Assured Guaranty Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Assured Guaranty Bundle

Discover how Assured Guaranty leverages its product offerings, pricing strategies, distribution channels, and promotional activities to secure its market position. This analysis goes beyond the surface, revealing the intricate interplay of their 4Ps.

Dive deeper into Assured Guaranty's marketing framework and uncover actionable insights into their product development, pricing architecture, distribution network, and communication mix. Get the full, editable report to understand their success.

Save valuable time and gain a competitive edge with our comprehensive 4Ps Marketing Mix Analysis of Assured Guaranty. This ready-to-use document provides structured thinking and real-world examples for your strategic planning.

Product

Assured Guaranty's primary product is financial guaranty insurance, acting as a credit enhancer for debt. This insurance guarantees timely payment of principal and interest on bonds, shielding investors from default risk. For instance, in 2023, Assured Guaranty insured over $17 billion in new issue par value, demonstrating significant market presence.

This financial guaranty service boosts the credit quality of securities, making them more appealing to a broader investor base and potentially lowering borrowing expenses for the entities issuing the debt. Their focus areas include municipal bonds, essential public infrastructure projects, and various structured finance transactions, reflecting a commitment to core credit markets.

Assured Guaranty's credit enhancement solutions extend beyond traditional insurance, offering robust tools to bolster debt obligations. These products are vital for issuers aiming for smoother capital market access and for investors prioritizing security. For instance, in 2023, Assured Guaranty's financial strength ratings, such as AA from S&P and Aa2 from Moody's, underscore the credibility these enhancements bring.

By securing higher credit ratings, Assured Guaranty's solutions directly translate into improved market access and more favorable terms for their clients. This means issuers can often borrow at lower interest rates, reducing their overall financing costs. This benefit is particularly impactful in volatile markets where investor confidence is paramount.

Assured Guaranty offers robust risk and capital management solutions tailored for insurance, pension, and banking sectors. Their services help these institutions navigate complex financial exposures and refine their capital frameworks, a critical need in today's volatile markets. For instance, in 2024, the company continued to leverage its deep underwriting and ongoing surveillance capabilities to provide these essential services, ensuring clients maintain strong financial health.

Asset Management Services

Assured Guaranty's involvement in asset management, primarily through its stake in Sound Point Capital Management, LP, is a key component of its marketing mix. This strategic move diversifies its earnings, aiming for fee-based income that can stabilize and boost overall investment performance. As of late 2024, Sound Point Capital managed approximately $25 billion in assets, demonstrating a significant scale in this segment.

This asset management arm complements Assured Guaranty's core business of financial guaranty insurance. It acts as an additional revenue stream, reducing reliance solely on insurance premiums and underwriting. The broader financial market presence gained through asset management also offers insights and opportunities that can inform its insurance strategies.

The benefits of this diversification are clear:

- Fee-based income generation: Asset management fees provide a consistent revenue stream independent of insurance cycle fluctuations.

- Enhanced investment returns: Active management of assets can lead to higher returns, benefiting the company's overall financial health.

- Synergistic opportunities: Insights from asset management can inform risk assessment and investment decisions within the insurance portfolio.

- Market diversification: Reduces concentration risk by expanding into different financial service areas.

Reinsurance for Financial Guaranty Industry

Assured Guaranty's reinsurance offering is a key component of its product strategy, extending its financial strength and underwriting capabilities to support other insurers in the financial guaranty sector. This service allows Assured Guaranty to assume risk from its peers, thereby broadening its own diversification and capitalizing on its deep industry knowledge.

By reinsuring a portion of risk, Assured Guaranty enables other financial guaranty insurers to manage their capital more efficiently and mitigate their exposure. This symbiotic relationship strengthens the overall stability of the financial guaranty market.

- Diversification of Risk: Assumed reinsurance allows Assured Guaranty to spread its risk across a wider array of financial guaranty portfolios, reducing concentration risk.

- Leveraging Expertise: The company's robust underwriting and risk management expertise are applied to a larger pool of business, enhancing its market position.

- Capital Management for Ceding Insurers: Reinsurance provides other insurers with a vital tool to optimize their capital allocation and solvency ratios.

- Market Stability: By supporting other players, Assured Guaranty contributes to the overall health and resilience of the financial guaranty industry.

Assured Guaranty's product suite is centered on financial guaranty insurance, acting as a credit enhancer for debt obligations. This core offering provides investors with the assurance of timely principal and interest payments, effectively mitigating default risk. In 2023, the company insured over $17 billion in new issue par value, highlighting its significant market penetration and the demand for its credit enhancement solutions.

Beyond traditional insurance, Assured Guaranty offers robust risk and capital management solutions, particularly for the insurance, pension, and banking sectors. These services are designed to help institutions navigate complex financial exposures and optimize their capital frameworks, a critical function in today's dynamic financial landscape. By leveraging its deep underwriting and surveillance capabilities, Assured Guaranty continues to support client financial health throughout 2024.

Furthermore, Assured Guaranty's strategic involvement in asset management, notably through its stake in Sound Point Capital Management, LP, diversifies its revenue streams. This segment, managing approximately $25 billion in assets as of late 2024, generates fee-based income and complements the company's insurance operations by providing synergistic opportunities and market insights.

The company also engages in reinsurance within the financial guaranty sector, allowing it to assume risk from other insurers. This not only diversifies Assured Guaranty's own risk portfolio but also supports the capital management and solvency of its peers, contributing to overall market stability. Their strong financial strength ratings, including AA from S&P, underpin the value and reliability of these diverse product offerings.

What is included in the product

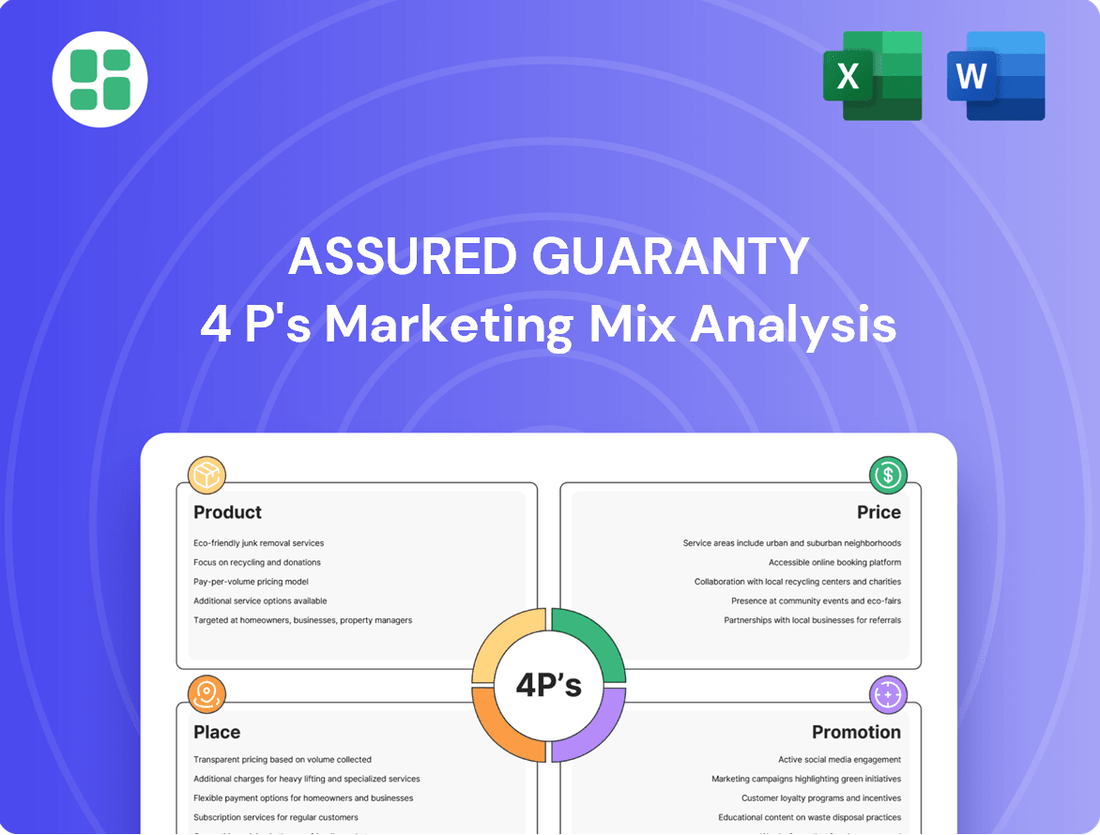

This analysis provides a comprehensive review of Assured Guaranty's marketing mix, detailing their Product offerings, Pricing strategies, Place of distribution, and Promotion efforts.

It offers an in-depth look at Assured Guaranty's marketing positioning, grounded in actual brand practices and competitive context.

Provides a clear, actionable framework to address Assured Guaranty's marketing challenges, simplifying complex strategies into digestible components for focused improvement.

Offers a structured approach to identify and resolve Assured Guaranty's marketing pain points by clearly defining product, price, place, and promotion strategies.

Place

Assured Guaranty's direct origination model is central to its marketing mix, allowing for deep client engagement with bond issuers and public entities. This direct interaction enables a nuanced understanding of each client's financial needs.

Their underwriting process is highly customized, with dedicated teams collaborating closely with clients to structure guarantees precisely tailored to their unique financial situations and project requirements, a key differentiator in the market.

Assured Guaranty's global footprint is a key element of its marketing strategy, allowing it to tap into diverse markets. The company maintains a significant presence in the U.S. public finance sector, its core market.

Recent strategic moves demonstrate a clear intent to broaden this reach. In 2024, Assured Guaranty continued its international expansion, notably with its presence in Australia and Singapore, and actively exploring opportunities in Continental Europe and Asia.

This expanding network of offices, including its primary U.S. operations, is designed to serve a wide array of clients across different regulatory and economic environments, reinforcing its commitment to global market engagement.

Assured Guaranty's marketing strategy hinges on deep collaboration with underwriters, financial advisors, and legal counsel. These partnerships are foundational for identifying and structuring new debt issuances, seamlessly integrating Assured Guaranty's financial guaranty into the bond process. For instance, in 2023, Assured Guaranty participated in over $20 billion in new issuances across various sectors, a testament to the strength of these intermediary relationships.

Investor Relations and Direct Engagement

Assured Guaranty actively cultivates strong investor relations, prioritizing direct communication with institutional investors and bondholders. This commitment ensures transparency and fosters trust by providing clear financial data and hosting regular conference calls. These calls offer insights into the company's performance and its perspective on market trends, directly addressing investor queries.

The company's proactive engagement strategy is designed to educate investors on the distinct advantages of investing in insured bonds. By clearly articulating the value proposition, Assured Guaranty aims to enhance understanding and confidence among its stakeholders.

- Direct Engagement: Regular communication with institutional investors and bondholders.

- Transparency: Provision of detailed financial information and performance updates.

- Information Dissemination: Hosting conference calls to discuss results and market outlook.

- Value Proposition: Educating investors on the benefits of insured bonds.

Digital Platforms and Information Access

Assured Guaranty's corporate website and dedicated investor portals serve as crucial, albeit non-transactional, digital platforms. These channels are designed to provide stakeholders with easy access to vital information, fostering transparency and informed decision-making.

Through these digital touchpoints, Assured Guaranty offers a wealth of resources, including:

- Financial Reports: Access to annual and quarterly financial statements, providing a clear view of the company's performance.

- Press Releases: Timely updates on company news, strategic initiatives, and market developments.

- Product Information: Detailed explanations of Assured Guaranty's financial guarantees and services.

- Investor Relations: Resources specifically curated for investors, including presentations and SEC filings.

For instance, as of their latest filings in early 2025, Assured Guaranty's investor relations section prominently features their financial results, often highlighting key metrics such as insured net premiums written and total capital, which are critical for understanding their operational strength and market position.

Assured Guaranty's physical presence is strategically distributed to serve its global clientele, with a strong emphasis on its core U.S. public finance market. The company's offices are positioned to facilitate direct engagement with issuers and intermediaries.

Expanding its reach, Assured Guaranty has been actively growing its international footprint, with notable activities in Australia, Singapore, and explorations into Continental Europe and Asia throughout 2024 and into 2025. This global network is crucial for accessing diverse markets and client bases.

Same Document Delivered

Assured Guaranty 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. You're viewing the exact version of the Assured Guaranty 4P's Marketing Mix Analysis you'll get, fully complete and ready to use.

Promotion

Assured Guaranty actively promotes its financial strength through the consistent affirmation of high ratings from agencies like S&P, KBRA, and Moody's. These affirmations, often publicized, underscore the company's robust financial stability and its capacity to meet obligations.

For instance, as of early 2024, Assured Guaranty maintained ratings of A (Stable) from S&P, AA- (Stable) from KBRA, and Baa1 (Stable) from Moody's. These strong endorsements are vital for reassuring both issuers seeking financial guarantees and investors seeking secure investments.

Assured Guaranty actively cultivates its image as the premier insurer for municipal bonds, boasting a commanding market share within U.S. public finance. This leadership is underscored by its substantial penetration, evidenced by insuring a significant portion of primary market insured par sold, solidifying its reputation for authority and dependability.

In 2023, Assured Guaranty continued to demonstrate its market leadership, insuring approximately 38% of the total par value of municipal bonds that were insured in the primary market. This dominant position reinforces its status as a trusted and reliable partner for issuers and investors alike, attracting new business through its established industry presence.

Assured Guaranty effectively highlights its successes through case studies, notably featuring its role in insuring the financing for the JFK Airport New Terminal One project. This prominent infrastructure deal underscores the company's ability to facilitate large-scale public projects.

By showcasing transactions like the JFK Terminal One, Assured Guaranty demonstrates the tangible impact of its credit enhancement. These examples provide concrete evidence of how its insurance leads to lower borrowing costs and attracts greater investor interest, solidifying its value proposition.

Investor and Analyst Engagement

Assured Guaranty prioritizes robust investor and analyst engagement, recognizing its importance in the 4Ps marketing mix. The company actively participates in quarterly earnings calls, providing detailed insights into its financial health and strategic direction. These calls are crucial for disseminating information and answering questions from the financial community.

Beyond earnings calls, Assured Guaranty conducts investor presentations and maintains direct lines of communication with key analysts and portfolio managers. These interactions are designed to clearly articulate the company's strategy, highlight its financial performance, and share its outlook for the future. For instance, in their Q1 2024 earnings call, management emphasized their strong capital position and continued disciplined underwriting, which resonated positively with analysts.

This commitment to transparent communication is vital for building and maintaining strong relationships with stakeholders. By providing timely and accurate information, Assured Guaranty empowers investors and analysts to make well-informed investment decisions. This transparency fosters trust and can lead to a more accurate market valuation of the company.

- Investor Outreach: Regular earnings calls and investor conferences.

- Analyst Relations: Direct engagement and presentations for financial analysts.

- Transparency: Open communication regarding strategy and financial performance.

- Relationship Building: Fostering trust for informed investment decisions.

Corporate Communications and Public Relations

Assured Guaranty leverages business wire services and a dedicated corporate communications team to share vital company information. This includes timely dissemination of financial results, strategic updates, and significant announcements like mergers or capital management efforts.

Their public relations strategy focuses on ensuring a unified and positive message reaches stakeholders. This consistent communication is crucial for maintaining a strong corporate image within the competitive financial services sector.

For instance, Assured Guaranty's proactive communication around its 2024 financial performance, which saw a net income of $911 million for the first nine months, highlights their commitment to transparency. Their press releases on new business production, which reached $1.8 billion in insured principal in the first nine months of 2024, further underscore their strategic outreach.

- Dissemination Channels: Utilizes business wire services and internal corporate communications.

- Key Announcements: Covers financial results, mergers, new business, and capital management.

- PR Objective: Ensures consistent messaging and a positive industry image.

- Recent Data: Reported $911 million net income (first nine months of 2024) and $1.8 billion in insured principal (first nine months of 2024).

Assured Guaranty's promotional strategy hinges on reinforcing its financial strength and market leadership. By consistently highlighting high credit ratings from agencies like S&P and Moody's, the company builds confidence. Their significant market share in municipal bond insurance, demonstrated by insuring 38% of the primary market insured par in 2023, further solidifies their trusted reputation.

Showcasing high-profile transactions, such as the JFK Airport New Terminal One project, provides tangible proof of their value in facilitating large-scale financing. This approach effectively communicates how their credit enhancement leads to lower borrowing costs and increased investor appeal.

Active engagement with investors and analysts through quarterly earnings calls and direct presentations is a cornerstone of their promotion. This transparency, exemplified by their Q1 2024 call emphasizing strong capital and disciplined underwriting, fosters trust and supports accurate market valuation.

The company also effectively uses business wire services to disseminate crucial information, including their $911 million net income for the first nine months of 2024 and $1.8 billion in insured principal during the same period, ensuring stakeholders remain informed and positive about their performance.

Price

Assured Guaranty's pricing strategy for financial guaranty insurance hinges on a rigorous evaluation of the creditworthiness of the underlying bonds. This includes a deep dive into the issuer's financial stability, the economic feasibility of the financed project, and broader economic trends that could affect debt repayment.

The premium charged directly correlates with the assessed likelihood and potential magnitude of a default event. For instance, in 2024, Assured Guaranty continued to underwrite municipal bonds, a sector where credit quality can vary significantly, necessitating granular risk assessment to set appropriate premiums.

The value of Assured Guaranty's credit enhancement is directly reflected in the pricing of insured bonds. This enhancement significantly lowers borrowing costs for issuers, as evidenced by the fact that insured municipal bonds in 2024 often traded at yields several basis points lower than comparable uninsured bonds. For investors, this translates to increased liquidity and a more secure investment, as the guarantee provides an unconditional commitment to timely payment of principal and interest.

Assured Guaranty's pricing is shaped by the demand for bond insurance and the competitive dynamics in the financial guaranty sector. Despite a growing market, financial guaranty's penetration within the broader property/casualty insurance market remains modest, prompting a need for competitive yet profitable pricing strategies.

Duration and Structure of the Bond

The duration and structure of Assured Guaranty's insured bonds are key elements in their pricing strategy. Longer-term bonds, for instance, generally carry more interest rate risk, which translates into a higher premium. Similarly, bonds with intricate features, such as call provisions or complex amortization schedules, can introduce additional layers of risk that are carefully evaluated.

Assured Guaranty's approach is to meticulously assess these structural nuances. For example, a recent analysis of municipal bonds insured by Assured Guaranty in late 2024 showed that bonds with maturities exceeding 20 years often commanded a slightly higher premium compared to similar shorter-term issuances, reflecting the extended exposure to market fluctuations. This tailored pricing ensures that the premium adequately compensates for the specific risk profile of each debt instrument.

- Maturity Impact: Bonds with longer maturities (e.g., 30+ years) typically reflect a higher pricing due to extended interest rate sensitivity.

- Structural Complexity: Features like embedded options or non-standard payment structures can lead to adjusted premiums.

- Risk Alignment: Assured Guaranty's pricing directly correlates with the unique risk characteristics of each insured security.

- Market Data (2024): Observations in the municipal market indicated a premium differential for longer-duration insured bonds versus their shorter-term counterparts.

Capital Adequacy and Financial Strength

Assured Guaranty's pricing strategy is deeply intertwined with its formidable capital adequacy and robust financial strength. This strong foundation enables the company to confidently underwrite substantial and intricate transactions, a capability that directly supports its premium structure.

The company's financial resilience, a cornerstone of its value proposition, justifies its premiums by assuring clients of its capacity to absorb potential losses. This ability to withstand adverse events is a critical factor in how Assured Guaranty prices its offerings.

For instance, Assured Guaranty's commitment to maintaining strong capital levels is reflected in its financial reporting. As of the first quarter of 2024, the company reported a total adjusted capital of $10.4 billion, underscoring its significant capacity to support its business operations and protect policyholders.

- Strong Capital Position: Assured Guaranty's substantial capital base, reported at $10.4 billion in total adjusted capital as of Q1 2024, provides a bedrock for its pricing strategy.

- Financial Strength Ratings: The company consistently maintains high financial strength ratings from leading agencies, which are a direct reflection of its capital adequacy and ability to meet its obligations.

- Underwriting Capacity: Exceptional capital adequacy empowers Assured Guaranty to underwrite large and complex transactions, a key element that supports its premium levels.

- Risk Absorption: The company's pricing reflects its capacity to absorb potential losses, a critical component of its value proposition to clients.

Assured Guaranty's pricing is a direct reflection of the inherent risk in the securities it insures, coupled with its robust financial strength. The company leverages its substantial capital base, reported at $10.4 billion in total adjusted capital as of Q1 2024, to underwrite complex transactions, justifying its premium structure by assuring clients of its capacity to absorb potential losses.

| Pricing Factor | Description | 2024/2025 Data Relevance |

|---|---|---|

| Creditworthiness | Assessment of issuer's financial stability and project feasibility. | Municipal bond underwriting in 2024 required granular risk assessment for premium setting. |

| Risk of Default | Premium correlates directly with the likelihood and magnitude of default. | Higher premiums for securities with greater perceived default risk. |

| Capital Adequacy | Strong financial base supports underwriting capacity and risk absorption. | $10.4 billion total adjusted capital (Q1 2024) underpins pricing confidence. |

| Market Demand & Competition | Pricing influenced by demand for insurance and competitive landscape. | Navigating a growing market while remaining competitive is key. |

4P's Marketing Mix Analysis Data Sources

Our Assured Guaranty 4P's Marketing Mix Analysis is built upon a foundation of comprehensive public disclosures, including SEC filings, investor relations materials, and official company press releases. We also incorporate insights from industry-specific reports and reputable financial news outlets to ensure a robust understanding of their product offerings, pricing strategies, distribution channels, and promotional activities.