Assured Guaranty SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Assured Guaranty Bundle

Assured Guaranty's robust financial strength and established market position are key strengths, but the company navigates a complex regulatory environment and potential shifts in the municipal bond market. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind Assured Guaranty's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Assured Guaranty solidified its position as the undisputed leader in U.S. public finance in Q1 2025, insuring a significant portion of the municipal bond market. The company reported insuring $15.2 billion in par value of new issues, representing a substantial share of the total insured volume. This dominance translates to a consistent and robust revenue stream, further bolstering its already strong reputation for reliability among municipal issuers and investors.

Assured Guaranty boasts a formidable capital position, with its capital adequacy surpassing the stringent 'AAA' stress levels defined by S&P. This financial fortitude is further underscored by its consistent AA financial strength ratings from S&P Global Ratings as of July 2025.

This robust financial foundation is a key strength, offering a significant competitive edge. It instills confidence in policyholders and equips the company with the resilience to absorb potential losses, bolstering its capacity to underwrite new business effectively.

Assured Guaranty's strength lies in its diversified underwriting strategy, spanning U.S. public finance, non-U.S. public finance, and global structured finance. This global reach allows them to tap into various markets, offering resilience against regional economic shocks. For instance, in 2023, Assured Guaranty reported a significant portion of its new business premiums coming from international markets, demonstrating the success of this global approach.

Proven Track Record of Shareholder Value Creation

Assured Guaranty has a proven track record of creating shareholder value, consistently returning capital through robust share repurchase programs and dividend payments. This commitment is evident in their substantial share buybacks, which have effectively boosted shareholders' equity and adjusted book value per share.

For instance, between 2013 and the end of 2023, Assured Guaranty repurchased approximately 46.7 million shares of common stock, amounting to over $2.6 billion. This aggressive capital return strategy underscores their dedication to enhancing shareholder returns.

- Consistent Capital Return: Demonstrated by substantial share repurchases and dividends.

- Shareholder Equity Growth: Repurchases have contributed to increased shareholders' equity.

- Adjusted Book Value Enhancement: Buybacks have positively impacted adjusted book value per share.

- Significant Share Repurchases: Over $2.6 billion in shares repurchased from 2013 to 2023.

Expertise in Complex Structured Finance and Infrastructure

Assured Guaranty's deep expertise in complex structured finance and infrastructure projects is a significant strength. This specialization enables them to underwrite and insure large, long-term deals, such as their involvement in the JFK Airport's New Terminal One project. This capability not only lowers borrowing costs for project issuers but also offers vital security to investors in major public and private infrastructure developments, demonstrating their capacity for handling substantial and intricate financial arrangements.

Assured Guaranty's dominant position in the U.S. public finance market, evidenced by insuring $15.2 billion in new municipal bond issues in Q1 2025, provides a stable and substantial revenue base. This market leadership, coupled with a robust capital position exceeding 'AAA' stress levels and consistent AA financial strength ratings from S&P as of July 2025, underpins its reliability and capacity for new business.

The company's diversified underwriting across U.S. public finance, non-U.S. public finance, and global structured finance, as demonstrated by significant international premium contributions in 2023, mitigates regional economic risks. Furthermore, Assured Guaranty’s proven commitment to shareholder value is highlighted by over $2.6 billion in share repurchases between 2013 and 2023, enhancing equity and book value per share.

Their specialized expertise in complex structured finance and large infrastructure projects, including participation in the JFK Airport's New Terminal One, allows them to manage substantial deals, benefiting issuers and investors alike.

| Metric | Value | Period | Source |

|---|---|---|---|

| U.S. Public Finance Insurance | $15.2 billion (par value) | Q1 2025 | Assured Guaranty Filings |

| Financial Strength Rating | AA | July 2025 | S&P Global Ratings |

| Share Repurchases | Over $2.6 billion | 2013-2023 | Assured Guaranty Filings |

What is included in the product

Delivers a strategic overview of Assured Guaranty’s internal and external business factors, examining its strengths, weaknesses, opportunities, and threats within the financial guarantee market.

Assures Guaranty's SWOT analysis offers a clear, actionable roadmap by highlighting key risk mitigation strategies and capitalizing on emerging market opportunities, thereby relieving the pain of uncertainty in strategic planning.

Weaknesses

Assured Guaranty's core business of insuring municipal and corporate debt makes it highly susceptible to economic downturns. A severe recession or a prolonged period of elevated interest rates could trigger a wave of defaults on the bonds it guarantees, particularly those in vulnerable sectors. For instance, during the 2008 financial crisis, the insurance industry faced significant strain due to widespread defaults, a scenario Assured Guaranty must continually manage.

Assured Guaranty's profitability can be significantly impacted by interest rate volatility. While investment yields have shown improvement, the company's investment portfolio and new business generation remain susceptible to rate fluctuations. For instance, a sudden rise in interest rates could make its bond insurance less appealing to issuers and potentially dampen refinancing activity, while also introducing unpredictability in the fair value of its trading securities.

Assured Guaranty's reliance on the U.S. public finance market, while a core strength, also presents a significant concentration risk. A downturn in this specific sector, perhaps due to widespread fiscal distress among U.S. states or municipalities, could disproportionately impact the company's financial health.

Regulatory and Accounting Standard Changes

Assured Guaranty, like others in the financial guaranty sector, faces the challenge of adapting to a shifting regulatory environment. The NAIC's Principles-Based Bond Project, set to take effect in January 2025, is a prime example of this evolving landscape. This necessitates substantial investment in system upgrades and data management to ensure ongoing compliance.

These regulatory shifts can introduce significant operational complexities and costs. The need for robust compliance efforts, including potential system overhauls and enhanced data governance, presents a continuous challenge for the company. For instance, the implementation of new accounting standards often requires extensive retraining and validation processes, impacting resource allocation.

- Adapting to NAIC's Principles-Based Bond Project (effective Jan 2025)

- Increased costs associated with system updates and data management

- Complexity in ensuring ongoing regulatory compliance

Limited Growth in a Mature Industry Segment

The financial guaranty insurance market, while specialized, is also quite mature. This maturity means growth opportunities in established areas might be constrained, as penetration rates for this specific type of insurance are lower compared to other insurance sectors. Assured Guaranty may need to focus on finding unique market niches or expanding its international presence to drive significant expansion.

For instance, while the overall insurance market continues to evolve, the specific segment of financial guaranty insurance faces inherent limitations due to its established nature. This could mean slower organic growth compared to emerging or rapidly expanding insurance lines. As of the latest available data, the global financial guaranty market size, while significant, reflects this maturity, with growth rates often tied to broader economic cycles and infrastructure spending rather than rapid market penetration.

- Mature Market Dynamics: The financial guaranty sector operates within a relatively stable but mature industry, impacting the pace of new customer acquisition.

- Penetration Rate Challenges: Lower penetration compared to other insurance types suggests limited untapped domestic markets for aggressive expansion.

- Growth Strategy Reliance: Future growth will likely depend on strategic initiatives like niche market development or international diversification rather than broad market capture.

Assured Guaranty's significant exposure to U.S. public finance creates a concentration risk; a downturn in this sector, perhaps due to widespread fiscal distress among U.S. states or municipalities, could disproportionately impact the company's financial health.

The company faces ongoing challenges adapting to a shifting regulatory environment, with the NAIC's Principles-Based Bond Project, effective January 2025, requiring substantial investment in system upgrades and data management for compliance. This necessitates robust efforts, including potential system overhauls and enhanced data governance, impacting resource allocation.

The financial guaranty insurance market is mature, leading to constrained growth opportunities in established areas due to lower penetration rates compared to other insurance sectors. Assured Guaranty may need to focus on niche markets or international expansion for significant growth.

| Weakness | Description | Impact |

|---|---|---|

| Concentration Risk | Heavy reliance on the U.S. public finance market. | Vulnerability to sector-specific downturns. |

| Regulatory Adaptation | Need to comply with evolving regulations like NAIC's Principles-Based Bond Project (Jan 2025). | Increased costs for system upgrades and data management. |

| Market Maturity | Mature financial guaranty sector with limited domestic penetration. | Slower organic growth, reliance on niche or international expansion. |

Same Document Delivered

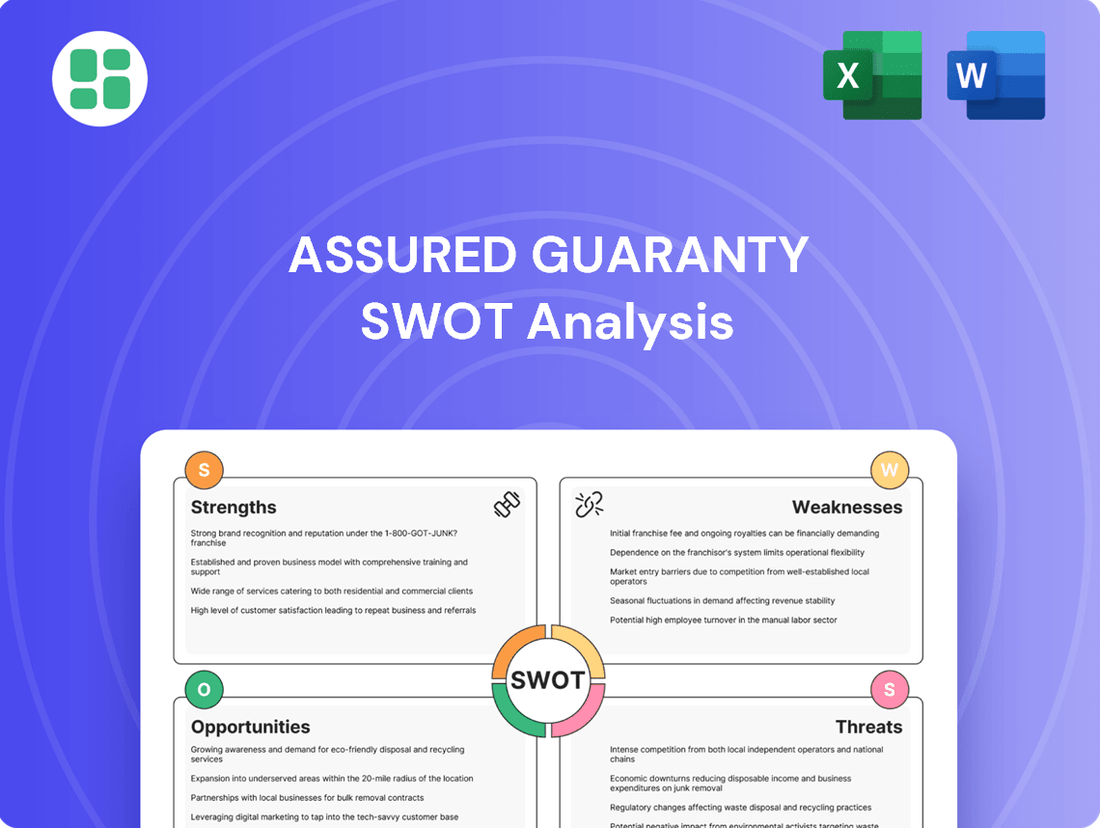

Assured Guaranty SWOT Analysis

This is the actual Assured Guaranty SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can see the core strengths, weaknesses, opportunities, and threats that define the company's strategic landscape. This preview accurately represents the detailed insights contained within the full report.

Opportunities

The global infrastructure market is experiencing robust growth, with the U.S. alone projected to invest trillions in upgrades over the coming decade. This surge in development, particularly in areas like transportation and energy, directly translates into a heightened need for financing solutions.

Assured Guaranty is well-positioned to capitalize on this trend, as governments and private sectors increasingly turn to municipal and infrastructure bonds to fund these massive projects. The company's ability to enhance the creditworthiness of these bonds makes them more attractive to investors, thereby facilitating crucial infrastructure development.

Asia Pacific’s rapid industrialization and urbanization, coupled with growing cross-border trade, are fueling a significant demand for financial guarantees. For Assured Guaranty, this presents a prime opportunity to expand its reach into these dynamic emerging markets.

Expanding into regions like the Asia Pacific could allow Assured Guaranty to tap into new business opportunities and diversify its revenue streams geographically. This strategic move aligns with the increasing need for robust financial security in developing economies, potentially boosting the company's global footprint and market share.

The growing demand for Environmental, Social, and Governance (ESG)-linked structured finance solutions offers a substantial opportunity for Assured Guaranty. The market for sustainable finance is expanding rapidly, with global issuance of green bonds reaching an estimated $600 billion in 2024, a significant increase from previous years.

Assured Guaranty can capitalize on this trend by applying its expertise in credit enhancement to facilitate the issuance of green bonds, social bonds, and sustainability-linked bonds. This strategic alignment with investor preferences for sustainable investments can unlock new revenue streams and strengthen its market position.

Leveraging Technology for Risk Assessment and Efficiency

Assured Guaranty can significantly boost its operations by embracing technological advancements. Tools like artificial intelligence and sophisticated data analytics are becoming crucial for refining risk assessment and streamlining underwriting. These technologies can process vast amounts of data far quicker than traditional methods, leading to more accurate risk profiling.

Investing in digital transformation presents a clear path to enhanced efficiency and improved client service. By digitizing workflows, Assured Guaranty can reduce operational costs and speed up response times. This also strengthens compliance by ensuring greater accuracy and auditability in processes.

- Enhanced Risk Modeling: AI can analyze complex datasets to identify emerging risks with greater precision than human analysts alone.

- Streamlined Underwriting: Automation of routine underwriting tasks frees up skilled personnel for more complex decision-making.

- Improved Operational Efficiency: Digital platforms can reduce manual processing, leading to faster turnaround times and lower overheads.

- Data-Driven Decision Making: Advanced analytics provide deeper insights into market trends and client behavior, informing strategic choices.

Secondary Market and Refinancing

The secondary municipal bond market is experiencing a surge in activity, creating significant opportunities for Assured Guaranty. This increased trading volume, particularly evident in early 2025, signals a strong investor appetite for liquidity and effective risk management. Assured Guaranty's bond insurance plays a crucial role in facilitating these transactions.

Refinancing opportunities are also on the rise, largely influenced by fluctuating interest rates. Municipal issuers are increasingly looking to refinance existing debt to secure more favorable borrowing costs. This trend directly benefits Assured Guaranty, as bond insurance is often a key component in successful refinancing efforts, making the bonds more attractive to investors.

Assured Guaranty's proactive engagement in the secondary market is already yielding positive results. The company observed heightened activity in early 2025, demonstrating its ability to capitalize on these market dynamics. This positions Assured Guaranty to benefit from both increased trading volume and the demand for its insurance products in refinancing scenarios.

Key opportunities include:

- Increased demand for insured bonds in secondary market trades, enhancing liquidity for investors.

- Facilitating municipal debt refinancing to lower borrowing costs for issuers.

- Leveraging investor demand for risk mitigation in a dynamic interest rate environment.

- Capitalizing on the observed uptick in secondary market activity in early 2025.

The global infrastructure development boom, particularly in the U.S. with trillions slated for upgrades through 2030, presents a significant opportunity for Assured Guaranty. The company's core business of insuring municipal and infrastructure bonds directly supports this growth, making essential projects more financeable. Furthermore, the expanding Asian Pacific markets, driven by industrialization and urbanization, offer new avenues for geographic diversification and increased market share.

The burgeoning demand for ESG-linked financial products, with green bond issuance projected to exceed $600 billion in 2024, aligns perfectly with Assured Guaranty's credit enhancement capabilities. By facilitating the issuance of sustainable bonds, the company can tap into this rapidly growing market. Simultaneously, embracing technological advancements like AI and advanced data analytics can streamline underwriting, improve risk assessment accuracy, and boost operational efficiency, leading to enhanced competitiveness.

The dynamic secondary municipal bond market, showing increased activity in early 2025, provides a robust platform for Assured Guaranty to facilitate trades and manage risk. This environment, coupled with rising refinancing opportunities driven by fluctuating interest rates, allows the company to offer vital credit enhancement. These trends underscore Assured Guaranty's ability to capitalize on market liquidity demands and provide value to both issuers and investors.

Key opportunities for Assured Guaranty include leveraging the increased demand for insured bonds in secondary market trades, facilitating municipal debt refinancing for cost savings, and capitalizing on investor appetite for risk mitigation amidst volatile interest rates. The observed uptick in secondary market activity in early 2025 further validates these strategic growth avenues.

Threats

A significant threat for Assured Guaranty stems from adverse credit developments and defaults among its insured entities. For instance, a substantial deterioration in the credit quality of major exposures, such as Puerto Rico, or widespread defaults triggered by unexpected economic shocks, could result in considerable claims payouts, negatively impacting the company's financial results. As of the first quarter of 2024, Assured Guaranty maintained a robust capital position, with a total adjusted capital of $10.5 billion, providing a buffer against such events, though managing existing and potential future losses remains a key challenge.

Assured Guaranty operates in a niche but competitive landscape where other credit enhancement tools can emerge as significant rivals. For instance, banks offer letters of credit, which serve a similar purpose of guaranteeing debt obligations, and these can be particularly attractive to issuers seeking flexibility or existing banking relationships. The availability of direct government support for certain projects also presents an alternative to private credit enhancement, potentially impacting demand for Assured Guaranty's services.

This intensified competition exerts downward pressure on pricing within the financial guaranty market. As more providers and alternative solutions become available, issuers have greater leverage to negotiate terms, potentially impacting Assured Guaranty's premium income. Furthermore, a crowded competitive field can lead to a fragmentation of market share, making it more challenging for any single provider, including Assured Guaranty, to maintain or grow its dominance.

Geopolitical tensions, like the ongoing conflicts in Eastern Europe and the Middle East, continue to fuel global economic uncertainty. This instability can lead to significant market volatility, impacting investor sentiment and potentially dampening demand for financial guarantees. For Assured Guaranty, this translates to a risk of reduced new business as companies and municipalities may delay or scale back capital projects.

Macroeconomic headwinds, including projections for slower global GDP growth in 2024 and 2025, add another layer of concern. Unexpected policy shifts, such as the imposition of new tariffs or changes in interest rate trajectories by major central banks, can further disrupt financial markets. Such an environment poses a threat to Assured Guaranty by increasing the likelihood of credit events within the insured portfolios and potentially affecting the pricing of its guarantees.

Regulatory Scrutiny and Capital Requirements

Increased regulatory scrutiny presents a significant threat, particularly concerning data governance and potential AI bias in financial operations. For instance, evolving capital regulations like Solvency UK and the NAIC Bond Project are likely to impose stricter requirements and elevate compliance costs for insurers. These shifts can directly impact Assured Guaranty's capital management strategies and overall profitability.

The potential for higher capital requirements could necessitate adjustments to investment strategies or even limit certain business activities. Furthermore, a more stringent regulatory environment might lead to increased operational expenses related to compliance and reporting. This could affect the company's ability to deploy capital efficiently and maintain its competitive edge in the market.

- Stricter compliance burdens: Evolving regulations can increase operational costs and complexity.

- Impact on capital management: New capital requirements may necessitate strategic adjustments to asset allocation and risk management.

- Potential for reduced profitability: Higher compliance costs and capital constraints could squeeze profit margins.

Cybersecurity Risks and Technological Disruption

Assured Guaranty, like all financial institutions, faces escalating cybersecurity threats due to its deep integration with digital systems. A significant data breach could severely damage its reputation and lead to substantial financial penalties. For instance, in 2023, the financial services sector experienced a notable increase in sophisticated ransomware attacks, with some reports indicating a 70% rise in attacks targeting critical infrastructure.

The rapid evolution of technology, particularly artificial intelligence (AI), presents a dual threat. While AI can offer efficiency gains, it also enables more advanced cyberattacks, such as AI-powered phishing campaigns or autonomous malware. By the end of 2024, it's projected that AI will be used in over 90% of all cyberattacks, requiring insurers to invest heavily in AI-driven defense mechanisms.

- Heightened Vulnerability: Increased reliance on digital platforms amplifies exposure to data breaches and operational disruptions.

- AI-Driven Threats: Emerging AI capabilities can create novel and more potent cyberattack vectors.

- Proactive Defense: Assured Guaranty must continually adapt its security infrastructure to counter evolving technological threats.

The primary threat to Assured Guaranty lies in the potential for significant claims payouts stemming from adverse credit events or defaults within its insured portfolios. Economic downturns or specific issuer distress, such as prolonged challenges in Puerto Rico, could trigger substantial losses. Despite Assured Guaranty's strong capital position, with total adjusted capital of $10.5 billion as of Q1 2024, managing these potential liabilities remains a critical concern.

Competition from alternative credit enhancement tools, like bank letters of credit, and direct government support for certain projects, pose a threat by diverting demand from Assured Guaranty's services. This competitive pressure can lead to reduced pricing power and market share fragmentation, impacting premium income and growth opportunities.

Macroeconomic instability and geopolitical risks contribute to market volatility, potentially dampening demand for financial guarantees and increasing the likelihood of credit events. Projections for slower global GDP growth in 2024-2025 and unexpected policy shifts further exacerbate these concerns for Assured Guaranty.

Escalating cybersecurity threats, amplified by AI-driven attacks projected to be used in over 90% of cyberattacks by the end of 2024, pose a significant risk. A data breach could severely damage Assured Guaranty's reputation and result in substantial financial penalties, necessitating continuous investment in advanced defense mechanisms.

SWOT Analysis Data Sources

This Assured Guaranty SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial statements, comprehensive market research reports, and expert analyses of the financial guarantor industry.