Assured Guaranty Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Assured Guaranty Bundle

Curious about Assured Guaranty's strategic product positioning? Our BCG Matrix preview offers a glimpse into their Stars, Cash Cows, Dogs, and Question Marks, highlighting key areas of focus. For a comprehensive understanding of their market share and growth potential, dive into the full report.

Unlock the complete Assured Guaranty BCG Matrix to gain actionable insights into their product portfolio's performance and future trajectory. This detailed analysis will equip you with the knowledge to make informed decisions about resource allocation and strategic investments. Purchase the full version today for a strategic advantage.

Stars

Assured Guaranty is experiencing robust growth in the U.S. municipal secondary market. In Q1 2025, their insured par written reached nearly 10% of total U.S. public finance par, a dramatic jump from just 1% in Q1 2024. This signifies a high-growth area where Assured Guaranty is quickly gaining ground.

This expansion is likely driven by increased investor demand for credit protection amidst market volatility, as investors look to safeguard their existing bond holdings. Assured Guaranty's strong performance here positions them as a key player in this expanding segment.

Assured Guaranty is a major player in insuring large-scale infrastructure projects, showcasing its strength in the Assured Guaranty BCG Matrix. A prime example is their involvement with the JFK Airport New Terminal One bonds, a substantial $2.2 billion undertaking. This includes a significant $600 million tranche they insured in July 2025, highlighting their capacity for massive financial commitments.

The global infrastructure sector is experiencing robust growth, and Assured Guaranty is well-positioned to capitalize on this trend. Their robust financial strength and deep expertise enable them to secure and lead in these substantial, long-term transactions. This capability underscores their leadership in a vital and expanding market.

Assured Guaranty is seeing a significant uptick in demand for insuring highly-rated municipal credits. In 2024, they experienced a 27% jump in policies and a 38% increase in the par amount insured for these AA-rated segments. This trend highlights that even issuers and investors focused on top-tier credit quality are recognizing the benefits of credit enhancement.

This growing appetite for insuring strong credits presents a substantial growth avenue within Assured Guaranty's established market. As a leader in this space, the company is well-positioned to capitalize on this expanding demand, demonstrating the increasing value of their services across a broader spectrum of creditworthiness.

Strategic Penetration of International Infrastructure

Assured Guaranty is strategically expanding its reach into international infrastructure projects, a key component of its growth strategy. This involves securing significant deals in non-U.S. public finance and infrastructure sectors. For instance, the company provided project financing for Spain's A-127 Aragon Regional Road and a loan for the Metro de Madrid.

While these international markets can involve extended development timelines, the global demand for infrastructure is substantial, presenting a high-growth opportunity. Assured Guaranty is capitalizing on this by applying its proven expertise to gain a foothold in these burgeoning international markets.

- International Infrastructure Deals: Assured Guaranty has been active in securing project financing for key infrastructure in Europe, including Spain's A-127 Aragon Regional Road and the Metro de Madrid.

- Global Growth Potential: The worldwide need for infrastructure development creates a significant, high-growth environment for the company's services.

- Leveraging Expertise: Assured Guaranty is applying its established underwriting and financial structuring capabilities to capture market share internationally.

- Strategic Market Penetration: The company's focus on non-U.S. public finance and infrastructure demonstrates a deliberate strategy to diversify and expand its revenue streams beyond its traditional markets.

Green and Sustainable Finance Sector Participation

The green and sustainable finance sector represents a significant growth opportunity for Assured Guaranty. As demand for ESG-aligned investments surges, the company's expertise in insuring public infrastructure and structured finance bonds positions it to capture a growing share of this market. The global green bond market, for instance, saw issuance reach an estimated $500 billion in 2023, a substantial increase from previous years, highlighting the accelerating demand.

Assured Guaranty's existing credit enhancement capabilities are directly applicable to the financing needs of green projects. These projects, ranging from renewable energy infrastructure to sustainable transportation, often require robust financial backing, which Assured Guaranty can provide. This strategic alignment allows them to support the transition to a more sustainable economy while expanding their own business footprint.

- Market Growth: The sustainable finance market is experiencing rapid expansion, with global ESG assets projected to exceed $50 trillion by 2025.

- Product Suitability: Assured Guaranty's credit enhancement products are well-suited to de-risk and facilitate the issuance of green bonds and other sustainable debt instruments.

- Infrastructure Focus: A significant portion of green finance is directed towards infrastructure, a core area of Assured Guaranty's insurance expertise.

- Opportunity: The accelerating demand for ESG-aligned investments presents a clear high-growth opportunity for Assured Guaranty to leverage its established strengths.

Assured Guaranty's "Stars" within the BCG matrix are those segments experiencing high growth and holding a strong market position. This includes their expanding role in the U.S. municipal secondary market, where their insured par written saw a significant jump from 1% in Q1 2024 to nearly 10% in Q1 2025. Their substantial involvement in large infrastructure projects, like the $2.2 billion JFK Airport New Terminal One, further solidifies their star status due to the high growth potential of global infrastructure development.

| Segment | Growth Rate | Market Share | BCG Classification |

|---|---|---|---|

| U.S. Municipal Secondary Market | High | Strong | Star |

| Large-Scale Infrastructure Projects (e.g., JFK Terminal One) | High | Strong | Star |

| Highly-Rated Municipal Credits | High (27% policy, 38% par increase in 2024) | Strong | Star |

| International Infrastructure | High | Growing | Question Mark/Star (potential) |

| Green and Sustainable Finance | Very High (Global green bond market ~$500B in 2023) | Emerging | Question Mark/Star (potential) |

What is included in the product

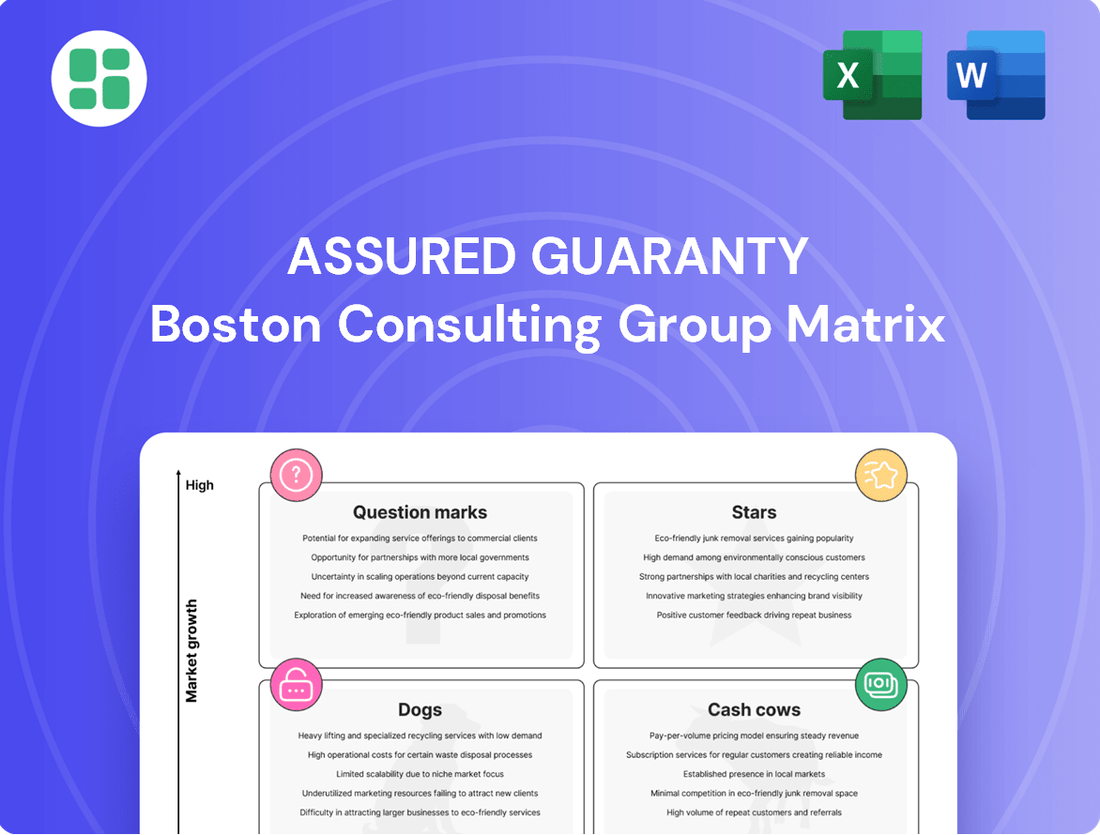

This BCG Matrix overview for Assured Guaranty analyzes its business units, identifying Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic recommendations on investment, holding, or divesting each unit based on market growth and relative market share.

A clear BCG matrix visualizes Assured Guaranty's portfolio, easing the pain of strategic resource allocation.

Cash Cows

Assured Guaranty's U.S. primary municipal bond insurance segment is a clear cash cow, dominating the market with a 64% share of insured par sold in the first quarter of 2025. This mature market benefits from Assured Guaranty's strong brand recognition, stringent underwriting processes, and high financial ratings, which translate into consistent gross written premiums and a stable present value of new business. The segment generates predictable cash flows with minimal need for significant promotional spending, reinforcing its status as a reliable profit generator.

Assured Guaranty's stable existing insured portfolio, a true cash cow, represents nearly four decades of insuring municipal, public infrastructure, and structured finance bonds. This extensive back book consistently generates substantial and reliable premium income, acting as a foundational source of cash flow for the company.

The sheer size and diversification of this portfolio mean it demands less new capital investment compared to the steady cash it produces. For instance, as of the first quarter of 2024, Assured Guaranty reported approximately $116 billion in insured exposure in its U.S. Public Finance segment, a testament to the longevity and stability of its insured assets.

Assured Guaranty's consistent reinsurance business acts as a stable cash cow within its BCG Matrix. This segment, focused on credit enhancement for other financial guarantors, generates predictable premium income. For instance, in 2023, Assured Guaranty reported approximately $1.6 billion in net premiums written, with a significant portion stemming from its financial guaranty business, which includes reinsurance activities.

This business line is characterized by its low volatility and reliable revenue generation, requiring minimal new investment for growth. It effectively utilizes Assured Guaranty's established expertise in financial guarantees, providing a dependable source of cash without demanding substantial market expansion efforts.

Profitable Asset Management Operations

Assured Guaranty's ownership stake in Sound Point Capital Management, LP, and its other investment management affiliates represents a significant Cash Cow. These operations consistently deliver strong investment returns, forming a diversified and reliable income stream for the company.

The alternative investments managed by these affiliates are particularly noteworthy, generating an impressive annualized internal rate of return of approximately 13% in 2024. This performance underscores the segment's contribution to Assured Guaranty's overall profitability and robust cash flow generation.

- Sound Point Capital Management's Strong Performance: The company's investment management affiliates, including Sound Point Capital, are a consistent source of high returns.

- Diversified Income Stream: This asset management arm provides a robust and varied revenue base for Assured Guaranty.

- Exceptional Returns in Alternatives: Alternative investments within this segment achieved an annualized internal rate of return of around 13% in 2024.

- Significant Profitability Driver: The asset management operations are a key contributor to the company's overall financial health and cash generation.

Strong Capital Position and Shareholder Returns

Assured Guaranty's strong capital position is a key indicator of its Cash Cow status. As of March 31, 2025, shareholders' equity per share reached a record $112.80. Furthermore, the company's capital adequacy redundancy surpasses S&P's 'AAA' stress level, highlighting its financial resilience.

This robust financial health translates directly into consistent shareholder returns. Assured Guaranty actively returns capital through dividends and substantial share repurchases. These actions are supported by healthy cash generation that exceeds immediate operational requirements, reinforcing its Cash Cow classification.

- Record Shareholders' Equity: $112.80 per share as of March 31, 2025.

- Capital Adequacy: Redundancy above S&P's 'AAA' stress level.

- Shareholder Returns: Consistent dividends and significant share repurchases.

- Cash Generation: Exceeds operational needs, enabling capital returns.

Assured Guaranty's U.S. primary municipal bond insurance segment is a clear cash cow, dominating the market with a 64% share of insured par sold in the first quarter of 2025. This mature market benefits from Assured Guaranty's strong brand recognition, stringent underwriting processes, and high financial ratings, which translate into consistent gross written premiums and a stable present value of new business. The segment generates predictable cash flows with minimal need for significant promotional spending, reinforcing its status as a reliable profit generator.

The company's stable existing insured portfolio, a true cash cow, represents nearly four decades of insuring municipal, public infrastructure, and structured finance bonds. This extensive back book consistently generates substantial and reliable premium income, acting as a foundational source of cash flow for the company. For instance, as of the first quarter of 2024, Assured Guaranty reported approximately $116 billion in insured exposure in its U.S. Public Finance segment, a testament to the longevity and stability of its insured assets.

Assured Guaranty's consistent reinsurance business acts as a stable cash cow within its BCG Matrix. This segment, focused on credit enhancement for other financial guarantors, generates predictable premium income. In 2023, Assured Guaranty reported approximately $1.6 billion in net premiums written, with a significant portion stemming from its financial guaranty business, which includes reinsurance activities. This business line is characterized by its low volatility and reliable revenue generation, requiring minimal new investment for growth.

| Segment | BCG Classification | Key Financials/Data |

| U.S. Primary Municipal Bond Insurance | Cash Cow | 64% market share (Q1 2025); Stable gross written premiums |

| Existing Insured Portfolio | Cash Cow | ~$116 billion insured exposure (Q1 2024); Consistent premium income |

| Reinsurance Business | Cash Cow | $1.6 billion net premiums written (2023); Low volatility revenue |

What You See Is What You Get

Assured Guaranty BCG Matrix

The Assured Guaranty BCG Matrix you are currently previewing is the identical, fully unlocked document you will receive upon purchase. This means the strategic insights and market positioning analysis presented here are precisely what you will gain access to, without any alterations or missing sections.

Rest assured, the Assured Guaranty BCG Matrix preview showcases the complete and final report you'll download after your purchase. You're seeing the actual data, analysis, and visual representation that will empower your strategic decision-making, ready for immediate application.

What you see here is the definitive Assured Guaranty BCG Matrix report, exactly as it will be delivered to you after purchase. This preview guarantees you'll receive a comprehensive, professionally formatted document ready for your strategic planning needs.

Dogs

Residual Legacy Distressed Exposures represent a category of assets within Assured Guaranty's portfolio that, while showing progress in resolution, still demand attention. These are often complex, illiquid structured finance transactions from past periods, like certain aspects of the Puerto Rico debt situation, that require continued oversight.

These exposures offer minimal new business potential or growth opportunities, acting more as a drain on resources. They can become cash traps, tying up capital for monitoring and potential loss development rather than generating new value for the company.

Assured Guaranty's pursuit of niche international markets, while a potential avenue for diversification, can also become a drag on performance if not managed effectively. For instance, consider their past explorations in smaller, less developed insurance markets where regulatory hurdles and local competitive landscapes proved more challenging than anticipated. These ventures might have required significant upfront investment in compliance and local expertise, but failed to generate substantial premium volume or profitability.

Such underperforming segments, if they persist, can dilute the company's overall return on equity. If these ventures are not strategically divested or scaled back, they continue to consume valuable resources and management attention that could be better allocated to more promising areas. For example, if a particular international subsidiary in a market like a small African nation only contributed $5 million in revenue in 2024 with a net loss of $1 million, it exemplifies a drain on resources without a clear path to significant growth.

Certain structured finance products, once popular, are now considered outmoded. These might include legacy collateralized debt obligations (CDOs) or certain types of asset-backed securities that no longer align with current regulatory frameworks or investor appetites. For instance, the market for CDOs backed by subprime mortgages effectively collapsed after the 2008 financial crisis, making them a prime example of an outmoded product line.

Continuing to support these outdated offerings can be a drain on resources. Maintaining the necessary infrastructure, specialized expertise, and operational capacity for products with minimal market activity is inefficient. This inefficiency directly impacts profitability and resource allocation for more promising ventures.

These outmoded product lines typically occupy a low market share and face extremely limited growth prospects. In the context of a BCG matrix, they would clearly fall into the Dogs quadrant, characterized by weak competitive positions and poor growth potential, representing a drag on overall company performance.

Underperforming Regional Public Finance Offices

Underperforming regional public finance offices within Assured Guaranty's portfolio would be classified as Dogs in the BCG Matrix. These units typically struggle with low market share and low growth, often found in stagnant or declining economic regions. For instance, a regional office in a state with a shrinking tax base and limited infrastructure development projects might exhibit these characteristics.

These underperforming segments are characterized by their inability to generate significant new business or capture substantial market share. This inefficiency leads to a drag on overall company performance, as resources allocated to these areas yield minimal returns. In 2024, Assured Guaranty, like many in the financial sector, faced varying regional economic conditions impacting public finance deals.

- Low Market Share: Regional offices failing to secure a significant portion of available public finance deals in their territories.

- Stagnant Market Growth: Operating in areas with limited new municipal bond issuances due to economic contraction or population decline.

- Inefficient Resource Allocation: Higher operational costs relative to the volume of business generated, indicating poor return on investment.

- Competitive Disadvantage: Facing strong competition from other financial institutions or municipal advisors in their specific geographic areas.

Non-Core, Non-Strategic Asset Management Ventures

Assured Guaranty's non-core, non-strategic asset management ventures represent investments that, while part of their broader financial operations, don't directly contribute to their primary insurance and financial guarantee business. These might be smaller partnerships or minority stakes in asset management firms that don't align with their core profitability targets or strategic growth. For instance, a venture with limited assets under management (AUM) or a focus on niche markets might fall into this category if it consumes resources without generating significant returns or strategic advantage.

These ventures can tie up capital and management attention, diverting focus from core, high-return activities. In 2024, Assured Guaranty continued to refine its portfolio, divesting or scaling back on non-essential financial services operations to concentrate on its strengths. For example, if a particular asset management subsidiary was only managing $500 million in AUM and generating a net profit margin of 5%, it might be considered non-strategic if the company's core operations yield significantly higher returns on capital.

- Limited Strategic Alignment: These ventures often lack a clear connection to Assured Guaranty's core business model of financial guarantees and insurance.

- Low Return on Investment: They may offer lower profit margins or slower capital appreciation compared to the company's primary revenue streams.

- Capital and Management Drain: These non-core activities can absorb valuable financial resources and executive bandwidth that could be better utilized elsewhere.

- Potential for Divestment: Companies often look to divest or wind down such operations to improve overall efficiency and focus.

Dogs within Assured Guaranty's BCG Matrix represent business segments or products with low market share and low growth potential. These are often legacy operations or ventures that have failed to gain traction and consume resources without generating substantial returns. For example, certain older structured finance products that are no longer in demand, or underperforming regional offices, fit this description.

These segments are characterized by their inability to generate significant new business or capture substantial market share, leading to a drag on overall company performance. In 2024, Assured Guaranty, like many financial institutions, continued to streamline its operations, likely identifying and addressing these "Dog" segments to improve efficiency and focus on more profitable areas.

Examples include outmoded product lines like legacy collateralized debt obligations (CDOs) with minimal market activity, or non-core asset management ventures with low assets under management. These areas typically have higher operational costs relative to the business generated, indicating a poor return on investment.

The strategic implication for Assured Guaranty is to either divest these underperforming assets or implement a turnaround strategy, though the latter is often challenging for true Dogs. The company's focus in 2024 was on optimizing its portfolio, which would naturally involve managing or exiting these low-growth, low-share segments.

Question Marks

Assured Guaranty's strategic expansion into new geographic markets, such as Australia and Singapore, alongside its focus on Continental Europe and other Asian territories, positions it to tap into high-growth areas for infrastructure and public finance. These ventures are characterized by a low current market share as the company builds its presence and client base.

The company's investment in these nascent markets is substantial, reflecting the need to cultivate relationships and develop a robust pipeline of business. This investment is crucial for transforming these new geographic entries from question marks into potential stars within Assured Guaranty's portfolio.

The digital asset and blockchain-backed securities space is a burgeoning frontier, with tokenized securities and blockchain bonds representing a high-growth, potentially disruptive market. While Assured Guaranty's current market share here is likely minimal, early engagement and strategic investment could pave the way for future leadership.

This emerging sector demands significant investment in research and development to navigate its complexities and capitalize on its potential. For instance, the global tokenization market is projected to reach trillions of dollars by 2030, highlighting the immense opportunity for early movers.

The global sustainable bond market reached an estimated $1.5 trillion in 2023, a significant increase from previous years, highlighting strong investor appetite for ESG-aligned assets.

Assured Guaranty, known for insuring municipal and infrastructure bonds, could leverage its expertise to specifically underwrite and market guarantees for these burgeoning ESG-focused instruments, such as green bonds and social bonds.

This strategic pivot would allow Assured Guaranty to capture a larger share of this rapidly expanding market, estimated to grow by over 20% annually through 2025, by offering enhanced credit security to ESG project developers and investors.

Innovative Public-Private Partnership (PPP) Structures

Assured Guaranty is well-positioned to capitalize on the burgeoning complexity of Public-Private Partnerships (PPPs). The financial guaranty sector is seeing an influx of innovative structures, particularly in emerging areas like digital infrastructure and renewable energy projects, often featuring novel risk-sharing arrangements. This evolving landscape presents a significant opportunity for Assured Guaranty to expand its market share in segments where its current penetration is limited but future deal flow is projected to be substantial.

To address these intricate PPP models, Assured Guaranty is likely enhancing its underwriting capabilities and forging strategic alliances. This proactive approach allows them to accurately assess and mitigate the unique risks associated with these new venture types. For instance, in 2024, the global PPP market saw significant growth, with infrastructure investment deals reaching hundreds of billions of dollars, many of which involved sophisticated risk allocation between public and private entities.

- Increased PPP Complexity: PPPs are moving beyond traditional infrastructure to sectors like healthcare technology and smart cities, introducing new risk profiles.

- Novel Risk-Sharing: Partnerships are increasingly incorporating performance-based payments and contingent liabilities, requiring specialized guaranty solutions.

- Market Penetration Opportunity: Assured Guaranty can leverage its expertise to gain traction in these less-penetrated but high-potential PPP markets.

- Underwriting Model Evolution: Development of advanced analytical tools and partnerships is crucial for accurately pricing and insuring these complex structures.

Expansion into Untapped Niche Structured Finance Sub-Sectors

Assured Guaranty can strategically expand into underserved niche structured finance sub-sectors that are showing robust growth. These could involve specialized areas like renewable energy securitizations or complex collateralized loan obligations (CLOs) where their existing expertise can be leveraged. Capturing market share in these emerging areas could position Assured Guaranty for future growth, potentially transforming them into Stars within the BCG framework.

The structured finance market is dynamic, with new niches constantly appearing. For instance, the market for securitizing future revenue streams from infrastructure projects or the issuance of green bonds backed by specific environmental assets represents significant untapped potential. By focusing on these specialized areas, Assured Guaranty can diversify its portfolio and build a strong competitive advantage.

- Emerging Niche: Securitization of future receivables from subscription-based businesses.

- Growth Potential: The subscription economy is projected to reach $1.5 trillion by 2025, indicating substantial underlying collateral.

- Strategic Focus: Developing expertise in underwriting and structuring these unique cash flows.

- Market Opportunity: Assured Guaranty can target this growing market by offering tailored credit enhancement solutions.

Question Marks represent areas where Assured Guaranty has low market share but high growth potential. These are often new markets or emerging sectors requiring significant investment to develop. The company's strategy involves nurturing these ventures, much like cultivating nascent geographic markets or exploring the digital asset space, to eventually transition them into Stars.

The company's investment in these nascent markets is crucial for transforming them. For example, the global tokenization market is projected to reach trillions by 2030, and Assured Guaranty's early engagement in this area, despite minimal current market share, positions it to capitalize on future growth.

Similarly, Assured Guaranty's focus on complex Public-Private Partnerships (PPPs) and niche structured finance sub-sectors, such as renewable energy securitizations, represents Question Marks. These areas offer substantial growth potential, but require specialized underwriting and market development to gain traction.

The company's proactive approach to these emerging areas, including enhancing analytical tools and forming strategic alliances, is key to converting these Question Marks into future revenue drivers. This strategic focus is vital for long-term portfolio expansion and market leadership.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Assured Guaranty's financial filings, industry-specific reports, and market growth projections to accurately position its business units.