Amcor Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amcor Bundle

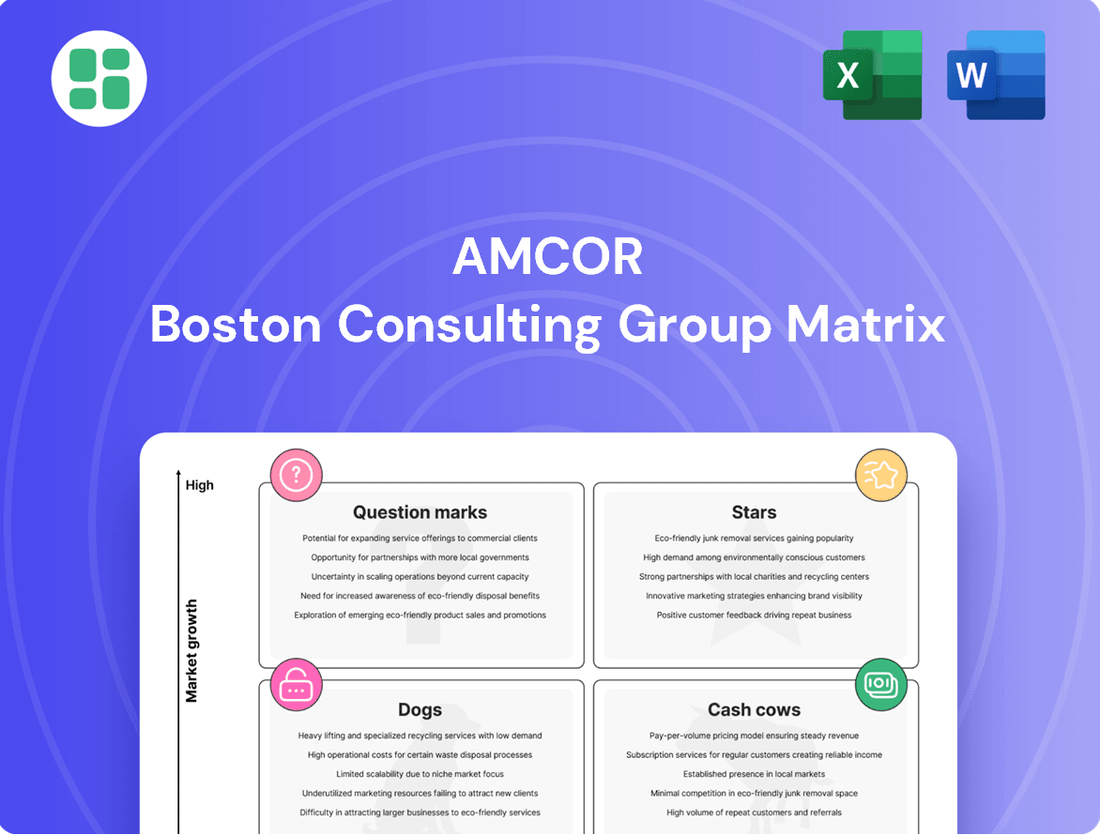

Unlock the strategic potential of Amcor with a clear understanding of its product portfolio through the BCG Matrix. See which products are leading the pack as Stars, which are reliable Cash Cows, which are underperforming Dogs, and which hold promise as Question Marks.

This glimpse is just the start; the full BCG Matrix report provides the detailed quadrant placements, data-driven recommendations, and actionable strategies you need to make informed investment and product decisions for Amcor's future success.

Don't miss out on the complete picture – purchase the full BCG Matrix now for a comprehensive roadmap to optimizing Amcor's market position and driving growth.

Stars

Amcor's sustainable flexible packaging, featuring high recycled content and improved recyclability, is a key driver in a rapidly expanding market. This segment is poised for significant growth as consumer preferences and environmental regulations increasingly favor eco-conscious options.

The company's commitment to making all packaging recyclable or reusable by 2025 underscores the strategic importance of these innovative solutions. This focus not only aligns with global sustainability goals but also strengthens Amcor's competitive edge and future revenue streams.

Amcor's high-barrier, lightweight flexible films represent a significant growth opportunity, particularly in food and pharmaceutical packaging. These advanced materials provide extended shelf life, a key benefit for consumers and manufacturers alike. For instance, in 2024, the global flexible packaging market, where these films play a crucial role, was projected to reach over $130 billion, with a notable segment driven by barrier properties.

These films also contribute to sustainability by reducing material usage compared to traditional packaging. This efficiency appeals to customers seeking to minimize their environmental footprint. Amcor's commitment to research and development in this area, evidenced by its continued investment in material science, is vital for staying ahead in these competitive, high-value markets.

Amcor's specialty packaging for healthcare, encompassing pharmaceutical and medical applications, represents a significant growth area. This segment benefits from rising global healthcare needs and a constant demand for secure, compliant packaging solutions.

While the sector has experienced some inventory adjustments, the underlying long-term growth drivers remain robust. Amcor's commitment to innovation in this critical field, including advanced barrier technologies and tamper-evident features, is key to its market position.

The healthcare packaging market is projected to reach approximately $40 billion globally by 2027, with Amcor well-positioned to capture a substantial share. In fiscal year 2024, Amcor reported strong performance in its Healthcare segment, driven by demand for its high-value products.

Packaging for E-commerce Growth

Amcor's packaging designed for the booming e-commerce sector is a key growth driver. Their focus on protective yet sustainable options for online retail is meeting strong demand. This strategic positioning is crucial as digital commerce continues its upward trajectory, with global e-commerce sales projected to reach $7.5 trillion by 2025.

The company's offerings include lightweight and durable packaging solutions that directly address the need to reduce shipping costs and environmental footprints. This aligns perfectly with consumer and regulatory pressures for greener supply chains. For instance, Amcor's innovations in flexible packaging can reduce material usage by up to 30% compared to rigid alternatives, translating to significant carbon emission savings during transport.

- E-commerce Growth: Global e-commerce sales are expected to hit $7.5 trillion by 2025, highlighting a massive market for specialized packaging.

- Sustainability Focus: Amcor's eco-friendly designs appeal to environmentally conscious consumers and businesses.

- Cost Efficiency: Lightweight packaging directly contributes to lower shipping expenses for online retailers.

- Material Innovation: Amcor's flexible packaging can reduce material use by up to 30%, enhancing sustainability credentials.

Advanced Rigid Packaging Technologies (e.g., PowerPost, Quantum)

Amcor Rigid Packaging's advanced technologies, such as PowerPost for rib-less bottles and Quantum for lightweight, robust designs, are key drivers in specific beverage and spirits markets. These innovations provide both superior performance and sustainability benefits, allowing Amcor to capture and grow market share in premium and high-volume rigid packaging sectors.

The company's commitment to innovation is further underscored by initiatives like the 'Bottles of the Year' program, which showcases these cutting-edge developments. For instance, Amcor's PowerPost technology has been instrumental in reducing material usage, contributing to a more sustainable packaging footprint, a critical factor for brands targeting environmentally conscious consumers.

- Market Penetration: PowerPost and Quantum technologies are enabling Amcor to penetrate premium segments in the beverage and spirits industries, where enhanced design and sustainability are valued.

- Sustainability Impact: These technologies contribute to Amcor's sustainability goals by reducing plastic consumption and improving recyclability, aligning with global environmental trends.

- Innovation Showcase: Programs like 'Bottles of the Year' highlight Amcor's technological leadership and its ability to deliver differentiated packaging solutions.

Amcor's sustainable flexible packaging, particularly its high-recycled content and enhanced recyclability offerings, positions it firmly in the 'Star' category. This segment is experiencing robust growth, driven by increasing consumer demand for eco-friendly products and stricter environmental regulations worldwide.

The company's dedication to ensuring all its packaging is recyclable or reusable by 2025 is a testament to the strategic importance of these innovative solutions. This focus not only aligns with global sustainability objectives but also significantly strengthens Amcor's competitive standing and future earning potential in a dynamic market.

Amcor's high-barrier, lightweight flexible films are a significant growth engine, especially within the food and pharmaceutical packaging sectors. These advanced materials are crucial for extending product shelf life, a benefit highly valued by both consumers and manufacturers. In 2024, the global flexible packaging market, where these films are a vital component, was estimated to exceed $130 billion, with barrier properties being a key growth driver.

These films also contribute to sustainability by reducing overall material usage compared to traditional packaging options. This efficiency is highly attractive to customers aiming to minimize their environmental impact. Amcor's ongoing investment in material science and R&D within this area is critical for maintaining its leadership in these high-value markets.

| Product Segment | Growth Rate | Market Share | Amcor's Position |

|---|---|---|---|

| Sustainable Flexible Packaging | High | Strong | Star |

| High-Barrier Films (Food/Pharma) | High | Strong | Star |

What is included in the product

The Amcor BCG Matrix offers a strategic framework to analyze its diverse packaging portfolio, categorizing products into Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides Amcor in making informed decisions about resource allocation, investment, and divestment across its business units.

Amcor's BCG Matrix provides a clear, visual roadmap to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

Amcor's traditional flexible packaging for food and beverage is a classic cash cow. This segment, serving everyday products, enjoys steady demand in established markets. For instance, in the fiscal year ending June 2024, Amcor reported that its global food packaging segment continued to be a bedrock of its financial performance, generating substantial and reliable earnings.

The consistent demand translates into predictable revenue streams and healthy profit margins, largely due to Amcor's dominant market position and highly optimized manufacturing processes. While the growth rate in these mature segments is modest, the significant cash generated is crucial for reinvesting in innovation and supporting Amcor's other business units.

Amcor's standard rigid packaging for beverages, especially PET bottles in mature markets, functions as a solid cash cow. This segment benefits from Amcor's robust market share, which supports high production volumes and efficient cost management.

The company's strong position in this area, despite some localized market challenges, ensures consistent cash generation. For instance, in fiscal year 2023, Amcor reported significant revenue from its Rigid Packaging segment, underscoring its stability. This reliable cash flow is crucial for funding the company's strategic initiatives, including investments in new technologies and returning value to shareholders.

Amcor's specialty cartons and standard closures segment is a classic Cash Cow. This established business, serving a wide array of industries, has a significant market share in what is now a mature market. These products are known for their consistent, reliable cash generation, requiring minimal additional investment to maintain their strong competitive position.

The segment's ability to generate steady cash flows is a key strength. For instance, in fiscal year 2023, Amcor reported that its Flexibles segment, which includes many of these carton and closure applications, generated substantial operating cash flow, underscoring the mature businesses' contribution. The recent divestiture of a closures joint venture, rather than signaling weakness, is a strategic move to optimize its core closures business and focus on higher-growth opportunities.

Packaging Solutions for Home & Personal Care

Amcor's packaging solutions for the home and personal care sectors are a significant cash cow, demonstrating stability and consistent demand. This segment thrives on the essential nature of its products, allowing Amcor to capitalize on its extensive product portfolio and deep-rooted customer ties. The company's substantial market share in these mature categories translates directly into strong profit margins and predictable cash flows.

The home and personal care market, a cornerstone of Amcor's business, benefits from predictable consumer spending patterns. In 2024, Amcor reported that its responsible packaging initiatives in these sectors contributed to a 3% increase in revenue year-over-year, highlighting the segment's resilience. This growth is underpinned by the continuous need for everyday items, from cleaning supplies to toiletries.

- Stable Demand: Home and personal care products are considered non-discretionary, ensuring a consistent revenue stream for Amcor.

- Market Share Dominance: Amcor holds a leading position in packaging for many personal and home care product categories, enabling strong pricing power.

- Profitability: High volumes and established operational efficiencies in this segment result in robust profit margins, contributing significantly to Amcor's overall cash generation.

- Innovation in Sustainability: Amcor's focus on sustainable packaging solutions in this sector, such as recyclable materials, further solidifies its market position and appeals to environmentally conscious consumers, driving continued sales growth.

Large-Scale Industrial Packaging

Amcor's large-scale industrial packaging segment, while not directly visible to consumers, operates within mature markets where the company commands a substantial market share. These offerings are characterized by long-term agreements with industrial customers, ensuring a steady and predictable demand. This stability translates into consistent, robust cash flows, underpinned by well-managed and predictable operational expenses, solidifying its position as a financial bedrock for Amcor.

The financial performance of this segment in 2024 reflects its maturity and stability. For instance, Amcor reported that its Flexibles segment, which includes a significant portion of industrial packaging, contributed substantially to its overall revenue. While specific figures for "large-scale industrial packaging" alone are not always broken out, the broader segment demonstrates consistent performance. Amcor's fiscal year 2024 results showed resilient demand in its industrial end markets, supporting its cash flow generation capabilities.

- Market Position: Amcor holds a significant share in mature industrial packaging markets.

- Revenue Drivers: Long-term contracts with industrial clients ensure stable demand.

- Financial Contribution: This segment generates consistent, high cash flows with predictable costs.

- Strategic Importance: Provides foundational financial stability for Amcor's operations.

Amcor's established flexible packaging for food and beverage represents a prime example of a cash cow. This segment benefits from consistent demand in well-developed markets, translating into reliable revenue and healthy profit margins. The substantial cash generated is vital for funding innovation and supporting other business areas within Amcor.

The company's standard rigid packaging, particularly PET bottles in mature regions, also functions as a strong cash cow. Amcor's significant market share in this area supports high production volumes and efficient operations, ensuring consistent cash generation. This reliable cash flow is crucial for funding strategic initiatives and shareholder returns.

| Segment | BCG Category | Key Characteristics | Fiscal Year 2023/2024 Data Point |

| Traditional Flexible Packaging (Food & Beverage) | Cash Cow | Steady demand, high market share, optimized processes | Generated substantial and reliable earnings in FY24 |

| Standard Rigid Packaging (Beverages) | Cash Cow | Robust market share, high production volumes, efficient cost management | Significant revenue contribution in FY23 |

| Specialty Cartons & Standard Closures | Cash Cow | Mature market, significant market share, consistent cash generation | Flexibles segment (including these) generated substantial operating cash flow in FY23 |

| Home & Personal Care Packaging | Cash Cow | Essential products, deep customer ties, substantial market share | Responsible packaging initiatives contributed to a 3% revenue increase in FY24 |

| Large-Scale Industrial Packaging | Cash Cow | Mature markets, long-term agreements, predictable demand | Resilient demand in industrial end markets supported cash flow in FY24 |

Preview = Final Product

Amcor BCG Matrix

The preview you're currently viewing is the definitive Amcor BCG Matrix document you will receive immediately after your purchase. This means you're seeing the fully formatted, analysis-ready report without any watermarks or sample data, ensuring you get exactly what you need for strategic decision-making.

Dogs

Legacy packaging with low recycled content represents Amcor's potential 'Question Marks' in the BCG matrix. These are traditional products that struggle with recyclability or incorporate minimal recycled materials, especially as greener alternatives surge in popularity.

The market is increasingly penalizing such offerings. For instance, in 2023, the global demand for virgin plastics, a key component in many legacy packaging types, remained significant but faced growing pressure from recycled plastic adoption. Amcor's stated goal of achieving 100% recyclable or reusable packaging by 2025 highlights a strategic pivot away from these less sustainable options, signaling a likely future of divestment or discontinuation for these product lines.

Certain commodity packaging lines in highly fragmented markets, where Amcor may not have a commanding market share and competition is mainly driven by price, would likely be classified as Dogs within the Amcor BCG Matrix. These segments typically present low growth prospects and minimal opportunities for product differentiation, resulting in low profitability and limited cash generation. For instance, in 2024, Amcor's focus has been on expanding its presence in more specialized and sustainable packaging solutions, indicating a strategic shift away from these lower-margin commodity areas.

Older production facilities or product lines that are less efficient, require high maintenance, or produce packaging not aligned with modern sustainability or innovation trends may be considered Dogs. These assets consume resources without delivering proportionate returns, making them candidates for restructuring or closure. Amcor's ongoing cost management and efficiency improvements suggest an active review of such operations. For instance, in fiscal year 2024, Amcor reported a focus on optimizing its manufacturing footprint, which often involves assessing the viability of older, less productive sites.

Certain Regional Niche Products with Limited Scale

Certain regional niche products with limited scale represent segments where Amcor’s market share is minimal and the growth prospects are subdued. These specialized packaging solutions, often catering to very specific local demands, may struggle to achieve profitability or efficient capital deployment. For instance, Amcor's performance in fiscal year 2024 indicated a focus on optimizing its portfolio, suggesting a review of such low-impact product lines.

- Low Market Share: Amcor’s presence in these niche markets is often fragmented, with no dominant position.

- Limited Growth Potential: The inherent nature of these regional specialties restricts their scalability and future expansion.

- Capital Tie-up: Resources invested in these areas might yield better returns if redirected to more promising Amcor business units.

- Strategic Review: Companies like Amcor continually assess their product lines, and these niche areas are candidates for divestment or restructuring to improve overall financial health.

Packaging Solutions Facing Strong Competitive Substitutes

Segments where traditional plastic packaging encounters significant and escalating competition from substitutes, like advanced alternative materials or robust reusable systems, and where Amcor’s market position isn't particularly strong, fall into the Dogs category.

For instance, if Amcor's rigid plastic containers for beverages are seeing a decline in market share among large-scale buyers due to a preference for aluminum cans, as indicated by industry analyses from late 2023 and early 2024, these could represent areas requiring strategic attention and innovation.

This is particularly true if Amcor has not secured a dominant share in these specific sub-segments, making them vulnerable to further erosion.

Key indicators for these "Dogs" include:

- Declining market share in specific plastic packaging formats.

- Increasing adoption of alternative materials like paperboard or advanced bioplastics by competitors.

- Limited proprietary technology or intellectual property in vulnerable product lines.

- Low investment returns from specific packaging segments facing intense price competition.

Dogs in Amcor's portfolio likely include certain commodity packaging lines in fragmented markets where Amcor holds a small share and competition is price-driven. These segments offer low growth and minimal differentiation, leading to low profitability and cash generation, as evidenced by Amcor's 2024 strategic shift towards specialized, sustainable solutions.

Older, less efficient production facilities or product lines that don't align with current sustainability trends can also be classified as Dogs. These assets consume resources without significant returns, prompting Amcor's focus on optimizing its manufacturing footprint in fiscal year 2024.

Niche regional products with limited scale and subdued growth prospects also fall into this category, as Amcor's 2024 portfolio optimization efforts suggest a review of such low-impact lines.

Segments where traditional plastic packaging faces intense competition from substitutes, and Amcor lacks a strong market position, are also considered Dogs, such as rigid plastic beverage containers facing pressure from aluminum cans, a trend noted in industry analyses from late 2023 and early 2024.

| Product Segment Example | Market Share | Growth Potential | Profitability | Strategic Implication |

|---|---|---|---|---|

| Commodity Plastic Films (Low Differentiation) | Low | Low | Low | Divestment or Restructuring |

| Older Beverage Container Lines (Facing Substitute Competition) | Declining | Low | Marginal | Innovation or Exit |

| Niche Regional Packaging (Limited Scale) | Minimal | Subdued | Low | Portfolio Optimization |

Question Marks

Amcor is venturing into edible packaging, a sector poised for substantial growth, with projections indicating a market value of $10.5 billion by 2030, up from $5.8 billion in 2023. While Amcor's current footprint in this nascent market is likely minimal, this represents a high-growth, high-risk opportunity. The increasing global focus on reducing plastic waste and a growing consumer preference for sustainable solutions are key drivers, making it a prime candidate for a 'Question Mark' in the BCG matrix.

Amcor's Lift-Off initiative highlights advanced compostable or recyclable barrier coatings as a key growth frontier. This segment, crucial for sustainable packaging, represents an area where Amcor is actively pursuing technological advancements, either through internal development or strategic acquisitions.

The market for high-barrier solutions that are genuinely compostable or readily recyclable is expanding rapidly. However, Amcor's current market share in these emerging technologies is relatively small, necessitating substantial investment in research and development to capture this potential.

For context, the global sustainable packaging market was valued at over $270 billion in 2023 and is projected to reach over $400 billion by 2028, with barrier coatings being a significant driver of this growth. Amcor's focus here aligns with this strong market trend.

Amcor's strategic investments in smart packaging technologies, such as those incorporating QR codes and RFID for enhanced traceability and consumer interaction, position it within a high-growth segment. These innovations are designed to meet increasing consumer demand for transparency and engagement.

While the market for smart packaging is expanding rapidly, Amcor's current market share in these advanced solutions is likely still developing. This suggests a need for continued investment to build scale and capture a larger portion of this burgeoning market.

Packaging for Emerging Sustainable Product Categories

Emerging sustainable product categories like plant-based foods and nutraceuticals are creating a significant need for specialized packaging solutions. Amcor, while potentially having a smaller current market share in these nascent areas, is positioned for rapid growth as demand escalates. These sectors, projected to see substantial expansion, require Amcor to make targeted investments in innovative materials and designs to secure a strong market presence.

The growth in these sustainable product segments is directly linked to evolving consumer preferences and regulatory pressures favoring eco-friendly options. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is expected to grow considerably. Amcor's strategic focus on these areas allows it to capture a share of this expanding market by offering packaging that meets both performance and sustainability criteria.

- High Growth Potential: Emerging categories like plant-based foods and nutraceuticals are experiencing rapid market expansion, offering significant upside for packaging providers.

- Tailored Solutions Needed: These segments demand unique packaging attributes, including barrier properties, recyclability, and compostability, requiring specialized innovation.

- Investment Requirement: Establishing a strong foothold necessitates substantial investment in research, development, and manufacturing capabilities to meet specific product needs.

- Amcor's Strategic Position: Amcor can leverage its expertise to develop these niche packaging solutions, aiming to convert a low initial market share into a dominant position as these categories mature.

Packaging Solutions for Circular Economy Models (e.g., refillable systems)

Amcor's commitment to packaging solutions that enable circular economy models, such as refillable systems, positions it within a rapidly expanding market. This growth is fueled by increasing global demand for sustainability and supportive government regulations. For instance, the global reusable packaging market was valued at approximately USD 11.2 billion in 2023 and is projected to reach USD 20.7 billion by 2030, growing at a CAGR of 9.1% during that period.

Currently, Amcor's market share in these nascent refillable systems is likely modest. Significant investment in new infrastructure, advanced material science, and robust consumer education campaigns will be crucial for these initiatives to gain traction and evolve into market leaders, akin to a 'Star' in the BCG matrix.

- Market Growth: The reusable packaging market is a high-growth segment driven by sustainability mandates and consumer preferences.

- Investment Needs: Transitioning to refillable systems requires substantial capital for infrastructure development and consumer engagement.

- Market Position: Amcor's current share in these specific circular packaging solutions is likely in the early stages, representing a potential 'Question Mark'.

- Future Potential: Successful adoption and scaling could propel these solutions into a 'Star' category as the circular economy gains momentum.

Amcor's exploration into edible packaging aligns with a market projected to reach $10.5 billion by 2030. Despite a potentially small current market share, this sector presents a high-growth, high-risk profile, characteristic of a 'Question Mark' due to evolving consumer demand for sustainable solutions and the need for significant investment in this nascent area.

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial disclosures, market research reports, and industry growth forecasts to provide a clear strategic overview.