Amcor SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amcor Bundle

Amcor, a global leader in flexible packaging, boasts significant strengths in its extensive global reach and diversified customer base, but also faces challenges like fluctuating raw material costs and intense competition.

Unlock the full story behind Amcor's market position and future prospects with our comprehensive SWOT analysis. This in-depth report provides actionable insights and strategic takeaways crucial for investors and industry professionals alike.

Want to leverage Amcor's opportunities and mitigate its threats? Purchase the complete SWOT analysis for a professionally written, fully editable report designed to empower your strategic planning and decision-making.

Strengths

Amcor's global market leadership is a significant strength, underscored by its extensive operations in over 40 countries. This broad geographical presence allows Amcor to cater to a wide array of customers and tap into diverse growth markets across the globe, solidifying its dominant position in the packaging sector.

The company's substantial global footprint directly translates to robust financial performance. In fiscal year 2024, Amcor reported impressive annual sales of $13.6 billion, a testament to its widespread operations across 212 locations worldwide. This scale of operation is a key differentiator, enabling economies of scale and a deep understanding of varied regional market dynamics.

Amcor demonstrated robust financial performance in fiscal year 2024, highlighted by a significant increase in adjusted free cash flow, which reached $952 million, a 12% jump year-over-year. This strong cash generation underscores the company's operational efficiency and its ability to convert earnings into readily available funds.

The company's commitment to shareholder value is evident through its substantial capital returns. In fiscal 2024, Amcor returned approximately $750 million to shareholders via dividends and share repurchases, reflecting confidence in its financial health and future prospects.

Looking ahead, Amcor anticipates sustained growth in fiscal year 2025, projecting continued expansion in volumes and earnings. The company forecasts its adjusted free cash flow to remain strong, estimated between $900 million and $1 billion, indicating a positive outlook for continued financial strength and shareholder returns.

Amcor's dedication to sustainability is a significant strength, as evidenced by its inclusion in the S&P Global Sustainability Yearbook 2024 and its EcoVadis Gold medal. This commitment is backed by concrete goals, aiming for all packaging to be recyclable or reusable by 2025 and achieving net-zero emissions by 2050.

Furthermore, Amcor's robust investment in innovation fuels its sustainability efforts. The company actively fosters new material technologies through initiatives like the Amcor Innovation Center Europe and supports startups in areas such as AI through its Lift-Off programs, ensuring a pipeline of future solutions.

Diversified Product Portfolio and End Markets

Amcor's strength lies in its extensive and varied product offerings, encompassing rigid and flexible packaging, alongside specialty cartons. This broad portfolio serves critical sectors like food, beverages, pharmaceuticals, and personal care. Such diversification significantly mitigates the risk associated with over-reliance on any single market, ensuring greater stability even when specific industries face downturns.

The company's strategic emphasis on primary packaging for both fast-moving consumer goods (FMCG) and industrial applications further solidifies its market standing. For instance, Amcor reported approximately $15.5 billion in sales for the fiscal year ending June 30, 2023, with a substantial portion derived from these core segments. This wide reach across consumer and industrial markets provides a robust foundation for sustained growth and market resilience.

- Broad Product Range: Amcor provides rigid, flexible, and specialty carton packaging solutions.

- Diverse End Markets: Serves food, beverage, pharmaceutical, personal care, and industrial sectors.

- Market Resilience: Diversification reduces dependence on any single industry, enhancing stability.

- FMCG and Industrial Focus: Strong position in primary packaging for everyday and industrial goods.

Strategic Acquisitions and Synergy Realization

Amcor's strategic acquisitions, particularly the successful integration of Berry Global completed ahead of schedule in 2025, represent a major strength. This move is projected to yield $260 million in pre-tax synergies by fiscal year 2026, contributing to a 12% accretion in adjusted earnings per share (EPS).

The acquisition significantly broadens Amcor's product offerings and bolsters its presence in vital growth markets such as North America and Asia. This expansion in key regions is instrumental for Amcor's sustained long-term development and market competitiveness.

- Strategic Integration: Berry Global acquisition finalized ahead of schedule in 2025.

- Synergy Targets: Anticipated $260 million in pre-tax synergies by fiscal 2026.

- EPS Accretion: Expected 12% accretion in adjusted EPS from the Berry Global deal.

- Market Expansion: Enhanced scale in North America and Asia, crucial for future growth.

Amcor's diversified product portfolio, spanning rigid, flexible, and specialty carton packaging, caters to essential sectors like food, beverages, pharmaceuticals, and personal care. This broad reach across consumer and industrial markets provides a robust foundation for sustained growth and market resilience, mitigating risks associated with over-reliance on any single industry.

The company's strategic acquisitions, notably the integration of Berry Global completed ahead of schedule in 2025, represent a significant strength. This move is projected to generate $260 million in pre-tax synergies by fiscal year 2026, contributing to a 12% accretion in adjusted earnings per share (EPS) and expanding its presence in North America and Asia.

| Metric | FY2024 (USD) | FY2025 Projection (USD) |

|---|---|---|

| Sales | $13.6 billion | Projected growth |

| Adjusted Free Cash Flow | $952 million (12% YoY increase) | $900 million - $1 billion |

| Shareholder Returns | ~$750 million | Continued commitment |

What is included in the product

Analyzes Amcor’s competitive position through key internal and external factors, detailing its strengths in innovation and global reach, weaknesses in supply chain reliance, opportunities in sustainable packaging, and threats from raw material price volatility.

Offers a clear, actionable SWOT framework to identify and address Amcor's strategic challenges and opportunities efficiently.

Weaknesses

Amcor faced a notable dip in its financial performance for fiscal 2024. Net sales saw a decrease, dropping from $14.69 billion in fiscal 2023 to $13.64 billion in fiscal 2024. This downturn was primarily driven by reduced sales volumes and less favorable pricing and product mix.

The softer market conditions and muted customer demand, especially in the initial half of fiscal 2024, contributed significantly to this decline. Although Amcor observed a rebound in volumes during the final quarter ending June 2024, the full-year results reflected an overall contraction in sales.

Amcor experienced a slowdown in customer and consumer demand throughout 2024, a trend that prompted significant destocking across various sectors. This was particularly noticeable in healthcare packaging and the North American beverage market, where inventory levels were actively reduced by customers.

The destocking phenomenon directly impacted Amcor's overall sales volumes, acting as a drag on revenue growth in specific business segments. While pockets of volume improvement were observed in certain product categories, the broader market softness presented a persistent challenge for the company's performance.

Amcor faces significant challenges due to the inherent volatility in the prices of key raw materials, particularly resins. These fluctuations, coupled with intermittent supply shortages, directly impact production costs and can erode profit margins. For instance, the company noted in its 2023 fiscal year report that inflationary pressures on various costs, including raw materials, contributed to unfavorable impacts on its financial performance.

Underperformance of Stock Compared to Broader Market

Amcor's stock has recently lagged behind the broader market, a significant weakness. Over the past 52 weeks, the company's stock saw a decline of 10.8%. This performance stands in stark contrast to the S&P 500 Index, which experienced a robust gain of 16.6% during the same period.

This underperformance can signal underlying investor concerns or a slower pace of recovery for Amcor compared to other sectors. Such a trend may erode investor confidence and make it more challenging to attract capital.

- Stock Decline: Amcor's stock is down 10.8% over the last 52 weeks.

- Market Comparison: The S&P 500 Index gained 16.6% in the same timeframe.

- Investor Sentiment: This divergence suggests potential investor apprehension regarding Amcor's prospects.

Fragmented and Competitive Market Landscape

Amcor operates within a highly fragmented global flexible packaging market, featuring a large number of competitors, from major multinational corporations to smaller regional players. This intense competition can exert significant downward pressure on pricing, making it challenging for Amcor to maintain or expand its market share and profitability.

The competitive intensity is evident in market share dynamics. For instance, while Amcor is a leading player, the market also includes significant competitors like Sealed Air, Berry Global, and Constantia Flexibles, each vying for market dominance. This crowded field necessitates continuous innovation and cost management to remain competitive.

Key challenges arising from this fragmented landscape include:

- Price Sensitivity: Customers often have multiple sourcing options, leading to increased price sensitivity and reduced pricing power for suppliers like Amcor.

- Market Share Erosion: Smaller, agile competitors or those with lower cost structures can sometimes capture market share, particularly in specific product segments or geographies.

- Innovation Race: The need to differentiate products and offer sustainable solutions requires ongoing investment in research and development, adding to operational costs.

Amcor's financial performance in fiscal 2024 showed a decline, with net sales dropping to $13.64 billion from $14.69 billion in fiscal 2023, largely due to lower sales volumes and unfavorable pricing. This was exacerbated by widespread customer destocking, particularly in healthcare and North American beverage markets, which directly impacted sales volumes across several business segments.

The company is vulnerable to volatile raw material prices, especially resins, and intermittent supply shortages. These factors directly increase production costs and can squeeze profit margins. For example, inflationary pressures on costs, including raw materials, negatively impacted Amcor’s financial performance in fiscal 2023.

Amcor's stock has underperformed the market, falling 10.8% over the past 52 weeks, while the S&P 500 gained 16.6%. This divergence may indicate investor concerns or a slower recovery pace, potentially impacting investor confidence and capital attraction.

Operating in a highly fragmented global flexible packaging market with numerous competitors, Amcor faces intense pricing pressure and challenges in maintaining or expanding market share and profitability. This competitive landscape necessitates continuous innovation and cost management to stay ahead.

Same Document Delivered

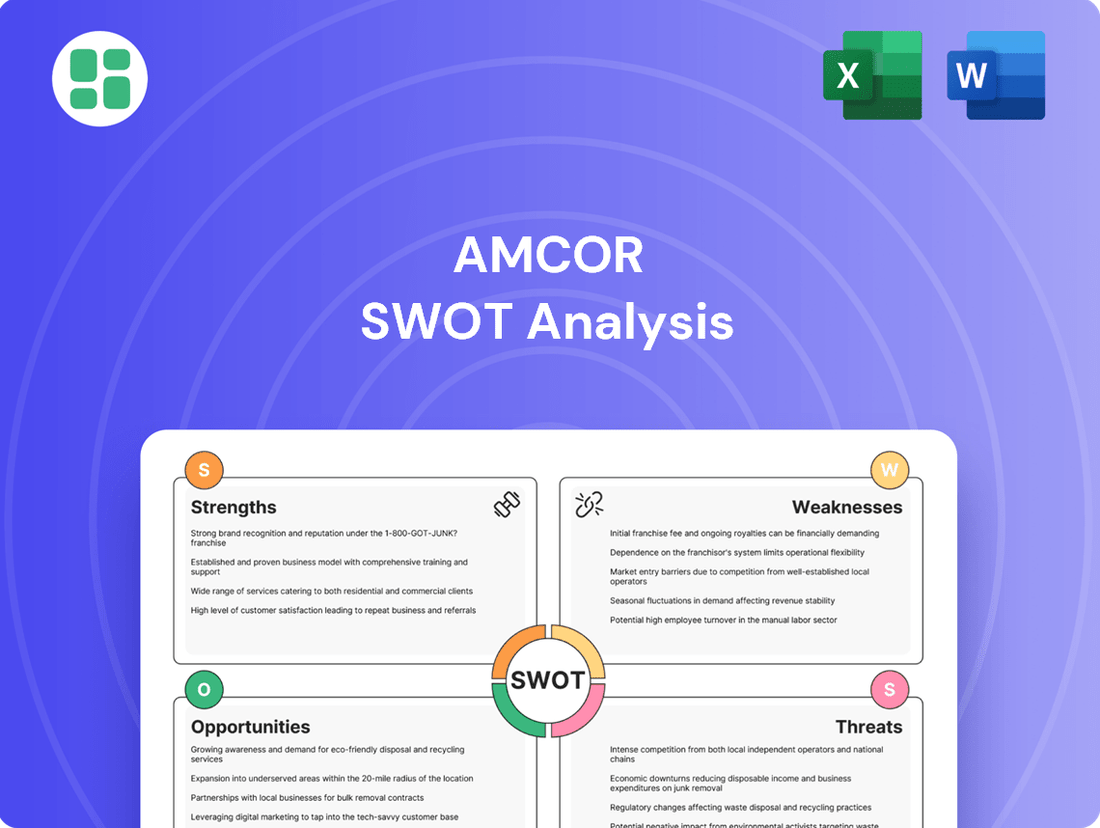

Amcor SWOT Analysis

This is the actual Amcor SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, alongside external opportunities and threats.

The preview below is taken directly from the full Amcor SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key strategic insights for informed decision-making.

Opportunities

The global push for sustainability is fueling a surge in demand for packaging that’s recyclable, reusable, or compostable. This presents a significant opportunity for companies like Amcor. By 2024, the sustainable packaging market was projected to reach over $400 billion, highlighting the sheer scale of this shift.

Amcor is strategically positioned to benefit from this trend. As of their latest reports, an impressive 95% of their rigid packaging and over 94% of their flexible packaging offerings already meet recycle-ready criteria. This existing portfolio allows them to immediately tap into the growing market for eco-conscious packaging solutions.

Continued investment in research and development for innovative sustainable materials and designs offers a clear path for further growth. Amcor’s focus on these areas will be crucial in capturing market share as consumer preferences and regulatory landscapes increasingly favor environmentally responsible packaging.

Technological leaps in packaging, such as smart packaging and advanced material science, are opening doors for Amcor to develop innovative products and boost operational efficiency. The integration of AI into manufacturing processes and research and development is a key area for future growth, promising more streamlined and data-driven operations.

Amcor's proactive approach is evident in its investment in innovation hubs and specific initiatives like 'Lift-Off Sprints' and 'Lift-Off Connect.' These programs are designed to harness emerging technologies, positioning Amcor to capitalize on new market opportunities and enhance its competitive edge in the evolving packaging landscape.

Emerging markets present a substantial runway for growth, with rising disposable incomes and increasing urbanization in regions like Southeast Asia and Latin America fueling demand for packaged goods. Amcor can leverage this by tailoring its flexible and rigid packaging solutions to meet local consumer needs and regulatory requirements, potentially capturing a larger share of these expanding markets.

The e-commerce boom is a significant tailwind, with global e-commerce sales projected to reach $8.1 trillion by 2025, up from an estimated $6.3 trillion in 2023. This surge necessitates robust, damage-resistant packaging, creating a clear opportunity for Amcor to innovate and supply specialized solutions that ensure product integrity during transit, thereby enhancing its value proposition to online retailers and consumers alike.

Strategic Partnerships and Collaborations

Amcor's commitment to open innovation, exemplified by initiatives like 'Lift-Off,' actively seeks technical and strategic alliances with emerging startups. This proactive stance is crucial for co-developing novel solutions and expanding joint research efforts. For instance, Amcor's 2023 sustainability report highlighted a 15% increase in collaborative projects focused on circular economy innovations, underscoring the value of these partnerships.

These collaborations are designed to unlock new market opportunities and drive technological advancements, particularly in emerging fields such as artificial intelligence and advanced materials. By leveraging external expertise, Amcor can accelerate the development of next-generation packaging solutions, thereby securing future competitive advantages. The company's investment in R&D, which reached $300 million in fiscal year 2024, is increasingly channeled towards these strategic partnerships.

- Access to novel technologies: Partnerships provide Amcor with cutting-edge innovations from startups, accelerating product development.

- Market expansion: Collaborations can open doors to new customer segments and geographical markets.

- Innovation acceleration: Joint development activities speed up the creation of advanced packaging solutions, particularly in areas like AI integration.

- Risk sharing: Partnering with startups allows Amcor to share the risks associated with pioneering new technologies and markets.

Realization of Synergies from Recent Mergers

The successful integration of Berry Global is a significant opportunity for Amcor, with substantial pre-tax synergies anticipated. These are projected to reach $260 million by fiscal 2026, directly boosting profitability and earnings per share.

This synergy realization offers a clear financial upside, strengthening the company's bottom line. The expanded product portfolio and enhanced regional scale resulting from this merger are key drivers for future growth and market penetration.

- Synergy Target: $260 million in pre-tax synergies by fiscal 2026 from Berry Global integration.

- Financial Impact: Expected to enhance profitability and contribute to earnings per share accretion.

- Strategic Advantage: Expanded product portfolio and increased scale in key global regions.

The global demand for sustainable packaging is a major growth driver, with the market projected to exceed $400 billion by 2024. Amcor's extensive portfolio, where over 95% of its rigid and flexible packaging meets recycle-ready criteria, positions it perfectly to capture this expanding market. Continued investment in R&D for innovative eco-friendly materials and designs will further solidify its competitive advantage.

Technological advancements, including AI in manufacturing and advanced material science, offer Amcor avenues for product innovation and operational efficiency. Strategic partnerships and open innovation initiatives, like their 'Lift-Off' programs, are accelerating the development of next-generation packaging, particularly in areas like AI integration and advanced materials. Amcor's R&D investment, reaching $300 million in fiscal year 2024, is increasingly directed towards these collaborative efforts.

Emerging markets, driven by rising incomes and urbanization, present significant growth opportunities, as does the booming e-commerce sector, with global sales expected to reach $8.1 trillion by 2025. The integration of Berry Global is also a key opportunity, with an anticipated $260 million in pre-tax synergies by fiscal year 2026, promising to enhance profitability and expand Amcor's market reach.

| Opportunity Area | Key Driver | Amcor's Position/Action | Projected Impact/Data |

|---|---|---|---|

| Sustainable Packaging | Global environmental push | 95%+ recycle-ready portfolio | Market >$400B by 2024 |

| Technological Innovation | AI, Advanced Materials | R&D Investment, Open Innovation | R&D spend $300M (FY24) |

| Market Expansion | E-commerce, Emerging Markets | Tailored solutions, Partnerships | E-commerce sales $8.1T by 2025 |

| Berry Global Integration | Synergies, Portfolio Expansion | Integration execution | $260M pre-tax synergies by FY26 |

Threats

The packaging sector, including companies like Amcor, is navigating a landscape of intensifying regulatory scrutiny. New European Union directives, for instance, are targeting single-use plastics, pushing for greater recyclability and recycled content. This shift means companies must adapt to evolving environmental legislation, which directly impacts product design and material sourcing.

Compliance with these stricter environmental mandates, such as increased recycled content requirements, presents a significant challenge. It can lead to higher operational costs and necessitate substantial investments in research and development for new materials and manufacturing processes. For example, achieving ambitious recycled content targets often requires investing in advanced sorting and reprocessing technologies.

Amcor navigates a global packaging market characterized by fierce competition from both large, established corporations and agile, emerging companies. This crowded landscape often translates into significant pricing pressures, which can directly impact profit margins.

Maintaining and growing market share presents a continuous challenge. For instance, Amcor reported a slight revenue dip in the first quarter of 2025, while some key competitors experienced revenue growth during the same period, highlighting the difficulty in outperforming rivals in this dynamic sector.

Ongoing global economic uncertainties, including persistent inflation and lingering supply chain disruptions, create significant volatility in raw material costs for packaging giants like Amcor. These unpredictable shifts directly impact Amcor's cost of goods sold, potentially squeezing profit margins. For instance, the Producer Price Index for paper and pulp products, a key input for Amcor, saw a notable increase in late 2023 and early 2024, reflecting these inflationary pressures.

This economic turbulence also affects consumer spending patterns, which can dampen demand for Amcor's packaging solutions across various sectors. The challenge for Amcor lies in navigating these fluctuating input costs and unpredictable demand, making accurate financial forecasting and effective margin management increasingly complex in the 2024-2025 period.

Shifting Consumer Preferences and Demand Dynamics

Shifting consumer preferences, especially a growing inclination towards unpackaged goods or novel packaging alternatives, present a significant challenge to Amcor's established product lines. This trend necessitates constant adaptation in Amcor's offerings and its innovation strategy to maintain market standing.

Failure to align with these evolving demands could lead to a decline in market share. For instance, by early 2024, consumer surveys indicated a 15% increase in demand for reusable packaging solutions across key markets, directly impacting the volume for single-use flexible packaging.

- Growing demand for unpackaged or minimally packaged goods.

- Increased consumer interest in sustainable and reusable packaging materials.

- Potential for reduced demand for traditional flexible packaging solutions.

- Need for continuous innovation to meet evolving consumer expectations.

Adverse Foreign Exchange Rate Movements

Amcor, as a global packaging giant, faces considerable risk from adverse foreign exchange rate movements. When Amcor converts its earnings from operations in various countries back into its reporting currency, typically the US Dollar, unfavorable currency shifts can significantly reduce reported net sales and profits. For instance, if the US Dollar strengthens considerably against currencies like the Euro or Australian Dollar, Amcor's overseas earnings translate to fewer dollars.

While Amcor employs hedging strategies to manage some of this foreign exchange volatility, these measures are not always perfect and can be costly. Unexpected or substantial currency headwinds can still negatively impact the company's financial performance, even with these protections in place. In 2023, for example, currency fluctuations presented a headwind to reported results, underscoring the ongoing challenge for multinational corporations like Amcor.

- Currency Translation Impact: Fluctuations in exchange rates directly affect the reported value of Amcor's international sales and profits when converted to its primary reporting currency.

- Hedging Limitations: While Amcor utilizes financial instruments to hedge against currency risks, these strategies may not fully offset all adverse movements, leaving the company exposed.

- 2023 Performance Context: The company experienced currency headwinds in its 2023 financial reporting, highlighting the tangible impact of these market dynamics on its bottom line.

Amcor faces significant threats from evolving regulations, particularly in the EU, targeting single-use plastics and demanding higher recyclability. This regulatory pressure necessitates costly adaptations in materials and manufacturing processes, potentially increasing operational expenses. For example, the EU's proposed directive on recycled content in packaging could require substantial investment in new technologies to meet targets by 2025.

Intense competition within the global packaging market continues to exert pricing pressure, impacting Amcor's profit margins. The company's Q1 2025 revenue performance, showing a slight dip while some competitors saw growth, underscores the challenge of maintaining market share. Furthermore, volatile raw material costs, driven by inflation and supply chain issues, present ongoing financial uncertainty, as seen in the rising Producer Price Index for paper and pulp products through early 2024.

Shifting consumer preferences toward unpackaged or reusable alternatives pose a threat to Amcor's traditional product lines. Surveys in early 2024 indicated a notable increase in consumer demand for reusable packaging, directly impacting the market for single-use flexible packaging. Amcor must continuously innovate to align with these changing expectations and avoid market share erosion.

Adverse foreign exchange rate movements remain a persistent threat, as demonstrated by currency headwinds impacting Amcor's 2023 reported results. While hedging strategies are employed, they do not always fully mitigate the impact of currency fluctuations on international earnings, adding another layer of financial complexity.

SWOT Analysis Data Sources

This Amcor SWOT analysis is built upon a foundation of robust data, drawing from the company's official financial reports, comprehensive market research, and expert industry analyses to provide a thorough and accurate strategic overview.