Assured Guaranty PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Assured Guaranty Bundle

Navigate the complex landscape surrounding Assured Guaranty with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, technological advancements, environmental regulations, and socio-cultural shifts are shaping its strategic direction. Equip yourself with actionable intelligence to anticipate challenges and capitalize on opportunities. Download the full report now to gain a critical competitive edge.

Political factors

Assured Guaranty's business is significantly tied to government infrastructure spending, as it offers credit protection for bonds funding these projects. The Bipartisan Infrastructure Investment and Jobs Act (IIJA) in the US, for instance, is directing substantial funding towards infrastructure improvements through 2025. This legislation alone allocated $1.2 trillion, with $550 billion in new spending for areas like roads, bridges, public transit, broadband, and clean energy.

The regulatory landscape for financial guarantors like Assured Guaranty is constantly evolving. In 2024, for instance, discussions around enhanced capital adequacy ratios for insurers, particularly those exposed to complex financial instruments, continued. These changes directly influence how Assured Guaranty manages its risk and plans its business operations.

Regulatory bodies such as state insurance departments and international financial authorities set the rules of engagement. These rules cover everything from the amount of capital insurers must hold to the types of business they can undertake and the protections they must offer consumers. For example, the Solvency II framework in Europe, which Assured Guaranty operates within for some of its business, dictates stringent capital requirements based on risk profiles.

A predictable regulatory environment is crucial for Assured Guaranty’s strategic planning. Conversely, unexpected shifts, such as increased oversight following market volatility in late 2023, can necessitate costly adjustments to compliance procedures and potentially limit the company's ability to pursue new market opportunities or product offerings.

Monetary policy, particularly interest rate decisions by central banks like the Federal Reserve, directly impacts Assured Guaranty by influencing borrowing costs for municipal issuers and the yield attractiveness of bonds for investors. For instance, the Federal Reserve's decision to maintain interest rates in the 5.25%-5.50% range as of mid-2024 makes borrowing more expensive for municipalities, potentially dampening new bond issuance but also increasing the relative appeal of insured bonds offering stable yields.

Fiscal policies also play a crucial role; government spending and taxation levels affect the financial health of public entities, which in turn influences their ability to service debt and the demand for Assured Guaranty's insurance. A robust fiscal environment with manageable deficits generally supports stronger municipal credit quality, thereby bolstering the market for insured municipal bonds.

Geopolitical Risks and International Relations

Geopolitical instability and evolving international relations directly influence the global infrastructure and structured finance markets where Assured Guaranty operates. For instance, ongoing trade tensions between major economic blocs could disrupt supply chains crucial for infrastructure projects, potentially impacting project viability and the creditworthiness of the entities involved. Assured Guaranty's exposure to sectors like UK utilities and Spanish project financing means it's directly exposed to these shifts.

Conflicts and trade disputes can significantly alter the economic landscape, affecting the credit quality of obligors in Assured Guaranty's non-U.S. public finance and structured finance portfolios. A prime example is the impact of the Russia-Ukraine conflict on energy markets, which can have ripple effects on infrastructure financing across Europe. This underscores the sensitivity of Assured Guaranty's business to global political developments.

Shifts in international economic alliances also present risks. For example, the re-evaluation of trade agreements or the formation of new economic blocs could alter investment flows and the perceived risk of projects in certain regions. Assured Guaranty's insured transactions, such as those in the UK's regulated utility sector, are inherently tied to the broader economic and political stability of these international partnerships.

Key considerations include:

- Impact on infrastructure project viability: Geopolitical events can delay or increase the cost of essential materials and labor for infrastructure development, affecting project completion and profitability.

- Credit quality of obligors: International disputes can negatively impact the financial health of companies and governments that are obligated to make payments on insured debt.

- Regulatory and legal changes: Shifts in international relations can lead to new regulations or legal frameworks that affect the enforceability of contracts and the overall investment climate for structured finance.

Public Policy on Municipal Debt

Government policies concerning municipal debt are a critical factor for Assured Guaranty. Potential shifts in the tax-exempt status of municipal bonds, or the level of federal assistance provided to struggling municipalities, directly influence the company's primary market. For instance, while the tax-exempt nature of municipal bonds has remained robust through recent legislative proposals, any alteration to the incentives for issuing or purchasing these bonds could significantly affect market dynamics and the need for credit enhancement services.

The municipal bond market is a cornerstone of Assured Guaranty's business. In 2023, the total value of municipal bonds issued reached approximately $450 billion, underscoring the scale of this market. Any legislative action that diminishes the attractiveness of these bonds to investors, such as changes to federal tax policies, could lead to reduced issuance and, consequently, lower demand for financial guarantees.

Looking ahead to 2024 and 2025, the political landscape remains a key consideration. Assured Guaranty must closely monitor potential policy changes at both federal and state levels. For example, discussions around infrastructure spending and fiscal responsibility could lead to new regulations or support mechanisms for municipal finance. The stability of the tax-exempt status is paramount, as its removal would fundamentally alter the municipal bond market's appeal.

- Municipal Bond Issuance: In 2023, U.S. municipal bond issuance was around $450 billion, a significant market for credit enhancers.

- Tax Policy Impact: Changes to federal tax laws, particularly those affecting the tax-exempt status of municipal bonds, pose a direct risk to Assured Guaranty's core business.

- Federal Aid to Municipalities: The availability and structure of federal aid for distressed municipalities can influence their ability to meet debt obligations, impacting the need for insurance.

- Legislative Monitoring: Ongoing monitoring of proposed legislation in 2024 and 2025 related to municipal finance and taxation is crucial for Assured Guaranty's strategic planning.

Government policies directly shape the municipal bond market, Assured Guaranty's core business. The stability of the tax-exempt status of these bonds, a key driver of demand, is under constant political scrutiny. Legislative changes in 2024 and 2025 concerning federal aid to municipalities or tax structures could significantly alter issuance volumes and the need for credit enhancement.

Federal infrastructure initiatives, such as the Bipartisan Infrastructure Investment and Jobs Act, are a significant driver of municipal bond issuance. This act allocated $1.2 trillion, with $550 billion in new spending through 2025, creating opportunities for Assured Guaranty to insure bonds funding these projects. However, political shifts could impact the pace and scale of future infrastructure spending.

The political environment influences the credit quality of municipal issuers. Fiscal policies and government spending priorities directly affect states' and cities' ability to service debt. For instance, a proactive approach to fiscal management by governments in 2024 can bolster the creditworthiness of municipal bonds, reducing perceived risk and potentially impacting demand for insurance.

| Political Factor | Description | Impact on Assured Guaranty | 2024/2025 Relevance |

| Municipal Bond Tax Status | The tax-exempt nature of municipal bonds is a key investor incentive. | Directly impacts demand for municipal bonds and thus insurance. | Ongoing political debate regarding tax policy could alter this status. |

| Infrastructure Spending Legislation | Government funding for infrastructure projects. | Drives issuance of municipal bonds that Assured Guaranty can insure. | Bipartisan Infrastructure Law ($1.2T total, $550B new spending) continues to drive projects through 2025. |

| Fiscal Policy & Aid to Municipalities | Government spending, taxation, and direct aid to local governments. | Affects the financial health and debt servicing capacity of issuers. | Changes in fiscal responsibility or aid packages can alter credit quality and insurance needs. |

What is included in the product

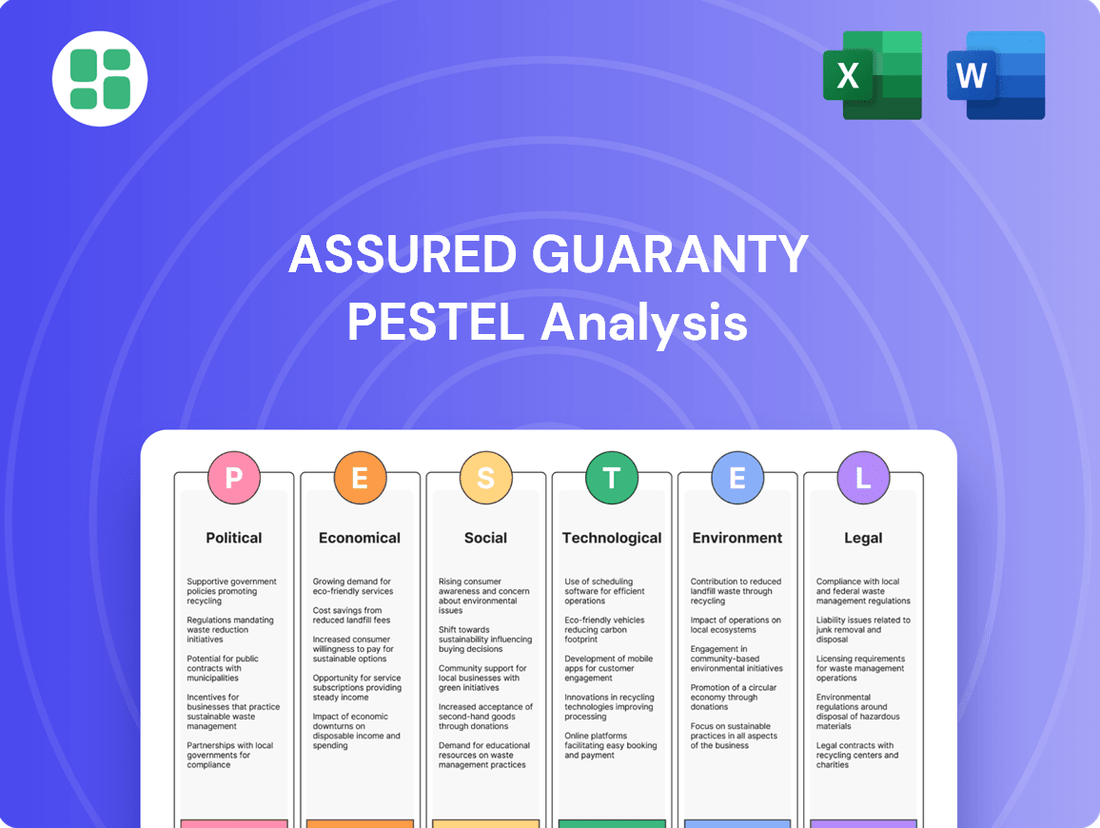

The Assured Guaranty PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company, providing a comprehensive understanding of its operating landscape.

Provides a concise version of Assured Guaranty's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions.

Economic factors

The current interest rate environment directly impacts Assured Guaranty's core markets. As of mid-2024, the Federal Reserve has maintained a hawkish stance, with benchmark rates holding steady in the 5.25%-5.50% range, a level not seen in over two decades. This elevated rate environment increases borrowing costs for municipal issuers, potentially driving demand for Assured Guaranty's financial guarantees to secure more favorable terms.

Fluctuating rates also influence investor appetite for municipal bonds. Higher yields on Treasuries and other fixed-income instruments can make municipals less attractive unless they offer comparable or enhanced yields, which credit enhancement can help achieve. For instance, if a municipal bond yield spread over Treasuries widens due to rate volatility, Assured Guaranty's insured bonds can offer a more competitive risk-adjusted return.

A prolonged period of higher interest rates, often termed a 'higher-for-longer' scenario, typically boosts demand for credit enhancement. Issuers facing higher debt service payments are more inclined to seek insurance to lower their borrowing costs and ensure market access. Simultaneously, investors, seeking safety in uncertain economic times, may favor highly-rated, insured bonds, increasing the value proposition for Assured Guaranty's services.

Inflationary pressures, such as the U.S. Consumer Price Index (CPI) which saw a 3.3% annual increase in May 2024, can significantly inflate the costs of infrastructure projects. This means Assured Guaranty's clients may need to issue larger bond amounts to finance the same development scope, potentially impacting the overall debt burden.

Robust economic growth, as indicated by the U.S. real GDP growth of 1.3% in the first quarter of 2024, generally strengthens the financial standing of Assured Guaranty's municipal and corporate obligors. This improved financial health translates to a lower likelihood of defaults within its insured portfolio, thereby reducing potential claims.

Conversely, economic contractions or recessions pose a direct risk. Should economic conditions worsen, obligors may struggle to meet their debt obligations, leading to an increased probability of claims against Assured Guaranty's financial guarantees.

The health of the municipal bond market is directly tied to Assured Guaranty's business. New issuance volume, investor appetite, and credit quality trends are key indicators of potential bond insurance opportunities. For 2025, the market is anticipated to experience consistent new issuance, driven by attractive absolute yields and robust underlying economic fundamentals.

Credit Market Conditions and Defaults

Broad credit market conditions, including credit spreads and default rates across public finance, infrastructure, and structured finance sectors, directly influence Assured Guaranty's risk exposure and profitability. For instance, during 2024, while overall default rates remained relatively subdued, certain pockets within structured finance, particularly those tied to consumer credit, showed signs of stress, impacting the cost of credit protection.

A stable credit environment with low defaults is generally favorable for Assured Guaranty, as it reduces the likelihood of claims. Conversely, rising defaults, especially in sectors like U.S. Residential Mortgage-Backed Securities (RMBS) or U.K. regulated utilities, can necessitate increased loss reserves, thereby impacting financial results. As of late 2024, while major infrastructure projects continued to perform well, some smaller municipal finance issuances experienced widening credit spreads, reflecting increased investor caution.

- Credit Spreads: Widening credit spreads in 2024 across various fixed-income sectors indicated a heightened perception of risk, potentially increasing the cost of capital for Assured Guaranty's clients.

- Default Rates: While overall default rates remained historically low through much of 2024, there were observed upticks in specific sub-sectors of structured finance, contributing to a more cautious outlook.

- Sectoral Performance: Public finance and infrastructure sectors generally demonstrated resilience, but certain segments of structured finance, particularly those linked to consumer discretionary spending, faced greater scrutiny.

Global Capital Flows and Investment

Global capital flows are increasingly targeting infrastructure and public finance, directly influencing the funding landscape for projects Assured Guaranty insures. A surge in investment, particularly from institutional investors and international groups, broadens the opportunities for the company to provide financial guarantees. For instance, in 2024, global foreign direct investment (FDI) in infrastructure was projected to reach over $1.5 trillion, a significant increase from previous years, highlighting this trend.

Assured Guaranty's involvement in major projects, such as the New Terminal One at JFK Airport, demonstrates its capacity to support substantial capital deployments. This type of engagement is crucial as it not only facilitates critical infrastructure development but also showcases Assured Guaranty's role in enabling large-scale investments. The project secured over $13 billion in financing, a testament to the scale of capital involved.

- Global infrastructure investment is a key driver for Assured Guaranty's business.

- Increased cross-border capital movements create more insured transaction opportunities.

- Large-scale projects like JFK's Terminal One highlight the company's role in facilitating significant financing.

- Institutional investors are playing a larger role in funding public finance projects in 2024-2025.

The economic outlook for 2024-2025 presents a mixed but generally stable environment for Assured Guaranty. While elevated interest rates, with the Fed Funds rate hovering around 5.25%-5.50% in mid-2024, increase borrowing costs for issuers, they also make insured municipal bonds more attractive to investors seeking yield and safety. Inflation, while moderating to 3.3% CPI year-over-year in May 2024, continues to impact project costs, potentially increasing issuance sizes.

Strong U.S. real GDP growth, at 1.3% in Q1 2024, bolsters the creditworthiness of Assured Guaranty's obligors, reducing default risk. However, potential economic slowdowns remain a concern, which could increase claims. Credit spreads widened in 2024, reflecting cautious investor sentiment, though default rates in core public finance sectors remained low.

| Economic Factor | 2024/2025 Outlook | Impact on Assured Guaranty |

|---|---|---|

| Interest Rates | Elevated (Fed Funds 5.25%-5.50%) | Increases issuer borrowing costs, enhances appeal of insured bonds. |

| Inflation | Moderating (CPI 3.3% YoY May 2024) | Increases project costs, potentially larger issuance sizes. |

| GDP Growth | Positive (US Real GDP 1.3% Q1 2024) | Strengthens obligor credit quality, lowers default risk. |

| Credit Spreads | Widening in 2024 | Indicates higher perceived risk, potentially higher capital costs for clients. |

Full Version Awaits

Assured Guaranty PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Assured Guaranty PESTLE Analysis provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It's a complete, ready-to-deploy resource for your strategic planning.

Sociological factors

Population growth and increasing urbanization are significant drivers of public infrastructure demand. For instance, the United Nations projects global urban populations to reach 6.7 billion by 2050, necessitating substantial investments in transportation, water, and energy systems worldwide.

Societal expectations for improved quality of life, including access to reliable utilities, efficient public transport, and modern social facilities, further fuel this demand. This creates a continuous need for financing such projects, often through municipal bonds.

Assured Guaranty's business model directly benefits from this persistent demand. By providing credit enhancement for municipal bonds, the company facilitates the funding of these essential public works, ensuring communities can build and maintain the infrastructure they need.

Public trust in financial institutions remains a critical factor, especially after events like the 2008 financial crisis. Surveys in 2024 indicate that while trust has seen some recovery, it's still a sensitive area for many consumers and investors. This directly impacts how readily issuers and investors engage with financial guarantors like Assured Guaranty.

Assured Guaranty's ability to attract business hinges on its perceived reliability. A strong reputation for financial stability and consistent performance is paramount. For instance, maintaining high credit ratings from agencies like Moody's and S&P, which Assured Guaranty has historically done, reinforces this perception and signals strength to the market.

Transparency in how Assured Guaranty manages risk and conducts its operations is key to fostering positive public perception. Open communication about its business model and financial health helps build confidence. This is particularly important in the current regulatory environment, where institutions are under greater scrutiny to demonstrate robust risk management practices.

Many developed countries, especially the United States, are grappling with aging infrastructure that requires substantial and continuous funding for repairs, maintenance, and upgrades. This situation translates into a consistent and stable demand for bond insurance, as local governments and states look for efficient financial solutions to fund these critical projects.

The infrastructure investment needs are considerable, with projections showing a significant funding gap extending through 2025 and into the future. For instance, the American Society of Civil Engineers' 2021 Report Card estimated a cumulative infrastructure funding gap of $2.59 trillion by 2029, highlighting the scale of the challenge and the ongoing need for financing mechanisms like those supported by bond insurers.

ESG Investing Trends

The increasing focus on Environmental, Social, and Governance (ESG) criteria is significantly reshaping where capital flows. This trend directly impacts the types of infrastructure projects that secure financing, favoring those with demonstrable environmental benefits.

Assured Guaranty's strategic positioning in financing projects like sustainable water management systems and renewable energy infrastructure aligns perfectly with this growing demand for ESG-compliant investments. This alignment is crucial for attracting capital from the expanding pool of ESG-focused investors.

The company's own commitment to environmental and social responsibility further bolsters its appeal. For instance, by Q1 2025, Assured Guaranty had insured over $5 billion in renewable energy projects, showcasing a tangible commitment to sustainable development.

- ESG Investment Growth: Global ESG assets were projected to reach $50 trillion by the end of 2025, indicating a substantial market shift.

- Renewable Energy Financing: Assured Guaranty's portfolio includes significant exposure to municipal bonds financing solar and wind farms, contributing to clean energy transitions.

- Social Impact Bonds: The company is also exploring opportunities in social impact bonds, which fund projects addressing societal challenges like affordable housing and education.

Demographic Shifts and Regional Growth

Demographic shifts significantly influence the financial landscape for municipal and state entities, directly impacting Assured Guaranty's risk assessment. For instance, the U.S. Census Bureau reported in 2023 that states like Florida and Texas continued to see robust population growth, projected to increase demand for infrastructure such as roads, schools, and utilities. This growth can translate to greater borrowing needs for these regions, potentially creating new opportunities for insured municipal bonds.

Conversely, areas experiencing population decline, such as parts of the Midwest, may face challenges in maintaining their tax bases and service levels. A shrinking population can lead to reduced revenue streams, straining a municipality's ability to service its existing debt. This dynamic directly affects the creditworthiness of municipal issuers and, consequently, the risk profile of the bonds Assured Guaranty insures.

Consider the aging demographic trend. As the U.S. population ages, there's an increasing demand for healthcare services and retirement infrastructure, which often require municipal financing. However, a larger elderly population can also mean a smaller working-age population contributing to tax revenues, creating a complex interplay of needs and financial capacity for local governments.

- Population Growth: States like Florida saw net domestic migration of over 300,000 people in 2023, increasing demand for public services and infrastructure financing.

- Aging Population: By 2030, all Baby Boomers will be 65 or older, placing increased demand on healthcare and social services funded by municipal bonds.

- Regional Disparities: While some areas boom, others like West Virginia experienced population decreases, potentially impacting their ability to fund essential services and repay debt.

- Labor Force Changes: Shifts in workforce demographics can impact local tax revenues, a key factor in municipal bond repayment capacity.

Societal expectations for enhanced public services and infrastructure quality continue to drive demand for municipal financing. This is particularly evident as populations grow and urbanize, necessitating investments in critical areas like transportation and utilities. Assured Guaranty's core business of insuring municipal bonds directly addresses this ongoing need.

Public trust in financial institutions, though recovering, remains a sensitive issue, influencing investor confidence in bond insurers. Assured Guaranty's emphasis on transparency and maintaining strong credit ratings is vital for fostering this trust and ensuring market engagement.

The increasing focus on ESG principles is redirecting capital towards sustainable projects, creating opportunities for Assured Guaranty to support environmentally conscious infrastructure. The company's investment in renewable energy projects, for example, aligns with this growing market trend.

Demographic shifts present a dual impact: population growth in certain regions increases infrastructure demand and borrowing needs, while declines in others can strain municipal finances and affect debt repayment capacity.

Technological factors

Assured Guaranty's reliance on advanced data analytics and risk modeling is paramount for navigating the complexities of its credit risk portfolio. By employing sophisticated algorithms and big data, the company can achieve more accurate underwriting, continuous portfolio surveillance, and refined loss forecasting. This technological edge is vital for proactively identifying potential defaults and strategically allocating capital.

The integration of machine learning and AI in risk assessment is a significant technological factor for Assured Guaranty. For instance, in 2024, the financial services industry saw a substantial increase in investments in AI-driven risk management solutions, with projections indicating continued growth through 2025. These tools enable granular analysis of vast datasets, leading to improved predictive accuracy in identifying credit deterioration and optimizing pricing for insured transactions.

Assured Guaranty, like all financial institutions, faces escalating cybersecurity threats that could jeopardize sensitive data and disrupt critical operations. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, a stark reminder of the pervasive risks. Protecting its digital infrastructure and client information is paramount for maintaining market trust and operational integrity.

The increasing sophistication of cyberattacks, including ransomware and data breaches, poses a significant challenge. For instance, the financial sector consistently ranks among the most targeted industries. A successful breach could lead to substantial financial losses, regulatory penalties, and severe reputational damage, impacting Assured Guaranty's ability to conduct business effectively.

Automation is significantly reshaping how Assured Guaranty handles its core functions. Technologies like artificial intelligence and machine learning are streamlining underwriting, allowing for quicker risk assessments and policy issuance. This not only boosts efficiency but also cuts down on operational expenses.

The impact of automation extends to claims management and other back-office operations. By automating routine tasks, Assured Guaranty can process transactions more rapidly, leading to improved turnaround times. This enhanced operational agility means better resource allocation and a greater capacity to scale the business as needed.

For instance, in 2024, the financial services sector saw substantial investment in AI-driven automation, with projections indicating continued growth. Companies adopting these technologies reported an average of 15-20% reduction in processing times for key operational workflows, a trend Assured Guaranty is likely to leverage.

Blockchain and Digital Ledger Technology (DLT)

Blockchain and Digital Ledger Technology (DLT) are poised to reshape financial markets, including the bond sector. Their potential to streamline issuance, trading, and settlement could disrupt existing intermediary roles, which may affect financial guarantors like Assured Guaranty.

While still in early stages, DLT offers enhanced transparency and efficiency in capital markets. This could fundamentally change how credit protection is structured and delivered, presenting both challenges and opportunities for established players.

For instance, in 2023, several pilot programs explored DLT for bond tokenization, with some projects aiming to reduce settlement times from T+2 to T+0. The global market for blockchain in financial services was projected to reach over $25 billion by 2025, indicating significant future investment and development.

- Increased Efficiency: DLT can automate many processes in bond issuance and trading, potentially lowering costs and speeding up transactions.

- Transparency: Shared ledgers offer greater visibility into transaction histories, which could improve trust and reduce fraud.

- Disintermediation: The technology might reduce reliance on traditional intermediaries, impacting the value proposition of services like financial guarantees.

- New Product Development: DLT could enable the creation of novel credit protection instruments and more efficient ways to manage collateral.

Artificial Intelligence (AI) in Financial Services

The integration of artificial intelligence (AI) and machine learning is rapidly transforming the financial services sector. These technologies are crucial for improving decision-making processes, bolstering fraud detection capabilities, and enhancing customer engagement. For Assured Guaranty, AI presents significant opportunities to sharpen risk assessment models, pinpoint developing market trends, and tailor offerings to individual issuers, thereby fostering a stronger competitive edge and greater operational efficiency.

The financial industry's investment in AI is substantial and growing. For instance, a 2024 report indicated that financial institutions globally are expected to spend over $15 billion on AI solutions, with a significant portion directed towards analytics and machine learning for risk management and customer service improvements. Assured Guaranty can leverage these advancements to gain deeper insights into complex financial instruments and predict potential credit events with greater accuracy.

- Enhanced Risk Assessment: AI algorithms can analyze vast datasets to identify subtle patterns and correlations indicative of credit risk, far beyond traditional methods.

- Market Trend Identification: Machine learning can process real-time market data to forecast economic shifts and identify emerging opportunities or threats for issuers.

- Personalized Issuer Solutions: AI can help tailor financial products and services to the specific needs and risk profiles of individual issuers, improving client relationships.

- Operational Efficiency: Automation of tasks like data analysis and compliance checks through AI can lead to significant cost savings and faster processing times.

Technological advancements are fundamentally reshaping Assured Guaranty's operational landscape. The company's ability to leverage sophisticated data analytics and AI for risk assessment and portfolio management is critical for its success. For example, in 2024, the financial services sector saw a 25% year-over-year increase in spending on AI-driven analytics tools, highlighting the industry's commitment to these technologies. This focus on technology enhances underwriting accuracy and proactive risk identification.

Cybersecurity remains a paramount technological concern, with global cybercrime costs projected to reach $10.5 trillion annually by 2025, according to industry forecasts. Assured Guaranty must continually invest in robust security measures to protect its sensitive data and maintain operational continuity against increasingly sophisticated threats like ransomware and data breaches. The financial sector, in particular, remains a prime target for these attacks.

Automation, powered by AI and machine learning, is streamlining Assured Guaranty's core functions, from underwriting to claims processing. Financial institutions adopting these technologies reported an average of 15-20% reduction in processing times in 2024. This efficiency gain not only cuts operational costs but also improves the company's capacity to scale and respond to market demands more effectively.

Emerging technologies like Blockchain and Digital Ledger Technology (DLT) present both opportunities and challenges. While DLT could enhance transparency and efficiency in capital markets, potentially reducing settlement times to T+0 as seen in pilot programs, it may also disrupt traditional intermediary roles. The global market for blockchain in financial services is expected to exceed $25 billion by 2025, signaling significant future development.

Legal factors

Assured Guaranty navigates a complex web of financial guaranty insurance regulations, which differ significantly across jurisdictions like U.S. state insurance departments and international regulatory bodies.

These rules dictate crucial aspects such as solvency margins, acceptable investment types, and expected business practices, directly influencing Assured Guaranty's operational freedom and how it structures its capital. For instance, in 2023, Assured Guaranty maintained robust capital levels, with its U.S. insurance subsidiaries consistently exceeding statutory capital and surplus requirements, demonstrating compliance with solvency mandates.

Federal and state bankruptcy laws, especially Chapter 9 for municipalities, are critical for Assured Guaranty. These laws directly shape how bondholders, including Assured Guaranty, recover funds if a municipality defaults. For instance, the process and priorities outlined in Chapter 9 can significantly impact the company's potential losses and the reserves it needs to hold.

Assured Guaranty's extensive involvement in Puerto Rico's debt restructuring, a complex process involving multiple legal frameworks, highlights the practical impact of these laws. The outcome of such cases can set precedents and influence future recovery rates for insured municipal bonds, making any shifts in bankruptcy law interpretation a key factor for the company's financial health.

Laws safeguarding bondholders and investors, such as stringent disclosure requirements and robust anti-fraud statutes, are fundamental to preserving the integrity of financial markets and bolstering investor trust in guaranteed debt. For Assured Guaranty, strict adherence to these regulations is not just a matter of compliance but a crucial element in preventing legal liabilities and reinforcing its standing as a dependable credit enhancer.

Antitrust and Competition Laws

Assured Guaranty, as a significant entity in the financial guaranty sector, operates under stringent antitrust and competition laws designed to foster fair market practices. Regulatory bodies closely monitor its market share and any proposed mergers or acquisitions to prevent monopolistic tendencies.

Violations of these laws can result in substantial penalties. For instance, in 2023, the European Commission fined several banks billions of euros for engaging in anti-competitive behavior in bond trading. While Assured Guaranty's specific fines aren't publicly detailed in this context, the precedent highlights the significant financial risks involved.

The company's strategic decisions, including its approach to pricing and product offerings, are scrutinized to ensure they do not stifle competition. Regulatory reviews of its market position are ongoing, particularly as the financial landscape evolves.

Key considerations for Assured Guaranty include:

- Market Share Scrutiny: Regulators monitor Assured Guaranty's dominant position to ensure it doesn't leverage its influence to disadvantage competitors.

- Merger and Acquisition Oversight: Any strategic consolidation by Assured Guaranty faces rigorous review to assess its impact on market competition.

- Compliance with Antitrust Regulations: Adherence to laws preventing price-fixing, bid-rigging, and other anti-competitive practices is paramount to avoid legal repercussions and reputational harm.

International Legal Frameworks

Assured Guaranty's global operations necessitate adherence to a complex web of international legal frameworks. This includes navigating the distinct contract law, financial services regulations, and corporate governance standards present in key markets such as the United Kingdom and Spain.

Failure to comply can lead to significant penalties and operational disruptions. For instance, the European Union's Solvency II directive, which sets capital requirements for insurers, directly impacts Assured Guaranty's European subsidiaries, demanding robust risk management and reporting structures.

Adapting to these varying legal landscapes is not merely a compliance exercise but a strategic imperative for Assured Guaranty's sustained global expansion and effective risk mitigation. The company's 2024 financial reports indicate a continued focus on legal and regulatory compliance across its international segments.

- UK Financial Services and Markets Act 2000: Governs Assured Guaranty's insurance and financial services activities within the United Kingdom.

- Spanish Corporate Law: Dictates corporate governance, reporting, and operational requirements for Assured Guaranty's Spanish entities.

- EU Solvency II Directive: Imposes stringent capital adequacy and risk management standards on Assured Guaranty's European insurance operations.

- International Contractual Enforcement: Assured Guaranty must understand and comply with varying legal principles for enforcing contracts across different jurisdictions.

Assured Guaranty's operations are heavily influenced by financial guaranty insurance regulations, which vary by U.S. state and international bodies, dictating solvency margins and investment types. For example, its U.S. subsidiaries consistently exceeded statutory capital and surplus requirements in 2023, demonstrating strong compliance with these solvency mandates.

Federal and state bankruptcy laws, particularly Chapter 9 for municipalities, are critical, shaping recovery processes for defaulted municipal bonds and influencing Assured Guaranty's reserve needs. The company's experience with Puerto Rico's debt restructuring underscores the significant impact of these legal frameworks on potential losses.

Antitrust and competition laws are also key, with regulators scrutinizing market share and acquisitions to prevent monopolistic practices. While specific fines for Assured Guaranty aren't detailed, the broader financial industry's penalties, such as billions in fines for bond trading anti-competitiveness in 2023, highlight the risks of non-compliance.

International legal frameworks, including contract law and financial services regulations in countries like the UK and Spain, alongside EU directives like Solvency II, are crucial for Assured Guaranty's global operations. The company's 2024 reports show a continued focus on navigating these diverse legal landscapes.

Environmental factors

Climate change presents indirect risks to Assured Guaranty by potentially affecting the financial stability of its municipal and infrastructure clients. For instance, the increasing frequency of extreme weather events like hurricanes and floods can strain local government budgets due to recovery costs and reduced tax revenues, impacting their ability to meet debt obligations. Assured Guaranty actively evaluates these climate-related vulnerabilities during its underwriting, ensuring it understands the potential strain on obligors.

Environmental regulations are constantly changing, impacting everything from pollution control to water management and the push for renewable energy. These shifts present a dual nature for Assured Guaranty: potential cost increases for certain municipal projects due to compliance, but also significant opportunities.

The growing demand for green bonds and financing for sustainable infrastructure projects is a key area where Assured Guaranty can leverage its expertise. For instance, the global green bond market saw substantial growth, with issuance reaching an estimated $500 billion in 2023 and projected to continue its upward trajectory in 2024 and 2025, driven by increased investor interest in ESG factors.

Assured Guaranty faces growing demands for detailed environmental, social, and governance (ESG) disclosures. Investors and regulators are pushing for more transparency regarding environmental impacts and how the company manages related risks. For instance, as of early 2024, a significant portion of institutional investors surveyed by PwC indicated they would divest from companies with poor ESG performance, highlighting the financial implications of transparency.

To meet these expectations, Assured Guaranty needs to bolster its reporting on environmental factors. This includes clearly outlining its approach to managing climate-related risks and its own operational footprint. By proactively showcasing its commitment to environmental stewardship, the company can strengthen its appeal to the rapidly expanding universe of ESG-focused investment funds, which saw global sustainable fund assets reach over $3.7 trillion by the end of 2023, according to Morningstar data.

Resource Scarcity and Infrastructure Resilience

Resource scarcity, such as water shortages or unreliable energy supplies, poses a significant risk to the long-term success and financial stability of infrastructure projects. These environmental factors directly influence the operational capacity and creditworthiness of assets Assured Guaranty insures. For instance, a municipality relying on a water-scarce region for its water treatment plant, which is backed by Assured Guaranty, faces increased operational costs and potential service disruptions.

Assured Guaranty's risk assessment must thoroughly evaluate the resilience of insured infrastructure against environmental stressors and the availability of critical resources. This includes analyzing how climate change projections might exacerbate water scarcity or impact energy grid stability in the areas where their insured projects are located. A 2024 report by the World Resources Institute highlighted that over 2 billion people live in countries experiencing high water stress, a figure expected to rise significantly by 2050, underscoring the growing importance of this factor.

Key considerations for Assured Guaranty include:

- Assessment of water dependency for infrastructure projects.

- Evaluation of energy source reliability and potential for supply disruptions.

- Analysis of climate change impacts on local resource availability.

- Review of disaster preparedness and resilience plans for insured assets.

Transition to a Green Economy

The global push for a greener economy offers Assured Guaranty significant opportunities. The company can play a vital role in securing financing for crucial projects like renewable energy installations, electric vehicle infrastructure, and climate-resilient public works. This aligns perfectly with Assured Guaranty's core mission of facilitating essential infrastructure development.

This transition can unlock new business avenues. For instance, the International Energy Agency (IEA) reported that global investment in clean energy reached an estimated $1.7 trillion in 2023, a figure projected to grow. Assured Guaranty could tap into this expanding market by guaranteeing bonds for these types of sustainable projects.

- Renewable Energy Bonds: Guaranteeing debt for solar, wind, and geothermal projects.

- Sustainable Infrastructure: Supporting financing for green transportation networks and resilient utilities.

- Climate-Resilient Projects: Facilitating investment in infrastructure designed to withstand climate change impacts.

Environmental factors present both risks and opportunities for Assured Guaranty, particularly concerning climate change and resource availability. The increasing frequency of extreme weather events can impact municipal clients' financial stability, while evolving environmental regulations create a need for greater ESG disclosure and transparency.

The company can capitalize on the growing demand for green bonds and sustainable infrastructure financing, a market that saw global issuance reach an estimated $500 billion in 2023 and is projected for continued growth through 2024 and 2025. Assured Guaranty's expertise in credit enhancement is well-suited to support this burgeoning sector.

Resource scarcity, such as water shortages, poses a direct risk to the operational capacity and creditworthiness of insured infrastructure projects. Assured Guaranty's underwriting process must thoroughly assess the resilience of these assets against environmental stressors and resource availability, especially given that over 2 billion people currently live in water-stressed countries.

| Environmental Factor | Risk to Assured Guaranty | Opportunity for Assured Guaranty |

|---|---|---|

| Climate Change & Extreme Weather | Financial strain on municipal clients due to recovery costs, impacting debt obligations. | Underwriting opportunities in climate-resilient infrastructure projects. |

| Environmental Regulations | Potential cost increases for projects needing to comply with new standards. | Growth in green bond market and financing for renewable energy projects. |

| Resource Scarcity (e.g., Water) | Impact on operational capacity and creditworthiness of insured infrastructure. | Supporting projects focused on water management and resource efficiency. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Assured Guaranty is built upon a robust foundation of data sourced from key financial regulators, credit rating agencies, and industry-specific publications. We meticulously track economic indicators, legislative changes, and market trends impacting the financial and insurance sectors.