence on fossil fuels for its customers.

- Net-Zero Commitment: Their strategic alignment with net-zero targets positions them as a leader in sustainable energy development.

Comprehensive and Accessible Healthcare and Mobility

AC Health is dedicated to making quality healthcare reachable for many Filipinos, operating a growing network of hospitals and clinics. This commitment is reflected in their expansion efforts, with plans to further increase their footprint across the archipelago.

AC Mobility is carving out a significant presence by offering a wide array of transportation and automotive services. Their focus on electric vehicles and the necessary charging infrastructure addresses a growing demand for sustainable mobility solutions.

These ventures directly tackle essential societal requirements, aiming to improve the quality of life for Filipinos by providing better access to healthcare and more efficient, eco-friendly transportation options.

- Healthcare Accessibility: AC Health aims to serve a substantial segment of the Philippine population, enhancing access to medical services.

- Mobility Solutions: AC Mobility provides a diverse range of transport and automotive options, including a growing emphasis on electric vehicles.

- Societal Impact: Both businesses are designed to meet critical societal needs, contributing to improved daily living for Filipinos.

Ayala Land creates integrated communities that are self-sustaining and environmentally conscious, offering a complete living experience. Their developments prioritize green spaces and sustainable infrastructure, contributing to enhanced resident well-being and long-term property value.

BPI provides comprehensive and innovative financial services tailored to diverse customer needs, from personal banking to corporate finance. They emphasize secure and accessible transactions, particularly through their robust digital platforms, ensuring a smooth customer journey.

Globe Telecom's core value is enabling a connected digital life through reliable mobile and broadband services. They further empower users with digital solutions like GCash, fostering financial inclusion and simplifying transactions for millions.

ACEN delivers clean and reliable energy from renewable sources, actively contributing to environmental sustainability and energy security. Their commitment to net-zero emissions aligns with global climate goals, offering a responsible energy choice.

AC Health and AC Mobility focus on improving societal well-being by expanding access to quality healthcare and providing sustainable transportation solutions, including a growing electric vehicle ecosystem.

| Company | Key Value Proposition | 2024 Data/Highlight |

|---|---|---|

| Ayala Land | Master-planned, sustainable communities | Ongoing expansion of green building certifications. |

| BPI | Dependable and digital financial solutions | Continued investment in digital infrastructure to enhance customer experience. |

| Globe Telecom | Seamless digital lifestyle enablement | GCash user base exceeding 60 million by early 2024. |

| ACEN | Clean and reliable renewable energy | Targeting significant expansion of renewable energy capacity. |

| AC Health / AC Mobility | Accessible healthcare and sustainable mobility | Expanding network of clinics and hospitals; growing EV infrastructure. |

Customer Relationships

Ayala prioritizes personalized client management for its high-value and corporate customers. Dedicated relationship managers act as single points of contact, offering tailored services across Ayala's diverse portfolio, especially within financial services and real estate development.

This direct engagement model fosters a deep understanding of individual client needs, leading to customized solutions and strengthening long-term loyalty. For instance, in 2024, Ayala Land reported significant growth in its premium property segments, driven by strong relationships with key corporate and individual buyers seeking bespoke living and business spaces.

Ayala actively engages its communities through its integrated developments, fostering a sense of belonging and shared progress. For instance, in 2023, Ayala Land's estate development projects directly supported local economies, creating thousands of jobs and contributing to community infrastructure.

Through the Ayala Foundation, the company implements targeted corporate social responsibility programs focused on education, livelihood, and disaster relief. These initiatives aim to build human capital and resilience, as demonstrated by the foundation's reach to over 1 million beneficiaries in 2023 across various impactful projects.

Ayala's commitment extends to forming strategic partnerships with local governments and non-governmental organizations, amplifying the impact of its development efforts. This collaborative approach ensures that community needs are met and that shared value is created, building enduring trust and mutual benefit.

Ayala's telecommunications arm, Globe, reported a 17% increase in digital self-service transactions in 2023, highlighting the growing reliance on online platforms for customer needs. This digital focus streamlines interactions, offering customers 24/7 access to manage accounts, pay bills, and resolve queries, thereby enhancing convenience and operational efficiency across its diverse business units.

Loyalty Programs and Exclusive Benefits

Ayala actively cultivates customer loyalty through well-established programs and exclusive perks. These initiatives are designed to foster repeat engagement across its wide range of businesses, from retail and hospitality to financial services. For instance, Ayala Malls often features tiered loyalty programs that offer discounts, early access to sales, and special event invitations, directly rewarding frequent shoppers. This strategy not only boosts sales but also builds a stronger emotional connection with consumers.

These programs are crucial for customer retention, making customers feel valued and appreciated. By offering tangible benefits, Ayala enhances its overall value proposition, encouraging customers to choose its brands repeatedly. This approach creates a community around its offerings, fostering a sense of belonging and exclusivity.

- Ayala Rewards Circle: This program consolidates loyalty benefits across various Ayala Land properties, including malls and hotels, offering points for purchases redeemable for discounts and exclusive experiences.

- BPI Rewards: For its banking arm, Bank of the Philippine Islands (BPI), loyalty is driven through credit card programs that offer points, cashback, and travel perks, encouraging higher transaction volumes.

- Exclusive Access: Customers in higher tiers of loyalty programs often receive priority access to new product launches, limited edition items, and private events, enhancing their perception of value.

Customer Feedback and Continuous Improvement

Ayala Corporation actively solicits customer input through multiple avenues, including surveys and direct engagement, to refine its diverse portfolio of products and services. This proactive approach ensures that Ayala's offerings consistently align with and anticipate shifting market needs and customer expectations.

In 2024, Ayala's commitment to customer-centricity was evident in initiatives across its business units. For instance, Ayala Land's residential developments incorporated feedback on smart home features and community amenities, leading to enhanced resident satisfaction. Globe Telecom's customer service improvements, driven by analysis of user feedback, contributed to a notable increase in net promoter scores.

- Feedback Channels: Ayala utilizes digital platforms, customer service interactions, and post-purchase surveys to gather insights.

- Data Integration: Customer feedback is systematically analyzed and integrated into product development and service delivery processes.

- Service Enhancement: Continuous improvement cycles are fueled by this feedback, aiming to elevate customer experience and loyalty.

Ayala nurtures deep customer relationships through personalized service, loyalty programs, and active feedback integration across its diverse businesses. This approach, evident in 2024 initiatives, focuses on understanding and anticipating customer needs to foster long-term engagement and loyalty.

The company leverages digital channels, like Globe's self-service options which saw a 17% increase in 2023 transactions, to enhance convenience. Loyalty programs, such as Ayala Rewards Circle and BPI Rewards, offer tangible benefits, driving repeat business and customer satisfaction.

| Business Unit | Loyalty Initiative | 2023/2024 Highlight |

|---|---|---|

| Ayala Land | Ayala Rewards Circle | Enhanced points redemption for exclusive experiences. |

| BPI | BPI Rewards (Credit Cards) | Continued growth in transaction-driven points accumulation. |

| Globe Telecom | Digital Self-Service | 17% increase in digital transactions in 2023, improving customer convenience. |

Channels

Ayala Land's physical sales offices are vital touchpoints for its real estate ventures, offering direct engagement and personalized advice to potential buyers. These locations, especially in bustling urban centers, are key to their market penetration.

For Bank of the Philippine Islands (BPI), its widespread network of branches serves as the backbone for customer transactions and relationship building. As of the first quarter of 2024, BPI reported over 1,100 branches nationwide, facilitating crucial financial services.

These physical presences are not just for sales or transactions; they also foster trust and accessibility, particularly for segments of the population who prefer face-to-face interactions or require immediate assistance with their property or banking needs.

Ayala leverages digital platforms and mobile applications extensively, with Globe's telecommunications services and GCash for financial technology being prime examples. These channels are crucial for reaching customers, offering convenience and accessibility through real-time services.

In 2024, GCash continued its rapid expansion, reporting over 60 million registered users, underscoring the immense reach of mobile financial services. Globe, a key Ayala subsidiary, also saw its digital services grow, with a significant portion of its subscriber base actively engaging through its apps for account management and service upgrades.

Ayala Land's retail malls and commercial establishments are crucial customer channels, directly connecting with millions of shoppers and visitors annually. These vibrant hubs showcase a wide array of products and services, fostering commerce and leisure. In 2024, Ayala Land continued to expand and enhance its portfolio, with its malls serving as significant revenue generators and key touchpoints for consumer engagement.

Direct Sales and Business Development Teams

Ayala's direct sales and business development teams are crucial for securing large-scale real estate transactions, corporate banking deals, and complex enterprise solutions in telecommunications and energy sectors. These specialized teams directly engage with institutional investors, government bodies, and major corporations, fostering deep relationships necessary for these high-value engagements.

This direct client interaction enables Ayala to craft highly customized solutions, precisely meeting the unique needs of each enterprise client. For instance, in 2023, Ayala Land’s industrial leasing segment saw significant growth driven by direct engagements with multinational corporations seeking build-to-suit facilities, underscoring the effectiveness of this channel.

- Key Client Segments: Institutional investors, government entities, large corporations.

- Primary Focus Areas: Large-scale real estate, corporate banking, telecommunications, and energy enterprise solutions.

- Strategic Advantage: Tailored solutions and robust relationship building for complex deals.

Third-Party Distributors and Agents

Ayala utilizes a network of third-party distributors and agents to significantly broaden its market reach, especially for financial services like insurance and mutual funds managed by BPI, as well as certain telecommunications offerings. This strategy is crucial for penetrating diverse markets and accessing specialized sales expertise that complements Ayala's internal operations.

These partnerships allow Ayala to expand its distribution capabilities considerably, reaching customers more effectively than relying solely on its own sales force. For instance, BPI's mutual fund distribution often involves external financial advisors and platforms, enhancing accessibility for a wider investor base.

By engaging third-party distributors and agents, Ayala effectively scales its sales and distribution network. This approach proved particularly valuable in 2024 as the group focused on expanding its digital channels and reaching new customer segments across its various businesses, from banking to telecommunications.

- Extended Market Penetration: Third-party networks allow Ayala to access customer segments and geographic areas that might be challenging to reach directly.

- Specialized Expertise: Partners often bring niche knowledge in specific product areas, such as financial planning or telecommunications solutions, enhancing customer engagement.

- Scalability: This model provides flexibility to scale distribution efforts up or down based on market demand and strategic priorities without significant fixed overhead.

- Cost-Efficiency: Leveraging external partners can be more cost-effective than building and maintaining an extensive internal sales and distribution infrastructure for all product lines.

Ayala's channels encompass a multifaceted approach, blending physical and digital touchpoints to serve diverse customer needs. From direct engagement at sales offices and bank branches to the vast reach of digital platforms like GCash and Globe's services, Ayala ensures accessibility and convenience. Its retail malls act as significant consumer hubs, while specialized teams handle large-scale enterprise deals, underscoring a strategy that caters to both individual and corporate clients.

Customer Segments

Ayala Land's residential property buyers span the entire market, from first-time homebuyers seeking affordable housing to high-net-worth individuals investing in luxury estates. This diverse customer base includes young families looking for starter homes and established professionals desiring premium residences with enhanced amenities. For instance, in 2024, the demand for mid-market condominiums remained robust, driven by urban migration and a growing middle class.

Ayala's banking arm, BPI, serves a broad spectrum of individual and corporate clients. This includes everyday people with savings and loan needs, as well as small and medium-sized enterprises (SMEs) and large corporations seeking comprehensive financial solutions.

For individuals, BPI offers a range of deposit accounts, credit cards, and personal loans. In 2023, BPI's retail deposit base grew, reflecting continued trust from individual depositors.

For businesses, BPI provides crucial services like commercial loans, trade finance, and treasury management. SMEs and large corporations alike rely on BPI for capital to fuel their growth and manage their operations effectively.

Ayala's telecommunications segment, primarily through Globe Telecom, caters to a massive customer base. This includes individual consumers relying on mobile and home internet services, as well as a significant enterprise market seeking robust connectivity, cloud solutions, and digital transformation tools.

In 2024, Globe Telecom reported a substantial number of mobile subscribers, reaching over 100 million. This vast network underscores the segment's reach, encompassing a broad spectrum of user needs from basic communication to advanced digital services for businesses.

Businesses and Institutions Requiring Energy and Infrastructure

This customer segment encompasses a broad range of entities, from large industrial manufacturers to bustling commercial centers and vital public sector organizations. These clients depend on consistent and robust energy and infrastructure to operate efficiently and sustainably.

ACEN, a key Ayala Corporation subsidiary, directly addresses the energy needs of this segment by providing renewable power solutions. Simultaneously, other Ayala companies contribute essential infrastructure development, offering integrated solutions that support economic growth and public services. For instance, in 2024, ACEN continued its expansion in renewable energy, with a significant portion of its portfolio serving industrial and commercial clients seeking to decarbonize their operations.

These customers are pivotal for driving large-scale projects and advancing sustainable development goals. Their demand for reliable energy and infrastructure underpins significant investment and innovation within the Ayala ecosystem. By 2024, the demand for green energy from corporations had surged, with many businesses setting ambitious renewable energy targets.

- Industrial Clients: Factories and manufacturing plants requiring stable and often large-scale electricity supply for continuous operations.

- Commercial Establishments: Retail centers, office buildings, and hospitality businesses needing reliable power for daily functions and customer experience.

- Public Entities: Government agencies, utilities, and municipalities that require infrastructure for public services, transportation, and community development.

Healthcare Patients and Educational Institutions

AC Health, Ayala's healthcare arm, directly serves a vast patient base seeking medical services through its expanding network of hospitals and clinics. In 2024, AC Health continued to focus on enhancing patient experience and accessibility, particularly in underserved areas. The company's strategy involves both organic growth and strategic acquisitions to broaden its reach and service offerings.

iPeople, on the other hand, addresses the educational needs of students and institutions by offering a diverse range of learning programs. This segment saw continued investment in digital learning platforms and curriculum development throughout 2024 to adapt to evolving educational landscapes. iPeople's commitment is to provide quality education from basic to higher learning.

These two customer segments are pivotal to Ayala's diversification strategy, tapping into essential social services with significant growth potential. By addressing healthcare and education, Ayala aims to create lasting social impact while pursuing sustainable business growth.

Key aspects of these customer segments include:

- Healthcare Patients: Seeking accessible, quality medical care across various specialties and service levels, with a growing demand for preventive and specialized treatments.

- Educational Institutions: Universities, colleges, and schools looking for enhanced learning management systems, curriculum support, and digital transformation solutions.

- Students: Individuals at all levels of education requiring effective learning tools, career development support, and pathways to higher education or employment.

- Broader Community: Benefiting from improved healthcare infrastructure and educational opportunities, contributing to overall societal well-being and economic development.

Ayala Land's residential offerings cater to a wide array of buyers, from first-time homeowners to those seeking luxury properties. This includes young families and professionals, with a notable demand for mid-market condominiums in 2024 driven by urbanization.

BPI's financial services reach individuals and businesses of all sizes, from everyday savers to large corporations. In 2023, BPI saw growth in its retail deposit base, indicating continued trust from individual clients.

Globe Telecom's telecommunications services serve both individual consumers and the enterprise market. By 2024, Globe had surpassed 100 million mobile subscribers, highlighting its extensive reach for diverse connectivity needs.

Ayala's energy and infrastructure segments, particularly ACEN, provide renewable power solutions to industrial, commercial, and public sector clients. The demand for green energy from corporations surged in 2024 as businesses pursued sustainability goals.

| Segment | Key Customer Groups | 2024/2023 Data Points |

|---|---|---|

| Residential Property | First-time buyers, young families, high-net-worth individuals | Robust demand for mid-market condominiums |

| Banking (BPI) | Individuals, SMEs, large corporations | Retail deposit base grew in 2023 |

| Telecommunications (Globe) | Individual consumers, enterprise market | Over 100 million mobile subscribers in 2024 |

| Energy & Infrastructure (ACEN) | Industrial clients, commercial establishments, public entities | Increased corporate demand for renewable energy |

Cost Structure

Ayala's cost structure heavily features capital expenditures, particularly for its major ventures in real estate development, telecommunications infrastructure, and renewable energy projects. These substantial investments are foundational for expanding its market reach and staying ahead of competitors.

For 2025, Ayala has projected a significant allocation of P230 billion towards capital expenditures. This figure underscores the company's commitment to funding large-scale initiatives essential for its long-term growth and operational capabilities.

Ayala's operating expenses are substantial, reflecting its status as a diversified conglomerate. These costs encompass salaries and wages for a large workforce, administrative overhead, and essential utilities and maintenance across its various business units, which span sectors like telecommunications, banking, property development, and water utilities.

For instance, in 2024, Globe Telecom, a key Ayala subsidiary, reported significant operating expenses related to network expansion and maintenance, crucial for its telecommunications services. Similarly, Bank of the Philippine Islands (BPI) incurs considerable costs for its extensive branch network, personnel, and regulatory compliance, all vital for its banking operations.

Efficiently managing these diverse operating expenses is paramount to maintaining profitability and competitiveness. Ayala's strategy involves leveraging economies of scale and implementing cost-optimization initiatives across its portfolio companies to ensure these inherent costs contribute positively to overall financial performance.

For Ayala Land, its real estate development powerhouse, the most significant expenses are tied to acquiring prime land in desirable locations and the substantial costs of construction. These upfront investments are crucial for building residential properties, commercial spaces, and integrated communities.

In 2024, Ayala Land continued its robust development pipeline, with land acquisition and construction representing a major portion of its capital expenditures. For instance, the company allocated significant capital towards its Visayas and Mindanao projects, highlighting the ongoing commitment to expanding its footprint and the associated land and building expenses.

Financing and Interest Expenses

Ayala Corporation's cost structure is significantly influenced by financing and interest expenses, a natural consequence of its capital-intensive operations across various sectors like real estate, banking, and telecommunications. These costs primarily stem from interest payments on its extensive debt portfolio, including loans and issued bonds, which are essential for funding its ambitious growth and development projects.

Effective management of these financing costs is paramount to Ayala's financial health. The company actively monitors its financial leverage, with the net debt-to-equity ratio serving as a key indicator of its financial risk and capital structure efficiency. For instance, as of the first quarter of 2024, Ayala Corporation reported a consolidated net debt of PHP 387.7 billion, highlighting the scale of its financing needs.

- Financing Costs: Interest expenses on loans and bonds represent a substantial portion of Ayala's operating costs, directly impacting profitability.

- Debt Management: Optimizing debt levels and financing structures is crucial for controlling these expenses and maintaining financial flexibility.

- Net Debt-to-Equity Ratio: This metric is closely watched to gauge the company's financial leverage and risk profile, with a target of maintaining a healthy balance.

- 2024 Data: In the first quarter of 2024, Ayala's interest expenses amounted to PHP 12.4 billion, reflecting the ongoing costs associated with its significant borrowings.

Technology and Network Maintenance Costs

Ayala Corporation, through its various subsidiaries like Globe Telecom, invests heavily in maintaining and upgrading its extensive telecommunications networks and IT infrastructure. These ongoing costs are critical for ensuring reliable service and staying competitive in the rapidly evolving digital landscape.

These expenses encompass a wide range of items, including software licenses for essential operating systems and applications, hardware maintenance contracts for network equipment, and robust cybersecurity measures to protect customer data and network integrity. For instance, Globe Telecom reported capital expenditures of PHP 61.6 billion in 2023, a significant portion of which is allocated to network enhancements and maintenance.

- Network Upgrades: Continuous investment in fiber optic expansion and 5G technology deployment.

- IT System Maintenance: Costs associated with software licenses, cloud services, and data center operations.

- Cybersecurity: Essential spending on advanced security solutions to safeguard digital assets and customer information.

Ayala's cost structure is heavily weighted towards capital expenditures for infrastructure and property development, alongside significant operating expenses across its diverse business units. Financing costs, driven by substantial debt for growth, are also a key component. Managing these costs efficiently is vital for profitability.

Revenue Streams

Ayala Land generates significant revenue through the sale of its diverse real estate offerings, including residential units, commercial lots, and office spaces. In 2023, the company reported a substantial portion of its revenue stemming from property sales, reflecting strong market demand for its developments.

Beyond outright sales, Ayala Land benefits from a robust stream of recurring income through its leasing operations. This includes revenue from its extensive portfolio of retail malls, prime office buildings, and hospitality properties like hotels, contributing to a stable and predictable financial base.

This dual approach of property sales and leasing creates a resilient and expanding revenue model for Ayala Land. The company's commitment to developing high-quality, integrated communities further bolsters these revenue streams, ensuring sustained growth and profitability.

Bank of the Philippine Islands (BPI), a key subsidiary of Ayala Corporation, draws substantial revenue from financial service fees and interest income. In 2023, BPI reported a net interest income of PHP 124.5 billion, demonstrating the core strength of its lending and investment activities.

Beyond interest, BPI’s diverse fee-based income streams, including wealth management and credit card operations, contributed significantly. For instance, fees and commissions reached PHP 46.9 billion in 2023, highlighting the effectiveness of its cross-selling strategies and broad customer engagement.

Globe Telecom's primary revenue stream, telecommunications service subscriptions, encompasses a broad range of offerings. This includes recurring monthly charges from millions of individual mobile and broadband subscribers, as well as substantial contributions from enterprise clients for their connectivity and communication needs.

Beyond core connectivity, Globe's revenue is significantly boosted by its digital services, notably GCash, the leading mobile wallet in the Philippines. This digital ecosystem generates income through transaction fees, merchant services, and various financial technology solutions, reflecting a growing shift towards digital commerce.

In 2023, Globe reported a consolidated service revenue of PHP 159.5 billion, with mobile services forming the largest segment. The company's strategic focus on data services and digital platforms continues to drive growth, with GCash alone processing over PHP 4 trillion in total transaction value for the year.

Power Generation and Sales

ACEN, Ayala Corporation's energy arm, primarily generates revenue by selling electricity from its diverse portfolio of power plants, with a strong emphasis on renewable sources. This revenue comes from both long-term Power Purchase Agreements (PPAs) with various off-takers and sales to the wholesale electricity spot market. The company's strategic expansion of its renewable energy capacity, particularly in solar and wind, directly fuels the growth of this core revenue stream.

In 2023, ACEN reported significant revenue growth, with its Philippine operations contributing substantially. The company's total attributable net income reached PHP 12.5 billion for the year, reflecting the increasing contribution from its renewable energy assets. This growth is a direct result of their strategy to expand installed capacity.

- 2023 Attributable Net Income: PHP 12.5 billion.

- Primary Revenue Source: Sale of electricity from renewable and thermal power plants.

- Sales Channels: Power Purchase Agreements (PPAs) and Wholesale Electricity Spot Market (WESM).

- Growth Driver: Expansion of renewable energy capacity.

Emerging Business Revenues (Healthcare, Logistics, Mobility, Retail)

Ayala's emerging businesses are actively cultivating distinct revenue streams. AC Health is generating income from hospital and clinic services, while AC Logistics is building revenue through its integrated logistics solutions. AC Mobility is focused on revenue from vehicle sales and the development of charging infrastructure.

These newer ventures are strategically positioned for substantial future growth and profitability. For instance, in 2024, AC Health's network of clinics and hospitals continued to expand its patient base, contributing to a steady increase in service revenues. AC Logistics secured key partnerships, enhancing its market share and revenue generation in the warehousing and distribution sectors.

- AC Health: Revenue derived from patient services across its hospital and clinic network.

- AC Logistics: Income generated from warehousing, freight forwarding, and last-mile delivery services.

- AC Mobility: Revenue streams from vehicle sales, after-sales services, and electric vehicle charging solutions.

- Retail Ventures: Exploring new avenues for revenue through various retail formats and offerings.

Ayala's diverse revenue streams are built on a foundation of established businesses and strategic expansion into new sectors. The core segments, real estate, banking, and telecommunications, provide consistent income, while emerging ventures are actively developing their own revenue generation capabilities.

The company's real estate arm, Ayala Land, benefits from both property sales and recurring rental income from its extensive portfolio of malls, offices, and hotels. BPI, its banking subsidiary, generates revenue primarily through net interest income and a growing array of fee-based services. Globe Telecom's revenue is driven by its massive subscriber base for mobile and broadband services, augmented by its successful digital ventures like GCash.

ACEN, the energy company, earns revenue from the sale of electricity, with a significant push towards renewables. The newer ventures, including AC Health, AC Logistics, and AC Mobility, are establishing distinct revenue streams from healthcare services, integrated logistics, and automotive sales respectively. These diversified income sources contribute to Ayala's overall financial resilience and growth potential.

| Business Segment | Primary Revenue Streams | 2023 Key Financials/Data |

|---|---|---|

| Ayala Land | Property Sales, Rental Income (Malls, Offices, Hotels) | Significant portion of revenue from property sales; stable recurring income from leasing operations. |

| BPI | Net Interest Income, Financial Service Fees (Wealth Management, Credit Cards) | PHP 124.5 billion net interest income; PHP 46.9 billion in fees and commissions (2023). |

| Globe Telecom | Telecommunications Subscriptions (Mobile, Broadband), Digital Services (GCash) | PHP 159.5 billion consolidated service revenue (2023); GCash processed over PHP 4 trillion in transaction value (2023). |

| ACEN | Electricity Sales (Renewable and Thermal Power Plants) | PHP 12.5 billion attributable net income (2023); revenue growth driven by expanded renewable capacity. |

| Emerging Businesses (AC Health, AC Logistics, AC Mobility) | Healthcare Services, Logistics Solutions, Vehicle Sales & EV Charging | AC Health expanding patient base; AC Logistics securing partnerships; AC Mobility focusing on EV infrastructure. |

Business Model Canvas Data Sources

The Ayala Business Model Canvas is built using a combination of internal financial reports, extensive market research, and strategic analyses of industry trends. These diverse data sources ensure that each component of the canvas is grounded in factual information and reflects the company's current operational and strategic landscape.