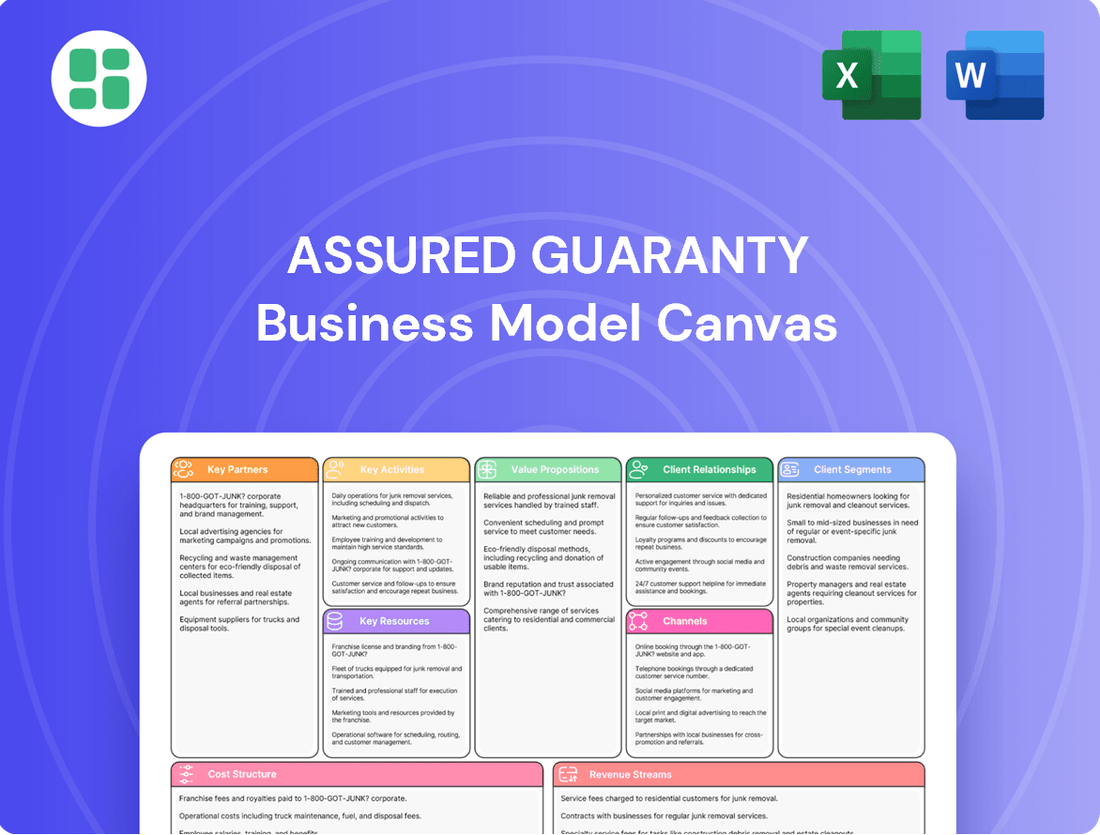

Assured Guaranty Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Assured Guaranty Bundle

Discover the strategic architecture behind Assured Guaranty's robust business model. This comprehensive Business Model Canvas unpacks their unique value propositions, key customer relationships, and revenue streams, offering a clear roadmap to their success. Download the full version to gain a competitive edge and inspire your own strategic planning.

Partnerships

Assured Guaranty's business model hinges on its crucial relationships with leading credit rating agencies like S&P, Moody's, and KBRA. These agencies' assessments are vital for securing and maintaining the high financial strength ratings that are the bedrock of Assured Guaranty's value proposition – improving the creditworthiness of the bonds it insures.

Maintaining open communication and transparency with these rating bodies is paramount for Assured Guaranty. This ongoing dialogue ensures that the market consistently trusts the company's financial stability and its capacity to meet its obligations, directly impacting its ability to attract and retain business.

Investment banks and underwriters are critical partners for Assured Guaranty, acting as the primary conduits for originating and structuring the debt securities that the company insures. These financial institutions are instrumental in providing Assured Guaranty access to a diverse range of issuers across public finance, infrastructure, and structured finance markets. Their expertise ensures that bond issuances are effectively structured and executed, with Assured Guaranty's credit enhancement playing a vital role in facilitating these transactions.

Assured Guaranty relies heavily on expert legal and financial advisors. These partnerships are crucial for navigating the intricacies of bond issuances, ensuring all regulatory hurdles are cleared, and managing potential legal disputes. For instance, legal counsel was instrumental in the complex London Interbank Offered Rate (LIBOR) transition and the resolution of the Lehman Brothers Intermediate Holdings (LBIE) settlement, demonstrating the value of specialized legal expertise.

Financial advisors play a vital role in structuring new deals and rigorously assessing the financial health of proposed projects. Their input is essential for identifying and mitigating the inherent legal and financial risks embedded within the insured portfolio. This expert guidance helps Assured Guaranty maintain the integrity and stability of its insured assets, a core component of its business model.

Government Entities and Regulatory Bodies

Assured Guaranty's business model relies heavily on strong relationships with government entities and regulatory bodies. These partnerships are crucial for maintaining licenses and ensuring compliance across various jurisdictions. For instance, their operations in the U.S. are overseen by bodies like the Maryland Insurance Administration, which sets standards for solvency and capital requirements.

These regulatory relationships are fundamental to Assured Guaranty's ability to operate as a financial guaranty insurance company. They ensure the company adheres to strict solvency and capital adequacy rules, which are essential for policyholder protection and market confidence.

- Regulatory Compliance: Partnerships with entities like the Maryland Insurance Administration are essential for licensing and ongoing operational integrity in the U.S. market.

- International Oversight: Assured Guaranty also navigates regulatory frameworks in international markets, requiring engagement with various governmental bodies.

- Solvency and Capital Requirements: These relationships ensure the company meets stringent solvency and capital requirements, vital for its financial stability and the security of its insured obligations.

Reinsurance Companies

Assured Guaranty engages with reinsurance companies not only as a buyer of reinsurance but also as a provider, reinsuring unaffiliated financial guarantors. This dual role highlights their active participation in the risk transfer market.

These partnerships are crucial for Assured Guaranty's risk management strategy. By reinsuring, they can effectively manage exposure to large or concentrated risks, which is vital for maintaining a strong capital position and financial stability.

- Risk Transfer Mechanism Reinsurance companies act as essential partners in transferring risk away from Assured Guaranty, allowing them to underwrite larger or more complex guarantees than they might otherwise.

- Capital Management Efficiency By utilizing reinsurance, Assured Guaranty can optimize its capital allocation, ensuring it remains robust and capable of meeting its obligations.

- Market Participation Assured Guaranty's involvement in providing reinsurance to others demonstrates a broader engagement with the financial guarantee market, leveraging its expertise.

Assured Guaranty's strategic alliances extend to issuers and obligors, the entities whose debt it insures. These relationships are foundational, providing the core business volume. For instance, Assured Guaranty actively insures municipal bonds, infrastructure projects, and structured finance transactions, demonstrating a broad issuer base.

The company's ability to secure favorable terms and attract a steady flow of insured business is directly linked to the strength and breadth of these issuer relationships. By offering credit enhancement, Assured Guaranty makes debt more attractive to investors, thereby facilitating capital formation for these entities.

Assured Guaranty's partnerships with institutional investors are also key. These investors are the ultimate buyers of the debt securities Assured Guaranty enhances, and their demand underpins the market for insured bonds.

| Key Partnership Type | Role in Business Model | Example/Impact |

|---|---|---|

| Credit Rating Agencies (S&P, Moody's, KBRA) | Validate creditworthiness, enable competitive pricing | High financial strength ratings are essential for market acceptance and business origination. |

| Investment Banks & Underwriters | Originate, structure, and distribute insured debt | Facilitate access to diverse issuers and markets, ensuring efficient transaction execution. |

| Legal & Financial Advisors | Provide expertise on complex transactions and risk mitigation | Crucial for navigating regulatory landscapes and resolving intricate issues like LIBOR transition. |

| Government Entities & Regulators | Grant licenses, set operational standards, ensure compliance | Maintain operational integrity and market confidence through adherence to solvency rules. |

| Reinsurance Companies | Manage risk exposure, optimize capital | Allow for underwriting larger guarantees and efficient capital deployment. |

| Issuers & Obligors | Provide the core business volume through debt issuance | Enable capital formation for municipalities, infrastructure, and structured finance. |

| Institutional Investors | Purchase insured debt, driving market demand | Their demand for enhanced credit quality fuels the market for Assured Guaranty's services. |

What is included in the product

A detailed business model for Assured Guaranty, outlining its core operations in financial guaranty insurance, customer relationships, and revenue streams.

This model focuses on Assured Guaranty's strategy of insuring municipal and infrastructure debt, highlighting key partners and cost structures.

The Assured Guaranty Business Model Canvas acts as a pain point reliever by offering a clear, visual representation of their complex financial guarantee operations, simplifying intricate relationships and stakeholder interactions for better understanding and strategic planning.

Activities

Assured Guaranty's core activity revolves around meticulous credit underwriting and risk assessment for debt issuances spanning public finance, infrastructure, and structured finance. This involves a deep dive into an issuer's financial stability, the long-term viability of their projects, and the broader economic landscape. For instance, in 2024, the company continued to emphasize its robust due diligence processes, a critical component in maintaining the integrity of its insured portfolio.

The company's underwriting expertise is the bedrock of its business, directly impacting its ability to manage potential losses and uphold its reputation for financial strength. This rigorous evaluation process is what allows Assured Guaranty to provide its financial guarantees, ensuring that investors receive timely payments on the insured debt. Their commitment to sound underwriting practices is paramount to their operational success and financial resilience.

Policy issuance and management is the core of Assured Guaranty's operations. This involves underwriting and issuing financial guaranty insurance policies, essentially a promise to pay bondholders if the issuer defaults. In 2023, Assured Guaranty's municipal segment, a significant area for policy issuance, saw continued strength, reflecting ongoing demand for credit enhancement in public finance.

The ongoing management of these policies is crucial, ensuring all terms and obligations are met. This includes monitoring the creditworthiness of insured entities and handling any potential claims. Assured Guaranty's robust servicing infrastructure is designed to manage a vast portfolio effectively, providing security for investors and stability for the municipal markets.

When an insured bond defaults, Assured Guaranty's primary role is to manage and resolve these claims, ensuring bondholders receive their promised payments. This process is critical for maintaining trust and fulfilling the company's guarantees.

The company actively engages in workout strategies and recovery efforts to mitigate financial losses stemming from defaults. For instance, in 2023, Assured Guaranty reported total claims paid of $3.4 billion, demonstrating their commitment to resolving defaults effectively.

Successful claims management is fundamental to Assured Guaranty's reputation and its ability to honor its insurance commitments. Their robust operational framework is designed to handle these complex situations efficiently.

Portfolio Monitoring and Surveillance

Assured Guaranty’s key activity of portfolio monitoring and surveillance is vital for safeguarding its insured assets. This involves a constant watch over the financial health of the entities and obligations it guarantees, looking for any hints of trouble or declining credit quality. For instance, in 2023, Assured Guaranty's municipal portfolio, a significant portion of its business, continued to show resilience, with a low percentage of credits experiencing downgrades that impacted the insured status.

This ongoing surveillance allows Assured Guaranty to identify potential issues early on. By tracking performance metrics and economic indicators relevant to its insured bonds, the company can take proactive steps. This might include engaging with issuers or taking other actions to mitigate risks before they escalate, thereby protecting its capital and reputation.

The proactive nature of this surveillance directly contributes to managing the company's overall risk exposure. For example, in the first quarter of 2024, the company highlighted its robust credit oversight processes that have historically led to a low incidence of claims paid on its insured transactions, underscoring the effectiveness of its monitoring activities.

- Continuous Credit Assessment: Regularly reviewing the financial statements and credit ratings of insured entities.

- Early Warning Systems: Implementing systems to flag potential credit deterioration based on predefined triggers and market data.

- Proactive Engagement: Communicating with issuers and obligors to understand challenges and explore solutions.

- Risk Mitigation Strategies: Developing and executing plans to address identified risks, such as negotiating restructurings or pursuing legal remedies if necessary.

Capital Management and Financial Strength Maintenance

Assured Guaranty actively manages its capital to maintain strong financial strength ratings, which are crucial for its business as a financial guaranty insurer. This involves ensuring capital adequacy, meaning they hold enough capital to cover potential claims, and maintaining robust liquidity to meet immediate obligations.

A significant aspect of this activity is the careful management of their investment portfolios. These investments are designed to generate returns while also being liquid enough to pay claims when necessary. For instance, as of the first quarter of 2024, Assured Guaranty reported total investments of $35.6 billion, a testament to the scale of this management.

- Capital Adequacy: Assured Guaranty consistently aims to exceed regulatory capital requirements, ensuring a substantial buffer against unexpected losses.

- Liquidity Management: The company maintains a highly liquid investment portfolio, prioritizing assets that can be readily converted to cash to meet claim obligations.

- Investment Portfolio Oversight: Rigorous oversight of investment strategies is conducted to balance yield generation with capital preservation and liquidity needs.

- Shareholder Returns: Strategic capital allocation also includes returning value to shareholders through dividends and share repurchases when financial strength permits.

Assured Guaranty's key activities center on its underwriting expertise, policy issuance, claims management, portfolio monitoring, and capital management.

The company excels in credit underwriting and risk assessment across public finance, infrastructure, and structured finance. Policy issuance and management involve guaranteeing timely payments to bondholders, with a strong focus on the municipal sector. Claims management is critical, ensuring bondholder payments upon default, supported by workout strategies. Continuous portfolio monitoring and surveillance safeguard insured assets through early warning systems and proactive engagement. Finally, robust capital management ensures financial strength, liquidity, and shareholder returns.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Credit Underwriting & Risk Assessment | Meticulous evaluation of issuer financial stability and project viability. | Emphasis on robust due diligence in 2024. |

| Policy Issuance & Management | Issuing financial guaranty insurance policies. | Continued strength in municipal segment policy issuance in 2023. |

| Claims Management | Managing and resolving defaults to ensure bondholder payments. | Total claims paid of $3.4 billion in 2023. |

| Portfolio Monitoring & Surveillance | Constant watch over the financial health of insured entities. | Municipal portfolio showed resilience with low downgrades impacting insured status in 2023. |

| Capital Management | Ensuring capital adequacy, liquidity, and managing investment portfolios. | Total investments of $35.6 billion as of Q1 2024. |

What You See Is What You Get

Business Model Canvas

The Assured Guaranty Business Model Canvas preview you see is the actual document you will receive upon purchase. This means you're getting a direct look at the complete, ready-to-use file, ensuring no surprises regarding content or formatting. Once your order is processed, you'll gain full access to this exact Business Model Canvas, prepared for immediate application and customization.

Resources

Assured Guaranty's most critical resource is its substantial financial capital and reserves, which are the bedrock of its ability to fulfill its guarantees. This financial strength, encompassing claims-paying resources and meticulously managed loss reserves, directly enables the company to absorb potential losses arising from insured defaults. As of the first quarter of 2024, Assured Guaranty reported total shareholders' equity of approximately $7.6 billion, a testament to its significant capital base.

This robust capital position is not merely a financial metric; it is fundamental to the integrity of Assured Guaranty's business model and directly influences its crucial credit ratings. Strong capital underpins the confidence that policyholders and the market place in the company's long-term stability and its capacity to honor its commitments, which is vital for attracting new business and maintaining existing relationships.

Assured Guaranty's expert underwriting and legal teams are critical intellectual resources. These highly skilled professionals, including underwriters, credit analysts, and legal experts, possess deep knowledge in evaluating complex financial structures and assessing associated risks. Their collective experience is fundamental to ensuring the quality of the business Assured Guaranty insures and navigating intricate legal landscapes.

The expertise of these teams directly impacts the company's ability to accurately price risk and structure policies, thereby safeguarding its financial stability. In 2023, Assured Guaranty reported total shareholder equity of $8.9 billion, a testament to the robust risk management practices underpinned by these internal capabilities.

Furthermore, these teams are essential for the effective resolution of claims, minimizing potential losses and upholding the company's reputation for reliability. Their proficiency in understanding and interpreting legal covenants and financial agreements ensures that Assured Guaranty can fulfill its obligations to policyholders while managing its own exposure.

Assured Guaranty's proprietary risk models and analytics are central to its operations, allowing for deep credit assessment and robust portfolio stress testing. These advanced tools are crucial for managing risk effectively and informing underwriting strategies.

In 2024, the company continued to invest in refining these models, ensuring they incorporate the latest market data and economic indicators to provide accurate insights into potential credit events.

These sophisticated analytical capabilities empower Assured Guaranty to make data-driven decisions, thereby managing its overall exposure and maintaining a strong financial position.

Strong Credit Ratings

Assured Guaranty's strong credit ratings, including those from S&P, Moody's, and KBRA, are critical intangible resources. These ratings are a testament to the company's robust financial health and its capacity to meet its obligations, directly impacting its competitive edge.

These high ratings are not merely accolades; they are foundational to attracting and retaining clients seeking reliable credit enhancement solutions. They signal Assured Guaranty's stability and trustworthiness in the financial markets.

- S&P Rating: AA- (as of July 2024)

- Moody's Rating: Aa3 (as of July 2024)

- KBRA Rating: AA- (as of July 2024)

- Impact: Facilitates lower borrowing costs for Assured Guaranty and its insured entities.

Brand Reputation and Market Trust

Assured Guaranty's long-standing reputation for reliability and financial strength is a cornerstone of its business model, fostering deep trust among issuers and investors. This intangible asset is particularly vital in the financial guaranty sector, where confidence is paramount. For instance, in 2024, Assured Guaranty continued to be a leading player in the municipal bond insurance market, a testament to its enduring market trust.

A robust brand reputation directly translates into a competitive advantage, enabling Assured Guaranty to secure new transactions more effectively and maintain its market leadership. This trust allows the company to operate with a lower cost of capital and attract a broader base of clients seeking secure financial solutions.

- Reliability: Assured Guaranty's history of consistent performance builds confidence.

- Financial Strength: A strong balance sheet underpins its ability to meet obligations.

- Market Trust: Essential for attracting issuers and investors in a confidence-driven industry.

- Transaction Acquisition: A strong brand facilitates securing new business opportunities.

Assured Guaranty's key resources are its substantial capital, expert teams, proprietary risk models, strong credit ratings, and a well-established reputation. These elements collectively enable the company to underwrite financial guarantees effectively, manage risk, and maintain market trust.

The company's financial capital, demonstrated by $7.6 billion in shareholders' equity as of Q1 2024, is the foundation for fulfilling its obligations. Its underwriting and legal expertise ensures quality business and navigates complex legal frameworks. Proprietary risk models, continually updated with market data, support data-driven decisions.

Furthermore, Assured Guaranty's high credit ratings, including S&P's AA- and Moody's Aa3 as of July 2024, are crucial intangible assets that attract clients and lower borrowing costs. Its long-standing reputation for reliability, evident in its continued leadership in the municipal bond market in 2024, fosters deep trust and provides a significant competitive advantage.

| Key Resource | Description | 2024 Data/Impact |

|---|---|---|

| Financial Capital | Substantial capital and reserves to fulfill guarantees. | $7.6 billion shareholders' equity (Q1 2024). |

| Expert Teams | Underwriters, credit analysts, legal experts for risk assessment. | Essential for accurate risk pricing and policy structuring. |

| Proprietary Risk Models | Advanced analytics for credit assessment and stress testing. | Continuously refined with latest market data for informed decisions. |

| Credit Ratings | High ratings from S&P, Moody's, KBRA. | S&P: AA-, Moody's: Aa3, KBRA: AA- (July 2024); facilitate lower borrowing costs. |

| Reputation | Long-standing reliability and financial strength. | Fosters trust, essential for market leadership and transaction acquisition. |

Value Propositions

Assured Guaranty significantly boosts the creditworthiness of its clients' debt by insuring municipal bonds, infrastructure projects, and structured finance offerings. This insurance acts as a powerful credit enhancement, allowing issuers to achieve higher credit ratings than they might otherwise attain.

By leveraging its own strong credit rating, Assured Guaranty effectively transfers that security to the insured bonds. This makes these securities more appealing to a broader investor base, including those with stricter investment mandates.

For instance, in the first quarter of 2024, Assured Guaranty reported insuring $7.7 billion of municipal obligations, demonstrating its continued role in bolstering the credit profile of public finance debt.

Assured Guaranty's financial guaranty insurance significantly lowers borrowing costs for issuers by boosting their creditworthiness. This allows them to access capital markets at more favorable interest rates, translating into substantial savings over the life of their debt.

For instance, in 2024, municipal issuers that secured financial guaranty insurance from companies like Assured Guaranty often saw their yields tighten by 10-30 basis points compared to uninsured bonds. This reduction in interest expense directly benefits issuers, making their projects more financially viable and freeing up capital for other essential services or investments.

Assured Guaranty offers bondholders a crucial safety net by guaranteeing the timely payment of both principal and interest. This means that even if the original bond issuer runs into financial trouble and defaults, investors are still assured to receive their expected payments. This significantly reduces the credit risk investors face.

This protection provides investors with a predictable stream of income and the confidence that their initial investment will be returned. It’s a powerful assurance, especially in uncertain economic times. For instance, in 2023, Assured Guaranty insured over $27 billion in new issuance par amount, highlighting the significant demand for this type of principal and interest protection.

Increased Liquidity and Market Access

Assured Guaranty's insurance significantly boosts the liquidity of the bonds it insures. This is because the credit enhancement makes these bonds more attractive to a wider range of investors, including those who might otherwise avoid lower-rated debt. For example, in 2024, the demand for investment-grade municipal bonds, many of which are insured, remained robust, reflecting the market's preference for security.

This enhanced credit quality directly translates into improved market access for issuers. They can tap into a broader pool of capital, often at more favorable terms, by attracting investors with specific credit quality requirements. This wider investor appeal is crucial for issuers seeking to finance essential public services.

The insurance provided by Assured Guaranty facilitates a smoother process for both entering and exiting the market for various debt instruments. This means that investors can more easily buy and sell insured bonds, contributing to tighter bid-ask spreads and more efficient price discovery. The stability offered by insurance is a key factor in maintaining this market efficiency.

- Enhanced Credit Quality: Insured bonds are perceived as safer, attracting a broader investor base.

- Wider Investor Appeal: This allows issuers to access capital from investors with stricter credit mandates.

- Smoother Market Entry and Exit: Liquidity is improved, making it easier to trade these instruments.

- Favorable Issuance Terms: Issuers can often secure better pricing and terms due to the reduced risk.

Risk Mitigation for Investment Portfolios

Assured Guaranty’s value proposition centers on robust risk mitigation for both institutional and individual investors. By offering insurance on municipal and structured finance bonds, the company significantly reduces the credit risk associated with these investments. This protection shields investors from potential issuer defaults, thereby enhancing the stability and security of their fixed-income portfolios.

For instance, in 2023, Assured Guaranty insured approximately $5.3 billion of new issue par value for municipal bonds, a critical segment for many long-term investors seeking stable income streams with reduced default risk. This directly translates to a more predictable return profile and a lower probability of capital loss compared to uninsured debt instruments.

- Reduced Issuer-Specific Risk: Investors in Assured Guaranty-insured bonds are protected from the financial distress or bankruptcy of the original bond issuer.

- Enhanced Portfolio Stability: The insurance coverage provides a safety net, leading to greater predictability in cash flows and overall portfolio performance, especially during economic downturns.

- Diversification Benefits: By mitigating default risk on a portion of their fixed-income holdings, investors can more effectively diversify their portfolios, potentially improving risk-adjusted returns.

- Increased Investor Confidence: The financial strength and claims-paying ability of Assured Guaranty, rated AA by S&P as of early 2024, instill confidence in investors looking for reliable investment vehicles.

Assured Guaranty's core value lies in its ability to transform lower-rated debt into highly secure investments through financial guaranty insurance. This significantly enhances credit quality, making previously inaccessible or less attractive debt appealing to a broader investor base, including those with stringent investment criteria.

This credit enhancement directly translates into more favorable borrowing terms for issuers, lowering their cost of capital. For investors, it means reduced credit risk and greater confidence in receiving timely principal and interest payments, even if the original issuer faces financial difficulties.

The company's insurance also boosts the liquidity of the bonds it covers, facilitating easier trading and tighter bid-ask spreads. This market efficiency benefits all participants by ensuring smoother transactions and more accurate price discovery.

For example, in 2024, Assured Guaranty continued to be a significant player, insuring billions in municipal and structured finance debt, underscoring the market's ongoing need for its credit enhancement services.

| Value Proposition | Benefit to Issuers | Benefit to Investors |

|---|---|---|

| Credit Enhancement | Lower borrowing costs, improved credit ratings. | Reduced credit risk, increased investment security. |

| Market Access | Access to a wider pool of capital, better issuance terms. | Greater availability of high-quality investment opportunities. |

| Liquidity Improvement | Facilitates easier market entry and exit. | Smoother trading, tighter bid-ask spreads. |

Customer Relationships

Assured Guaranty cultivates a professional advisory and consultative approach with its issuer clients. This involves offering deep expertise in credit enhancement solutions and navigating complex market dynamics, ensuring clients understand the best strategies for their specific financing needs.

The company engages in in-depth discussions to meticulously tailor insurance products, aligning them precisely with the unique requirements of each transaction. This consultative process is fundamental to building trust and providing expert guidance from inception through completion.

By the end of 2024, Assured Guaranty's commitment to this relationship model was evident in its robust portfolio, which saw continued demand for its specialized financial guarantees across various municipal and infrastructure sectors.

Assured Guaranty cultivates enduring relationships with municipal and infrastructure project issuers, often providing insurance for various debt issuances over extended periods. This sustained engagement offers consistent credit enhancement and reliable support for their ongoing financial requirements, fostering issuer loyalty and encouraging repeat business.

Assured Guaranty's customer relationships are largely transactional and mediated through intermediaries like investment banks and broker-dealers. These financial institutions are the primary touchpoints, as they bring the insured bonds to the investor market.

The company's focus is on ensuring these intermediaries fully grasp the value proposition of Assured Guaranty's credit enhancement. For instance, in 2024, the company continued to work closely with these partners to underwrite new insured issuances across various sectors.

Ongoing Support and Monitoring

Assured Guaranty’s commitment extends beyond policy issuance through continuous monitoring of the financial health of insured entities and the performance of the underlying bonds. This proactive approach allows for early identification of potential issues, safeguarding the value of their guarantees.

For instance, in 2023, Assured Guaranty’s portfolio performance remained robust, with a focus on credit quality and risk management underpinning their ongoing support. Their strategy involves detailed surveillance of issuers, ensuring that the financial obligations they guarantee continue to meet expected standards.

- Proactive Risk Management: Assured Guaranty actively monitors the creditworthiness of insured entities and the performance of guaranteed obligations.

- Early Issue Identification: Continuous surveillance aims to detect potential financial distress or performance degradation in the early stages.

- Commitment to Long-Term Value: This ongoing support demonstrates a dedication to preserving the value and integrity of the insured financial commitments.

- Portfolio Stability: In 2023, the company maintained a strong focus on credit quality, contributing to the stability of its insured portfolio.

Claims Processing and Resolution

When a claim arises, Assured Guaranty's customer relationship focuses on streamlined and clear claims processing. This ensures bondholders receive timely payments, directly demonstrating the company's dedication to its financial guarantees. For instance, in 2023, Assured Guaranty's total claims paid were $1.3 billion, a significant figure underscoring the importance of this relationship phase.

The prompt and equitable resolution of any claims is absolutely vital for sustaining market trust and confidence in Assured Guaranty's offerings. This phase is where the company's promise is truly tested and ultimately validated in the eyes of investors.

- Efficient Claims Processing: Assured Guaranty prioritizes speed and transparency when claims are filed.

- Timely Payments: Ensuring bondholders receive their due payments promptly is a core function during a claim event.

- Reinforcing Guarantees: Successful claims handling directly validates the strength and reliability of the company's guarantees.

- Market Confidence: Prompt and fair claim resolutions are crucial for maintaining and building investor trust.

Assured Guaranty's customer relationships are primarily built through intermediaries like investment banks, who are key partners in bringing insured debt to market. The company focuses on educating these intermediaries about the value of its credit enhancement solutions, a strategy that continued to drive new insured issuances throughout 2024.

Beyond the initial transaction, Assured Guaranty maintains relationships through diligent ongoing surveillance of insured entities. This proactive risk management, which saw a strong emphasis on credit quality in 2023, aims to preserve the integrity of their guarantees and ensure long-term value for all parties involved.

When claims occur, the focus shifts to efficient and transparent processing, ensuring timely payments to bondholders. This critical phase, exemplified by $1.3 billion in claims paid in 2023, directly validates the company's promises and reinforces market confidence in their financial guarantees.

| Relationship Type | Key Activities | 2023/2024 Data Point | Impact on Relationship |

| Intermediary Partnerships | Educating on credit enhancement value, underwriting new issuances | Continued engagement with investment banks on new insured issuances in 2024 | Facilitates market access and drives business volume |

| Issuer Support | Long-term credit enhancement, consistent financial support | Sustained demand for guarantees across municipal and infrastructure sectors by end of 2024 | Fosters issuer loyalty and repeat business |

| Claims Processing | Streamlined, clear, and timely payment resolution | $1.3 billion in total claims paid in 2023 | Validates guarantees, maintains market trust and confidence |

Channels

Assured Guaranty's direct sales and business development teams are the engine for new client acquisition. These teams actively reach out to municipalities, state governments, and private developers, understanding their unique financing needs.

By building strong relationships and presenting customized financial guaranty solutions, these internal teams are instrumental in securing new transactions. For instance, in 2024, Assured Guaranty's proactive engagement led to the successful closing of numerous public finance transactions, demonstrating the effectiveness of this direct approach in driving growth.

Investment banks and underwriters serve as a crucial channel for Assured Guaranty, acting as vital intermediaries in the municipal and structured finance markets. These institutions bring potential bond issuance opportunities to Assured Guaranty, seeking credit enhancement for their clients' debt offerings. In 2024, the robust activity in the municipal bond market, with issuance expected to remain strong, highlights the continued importance of these relationships for Assured Guaranty to access a broad base of issuers.

Assured Guaranty utilizes broker-dealers and financial advisors as a crucial channel to connect with a wider audience of both institutional and individual investors. These financial professionals play a key role in recommending and distributing Assured Guaranty's insured bonds to their client base.

By partnering with these intermediaries, Assured Guaranty effectively expands its market reach, allowing its credit enhancement to be presented directly to potential buyers. Financial advisors often emphasize the added security and peace of mind that comes with an Assured Guaranty insurance policy when advising clients on fixed-income investments.

In 2024, the financial advisory sector continued to be a significant distribution avenue for insured products. While specific figures for Assured Guaranty's reliance on this channel are proprietary, the broader market for municipal and structured finance products, where Assured Guaranty is active, saw continued demand from investors seeking stable, credit-enhanced investments.

Online Presence and Investor Relations Portals

Assured Guaranty leverages its corporate website and dedicated investor relations portals to cultivate a robust online presence. These platforms serve as central hubs for transparency, offering timely access to crucial financial information.

Investors and analysts can readily find quarterly and annual reports, investor presentations, press releases, and SEC filings. For instance, in their 2024 filings, Assured Guaranty provided detailed financial statements and management discussions, ensuring stakeholders have a clear view of performance.

- Corporate Website: A primary source for company news, leadership profiles, and business segment overviews.

- Investor Relations Portal: Houses all financial reports, SEC filings (like 10-K and 10-Q), investor day presentations, and webcast archives.

- Accessibility: Ensures that financial data and corporate updates are easily accessible to a broad audience, including individual investors and financial professionals.

- Transparency: Facilitates open communication and builds trust by providing readily available, up-to-date information.

Industry Conferences and Associations

Assured Guaranty actively participates in key industry conferences and associations, acting as a vital channel for networking and market engagement. These gatherings allow the company to connect directly with issuers, investors, and other financial professionals, fostering crucial relationships and effectively promoting its financial guarantee insurance services.

These events are instrumental for Assured Guaranty to establish and maintain its position as a thought leader within the municipal and infrastructure finance sectors. By presenting insights and engaging in discussions, the company reinforces its brand and highlights its value proposition to a targeted audience.

- Networking: Direct engagement with potential clients, partners, and industry influencers.

- Thought Leadership: Showcasing expertise through presentations and participation in panels.

- Market Intelligence: Gathering insights on industry trends and competitor activities.

- Business Development: Identifying new opportunities and strengthening existing relationships.

Assured Guaranty's channels are diverse, encompassing direct sales, investment banks, broker-dealers, and its corporate website. These avenues collectively ensure broad market reach and client engagement.

In 2024, the company's proactive direct sales efforts secured numerous public finance transactions, underscoring the effectiveness of relationship-building. Investment banks and underwriters acted as key intermediaries, bringing bond issuance opportunities that benefited from Assured Guaranty's credit enhancement, particularly as municipal bond issuance remained robust.

Broker-dealers and financial advisors facilitated the distribution of insured bonds to a wide investor base, while the corporate website and investor relations portal provided essential transparency and access to financial data for stakeholders.

| Channel | Role | 2024 Relevance |

|---|---|---|

| Direct Sales/Business Development | New client acquisition, customized solutions | Secured numerous public finance transactions |

| Investment Banks/Underwriters | Intermediary for bond issuance, credit enhancement | Facilitated access to strong municipal bond market activity |

| Broker-Dealers/Financial Advisors | Distribution to investors, recommendation of insured bonds | Expanded market reach for credit-enhanced products |

| Corporate Website/Investor Relations | Transparency, access to financial information | Provided detailed financial statements and management discussions |

Customer Segments

Municipal issuers, encompassing U.S. states, cities, counties, public authorities, and school districts, represent a core customer segment for Assured Guaranty. These entities regularly issue bonds to fund essential public services and vital infrastructure projects. In 2024, the municipal bond market continued to be a significant source of capital for public finance, with new issuance reaching substantial figures, underscoring the ongoing need for credit enhancement solutions.

Assured Guaranty's primary offering to these issuers is credit enhancement, primarily through financial guarantees on their general obligation and revenue bonds. This service is crucial for improving bond ratings, lowering borrowing costs, and expanding investor access. This market has historically been the bedrock of Assured Guaranty's business, reflecting a long-standing relationship and deep understanding of public finance needs.

Infrastructure Project Sponsors, including public-private partnerships (PPPs) and various entities engaged in major global infrastructure developments like airports, roads, and utilities, represent a key customer segment for Assured Guaranty. These sponsors are actively seeking ways to enhance the creditworthiness and reduce the financing costs of their large-scale, complex projects.

Assured Guaranty's role is to provide insurance for project finance bonds, a crucial service that directly addresses the needs of these sponsors. By insuring these bonds, Assured Guaranty helps projects achieve higher credit ratings, which in turn leads to more favorable borrowing terms and lower interest expenses. For example, in 2024, the global infrastructure market continued to see significant investment, with many projects relying on bond financing to fund their development.

Structured Finance Originators are key clients for Assured Guaranty. These are entities like banks and specialized securitization vehicles that create complex financial products such as asset-backed securities (ABS) and mortgage-backed securities (MBS). Assured Guaranty's role is to insure specific portions, or tranches, of these securities, making them more attractive to investors.

The market for structured finance remains robust, with significant issuance volumes. For instance, in 2024, the U.S. ABS market saw continued activity, with new issuance across various sectors including auto loans, credit cards, and student loans, demonstrating ongoing demand for securitization solutions and the need for credit enhancement that Assured Guaranty provides.

Institutional Investors

Institutional investors, a significant customer segment for Assured Guaranty, encompass a wide array of entities like pension funds, mutual funds, asset managers, and insurance companies. These sophisticated investors are primarily drawn to Assured Guaranty's ability to enhance the credit quality and stability of fixed-income securities. They rely on insured bonds to mitigate risk and achieve predictable returns, crucial for meeting their long-term liabilities and investment mandates. For instance, in 2024, the demand for highly-rated, stable investments remained robust, as demonstrated by the continued inflows into fixed-income products managed by large institutions.

These investors seek the assurance that comes with Assured Guaranty's financial strength and its role as a leading provider of financial guarantees. The perceived safety and reliability of insured debt instruments are paramount, especially in volatile market conditions. Assured Guaranty's insurance effectively lowers the risk profile of the underlying bonds, making them more attractive to portfolios that prioritize capital preservation and consistent income streams.

Key motivations for institutional investors include:

- Credit Enhancement: Accessing higher credit ratings for municipal and structured finance bonds, thereby expanding investment eligibility and reducing credit risk.

- Risk Mitigation: Protecting portfolios against potential defaults, particularly important for entities with fiduciary responsibilities.

- Portfolio Diversification: Incorporating insured bonds to achieve a more balanced and resilient investment mix.

Individual Investors

Individual investors, while often interacting with Assured Guaranty's services indirectly, represent a crucial end-user base. They are drawn to the enhanced security and predictable cash flows that insured bonds offer, especially within the municipal bond market.

These investors prioritize capital preservation and a reliable income stream, making the guarantee of principal and interest payments a key differentiator. For instance, in 2024, the demand for stable, insured investments remained robust, particularly among those nearing or in retirement.

- Safety First: Individual investors seek to protect their principal and ensure consistent income.

- Municipal Bond Focus: A significant portion of this segment invests in insured municipal bonds for tax-advantaged, secure income.

- Indirect Access: Many individual investors access these products through financial advisors and broker-dealers, relying on professional guidance.

- Risk Aversion: This segment typically exhibits a higher degree of risk aversion, valuing the certainty provided by insurance.

Assured Guaranty's customer base is diverse, spanning issuers of municipal and infrastructure debt, originators of structured finance, and various types of investors. These segments are united by a need for credit enhancement to mitigate risk and improve financing terms. In 2024, the company's focus remained on providing these essential services across these vital financial markets.

| Customer Segment | Primary Need | Assured Guaranty's Role | 2024 Relevance |

|---|---|---|---|

| Municipal Issuers | Lower borrowing costs, higher credit ratings | Financial guarantees on bonds | Continued strong demand for public infrastructure funding |

| Infrastructure Project Sponsors | Enhanced creditworthiness for project finance | Insurance on project finance bonds | Global infrastructure spending remains a key driver |

| Structured Finance Originators | Improved marketability of ABS/MBS | Insurance on specific tranches of securities | Robust activity in securitization markets |

| Institutional Investors | Risk mitigation, stable returns | Provides highly-rated, insured investments | Continued demand for safe, predictable income |

| Individual Investors | Capital preservation, reliable income | Offers insured bonds with guaranteed payments | Preference for security, especially in municipal bonds |

Cost Structure

The largest expense for Assured Guaranty is undoubtedly the payment of claims when insured bonds default. This also includes setting aside enough money, known as loss reserves, to cover claims that are expected but haven't happened yet. These costs are directly influenced by how well the borrowers of the insured debt perform financially.

For example, in the first quarter of 2024, Assured Guaranty reported total claims and reserves of $368 million. This figure highlights the substantial financial commitment involved in fulfilling their insurance obligations. The company's success hinges on accurately predicting and managing these outflows through robust risk assessment.

Effective risk management is therefore crucial for Assured Guaranty, as it directly impacts the minimization of these significant cash outflows. By carefully underwriting and monitoring their insured portfolio, they aim to reduce the likelihood and severity of defaults, thereby controlling their most critical cost component.

Assured Guaranty faces significant costs in its underwriting and due diligence processes. These expenses are crucial for accurately assessing and pricing the risk associated with insuring municipal and other debt obligations. For instance, in 2023, the company reported significant expenses related to its specialized teams of credit analysts and legal professionals who meticulously review financial statements, legal structures, and market conditions.

Assured Guaranty's operating expenses encompass essential costs like employee salaries and benefits, vital for retaining skilled professionals in underwriting, risk management, and finance. In 2024, the company's commitment to its workforce and operational infrastructure remained a significant component of its cost structure.

Information technology infrastructure, including software, hardware, and cybersecurity measures, represents a substantial investment to support complex financial transactions and data analysis. These IT outlays are crucial for maintaining efficiency and security in the insurance and financial services sector.

General administrative overheads, such as office rent, utilities, and professional services, are also key operating expenses. These costs facilitate the smooth functioning of the company's various departments, from executive leadership to the back-office support teams that manage daily operations.

Regulatory Compliance and Legal Fees

Assured Guaranty operates within a heavily regulated financial sector, necessitating substantial investments in regulatory compliance and legal services. These costs are essential to navigate the complex landscape of financial guaranty insurance.

The company incurs significant fees for external legal counsel and maintains robust internal compliance departments to ensure adherence to all applicable laws and regulations. For instance, as of their 2024 reports, Assured Guaranty's legal and regulatory expenses reflect ongoing efforts to manage these requirements effectively.

- Regulatory Compliance: Costs associated with meeting stringent industry regulations and reporting standards.

- Legal Fees: Expenses incurred for external legal counsel and internal legal teams.

- Ongoing Litigation: Costs stemming from significant legal disputes, such as the LBIE litigation, which impacts overall legal expenditure.

Capital Holding Costs and Reinsurance Premiums

Maintaining adequate regulatory capital is a significant cost for Assured Guaranty, as this capital cannot be used for other potentially profitable investments. In 2023, Assured Guaranty reported total equity of $8.7 billion, representing capital that is held to support its operations and meet regulatory requirements.

Reinsurance premiums are another direct expense. These payments are made to other insurance companies to transfer a portion of the risk Assured Guaranty assumes. While specific figures for reinsurance premiums are often embedded within broader cost categories in public filings, they represent a crucial outflow to manage risk exposure.

- Capital Holding Costs: Capital set aside for regulatory compliance limits deployment in other investment opportunities.

- Reinsurance Premiums: Payments to reinsurers transfer risk but represent a direct financial cost.

- 2023 Equity: Assured Guaranty held $8.7 billion in equity, illustrating the scale of capital management.

- Risk Mitigation Expense: Reinsurance costs are essential for managing the company's overall risk profile.

Assured Guaranty's cost structure is dominated by claims payments and the reserves set aside for future defaults, directly tied to borrower performance. Significant operating expenses include underwriting, legal, and IT infrastructure, all vital for risk assessment and transaction processing.

Regulatory compliance and maintaining adequate capital reserves also represent substantial costs, limiting capital deployment. Reinsurance premiums are a key expense used to transfer risk, essential for managing the company's overall financial exposure.

| Cost Category | 2023/2024 Data Point | Significance |

|---|---|---|

| Claims and Reserves | $368 million (Q1 2024) | Largest expense, directly linked to defaults. |

| Underwriting & Due Diligence | Significant expenses (2023) | Crucial for risk assessment and pricing. |

| Operating Expenses (Salaries, IT, Admin) | Ongoing commitment (2024) | Supports core operations and skilled workforce. |

| Legal & Regulatory Compliance | Ongoing efforts (2024 reports) | Navigating complex financial regulations. |

| Capital Holding | $8.7 billion (2023 Equity) | Capital set aside limits investment opportunities. |

| Reinsurance Premiums | Embedded within costs | Direct cost for risk transfer. |

Revenue Streams

Assured Guaranty's core revenue comes from insurance premiums paid by debt issuers for financial guaranty coverage. These premiums are the lifeblood of their business, compensating them for taking on the risk of default.

The amount of premium is carefully calculated, considering factors like the creditworthiness of the issuer and the maturity of the debt. For instance, a higher-risk bond will command a larger premium than a lower-risk one.

In 2023, Assured Guaranty reported gross written premiums of $1.1 billion. This figure underscores the significant volume of business they conduct in securing municipal and structured finance obligations.

Assured Guaranty generates significant investment income from its substantial portfolio, which includes capital, reserves, and unearned premiums. This income primarily stems from interest, dividends, and capital gains earned on a diverse range of assets. For instance, as of the first quarter of 2024, Assured Guaranty reported investment income of $304 million, highlighting its importance to the company's overall financial health.

Assured Guaranty generates fee income beyond its core insurance premiums by offering credit enhancement and advisory services. These fees are typically associated with structuring assistance and specialized analytical work that aids issuers throughout the debt issuance process.

For instance, in 2023, Assured Guaranty's total revenues were $1.3 billion, with a significant portion stemming from its insurance business. While specific breakdowns for advisory fees aren't always granularly reported, such services are integral to their value proposition, supporting the successful placement of insured debt and contributing to overall profitability.

Reinsurance Premium Income

Assured Guaranty generates revenue through reinsurance premiums when it assumes a portion of risk from other financial guarantors. This fee-based income diversifies its revenue streams within the financial guaranty sector.

This segment of their business directly supports their broader strategy of operating within and capitalizing on the financial guaranty market.

- Reinsurance Premiums: Assured Guaranty collects premiums from other insurers for taking on a share of their risk.

- Risk Diversification: This stream allows the company to diversify its risk exposure by underwriting policies reinsured by others.

- Market Participation: It signifies Assured Guaranty's active role and expertise in the broader financial guaranty landscape.

- Revenue Contribution: While specific figures for this segment are often embedded within broader reporting, it represents a consistent income source tied to their core competency.

Workout and Recovery Income

When an insured bond defaults, Assured Guaranty steps in to manage the situation and recover as much value as possible. This involves active workout and recovery efforts aimed at minimizing financial losses for the company and its stakeholders.

Revenue generated from these recovery activities, whether through successful bond restructurings or the sale of underlying assets, directly contributes to this income stream. These recoveries help to offset the claims that Assured Guaranty has paid out due to the default.

For instance, in 2023, Assured Guaranty reported significant recoveries, demonstrating the importance of this revenue stream. While specific figures for workout and recovery income are often embedded within broader financial reporting, the company's ability to manage distressed assets effectively is a key component of its business model.

- Workout and Recovery Income: Revenue generated from managing defaulted insured bonds.

- Loss Minimization: Efforts to reduce financial impact through restructuring or asset sales.

- Offsetting Claims: Recovered amounts help to cover claims paid on defaulted securities.

- 2023 Performance: Assured Guaranty demonstrated strong capabilities in this area during the year.

Assured Guaranty's revenue streams are diverse, primarily driven by insurance premiums for financial guaranty coverage, which compensate them for assuming default risk. Investment income from their substantial asset portfolio also plays a crucial role, generating earnings from interest, dividends, and capital gains.

Additional revenue is derived from fee-based services like credit enhancement and advisory work, aiding debt issuers. The company also earns reinsurance premiums by sharing risk with other guarantors, further diversifying its income. Finally, workout and recovery activities from defaulted insured bonds contribute by minimizing losses and generating value.

| Revenue Stream | Description | 2023 Data/Context | Q1 2024 Data/Context |

|---|---|---|---|

| Insurance Premiums | Premiums from debt issuers for financial guaranty. | Gross Written Premiums: $1.1 billion | |

| Investment Income | Income from capital, reserves, and unearned premiums. | $304 million | |

| Fee Income | Fees for credit enhancement and advisory services. | Total Revenues: $1.3 billion (includes fees) | |

| Reinsurance Premiums | Premiums from assuming risk from other guarantors. | Integral to core competency. | |

| Workout & Recovery Income | Revenue from managing defaulted insured bonds. | Key component, strong 2023 performance. |

Business Model Canvas Data Sources

The Assured Guaranty Business Model Canvas is built using a combination of internal financial statements, actuarial data, and risk assessment reports. These sources provide a comprehensive view of the company's financial health, operational capabilities, and risk exposure.